Compilation: Bocaibocai

Preface: Perhaps many people have not noticed that the entire blockchain industry is experiencing an unprecedented transformation driven by the public sector, which will affect the future structure of the entire human financial and monetary system.

In June 2024, the Monetary Authority of Singapore (MAS) officially released the white paper "Global Layer 1: Foundation Layer for Financial Networks," marking Singapore's establishment of an important "central bank blockchain." At the same time, the "mBridge" blockchain for currency bridges jointly created by the Bank for International Settlements, the People's Bank of China, and the Hong Kong Monetary Authority entered the MVP stage and openly invited international cooperation.

Prior to this, the Bank for International Settlements (BIS) published an article "Financial Internet (Finternet)" in April 2024, outlining the future blueprint and vision of tokenization and unified ledgers, indicating the central bank's attitude towards this transformation.

In October 2023, the author published a 30,000-word research report "Future Blueprint of RWA Asset Tokenization: Comprehensive Analysis of the Underlying Logic and Large-scale Application Implementation Path," which comprehensively discussed the underlying logic of tokenization and the path for large-scale application, emphasizing the future development from a practical perspective rather than focusing on RWA track projects in the cryptocurrency market.

In this article, the author's personal opinion is that the vast majority of real-world assets will be tokenized on permissioned chains with regulatory compliance frameworks, forming a multi-chain interoperability pattern across different regulatory jurisdictions. In this pattern, legal tender on the chain, such as CBDC and tokenized deposits, will become the main currency used.

From the white paper of the Monetary Authority of Singapore, it can be observed that the industry development seems to be moving in the direction predicted by the author. Based on this, the author also shares some of his own views on the future direction of the industry:

Although the scale of RWA is in the trillions, the RWA track will gradually evolve into a game for the powerful and traditional financial institutions, leaving little opportunity for pure Web3. The core is compliance + assets, compliance is determined by the powerful, and assets are held by capitalists and financial institutions. Technology is not the moat of this track, so it seems that entrepreneurs in the RWA track only have two paths: "fully compliant" and "completely non-compliant."

Areas such as cross-border payments, international trade, and supply chain finance, which were previously considered to have the most potential for improvement and application in blockchain, will have a great opportunity to truly land in this wave of global public and private sector mobilization. These areas also represent markets of billions or trillions, but they are also tracks that rely on compliance and resources.

In the white paper, MAS clearly stated that public chains are not suitable for regulated activities or regulated financial institutions, and there is currently a lack of infrastructure suitable for financial institutions in the market. Therefore, the kind of future where trillions of assets will be put on the chain may not necessarily be on a public chain. According to the author's understanding, some RWA investors' concerns come from some unknown risks, such as security risks, which are almost inevitable in public chains, where there is no accountability. The author boldly predicts that public permissioned chains will experience exponential growth in the future, as clear legal regulation and accountability will dispel the concerns of most investors.

In the white paper, the native token of Global Layer 1 is the central bank digital currency (CBDC), and stablecoins are not mentioned. According to the author's observation, for central banks, CBDC and tokenized bank deposits are the primary choices, while stablecoins are not given priority due to structural flaws such as the inability to achieve the "singularity" of currency and the risk of de-pegging. However, does this mean that CBDC will replace stablecoins in the future? Not necessarily, but it may present an interesting scenario of "render unto Caesar the things that are Caesar's, and unto God the things that are God's." The author may discuss this topic specifically in the future.

a16z partner Chris Dixon once stated in his book "Read Write Own Building the Next Era of the Internet" that the industry has two different cultures: "computer" and "casino," representing different paths of development in the industry. "Computer culture" represents developers, entrepreneurs, and many visionary individuals who can place encryption in the broader context of the history of the Internet and understand the long-term technological significance of blockchain. On the other hand, "casino" culture focuses more on short-term gains and profiting from price fluctuations. The author's personal opinion is that as the industry develops, the wild growth dividend will gradually disappear, and "casino" culture will continue to exist, but there will be fewer opportunities for ordinary people, and people will increasingly focus on "computer" culture to truly drive technological development and create real value.

Many people may have noticed that the author's update frequency is decreasing, and the content is rarely related to the market, but rather focuses on the trend of central bank development. This is because the author is currently following a series of pilot projects in cooperation with central banks with entrepreneurial teams, and most of the energy is focused on entrepreneurial matters. Therefore, in the future, the author will continue to update similar content, which may not directly make you money, but it can help you understand the latest industry development trends from another perspective, and the author believes that these contents will attract many like-minded friends. Respect! The following is the text of the white paper:

1. Introduction

The Global Layer 1 (GL1) initiative explores the development of a multifunctional shared ledger infrastructure based on distributed ledger technology (DLT), developed by regulated financial institutions for the financial industry. Our vision is to enable regulated financial institutions to deploy intrinsically interoperable digital asset applications across jurisdictions using this shared ledger infrastructure, managed by universal asset standards, smart contracts, and digital identity technology. Creating shared ledger infrastructure will release liquidity dispersed across multiple locations and enable financial institutions to collaborate more effectively. Financial institutions can expand the services offered to customers while reducing the cost of self-built infrastructure.

GL1 focuses on providing shared ledger infrastructure for financial institutions to develop, deploy, and use applications applicable to the value chain of the financial industry, such as issuance, distribution, trading and settlement, custody, asset servicing, and payments. This can enhance cross-border payments and cross-border distribution and settlement of capital market instruments. Establishing a financial institution alliance using DLT to address specific use cases such as cross-border payments is not a new development. The transformative potential of GL1's unique approach lies in developing shared ledger infrastructure that can be used for different use cases and can support composite transactions involving multiple financial assets and applications while complying with regulatory requirements.

By leveraging the capabilities of a broader financial ecosystem, financial institutions can provide richer and more extensive services to end users and bring them to market more quickly. GL1's shared ledger infrastructure will enable financial institutions to build and deploy composite applications, leveraging the capabilities of other application providers. This can manifest as institution-level financial protocols for programmatic modeling and execution of foreign exchange conversion and settlement. This, in turn, can improve the interaction of tokenized currencies and assets, achieve simultaneous delivery versus payment (DvP) settlement of digital and other tokenized assets, and payment versus payment (PvP) settlement of foreign exchange conversions. Furthermore, this can support delivery versus payment versus payment (DvPvP), where the settlement chain consists of a set of synchronized tokenized currencies and asset transfers.

