"Technical barriers" are paper tigers, and "having people come to play with you" is the key to survival.

Interview: Jack, BlockBeats

Translation: Luccy, Ladyfinger, BlockBeats

After the end of the Alt L1 era led by the "Solunavax Three Musketeers," the "new public chain" track has become boring. On the one hand, the improvement of modular infrastructure such as L2 and RaaS has made "creating a chain" a relatively simple matter. On the other hand, large and comprehensive new public chains have shown a high degree of homogenization from ecological architecture to front-end experience, with a bunch of new terms in the promotional materials, but in reality, even the names are the same, same, same.

In the past year, both teams and VCs have excessively focused on the so-called technological innovation of the chain, emphasizing TPS and settlement speed all day long, but ignoring the basic issue of product PMF. Under the community calls for "anti-VC coins" and "anti-high FDV," the market is no longer willing to foot the bill for these high-performance new ecological public chains, and many large projects have become ghost chains.

In contrast, Solana and TON, which take user activity as a breakthrough, are particularly popular. People are losing money happily in pump.fun and getting cramps in their pinkies on Telegram. You can see from the price performance of SOL and TON that as long as there is a reason, people will buy at a high price. So "VC coins" are not the fundamental reason for the birth and death of new public chains. "Technical barriers" are paper tigers, and "having people come to play with you" is the key to survival, which is also the simplest way to judge the potential of public chains. According to this logic, if we review the new public chains in the market today, perhaps only Berachain can surpass the passing line.

Recently, BlockBeats interviewed Smokey The Bera, co-founder of Berachain, and chatted about their "hasty" logo design and how they plan to "squander" the $140 million in financing they have on hand.

Grassroots culture + sky-high valuation = ?

Berachain, from any angle, is an atypical chain. The somewhat abstract brand name, the casual logo design, and even the consensus mechanism have turned into a DeFi game. But it is precisely such a grassroots-colored chain that has completed two rounds of financing, A and B, totaling $140 million in the past year at a sky-high valuation. Before understanding it deeply, Berachain might really make you doubt the world is a big stage.

However, in reality, Berachain has the most genuine Degen genes. It originated from a rebase NFT project called Bong Bears, and was subsequently launched by several DeFi OGs, quickly attracting a group of early DeFi investors to join. Despite its emphasis on grassroots culture, Berachain is not a grassroots project in terms of strength or financial resources.

Interestingly, from Bong Bears NFT to today's Berachain, "liquidity" seems to have always been a key word around which the team has built its products. Behind liquidity is the design of gameplay, gaming, and returns, and the measure of the product is no longer the technical level, but the user profile and activity level.

BlockBeats: Before we start, could you please briefly introduce your background and why you decided to "transition" from an investor to a project founder?

Smokey the Bera:

Most of my career has been spent founding companies or allocating capital for companies. Before becoming a venture capitalist, I was actually already a founder. At that time, I was in the healthcare and biotechnology field, which is very different from the crypto field. But I think once you become a founder in one field, it becomes much easier to become a founder in another field, or you will understand better what it feels like to be a founder. That's why the transition was relatively easy for me to adapt to.

I think being a venture capitalist is a good path in some ways. I learned a lot through trial and error in my first entrepreneurial venture, and the results were good. Then I thought, I could work in the venture capital industry and use it to gain experience that I might not necessarily learn when focusing on a single product.

And now, I can say that I have gained a lot of information from my previous experience as a founder and venture capitalist, and have once again become a founder, but it wasn't particularly planned. As you mentioned, we initially saw Bong Bears as an interesting NFT experiment, but things developed beyond our expectations, and at some point we realized that we needed to take this project seriously.

In short, I like to explore new and novel things, and the role of a venture capitalist can help me do that to some extent, but I think as a founder, you can have a greater impact on certain things. So in many cases, if you want to see some rare opportunities, you have to go and do it yourself.

BlockBeats: Talking about Berachain, even with your institutional background and the project's huge financing, it gives people a casual and Degen feeling, unlike the conventional "VC project." Is this atmosphere intentionally maintained by you?

Smokey the Bera:

Yes, when we look back at the past few years of crypto projects or projects that have actually been able to build a real community and ecosystem, we can see a ripple effect: you initially attract some native crypto users or "on-chain Degens," and then this influence gradually spreads to other users.

