原文标题:《加密的链上「聚变」:结构性供需失衡加剧,数据揭⽰下⼀轮上涨的坚实蓝图?|WTR 4.28》

原文来源:WTR 研究院

本周回顾

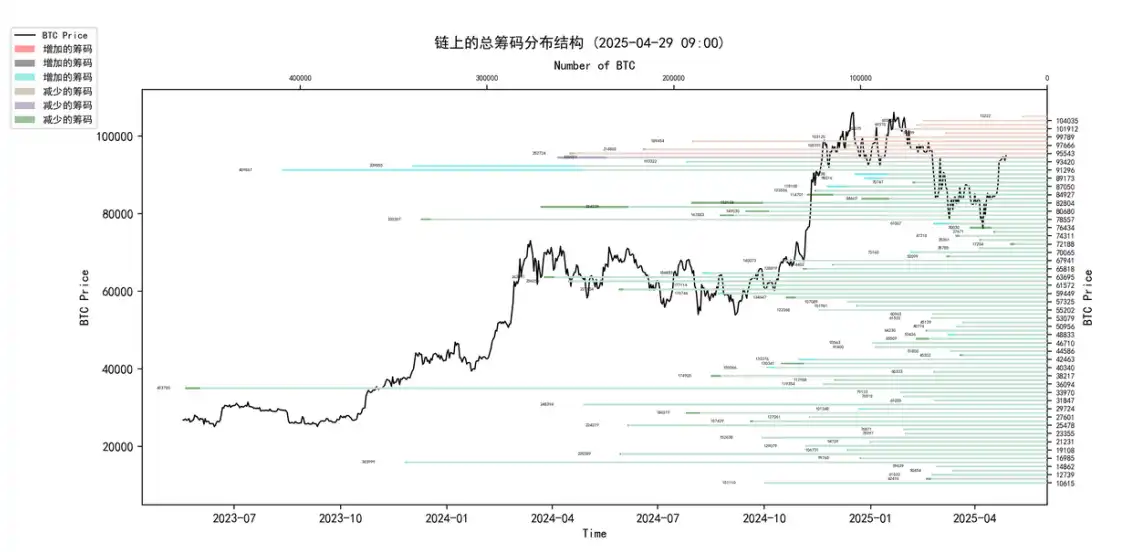

本周从 4⽉21⽇到 4⽉28⽇,冰糖橙最⾼附近$95758,最低接近$85144,震荡幅度达到 12.46% 左右。观察筹码分布图,在约 92000 附近有⼤量筹码成交,将有⼀定的⽀撑或压⼒。

• 分析:

1. 60000-68000 约 153 万枚;

2. 76000-89000 约 172 万枚;

3. 90000-100000 约 219 万枚;

• 短期内跌不破在 75000〜80000 概率为 80%;

• 其中短期内涨不破 95000~10000 的概率为 50%。

重要消息⽅⾯

经济消息⽅⾯

• 本周关键数据预告:

◦ 周三公布⼀季度 GDP(前值 2.4%,预期⼤幅降⾄0.4%)

◦ 周五公布⾮农就业(前值 22.8 万,预期降⾄13.5 万)和失业率(前值 4.2%,预期 4.2%)

◦ 周三还有核⼼PCE(前值 2.6%,预期 3.2%),周⼆有 JOLTs 职位空缺。

• 整体预期悲观:本周美国财经和就业数据预期普遍较差,GDP 和⾮农预期⼤幅下降。

• 衰退担忧:巴克莱银⾏质疑美国今年能否避免经济衰退,认为这增加了美联储降息的理由。

• 美联储与货币政策:

◦ 政策批评:美联储主管热⻔候选⼈凯⽂·沃什(Kevin Warsh)严厉批评当前美联储困境是「⾃作⾃受」,认为其需接受严格质询和监督,进⾏战略重置以挽回信誉。

◦ 静默期:美联储已进⼊5⽉7⽇议息会议前的静默期,市场预计本次会议将连续第三次维持利率不变。

◦ 降息预期:市场对降息预期强烈但时间点存在分歧。

▪ LSEG 数据显⽰7⽉降息预期已被完全消化,6⽉仍存在降息可能。

▪ CME 数据显⽰5⽉降息概率低于 10%,6⽉概率在 60-70%,7⽉则被市场完全定价(fully priced in)。

◦ 市⾯上降息理由:除了经济衰退担忧,美国银⾏警告美元处于⻓期贬值通道,资⾦将持续撤离美国直⾄美联储降息。

▪ 经济学家 Javier Bianchi 认为关税是负⾯需求冲击(意味通缩),美联储必须降息以避免更严重经济后果。

• 关税影响:

◦ 巴克莱银⾏指出,近期川普相对温和的关税⾔论使市场暂时平静,但结果仍⾼度不确定。

◦ 经济学家认为关税是负⾯需求冲击,具有通缩效应,是美联储需要降息的原因之⼀。

• 美元展望:

◦ 美国银⾏警告美元处于⻓期贬值通道。

加密⽣态消息⽅⾯

1. 市场情绪与资⾦流:

◦ 市场情绪回暖:加密货币恐惧与贪婪指数回升⾄54(中性)。CryptoQuant⽜市指数达 60,表明乐观情绪重燃。

◦ 资⾦流⼊加密市场:分析师 ali_charts 称过去⼀周加密市场流⼊近 90 亿美元,显⽰兴趣回升。Matrixport 观察到美元向加密货币转化的初步回暖迹象,流动性改善。

◦ 稳定币增⻓:Tether 于 4⽉28⽇增发 10 亿美元 USDT。稳定币总市值过去 7 天增⻓1.61%⾄2381.01 亿美元。

◦ 需求增⻓:分析师认为对 BTC 和稳定币流动性的需求再次增⻓。

2. 加密市场 (BTC):

◦ 价格表现:(BTC)价格回升⾄9.3-9.5 万美元区间。

◦ 短期交易者活跃:IntoTheBlock 数据显⽰上周 BTC 短期交易者持仓显著增加,显⽰投机需求回暖,可能预⽰更⼤范围上涨的开端。◦ 市场预期:Bitfinex 分析师指出,市场越来越预期 BTC 在 2025 年第⼆季度达到更⾼价格⽔平。

3. 加密 (ETF):

◦ BTC 现货 ETF: 上周累计净流⼊⾼达 30.629 亿美元。⻉莱德 IBIT 连续 9 个交易⽇净流⼊,期间增持价值 16 亿美元 BTC。ETF 流⼊增加被视为市场温和乐观的体现。

◦ ETH 现货 ETF: 上周累计净流⼊1.571 亿美元。灰度与 SEC 就 ETH ETP 的质押监管问题进⾏了讨论,提议修改申请⽂件以允许质押。

◦ XRP 期货 ETF: SEC 批准三⽀XRP 期货 ETF,计划于 2025 年 4⽉30⽇上市。

4. 监管与政策:

◦ 美国联邦层⾯ (SEC):

▪ SEC 委员 Hester Peirce 批评当前美国加密监管环境混乱(如「⿊暗中玩熔岩地板游戏」),呼吁尽快建⽴明确合规渠道和指引。

▪ SEC 批准 XRP 期货 ETF。

▪ SEC 与灰度讨论 ETH ETF 质押问题。

◦ 美国州级层⾯: 亚利桑那州的两项 BTC 储备法案安排进⾏三读,若通过将成为⾸个设⽴BTC 储备的州。

5. 其他:

◦ ⾹港投资骗案:⾹港警⽅提⽰警惕社交平台上的加密相关投资骗局。

◦ 市⾯的市场展望:市场期待在(可能存在的)暂停降息结束后,加密资产在夏天逐渐升温。

⻓期洞察:⽤于观察我们⻓期境遇;⽜市/熊市/结构性改变/中性状态

中期探查:⽤于分析我们⽬前处于什么阶段,在此阶段会持续多久,会⾯临什么情况

短期观测:⽤于分析短期市场状况;以及出现⼀些⽅向和在某前提下发⽣某种事件的可能性

⻓期洞察

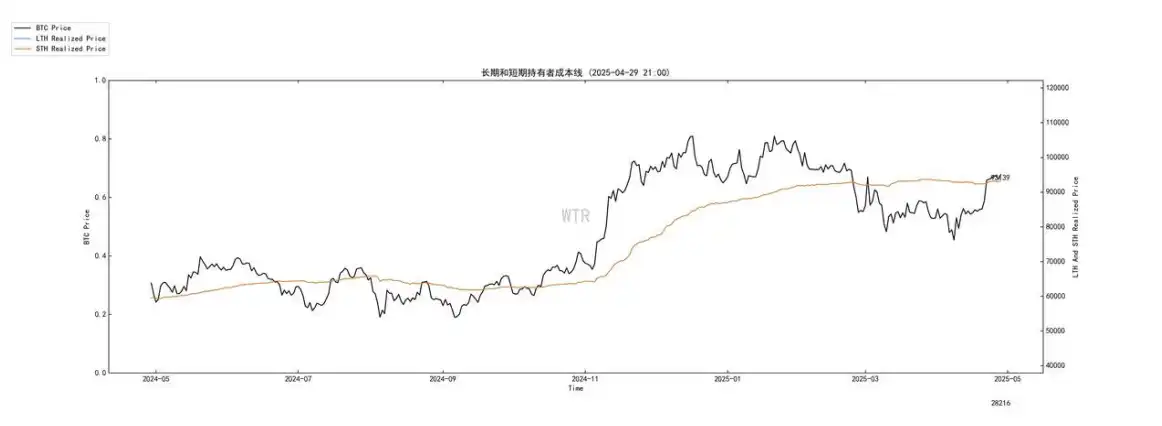

• 短期持有者实现价格

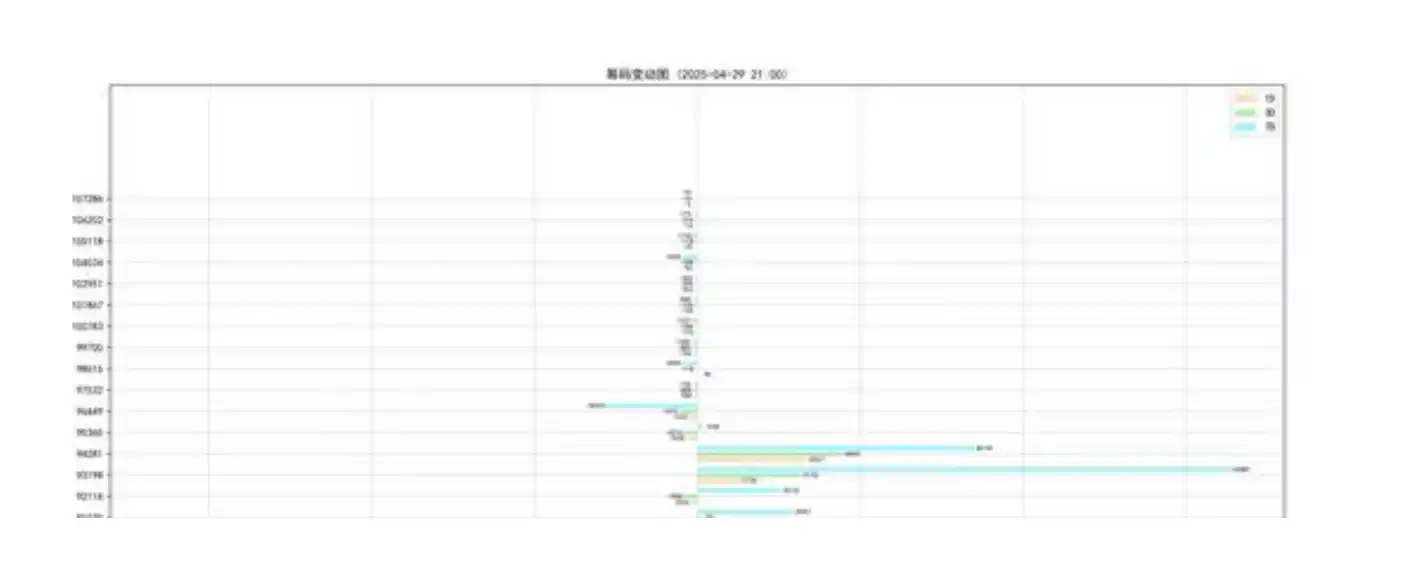

• 买卖链上深度图

• ⾮流动性的⻓期巨鲸

• 美国现货 ETF 流量

• 交易平台⼤额净转移量

(下图 短期持有者实现价格)

平均⽽⾔,近期⼊场的投资者群体⽬前处于盈利状态。这极⼤地减轻了市场的潜在抛售压⼒,因为短期投机者(93600 美元)没有紧迫的回本或⽌损需求,反⽽可能因为盈利⽽增强持币信⼼或追加⼊场。是⼀个积极的市场情绪和健康的短期持有者状态信号。

(下图 买卖链上深度图)

直观地反映了当前市场的链上供需结构。⼤量的链上筹码的买⼊,意味着市场承接意愿与深度较好,回调时会有较强的承接意愿。

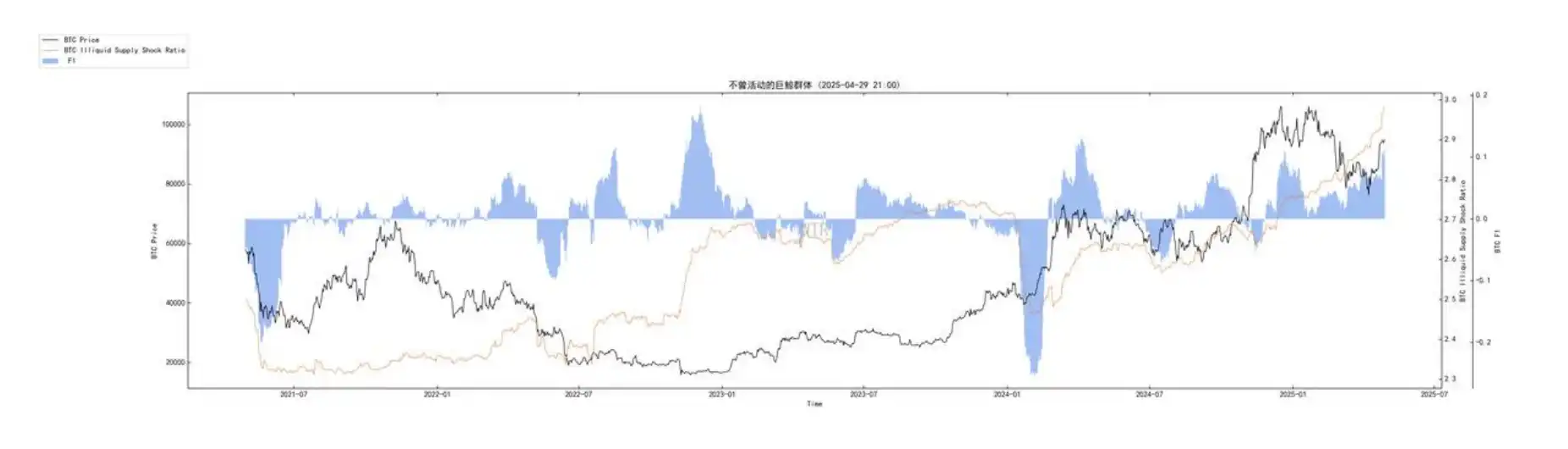

(下图 ⾮流动性的⻓期巨鲸)