This article introduces the GL1 initiative and discusses the role of shared ledger infrastructure, which will comply with applicable regulations and be managed by universal technical standards, principles, and practices. Regulated financial institutions can deploy tokenized assets across jurisdictions. The participation of public and private sector stakeholders is crucial to ensure that the shared ledger infrastructure is established in accordance with relevant regulatory requirements and international standards, and meets market demand.

2. Background and Motivation

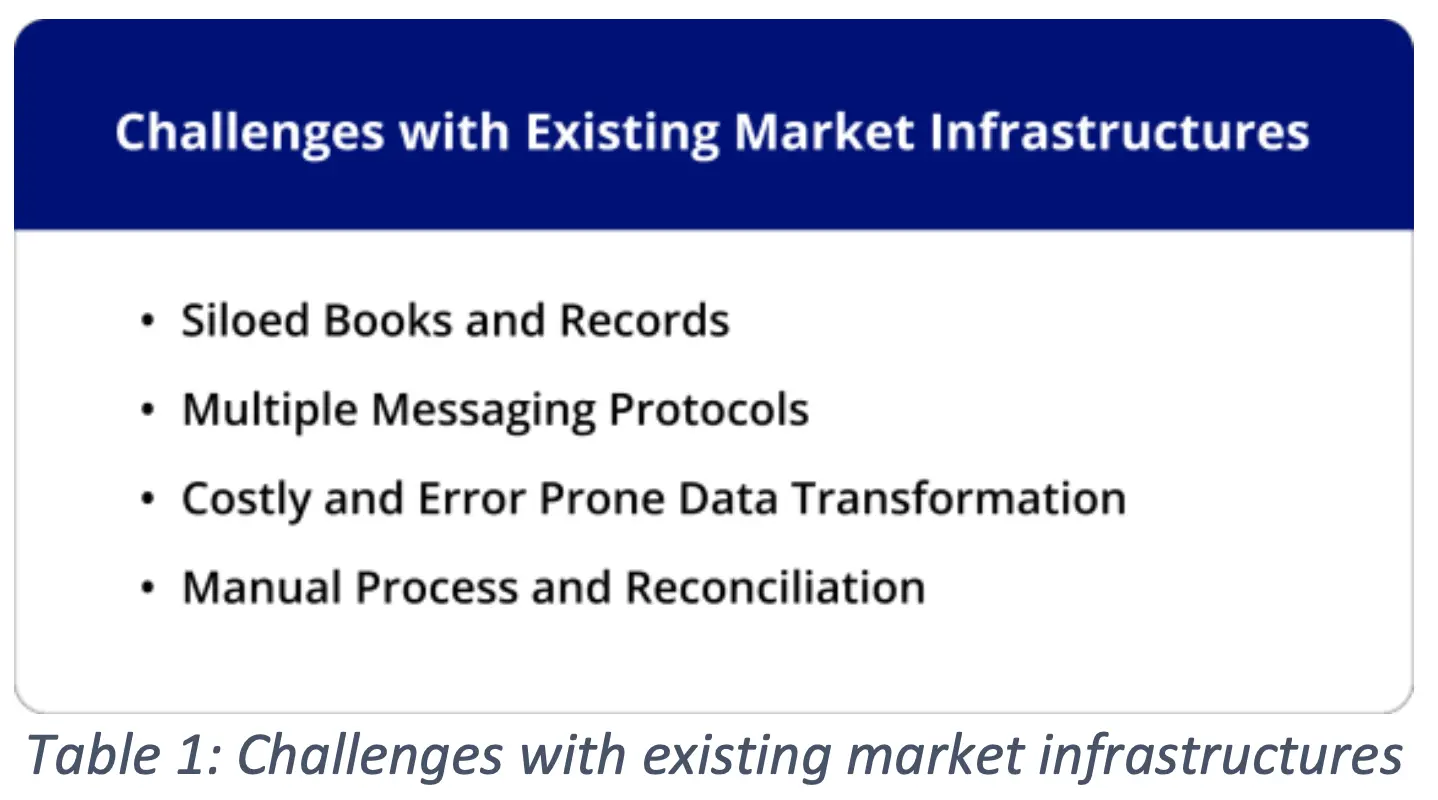

The traditional infrastructure supporting the global financial market was developed decades ago, resulting in isolated databases, different communication protocols, and high costs associated with maintaining proprietary systems and custom integrations. While the global financial market remains robust and resilient, industry demands have become more complex and scalable. Incremental upgrades to existing financial infrastructure may not be sufficient to keep pace with the complexity and rate of change.

