1. Background

With the introduction of the Ordinals protocol and the BRC-20 standard, today's Bitcoin has not only revolutionized payment methods and value storage, but also changed the traditional financial system.

Further reading: "Interpreting the Bitcoin Ordinals Protocol and BRC20 Standard: Innovation and Limitations"

The exploration of the ecosystem has become more diverse, especially in the context of Bitcoin staking. While BitVm is still a long way off, projects like Babylon and PStake are already leveraging Bitcoin's security features to operate POS chains without changing the core Bitcoin protocol.

The staking layer has been initially breached, and traditional staking has brought security borrowing. Now, PStake further expands the evolution of liquidity staking, allowing BTC to maintain its liquidity while staked, making BTCFI seem not far away.

2. BTCFi

2.1 What is BTCFi

Bitcoin has never been considered an active asset, and its market value of trillions of dollars has been mostly idle. The focus on "security" in the BTC ecosystem is much higher than in other ecosystems, so any attempt to expand BTC seems particularly cautious.

BTCFi, decentralized finance built on the Bitcoin public chain, refers to the introduction of decentralized finance (DeFi) functionality into the Bitcoin ecosystem, allowing Bitcoin to not only serve as a store of value, but also to play a role in financial applications.

In essence, BTC and ETH users are fundamentally different. For C-end users, they care more about equal profit opportunities, decentralized culture, and equal power, so they are less sensitive to gas fees and often prefer to explore the potential of assets. In contrast, institutions and large holders who have been deeply involved in BTC infrastructure and stable finance for many years tend to adopt a long-term and conservative approach to earning profits, prioritizing security and stability.

BTCFi can meet the needs of B-end users and non-fomo ordinary users, transforming Bitcoin from a passive asset to an active one.

The author has previously discussed various DeFi infrastructures on Ethereum, most of which, including various stablecoin lending protocols, still rely on over-collateralization models, which are no longer consensual.

Further reading: "An Explanation of AAVE's Latest Stablecoin GHO Proposal".

Speaking of which, they all use over-collateralization models, the difference lies in whether the operating platform has the binding force of native smart contracts. So, do Bitcoin holders also have the opportunity to participate in staking, lending, and liquidity provision to gain new revenue opportunities? Currently, the total value locked (TVL) of BTCFi accounts for only 0.09%, which is very low compared to other public chains. DeFi accounts for as much as 14% in the Ethereum ecosystem, 6% in Solana, and 3% in Ton.

3. Dilemma of BTC Expansion Solutions

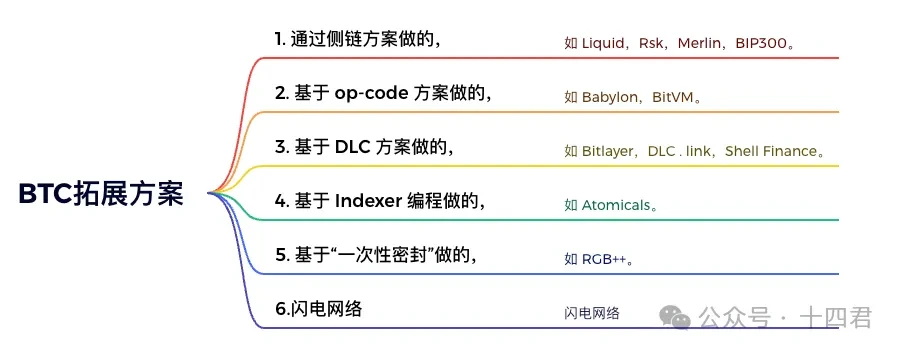

BTCFi often relies on various BTC expansion solutions. The current attempts to expand on BTC mainly include:

Many projects are already well-known. The expansion solutions may seem diverse, but ultimately they all share a commonality, which stems from the caution of BTC's native protocol evolution.