这再次确认,加密资产从可交易状态转移到⻓期锁定状态的速度极快且未⻅放缓。反映了市场深层、持续且强烈的囤积⾏为,「活跃供应」正被快速抽离市场,供应端的紧缩效应⽇益加剧,这是极其重要的中⻓期看涨基本⾯。

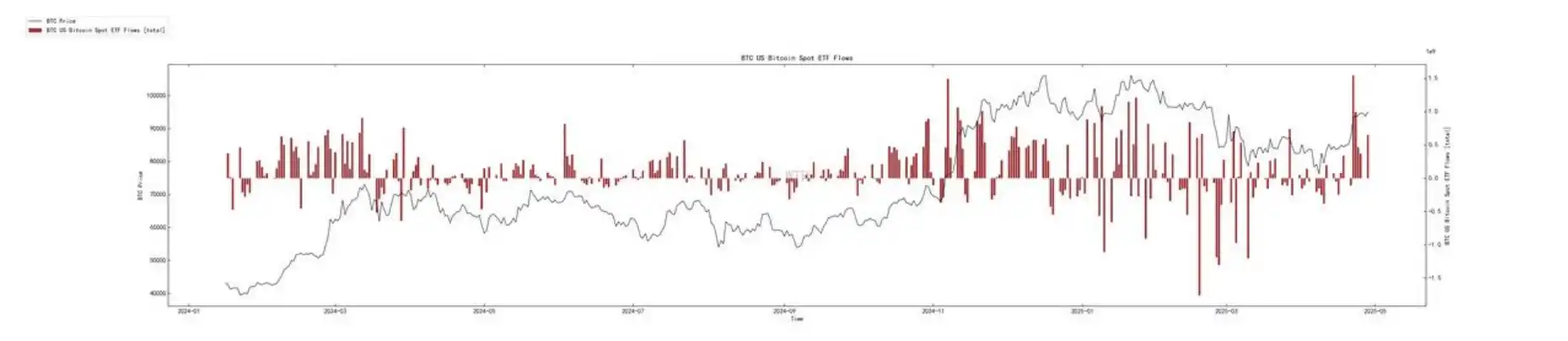

(下图 美国现货 ETF 流量)

来⾃美国现货 ETF 这⼀关键合规渠道的新增购买需求不仅回归,⽽且保持着相当的强度和持续性。这股⼒量直接、持续地从市场上吸收 BTC 供应,是当前市场重要的增量买⽅来源,有⼒地⽀撑着价格。

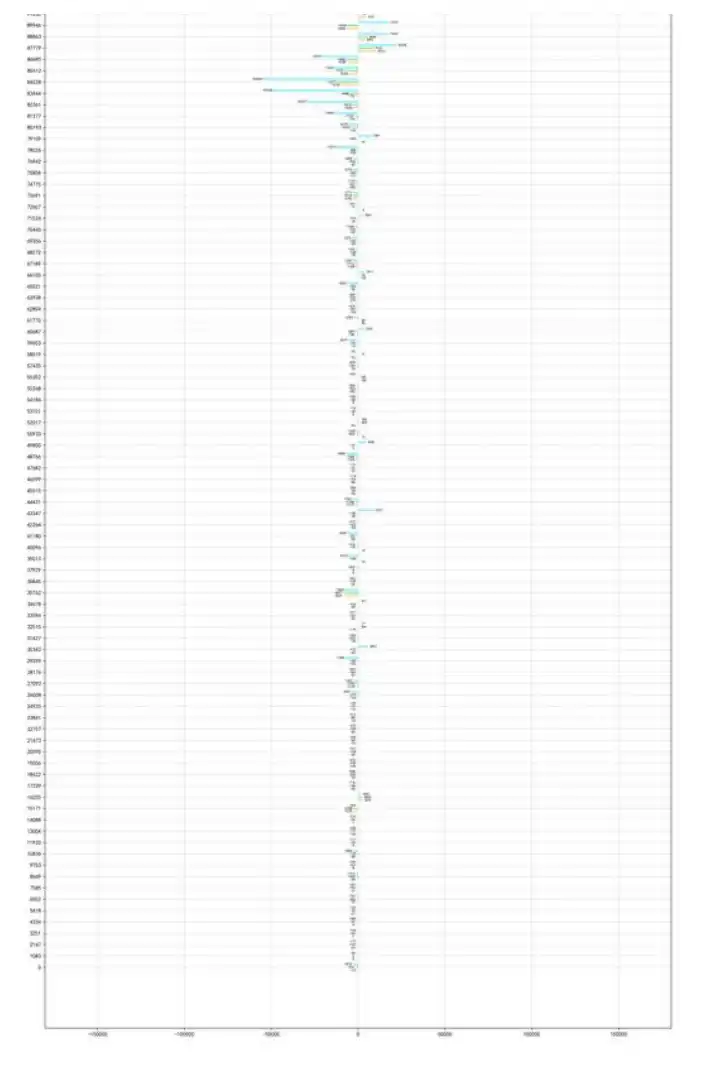

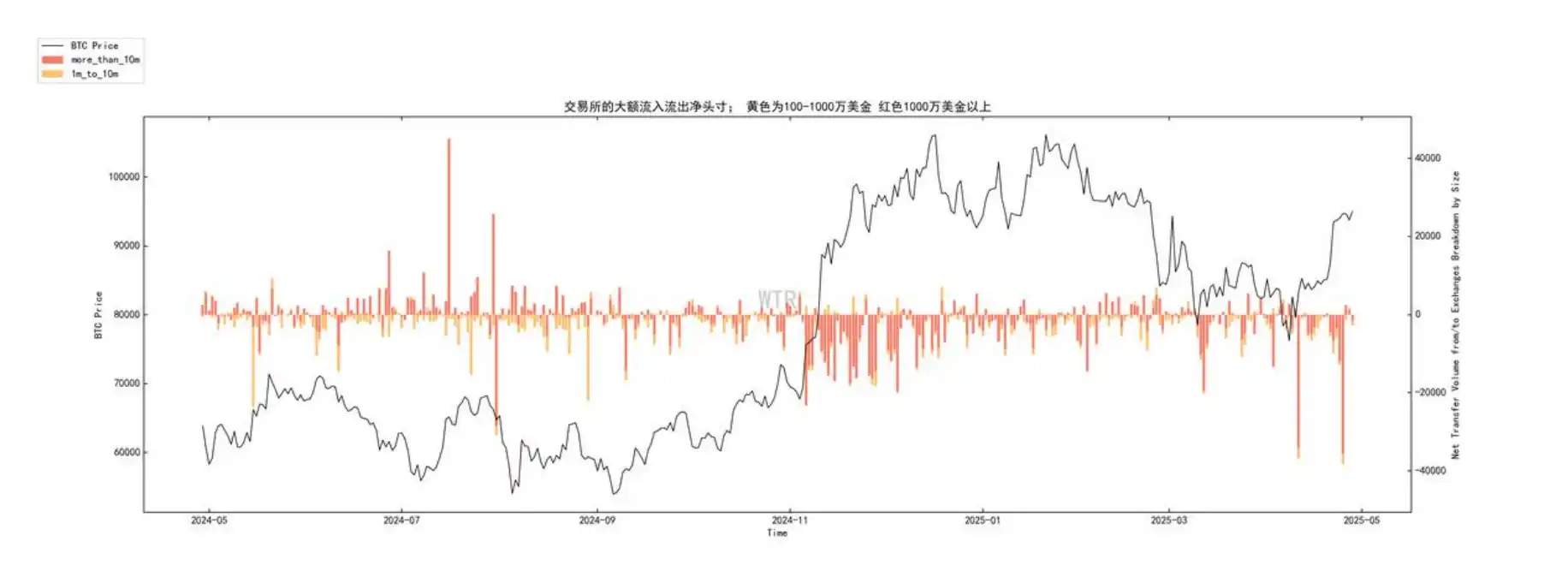

(下图 交易平台⼤额净转移量)

