Author: Jack, BlockBeats

In the cryptocurrency circle, it's becoming increasingly difficult to be a KOL. After the migration from the Chinese encrypted community to Twitter, the market and ordinary investors demand KOLs who are knowledgeable, professional, and able to identify alpha opportunities early. Under increasingly stringent market standards, crypto KOLs are experiencing a new round of natural selection, with the older generation gradually fading from the center stage, while also giving rise to opportunities for the new generation of influential KOLs.

Recently, we had a conversation with an influential KOL, 0xSleepinRain (@0xSleepinRain), who has transformed from a "crypto novice" to a Weibo influencer, and then to managing his own paid community. His growth trajectory is definitely an inspirational example of grassroots retail investors making a comeback. Among the influential players, 0xSleepinRain gives the impression of being the class monitor, organizing and sharing his study notes every day. In his own words, his secret to success is "the early bird catches the worm."

From Media Personnel to KOL

0xSleepinRain (referred to as Morty below) majored in mechanical engineering during his undergraduate studies, learning about material forging, technical drawing, and other engineering technologies. In his own words, "the most likely outcome after graduation would be working in a factory screwing bolts." However, as a science and engineering student, he had a strong affinity for writing. From the adventurous experiences during his student days, to his first job in the crypto circle, and his current daily work routine, they are all closely related to writing and content creation. It must be said that in the current crypto industry, content leverage seems to be the most effective leverage.

Entry into the Crypto Circle

During his university years, Morty discovered the opportunities on content platforms such as Baijiahao, Toutiao, and Huoshan Video, and started operating self-media accounts with his classmates, earning his first bucket of gold. In reality, at that time, doing Douyin might have been a better choice, but because he wasn't very good at making videos, Morty gave up that opportunity. Looking back now, this basically laid the foundation for his preference for writing.

In 2018, Morty graduated and the platform dividend gradually faded. Realizing the limitations of the industry's prospects, he went to Hangzhou in search of opportunities. After sending out three or four resumes, Morty joined the crypto media, Bibi News, and thus became involved with crypto. Once, he had the opportunity to interview Gavin Wood, who had just started Polkadot at the time, and thought this person was very impressive, so he bought some DOT. Later, at an industry event in Shanghai, Morty received an invitation from the Chinese team of Cointelegraph, and without hesitation, he sold his position and moved to Shanghai.

Before this, the daily tasks in the media were purely work for Morty, and he did not participate in trading coins. At the end of 2021, watching the DOT he sold at $5 rise to $60, Morty gradually realized that he could also try trading coins. "I have a life motto, which is to create memories. You can't just work every day, you have to do something else."

BlockBeats: Which project had the most impact on you at the time?

0xSleepinRain: The project that had the deepest impact on me was Burger Swap, which was the first DEX on BSC. It rose from $0.5 to $27 at the time. Because I didn't have much money at the time, I skipped a meal every day to buy it at around $0.5, bought about 2000U, and then sold half at around $7. Later, it rose to $27, and I didn't sell. I finally sold everything when it dropped back to $7. At the time, I didn't really understand, but if I could go back to that time now, I would definitely do better.

BlockBeats: What other projects had a significant impact on you?

0xSleepinRain: Avalanche and Solana probably had a significant impact on me. Solana had the biggest impact. I bought SOL at around $35 to $45, sold 25% at $80, another 25% at $100, and another 25% at $120, and finally sold everything at $140. I didn't expect it to rise to $200 in the end.

I had a position on Binance at the time, but after buying, it "519" (Chinese internet slang for a sudden drop in price). When SOL dropped to $26, I added some more. I remember, in the second half of that year, SOL started rising the earliest, reaching $70 to $80, and then the market went crazy. Later, I also had thoughts about Avalanche because the foundation had launched an Avalanche Rush with a lot of incentives, which I thought could attract market attention. However, I completely missed out on Luna.

BlockBeats: In the previous crypto cycle, it was still dominated by "Weibo shoutouts." It's difficult for most newcomers who entered the circle in 2021 or 2022 to learn useful investment logic from "signal-boosting teachers." How did you build your knowledge?