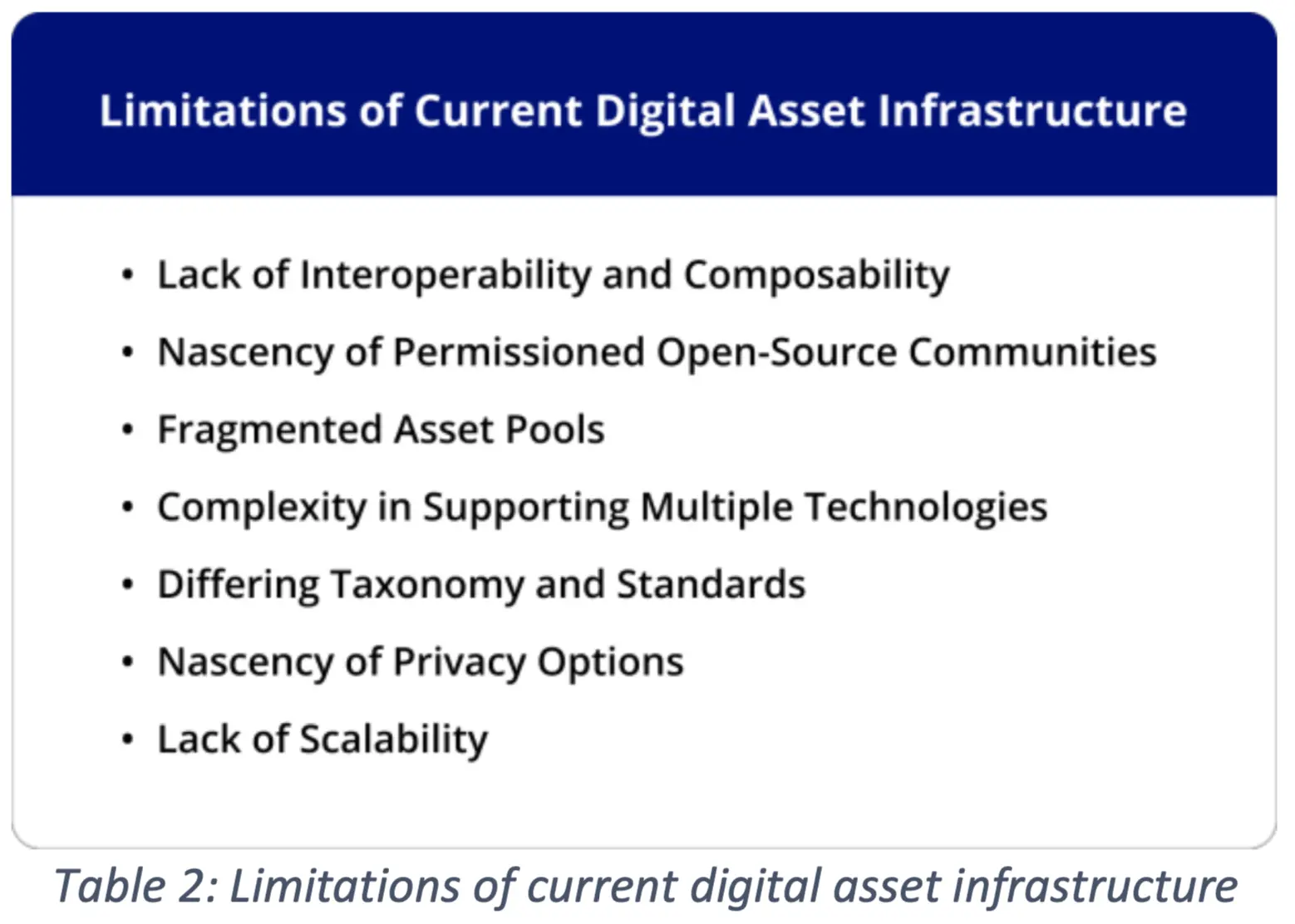

As a result, financial institutions are turning to technologies such as distributed ledger technology (DLT) because it has the potential to modernize market infrastructure and provide a more automated and cost-effective model. It is worth noting that industry participants have initiated their own digital asset programs. However, they have chosen different technologies and vendors for their respective programs, limiting interoperability.

The limitations in interoperability between systems have led to market fragmentation, with liquidity being trapped between incompatible infrastructures in different locations. Holding liquidity in different locations may increase capital and opportunity costs. Additionally, the proliferation of different infrastructures and the lack of globally recognized digital asset and DLT-related classifications and standards have increased adoption costs, as financial institutions need to invest in and support different types of technologies.

To achieve seamless cross-border transactions and fully realize the value of DLT, compliance infrastructure designed around openness and interoperability is needed. Infrastructure providers should also understand the applicable legal and regulatory framework related to the issuance and transfer of tokenized financial assets, as well as the regulatory treatment of products created under different tokenized structures.

Recent working papers from the BIS have outlined the vision of "Financial Internet" (Finternet) and "Unified Ledger," further supporting the role of tokenization in applications such as cross-border payments and securities settlement. If managed properly, an open and interconnected financial ecosystem can improve access to and efficiency of financial services through better integration of financial processes.

Although experiments and pilots for asset tokenization have made good progress, the lack of financial networks and technological infrastructure suitable for executing digital asset transactions has limited the ability of financial institutions to deploy tokenized assets at a commercial scale. As a result, market participation in tokenized assets and secondary trading opportunities are still relatively low compared to traditional markets.

The following paragraphs will discuss two network models commonly used by financial institutions today, as well as a third model that combines the openness of Model 1 and the safeguards of Model 2.

Model 1: Public Permissionless Blockchain

Currently, public permissionless blockchains have attracted a large number of applications and users because they are designed to be open and accessible to all parties. Essentially, they are similar to the internet, and public networks can grow exponentially as participation in the network does not require approval. Therefore, public permissionless blockchains have significant potential network effects. By building on shared and open infrastructure, developers can leverage existing capabilities without having to rebuild similar infrastructure themselves.

Public permissionless networks were not initially designed for regulated activities. They are essentially autonomous and decentralized. There are no legal entities responsible for these networks, and there are no executable service level agreements (SLAs) regarding performance and resilience (including network risk mitigation), as well as a lack of determinism and guarantees in transaction processing.

Due to the lack of clear accountability, anonymity of service providers, and the absence of service level agreements, these networks are not suitable for regulated financial institutions without additional safeguards and controls. Furthermore, legal considerations and general guidelines regarding the use of such blockchains are not yet clear. These factors make it difficult for regulated financial institutions to use them.

Model 2: Private Permissioned Blockchain

Some financial institutions have recognized that existing public permissionless blockchains cannot meet their needs. Therefore, many financial institutions choose to establish independent private permissioned networks and their ecosystems.

These private permissioned networks have technical features that enable them to implement rules, procedures, and smart contracts according to applicable laws and regulatory frameworks. They are also designed to ensure network resilience in the face of malicious behavior.

However, the proliferation of private and permissioned networks, if they cannot interoperate with each other, may lead to greater fragmentation of wholesale funding market liquidity in the long run. If not addressed, fragmentation will reduce network effects in the financial market and may create friction for market participants, such as inaccessibility, increased liquidity requirements due to the separation of liquidity pools, and price arbitrage across networks.

Model 3: Public Permissioned Blockchain

Public permissioned networks allow any entity that meets participation criteria to participate, but the types of activities participants can engage in on the network are restricted. A public permissioned network operated by financial institutions for the financial services industry can realize the advantages of an open and accessible network while minimizing risks and concerns.

Such networks will be built on principles of openness and accessibility similar to the public internet, but with built-in safeguards to serve as a value exchange network. For example, the network's governance rules may be limited to regulated financial institutions becoming members. Transactions can be supplemented by privacy-enhancing technologies such as zero-knowledge proofs and homomorphic encryption. While the concepts of public and permissioned networks are not new, there is no precedent for such networks being provided at a large scale by regulated financial institutions.