For us, from the team's personality and the brand built around BeraNFT, being too formal would be of little effect. We didn't try to present ourselves like Sui or Aptos, even though we have a very qualified team that can compete fiercely with any other organization. But so far, even with a very limited marketing budget, the progress we have made can prove this point very well.

From the perspective of community alignment, this is also a suitable choice. As mentioned earlier, Berachain originated from a Bong Bears NFT project, which is almost impossible to present in a formal way, but in turn, it has become one of the strongest parts of our community. Because it is a very grassroots, very organic concept, people come together because of the culture, not by using bots or PUA users to complete various tasks, just a "gathering" of people who believe in this concept and enjoy teasing and socializing with each other, and trying to create a collegial environment.

BlockBeats: In the current market, people are increasingly nostalgic for those naturally grown "organic small-cap experiments," and this is exactly the atmosphere that Berachain conveys to users. But at the same time, you have also raised a large amount of VC capital. On the one hand, you hope to maintain a natural small-group atmosphere, and on the other hand, there is a lot of capital and speculators waiting for returns. How do you balance this conflict?

Smokey the Bera:

I think this is a multifaceted answer. There is a saying now that capital and community cannot coexist, but I think this is actually wrong. Capital can help you develop a community, create asymmetric opportunities and transactions that the majority of the group cannot access, especially now that we see more and more people with considerable financial reserves.

Many low FDV and early grassroots projects are actually in a more disadvantageous position in future communities because they are forced to sell the project's tokens to the open market or OTC platforms. Our view is that we would rather raise VC funds to have greater leverage in the market, attract the best talent, rather than sell to the community in the future. Every time you see the Ethereum Foundation selling tokens, people will say "the Ethereum Foundation is dumping its own tokens," and we don't want to do that.

I believe another important aspect is that when I explore new ecosystems, whether it's Arbitrum, Optimism, or other new L1s, in most cases, the real wealth creation is not from staking or governance gas tokens, but often from projects launching tokens on the chain. Looking back at all the recent L1 or L2 releases, most of them have done a poor job of attracting potential projects from zero to one to launch their tokens on their own chain, and they are basically relatively generic forks of existing products, so people lose interest after playing for a month or two. Look at the Blast ecosystem, Orbit Protocol once had a TVL of 5 billion US dollars, and now the FDV is less than 3 million US dollars. When the market is not favorable to L1 or L2 tokens, people simply don't want these tokens, so they often become very common "Pump & Dump" projects.

If we truly want a thriving ecosystem and maintain a sense of community, we need early community-driven, highly interconnected projects that truly provide opportunities for people. That's why we focus on building a local ecosystem before the release, to avoid the situation where there is nothing interesting to play with in the first 6 to 12 months for most L1s. On Berachain, we expect to see a series of exciting new projects that will quickly launch their tokens, giving people the opportunity to experience new things and continue to create wealth effects.

I believe that in this way, we can have the best of both worlds, with the capital to support projects for five to ten years or more, and the ability to take advantage of various strategic opportunities within the ecosystem. We have an incubator that can help us collaborate with the best teams in the ecosystem and quickly advance their development from a resource perspective. So far, there are 10 projects, with 5 of them completing the first batch of incubation, and two of them receiving investments from Binance Labs and Polychain. This brings top talent to the ecosystem and sets high standards, a process that usually takes several months or even years. So we see this "treasury fund" as a means to truly serve the community, rather than extracting value from it.

BlockBeats: Behind Berachain, there are many VC institutions, and there is an official accelerator within the ecosystem. How do you ensure that there are no "VC parties" and "princeling projects" within the ecosystem, and how can you cultivate naturally grown "organic" projects?

Smokey the Bera:

I want to be honest and say that our foundation does have an incubation department, but the projects involved account for only 5% to 10% of the total projects on Berachain. We tend to work with teams that we believe have great potential and with whom we hope to work closely, especially those who have good ideas but lack marketing resources for their first venture, and we provide them with experience and guidance. I don't want to mislead anyone by saying we don't incubate, but our approach to incubation is different from other teams. We are not just incubating some common ecological foundational projects, but focusing on novel and unprecedented things.

From our communication with the community, several things are very important to us. First is to show the world that you are excited about the product you are building. For the Berachain ecosystem, having a passionate community or a very active early group makes it easier for developers to notice you and see opportunities here.