证实了⼤型实体(鲸⻥)持续地、⼤规模地将⽐特币从交易平台提⾛。他们的战略性积累⾏为仍在进⾏中,进⼀步减少了中⼼化交易平台的即时抛售压⼒,并增强了市场的⻓期看好预期。

综合分析与推理逻辑链 :

1. 起点 - 宏观背景与市场情绪: 宏观经济存在谨慎预期(数据预期差),但市场已强烈 price-in 未来降息。加密市场情绪已显著回暖,资⾦流⼊加速(宏观/消息⾯)。

2. 验证 - 需求端确认: 链上数据强⼒验证并强化了资⾦流⼊和需求复苏的判断;ETF 持续强劲净流⼊(图 4),短期交易者活跃且已盈利(图 1),对 BTC 和稳定币需求增⻓(消息⾯)。

3. 验证 - 核⼼玩家⾏为: 链上数据显⽰核⼼⼒量极其看好并采取⾏动;鲸⻥持续⼤规模从交易平台提币(图 5),⻓期持有者的囤积⾏为仍在⾼速进⾏(图 3 - ⾮流动的⻓期巨鲸)。

4. 供需失衡加剧: 需求端(ETF、内部需求)保持强劲,同时供应端(鲸⻥提币锁定、⻓期持有者持续囤积)正被快速抽离市场,导致可流通供应急剧减少,供需失衡的局⾯正在形成并加剧。

5. 当前: 市场处于健康的上涨或盘整待涨状态:短期持有者盈利减轻抛压(图 1),下⽅有强劲买盘⽀撑(图 2 链上筹码买卖墙),上⽅虽有卖盘阻⼒(图 2 链上成本买卖墙)但⾯临强⼤的持续买⽅⼒量(图 4 ETF + 图 5 鲸⻥ + 内部需求),且供应持续紧缩(图 3 ⻓⾮流动的⻓期巨鲸)。

6. 核⼼驱动⼒: 当前市场的主要驱动⼒来⾃结构性的供需失衡(由 ETF 引⼊新需求、鲸⻥和 LTH 也就是⻓期持有者)持续积累导致供应减少共同作⽤)以及对未来宏观流动性改善(降息)的强烈预期。

未来展望:

• 中短期 : ⼤概率震荡向上,挑战关键阻⼒位

◦ 强⼤的链上⽀撑(图 2 买盘墙、图 5 鲸⻥持续买⼊)和持续的需求注⼊(图 4 ETF 流⼊)将限制下⾏空间。短期持有者盈利(图 1)降低了恐慌抛售⻛险。市场⼤概率会继续向上试探,主要挑战来⾃短期投机者到⼀定盈利百分⽐的卖单阻⼒墙如 10.1 万美元或 11.6 万美元)。

◦ 未来市场偏向于震荡上⾏或在⾼位强势整理。突破 10-10.1 万美元等关键阻⼒位是短期内的主要看点,这需要 ETF 流⼊和鲸⻥购买能够持续吸收上⽅的卖盘。

◦ 回调预计会遇到较强⽀撑。

• 中⻓期:供应紧缩效应驱动,上涨潜⼒巨⼤

◦ 只要鲸⻥持续净流出(图 5)和⾮流动的⻓期巨鲸保持⾼速增⻓(图 3)这两⼤核⼼趋势不变,供应紧缩的效应将⽇益显著。

◦ 随着时间推移,越来越少的「活跃」⽐特币可供交易。若届时宏观如期降息,改善流动性预期,叠加 ETF 带来的持续结构性需求(图 4),可能会触发更猛烈的「供应挤压」⾏情。

◦ 展望:

中⻓期前景⾮常乐观。基于当前极其强劲的链上基本⾯(供应快速锁定+需求持续注⼊),市场正在为下⼀波显著的上涨⾏情奠定坚实基础。突破关键阻⼒位(如$100k)后,上涨空间有望进⼀步打开,具体节奏受宏观催化剂影响,但链上结构已指向明确的上升趋势。

中期探查

• 流动性供应量

• 稳定币供应量净头⼨

• 巨鲸综合得分模型

• 各价位结构分析

• 交易平台趋势净头⼨

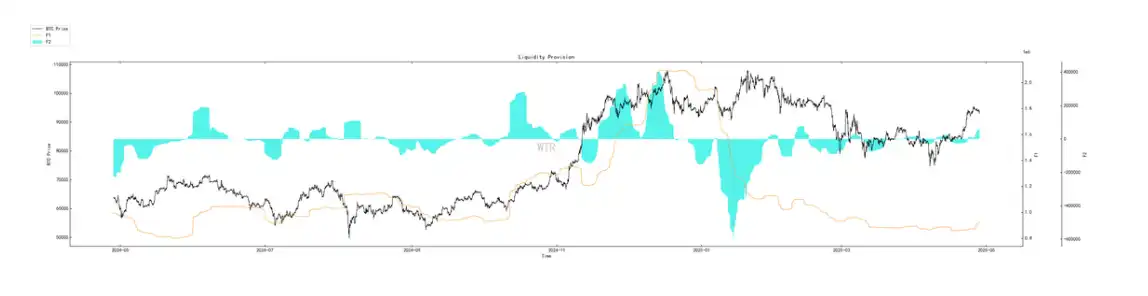

(下图 流动性供应量)

流动性供应量处于良性修复的状态,可能市场暂时处于慢慢恢复动能的阶段中。

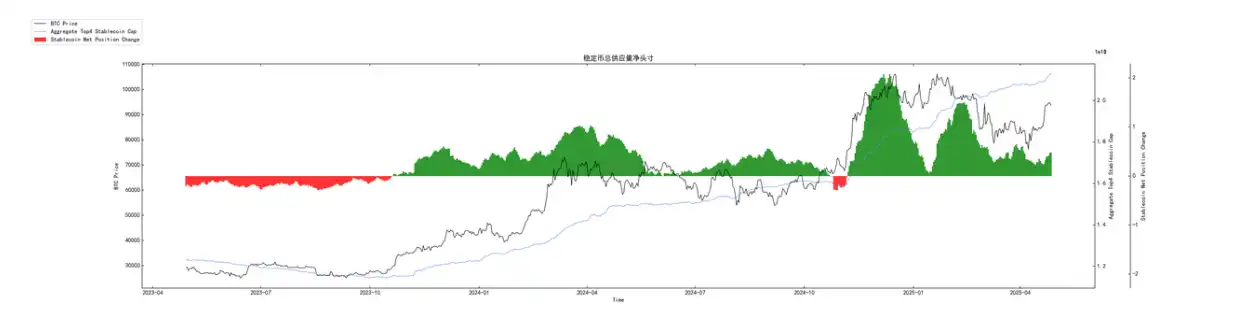

(下图 稳定币供应量净头⼨)