3.1 Understanding BTC Community Game from BIP-300

Let me briefly explain the evolution of BIP-300. BIP-300 is usually referred to as the Bitcoin Improvement Proposal for Drivechain (Drivechain). It was initially introduced in 2017, building a sidechain concept called "Drivechain" on the Bitcoin blockchain, allowing BTC to be used as the native token, and enabling trustless transfer between the mainnet and these Drivechains in a two-way peg (2WP) manner. Technically, it seems not to be a challenge, as Drivechain is based on BIP, which ultimately means modifying the BTC source code through a soft fork, rather than relying on additional extensions that do not depend on soft forks.

However, BIP-300 quickly became the subject of repeated discussions and could not be smoothly promoted. The advantages are obvious, but opponents argue that it deviates from the definition of digital store of value, making it easy to open the door to Bitcoin network fraud and leading to more scrutiny by regulatory agencies. Moreover, two-way pegging may completely disrupt the economics and assumptions of Bitcoin. There were even discussions about mining profitability, as merged mining essentially allows miners to earn "free funds" by doing what they are already doing.

Ultimately, it fell into a discussion of the classic legitimacy of BTC, making it difficult to continue to push forward. Looking back on this journey, the core community fundamentally guards the idea that Bitcoin needs another system to complement it, rather than trying to create new alternatives to compete with it.

So, it's more difficult to gain consensus from the BTC Core community than to conquer the ZK holy grail (laughs). Therefore, it is not difficult to understand why many subsequent innovative ideas no longer rely on directly modifying BTC itself, but continue to innovate in terms of gameplay.

3.2 Limitations of Native Programming Capabilities

While the exploration directions are diverse, they face similar dilemmas, mainly in two aspects:

Lack of native smart contract functionality: Bitcoin itself does not support complex smart contracts, only basic functionalities such as time locks or multi-signature locks using BTCscript.

Limited interoperability: There is limited interoperability between Bitcoin and other blockchains, and most solutions rely on centralized institutions.

Constrained by these two points, it also leads to liquidity dispersion. Currently, in the minds of users, Bitcoin on-chain is mainly for storage, while liquidity is concentrated in centralized exchanges or wrapped tokens like Wbtc on ETH, which also limits users' ability to efficiently trade and provide liquidity in decentralized finance ecosystems. Although Bitcoin's original design is relatively simple, the two important updates in recent years have brought possibilities to BTC.

SegWit (Segregated Witness)

Activated in August 2017, its core change is to separate the signature (Witness Data) from the transaction data, making the transaction data smaller, reducing transaction fees, and increasing the capacity of the Bitcoin network. With SegWit, Bitcoin's capacity limit increased from 1MB to 4MB.

Taproot Upgrade

3.3 Limitations of Other Models

Overlay Protocols such as BRC-20

Although the popularity of BRC-20 has brought traffic and attention to the Bitcoin ecosystem, subsequent standards such as ARC-20, Trac, SRC-20, ORC-20, Taproot Assets, and Runes have emerged to address the problems of BRC-20 from different perspectives. However, the core issue of such overlay protocols ultimately lies in the decentralized indexing, which may lead to discrepancies between indexers and the risk of irreparable damage if indexers are attacked.

The biggest problem with the Lightning Network is the limitation of its use cases, as it can only facilitate transaction activities and cannot support more diverse scenarios.

Not to mention various scaling protocols, RGB, DLC, and sidechains like Rootstock and Stacks, which are still in the early stages and relatively weak in terms of scaling effects and smart contract functionality, or rely primarily on multi-signature wallets for security.

As a result, more and more voices in the community are suggesting that Bitcoin should not simply replicate Ethereum's applications on the Bitcoin network.

In this context, a more practical on-chain liquidity staking solution is gradually emerging, one that does not rely on external smart contracts or sidechains, but directly implements staking mechanisms on the Bitcoin network, introducing liquidity to earn rewards.

