Author: YuppieZombie, Lumos Ngok, Noah Ho

Estimated Reading Time: 22 minutes

Introduction

Recently, the Telegram ecosystem has rapidly developed and become a hot topic in the Web3 field. The communication giant Telegram, with 900 million users, quietly launched mini-programs and bot development features. Currently, Telegram mini-programs can completely replace most websites, support seamless authorization, integrate payments through 20 payment providers (including Google Pay and Apple Pay), and provide more customized functions, such as automatically sending news, news summaries, and the recently popular Catizen mini-game. In addition, Telegram has also developed the Ton chain to support convenient blockchain transactions. This "traffic + payment" route similar to WeChat has enabled Telegram to develop rapidly.

Chinese users are already very familiar with WeChat mini-programs. Nowadays, mini-programs have penetrated into all aspects of life. For example, when ordering a cup of Luckin Coffee, the store often recommends ordering through the mini-program to enjoy a better price. Similarly, on WeChat, mini-programs like Maoyan and Taopiaopiao allow users to easily purchase movie tickets with just a swipe on the WeChat interface, making it extremely convenient. Recently, with the popularity of GPT, the leading AI assistant Kimi has also entered the WeChat mini-program, allowing users to ask Kimi questions anytime, anywhere by simply swiping down the WeChat page, making work and study more convenient. The Internet era has gone through the development process from the initial web version to the flourishing of various apps, and has now evolved to the dominance of several major platforms such as WeChat, Alipay, Douyin, and Meituan. With the monopoly of Internet giants, individual shops have gradually gone online on various platforms, each containing a large number of mini-programs, so much so that it has become overwhelming.

Against this backdrop, this article will delve into the development history and current status of Web2 and Web3 mini-programs. First, we will review the development history of WeChat mini-programs, analyze the reasons for their success, and the existing ecosystem. Then, we will introduce the rise of Telegram mini-programs, explore their integration with Web3 technology, and their applications in the blockchain field. Finally, we will look at the future development trends of mini-programs, discuss how they will continue to change our way of life, and lead the next era of the Internet.

Web2 Era: Development History and Current Status of Mini-Programs

Origin of Mini-Programs:

The origin and development of mini-programs have been driven by several major companies, with WeChat mini-programs being the earliest and most typical representative. The origin of mini-programs can be traced back to 2013 when Baidu proposed the concept of "light applications," defining a full-featured app that does not require downloading and can be used instantly, with a user experience comparable to native apps and the searchable and intelligently distributed characteristics of web apps. However, light applications did not achieve the expected success. Subsequently, Google proposed the concept of PWA (Progressive Web App) in 2016, but it was not widely used in China. Finally, WeChat mini-programs, with the massive user base of WeChat and strong platform support, successfully led the trend of mini-program development. Today, mini-programs have become an indispensable part of the mobile Internet, providing new possibilities for users and developers.

- WeChat Mini-Programs: The concept of WeChat mini-programs was first proposed by Zhang Xiaolong in 2016, aiming to provide a new service form that allows users to enjoy "reachable" services within the WeChat ecosystem. On January 9, 2017, WeChat mini-programs were officially launched, allowing users to use applications without the need to download and install, realizing the concept of "use and leave." WeChat mini-programs quickly developed into an important tool for connecting online and offline services, and in 2018, a mini-program advertising component was launched, allowing developers to earn advertising revenue through mini-programs.

- Alipay Mini-Programs: On September 20, 2017, Alipay mini-programs were officially opened to the general public. In April 2018, the State Administration for Market Regulation launched the "electronic business license" mini-program on Alipay, allowing business owners to obtain and use business licenses at home. To date, Alipay has become the second largest mini-program platform in China.

- Baidu Mini-Programs: On July 4, 2018, Baidu Smart Mini-Programs were officially launched. On January 10, 2019, the Guangdong Public Security Department, in collaboration with Baidu and other internet companies, launched the "Guangdong 110" smart mini-program alarm platform, accelerating the construction of smart new policing. On April 25, the national mini-program "Switzerland" was launched. On November 25, Baidu announced that the monthly active users of smart mini-programs exceeded 300 million.

- Douyin Mini-Programs: In July 2021, Douyin piloted its self-operated "Heartbeat Takeout" service. Although it was eventually removed due to the difficulty of building a delivery system, this attempt opened up the exploration of Douyin mini-programs in the local life service field. As of March 2024, the traffic of mini-programs on the Douyin platform reached 232 million.

Analysis of the Popularity of Mini-Programs:

- User Convenience: Mini-programs provide users with extremely convenient usage experience with features such as "no installation required, easily accessible, use and leave, no need to uninstall."

