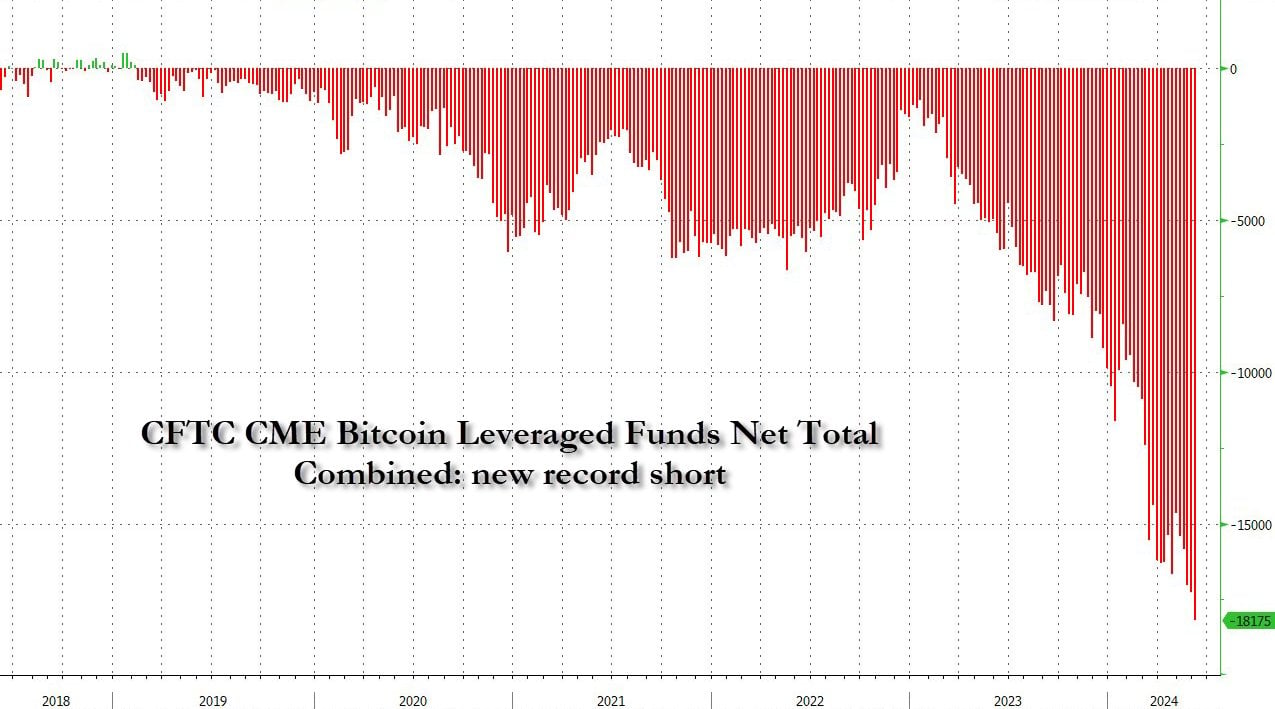

While crypto enthusiasts and analysts have been optimistic about bitcoin (BTC) for quite some time, particularly as the price neared the $72,000 threshold, hedge funds are anticipating a decline in bitcoin’s value.

On June 7, when BTC dipped to $68,450 and then modestly recovered to above $69,000, the financial news outlet Zerohedge posted on the social media platform X, highlighting a “big jump and new record high in bitcoin hedge fund net shorts.”

Source: Zerohedge – COT report from CFTC.

That was at 7:29 p.m. EST on Friday. Eight hours earlier, Zerohedge reported that the latest weekly COT update from the CFTC would likely reveal a substantial increase in record BTC hedge fund net shorts. This prediction was quite accurate, as confirmed by the following report.

“When this snaps, it will make Volkswagen/GME look like amateur hour,” Zerohedge remarked.

Essentially, a substantial rise in net short positions indicates a significant shift in market sentiment, at least among hedge funds. This increase in shorting activity suggests that hedge funds are betting more heavily on a decline in bitcoin’s price. Such positions are typically adopted by those expecting a drop in value, aiming to gather meaningful profit from falling prices.

At times, this bearish outlook by institutional players like hedge funds can influence broader market sentiment, potentially leading to increased volatility and downward pressure on BTC prices. However, a sudden spike in BTC prices can devastate short positions, erasing them in a matter of minutes. This is essentially what transpired on Friday; however, when BTC dropped below the $69,000 mark, it was the long positions that were liquidated.

If bitcoin’s price were to rise dramatically, hedge funds with significant short positions would face substantial financial losses. The higher the price climbs, the greater the losses for BTC short position holders. This scenario could potentially trigger a short squeeze, where the rapid price increase forces short sellers to buy back their positions to limit losses, further driving up the price of bitcoin. The fact is, in the world of bitcoin trading, even the best-laid plans can face unexpected twists.

What are your thoughts on the increasing bearish sentiment among hedge funds towards bitcoin? Share your insights in the comments below.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。