If the goal is set as "earning 500,000 in the secondary market within a year," without knowing what to ambush, there is no need to search everywhere. By following the exchange dynamics and making purchases, there can be good returns.

This article mainly uses pStake as an example to explain what kind of projects meet Binance's newly released "Binance Coin Listing Project Open Recruitment Plan." After deeply understanding this, everyone can independently evaluate the market based on market information, project fundamentals, and technical aspects. This way, you can gradually form your own investment logic and no longer suffer losses due to KOL's calls.

The article is mainly divided into the following three parts:

- Part One: Novice stage, blindly following market information (baccarat gameplay)

- Part Two: Versatile stage, analyzing projects based on fundamentals (after earning money several times in baccarat, start studying the cards, and most people stop here)

- Part Three: Awakening and transformation stage, seeking more data support, constantly verifying and overturning, and finally making decisions

Part One, Novice Stage

In the secondary market, many people are at this stage. They like to blindly follow any seemingly favorable information, which is also a way for novices to make money, just like playing baccarat. Beginners often have a relatively high winning rate and can make money.

But even though beginners seem to not understand anything when playing baccarat, they still have their own methods. They will place bets based on the information at the table, such as following the trend, following the dealer, or betting against.

In the cryptocurrency market, it's the same. Beginners often make money, but many people don't know how to get started. In fact, you can also make money in the cryptocurrency market based on information.

I. What is the specific operational logic?

For example, the day before Binance Exchange released the "Binance Coin Listing Project Open Recruitment Plan," Binance Research Institute released an introduction to the major market events and team viewpoints in an article (link), mentioning many projects. If these projects are carefully studied, some of them actually have a probability of being listed on Binance Exchange.

II. What impact does an article have on speculation?

An article doesn't have a significant impact on price increases. Before important announcements are made, a lot of funds have already pushed up the price. At this point, it may be a lure for more buyers (for projects already listed). If the signal for luring more buyers is discovered early, just like following a "trend" in baccarat, there is a certain probability of making a profit, and this probability is quite high. However, this is only suitable for short-term trading and not for long-term investment.

So, we cannot blindly invest long-term based on just one article. What we need to do is to select the projects preliminarily screened by research institutions, conduct our own research, and see if there is any profit potential. If there is an expectation of being listed on Binance, we also need to compare horizontally to see if it can be listed on Binance.

?Here, taking the BNB Chain liquidity staking protocol invested by Binance Labs, pStakeFinance, as an example, try to analyze the probability of the token being listed on Binance.

?This article is only for case analysis and not investment advice. After reading the case, it's best to do your own analysis and make your own decisions.

III. Does being invested by Binance Labs guarantee listing on Binance Exchange?

First, let's clarify the relationship between Binance Labs and Binance:

? Binance Labs was officially established in April 2018 and was once the venture capital department of Binance. It has now been spun off as an independent entity.

As of March, Binance Labs has invested in approximately 250 projects. According to incomplete statistics, about 40 projects have not yet issued tokens, and more than 20 projects have not been listed on Binance.

In terms of investment layout, Binance Labs' investment scope is very broad, covering most of the Web3-related tracks, including public chains, protocols, infrastructure, NFT, blockchain games, metaverse, DeFi, and CeFi, among others.

Binance Labs particularly values infrastructure, security, on-chain applications, data analysis, and security, among other areas. These areas are not only the core of the cryptocurrency industry's development but also the investment direction that Binance Labs prioritizes.