- Low Development and Maintenance Costs: Compared to native applications, the development cost of mini-programs is significantly lower because they do not require separate development for different operating systems, and maintenance is simpler. For example, WeChat mini-program developers can use familiar front-end technologies such as HTML, CSS, and JavaScript for development. At the same time, WeChat mini-programs provide rich APIs and components that can easily call functions provided by WeChat, such as obtaining user information, local storage, and payment functions, without the need to start from scratch. In addition, the platform's unified handling of sandbox isolation, platform control (authentication, review, version control), syntax constraints, capability encapsulation, package compilation, and loading strategies ensure the stability and security of mini-programs.

- Huge Potential User Base: Platforms such as WeChat (as of March 31, 2024, combined monthly active accounts of WeChat and WeChat reached 1.359 billion), Alipay (as of June 2022, 1.045 billion), and Douyin (as of June 2023, approximately 723 million monthly active users) have a massive user base, providing a huge potential market and user base for mini-programs. In March 2024, the traffic of mini-programs on WeChat, Alipay, Baidu, and Douyin platforms reached 945 million, 648 million, 389 million, and 232 million respectively, forming a strong "traffic pool" effect for mid-to-long-tail apps and offline merchants.

- Traffic and Marketing Advantages: WeChat mini-programs can seamlessly integrate with other WeChat functions such as official accounts, WeChat Pay, discovery column, and search column, using WeChat's social network for rapid dissemination and marketing. Alipay mini-programs, through the combination of life accounts and mini-programs, have enhanced user retention and brand trust, especially in low-frequency businesses. Douyin mini-programs benefit from the traffic aggregation advantage of the Douyin platform, with significantly higher user immersion time compared to other platforms.

- Adaptability to Lightweight Application Scenarios: The lightweight design of mini-programs is particularly suitable for essential but infrequently used tool applications. Mini-programs occupy minimal phone storage space, loading only the resources and data needed at runtime, and their design tends to be simple and lightweight, with developers encouraged to retain only necessary functions and avoid redundancy, making the size of mini-programs much smaller than feature-rich traditional apps. In addition, the update and maintenance of mini-programs are usually managed uniformly by the host platform, eliminating the need for manual updates by users.

- Avoiding Platform Revenue Sharing: For developers, mini-programs can avoid the high revenue sharing and strict review mechanisms of platforms such as the Apple App Store, increasing revenue and saving time costs.

In summary, the popularity of WeChat mini-programs among developers and users is mainly due to their advantages in convenience, cost, user base, marketing capabilities, application scenario adaptability, and avoiding platform revenue sharing. These advantages have made mini-programs the preferred platform for many enterprises and individual developers, and have also made users more inclined to use mini-programs rather than download traditional apps.

Composition and Ecosystem of the Mini-Program Industry Chain:

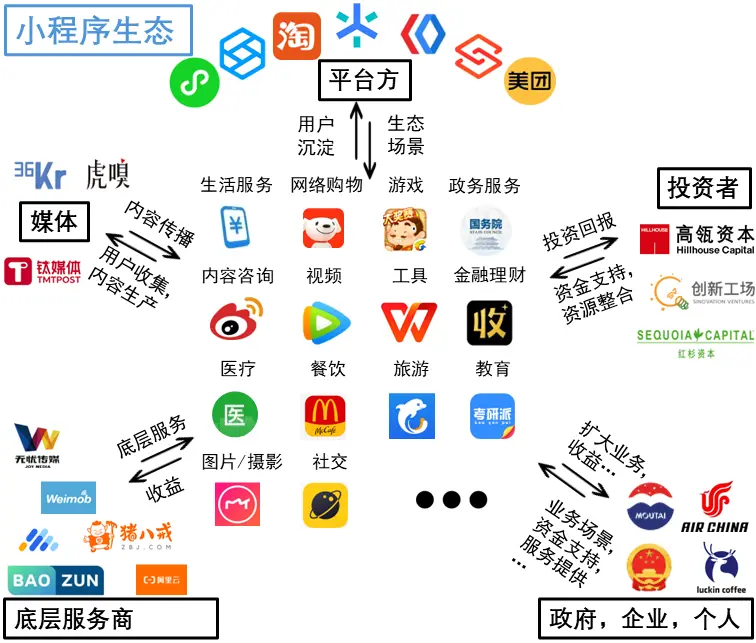

Comprehensive Competition Among Multiple Platforms: The mini-program industry currently involves almost all major internet companies, including WeChat, Alipay, Douyin, Baidu Smart Mini-Programs, Meituan, Taobao, JD.com, Xiaohongshu, and Kuaishou. Developers cover almost all online scenarios: online shopping, life services, games, government affairs, content consultation, videos, tools, community group buying, offline retail, catering, tourism, education, images/photography/videos, and social networking. Various service providers (SaaS, BaaS, development service providers, mini-program stores, marketing service providers, MCNs, and operational agents) all provide solutions, operations, advertising, live streaming, data, and underlying architecture for mini-programs. Mini-programs provide commercial/social services and user retention for platform providers, while platform providers provide the mini-program ecosystem and commercial scenarios. Governments, media, enterprises, and venture capital provide investment, resource integration, and partial promotion for mini-programs, and mini-programs provide direct investment returns and production in return.

