Predictive markets are an important source of data and may be the closest to the truth.

Author: LAWRENCE

Translation: Deep Tide TechFlow

Birth

In the year 1503, the papal election was underway. The citizens of the Papal States awaited the coronation of a new pope, despite the unrest in the Papal States due to the Italian Wars and the backdrop of the Protestant Reformation, with three hostile armies surrounding the city.

In Rome, many people waited with bated breath, not only because of the historical significance of the election, but also because they were betting on the outcome. Bank-employed messengers ("sensali") raced around the city, transmitting betting slips and changing odds in real time, as 39 cardinal electors were isolated until a new pope was chosen. After a tense day, the favorite candidate, Cardinal Piccolomini, with odds of 30 to 100, was elected as Pope Pius III, the 215th pope of the Catholic Church. Many citizens shed tears, some out of joy for winning their bets, and others out of financial ruin.

However, for the fervent gamblers, Pope Pius III died of an infected leg ulcer after only 26 days in office. Another papal election was held within a month, providing another opportunity for the citizens of Rome to recoup their losses.

Over the next few decades, such stories repeated themselves—papal election betting became a norm for the citizens of Rome and a recognized activity. By the late 16th century, this phenomenon had become so rampant that the 229th pope, Pope Gregory XIV, decisively intervened, threatening to completely ban it or expel those involved from the Church.

However, history always repeats itself, and election betting, like a hydra, was often banned but never disappeared. Election betting resurged in the early 20th century. In the 1916 election between Charles Evans Hughes and Woodrow Wilson, the betting pool swelled to $280 million, equivalent to today's value.

Today, in the United States, such practices are highly regulated and require approval from the Commodity Futures Trading Commission (CFTC). More importantly, according to a 2012 ruling, regulated markets cannot offer contracts on political events. This has left a huge market gap, providing significant opportunities for emerging companies.

Chaos Emerges

We live in a highly dramatic world, where aggressive attitudes are often rewarded. The rise of short video media further fuels this trend, as our attention spans grow shorter in an information-overloaded world. In this era of instant gratification and material abundance (in developed countries), provocative content can bring attention and financial rewards to creators. The 2024 US presidential election is a typical example, being the most controversial election in decades, which has also sparked the rise of predictive markets, leading audiences to follow their idols more fervently.

From sports to entertainment, betting has always captured human attention. Now, predictive markets are bringing this allure to politics and more fringe events, and may persist in the long term.

No other crypto application has attracted as much attention as Polymarket, one of the world's largest predictive markets. While Polymarket was not the first crypto predictive market, it emerged at the right time and place, with exceptional business development and outstanding social marketing support.