?**Key points: **infrastructure, security

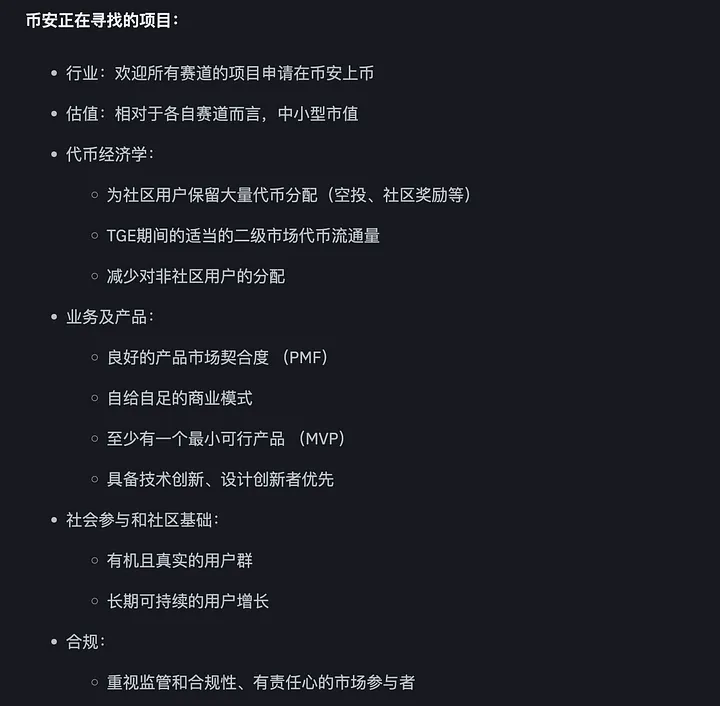

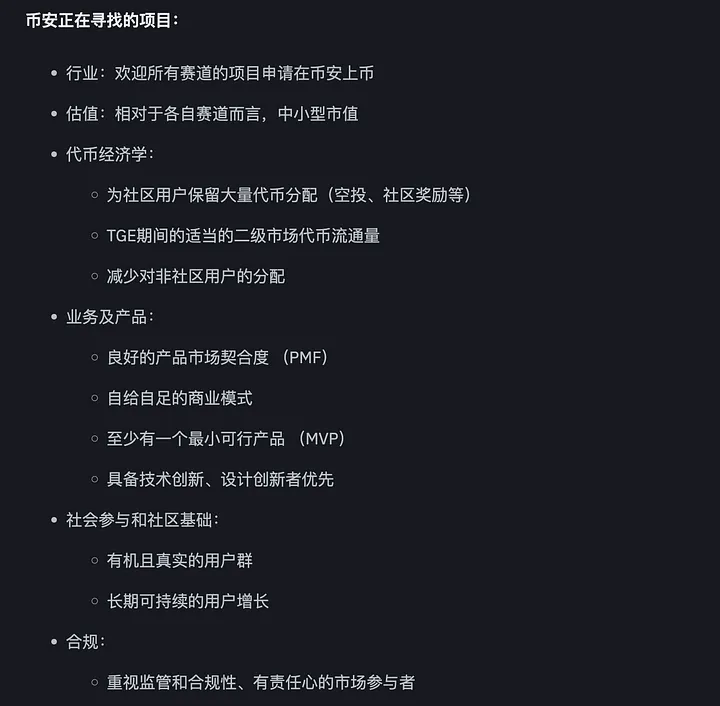

IV. Requirements of the "Binance Coin Listing Project Open Recruitment Plan"

? Valuation requirements: small and medium-sized market value in various tracks

? A large amount of token distribution reserved for community users (airdrops, community rewards, etc.)

? Appropriate circulation

? Self-sustaining business model

Based on the above requirements, let's see if $pStake meets the listing requirements.

Part Two, Information in the Versatile Stage

Similar to many new employees in investment banks, after passing the training period, they start searching for fundamental information everywhere. Just like me, they search for some useless information everywhere, seeming very busy and professional, but it's of little value. It's all superficial content, just scratching the surface.

This stage is when many novices transition from "making money blindly" to "not making money," and it's also where many bloggers are.

About pStakeFinance Fundamentals

(I) Focus on infrastructure and security

pSTAKE Finance is a liquidity staking infrastructure invested by Binance Labs, the only BNB Chain LST integrated with Ceffu Global (Binance custody), allowing institutions and whales to enter the BNB staking market at the lowest liquidity staking cost.

