Author: Nian Qing, ChainCatcher

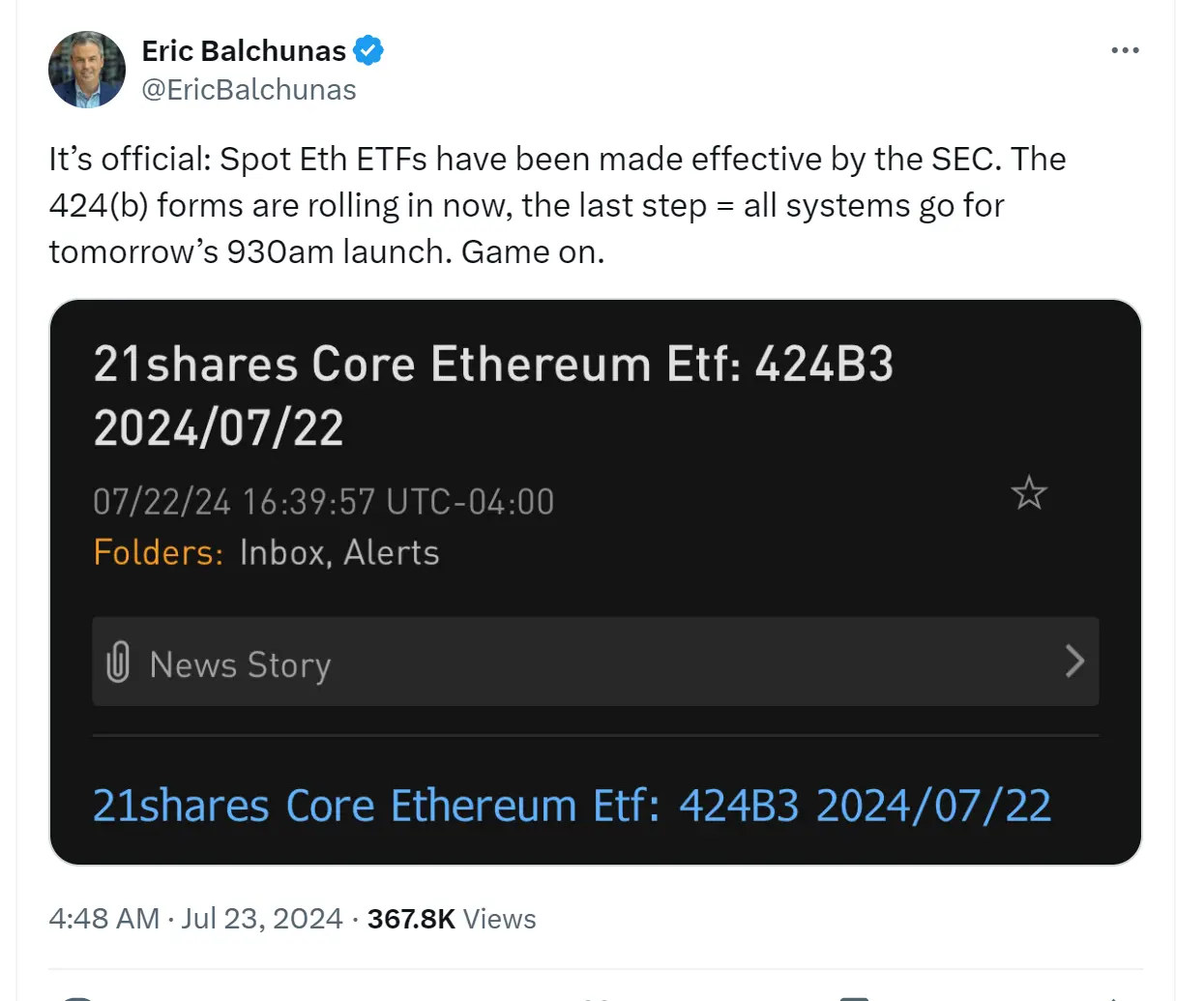

On Monday local time in the United States, according to regulatory documents and announcements from related companies, the U.S. SEC has officially approved the listing of several companies' Ethereum spot ETF trading applications. The Ethereum spot ETF has officially taken effect, with 424(b) forms being released one after another. Everything is ready, and now we are just waiting for the related ETFs to be listed at 9:30 am Eastern Time on Tuesday (9:30 pm Beijing Time on July 23).

