Market is dull, but stablecoin yields are hot, some strategies worth paying attention to.

Author: Thor Hartvigsen

Translation: Shanooba, Golden Finance

Introduction

As new tokens are introduced with more moderate but potentially more realistic valuations, the excitement surrounding airdrops is gradually diminishing. Therefore, it is no longer possible to achieve an annualized yield of over 40% through stablecoins, for example, on platforms like Pendle or various lending markets. As a relatively conservative individual investor, I prefer to keep a portion of my investment portfolio in stablecoins. Last week, I asked the market for the best stablecoin farms available, and I received over 150 responses and contacts from multiple teams explaining the high yields that can be obtained through their products.

After researching these different strategies over the past week, this report attempts to present the best locations for stablecoins (as well as structured stablecoin products) to yield the highest returns.

JLP

JLP is not a stablecoin. In fact, it's not at all. It is a structured product, similar to GMX's GLP, which was very popular in 2022/23. However, among the numerous strategies I researched, JLP stands out and requires further analysis.

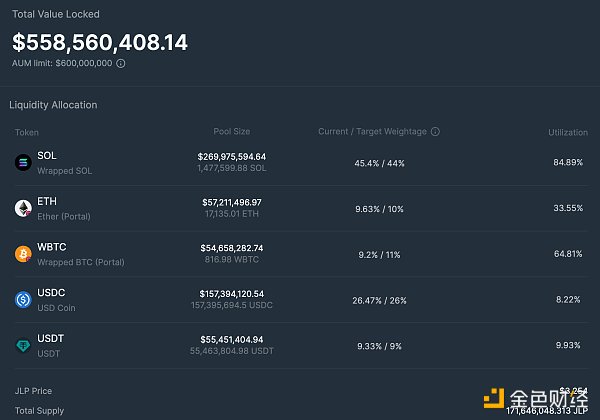

JLP is a structured product launched on the Jupiter exchange on Solana. In addition to other offerings, Jupiter provides perpetual futures trading for BTC, ETH, and SOL with leverage of up to 100x, and JLP acts as the liquidity and counterparty for these trades. JLP is composed of a basket of assets as shown below.

JLP Composition

For every $1 of JLP purchased, you are actually purchasing:

- $0.454 SOL

- $0.0963 ETH

- $0.092 BTC

- $0.2647 USDC

- $0.0933 USDT

Therefore, the price of JLP depends first on the prices of the underlying assets. If BTC, SOL, and ETH appreciate, JLP will also appreciate, but to a lesser extent, as it contains approximately 35% stablecoins, and vice versa. More specifically, the price of JLP depends on three factors:

- Prices of the underlying assets (BTC, ETH, SOL, USDC, and USDT)

- Fees paid by traders

- Traders' profits and losses

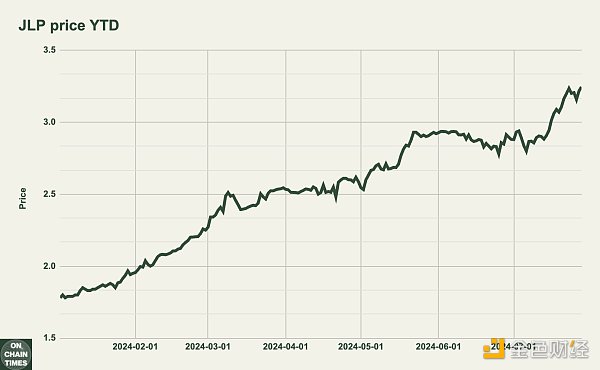

75% of all fees generated on perpetual contracts by traders go into the JLP treasury. This is equivalent to a 50% APY at current fee levels and accumulates through the appreciation of JLP's price. Finally, JLP acts as the counterparty for Jupiter traders. If traders profit, the gains are paid from the JLP treasury, and if traders incur losses, the losses are added to the treasury. The chart below shows the price of JLP since the beginning of this year.