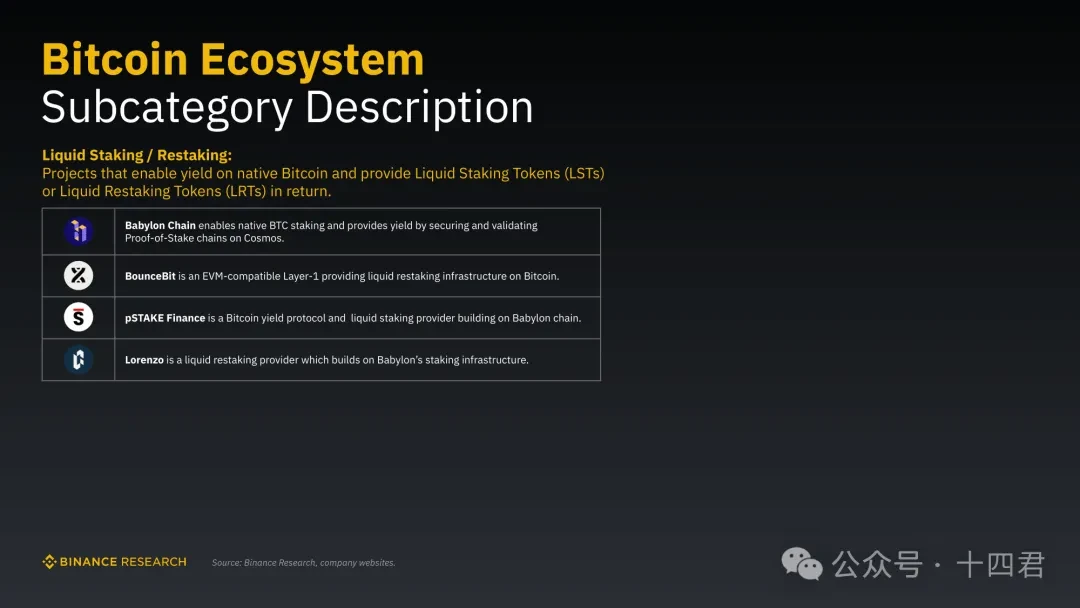

The recent Binance Research report also mentioned four heavyweight BTCFi protocols, namely Babylon, Bouncebit, PSTAKE Finance, and Lorenzo.

4. pSTAKE Finance on Bitcoin

pSTAKE has been providing staking and yield services on various chains since 2021, and in the case of BTC, pSTAKE is built on top of Babylon. This system is not rejected by the BTC core community (unlike Pionex, which has been heavily rejected and even attempted to be soft-forked out of existence), because this original chain liquidity staking solution does not transfer BTC to other chains. It utilizes Babylon's Remote Staking mechanism, which allows staking on the Bitcoin chain while transferring the security effects of BTC to other chains, thereby maximizing the value of BTC assets.

Through this bidirectional security sharing protocol, it provides security validation for POS chains and generates income for BTC holders participating in staking.

So, how does Babylon achieve this, and what exactly is pSTAKE on top of it?

4.1 The Cornerstone of pSTAKE Liquidity Yield, Babylon's Traditional Staking Protocol

Babylon is not overly complex. It is a Bitcoin security sharing protocol consisting of three core modules: BTC staking contract, Extractable One-Time Signatures (EOTS), and BTC timestamp protocol. The staking contract is a set of BTC script contracts, primarily using two opcodes:

OP_CHECKSEQUENCEVERIFY: Implements relative time locks, allowing transaction outputs to be spent only after a certain time has passed.

OP_CHECKTEMPLATEVERIFY: Sets conditions for spending transaction outputs, such as creating mandatory spending to a specific recipient, rebinding inputs, etc.

After participating, users have only two paths: normal staking (unstaking upon maturity) and violation (asset confiscation).

The core here is the confiscation method, which utilizes the Extractable One-Time Signatures (EOTS). In addition to participating in the consensus protocol of the PoS chain, users also need to complete EOTS signature rounds on Babylon.

The cryptographic mechanism here is that when a signer signs a message only once, the private key is secure. However, if the same private key is used to sign two different messages, the Babylon system can extract the private key information through signature comparison, allowing the private key to be obtained and the user's staked BTC assets to be burned (while still staked in the BTC contract). Upon maturity, the user must compete with Babylon in terms of transaction speed. Since BTC blocks are produced every 10 minutes, it is highly likely to be discovered, and all assets will be treated as miner fees, prioritized for inclusion in a block, and thus burned.