We also have some community members whom we have known for a long time, and they have witnessed the continuous development of the project and at some point felt the urge to build something themselves. So, it is very important to have such community leaders who, from just posting and trading, become builders.

Secondly, I believe in having a supportive culture, where the foundation or lab is hands-on in helping these projects.

I see many ecosystems either take a very hands-off approach, thinking that once the infrastructure is built, the applications will follow, or just throw a lot of money at people. I think both of these approaches are wrong. Throwing a lot of money will only attract developers who cannot find capital on their own in the short term, and being completely hands-off will not make any team working in your ecosystem feel supported.

I think the best thing the foundation can do is to show that it has put in a lot of work for ecosystem projects and invested a lot of beneficial time, including collaborating with these teams on market strategy, token economics strategy, or anything else, to ensure they have the best possible experience and truly become an extension of their team in an unofficial way.

The key here is to be their advisor, to help solve problems, rather than do everything for them. Our role is to guide them in the right direction. This is like the ancient Chinese saying "Give a man a fish and you feed him for a day; teach a man to fish and you feed him for a lifetime." It's a simple and straightforward metaphor, but it aptly explains our philosophy.

BlockBeats: So, Berachain is prepared for developers in terms of liquidity, community, and project growth, with liquidity helping to kickstart, the community helping to find users, and the incubator acting as a mentor, in short, if you're a developer, this is the place for you.

Smokey the Bera:

I completely agree. The key is to show our presence and our willingness to invest time and effort. In this scenario, the team is the customer, and our task is to ensure that they feel truly supported and integrated into a carefully planned, non-toxic ecosystem. This is not an environment filled with negativity and mutual belittlement, but an atmosphere of fun, friendliness, and encouragement.

We have a developer chat group with about 400 members developing different products on the chain. Although there is a lot of copy-pasting and joking in the group chat, I actually like this atmosphere because it fits the image of our ecosystem very well. When new teams join, they announce their building plans and inquire about potential partners and projects others are developing. Such interactions naturally lead to some very cool collaboration opportunities before the chain goes live.

BlockBeats: How do you create a practical project? It seems that projects with tokens have no revenue-generating ability, and projects that can generate revenue do not consider issuing tokens.

Smokey the Bera:

This is a fact, and many times issuing tokens has become the "last act" of a project's life. I have always believed that the best projects can gain widespread adoption without tokens, and then use tokens to further drive that adoption.

Of course, it's easier said than done. To achieve this state, you need to provide an outstanding product or offer a unique service. Only when users have no other options elsewhere will you see a high degree of adoption, otherwise, users will only try various methods to get more of your tokens.

As for how to build a good project, I think the key is innovation, not for the sake of innovation itself, but also excellent communication, deep consideration of user experience, and product thinking. A particularly bad tendency in the crypto industry is to build castles in the air around highly technical or terminological concepts that people cannot truly understand, and ultimately these technologies do not have much practical use, even though they look cool in theory. If you approach the problem from a more product-centric perspective, you will go further.

Take Berachain as an example, the question I think about the most is: how do we ensure that we effectively educate people to understand what Proof of Liquidity (POL) is and how it differs from the applications we have seen before. Of course, it is very powerful at the technical level, but we want the system to be familiar to users like a familiar tool, while providing them with some unprecedented new features. This is what many excellent projects do, they provide users with the opportunity to do new things that have a clear demand, but in a way that is not unfamiliar or intimidating.

