From "Internet scams" to "political lobbying tools", ten years have passed. What exactly has enabled Bitcoin to make a comeback?

Author: Biteye core contributor Viee

Editor: Biteye core contributor Crush

"Never sell your Bitcoin," Trump said at the Nashville Bitcoin 2024 conference this weekend, providing the cryptocurrency market with the strongest emotional value in recent times.

During Trump's speech, Bitcoin experienced a V-shaped trend, first a short-term decline, falling below $67,000; by the end of the speech, when he announced that Bitcoin would be listed as a strategic reserve asset, Bitcoin surged in a straight line, recovering all losses and even breaking through $69,000.

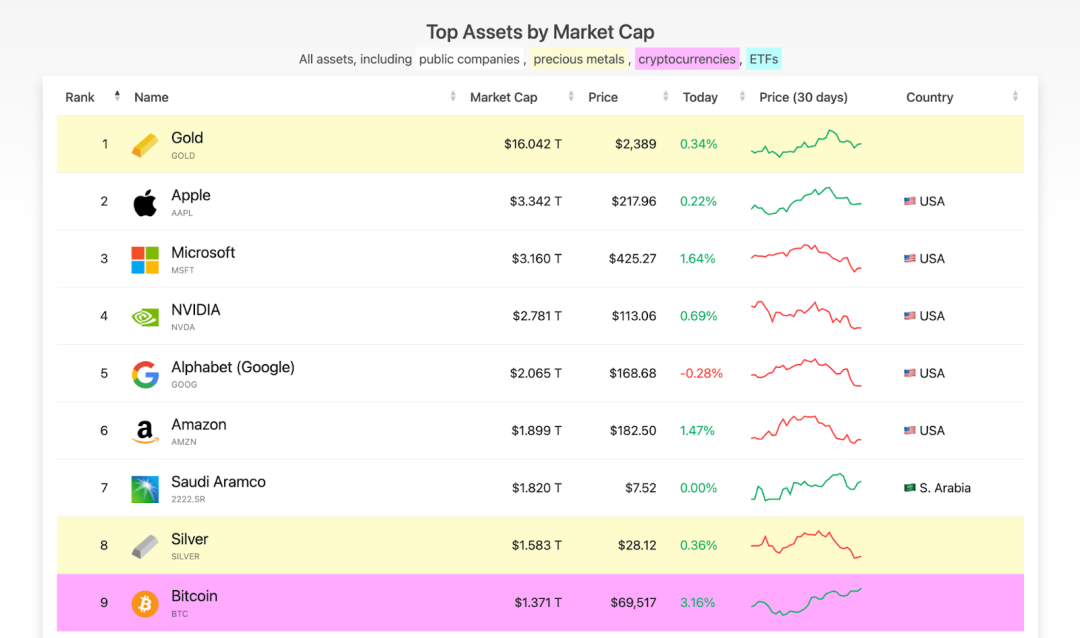

During his previous presidency, Trump harshly criticized cryptocurrencies as "scams". However, now, he even bluntly stated at the Bitcoin conference that "Bitcoin has become the ninth largest asset by global market value, and will soon surpass silver, and in the future will surpass gold."

This significant shift indicates that cryptocurrency users are becoming a gradually growing political force.

From "Internet scams" to "political lobbying tools", ten years have passed. What exactly has enabled Bitcoin to make a comeback?

01 Gold exits, Bitcoin enters: the value reserve of the new era

Not only Trump, Mike Novogratz, CEO of asset management company Galaxy Digital, has also publicly stated, "Although Bitcoin's current market value is less than one-tenth of gold's, it is rapidly rising and will definitely surpass the market value of gold, and it won't take long."

Michael Saylor, CEO of MicroStrategy, holds a similar view, believing that "digital gold" will replace physical gold by the end of this century.

Have you ever wondered why so many world-class experts openly express their faith in Bitcoin? Is it a fantasy, or is there solid evidence?

First, you need to know why Bitcoin is similar to gold.

- Scarcity. The total supply of Bitcoin is fixed at 21 million, and it is expected that all Bitcoin will be mined by 2140. This limited supply gives Bitcoin a similar scarcity to gold.

- Inflation resistance. As "digital gold," Bitcoin is considered an effective hedge against inflation. Although Bitcoin has only been around for about ten years and has only experienced inflation during the COVID-19 pandemic, its unique algorithm and distributed system give it the ability to resist inflation. Research by JPMorgan shows that institutional investors are increasingly inclined to choose Bitcoin over gold as a safe-haven asset.

- Intrinsic value. The value of gold comes from its widespread use in luxury goods and electronic products. The value of Bitcoin comes from its innovation in the monetary system, and its encryption technology and distributed network allow billions of people who are not part of the banking system to enter the financial system.

Since both assets are popular, what is the real reason Bitcoin is superior to gold?

The answer lies in performance and supply. Bitcoin has enjoyed an annual return of nearly 120% over the past decade, while gold's annual return is only 2%. Unlike gold, Bitcoin has a clearly defined upper limit on its supply, ensuring its inherent scarcity.

Gold has always been a symbol of value storage and wealth preservation. However, after decades of inflation ending in the 1970s, gold's performance has been relatively lackluster.

From 1980 to the end of 2023, gold's total return rate adjusted for inflation was -4%. In the past decade, gold's annual return rate was only 2%.

In addition, the supply of gold is difficult to control, with mining and new discoveries making its quantity uncertain. Historically, the United States even confiscated gold through Executive Order 6102, showing gold's vulnerability to government intervention.