"Oops, I did it again" – Security of One-Time Signatures under Two-Message Attacks

The BTC timestamp protocol is also a clever design to avoid the longest chain attack in POS scenarios. In simple terms, it publishes timestamps of events from other blockchains to Bitcoin, allowing these events to enjoy Bitcoin's timestamp. Given Bitcoin's high security, there are also rules limiting the timestamps above, requiring each new block to have a timestamp greater than the average timestamp of the previous 6 blocks.

All of Babylon's staking mechanisms are modular and easy to reuse, which has created an opportunity for pSTAKE to collaborate and build on it.

4.2 What is pSTAKE Bitcoin Liquid Staking

pSTAKE is a liquidity staking protocol that operates similarly to Babylon, essentially functioning within the PoS ecosystem. Its main feature is allowing users to stake their cryptocurrency assets while retaining liquidity, similar to Lido's sETH.

The key difference between liquidity staking and traditional staking is liquidity.

Traditional staking involves users depositing tokens into a PoS protocol to increase economic security, but in doing so, they forfeit liquidity. This means their tokens are locked and cannot be used elsewhere, which is the current situation with Babylon, as it prioritizes security.

Liquidity staking, on the other hand, allows stakers to retain the liquidity of their assets and continue using them elsewhere, addressing the liquidity dilemma in traditional staking.

In practice, when users deposit assets on BTC, the platform mints Liquidity Staking Tokens (LST) for users on the POS chain. Users can freely trade or use these tokens on other DeFi platforms, and they can also redeem LST for the underlying assets at any time.

So, where does the source of income come from?

In fact, users first stake BTC with pSTAKE, and pSTAKE will then stake the assets with Babylon to generate income, which is then distributed to the users as dividends.

When users stake BTC, pSTAKE also distributes a liquidity token called pToken to the users, allowing them to continue using this liquidity token just like sETH generated by Lido.

When users want to redeem BTC, they only need to destroy the pToken in the pSTAKE app, which will stop the rewards and exchange the assets back to your BTC from the liquidity pool.

The BTC staked with pSTAKE is also provided with associated services by BTC custody providers such as Cobo's MPC, similar to Merlin.

Ultimately, this forms a dual-token system, where pTOKENs represent unstaked assets that can be freely used in DeFi, while stkTOKENs represent staked assets that can accumulate staking rewards.

4.3 Conclusion

pSTAKE itself has years of asset management experience and multiple secure audit records for contracts, and after collaborating with Babylon, it has:

Enhanced liquidity: By collaborating with Babylon, a platform focused on improving asset utilization efficiency through advanced blockchain technology, it can further optimize and expand liquidity.

Increased income potential: Babylon's platform and technical expertise may provide more value-added opportunities for assets staked with pSTAKE. Through Babylon's network, the assets in pSTAKE may have access to a wider range of DeFi protocols and yield strategies, including more complex trading algorithms or high-yield liquidity pools. This not only provides users with more diversified investment choices but may also increase the overall return on these assets.

Improved security and compliance: Collaboration with Babylon may bring additional security and compliance advantages. With Babylon's high asset management security and the support of MPC service providers like CoBo, the system can be further strengthened to ensure yield.

In summary, through pSTAKE's Bitcoin liquidity solution, BTC holders can stake their assets, and the source of income comes from Babylon's services, providing liquidity tokens to users to maintain liquidity.

Currently, pSTAKE has not fully launched its official version, and the current experience can only be tested on the testnet. Therefore, many asset management mechanisms and yield expansion mechanisms have not been disclosed, and there is no TVL data to reveal.

However, with the support of Binance Labs, it has caught the attention of the author, as Binance has always been heavily involved in staking, understanding that what users need is financial gameplay, which is the most practical demand in the blockchain industry.

Therefore, the trillions of idle BTC in the long term are not a problem after all.

Finally, returning to the focus on security in BTC, MPC asset management service providers like CoBo are already being understood and recognized by users in projects like Merlin. After all, it is better to cherish the present and operate the system optimistically, providing asset management security certainty through the certainty of underlying yield, rather than waiting for years for BITVM and then achieving ZK-level trust.

Appendix

Why pSTAKE is Building BTC Liquid Staking on Babylon - pSTAKE

pSTAKE | Bitcoin Liquid Staking and Yields

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。