Users Have Fully Adapted Mini-Programs into Production and Life: In 2023, the scale of internet application users in instant messaging, short videos, online payments, and search engines in China reached 10.381 billion, 10.185 billion, 9.114 billion, and 8.017 billion respectively. The average monthly usage of mini-programs per person across the entire network is 15.2.

Development Momentum: In terms of the number of mini-programs and transaction volume, WeChat and Alipay are on par and ahead of other platforms such as Douyin, Kuaishou, and Baidu. WeChat remains in the top position, while Alipay has become the second largest open ecosystem for mini-programs on the internet, with leading platforms accelerating their entry. Douyin mini-programs have shown strong growth, with a 280% year-on-year increase in the number of mini-programs, a 640% year-on-year increase in developers, an 84% year-on-year increase in mini-program DAU, and a 201% month-on-month increase in the number of mini-program matrix accounts (March to December 2023).

Distribution of the Mini-Program Industry: Life service mini-programs have the highest number of entries in various rankings, accounting for the highest proportion and the largest number of visits (approximately 40%). The number of entries for offline retail and games has started to increase significantly. Online shopping mini-programs are affected by the economic environment and have significant fluctuations, but they account for the highest proportion of shares (up to 49%), and vertical e-commerce accounts for the largest proportion (70.2%) within online shopping mini-programs. Life service mini-programs are widely used, with a wide variety of types and ample innovation space. Tool mini-programs have the most stable development. It is worth noting the rise of mini-dramas, becoming the most lucrative track in the second half of 2023.

AI Empowers Mini-Program Services to Become More Advanced: The application of AI technology in mini-program services is driving services towards more efficient, intelligent, and personalized directions. Some common scenarios include personalized recommendations, intelligent customer service, voice interaction, automated marketing, content generation, and intelligent search.

Standardization of Content Production and Marketing for Mini-Programs: Promotion relies on endorsements from KOLs' social relationships and joint efforts from MCN companies to expand promotion. The drainage methods focus on driving non-structured groups and emphasize guiding "tap water" to involve the general public in brand building. Additionally, it is worth mentioning the rise of brand collaborations, with mini-programs supporting new content marketing across all platforms. For example, the "Maotai x Luckin Coffee" collaboration became a highly successful case that went viral across all platforms.

Huge Potential in Vertical Fields of Life and Entertainment: Vertical fields such as parenting, travel, science popularization, pets, entertainment, automotive, and health have a relatively high average replacement rate, with strong growth in both user numbers and average time spent per person.

Web3 Era: The Rise and Characteristics of Telegram Mini Apps

Telegram has recently introduced a new feature that allows "mini-apps" to run within its application, similar to WeChat mini-programs, enabling it to provide flexible interfaces similar to internet websites directly within Telegram for various operations such as playing mini-games and electronic payments. This feature is similar to the bots that have been running in Telegram for some time, but it provides a more advanced user experience.

Specifically, Telegram Mini Apps have the following characteristics:

- Seamless Integration: Telegram Mini Apps can be directly integrated into Telegram, one of the most popular messaging platforms with millions of active users. A user might be discussing an upcoming event in a Telegram chat. Through Mini Apps, they can directly open an application within the chat to book a venue, select catering services, or even purchase tickets, all without leaving the Telegram application.

- Enhanced User Experience: Users can interact with and use complex web applications without the need to separately download or install applications. For example, if a Mini App is an online store, users can browse products, view recommendations, and make purchases directly within Telegram, without the need to download an additional shopping app. This experience is similar to accessing a full-featured e-commerce website in a browser, but fully integrated within Telegram.

- Versatility: Mini Apps can be applied in various scenarios such as e-commerce, customer support, games, and quizzes. Because Mini Apps can be any type of application, such as an online education platform, users can directly access courses, participate in quizzes and exams within Telegram, or a fitness app providing exercise guidance and health tracking.

- Rapid Development: Developers can quickly develop Mini Apps using familiar web technologies such as HTML, CSS, and JavaScript. A developer might develop a simple application within a few days.

- Cross-Platform Compatibility: Mini Apps can be used in all official Telegram applications, whether users are on mobile, tablet, computer, or through Telegram's web version, they can access and use Mini Apps. This means developers do not need to develop multiple versions of the application for different platforms.