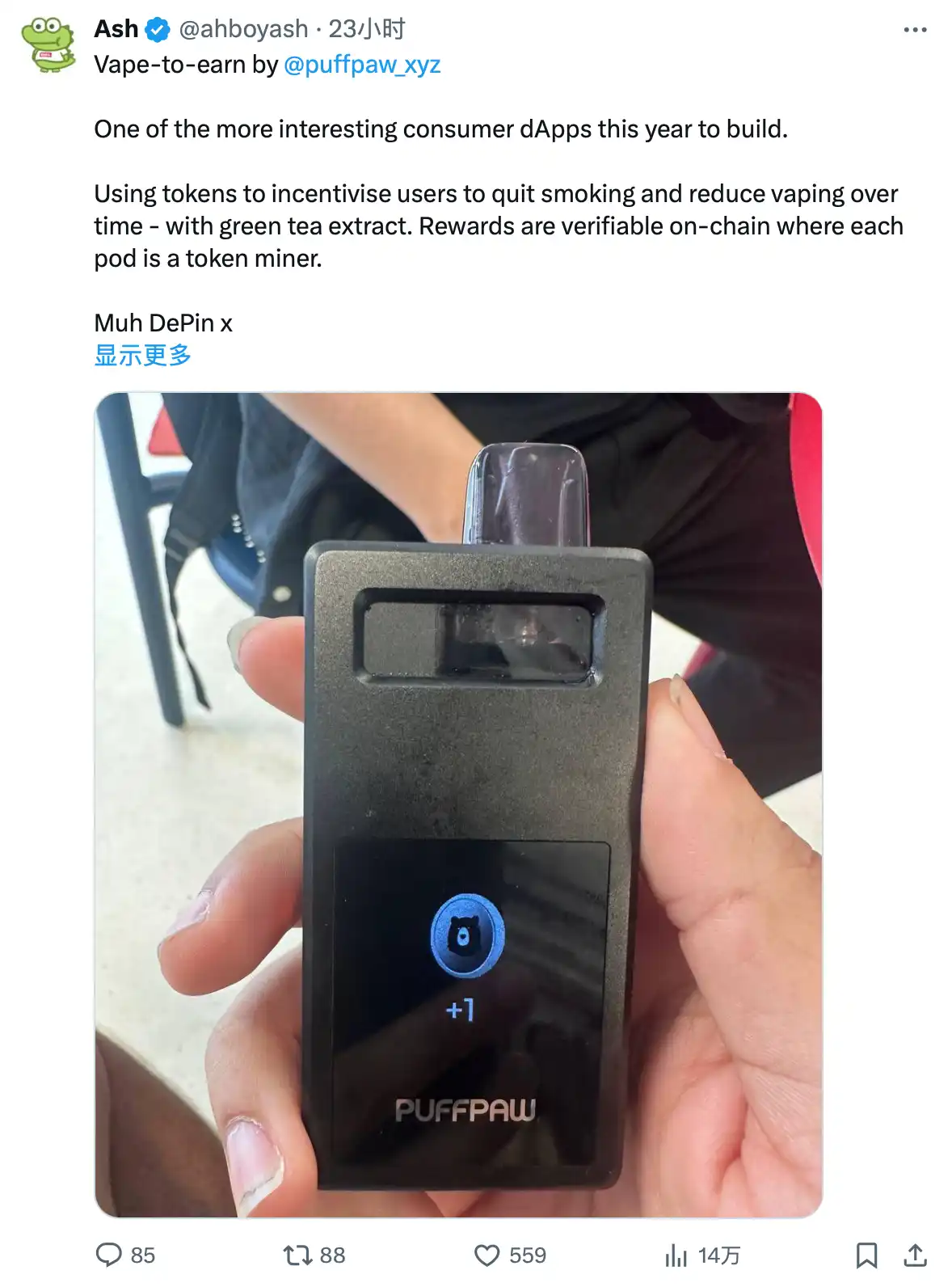

For example, token launchpads are often seen, and Pump.fun has added a collaborative curve element to it, which is familiar to people and not intimidating. On the other hand, the increasingly popular projects, such as Expomets on BeraChain, encourage users to leverage long and short trades on low-market cap meme coins and altcoins. Leveraged trading of junk coins is definitely one of the most obvious product-market fit cases in the cryptocurrency space. Therefore, it is crucial to build products that truly suit the user base. Many people are just stuck in the theoretical construction phase without realizing that what they are building may not be truly needed.

BlockBeats: Based on this methodology, is creating an "on-chain casino" or "leveraged market" the best choice for entrepreneurs?

Smokey the Bera:

I don't think it's the best choice. More accurately, it is a project that has achieved a certain balance between product and market demand. But the key lies in the distribution strategy, which is a challenge in the crypto field, as few teams can achieve excellent distribution.

