In such a big environment, is now the best time to buy the dip?

In the first half of 2024, the cryptocurrency market experienced many major events. For example, the approval of the BTC spot ETF, the imminent approval of the ETH ETF, and the expectation of the SOL ETF. At the same time, the global economy is beginning to enter a rate-cutting cycle. Although it is not clear when the United States will cut interest rates, its inflation has been well controlled, which is undoubtedly a great positive for the cryptocurrency market. In addition, changes in regulatory policies remain one of the key factors affecting the cryptocurrency market. The stance of governments on cryptocurrencies varies, and the direction of regulatory adjustments will also be an important variable in determining market trends. In the just-ended last quarter, BTC fell by 16%, with continuous outflow of institutional funds and a lack of breakthrough technological innovations, which brought certain difficulties to the entire cryptocurrency market. BTC is currently fluctuating and adjusting within the range of $56,000 to $70,000, and investors are generally in a wait-and-see state. In such a big environment, is now the best time to buy the dip? Will the cryptocurrency market welcome a new bull market in the second half of the year? These questions are worth further exploration.

I. Timeline of important cryptocurrency events this month

Entering July, in addition to the above important project milestones, the cryptocurrency market still needs to closely monitor:

The Bitcoin repayment plan by MT.Gox in June caused a major market downturn, and we need to continue to follow this development in July;

Close attention to the approval process of the Ethereum spot ETF, as well as the approval status of the latter part of the S-1 document;

Large unlocks of tokens such as WLD, SOL, ALT, XAI, and ARB;

FTX creditors will vote to decide whether to compensate in cash or cryptocurrency;

In terms of mainstream public chains, Cardano will undergo a hard fork of the Chang mainnet; HNT has a new subnetwork proposal; Arbitrum's ARB will launch staking functionality;

Finally, Jupiter's JUP will reduce its total supply by 30%, Gala Games' G token will undergo a 1:60 reshaping, and Orion ORN will launch the Lumia brand upgrade.

