Authors: Liu Honglin, Zheng Yuan, Man Kun Law Firm

Recently, many netizens have consulted Man Kun Law Firm, claiming that when they were withdrawing funds from a certain cryptocurrency exchange, they received a notification from customer service requesting payment of a so-called "tax fee" in order to complete the withdrawal. The customer service claimed that this was to comply with local tax laws and demanded a high fee from the netizens. After the netizens made the payment, they were still unable to withdraw funds, and the customer service became unresponsive.

Such situations are very common in the cryptocurrency circle, and the ambiguous and misleading methods used make it difficult for many newcomers to distinguish between truth and falsehood. In this article, Man Kun Law Firm shares insights on the "tax fee" scam in Web3 and how to deal with it.

To cut to the chase, there are currently no clear regulations in China regarding the payment of taxes on virtual currencies. Therefore, any requests for tax payments or requests for sending money are definitely scams.

Summary of Tax Fee Scams

These types of scams typically take advantage of users' lack of understanding of tax regulations, posing as exchange or government personnel and demanding payment of so-called "tax fees" or "handling fees" from users. Once the user makes the payment, the scammer disappears or continues to demand further payments. If the user refuses to pay, the scammer often resorts to coercive measures such as freezing the account to urge the user to make the payment. Especially for novice users, it is easy to fall victim to these scams.

It is particularly noteworthy that various exchanges around the world have come up with numerous tricks. Compared to the past exit scams, today's counterfeit exchanges have become much more sophisticated, setting up layers of traps and waiting for users to fall into them, leaving them penniless and with no means of complaint.