Conducting experiments on a large scale

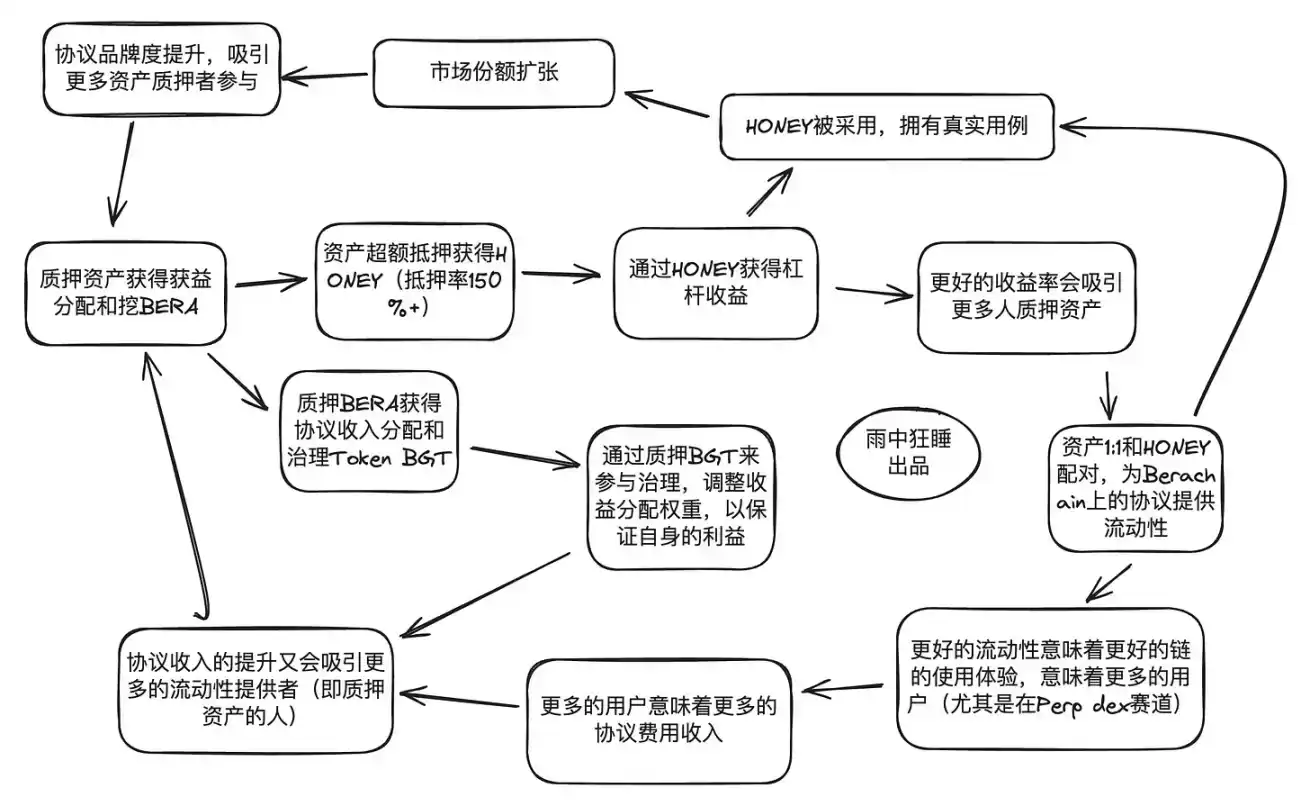

Compared to most new public chains, Berachain is really playing with the consensus mechanism. Berachain's POL liquidity proof uses three tokens: BERA, governance token BGT, and stablecoin HONEY. BERA is used as the native token to pay gas and block rewards, BGT is a non-transferable governance token that allows holders to participate in the decision-making process for block reward distribution, and HONEY is the native stablecoin minted by users through collateral.

Users deposit assets into the ecosystem to receive BERA and use HONEY to form LP and provide initial liquidity to the protocol, thereby obtaining BGT emissions. In addition to obtaining BGT through LP staking, projects whitelisted in the ecosystem also qualify for BGT rewards. Staking BGT not only allows for network fee income distribution but also has an impact on the quantity and direction of BGT emissions, such as giving more to project A and less to project B.

To obtain more BGT, projects need to engage in various "bribery" activities with BGT stakers, and when participants transition from one liquidity pool to a project, the bribery game naturally becomes more prevalent. In other words, Berachain has turned itself into a large-scale Curve.

BlockBeats: So for Berachain, its biggest advantage is having a large amount of capital to provide initial liquidity for the entire ecosystem from the beginning. The key is to have a gamified mechanism that encourages the flow and circulation of these funds among various projects and user groups.

Smokey the Bera:

Yes, many of the best ecosystems can establish a walled garden. In other words, you want an ecosystem where people can maximize their capital without needing to go elsewhere for specific services.