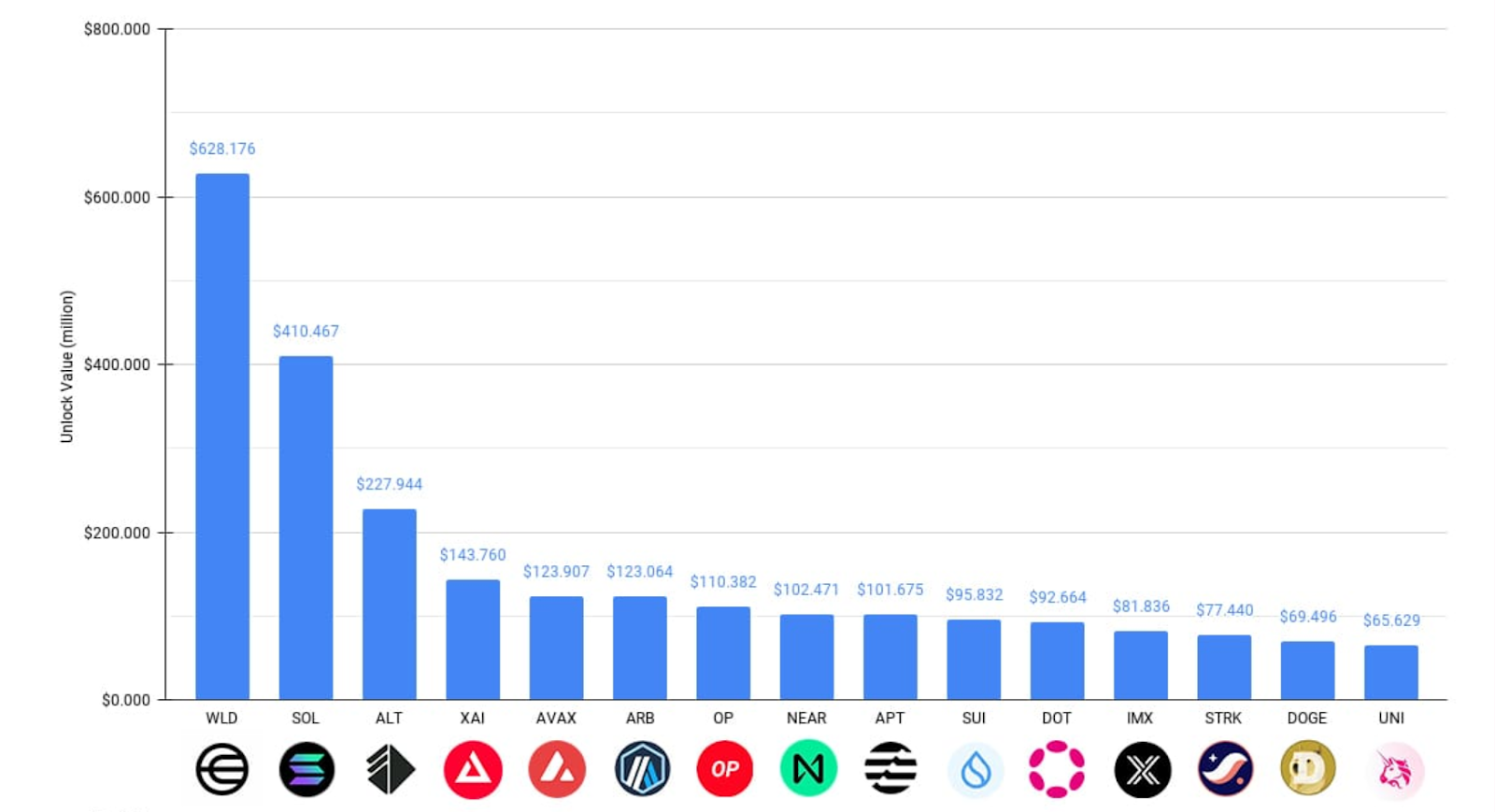

Many tokens are facing large unlocks. The following is the top 15 projects ranked by unlock value in July, as compiled by @Token_Unlocks:

$WLD has the highest unlock value this month, exceeding $600 million, accounting for 53.36% of the current circulating supply.

$SOL ranks second, with an unlock value of over $400 million. While $400 million seems like a lot, due to the high market value of $SOL, the unlock amount only accounts for 0.5% of the current circulating supply.

$ALT has a significant unlock this month, with nearly 45% of the current circulating supply already unlocked.

$XAI also has a high unlock amount this month, accounting for 71.59% of its current circulating supply.

Ethereum layer 2 tokens $ARB, $OP, and $STRK will unlock $120 million, $110 million, and $70 million in July, respectively.

II. Macro data analysis

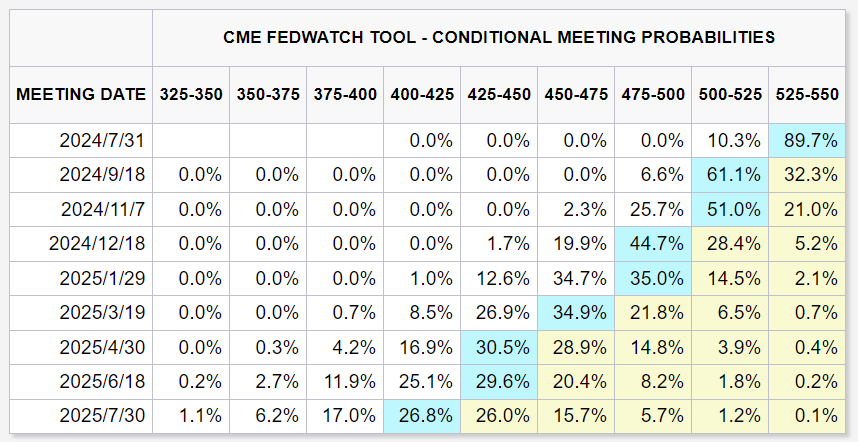

After entering July, the focus of the macro economy still remains on when to cut interest rates. Federal Reserve Chairman Powell has long stated that the timing of interest rate cuts will be judged based on two key factors: inflation and unemployment rate (4+2 indicators). In the context of the profound impact of the international landscape changes and the adjustment of Sino-US industries on the global economy, these changes will not show results in the short term.

The US core PCE annual rate for May, released last Friday, fell to 2.6%, the lowest level in three years, providing confidence for a rate cut in September. However, how the economic data for July and August will perform remains the focus of the market. The decline in May core PCE was mainly due to the decline in prices of three major elements: housing, automobiles, and crude oil. However, after entering July, the prices of these three major elements have rebounded, and the market's smart money did not bet in advance on the optimistic expectations for the June core PCE data. Therefore, the market remains cautious, especially before the June data is released, the market's attitude towards risk assets such as Bitcoin also reflects this cautious sentiment. Although Bitcoin faces downside risks, its downside potential is limited in the absence of major bearish news.

In addition, the changes in the international economic environment should not be ignored. The adjustment of industries between China and the United States is having a profound impact on the global economic landscape, and this process may take a long time to fully show its results. This adjustment has important implications for the global supply chain, trade relations, and investment flows, and the market needs to pay attention to this.