Source - Dune

It is worth noting that due to the appreciation of the underlying assets and the substantial fees charged to traders, JLP has risen from $1.78 to $3.25 in just one year. This represents a 61.28% increase, with very little decline, resembling a chart that almost only rises. The 61.28% return on investment since the beginning of the year is equivalent to an annual return of 106.5%, far exceeding any type of stablecoin product. However, comparing it to stablecoin strategies is somewhat disingenuous, as JLP only contains a 35% stablecoin component. Holding JLP instead of using stablecoins for farming entails taking on more risk (e.g., traders' PnL exposure) and the volatility of the underlying assets.

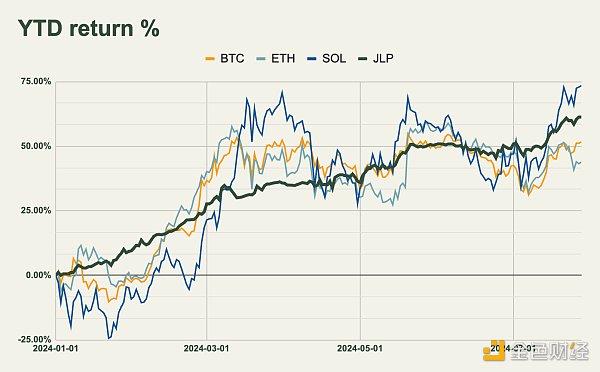

But how does JLP perform compared to BTC, ETH, and SOL? As shown in the chart below, JLP's performance has been better than BTC and ETH but not as good as SOL so far this year.

Source - Tradingview

However, is JLP safer than simply going long on SOL? To further analyze, we can compare the returns of JLP to BTC, ETH, and SOL on a volatility-adjusted basis.

Source - Tradingview

By calculating the year-to-date price performance of these assets, subtracting the risk-free rate, and dividing by their volatility, we obtain a risk-adjusted return measure, namely the Sharpe ratio (risk-adjusted return). The higher this number, the better the investment. As shown in the table, JLP's investment volatility is much lower compared to holding only BTC, ETH, or SOL, and it has performed significantly better on a volatility-adjusted basis since the beginning of the year. Please note that past performance is not indicative of future performance, but it is still interesting.

However, the risk-adjusted return is not the same as the risk-adjusted return, as the risk vector contained in JLP is not just volatility. When holding JLP, you face smart contract risk, and if traders are very profitable (partially depleting JLP funds), the price may also be negatively affected. Since there are no long-tail assets available for trading on Jupiter, the risk of price manipulation is low, and the likelihood of events like AVAX is low, when GLP was partially depleted.

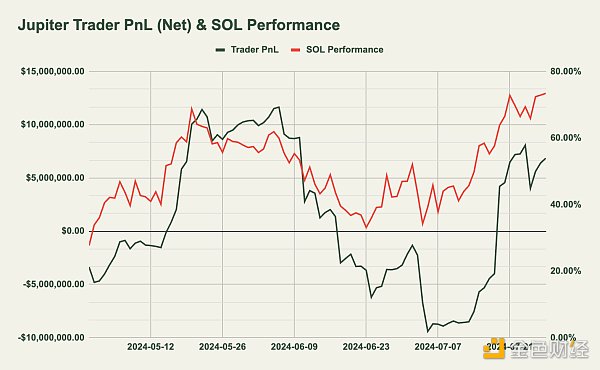

Nevertheless, we can examine the overall performance of traders on Jupiter to attempt to quantify the counterparty risk of JLP. The chart below shows the net PnL of Jupiter traders over the past three months.

Source - Chaos Labs

It is worth noting that traders have remained consistently profitable over the past three months, with a cumulative profit of $6.85 million. This actually means that $6.85 million from the JLP treasury has been paid to traders, negatively impacting its performance. Nevertheless, due to the substantial fees paid by traders, JLP's performance remains strong.

More interestingly, there seems to be a high correlation between the cumulative trader PnL on Jupiter and the price of SOL, as shown below.