For Berachain, this will be the first chain that can "have the best of both worlds." You can participate in LP and engage in social and governance activities in multiple different applications such as DeFi, NFT, and GameFi, and then make specific projects eligible to receive native rewards from the chain by getting whitelisted or voting, which means you can earn native staking rewards on Berachain while obtaining project governance tokens, and your influence on network incentive distribution is also doubled.

So we hope to minimize people's opportunity costs and have an ecosystem that can effectively attract external funds and to some extent be self-contained, so there won't be a large outflow of funds, leading to ecosystem instability and the ability to build more complex products.

BlockBeats: Perhaps Blast encountered this situation, where most users withdrew their funds immediately after the airdrop distribution was completed.

Smokey the Bera:

Exactly. I think the role of incentive mechanisms and community stability is very important in the entire ecosystem. If a community becomes too utilitarian or is designed too intricately, it is difficult to achieve lasting effects, which to some extent reflects the current situation.

On the other hand, you can see that many ecosystems that have stood the test of time have meaningful interaction mechanisms with the community, gathering the community together through their unique culture or methods. For example, Solana has done this very well. There is also a more peculiar case, which is the Tron ecosystem. No one talks about or considers Tron, but there is a lot of capital there, the issuance of USDT, and once people enter, they don't leave. I think this is also an interesting thinking model.

BlockBeats: Returning to the POL consensus mechanism of Berachain. It somewhat reproduces the concept of "protocol-owned liquidity" proposed by OHM, which means that the protocol or ecosystem has the autonomy to allocate liquidity. At the same time, in its specific implementation, it adopts a "bribery" mechanism similar to Curve, giving outsiders a gamified feeling. In this cycle, people generally do not have a positive view or are no longer paying attention to "DeFi experiments," especially after the recent founder liquidation event at Curve. But you chose to further amplify this experiment and elevate it to the level of a public chain. Why?

Smokey the Bera:

I think there are several subtle differences here. On the one hand, it can be seen as a DeFi ecosystem, and on the other hand, you can simply view it as a liquidity mechanism. I believe that all projects in the crypto field will, to some extent, rely on liquidity, whether it's providing liquidity pools for their tokens in DEX or launching the protocol itself, all projects will ultimately operate under the support of some DeFi-related technology.

Many GameFi projects basically have fee and reward accumulation mechanisms. Projects like Fantasy Top and Pump.fun have a collaborative curve (Bonding Curve) completely driven by DeFi behind them. In fact, the area that generates the most usage and revenue in DeFi or the entire cryptocurrency field is still DeFi projects, even if it's not as obvious now as it used to be, it's just that people don't openly discuss it as before, but if you understand Ethena, Jito, Pendle, and Pump.fund, they are all DeFi projects.

I think that while DeFi is an obvious and very clear initial use case for proving liquidity, it can actually be extended to any other field. It can be used to support gaming projects and social projects, and can be used for anything involving value exchange and liquidity. Therefore, it is actually a very flexible tool for the future. DeFi has a very clear initial use case, but we see more and more "exotic" things starting to be driven through it.

In fact, Berachain's mechanism is not close to the protocol-owned liquidity model, it does help to bootstrap the protocol's liquidity, but it is more like liquidity directly guided by validators or LPs. Because ultimately, the way it works is that each validator has a set of threshold settings (Gauges), and users choose to delegate to validators based on their ideas for allocating block rewards.

So, users are essentially encouraged to work with some validators, who will allocate these block rewards to the pools they provide liquidity to each time they win a block, thereby increasing their own rewards. These pools also have a certain "bribery incentive," and users hope to win these incentives through validators.

But I think Curve has been very successful in many ways, so if you really want to understand the basics, you can see Berachain as "Curve-ification at the chain level," because you can directly and quickly allocate incentives not only to a specific DEX pool, but to any protocol on the chain.

BlockBeats: If Berachain is seen as the "public chain extension" of the Curve experiment, what are the differences in the mechanism compared to Curve?

Smokey the Bera:

The biggest difference lies in the logic of the validator protocol. In Curve, you can earn CRV emissions through farming and LP mining, and generally need to choose to lock it for a period of time to obtain veCRV, and the lock duration and quantity will affect the mining yield of CRV.