The GL1 initiative will explore and consider various network models, including the concept of public permissioned infrastructure in the context of relevant regulatory requirements. For example, regulated financial institutions can operate nodes for GL1, and participants in the GL1 platform will undergo Know Your Customer (KYC) checks. Subsequent sections will describe how GL1 operates in practice.

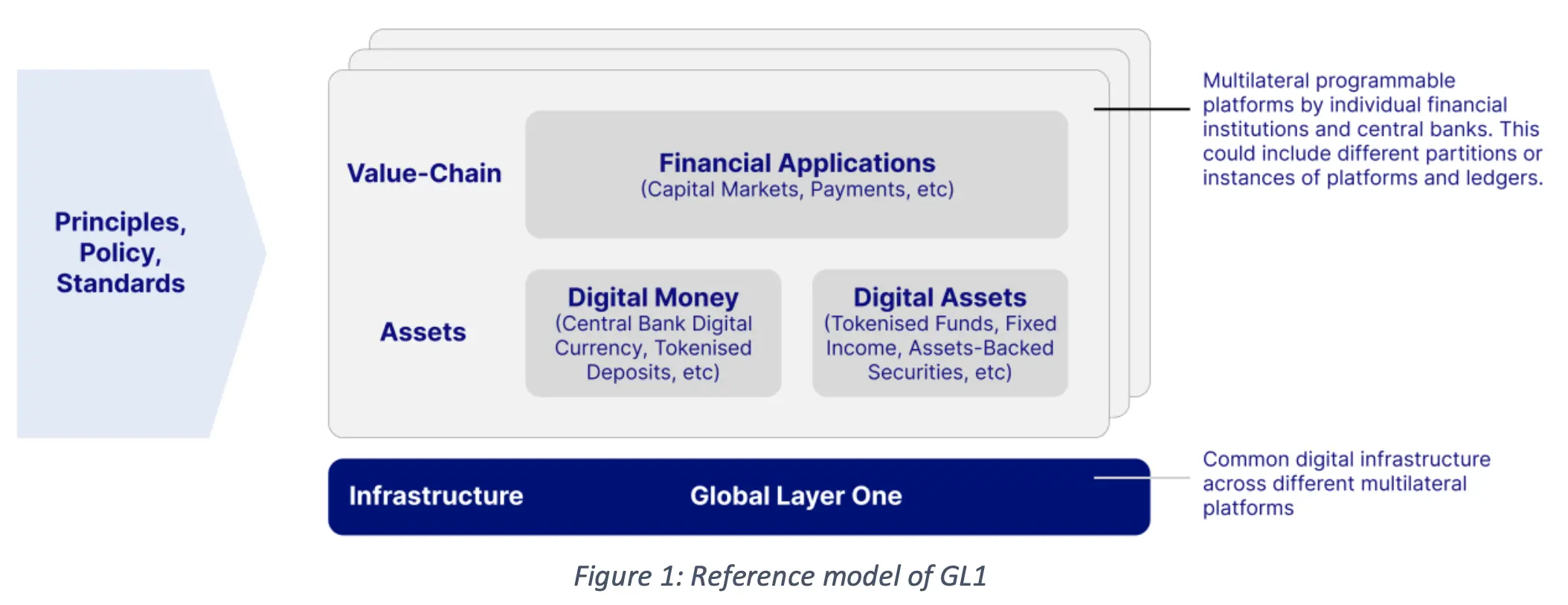

The GL1 initiative aims to facilitate the development of a shared layer infrastructure for hosting tokenized financial assets and financial applications along the financial value chain.

The infrastructure of GL1 will be agnostic to asset types; it will support tokenized assets and tokenized currencies issued by network users (such as regulated financial institutions) in different jurisdictions and denominations. This can streamline processing, support automatic real-time cross-border fund transfers, and facilitate simultaneous foreign exchange (FX) swaps and securities settlements based on predefined conditions.

The infrastructure will be developed by financial institutions for the financial services industry and will serve as a platform, providing the following functionalities:

- Cross-application synchronization

- Composability

- Privacy protection

- Inherent application compatibility with assets already tokenized and/or issued on the infrastructure

The GL1 operating company will act as a technology provider and a public infrastructure provider across markets and jurisdictions. To facilitate the development of the solution ecosystem, GL1 will also support regulated financial institutions in building, operating, and deploying applications on a universal digital infrastructure covering:

- Transaction lifecycle (primary issuance, trading, settlement, payments, collateral management, corporate actions, etc.)

- Issuance and trading of different asset types (e.g., cash, securities, alternative assets)

3.1 Key Objectives

The vision of creating more efficient clearing and settlement solutions and unlocking new business models through programmability and composability features will be the focus of the GL1 initiative, which will emphasize the following aspects: a) Supporting the creation of multifunctional networks. b) Enabling the deployment of various applications ranging from payments to capital raising and secondary trading. c) Providing infrastructure for hosting and executing transactions involving tokenized assets, which are digital representations of value or rights that can be electronically transferred and stored. Tokenized assets can include assets across asset classes (such as stocks, fixed income, fund shares, etc.) or currencies (such as commercial bank money, central bank money). d) Encouraging the development and establishment of internationally recognized common principles, policies, and standards to ensure interoperability of tokenized assets and applications developed on and for GL1 internationally and across networks.

3.2 Design Principles

To achieve the goal of serving the financial industry's needs, the foundational digital infrastructure of GL1 will be developed based on the following set of principles:

- Open and standards-based: Technical specifications will be open and accessible, allowing members to easily build and deploy applications. Industry standards and open-source protocols may be used where appropriate (for payment messaging and tokens). Efforts will be made to ensure flexibility in design and to propose or incorporate future standards if existing standards are not developed or sufficient.

- Compliance with applicable regulations and openness to regulatory authorities: The GL1 platform will comply with applicable laws and regulatory requirements. Policy controls specific to jurisdictions should be developed at the application layer, not built into the GL1 platform. Legal and regulatory requirements applicable to members or end-users may depend on the analysis of commercial applications, services, and the location of members or end-users.

- Good governance: Clear and transparent governance arrangements, operational arrangements, membership agreements, and rules will be in place to ensure clear boundaries of responsibility and accountability.