Chapter One: Genesis

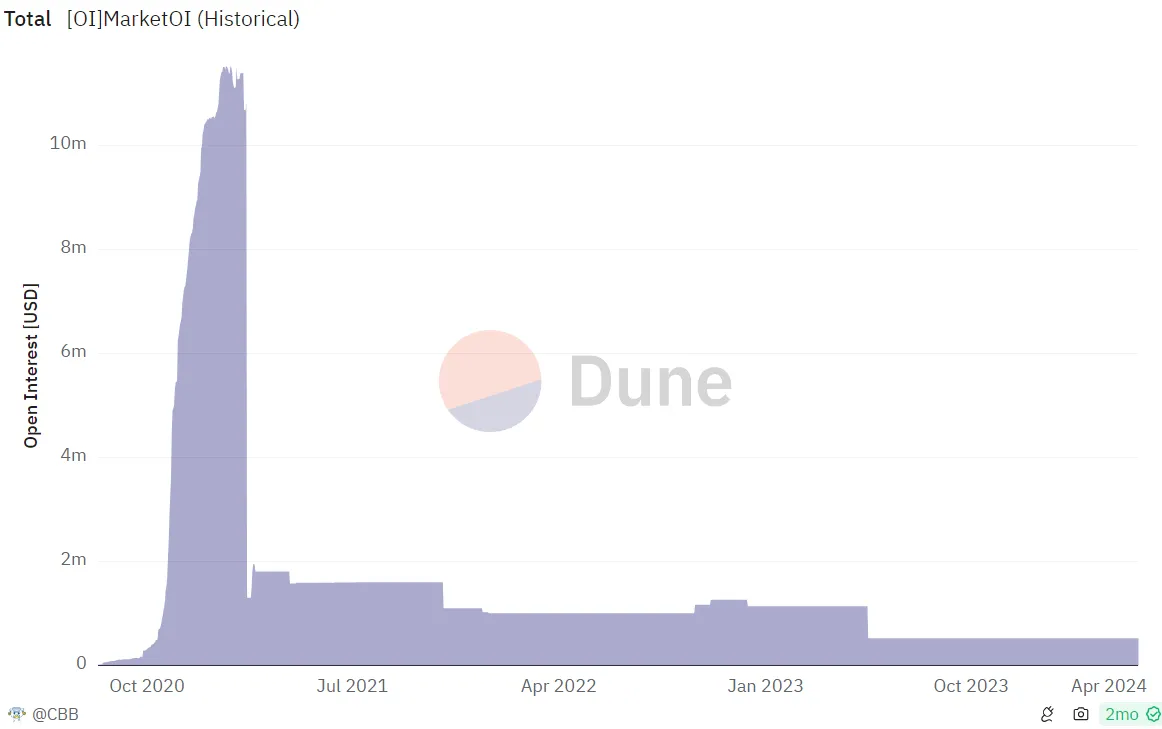

The pioneer of crypto predictive markets is Augur, which allows third parties to bet on event outcomes. Augur was founded in 2015 and conducted an ICO ($REP) in the same year, becoming one of the earliest protocols to do so. After three years of development, Augur went live on the mainnet in 2018. Augur v2 was launched in 2020, but on-chain activity did not significantly increase. At its peak, v2's open interest contracts barely exceeded $11 million, and as of today, it is only $500,000.

Note: The peak in October 2020 is related to the presidential election at that time.

Chapter Two: The Road to Dominance

Polymarket was born in 2020, amidst the shadow of Augur v2. Similar to Augur, Polymarket is a decentralized predictive market platform that allows users to trade on the outcomes of world events. After years of effort, it truly came into its own in 2023 with a controversial market on whether the Titan (a submersible visiting the wreckage of the Titanic) would be found before running out of oxygen.