The economic data in the coming months will have a crucial impact on market expectations and the Federal Reserve's policy decisions. Investors need to closely monitor the upcoming data, while considering changes in the international economic environment and market sentiment, in order to make wiser investment decisions.

Since March, altcoins have undergone a correction for more than three months, and Bitcoin has also formed a clear M-top pattern. The highly anticipated June 27th election debate, the PCE data on June 28th, and the launch of the Ethereum spot ETF on July 2nd did not bring the expected positive news to the market. Although the PCE indicator is favorable for US stocks and risk markets, the market's digestion and interpretation of this data has been influenced by the US election, becoming more hesitant and indecisive. The rapid fluctuations in the short term further highlight the market's divergence and uncertainty about the future direction.

III. Key macro market factors

The cryptocurrency market has always been influenced by many key factors. The correlation between US stocks and cryptocurrencies in the past cycles is self-evident. In the big environment of the global economy entering a rate-cutting cycle, the overall performance of risk assets will also be crucial. At the same time, the strong US dollar has remained near its highest level in the past 30 years, which will also exert certain pressure on the cryptocurrency market. A strong US dollar will make cryptocurrencies priced in dollars relatively more expensive, and to some extent reduce investors' risk appetite. When faced with high interest rates, investors are more likely to choose to deposit funds in banks to earn interest, which will affect market liquidity.

In addition, the approval and listing of the most anticipated Ethereum spot ETF will inject new momentum into Ethereum and the entire cryptocurrency ecosystem in the second half of the year. There is also the US presidential election in the second half of the year, and political factors have a very important impact on market sentiment. These various factors will jointly determine the direction of the cryptocurrency market in the second half of 2024.

On Tuesday morning Eastern Time, Federal Reserve Chairman Powell stated at the Central Bank Forum hosted by the European Central Bank that the Fed has made significant progress in controlling inflation, but he hopes to see more progress before being confident enough to start cutting interest rates. This forum also attracted the participation of ECB President Lagarde and the President of the Central Bank of Brazil.

Powell expressed satisfaction with the progress made in controlling inflation over the past year: "We have made significant progress in the process of bringing inflation back to target levels. The latest inflation data indicates that we are returning to a cooling inflation trajectory." However, he emphasized that too rapid policy adjustments could undermine the progress in controlling inflation, while too slow adjustments could hinder economic recovery and expansion. Powell pointed out that the Fed needs to find a delicate balance between controlling inflation and avoiding deterioration of the labor market.

Regarding the labor market, Powell stated that the US unemployment rate remains at a low level of 4%, and the labor market is gradually cooling. Powell expects inflation in the next year to be in the lower to middle range of 2%-3%, but he expressed concern about higher service sector inflation, especially the part related to wages.

Although market expectations for a rate cut in September have increased, Powell refused to give a specific time. When asked if a rate cut in September is possible, Powell said, "I wouldn't specify any particular date at this time." This statement indicates that the Fed remains cautious about cutting interest rates, and future policies will continue to be data-driven.

Powell also mentioned that fiscal policy is the responsibility of politicians, and debt sustainability should be the focus in the future. Boosted by Powell's speech, the Nasdaq index turned higher, the S&P 500 index erased its initial decline, US Treasury yields extended their decline, and the US dollar index fell to an intraday low. Derivatives market traders continue to expect the Fed to cut interest rates twice this year.

Potential Impact of the Election on the US Market

The major factor that may cause political and economic fluctuations in the United States is still the election. As voters' expectations for the election of Trump and Biden change, the market is also weighing the different impacts and expectations of the election of different candidates. If the market sparks a "Trump rally" storm, with the expectation that he will implement loose policies on a large scale and inject a large amount of funds into the stock market after being elected, capital will flow into the risk market in advance, causing a significant rise.

Market participants are concerned about the uncertainty brought by the election, not only because of the huge policy differences between different candidates, but also because of their potential impact on the economy. Trump's policies tend to be massive fiscal stimulus and tax cuts, which may be seen as favorable for the stock market. On the other hand, Biden focuses more on infrastructure investment and social welfare, which may also promote economic growth, but the market remains cautious about his potential tax policies.

If the expectation of Trump's victory rises, the market may reflect this expectation in advance, with funds rapidly flowing into stocks and other risk assets, driving up market prices. However, this market trend also brings potential risks, including policy implementation uncertainty and long-term economic impact. The market will continue to closely monitor the election developments, assess the likelihood of each candidate's victory, and the impact of their policies on the economy.