购买⼒近期有较⼤幅度的恢复,可能市场在缓慢地积累动能。

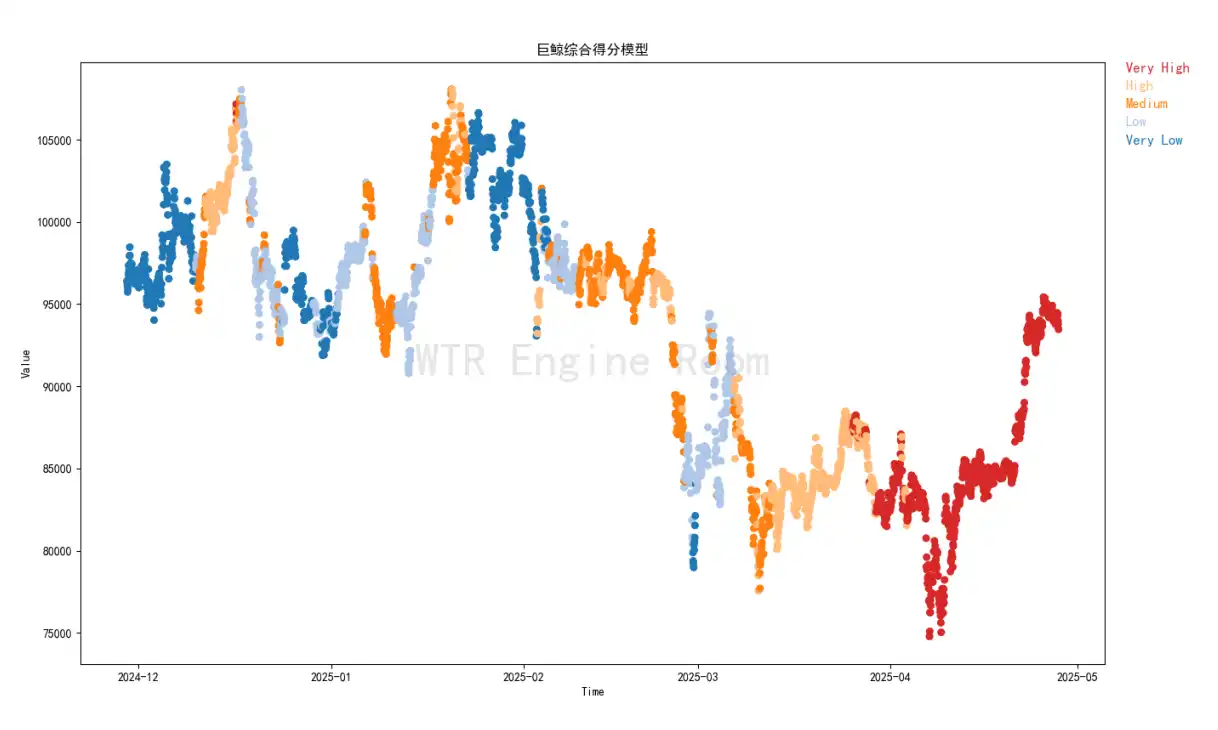

(下图 巨鲸综合得分模型)

巨鲸仍有较⾼的买⼊持有意愿,近期市场整体的上升过程中,巨鲸⼀直保持着「very high」的状态。盘⾯⽬前来看有较为坚实的⼤群体持有,可能对价格的稳定性有较⼤帮助。但反过来看,巨鲸⼀致性的⾏为也会影响到盘⾯最终的结果。

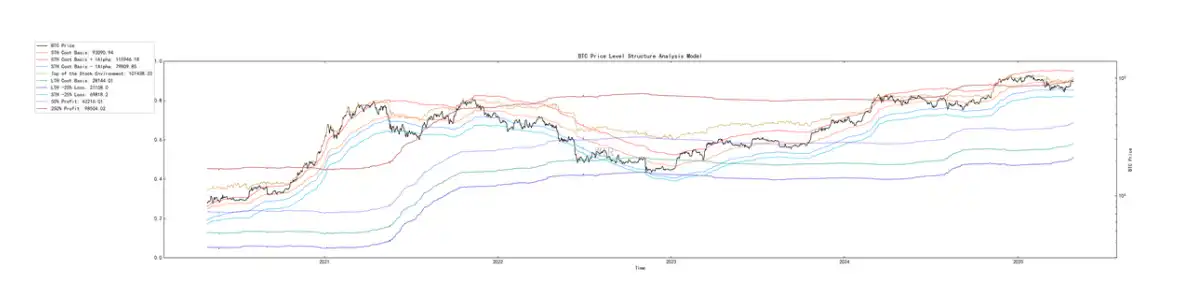

(下图 各价位结构分析)

从⽬前结构来看,短期成本 93000 左右⽬前是重要的⽀撑位。同时,随着市场结构演变,存量顶的价位在 100000 左右。若购买⼒持续性递增,或巨鲸群体的持有意愿未下降,可能市场有触及存量顶的预期。但⽬前市场可能偏向于调整和蓄⼒交叠的复杂结构。从下图中可看出。

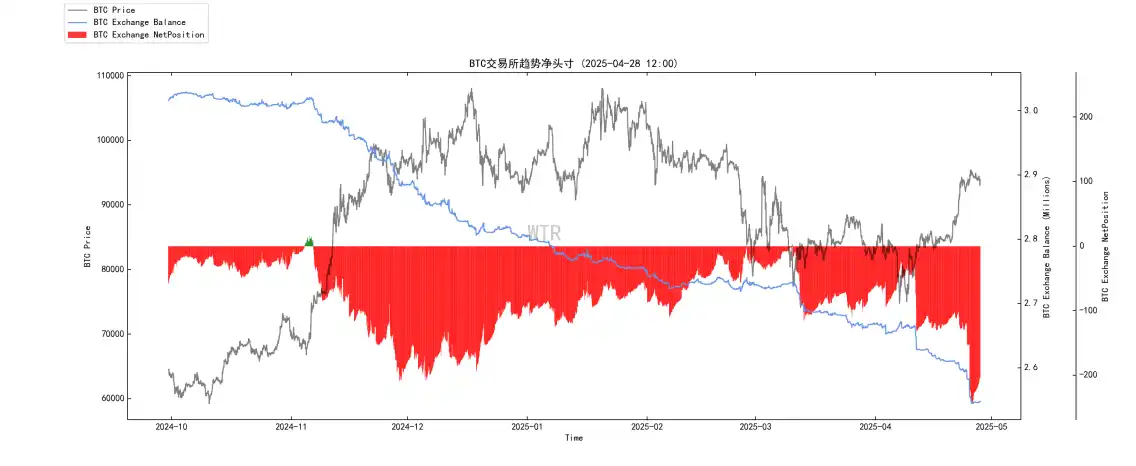

(下图 交易平台趋势净头⼨)