This indicates that SOL is the largest traded asset on Jupiter perps, confirmed by the 24-hour trading volume: BTC at $139 million, ETH at $80 million, and SOL at $633 million (representing 74.3% of the total trading volume). It also suggests that the open interest leans towards long positions, meaning that most traders are long rather than short.

In conclusion, in the event of a significant rise in SOL, traders may profit, which would have a negative impact on the price of JLP. However, at the same time, the appreciation of SOL has a positive impact on JLP, making it a kind of hedge to some extent. It is important to remember that this is not a stablecoin strategy, as it exposes you to SOL, BTC, and ETH. This may not be suitable if you are bearish on SOL. Finally, another risk of this asset is smart contract risk and the risk of Jupiter exploits.

2 Syrup

Syrup is a protocol built on top of the Maple FinanceRWA lending market. On Syrup, depositors can transparently earn TradFi yields by providing overcollateralized loans to institutions. Depositors of USDC on Syrup can earn an annualized yield of 16-20%, which is paid by institutional borrowers.

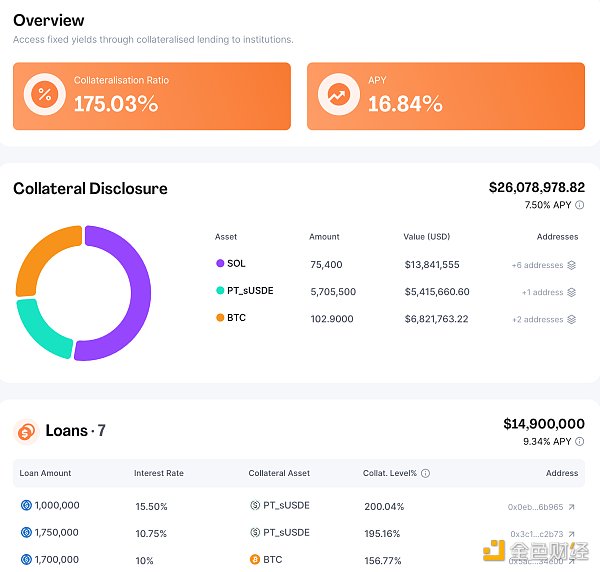

Currently, the total value locked (TVL) of user deposits in USDC is $41.5 million, which is lent to institutions. These institutions have put up $26 million in collateral (SOL, PT-sUSDe, and BTC) and have borrowed $14.9 million. The yields provided to the USDC lenders come from the yield on the institutional collateral (7.5% APY) and the USDC borrowing rate (9.34% APY). All of this can be seen in the following chart.

Syrup Finance

Syrup Finance

In addition, Syrup also offers "points" to lenders, with rumors of a token launch later this year. Locking USDC can double the points earned, but also increases the risk.

3 Additional Yields

PYUSD

PYUSD is a stablecoin issued by Paypal, with a supply that has grown to over 600 million. Paypal is currently offering significant rewards to PYUSD depositors on Kamino Finance. The yield is approximately 20% APY.

Morpho

Morpho is a decentralized and permissionless lending market with so-called "curators" who can drive market and strategy development. USDC lenders in curator markets like Gauntlet and Steakhouse have earned substantial yields, especially when considering $MORPHO rewards.

Usual

Usual recently launched the RWA-backed stablecoins USD0 and USD0++. Holding USD0++ allows for RWA collateral yields and "pills" (points). The first event recently went live and will last for 99 days. Like Ethena, Usual has integrated its stablecoins into various protocols, providing multiple ways to earn additional points before the airdrop.

Conclusion

So, can mining stablecoins alone outperform the market? In general market conditions, it may not (perhaps only in the case of a significant market downturn). However, earning high yields from the idle portion of your portfolio can bring significant additional returns (while remembering that these strategies come with risks).

JLP is particularly interesting. Although it is not a stablecoin but a structured product, its performance is better than the market, with lower volatility. If SOL remains strong for the remainder of the year and JLP continues to collect high fees, it may continue to perform strongly.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。