Overall, the US election is not only a political game, but also a major event that affects the global market. Investors need to remain vigilant, adjust their strategies in a timely manner, and be prepared for potential drastic fluctuations and changes in the market.

IV. Key Sectors to Focus On

ETH Ecosystem

Key targets to focus on: ETH, ENS, LDO, SSV, ETHFI

The ETF Store predicts that the Ethereum spot ETF may be launched in the week of July 15th. Once the ETH spot ETF is approved and listed by the SEC, it will significantly improve market sentiment. Similar to the approval of the Bitcoin ETF, the approval of the Ethereum ETF means that more institutional investors can enter the market more conveniently, driving up the price of the coin. At that time, the entire Ethereum ecosystem will also rise, and attention can be focused on Ethereum's own ENS, as well as the leading staking project LDO and the re-staking leader ETHFI. In the second half of the year, we can also look forward to the technical innovation brought by the parallel EVM: continue to pay attention to the latest developments of Fuel, Monad, Berachain, and the application of Sei on the gaming chain.

SOL Ecosystem

Key targets to focus on: SOL, JUP, HNT

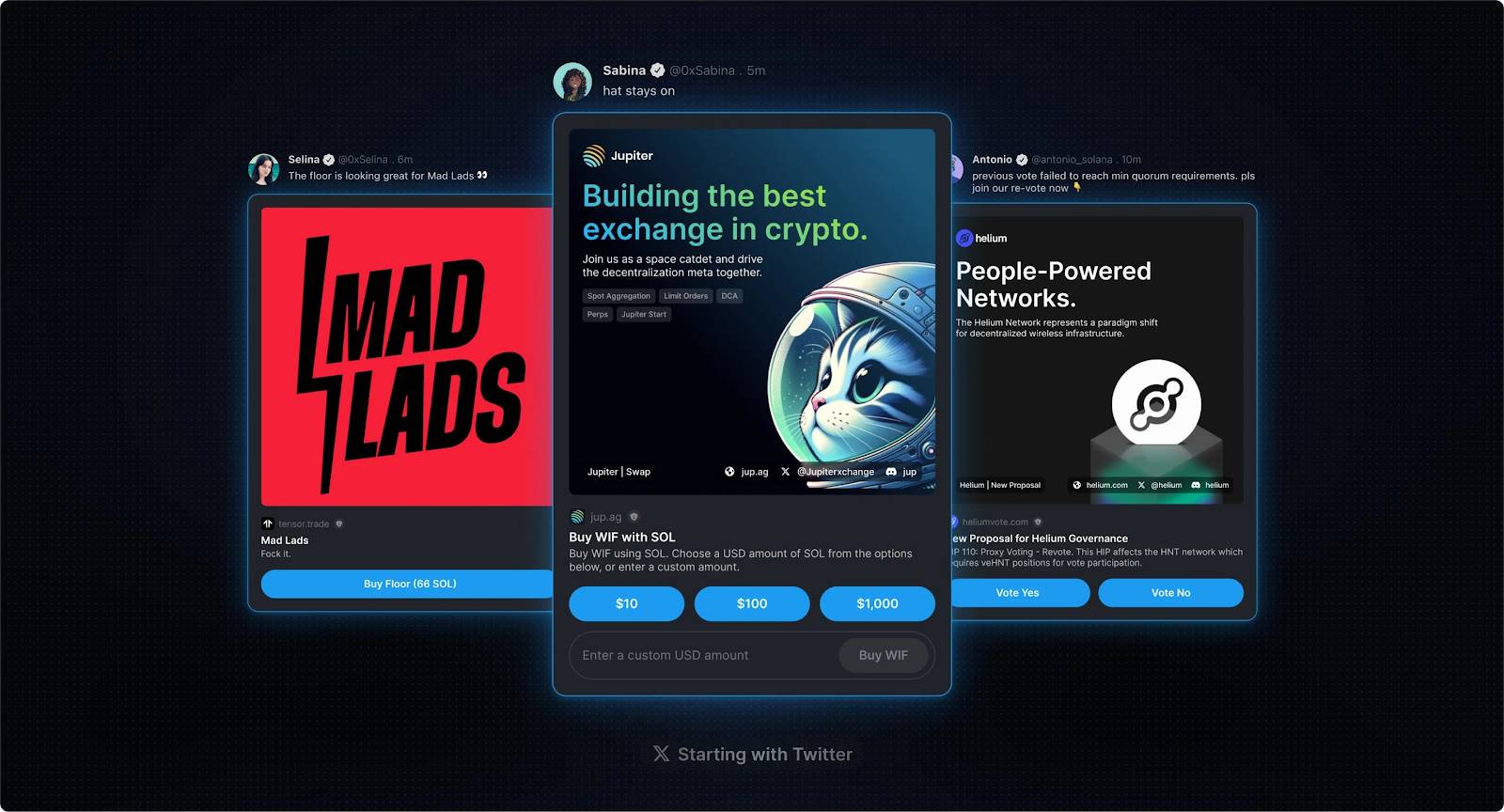

On June 28th, asset management giant VanEck submitted an application for the Solana ETF (VanEck SolanaTrust) to the SEC. Subsequently, 21Shares also submitted the S-1 file for the Solana ETF, attracting significant market attention. Solana also recently launched the powerful Blinks, which converts various interactive operations on Solana into a button on Twitter, such as Mint, Swap, and more. By linking social media accounts, users can easily follow popular assets on the trading chain, opening up a variety of application scenarios. The high-speed information requirements of early Meme tokens may be met through Blinks, further opening up the Meme market. Currently, a series of protocols including the wallets Phantom and Backpack, the DEX Jupiter, and the NFT platform Tensor all support Blinks.

This month, Helium will also announce a new subnetwork proposal, which can be worth paying attention to in terms of the trend of HNT. In addition, the Solana ecosystem's re-staking liquidity aggregation protocol Sanctum is also about to airdrop, and its token economy for $CLOUD has been announced, with 10% allocated for airdrops. With a TVL of over $800 million, it is the fifth largest project in the Solana ecosystem TVL and worth paying attention to.

AI Sector

Key targets to focus on: RNDR, AKT

Capital continues to pour into the AI sector, driving the development of AI technology, and also boosting the cryptocurrency sector related to AI concepts. It is expected that the market's continued preference for artificial intelligence will continue to benefit decentralized GPU markets such as Render and Akash. In July, there are also new developments to watch for the three coins AGIX, FET, and OCEAN.

MEME Sector

Key targets to focus on: PEPE, BONK, WIF, TRUMP