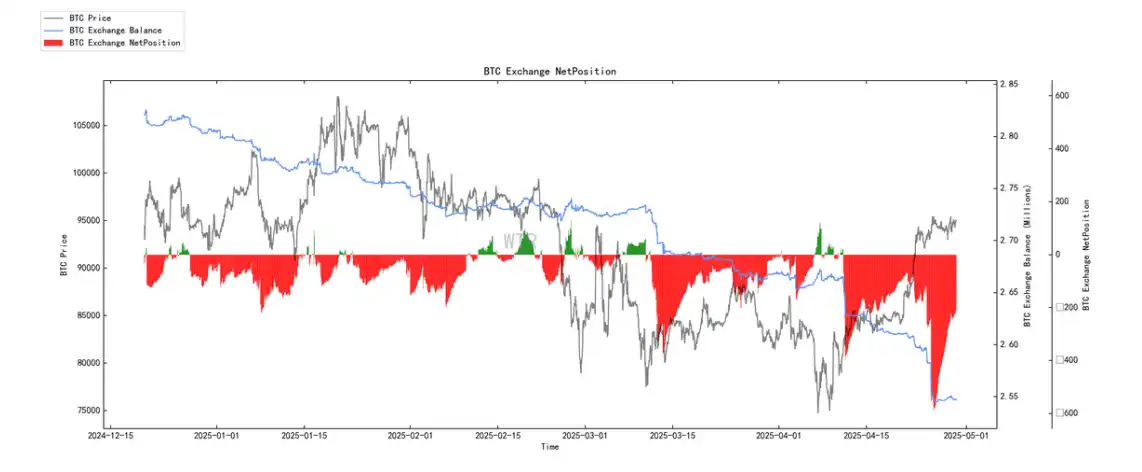

交易平台内部,此前有⼤量 BTC 流出积累现象,当前有所放缓。但截⾄⽬前并未表现出流⼊积蓄潜在抛压的结构性变动,可能市场尚且处于调整的安全边界中。

短期观测

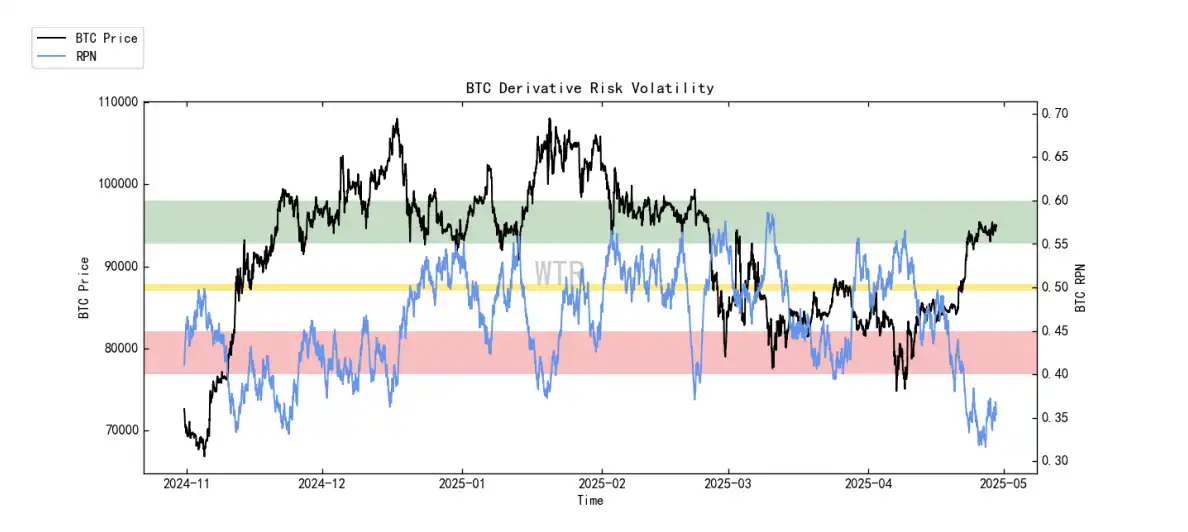

• 衍⽣品⻛险系数

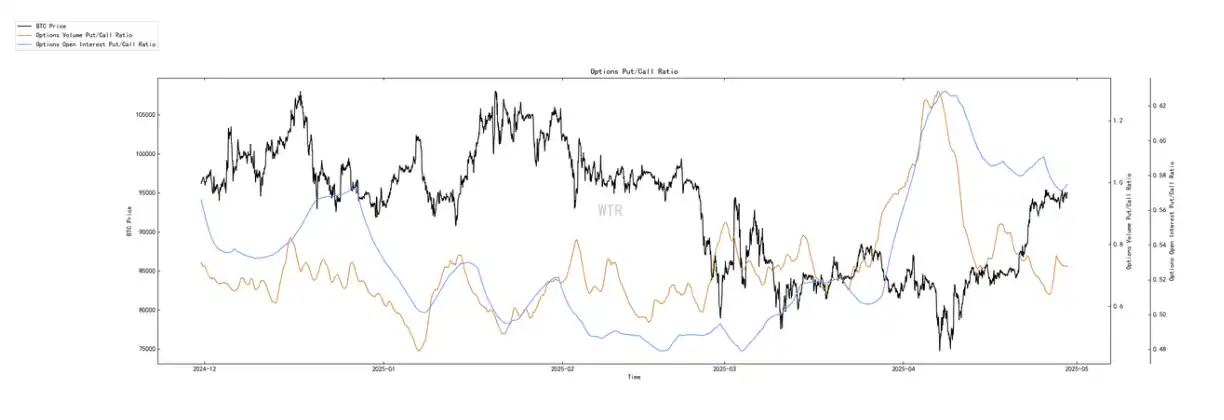

• 期权意向成交⽐

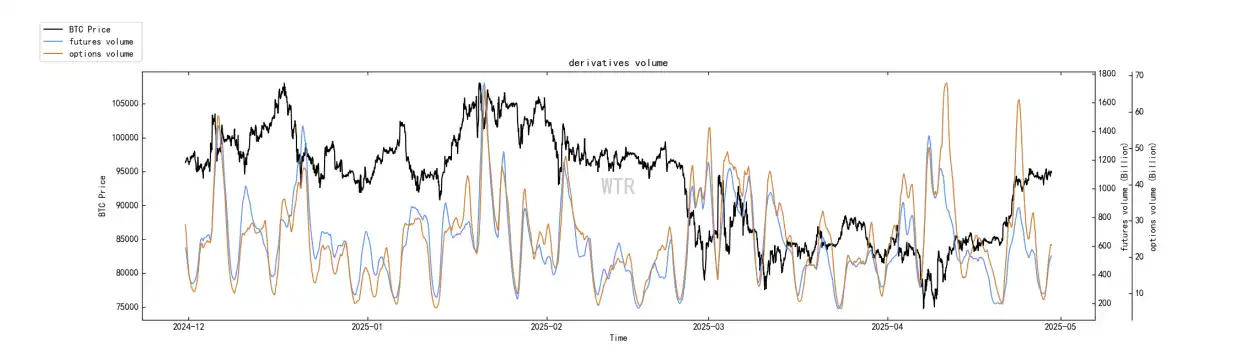

• 衍⽣品成交量

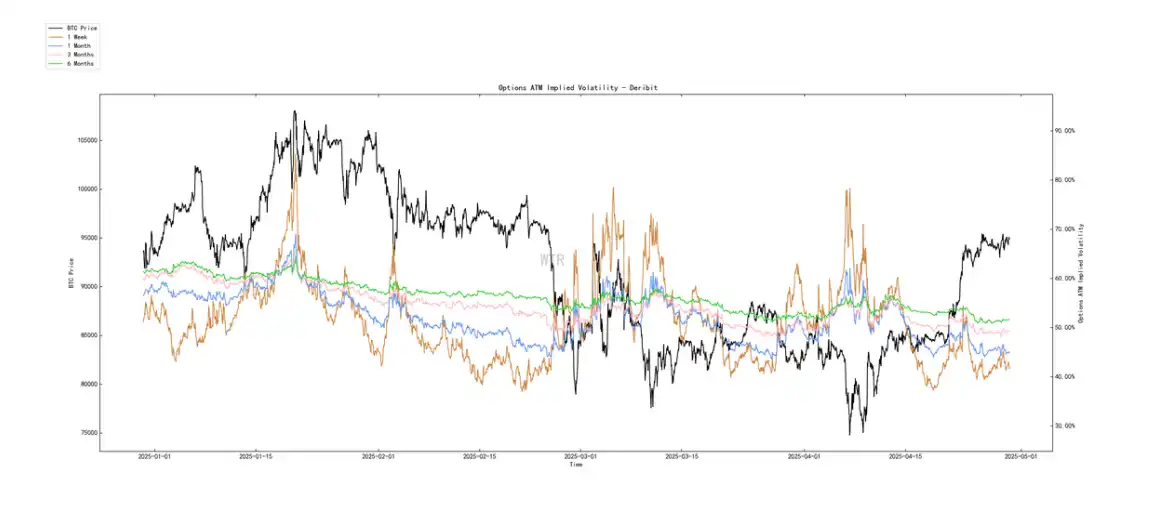

• 期权隐含波动率

• 盈利亏损转移量

• 新增地址和活跃地址

• 冰糖橙交易平台净头⼨

• 姨太交易平台净头⼨

• ⾼权重抛压

• 全球购买⼒状态

• 稳定币交易平台净头⼨

• 链下交易平台数据

衍⽣品评级:⻛险系数处于红⾊区域,衍⽣品⻛险增加。

(下图 衍⽣品⻛险系数)