Currently, the market value of $BNB is 88 billion USD, but only 0.29% of the total supply of BNB is in liquidity staking, while ETH has 11.5% in liquidity staking.

Based on the current liquidity staking situation of Ethereum, if the BNB Chain's liquidity staking increases to 11.5%, it will create a market of 10 billion USD, which would be a 40-fold increase in the current situation.

If a 40-fold increase can be achieved, this is what pSTAKE, BNB Chain, and Binance all hope to see. Because for PoS blockchains, higher staking can ensure network security.

The introduction of pSTAKE Finance has been analyzed in previous articles and will not be repeated here. Related content from previous periods:

https://link.medium.com/Xk8dXgSjZJb

(II) pSTAKE Token Information

? The current FDV of $pSTAKE is 41 million USD, meeting the requirements of small and medium-sized market value.

? Total supply: 500,000,000

? Circulating supply: 468,888,892

? Circulation rate: 93.78%

? FDV: 41,696,389

? MC: 39,101,947

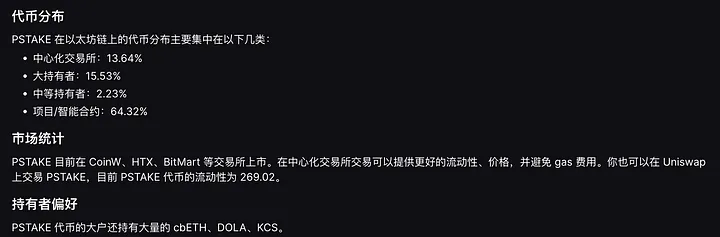

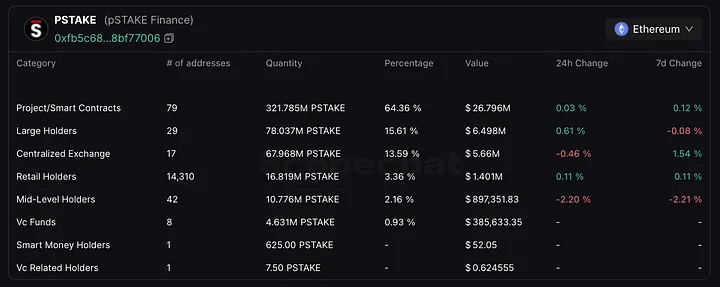

(III) Token Distribution

From the perspective of token holders, 80% of the tokens are held by the project's smart contract and large holders. The top 20 addresses hold a total of 413 million PSTAKE, accounting for 82.65% of the total supply.

The tokens are concentrated in the hands of investment institutions and the project team, indicating that the fundraising is basically completed, and favorable information is awaited for release.

Many readers may think that the article ends here, but that would be too superficial. Indeed, many bloggers end their content after analyzing the fundamentals and holding structure.

But here, we will not stop. Let's continue.

Part Three, Awakening and Transformation Stage

For readers who have reached this point in the article, most are trying to change.

Many people cannot reach this stage because it requires information collection and data analysis, continuous verification, continuous overturning, and then deciding whether to enter the market.

This process is very painful and lonely. Sometimes after researching for a few days, you may find that the project you researched is not suitable for investment at the moment, and then you see another project unexpectedly skyrocket in the market. After experiencing this kind of situation several times, you may give up on doing in-depth analysis.

This article mainly uses pStake as an example to try to enable everyone to use in-depth data to see if a project meets the requirements for listing on Binance, and then decide whether to invest.

Specific content is as follows:

I. Binance's Search: Small and Medium Market Value Projects — Data Analysis

The "Binance Coin Listing Project Open Recruitment Plan" indicates that they are looking for small and medium market value projects in various tracks. So, let's take a look at the characteristics of small and medium market value and which projects have already issued tokens in the tracks.

(I) Characteristics of Various Market Value Stages and Possible Strategies

From the above image:

- Medium market value range: between 50 million and 100 million USD. Projects in this range are relatively stable and have achieved initial success. The projects are well-established, have strong liquidity, and have formed a strong community.