But Berachain does not have such a mechanism. Each validator has their own set of threshold settings (Gauges) for how their rewards or earnings are generated. Whenever a validator wins a block, they can choose the emission of the native token BGT, for example, sending 50% of the reward to Pool A, 25% to Application B, and 25% to Application C. The generation of APY and incentive weight in the entire system is derived from the weighted average of the delegation weight of the validator's BGT token. If one validator is delegated 1000 BGT and another validator is only delegated 100 BGT, even if both have set their reward distribution to 50% for Pool A and 50% for Pool B, the former will still receive more rewards from these pools because of its higher weight.

Another interesting aspect is that we do overlap with projects like Convex. The protocol can directly collaborate with validators to bootstrap their own liquidity, somewhat similar to the past Curve War, but the rewards come from emissions on an L1 public chain, and unlike veTokens that rely solely on locking and holding, BGT is a token that can earn fees from the operation of the public chain network and create burning pressure.

So, on one hand, you actually hold an asset that can accumulate value over time and are incentivized to hold this asset. Validators can choose to directly collaborate with the protocol, for example, a validator can approach a project team and say, "Hey, you give me your X token, and in exchange, I will allocate my Y emissions directly to your pool or protocol." This is a good way to provide validators with diversified income channels, and the process is similar to making an early-stage investment in a protocol, with almost no cost to the validator.

On the other hand, this mechanism can also serve as a tool for incentive distribution in the ecosystem, as users generally delegate to specific validators supporting protocols based on their preferences or desired incentives. You can say, "Hey, I want to delegate my BGT to this validator because they have incentives on Protocol X, and I happen to want exposure to Protocol X." I think the level of choice or game theory involved is higher than what I have seen in the Curve ecosystem, and it is also controlled by different trading pairs, validators can set rule weights, which actually greatly increases the complexity of this equation on different levels.

BlockBeats: In past DeFi experiments, everyone had to deal with token dumping issues, giving rise to models like ve(3,3) veTokens. How does BeraChain plan to address the emission issue of BGT?

Smokey the Bera:

I think the most important point is that we are not actually trying to rely on locking mechanisms to solve this problem. I understand the value of locking, understand its rationale, and logically, it makes sense, but I also believe that in many cases, this will only lead to more unhealthy hoarding of tokens and make sell-off events more intense than in other situations.

So, we actually try to avoid various veToken models. In Berachain, you can easily unbond or undelegate from a validator, we don't have a 21-day exit period like Cosmos, but rather a queue like ETH. If you want to have a good token, you have to build a good project. This is not a particularly novel insight, but many people try to bypass the process of building a good project by making their tokens more scarce, which is not the real answer.

I think you have to find a good scenario or method to make your token useful and effectively build an ecosystem around it. In the case of Berachain, that's what we're doing.

Users receive BGT from on-chain native emissions, and BGT is soul-bound and non-transferable, unable to be sold on the open market. At this point, you face two choices: one is to delegate these BGT to a validator to achieve compounding returns, including obtaining incentives from new protocols, receiving network fees, and effectively playing a role in on-chain incentive distribution and governance. The other is to burn them and receive BERA tokens, and speculate using the liquidity and ecosystem value of BERA tokens.

Berachain embeds the user's token usage choice into the underlying layer of the L1 chain, allowing you to choose long-termism and stack a large amount of BGT to be able to obtain a large amount of incentives and become a group that influences the direction of incentive distribution in the ecosystem. Or you can choose to immediately obtain a large amount of liquidity and then use it to form LP elsewhere on the chain. This freedom of choice is actually very healthy for allowing people to explore the ecosystem in their own way.

Many people currently overlook the design of token demand when designing projects, and our goal is to ensure that the existence of the token has practical utility. In most cases, attempts to delay and evade token dumping through complex locking mechanisms or other means often lead people to seek other ways to circumvent these restrictions, such as through strange OTC markets or derivative markets, and these practices often do not yield good results.

In conclusion

On June 13, Berachain's testnet V2 was launched, introducing BeaconKit and increasing the number of validators to over 200. This upgrade also makes Bearchain the first L1 project to achieve "EVM Identical" consistency. In fact, the Berachain team is not lacking in technical capabilities, but they have found that in the crypto space, it has almost never been successful to sell technology superiority to C-end users.

BlockBeats: Let's briefly discuss the technical aspects. Berachain V2 introduces the new concept of "EVM Identical," how does it differ from "EVM Compatible"? In the end, who will clearly feel the difference between them?