- Enhanced User Interaction: Mini Apps provide a simplified way for users to communicate with projects. A Mini App can be an interactive survey or voting tool, allowing users to directly participate in surveys, collect feedback, or make decisions within Telegram groups. This application can promote communication and collaboration within groups, increasing engagement.

In addition, Telegram's Mini Apps also collaborate with TON, enhancing the functionality of Mini Apps through TON Chain. TON's Mini Apps provide a convenient entry point for Web2 users to easily enter the Web3 world. In fact, the TON public chain was initially promoted by Telegram, but was canceled in 2019 due to intervention by the U.S. Securities and Exchange Commission (SEC). Nevertheless, the community and other developer teams continued to advance the project, leading to the current TON public chain. Although TON is not directly related to Telegram, Telegram founder Pavel Durov and the team have continued to support the project, emphasizing the business relevance between the two.

Specifically, the collaboration between TON (The Open Network) and Telegram's Mini Apps can bring multiple benefits to the latter:

- The TON payment system allows users to make instant and fast payments within Telegram, greatly enhancing the payment experience and convenience.

- Through integration with TON, Telegram's Mini Apps can also support fiat currency payments, further expanding the coverage and convenience of payments.

- TON's sharding technology improves the scalability and performance of the blockchain, enabling Mini Apps to handle larger-scale transactions and user requests, supporting more complex application scenarios.

- TON's token economic model can provide economic incentives for Mini Apps, encouraging user participation and usage, while also providing incentive mechanisms for developers to promote the continuous development and innovation of applications.

Comparison Between WeChat Mini-Programs and Telegram Mini Apps

WeChat Mini Programs is a lightweight application platform launched by Tencent in 2017, allowing users to access various applications within WeChat without the need to download or install them. Initially, mini-programs mainly provided basic tools and services, gradually expanding into e-commerce, games, social, education, and other fields. With continuous improvement in functionality and diverse user demands, WeChat Mini Programs introduced rich development tools and interfaces, integrating powerful features such as WeChat Pay, rapidly becoming an important part of China's mobile internet ecosystem. Its openness and convenience have attracted a large number of developers and businesses, driving the rapid development and popularization of mini-programs. Although WeChat Mini Programs and Telegram Mini Apps are both small applications embedded in social platforms, they have significant differences in several aspects:

1. User Experience and Access Methods

WeChat Mini Programs

- User Experience: Users can access mini-programs by scanning QR codes, sharing links, or searching within WeChat. The interface is usually consistent with the overall style of WeChat, providing a smooth user experience.

- Access Methods: Developers use the development tools and APIs provided by WeChat to build mini-programs, primarily using technologies such as JavaScript, WXML, and WXSS. They need to pass WeChat's review before publishing.

Telegram Mini Apps

- User Experience: Users can access Mini Apps through chatbots, groups, channels, or embedded buttons. The interface design is more flexible, allowing for diverse experiences beyond Telegram's default style.

- Access Methods: Developers use Telegram's Bot API and Mini Apps API to develop applications, primarily using standard web technologies such as HTML, CSS, and JavaScript. The publishing process is relatively simple, without strict review mechanisms.

2. Application Scenarios and Business Models

WeChat Mini Programs

- Application Scenarios: Covering a wide range of fields including e-commerce, games, social, tools, and education, particularly suitable for lightweight, high-frequency applications.

- Business Model: Mainly profit through service fees, advertising, e-commerce, and value-added services. WeChat provides rich monetization methods such as WeChat Pay and advertising platforms.

Telegram Mini Apps

- Application Scenarios: Mostly used for information services, entertainment, financial tools, and social interaction. Due to Telegram's advantages in privacy protection and security, financial tools and private social interactions are its strengths.

- Business Model: The business model of Telegram Mini Apps is still under exploration, possibly through subscription services, value-added features, and third-party payment interfaces for monetization.

3. Governance and Community Engagement

WeChat Mini Programs

- Governance: Led by Tencent, with a strict review mechanism to ensure content compliance and security.

- Community Engagement: The developer community is relatively closed, relying more on Tencent's support and official documentation.

Telegram Mini Apps

- Governance: Relatively open, Telegram provides basic usage guidelines, but there is a high degree of freedom in development and publishing.

- Community Engagement: The developer community is open, and Telegram's official team interacts frequently with developers, contributing to the community.