- Small market value range: between 10 million and 50 million USD. These projects have gradually developed market resilience, and their development is relatively mature. Liquidity is gradually being established, and the community is gradually growing. However, continuous development is still needed to increase community attractiveness and find breakthrough opportunities.

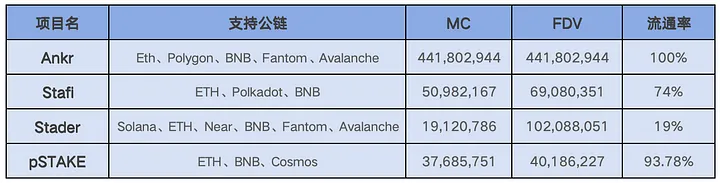

(II) Market Value Comparison of Projects that Have Issued Tokens in the Track

According to RootData statistics, there are a total of 155 projects in the LSD track, and 41 projects have already issued tokens, with an issuance rate of 26.45%. Most projects are still under development.

Using the RootData X Influence Index ranking, the top 33 projects are included for sample analysis.

Among them, there are 6 small and medium-sized projects with FDV between 30 million and 80 million, and only StaFi has been listed on Binance.

Looking at FDV alone does not indicate much and may only be a form of self-encouragement for venture capitalists. It may only serve the purpose of track ranking.

For retail investors in the secondary market, we are more interested in looking at MC. After reordering the data table, it becomes easier to see which projects are small and medium market value:

- Numbers 9, 12, and 13 are medium-sized projects, with only StaFi listed on Binance. They belong to the early ETH on LSD leaders.

- Numbers 15, 8, 10, 14, and 16 fall within the small project range, and none of them are listed on Binance. However, it can be seen here that pStake's MC:FDV is approaching 1, making it the only project in the statistical table with Binance Labs investment and the project with the MC:FDV value closest to 1 (this is important and needs to be considered).

pStake is announced as the "BNB Chain liquidity staking infrastructure" among the 155 LSD projects. Its extremely low fees make pStake an indispensable liquidity staking protocol for users on the BNB Chain.

Expansion: Reasons for Investors to Refer to MC:FDV Ratio

- At present, investors are cautious about low MC and high FDV projects. An excessively high FDV and low MC indicate low market demand, tokens concentrated in the hands of a few, and a large number of tokens yet to be circulated. People believe that token prices will continue to fall, so they refuse to be the bagholders.

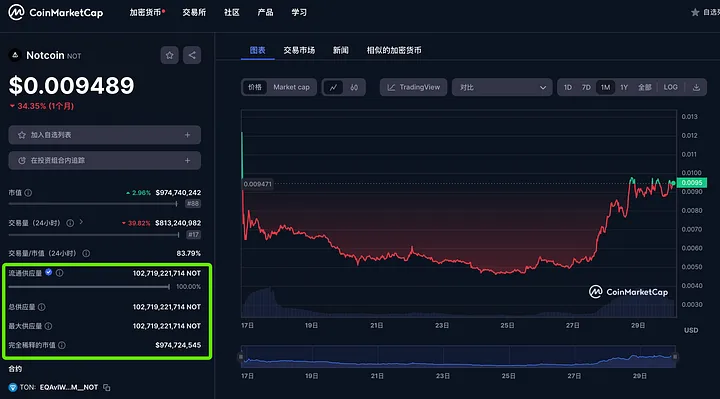

- The market prefers tokens with an MC:FDV ratio of 1 or close to 1, such as $not, which was listed on Binance on the 17th of this month. After the token was airdropped and sold off within 5 days of listing, the token price continued to rise, increasing by 70% in a week.

Tokens with a 1:1 ratio may experience short-term price increases, but if they do not have widespread adoption and continuous new buying interest from users, their prices often decline.