The first batch of issuers for Ethereum spot ETF applications include:

- BlackRock Ethereum Spot ETF with a fee of 25% (0.12% for the first 25 billion USD or the first 12 months), with the code ETHA;

- Fidelity Ethereum Spot ETF with a fee of 25% (management fee waived for the entire year of 2024), with the code FETH;

- Bitwise Ethereum Spot ETF with a fee of 20% (0% for the first 5 billion USD or the first 6 months), with the code ETHW;

- 21Shares Ethereum Spot ETF with a fee of 21% (0% for the first 5 billion USD or the first 12 months), with the code GETH;

- VanEck Ethereum Spot ETF with a fee of 20% (0% for the first 15 billion USD or the first 12 months), with the code ETHV;

- Invesco Galaxy Ethereum Spot ETF with a fee of 25%, with the code QETH;

- Franklin Ethereum Spot ETF with a fee of 19% (0% until January 31, 2025, or the first 100 billion USD), with the code EZET;

- Grayscale Ethereum Spot ETF with a fee of 50%, with the code ETHE;

- Grayscale Ethereum Mini Trust ETF with a fee of 15%, with the code ETH.

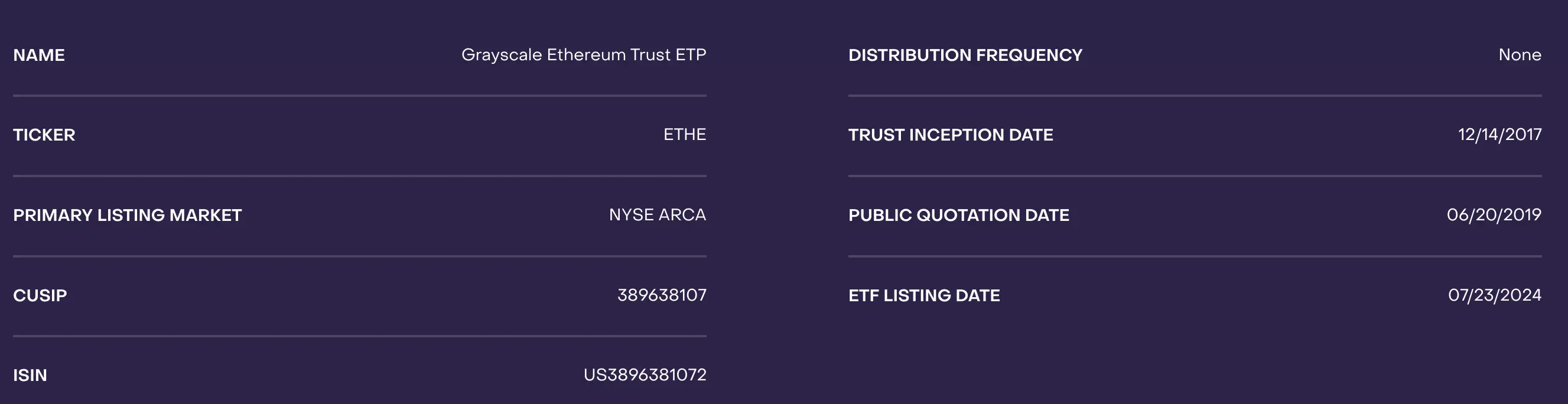

It is worth mentioning that similar to Grayscale's GBTC, Grayscale will convert the existing Grayscale Ethereum Trust ETHE into an ETF, maintaining the previous fee rate of 2.5%. In October last year, Grayscale and NYSE Arca jointly applied to convert the Grayscale Ethereum Trust fund into an Ethereum spot ETF.