久违的市场轧空后,⻛险系数仍处于红⾊区域,当前结合⻛险系数以及筹码累积情况来看,进⼀步轧空的概率较⼤。

(下图 期权意向成交⽐)

看跌期权⽐例和交易量均有所下降,当前看跌期权⽐例处于中⾼位。

(下图 衍⽣品成交量)

衍⽣品成交量处于中低位。

(下图 期权隐含波动率)

期权隐含波动率短期⽆太⼤变化。情绪状态评级:中性

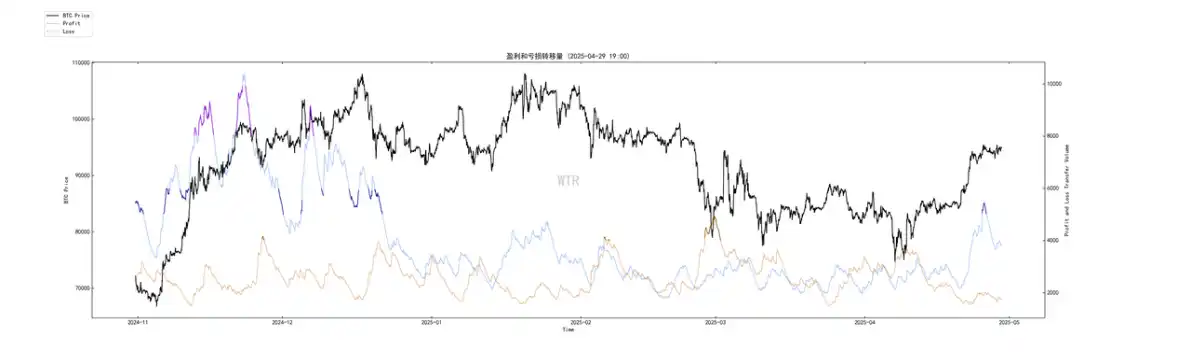

(下图 盈利亏损转移量)

本次市场拉升市场积极情绪 (蓝线) 回升较为明显,触及短期极值区域,总体来说当前市场仍处于冷静中性当中,并未真正进⼊狂热阶段。

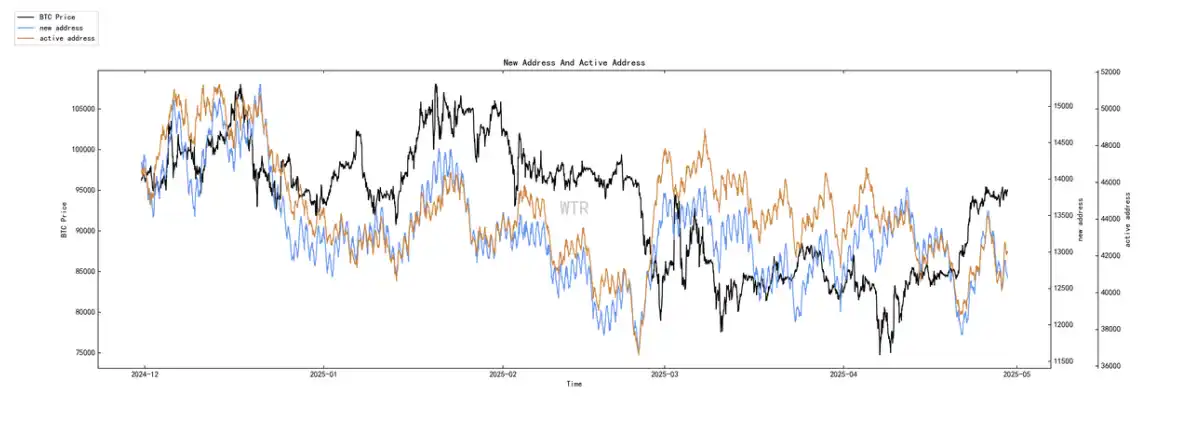

(下图 新增地址和活跃地址)

新增活跃地址处于中低位。现货以及抛压结构评级:整体上 BTC 持续⼤量流出,ETH 仅有少量流出。

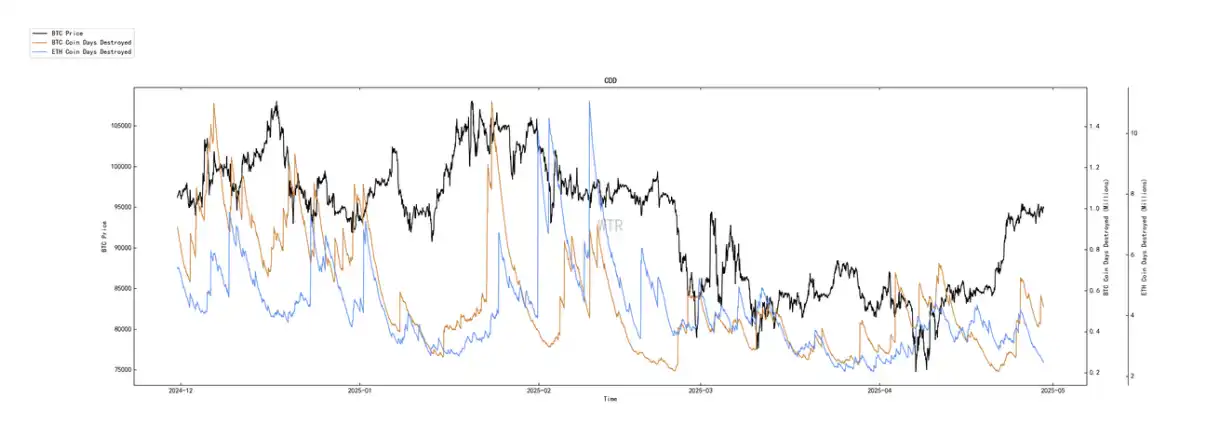

(下图 冰糖橙交易平台净头⼨)

当前 BTC 有⼤量流出。

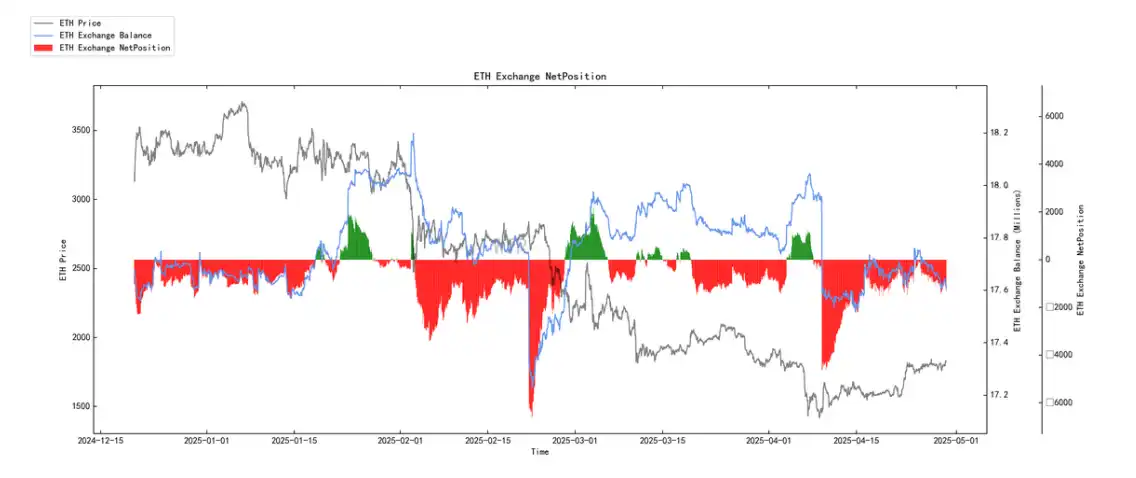

(下图 E 太交易平台净头⼨)

