作者:Alex Liu,Foresight News

Neutrl,一个稳定币协议

4 月 17 日,合成美元稳定币项目 Neutrl 宣布完成 500 万美元种子轮融资,数字资产私募市场 STIX 和风险投资公司 Accomplice 领投,Amber Group、SCB Limited、Figment Capital、Nascent 以及 Ethena 创始人 Guy Young 和 Arbelos Markets(最近被 FalconX 收购)的衍生品交易员 Joshua Lim 等天使投资人参投。

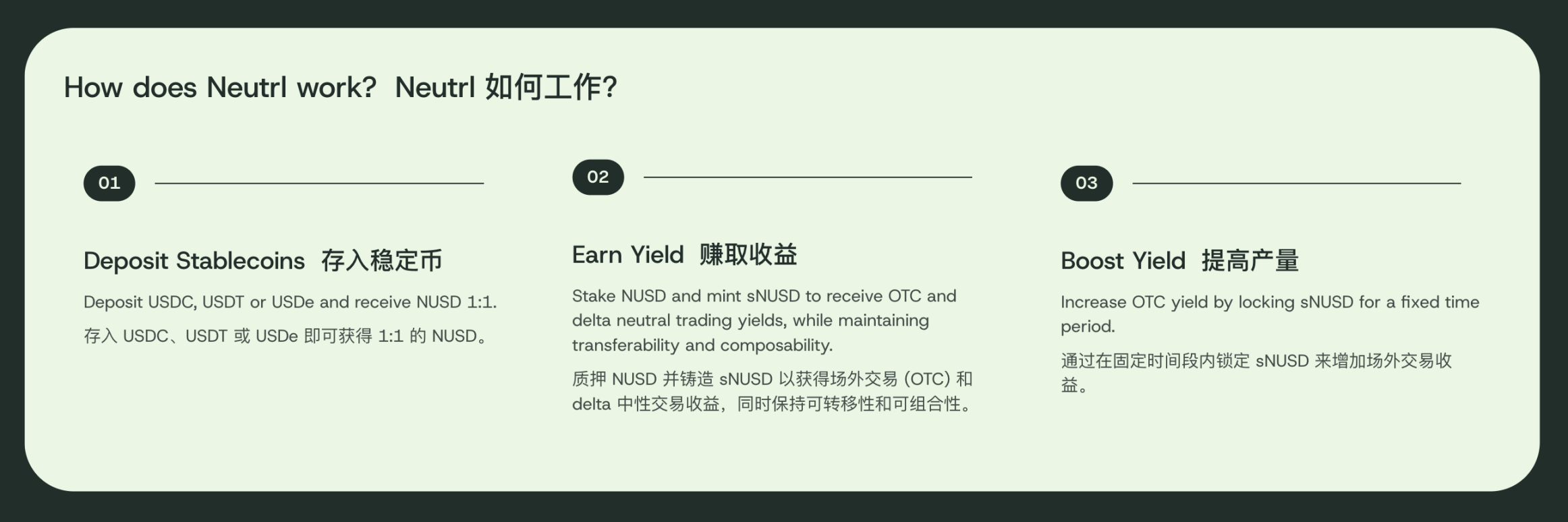

Neutrl 的产品模式类似赛道的龙头 Ethena,有和美元 1: 1 锚定的合成稳定币 NUSD 和产生收益的生息资产 sNUSD,分别对应 USDe 和 sUSDe。不同之处在于收益来源,Ethena 的收益来源于加密永续合约市场中的资金费率套利,而 Neutrl 的收益来源则更加激进:OTC 代币的折扣套利。

收益来源:OTC 折扣套利

VC(风险投资)等机构能以散户无法接触到的低估值得到项目的代币,这些代币也会附加更苛刻的解锁条件。一般来说,代币会有半年至一年的锁仓时间,两年至四年的线性释放周期。

缺乏现金流但代币尚未解锁?害怕代币在解锁时价值已大幅下降?单纯想尽快套现离场游艇别墅享受生活? OTC(Over The Counter,场外交易)便提供了这样一个选项:提前以折扣价卖出仍未解锁的代币。折扣幅度和项目质量与解锁条件相关,但通常会比较高。如某代币在一年后解锁,当前的 OTC 折扣可能在 50% 以上。

Neutrl 将用户存入的资产用于购买折价的锁仓 VC 币,同时合约做空等量的代币对冲以实现中性的风险(收益和代币价格波动无关。)

举个例子:在 Mantra 项目代币 OM 崩盘前以 60% 的折扣买入 1 年后解锁的代币,假设买入了 40 万美元。同时使用合约做空 100 万美元的 OM 代币。在不考虑合约资金费率和其他复杂因素的情况下,相当于已经锁定了 1 年后 60 万美元的收益。

即使现在 OM 代币在一夜间闪崩了 90%,OTC 买入的 40 万美元代币价值接近归零,但空单盈利 90 万美元,直接平仓反而缩短了利润落实的周期。如果 OM 没有崩盘,在一年后上涨了 50%,空单亏损 50 万美元,但是解锁的代币价值 150 万美元,所以说 60 万美元的利润被锁定。

潜在风险:它是「稳定币」吗?

这个策略看似很完美,但也存在问题。VC 为何不自己做空这部分仓位对冲,反而选择折价卖出呢?

首先,不排除某些 VC 的确在这样操作。但实际情况是 VC 投了哪些项目、资金用途通常被要求对 LP、投资者披露。投资机构做空自己的仓位,或许会损失商誉。其次,VC 们可能拥有某项目 10% 以上的代币,合约市场无法承接如此大量的做空体量,只能选择折价卖出。

而且,这样的策略面临着两大风险:资金费率异常和代币大幅上涨。

资金费率方面:若做空人数太多,做空方将不断向多头支付资金费率。负费率拉满的极端情况下,一天资金费率可能高达本金的 10%。对于动辄一年甚至四年的 OTC 锁仓周期而言,支付的资金费率可能高于 OTC 折扣带来的收益。当然,如果在牛市的大背景下,正费率也能带来额外的收益。

而如果代币价格大幅上涨,超过一倍,需要「无限保证金」撑到 OTC 代币解锁才能实现收益,否则空单中途爆仓,代币价格在之后重新下跌,就只剩空单的实际亏损了。并非每个人都能空到丝滑下跌的「W」和「MOVE」,如果空「TIA」而中途爆仓,最后就得不偿失了。

结论

Neutrl 背后是一个高风险的策略套利,它们在风险管控上可能比普通投资者专业,但潜在风险依旧不可忽视。

这个高风险套利基金以稳定币的名义吸收用户存款,似乎欠妥,需要更加强调风险。但 Ethena 本质也是披着稳定币壳子的套利基金,没有 Ethena 和 Neutrl,散户很难有机会接触到它们背后的策略收益,也算是 CeDeFi 领域的创新和进步,为用户开放了更多收益选择。

Neutrl 还未正式上线,目前可以前往官网提交 Waitlist 申请早期访问。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。