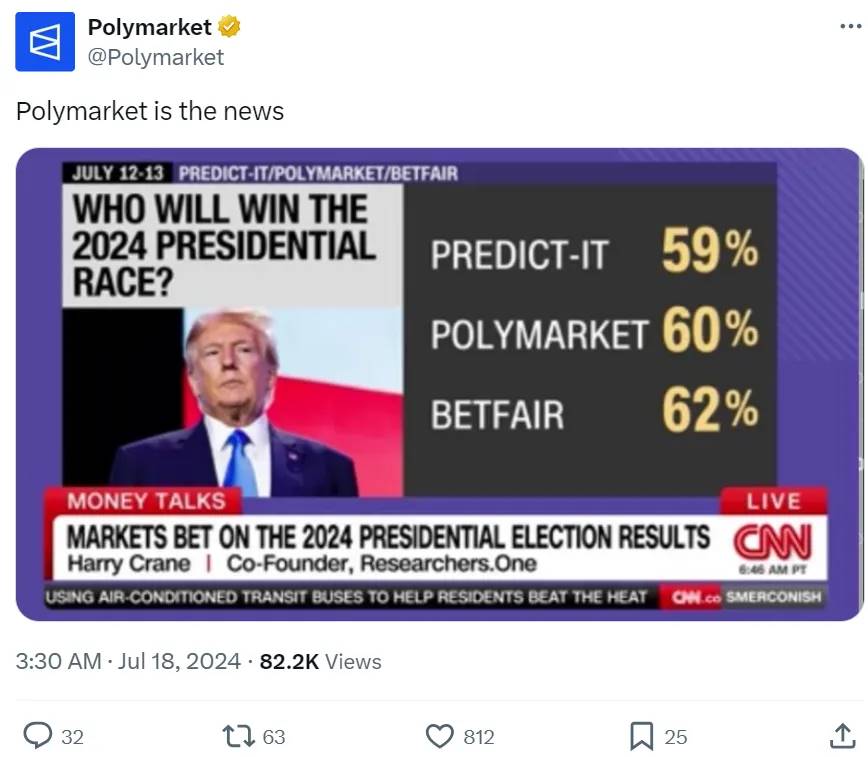

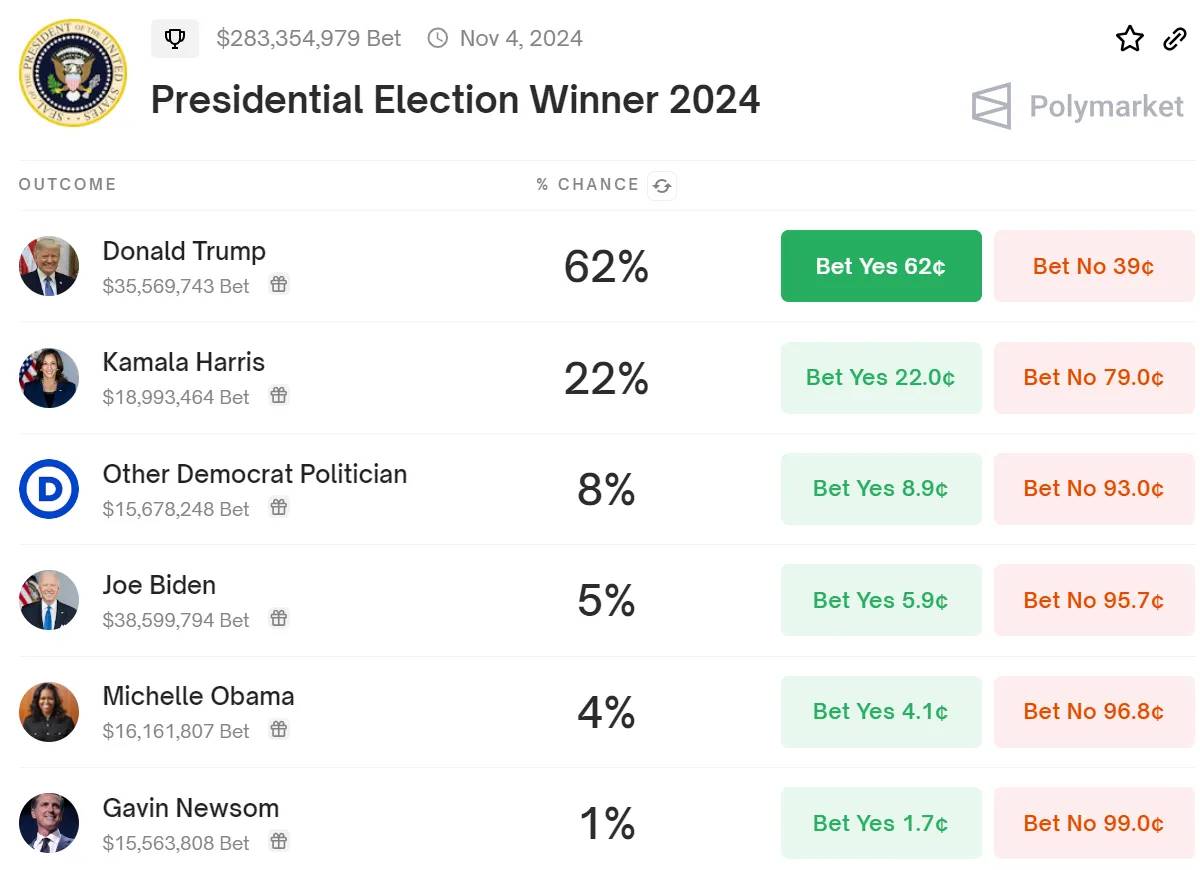

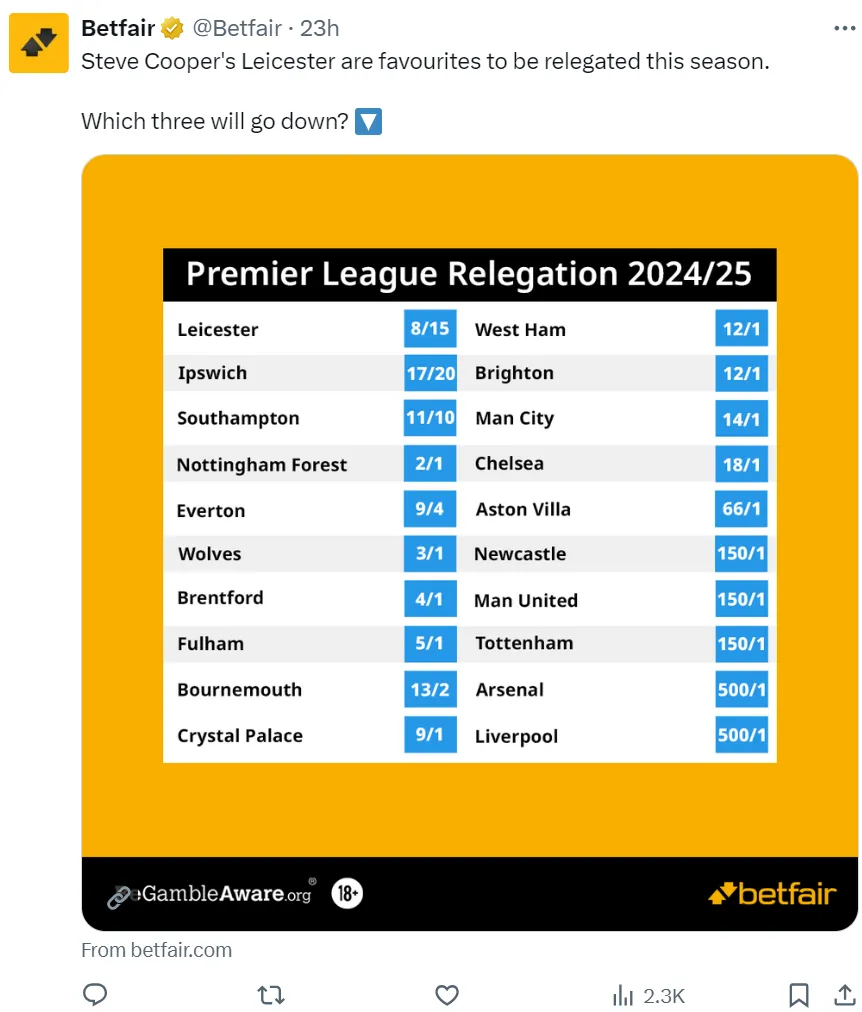

As of today (July 2024), Polymarket has grown to become one of the world's largest predictive markets, with over $283 million in open interest contracts just between Biden and Trump in the presidential election. This far surpasses all other betting platforms, including the centralized competitor Betfair (with open interest contracts of £31 million).

The operation of Polymarket is straightforward—users purchase shares in the market, and the price of these shares represents the current probability of the event (ranging from 0 to 1). These prices fluctuate based on real-time market and financial demand, representing the probability of the event. It is worth noting that users can exit the market at any time, just like most liquid assets. The protocol also supports mutually exclusive markets with multiple binary questions, providing traders with more complex strategies.

Polymarket's pool for the presidential winner

At its core, Polymarket is a hybrid decentralized predictive market that bypasses KYC procedures through USDC on Polygon. Architecturally, it is partially on-chain; order matching on the order book is done off-chain, but all bets are settled on Polygon. However, market creation is somewhat permissioned, and users must be manually approved by the team on Discord.