- Neutrality: Design should prevent concentration or aggregation of control by any single entity or related group of entities and geographical regions. Key operational decisions, including technology choices, will be based on technical merits (among other factors) and evaluated by members.

- Business fairness: Financial institutions should be able to compete fairly on the GL1 platform. The GL1 operating company will not make decisions aimed at unfairly benefiting one financial institution over others.

- Accessible in functionality and economics: Financial institutions meeting membership criteria will be eligible to participate. Membership criteria, operating costs, and fees will be designed to promote the integrity, stability, and sustainability of the network.

- Financial self-sufficiency: The GL1 platform can operate as an industry utility. Revenue, including subscription fees and transaction fees, will be used for operating costs and reinvestment (such as enhancement and technology research and development) to ensure the ongoing sustainability of GL1.

3.3 Architecture Overview

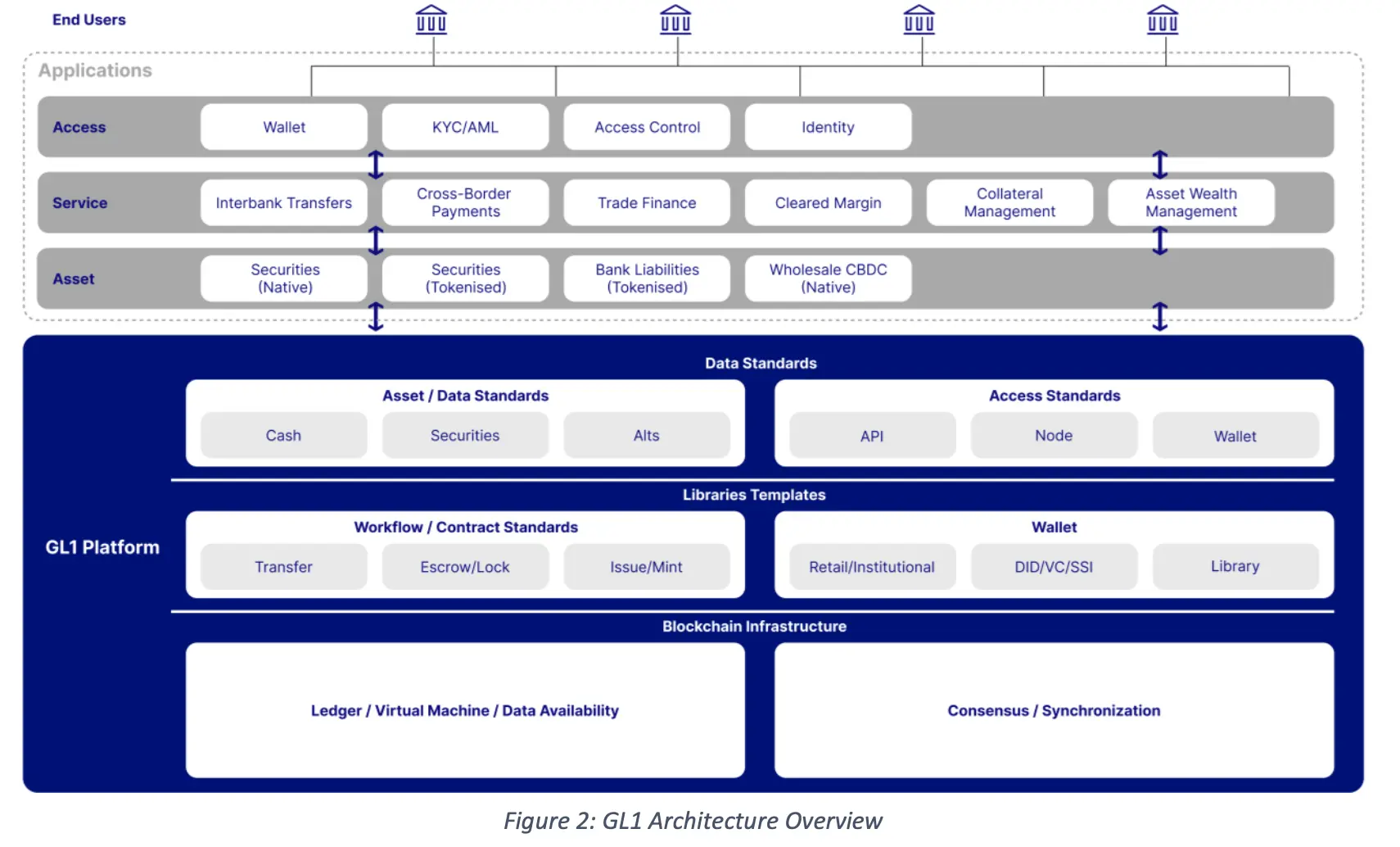

The architecture of GL1 can be described as the foundational layer in the four-layer conceptual model of a digital asset platform. This four-layer model was first introduced in the Monetary Authority of Singapore's "Project Guardian - Open and Interoperable Networks" and the International Monetary Fund's "ASAP: A Conceptual Model for a Digital Asset Platform" working papers.

While still under consideration, the expected interactions of GL1 with other layers of the stack can be described as follows:

- Access Layer: The access layer refers to how end-users access various digital services built around the GL1 platform. Each service provider will be responsible for: a) providing wallet functionality that complies with GL1 standards; b) conducting KYC checks on their respective customers; c) onboarding, authorizing, and offboarding their direct customers; d) serving their own customers. Non-designated financial institutions may access GL1 services, but they would first need to access through designated financial institutions.

- Service Layer: Regulated financial institutions and trusted third parties meeting participation criteria should be able to build and deploy application services on the GL1 platform, such as interbank transfers and collateral management. Participating financial institutions will need to adhere to settlement function standards defined by GL1, including: Delivery versus Payment (DvP), Payment versus Payment (PvP), and Delivery versus Delivery (DvD). Service providers can also develop their own smart contract logic not included in the default software library of GL1.

- Asset Layer: The asset layer will support the local issuance of cash, securities, and other assets, as well as the tokenization of existing physical or simulated assets. Supported asset types may include cash and cash equivalents, stocks, fixed income, commodities, derivatives, alternative assets, fund shares, letters of credit, promissory notes, asset reference tokens, and other tokens. Assets on GL1 will be deployed in token form and designed to be technically interoperable across multiple GL1 applications and service providers.