表⾯上看 ETH 交易平台内净头⼨在持续流出,但实际上观察蓝线,ETH 交易平台内净头⼨余额和 12⽉市场顶部时期⼏乎相当。短期来看 ETH 的场内抛压仍然会持续存在。

(下图 ⾼权重抛压)

⽆⾼权重抛压。

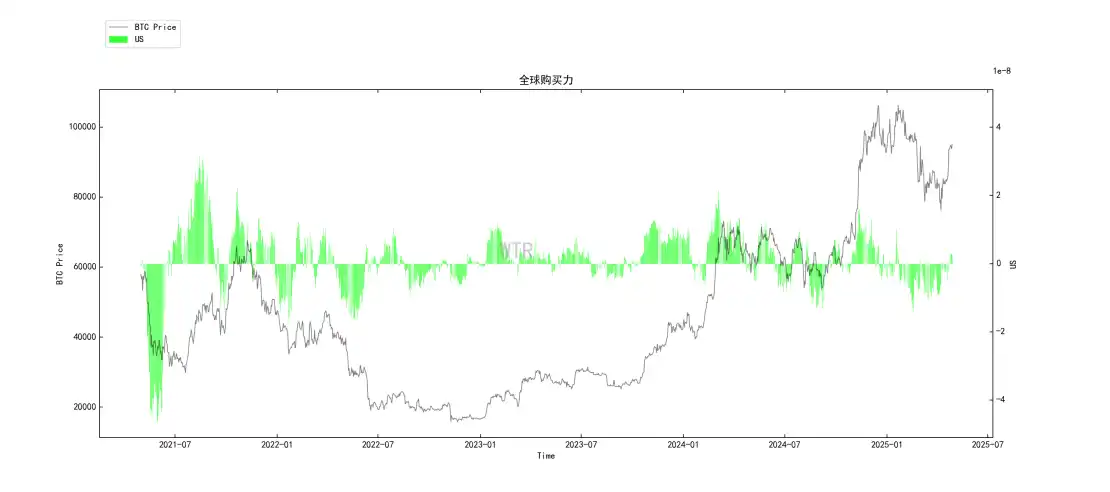

购买⼒评级:全球购买⼒少量回升,稳定币购买⼒持平。

(下图 全球购买⼒状态)

全球购买⼒有少量回升。

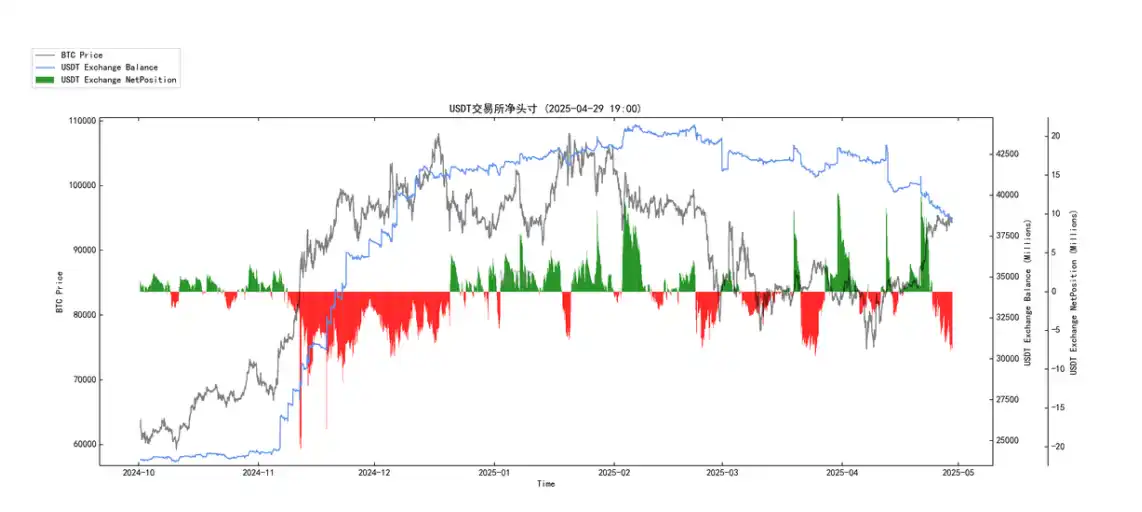

(下图 USDT 交易平台净头⼨)

稳定币购买⼒整体和上周持平。

链下交易数据评级:本周数据⽹站故障,暂⽆链下交易数据。

本周总结:

消息⾯总结:

市场正处在⼀个宏观谨慎预期与加密内部强劲复苏信号并存的特殊阶段,呈现出⼀定的「脱钩」特征。加密市场受强劲的 ETF 资⾦流⼊、回暖的市场情绪和活跃的短期交易者推动,展现出强⼤的内⽣动⼒,似乎在提前交易未来的降息预期。短期内,这种乐观势头有望延续,但需警惕本周关键宏观数据可能带来的波动。中期市场的核⼼驱动⼒将是美联储降息预期的实际兑现情况。⻓期来看,结构性⽜市的基础因当前的积极发展⽽更加稳固。

链上⻓期洞察:

1. 市场内部结构极其健康且强劲,表现为需求旺盛(ETF 持续流⼊);

2. 核⼼玩家坚定积累(鲸⻥⼤额提币);

3. 供应快速锁定(⾮流动的⻓期巨鲸飙升);

4. 短期持有者已摆脱亏损压⼒。

• 市场定调:

市场在短期内具备向上动能或者⽀撑能⼒;

中⻓期来看,⽇益加剧的供需失衡正在为潜在的「供应挤压」⾏情和更显著的上涨奠定基础,整体展望积极乐观。

链上中期探查:

1. 流动性良性修复,市场动能缓步回升。

2. 购买⼒显著回升,市场蓄能待发。

3. 巨鲸持币意愿强,当前在⽀撑价格。

4. 当前⽀撑位 93000,存量顶 100000,市场在蓄⼒调整。

5. 交易平台流出趋势放缓缓,当前处于调整的安全边界中。

• 市场定调:

调整,蓄⼒

市场整体处在调整和蓄⼒的复杂结构中,⽬前呈现流动性修复,巨鲸有买⼊持有意愿,市场尚且稳定。

链上短期观测:

1. ⻛险系数处于红⾊区域,衍⽣品⻛险增加。

2. 新增活跃地址较处于中低位。

3. 市场情绪状态评级:中性。

4. 交易平台净头⼨整体呈现 BTC 持续⼤量流出,ETH 仅有少量流出。

5. 全球购买⼒少量回升,稳定币购买⼒持平。

6. 短期内跌不破在 75000〜80000 概率为 80%;其中短期内涨不破 95000~100000 的概率为 50%。

• 市场定调:

市场突破短期持有者成本线 (93K) 且在附近价位有⼤量成交筹码,市场积极情绪和购买⼒都有少量回升。短期预期市场有很⼤可能在当前价位震荡后继续轧空,当前⾯临回调的⻛险较低。

⻛险提⽰:以上均为市场讨论和探索,对投资不具有指向性意⻅;请谨慎看待和预防市场⿊天鹅⻛险。

本文来自投稿,不代表 BlockBeats 观点。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。