According to data from Grayscale's official website, the ETHE trust was established in December 2017, listed in June 2019, and the date of ETF listing is July 23. Currently, ETHE holds 2.63 million ETH. Due to its early establishment, Grayscale's average holding price for ETH is only a few hundred USD. In addition, with the conversion of ETHE to ETF, the fee rate remains at 2.5%. Some opinions believe that due to ETHE's previous existence as a trust, which did not allow redemptions during its existence and had a 6-month lock-up period, coupled with the high fee rate of ETHE, which is 10 times higher than its competitors, this will lead to significant outflows.

Although Grayscale introduced the Grayscale Mini Trust ETF (with fees reduced from 0.25% to 0.15%, and free for the first 6 months, currently the lowest fee rate ETF) to prevent capital outflows, it is still difficult to avoid the selling pressure that occurred after the listing of GTBC.

Viewpoint: Selling pressure of ETHE will not be as significant as GBTC

ETHE trust was listed in 2019 and, like GBTC, is one of the earliest funds in the U.S. market that is tied to ETH. Previously, ETHE was a closed-end fund, and due to its structure, there were arbitrage opportunities relative to the net asset value of the fund. However, due to a series of bankruptcies such as FTX and DCG, GBTC and other trusts were once criticized by the market as the "instigator of institutional bubbles and collapses."

In addition, ETFs are more transparent, have stronger liquidity, lower thresholds, and redemption risks, and are more easily accepted by mutual fund managers and pension funds. Therefore, they are more likely to be popular in the market. Therefore, while other institutions are applying for spot ETFs for cryptocurrencies, Grayscale's GBTC and ETHE trusts, in order to avoid being gradually marginalized, have ultimately been converted into ETF products.

Because after GBTC successfully converted to a Bitcoin spot ETF, the selling pressure lasted for over a month, there are concerns in the market about the potential large-scale outflows after the listing of ETHE.