(III) Evaluating Projects Based on Locked Assets in the Protocol

Using the market value to TVL ratio, we can gain a deeper understanding of how the market values projects based on locked assets in the protocol.

- Among projects with a market value of less than 50 million, Tenet Protocol has the highest ratio, while Marinade has the lowest. pSTAKE Finance is moderate.

This indicator is similar to the price-to-earnings ratio in the traditional stock market. The higher the market value to TVL ratio, the more expensive the price.

In simple terms:

- A high ratio may indicate overpricing of assets.

- A lower ratio may indicate that the asset price is too low and is not favored by investors compared to assets in the same track.

If we look at the candlestick chart, we can see that the token's trend matches the evaluation in the image above. This indicates that when evaluating projects, we need to make horizontal comparisons.

In the small market value category, pSTAKE Finance's market value to TVL ratio is moderate, and the token's trend is relatively stable, meeting community expectations. What pSTAKE Finance needs to do is to provide incentives and empower TVL.

II. Binance's Search: Small and Medium Market Value Projects — Fundamental Analysis

Through the above data analysis, we can discover potential projects in the secondary market within the track. However, no matter how good the data is, Binance sometimes does not list the token.

Using pSTAKE Finance as an example, let's go back to the "Binance Coin Listing Project Open Recruitment Plan" and see if any projects meet the requirements in Binance's announcement.

(I) Valuation

There are many ways to calculate valuation, and various data platforms also publish relevant data for everyone to calculate valuation. However, there are also other methods used by some diamond hands, such as:

- NVT ratio, which evaluates the relationship between market value and trading volume. A higher NVT indicates that the network may be overvalued relative to the trading volume, while a lower NVT indicates that the network may be undervalued relative to the trading volume. pSTAKE Finance has a 24-hour NVT value of 30.26, Stride has a 24-hour NVT value of 1326, and Lido has a 24-hour NVT value of 1.28. pSTAKE Finance is a project that is neither overvalued nor undervalued, and the market is relatively stable.

- Market value to TVL ratio, as mentioned earlier, can provide a deeper understanding of how the market evaluates projects based on locked assets in the protocol. The ratio for pSTAKE Finance is 5.11, a moderate value. The project still needs to empower TVL to gain widespread acceptance for its BNB Chain liquidity protocol positioning.

pSTAKE Finance has a circulating market value of 37 million (as of May 30th) and a fully diluted market value of 40 million, falling within the small market value range.

There are 4 platforms for BNB liquidity staking: Ankr, Stader, Stafi, and pSTAKE.

- Ankr's tokens have all been released, and the bonus period has passed.

- Stafi has released a small amount, and there is not much official news. The project's operations will be observed in the future.

- Stader is currently normal in all aspects, and the project's operational situation will be observed in the future.

- pSTAKE's tokens are currently 93.78% released (as of May 30th). pSTAKE is a project invested in by Binance Labs and has close cooperation with BNB Chain. It is worth continuous attention.

(II) Token Economics

This article only discusses public information, which is the basic information accessible to the general public. Therefore, using basic information to evaluate projects is more intuitive.

The "Binance Coin Listing Project Open Recruitment Plan" has three requirements for token economics:

- Reserve a large amount of tokens for community user distribution (airdrops, community rewards, etc.).

- Appropriate secondary market circulation during TGE.

- Reduce distribution to non-community users.

pSTAKE Finance has an MC:FDV value of 0.94, very close to 1, indicating that the tokens have been mostly released.

Tokens with a 1:1 ratio may experience short-term price increases, but if they do not have widespread liquidity and continuous user buying interest, their prices often decline.