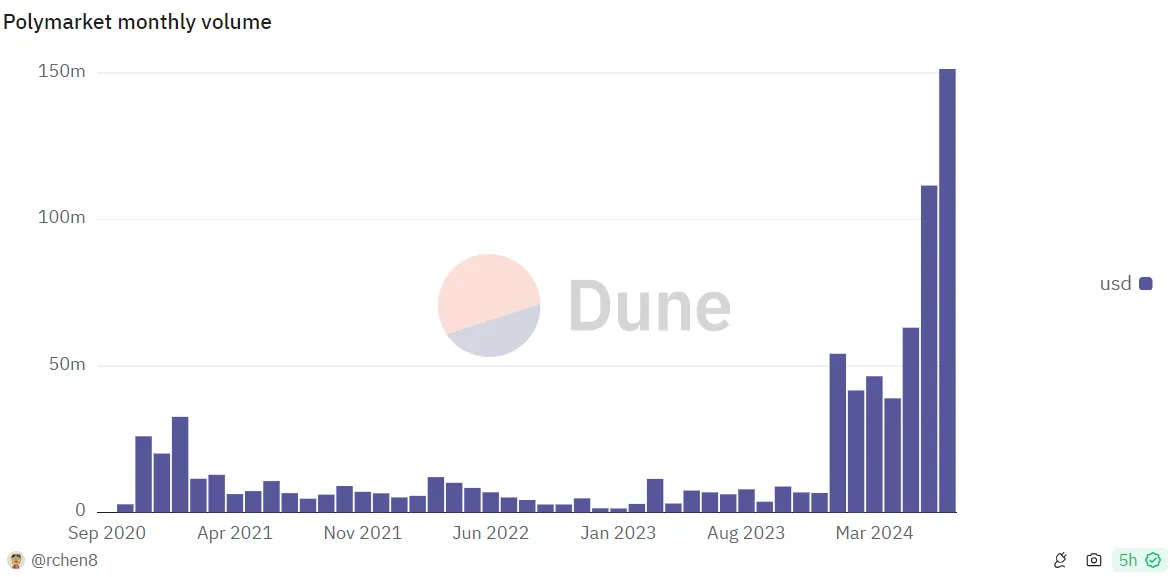

Polymarket's growth significantly increased in early 2024, with monthly trading volume reaching a record high of $151 million as of July, compared to $6 million in the same period last year. Monthly active users (MAU) reached an astonishing 25,000, compared to just 1,000 in July 2023. 2024 also witnessed an influx of new users, with over 70,000 new members joining in the past 3 months.

Chapter Three: Trial

It can be said that Polymarket's success has two key factors:

a. Solid product-market fit (PMF) at the right time and place

The polarization of American politics, coupled with our shrinking attention spans in an information-overloaded world, has made us more focused on dramatic real-life events and radicalization of everything, fueled by the influence of social media.

While this polarization may not directly lead to political violence, it has indeed fostered an environment that encourages it. From the January 6, 2021 attack on the US Capitol by Trump supporters attempting to keep the then-president in power, to the failed assassination attempt on Trump in July 2024, such incidents have occurred time and again. While the US may have avoided a civil war, the radical rhetoric on all social media platforms suggests that this situation has no end in sight.

Similarly, the rise of short video apps like TikTok has shortened user attention spans. The behavior of endless scrolling is akin to the basic principles of a slot machine ("random reinforcement"), constantly providing satisfaction and dopamine rushes.