Telegram: Bridging the Gap Between Web2 and Web3

Telegram Mini Apps are currently very popular, and more importantly, they have become a bridge between Web2 and Web3. Its large user base provides a solid foundation for this. Its freedom and lack of censorship make its user profile more compatible with the Web3 community. As the most Web3-friendly Web2 software, a large proportion of its user base consists of Web3 enthusiasts or potential Web3 users. As analyzed above, the low development cost, ease of use, and dissemination of mini-programs make the TG ecosystem very easy to spread. The native support of Ton further reduces the barriers to on-chain interaction. In this section, we will introduce some popular applications in the TG ecosystem and how they have brought Web2 users into Web3 through case studies.

NotCoin

NotCoin is a "tap-tap-tap" game on the TG Mini Apps, where the main operation is very simple: users continuously tap the screen to earn in-game coins when they have energy. Building on the traditional GameFi Play2Earn model, NotCoin introduces the Tap2Earn concept, allowing users to earn money by simply tapping the screen. In addition, NotCoin also features skill upgrades, task systems, team cooperation, point leagues, and inviting new users. From its official launch on January 1, 2024, to the token listing on Binance on May 16, NotCoin attracted over 35 million players, with over 5 million daily active users.

As a simple TG Mini Apps game, NotCoin greatly reduces the user threshold with the help of the large TG user base and easy operation. The game's viral mechanism also contributes to its rapid spread. In terms of the token economic system, the project only retains 5% of the tokens, with no VC reserves, and 78% of the remaining 95% is distributed to all game users. This community project without VC and the majority of tokens distributed to users has been highly praised by the community in the current environment. Ultimately, NotCoin successfully launched on Binance LaunchPool on May 16.

NotCoin has successfully attracted a large number of users and subtly transformed a significant portion of them into Web3 users. The project airdropped most of the tokens to players, covering a large user base. During the airdrop phase, users had two options: to transfer the tokens to Binance or to the TG wallet. Regardless of the choice, it brought new players to the Web3 world. Users who chose to transfer the airdrop to Binance may become cryptocurrency traders, while those who chose to transfer the airdrop to the TG wallet became players on the Ton chain.

NotCoin's success not only relies on the comprehensive support from TG but also benefits from the support of Binance. Binance has long been committed to bringing in Web2 users, injecting fresh blood into Web3. Looking back at the controversial Binance LaunchPad projects EDU and HOOK in 2023, they are both non-native Web3 projects, representing asset tokenization in education and a Web3 learning platform, respectively. Binance has already gained a certain market share among Web3 users, but facing high customer acquisition costs, it hopes to bring in more Web2 users to Web3, expanding the overall market size and contributing to its user base. Therefore, Binance noticed NotCoin as early as the end of February and conducted a joint campaign with them. Ultimately, NotCoin successfully landed on Binance LaunchPool.

From Binance's perspective, TG user profiles highly overlap with Web3 user profiles, indicating high-quality TG users. Therefore, Binance chose to have NotCoin listed on its platform. NotCoin is a successful example. As a TG mini-game, it attracted tens of millions of users in just over four months and transformed these users into cryptocurrency traders or blockchain users through the airdrop.

Catizen

Catizen comes from a team with extensive experience in mini-program games on WeChat and Facebook, with over 5 years of experience in development and operation. Compared to other games, this game is more mature in terms of gameplay. In the game, players play as the owner of a cat shop, where cats automatically serve customers to earn profits. The earnings depend on the number and level of cats in the shop. Players can use coins to purchase new cats and obtain higher-level cats by synthesizing two cats of the same level, to earn higher per-second profits.

Catizen, with its cute art style and addictive business simulation gameplay, gained over 20 million users within three months of its launch, with a daily active user (DAU) count of 2.5 million. Through excellent in-game user monetization guidance and potential airdrop expectations, Catizen has generated over $12 million in revenue through in-app purchases. This achievement is remarkable, especially for traditional GameFi, where the lack of external revenue sources leads to strong Ponzi-like properties. Catizen's revenue of over $10 million within three months to some extent addresses the issue of lacking external revenue.

Catizen not only attracted tens of millions of players but also guided players to bind their TG wallets within the game and engage in on-chain contract interactions. Within the game, there are options for users to interact with smart contracts to earn in-game profits, which take place on the Ton blockchain and require only gas fees, without any additional charges. For example, occasional appearances of a small dog can provide players with 500% earnings for a period of time. If obtained for free, it lasts only 1 minute, but through contract interaction, it can last for 4 minutes. Catizen's clever in-game incentive mechanism has attracted over a million on-chain users, who engage in smart contract interactions on the Ton blockchain through Catizen. This guidance from Catizen may be due to its acceptance of investment from Ton.

Catizen has achieved remarkable results in multiple aspects, not only attracting a large number of users and bringing high revenue to the project, making profitable web3 games possible, but also guiding a large number of users to enter the Ton blockchain and become web3 players. In terms of airdrops, although Catizen is not as generous as NotCoin to its users, with the initial plan allocating 20% to the team and 8% to VCs, and only 35% to users, it continuously increased the airdrop ratio to 43%.

