Reposted from: WILLIAM SUBERG

Bitcoin futures liquidation has left market newcomers licking their wounds after a sharp pullback in Bitcoin prices. According to new research, the market speculators have been "washed out," with liquidations reaching $365 million.

Cryptocurrency analytics firm Glassnode confirmed the "statistically significant capitulation" in its latest weekly report, "The Week Onchain."

Bitcoin's unrealized losses echo FTX event

As a result of this week's sharp drop in Bitcoin prices, short-term holders (STHs) have come under immense pressure. As reported by Cointelegraph, these new entrants sold $850 million worth of Bitcoin at a loss at one point. Now, Glassnode's new findings show the extent to which overleveraged players have been removed from the market.

Short-term holders (STH) refer to investors who hold a certain amount of Bitcoin for no more than 155 days, while long-term holders (LTH) hold for over 155 days.

Short-term holders are far more sensitive to market shocks than long-term holders, and this week's drop in Bitcoin price to $49,500 is no exception.

Glassnode summarized, "The current unrealized losses of short-term holders have reached the highest level since the FTX collapse, once again highlighting the severe pressure investors are under in the current market conditions."

Currently, only 7% of Bitcoin held by short-term holders is in a profitable state, echoing the scenario of Bitcoin's price falling below $30,000, a drop that began a year ago.

"This data is more than 1 standard deviation below the long-term average, indicating significant financial pressure on recent buyers," the research further pointed out.

Short-term holders account for the majority of on-chain losses. Glassnode also confirmed that short-term holders "dominate" on-chain losses, with long-term holders accounting for only 3%.

Various other indicators also provide insights into the clearing out of speculators, with the research describing the market's reaction to the price drop as "panic and fear."

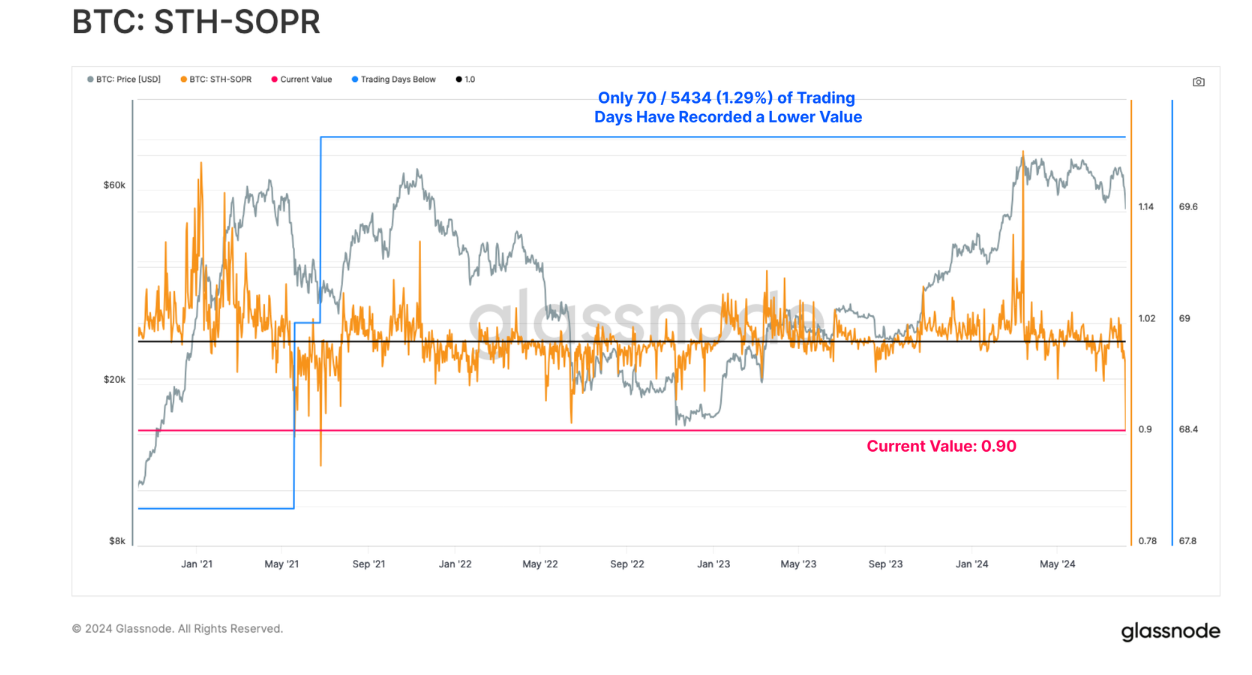

For example, the Spent Output Profit Ratio (SOPR) indicator for short-term holders recorded a low point that has occurred only 70 days in Bitcoin's history.

"The short-term holder SOPR has also reached an astonishing depth, with new investors locking in an average of 10% in losses," commented "The Week Onchain."

Bitcoin's eventful August

SOPR has also attracted attention elsewhere. In a Quicktake blog post on August 7, on-chain analytics platform CryptoQuant came to a similar conclusion, suggesting that the current price may signal a potential buying opportunity.

The analyst XBTManager noted, "We know that the indicator last reached the 0.95 level in December 2022, which initiated the bull market. Typically, in a bull market trend, the range of 0.95-0.90 is a good buying level. Currently, the indicator is at 0.90."

Glassnode concluded that August has been an "extremely eventful month."

"Bitcoin has seen its largest pullback since the cycle high (-32%), triggering statistically significant capitulation of short-term holders. Futures liquidations added fuel to the fire, forcing the closure of contracts worth over $365 million and causing a decrease of 3 standard deviations in open interest," it wrote.

"This has led to a massive clearing of leverage and paved the way for the critical importance of on-chain and spot market data for analysts to assess the recovery in the coming weeks."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。