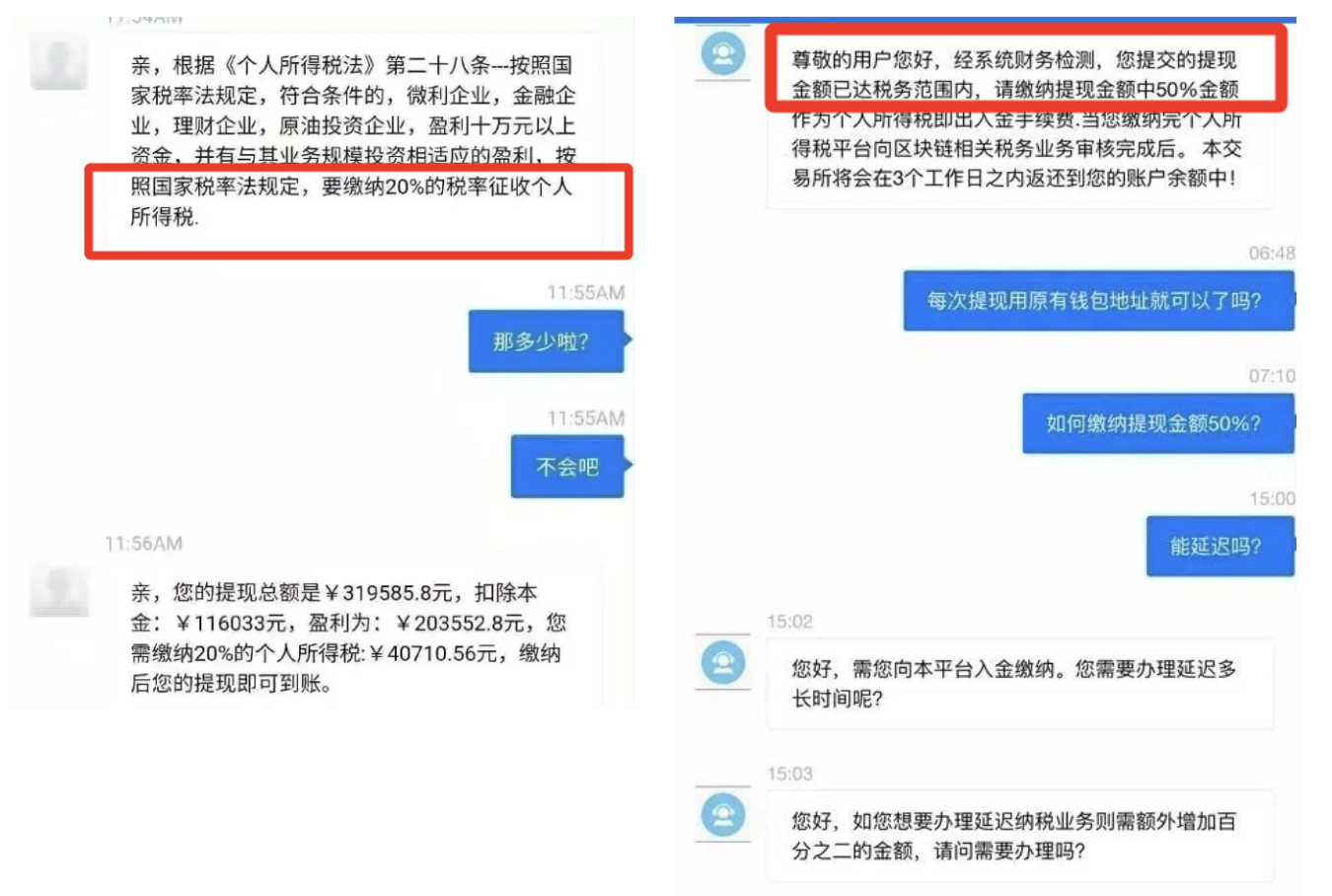

One such example is the HXEX exchange, as reported by an investor:

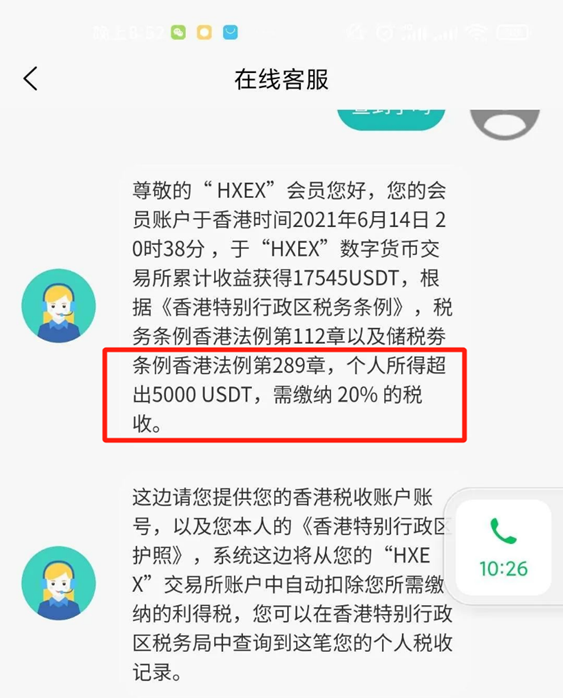

Initially, this investor was pulled into a cryptocurrency contract exchange group by a friend, and was guided by a teacher to trade Tether (USDT) on the HXEX exchange. Although the trading account did show a profit of 17,545u, problems arose during the withdrawal process. They were asked to pay a "clearance fee," and after paying the fee, they were further required to pay "20% personal income tax."

From the above image, it is evident that the customer service used the reason of "personal income exceeding 5,000 USDT, requiring a 20% tax payment" to deceive members into giving up their virtual assets. According to Hong Kong's tax regulations, the tax system in Hong Kong includes three main direct taxes: profits tax, salaries tax, and property tax. The main methods of tax payment in Hong Kong are as follows:

- In-person payment at post offices, convenience stores, the Business Registration Office, or the Stamp Office;

- Telephone/electronic payment using payment slips, electronic checks, bank transfers, or ATMs;

- Payment by mail using crossed cheques;

- Overseas payment. Holders of Hong Kong bank accounts can use mail-order crossed cheques or online banking services. Those without Hong Kong bank accounts can mail bank drafts or have someone else make the payment in Hong Kong.

Therefore, cryptocurrency exchanges cannot and do not have the authority to collect corresponding tax payments. In fact, this so-called "HXEX exchange" is simply a counterfeit exchange scam. Not only is there no information about it on cryptocurrency information platforms, but it has also repeatedly attracted attention by launching worthless cryptocurrencies and pyramid scheme projects. Currently, these valueless cryptocurrencies have all become worthless, and countless investors have been left empty-handed.

Global Tax Policies

As seen from the above, cryptocurrency investors who fall victim to scams often do so due to their lack of familiarity with the tax policies related to cryptocurrencies in various countries. Therefore, Man Kun Law Firm believes it is necessary to summarize the tax treatment policies for cryptocurrencies in major countries and regions in order to better assist global cryptocurrency investors in avoiding tax fee scams.