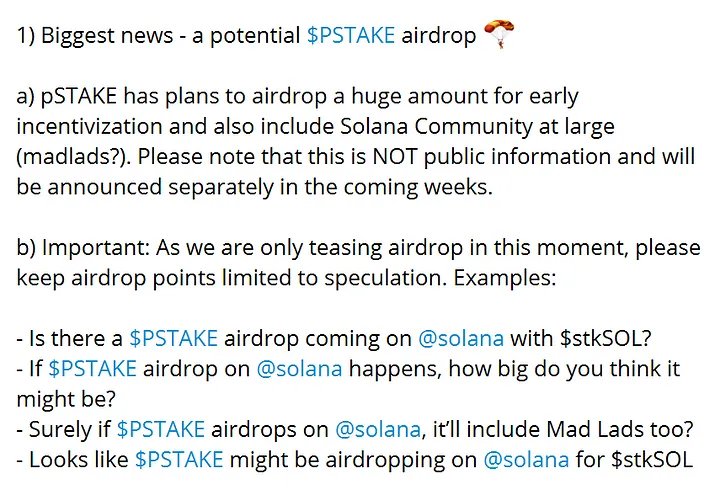

Recently, pSTAKE Finance has launched a new airdrop activity, with 20 million tokens (worth $1,606,779) to be airdropped to users.

Summary: The above fundamentals meet the requirements of the "Binance Coin Listing Project Open Recruitment Plan" regarding token economics.

(III) Business and Products

The "Binance Coin Listing Project Open Recruitment Plan" has three requirements for project business and products:

- Good product-market fit.

- Self-sustaining business model.

- Preference for technical innovation and design innovation.

pSTAKE Finance is about POS chain infrastructure, a key component that cannot be bypassed by any POS chain, indicating a high product-market fit.

pSTAKE Finance is seeking more high-quality asset partnerships and has enabled staking for $ATOM, $OSMO, $DYDX, $STARS, $BNB, $ETH, but has not enabled staking for Sol, a high-quality asset. This is not in line with the style of the parent company, Persistence. It is possible that the project has been deployed and is awaiting an official announcement.

When staking on the pSTAKE Finance platform, the system charges fees and pays returns, completing the business cycle through the LRD model of the parent company, Persistence.

For more information on the business model, refer to: https://link.medium.com/7RGGHZgI0Jb

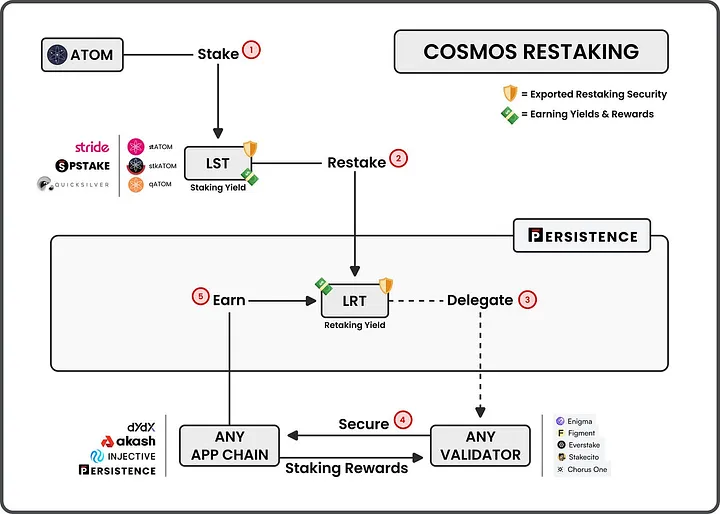

In terms of technology, pSTAKE Finance is a liquidity staking protocol built on the technology of the parent company, Persistence (which has provided staking protocol support for multiple public chains). It is often referred to as the LST solution. Many people compare Persistence to Cosmos's Eigenlayer, which integrates the underlying technology solutions of LST and LRT on Cosmos. Their relationship is as follows:

Conclusion

Binance recently released the "Binance Coin Listing Project Open Recruitment Plan." This article attempts to use various indicators favored by exchanges to conduct an in-depth analysis of the project, using pSTAKE Finance, which is invested in by Binance Labs, as an example. Analyzing a token does not guarantee that it will rise, and analyzing a project does not mean it will immediately be listed on Binance. Specific actions should be based on market dynamics.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。