b. Solid Go-To-Market (GTM) Strategy to Attract and Retain Users

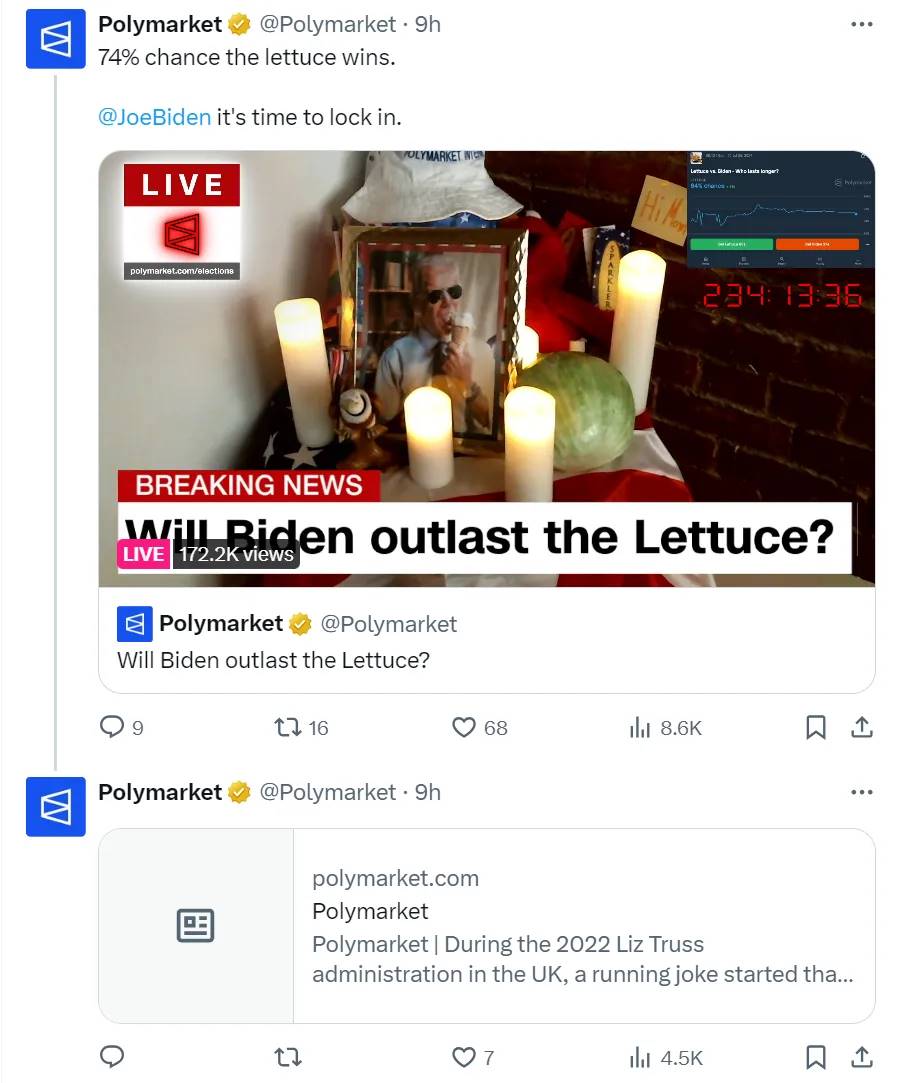

One of the many tweets using memes to attract users to the platform

Polymarket's Twitter marketing strategy stands out among its competitors. With colorful memes and witty banter, Polymarket has gained more attention and engagement. Its tweets are more appealing compared to those of ordinary competitors.

Polymarket's viral spread also contributes to driving organic marketing, not only helping to retain users but also increasing their mindshare. This is crucial, especially considering the cyclical nature of major events.

Utilizing impact to drive viral spread of tweets for organic marketing

Chapter Four: Omens

The brightest light often casts the longest shadow. Despite Polymarket's mainstream media attention, it still faces some potential challenges that need to be carefully managed.

a. Unusual interest brought by the US election; significant drop in trading volume post-election

The post-election impact will be significant, with limited operational mitigations. Apart from occasional major events, sports markets also provide a great revenue source for Polymarket, despite being saturated and fragmented.