No Tax Required

El Salvador

In El Salvador, all businesses must accept Bitcoin as a form of payment, and if you have Bitcoin and make a profit from it, you can be exempt from capital gains tax or income tax on that portion in El Salvador.

Dubai, United Arab Emirates

In 2022, Dubai implemented the "Dubai Virtual Asset Regulation Law" and established the Dubai Virtual Asset Regulatory Authority (VARA). As part of the United Arab Emirates (UAE), Dubai does not levy personal income tax or capital gains tax on individual investors.

Singapore

Singapore is a global center for digital innovation and technology startups, and is also one of the most cryptocurrency-friendly countries in the world. The country does not levy capital gains tax, meaning individual investors do not have to pay taxes on profits from selling cryptocurrencies.

Belarus

Belarus is another cryptocurrency-friendly choice in Europe. In 2018, Belarus passed Decree No. 8, "On the Development of the Digital Economy," which stipulates that mining, purchasing, and selling of cryptocurrencies are considered personal investments, and individuals and businesses are not required to pay any taxes.

Tax Required

Hong Kong

In Hong Kong, institutional investors are required to pay 8.25% or 16.5% profits tax based on different gains from cryptocurrency-related businesses. If institutions distribute dividends, interest, and other income derived from securities tokens to investors in Hong Kong, they are required to withhold and pay advance income tax. Currently, Hong Kong does not levy income tax on capital gains from issuing, holding, or disposing of cryptocurrencies, and virtual asset investments in Hong Kong are not subject to capital gains tax.

United States

The Internal Revenue Service (IRS) has further refined its regulations on digital assets under the "Infrastructure Investment and Jobs Act." The IRS website explicitly states that cryptocurrencies, stablecoins, NFTs, and other digital assets fall under the category of reportable digital assets. According to this law, any U.S. person receiving $10,000 or more in digital assets in trade or business must report the transactions to the IRS within 15 days, and failure to comply may result in felony charges.

Japan

The new version of the Japanese Consumption Tax Law, effective from July 1, 2017, abolished the 8% Bitcoin consumption tax. However, this does not mean that profits from cryptocurrency investments are exempt from taxation. According to Bloomberg, in 2017, the National Tax Agency of Japan stipulated that capital gains from Bitcoin transactions are considered "miscellaneous income," with tax rates ranging from 15% to 55%.

Malta

Malta is one of the most cryptocurrency-friendly countries in the world, also known as the "Blockchain Island." In Malta, long-term capital gains tax is not required for cryptocurrency trading, but a 35% income tax may be required for cryptocurrency trading.

Tax Payment Methods

The methods of tax payment vary from country to country. For example, in the United States, under the new regulations, cryptocurrency exchanges and payment processors will be required to report users' transactions to the IRS. In Canada, when selling Bitcoin or other cryptocurrencies for fiat currency, it is necessary to calculate the capital gains for each transaction and include these figures in the tax return, and capital gains tax must be paid.

In general, users are responsible for handling tax matters themselves, and exchanges do not have the right to directly collect or deduct these taxes during withdrawals.

Recommendations from Man Kun Law Firm

In the irreversible trend of Web3, various tax fee scams continue to emerge. Although cryptocurrency investment is not recommended in mainland China, Man Kun Law Firm still hopes that cryptocurrency investors in other countries and regions around the world can participate more safely in the following ways:

- First, choose reputable platforms: Under the premise of legality and compliance, choose reputable cryptocurrency trading platforms for transactions. These platforms usually have more comprehensive security measures and customer service, reducing the risk of falling victim to scams.

- Second, verify identities: When faced with requests involving funds, do not easily believe any unverified fee requests, especially during withdrawal operations. In such situations, it is essential to verify the other party's identity through official channels. Confirm whether there are similar regulations and do not trust unverified contact information.

- Third, understand tax regulations: In the event of complex tax or legal issues, consult professional lawyers or tax advisors to confirm whether there are similar regulations requiring exchanges to collect tax payments.

- Finally, if encountering suspected scams, promptly report to the official exchange and relevant regulatory authorities, and retain all relevant evidence (such as chat records, payment receipts, etc.) for potential legal action.

It is reiterated that participating in cryptocurrency investment and trading activities carries legal risks. In China, any legal person, unincorporated organization, or individual investing in cryptocurrencies and related derivatives, in violation of public order and good customs, will have their relevant civil legal actions invalidated and bear the resulting losses themselves. Those suspected of disrupting financial order and endangering financial security will be dealt with by relevant authorities in accordance with the law.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。