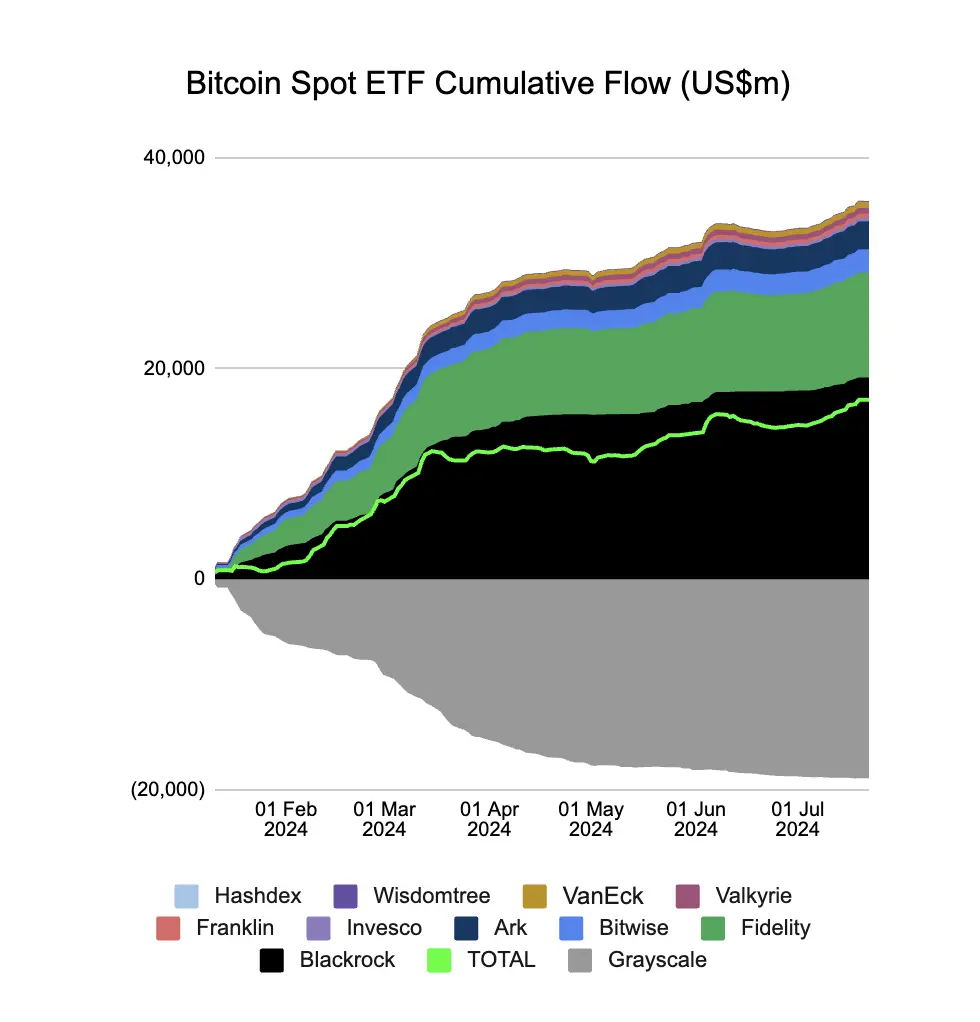

Data from Farside Investors shows that as of July 22, GBTC has been facing continuous capital outflows, with a cumulative net outflow of 18.49 billion USD. Although the scale of ETH held by Grayscale (valued at approximately 9.3 billion USD) is significantly different from that of GBTC, it is conceivable that the high fee rate of ETHE will still lead to certain outflows.

However, @analyst Theclues believes that there are significant differences between ETHE and GBTC, and the selling pressure after the listing of ETHE will not be as intense as that of GBTC.

She believes that the BTC ETF passed without any hitches previously and is expected to be stable, with nearly 100% increase in the three months before January 10.

On the other hand, the ETH ETF has been full of twists and turns, especially the huge reversal from "unable to pass in the short term" to "passed in July," and the speculation is expected to restart from 2800, with a current increase of 21%. The motivation for selling the news comes from the profit situation of speculative funds. In comparison, the motivation for selling ETH is incomparable to that of BTC.

In addition, although there are arbitrage profit-taking opportunities for ETHE (buying at a 40% discount), there are significant differences between ETHE and GBTC. Before the conversion to ETF, GBTC had a weekly trading volume of only slightly over 1 billion USD, while ETHE has had a weekly trading volume of over 4 billion USD for several weeks. In addition, the premium for ETHE has narrowed to within 6% early on, while GBTC's premium gradually recovered only in the two weeks before the conversion to ETF. Therefore, there is sufficient space and market depth for arbitrage positions in ETHE to sell ETHE shares. She believes that many predictions of selling pressure are based on the subjective view that the "predicted subject" is stationary.

Furthermore, even if there is selling pressure and dumping in the short term, ETHE will be absorbed by other Ethereum ETFs in the long term. We can see from the inflow and outflow trends of the Bitcoin spot ETF that although the outflow scale of GBTC is large, as of July 22, the net inflow of the Bitcoin spot ETF has exceeded 17 billion USD. From the price performance, the selling pressure has not had much impact on the price of Bitcoin.

In addition, compared to GBTC, there is another key measure: Grayscale has split the Mini Trust ETF from ETHE. According to its official website, as of July 18, 2024, 10% of the underlying ETH of the Grayscale Ethereum Trust (ETHE Trust) was split to create the Grayscale Ethereum Mini Trust (ETH Trust). Therefore, the net asset value of ETHE Trust shares will be 10% lower than the net asset value of the day before, without considering any potential rise or fall in ETH prices. ETHE Trust shareholders will receive the split benefits without taking any action and will have the right to receive ETH Trust shares in a 1:1 ratio. Therefore, their overall exposure to ETH will remain unchanged.