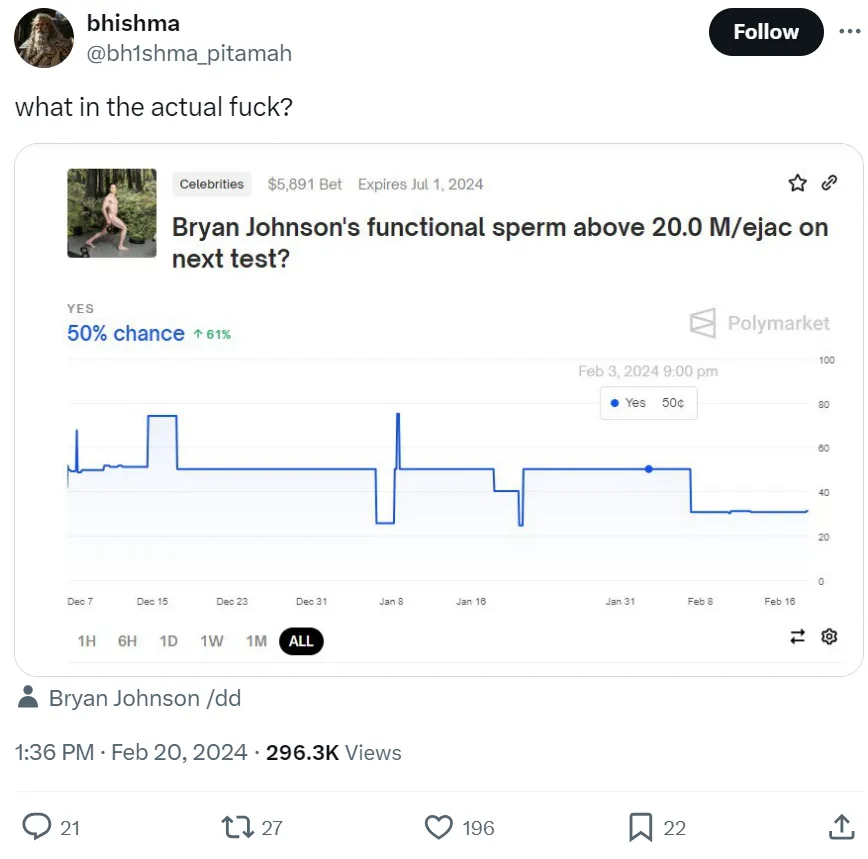

b. Niche and potentially "viral" markets can bring attention but may also bring harmful traffic

Quirky markets like Bryan Johnson's, while interesting, carry the risk of exposure to harmful traffic and insider trading. Relevant individuals (or their associates) may have prior knowledge of the results before settlement and use this to their financial advantage. Therefore, these markets may be primarily used for marketing purposes rather than actual financial gain.

c. Subjectivity of results may highly polarize the community, leading to Polymarket leaning towards the majority

In highly technical predictive markets, the protocol may tend to cater to the opinions of the majority. The May 2024 ETH ETF prediction pool is an example. The controversy lies in the definition of "approval," with differing opinions on partial approval (19b-4 application) and full approval (19b-4 application and Form S-1). After the SEC approved the 19b-4 application, the pool was dissolved as "yes," leading to strong opposition from the "no" buyers.

Nevertheless, I expect such issues to diminish over time as the team gradually deploys clear pools for "yes" and "no" scenarios.

Conclusion: The Final Viewpoint

Ultimately, predictive markets as an important source of data may be the closest to the truth. Due to the financial incentives within the mechanism, the involved substantial financial interests often surpass the insights of individual experts. They provide a powerful and unparalleled perspective on future outcomes, shaping our understanding with astonishing accuracy.

Regulatory bodies may crack down on these markets, but their ability to do so is limited, as Polymarket primarily operates on-chain. And historically, the demand will always exist.

The Eternal Game

It is now 2036, and people are watching live broadcasts of the year's hottest events through VR headsets. The quadrennial US presidential election has become a new sports league.

On election night, billions of people worldwide are glued to their headsets—not only watching the live broadcast but also interacting in multiple VR rooms, one of which not only offers spam functionality but also features predictive markets. Politics and major events are no longer dull and boring but have become more thrilling, with trillions of dollars at stake.

In the VR within the metaverse

In this new world, predictive markets have evolved from niche financial tools to mainstream entertainment, reflecting the deep integration of technology and culture. As we move forward in this hyper-connected world, the boundaries between political engagement and digital entertainment continue to blur, redefining how we experience and interact with global events. The evolution of predictive markets into such a central role highlights their profound impact on our collective consciousness and how we understand and foresee the course of history.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。