- Platform Layer (Global Ledger 1): GL1 will provide infrastructure components for the platform layer, including blockchain infrastructure (including ledger and consensus mechanisms), libraries and templates, data standards, and platform-wide services. Infrastructure for record-keeping will be separate from the application layer, ensuring that assets on the GL1 platform are compatible across multiple applications, even if those applications are provided by different institutions. The platform will include standardized protocols for consensus and synchronization mechanisms to facilitate asset transfers and cross-application communication. The platform will also ensure privacy, permission management, and data isolation from other applications and participants.

Entities acting as validators and ensuring the integrity of recorded transactions under GL1 will need to adhere to technical risk management controls in the financial sector, including business continuity plans and network security protection. In return for their efforts, validators may be rewarded through pre-paid transaction fees or deferred recurring payments based on subscription fees.

To ensure compatibility with other layers of the stack, the GL1 platform will adhere to a set of defined data and operation standards (assets, tokens, wallets, etc.), and include core functionalities, common libraries, and business logic (access, smart contracts, workflows) that can be leveraged as optional "starter kits."

4. Potential Use Cases of GL1

GL1 will be designed to support multiple use cases and will be agnostic to asset types. It will support all regulated financial assets, tokenized central bank currencies, and commercial bank currencies on the shared ledger infrastructure. Participating central banks can also issue central bank digital currencies (CBDC) as common settlement assets on GL1.

For GL1, any financial institution meeting minimum eligibility criteria and passing a due diligence process can participate in and use GL1 services without the need for central management approval. However, only licensed parties can build and deploy commercial applications on the GL1 platform and must adhere to GL1's data and security standards. Permitted activities by financial institutions will be proportionate to their risk profile and their ability to mitigate related risks.

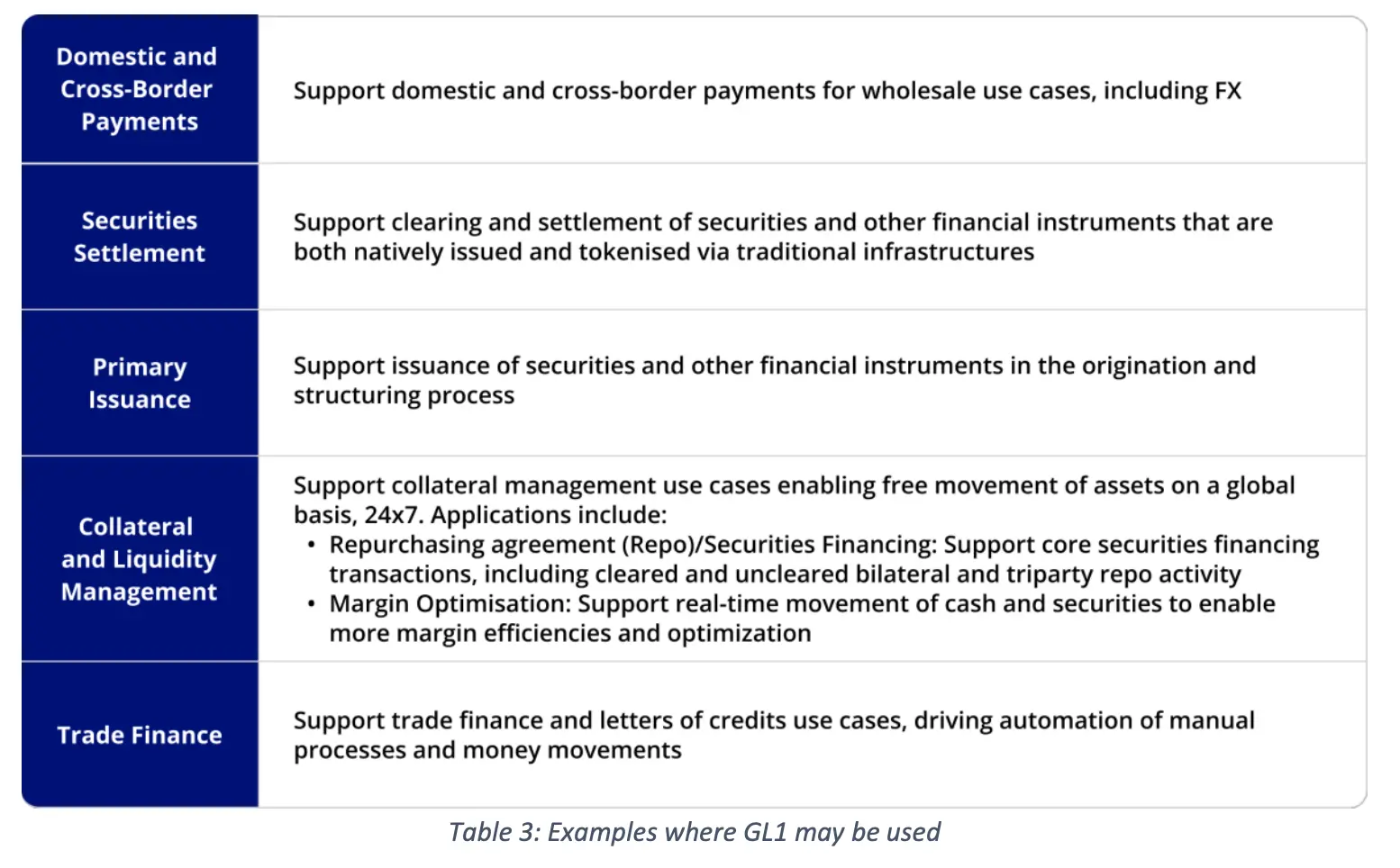

Preliminary identified use cases include cross-border payments and cross-border distribution and settlement of capital market instruments on the digital asset network. Table 3 provides examples of potential use cases for GL1.

The examples included in this article are for illustrative purposes only and should not be considered formal opinions applicable to all use cases on the GL1 platform.