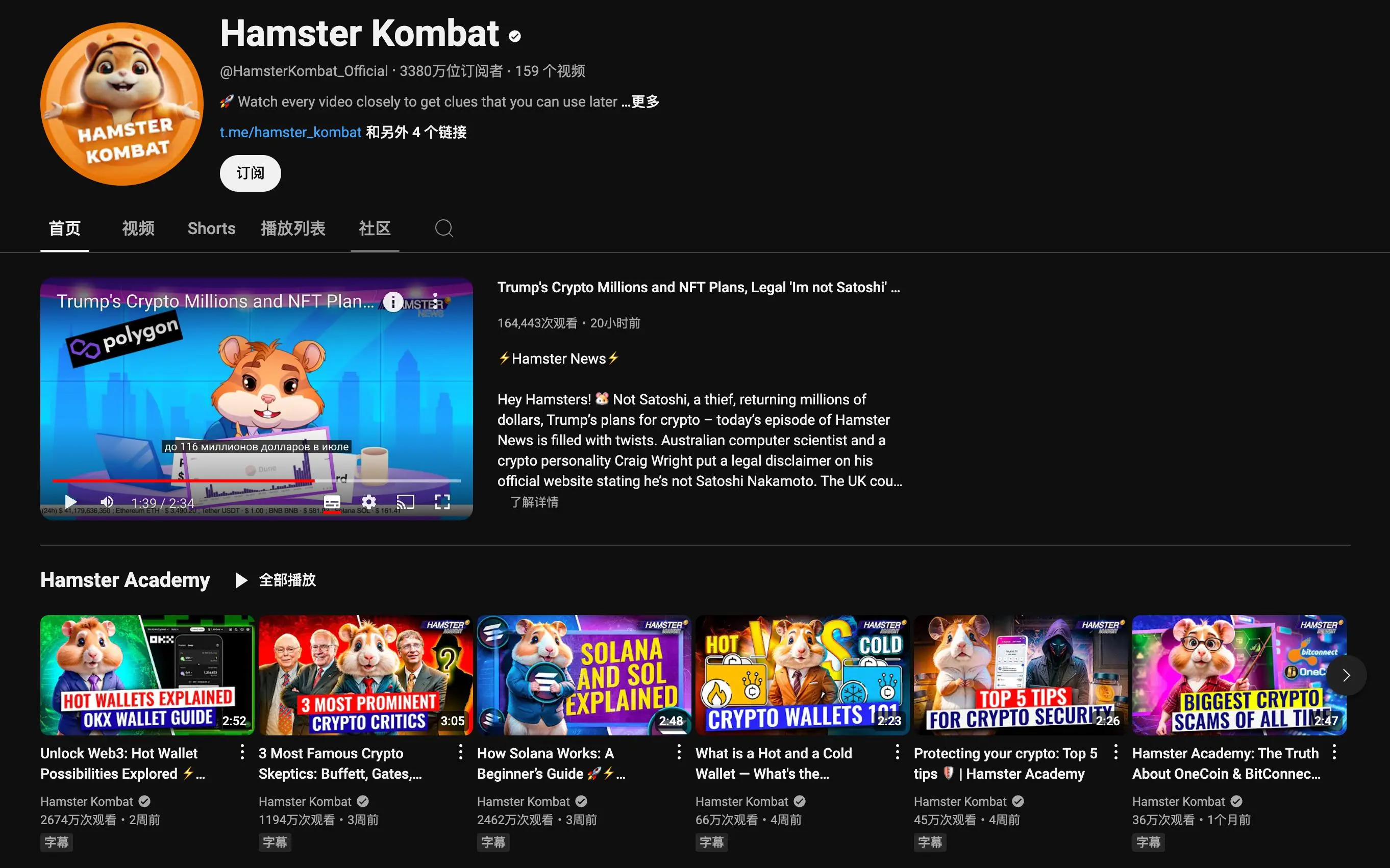

Hamster Kombat

Hamster Kombat is similar to NotCoin, but it is much more than just a copycat. Compared to the simple gameplay and settings of NotCoin, Hamster Kombat is more complex in its background setting and gameplay. The game's background setting allows players to play as the CEO of a cryptocurrency exchange, earning points by tapping the screen to consume energy. The game also includes management elements, allowing players to upgrade the exchange by spending coins, such as upgrading employee levels, marketing, and making compliant investments, to earn more profits.

This background setting allows players to experience the game from the perspective of a cryptocurrency exchange CEO, increasing their understanding and identification with virtual currencies. In addition, Hamster Kombat combines the task system with watching video tasks, driving traffic to its own YouTube channel. Players watch two videos per day, introducing blockchain knowledge and news.