However, Bitcoin is emerging with unparalleled advantages. As the world's first cryptocurrency, Bitcoin not only has strict limitations on its supply, with a total fixed supply of 21 million, but also cannot be changed by anyone, ensuring its scarcity.

Over the past decade, Bitcoin has had an annual return rate as high as 120%, a figure that far exceeds gold. Furthermore, based on a global blockchain network, Bitcoin's immutable and confiscation-resistant nature provides investors with unprecedented security.

As the market matures, Bitcoin's volatility is gradually decreasing, providing long-term investors with more stable opportunities.

More importantly, Bitcoin gives holders true financial sovereignty, immune to currency manipulation, perfectly meeting the demands of the digital age.

Therefore, Bitcoin has emerged as the value reserve of the new era!

02 Global financial new trend: Bitcoin moving towards national strategic reserves

Returning to the aforementioned, Trump's mention of listing Bitcoin as a strategic reserve asset at the conference directly pushed the price of Bitcoin to climb above $69,000.

His exact words were: "If I am elected, my government policy will be that the United States will retain 100% of all Bitcoin currently held or acquired in the future. We will retain 100%. I hope you do well. This will actually be the core of the strategic national Bitcoin reserve."

Although this commitment is relatively conservative, it undoubtedly highlights the importance of Bitcoin as a global financial asset. Trump also openly criticized the Biden administration's suppression of cryptocurrencies, stating that this policy has damaged the U.S. economy.

In contrast to Trump's caution, independent presidential candidate Robert Kennedy has shown a more radical vision.

If elected, he promises to launch a grand Bitcoin reserve plan—purchasing 550 Bitcoin every day until the reserve reaches 4 million Bitcoin. This proposal is much bolder than Trump's plan and aims to establish Bitcoin as a national strategic asset.

In Wyoming, Senator Cynthia Lummis is also actively promoting a national reserve plan for Bitcoin. She plans to draft a bill requiring the government to establish a reserve of up to 1 million Bitcoin within five years, and to use it only to reduce national debt over the next 20 years.

This plan undoubtedly further strengthens Bitcoin's position as a long-term financial asset.

The above public statements have rapidly pushed Bitcoin into a hot topic in the global financial and political arena. We all know that national governments are possible holders of Bitcoin as reserve assets. For example, the U.S. government is one of the largest holders of Bitcoin, with the federal government holding nearly 210,000 Bitcoin, accounting for 1% of the total supply.

In 2021, El Salvador announced Bitcoin as its official currency anchor, becoming the first country to adopt BTC as legal tender. In addition, Switzerland has also legislated to include Bitcoin in its national bank reserves.

So, what does this all mean?

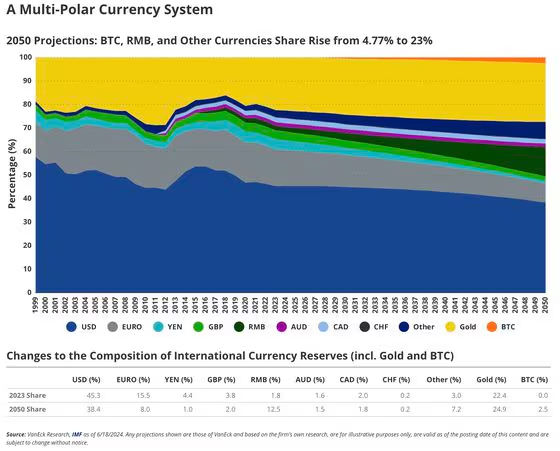

According to a report by VanEck, assuming that geopolitical tensions and the cost of debt repayment put pressure on the existing system, Bitcoin may become an important part of the international monetary system in the coming decades.

The report predicts that Bitcoin's global reserve asset status will gradually rise, and its share in international foreign exchange reserves is expected to reach 2.5%.

In this way, it can be seen that Bitcoin is gradually transitioning from an emerging asset to an important component of the global financial system. Whether in the U.S. or the international market, Bitcoin's position is rapidly rising.

So, Hong Kong is not to be outdone.

Fang Hongjin, Co-Chairman of the Hong Kong Blockchain Association, recently suggested that the Hong Kong government should use Bitcoin's inflation resistance to diversify the asset allocation of its foreign exchange reserves, in order to reduce its reliance on the U.S. dollar, and should continue to purchase and hold Bitcoin as part of its foreign exchange reserves.

He believes that Bitcoin not only has the potential to surpass gold, but can also significantly enhance Hong Kong's influence in the global financial market.

Hong Kong Legislative Council member Wu Jiezhuang also expressed support for this trend when commenting on Trump's speech at the U.S. Bitcoin summit.

He believes that Bitcoin and Web3 are key nodes in global development and can be included in official fiscal reserves in the future under compliance.

He also emphasized that Hong Kong should accelerate the development of the Web3 ecosystem to attract top talent and investment globally.

Hong Kong is actively exploring the possibility of including Bitcoin in its foreign exchange reserves, showing us that Bitcoin may become a key pillar in the global financial system.

From the U.S. to Hong Kong, an increasing number of governments and financial institutions are paying attention to Bitcoin's unique advantages.

03 Conclusion

In an increasingly digital world where fiat currencies are constantly depreciating, Bitcoin, with its scarcity, high returns, and financial sovereignty, is gradually replacing gold as the choice for the new generation of value reserves.

It is expected that in the coming years, this trend will drive Bitcoin's further rise in the international market.

If the thought of Bitcoin dropping from $60,000 to $50,000 now makes you lose your appetite, let me tell you a horror story: if it reaches the market value of gold, the price of one Bitcoin may soar from the current $69,000 to nearly $600,000.

At that time, you may understand the weight of the phrase "Never sell your Bitcoin".

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。