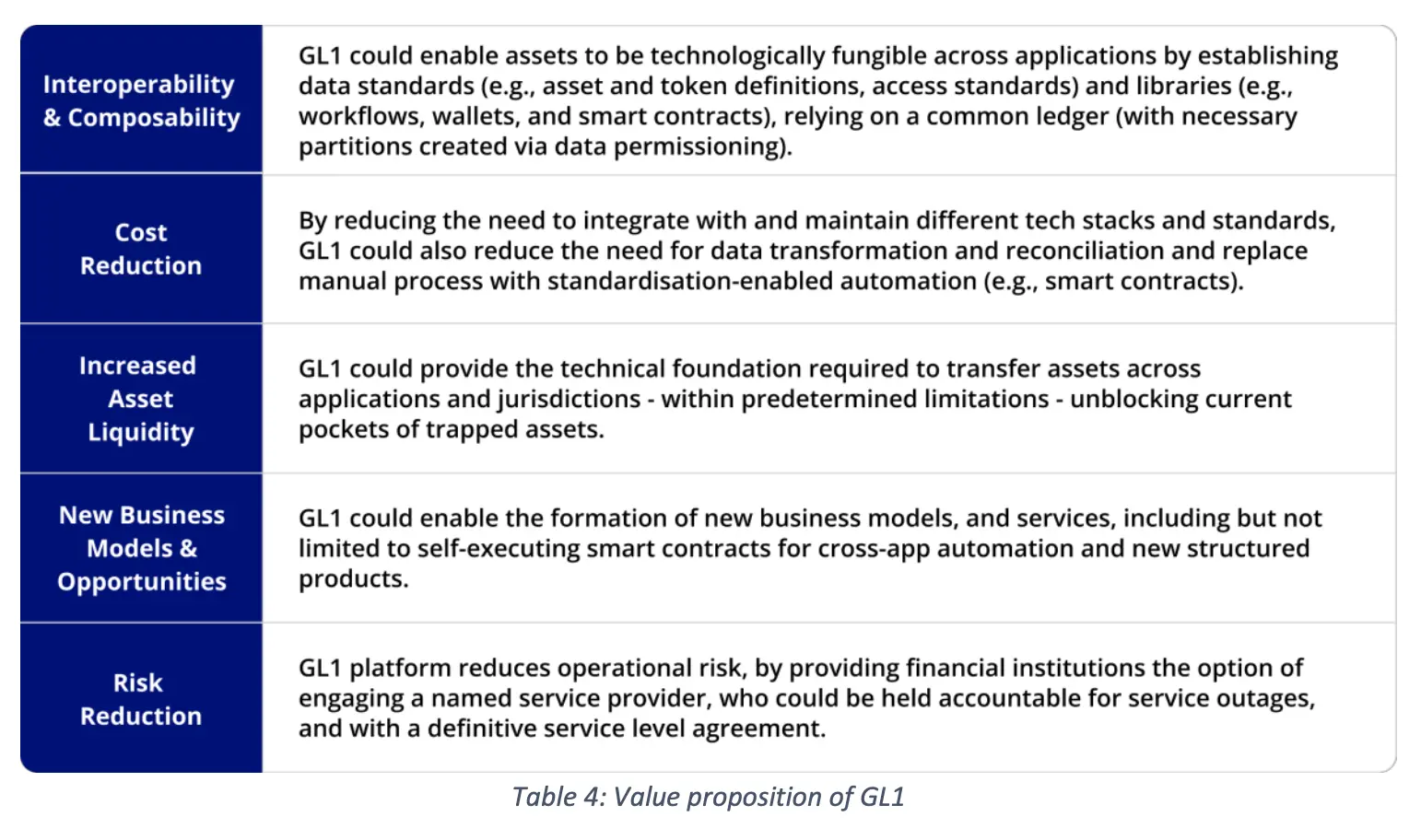

Value Proposition of GL1

By introducing digital asset applications and involving regulated financial institution participants in the shared ledger infrastructure, the financial industry is expected to realize the benefits of digital assets and potentially significantly accelerate the modernization of traditional market infrastructure. Table 4 describes some potential value propositions of GL1.

5. Operating Model

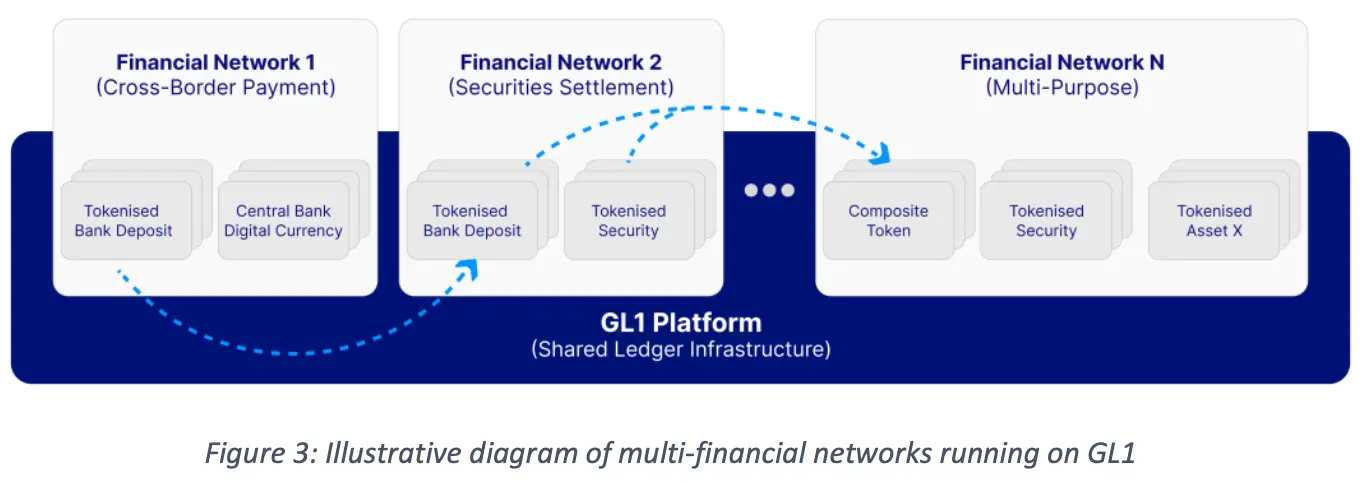

In practical operation, multiple financial applications and networks can be established using the GL1 platform. The financial network defined here refers to a consortium of financial institutions that agree to transact using a common set of business arrangements and governance rules that define the responsibilities and obligations of each party.