The MEME factory Pump.fun has surpassed Ethereum in daily income. In the market downturn and the sharp decline of altcoins, investors are seeking solace in MEME. We can choose projects that have entered the public eye and have strong community consensus as investment targets, such as PEPE, to avoid rapid and significant retracements. As a product driven by emotions, any uplifting news can become a catalyst for an increase. A large, active, and engaged community is always the backbone of MEME, and the communities of WIF and BONK have done well in this regard. If choosing investment targets in the Solana ecosystem MEME, WIF and BONK are likely to be the top choices for many. In the second half of the year, there are also many short-term opportunities for TRUMP in the ongoing US election. Overall, participating in MEME projects carries high risks and randomness, so investment should be approached with caution.

GameFi and SocialFi Sectors

Key targets to focus on: TON, RON

TON has shown strong resistance to decline in this round of correction, with a positive return rate for the month, performing very well. In July, the Telegram mini-games Hamster and Catizen will also launch their tokens, and their performance and trends can be closely monitored. In addition, the game public chain Ronin will undergo the Goda upgrade this month, and after the hard fork, validators will be able to receive rewards daily by generating blocks, and the upgradability of smart contracts has been introduced. Proposal REP-0014 implements Ethereum's EIP-1559 on Ronin, transferring gas fees to the Ronin treasury. It is worth paying attention to whether the treasury funds will be used for RON repurchases in the future.

V. Conclusion

BTC has once again fallen below $58,000, and the market is very pessimistic. Currently, BTC hashrate has dropped to its lowest level since December 2022, and multiple indicators such as miner reserves, exchange reserves, and the Miner Position Index (MPI) indicate that the market may have bottomed out, with miners' willingness to hold positions increasing and a lower likelihood of BTC selling by miners at this stage. To some extent, this means that market sentiment and expectations are improving, and Bitcoin is seeking new upward momentum to lay the foundation for a subsequent rebound. This momentum may come from the formal interest rate cut in the United States, the emergence of new breakthrough technologies in the market, or the resolution of the election dust, with crypto advocate Trump introducing policies more favorable to the market. At that time, long-term cautious investors will re-enter the market, driving funds back in.

Overall, the cryptocurrency market still has strong rebound potential in the second half of 2024, and we should closely monitor the multiple changes in policies, fundamentals, innovation, and market sentiment. This article does not serve as any investment advice, and risk control is still the most important thing we always talk about. "If a losing position causes you negative emotions, it's simple: get out quickly, because you will always have the opportunity to trade again (Paul Tudor Jones)." When the market is not doing well, it's best not to linger, exit and wait patiently for the next opportunity, to avoid overtrading driven by emotions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。