Smokey the Bera:

The main difference is in the developer experience. Although many chains claim to be EVM compatible, they are often not completely consistent, which can lead to developers encountering obstacles when migrating applications from the mainnet to other ecosystems. Typically, they need to maintain a Geth branch or similar library and make adjustments for specific consensus mechanisms.

As far as we know, Berachain is the first L1 chain to build a completely EVM-consistent environment. This means you can run execution clients like Reth, Nethermind, Aragon, Geth, etc., without any issues because they provide the exact same execution environment as Ethereum. As a result, any new EIP can be easily integrated, and the extension of compatibility is also completely the same. If developers want to build L2 on their chain, they can do so in the exact same way as on Ethereum, which is usually difficult to achieve in other L1 ecosystems.

Objectively, this also reduces a lot of workload for us, and in comparison to maintaining a large research team or engineering team for actual forks and comparisons with this environment, we believe that any contribution to the ETH mainnet benefits us to some extent. From the perspective of developer tools, this is a great boon for building extensive infrastructure, L2, and extensions. Overall, I think this is a very reliable tool that provides us with strong support.

BlockBeats: Many ZK Rollup projects that were highly anticipated last year now seem to be facing some difficulties. Has Berachain learned any "avoiding pitfalls" experiences from these projects?

Smokey the Bera:

No, we didn't really see the value in them. Although they are seen as a cool attempt in the geek circle, in actual communication, we found that developers encounter more problems in the process of developing products than solutions. As a developer, the resistance is huge because there are always many voices vying for your attention, asking you to choose Chain A or Chain B for development. If you encounter many obstacles when exploring a new chain ecosystem, it is often easier to choose to give up and say "I don't want to develop here" than to solve these problems. Therefore, our goal is to minimize the obstacles that developers may encounter as much as possible, ensuring that they can smoothly enter and use our ecosystem.

BlockBeats: If Berachain achieves huge success in the future, other established or new players may try to imitate your mechanism, what will Berachain do then?

Smokey the Bera:

I believe that technology itself is not the competitive advantage of a project. We do strongly support the idea of open-source software, although each codebase may hide some unknown details. But ultimately, technology is not the core factor that determines the success or failure of a project. It is a basic threshold, and if the technical performance is not up to standard, users naturally won't adopt it. What really matters is the combination of technical performance and distribution strategy, which helps to build a community and ecosystem.

I am confident that if someone claims that their project is an "enhanced version of Berachain," or if they imitate Berachain through forking and copying, there is no problem with that. In fact, I think such competition and imitation are beneficial. Just like Uniswap and Velodrome have been forked on different blockchains, these forks often add value to their original projects. I look forward to Berachain also having a similar positive impact, and even if multiple forks appear, we remain optimistic about their success.

I believe that simple technical replication cannot replicate the soul of an ecosystem, including its community culture and values. Although this may sound somewhat idealistic, I believe it has a real basis.

BlockBeats: One last question, if Berachain becomes successful in enterprise-level applications in the future, will you consider changing the current "grassroots brand" name and logo image?

Smokey the Bera:

We recognize that different people have different use case needs. As I mentioned, as we build and expand the company, many members have rich professional backgrounds in traditional fields, so we are very comfortable in a professional business environment. The identities of many of our team members are public, such as Adam, who is responsible for business development and has previously worked on hot startup projects for Amazon Web Services, handling thousands of top accounts, and later worked in business development at Third Web. This background allows us to showcase our past achievements and professional image while working at Berachain.

Our supporters include traditional institutions and individuals such as GoldenTree and Stephen Tannenbaum, as well as lead investors like Rrevan Howard Digital, who come from more traditional fields. Although the project may remain anonymous, there is strong corporate support behind it. In the future, we plan to further develop this direction, although we cannot reveal too much at the moment.

Brands are changeable, but enterprises are more concerned with our performance - whether we are excellent enough and whether we can build things from scratch. As the project enters the later stages of execution, people pay less attention to the brand and more to the actual results we can deliver.

We also see adjustments to the BeraChain brand in different contexts. For example, an L2 built on BeraChain recently completed a significant round of financing, and the team has extensive experience in the gaming industry, which will help bring tens of millions of users into the ecosystem. Through such branches, we can show people the different faces of Berachain based on different use case needs, such as consumers, gaming, etc. We are committed to keeping the brand true to its roots, while as the project progresses, we will strive to make more content and information more accessible to the general user, whether they are familiar with cryptocurrencies or blockchain technology.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。