Hamster Kombat has performed remarkably well, with over 200 million users as of the end of June. Additionally, its official YouTube channel has over 30 million subscribers, with an average video view count of over 20 million. The game's airdrop mechanism requires users to first bind their TG wallets, effectively guiding users into the web3 world.

From the perspective of guiding users into web3, Hamster Kombat has achieved success in multiple aspects. Firstly, it has attracted a large number of users and guided them to register and bind their TG wallets through the airdrop mechanism. Secondly, in terms of user education, the game allows players to play as the CEO of a cryptocurrency exchange, enhancing their understanding of virtual currencies through unique gameplay. Through daily video uploads and the task system, the game incentivizes players to learn about web3 knowledge and follow web3 news, subtly introducing these concepts to them. Acceptance and learning are prerequisites for joining web3, and Hamster Kombat has successfully achieved this.

Conclusion and Outlook

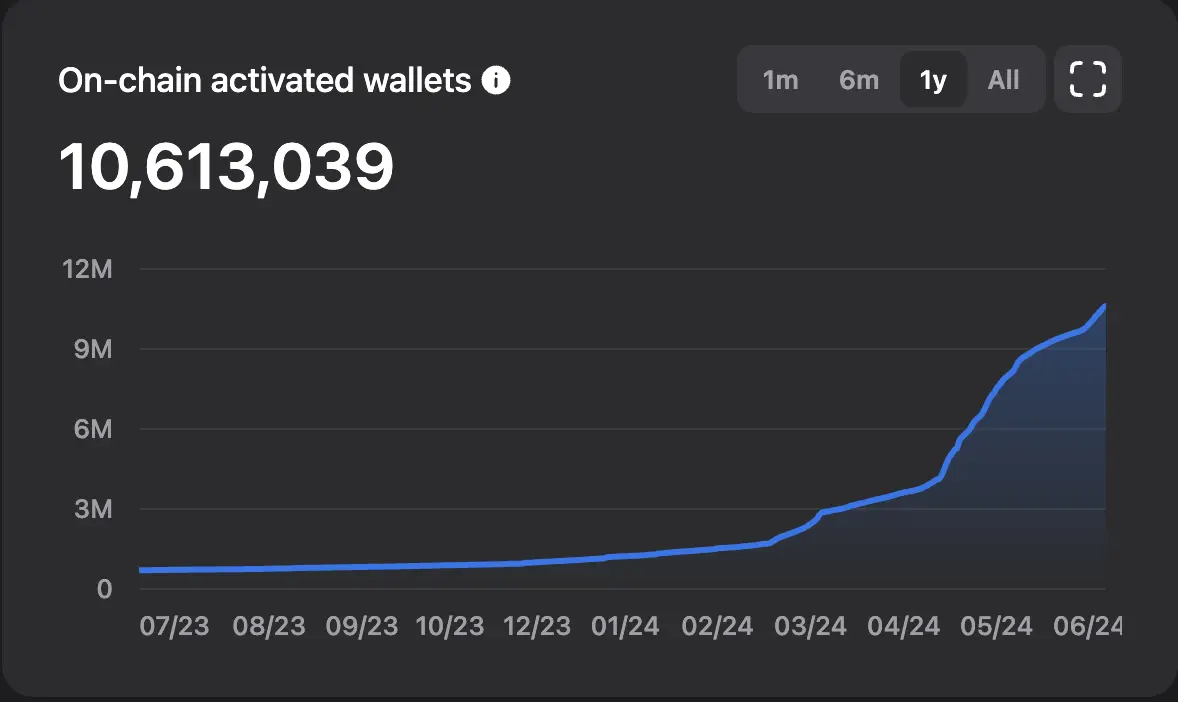

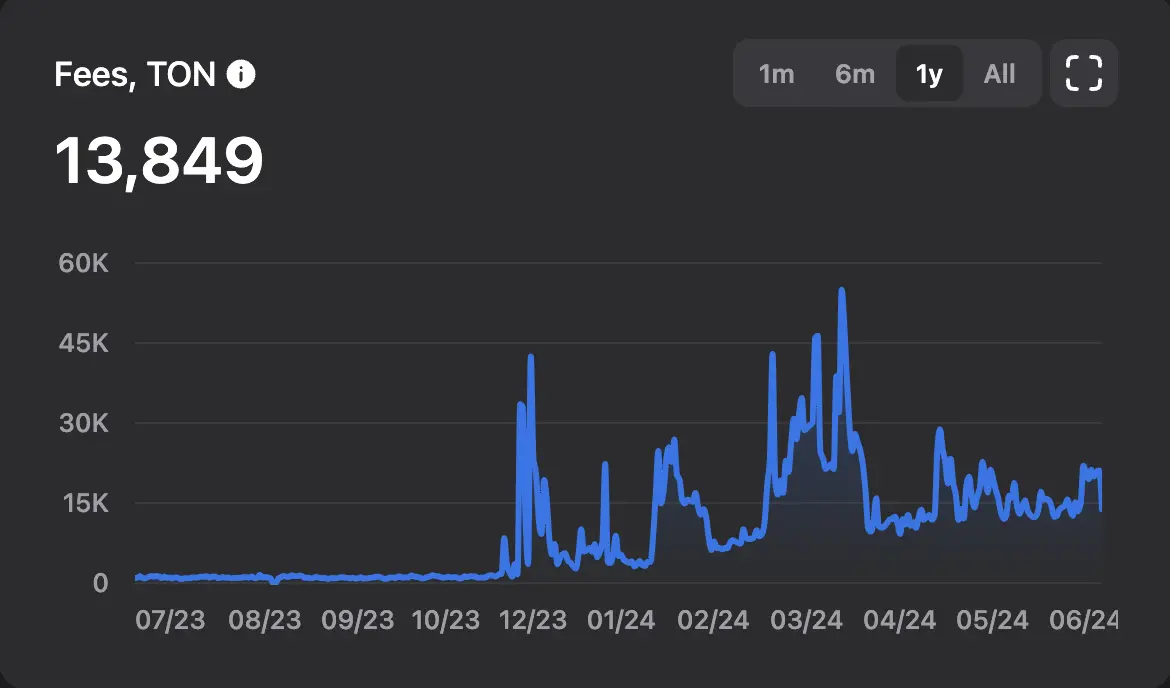

Relying on TG's high potential web3 customers and the seamless integration of payments and on-chain interactions in mini-programs, Pionex provides a new entry point into the web3 world. From the data, the popularity of TG mini-programs has brought rapid user growth to the Ton blockchain. From early 2024 to the present, the number of active wallets has increased from one million to over ten million in just seven months, a tenfold increase. Similarly, this is also reflected in the daily consumption of Ton on the chain, which has increased from an average of 1000 Ton per day last year to tens of thousands of Ton per day now.

TG's mini-programs are more like a hybrid model of web2 and web3, neither fully centralized nor fully decentralized. In terms of payment methods, there are both centralized fiat in-app purchases and on-chain transfers and interactions, with on-chain wallets being divided into abstract custodial wallets and external wallets. In terms of operations, some operations are centralized, while those involving assets are processed on-chain. The profit model is also a hybrid, including web2 advertising fees, in-app purchase fees, as well as web3 NFT minting fees and transaction fees. In the TG ecosystem, blockchain is more of a complement to web2 rather than a core player in native web3. This enriches the application scenarios of blockchain technology and benefits traditional applications.