Financial networks can be organized around specific use cases. For example, a financial network may consist of applications focused on cross-border payments. Meanwhile, other financial networks may focus on use cases such as cash and securities settlement.

The financial networks can also include different types of tokenized assets. Some financial networks may focus on using wholesale central bank digital currencies (CBDC), while others explore the use of central bank currencies and commercial bank currencies on the shared ledger. Financial networks can also span multiple use cases and jurisdictions, for example, the Monetary Authority of Singapore's (MAS) Project Guardian wholesale network will include applications supporting forex exchange, fixed income, asset, and wealth management tokenized products.

While each financial network is or will be independently governed and has different characteristics, the potential to expand the coverage of a single financial network may be a significant motivation for them to choose a common infrastructure. By using the same shared ledger infrastructure, tokenized assets can be transferred between different financial networks, and new applications can be composed by building applications originating from multiple financial networks.

In some cases, financial institutions may not be able to transact on a network based on shared ledger infrastructure but can address this by interlinking financial networks based on different ledger technologies. The benefits and drawbacks of interlinking networks are detailed in the Monetary Authority of Singapore's (MAS) "Project Guardian - Interlinking Networks" technical paper. Further considerations for expanding networks can be found in the "Open and Interoperable Networks of Project Guardian" paper.

As a regulated financial services platform, some activities on the GL1 platform may be restricted, allowing only designated service providers to engage. The relevant operators are expected to define rulebooks and specify the types of activities allowed. For example, all participants may initiate transactions, but only designated financial institutions may deploy smart contracts. Additional control measures may be defined at various network and application levels, with access to specific functionalities restricted to selected parties through necessary screening or authentication processes.

Settlement arrangements: The GL1 platform can support the clearing and settlement of payments, securities, and other financial transactions by financial market infrastructure (FMI) operators. When establishing the GL1 platform, the GL1 operating company can serve as a technical infrastructure provider for FMI operators. FMIs may still play a critical role in the value chain, but functions traditionally performed by specific types of FMIs or critical service providers (CSPs) may be reorganized.

For example, under existing arrangements, trade execution, clearing, and settlement functions are performed by different systems operated by different parties. Ownership of securities is transferred and records of central securities depositories (CSD) are updated when payments are made through a separate system.

With GL1, this coordination can be automated through smart contracts. In the new arrangement, both cash and securities transactions will be settled and executed on the same shared ledger infrastructure. This means that cash and securities can be exchanged simultaneously, and either the cash or securities portion of the transaction will succeed, or both will fail. This arrangement aims to minimize the impact on the system in the event of counterparty default.

Settlement finality: A key requirement in the design of GL1 is the platform's ability to support settlement finality, clearly defining when a settlement becomes irrevocable and unconditional. In a distributed network, this is not straightforward, as multiple validating nodes simultaneously verify transactions and update records. Choosing an appropriate algorithm for achieving consensus on ledger state to ensure consistency between the ledger operation phase and the transfer being considered as having settlement finality will be an important design decision.

In the case of GL1, it is assumed that a deterministic consensus algorithm is needed to support settlement finality. For example, it can be defined by FMI operators that settlement is deemed final and irrevocable once a predetermined number of validating nodes operated by designated financial institutions achieve consensus on the ledger state. For completeness, FMI operators utilizing the GL1 platform should be aware of the relevant regulatory regimes applicable to settlement finality.

Organization and regulatory oversight: As designed, the GL1 operating company may operate within markets and jurisdictions involving participating financial institutions. Based on specific arrangements between the GL1 operating company and participating financial institutions, and subject to commercial and legal analysis, the infrastructure of GL1 and its operating company may be considered as an FMI and/or critical service provider in certain jurisdictions where they operate.

The operating company and participating financial institutions need to consider and manage potential risk factors. These risks include credit, liquidity risk, operational impact of loss or delay in accessing the GL1 platform, and taking appropriate measures to mitigate the impact of systemic downtime. Environmental, social, and governance risks also need to be considered.

Depending on the organizational form and settlement arrangements, financial institutions utilizing the GL1 platform may also be subject to different applicable licensing and regulatory requirements. Further commercial, legal, and governance analysis is needed to determine the responsibilities and accountabilities of the GL1 operating company in settlement arrangements with participating FMI operators in their respective jurisdictions.

In this regard, the GL1 operating company will collaborate with relevant stakeholders, including supervisory authorities, to ensure the rule of law is maintained in the infrastructure of GL1.

Future work: Since its establishment in November 2023, the Monetary Authority of Singapore (MAS) and participating financial institutions have been discussing and generating insights and ideas about the GL1 shared ledger infrastructure. Among the topics discussed, participating financial institutions have considered:

Potential business use cases deployed on the GL1 platform, such as domestic and cross-border payments, primary issuance of securities and other financial instruments, collateral management, and securities settlement.

Alignment of the governance model for GL1, requiring the operation of an independent legal entity as the operating company for GL1, and a non-profit organization focused on governance principles, standards, and best practices.

Preliminary assessments of policy, risk, and legal considerations for providing services.

Preliminary assessments and recommendations on the applicability of existing distributed ledger technology (DLT) for potential business needs in developing GL1.

In the next phase, GL1 will take a dual-track approach to promote its development. GL1 will explore establishing a non-profit organization to develop common principles, policies, and standards for operating GL1. This will complement the potential establishment of independent operating companies that will build and deploy the infrastructure of GL1.

The development of governance and operating models may include considerations of member types and distribution, target operating models, expected operating costs, proposed fee structures, estimated revenues, and cost neutrality to reach the break-even point for entities. It may also expand on preliminary assessments of potential solution options and technical design considerations to achieve GL1's potential.

Existing distributed ledger technology is expected to be used and potentially enhanced to support the specific requirements of GL1.

In summary, GL1 is expected to be a multi-year initiative aimed at establishing the foundational digital infrastructure capable of shaping the future of financial networks. When this vision is realized, it may fundamentally change the lifecycle of assets and the operation of capital markets. Achieving this potential will require unprecedented multilateral cooperation across jurisdictions, including the participation of both private and public sectors, unseen since the advent of the internet.

The power of uniting networks of global banks, public sector authorities, and international organizations is evident: the initiative welcomes contributions from the international community to drive the development of GL1 as foundational digital infrastructure, supporting the transformation of the financial industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。