Currently, Grayscale owns both ETHE and ETH ETFs. ETHE holds an initial 90% of ETH with a management fee of 2.5%, making it more suitable for institutional and professional investors, while ETH holds an initial 10% of ETH with a lower management fee to reduce user attrition.

Therefore, compared to GBTC, as holders transition to the mini trust, the outflow of ETHE will be more moderate.

Grayscale's mini trust can also help long-term holders to reasonably avoid taxes. The mini trust helps ETHE holders find a good middle ground between not reducing income and selling, especially for holders who are potentially affected by capital gains tax.

Estimated Inflow Scale of ETH ETF

Currently, several institutions have estimated the inflow scale of the ETH ETF:

The Grayscale research team expects the demand for the U.S. Ethereum spot ETF to reach 25%-30% of the demand for the Bitcoin spot ETF. A large part of Ethereum supply (such as staked ETH) may not be used for the ETF.

ASXN's Digital Asset Research believes that after the ETH ETF is launched, ETHE holders will have a two-month window to exit at prices close to face value. This is a key variable that will help prevent outflows from ETHE, especially the outflow of exit traffic. ASXN's internal estimate is an inflow of 800 million to 1.2 billion USD per month. This is calculated by taking the market value-weighted average of Bitcoin inflows per month and then multiplying it by the market value of ETH.

Bloomberg ETF analyst Eric Balchunas predicts that the Ethereum spot ETF may receive 10% to 15% of the assets received by the Bitcoin spot ETF, reaching 5 to 8 billion USD.

Galaxy expects the net inflow of the ETH ETF to reach 20-50% of the net inflow of the BTC ETF within the first five months, with a target of 30%, which means a net inflow of 1 billion USD per month.

ShenYu predicts that the initial major inflow between June and December may come from retail investors, accounting for 80 to 90% of the total funds, with less participation from institutional users. Considering that ETHE is similar to GBTC, the market may face some arbitrage and selling pressure, and whether it can withstand this selling pressure remains to be seen. After December, institutional investors may gradually enter the market.

However, the market generally believes that the inflow from the ETH ETF will be limited.

Nikolaos Panigirtzoglou of JPMorgan predicted at the end of May that the inflow of the Ethereum ETF may only be a small fraction of that of Bitcoin.

Citi Bank expects the inflow to account for 30%-35% of the Bitcoin inflow. CoinDesk cited the report, stating that this figure will reach 4.7 to 5.4 billion USD within the next six months.

Both banks believe that Bitcoin has a first-mover advantage and emphasize that the functionality provided by Ether cannot be achieved through an ETF, thus limiting the demand.

How Will ETH Price Be Affected?

Currently, the general market view is that the news of the approval of the Ethereum spot ETF appeared to have a "Sell the News" effect in May, and with the SEC's approval of the 19-b and S-1 application documents, the market's waiting time was long enough, which likely means that the impact of the ETF on the market has already been digested, as the ETF is not expected to cause significant fluctuations in the price of ETH.

In addition, there are some more optimistic views that after the initial launch of the ETFs, Ethereum's performance will surpass that of Bitcoin.

Research from the analysis company Kaiko shows that the upcoming ETH ETF should enhance the performance of ETH relative to BTC. Kaiko states that since the approval of the ETF by regulators in May, the ratio of ETH to BTC (an indicator for comparing the two major cryptocurrencies) has significantly increased, from 0.045 to 0.05, and has remained at a high level. In other words, it takes more Bitcoin to buy one ETH, and when the ETF goes live, this trend will only deepen further. Although the price of ETH has been fluctuating since May, this ratio indicates that ETH is ready for an upward trend.

Rachel Lin, CEO of SynFutures, stated in May that in addition to demand factors, changes in supply will also bring upward potential, leading to a tightening of the price ratio between BTC and ETH. She believes that the market's attitude towards Ethereum is "not optimistic enough" at the moment, and all indicators suggest that ETH will experience a massive bull market in the coming months.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。