Although TG mini-programs have recently performed remarkably well, bringing a large influx of new blood into the web3 world and attracting numerous users to be active on the Ton blockchain, in the long run, the TG ecosystem is different from BTC, Ethereum, Solana, and other blockchains that serve finance through blockchain technology. The TG ecosystem is more like using technology to serve other fields. This is an exploration and attempt of blockchain technology in more applications, different from the current mainstream web3 dominated by finance.

This difference comes from several aspects. Firstly, the users are different. In finance-dominated ecosystems, users are mainly investors, while in the TG ecosystem, most users are consumers, with fewer investors in number, and the average spending power of investors is higher. Secondly, the applications are different. Mainstream chains such as ETH and Solana mainly focus on applications in the financial sector, including DeFi, Oracle, etc., even GameFi and SocialFi are also focused on the financial aspect, ultimately becoming financial schemes. These chains provide a certain guarantee for financial security and liquidity due to their larger scale. On the other hand, the projects that have exploded in the TG ecosystem are mainly games, gambling, payment projects, etc., which rely more on the number of users and usage time.

As seen in the TVL ranking, even though Ton's TVL has surged to $700 million, it still lags far behind Ethereum's over $50 billion, as well as Solana and BSC's over $4 billion. Therefore, we believe that the TG ecosystem is not snatching business from existing web3 projects, but rather opening up a new path to convert web2 users into web3 users. Its application scenarios are different from traditional web3. The TG ecosystem is more like enhancing WeChat mini-programs with payment functions, while ecosystems like ETH and Solana enhance finance with technology. The TG ecosystem is still in its early stages, and there will definitely be more practical applications appearing in the TG ecosystem in the future, not limited to games, ultimately becoming a super app like WeChat. The development of the Ton blockchain will lean more towards being a payment method and auxiliary for applications. Whether the TG ecosystem will get more involved in the financial sector remains to be seen in response to traditional old chains.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。