0xSleepinRain: I've met many mentors on my journey. For example, former colleagues at Cointelegraph Chinese, friends I got to know at the end of 2022, and KOLs I met on Weibo/Twitter, they taught me a lot of things. For example, they helped me understand something called information dissemination.

For example, the information from the project team is at level A, and when it reaches the VCs, it's at level B. If the project team wants to do something, the VCs will know first, and the retail investors will know last. The process of this transmission may determine the price trend, so for retail investors, it's a process of "catching the falling knife." They also made me realize that trading coins can also be profitable, which made me more interested in doing a lot of reading and thinking.

Building a Community

In the second half of 2021, while still working at Cointelegraph Chinese, Morty didn't initially have the idea of becoming a KOL, but because he had a habit of writing, he felt it was somewhat wasteful to only share the information he organized with himself, so he started sharing it on social media. A year later, he became a well-known crypto KOL with over 10,000 followers on Weibo.

In September 2022, a candlestick chart analyst approached Morty, hoping to collaborate on a paid group, but Morty felt he wasn't ready yet, so he spent time preparing by organizing on Notion, etc. Although the collaboration didn't materialize in the end, it gave Morty a good opportunity to build a community.

At the end of 2023, Morty completely left Weibo and partnered with his good friend, Huang Mantou, to start their own paid community. Huang Mantou and Morty were colleagues at DeepTide, with one person finding information and the other doing analysis. After partnering, Huang Mantou was still responsible for finding alpha information, while Morty analyzed the market and narratives. Since the end of last year, Morty's paid group has grown from 200 to nearly 500 members. In his view, managing the community has also made him a more confident person.

BlockBeats: How big do you plan to grow this community?

0xSleepinRain: Judging by the number of members, I probably won't recruit beyond 500. If I were purely here to fleece the sheep, my community wouldn't have reached this size, and I've been very serious about managing the community. I share a lot of things I consider important in the group, as well as my personal investment operations.

BlockBeats: Does this judgment bring you positive feedback?

0xSleepinRain: Yes, and while managing the community, I've met many interesting people who also bring positive feedback. Although many members joined the group by paying, they also bring me a lot of new insights, which I think is pretty cool. So it gives me more confidence and interest in doing this well.

BlockBeats: Does managing this community consume a lot of energy?

0xSleepinRain: I'm used to it, I will integrate this matter with my own growth. In fact, building a community is also a process of personal growth for me, and I think it's a cool thing. For example, when you read, you share your thoughts with the members of the community, and then you have a lot of people to exchange ideas with. This kind of feedback from the community is actually a form of information flow, including their current emotions, which I can also perceive. It's actually about observing the market, understanding the market, and it's really difficult to trade without being connected to the market. I think this can help me connect more closely with the market.

BlockBeats: Besides your community members, do you frequently communicate with other practitioners in the industry?

0xSleepinRain: There are some regular people, some who are purely trading, some who are doing arbitrage, and some who are smart money, etc. I quite like this process of communication, as it helps me understand, "Oh, they're looking at the problem from this angle." I think it's quite difficult to go it alone, there will be a cognitive bias, and even now, Twitter recommendations are also a form of bias, so I expand my information flow through email subscriptions and building Twitter Lists.

Cognitive Construction and Investment Logic

Morty strongly believes in the wisdom of "the early bird catches the worm." Whether at Bibi News, Cointelegraph Chinese, or later at DeepTide, he tried to learn new things from others as much as possible. "You must improve your cognition, and in the end, your assets will definitely return to your cognitive curve." His experiences at Cointelegraph and DeepTide gave Morty a lot of inspiration, and he learned the two most important things: information dissemination and building his own information flow.

BlockBeats: How do you establish an effective information acquisition framework?

0xSleepinRain: I habitually subscribe to content that I consider good. I have subscribed to many accounts on Substack via email, and I also have Lists on X that I follow. There are many other people's viewpoints in these, and I add my own thoughts to make some judgments.

Additionally, I organize the things I have been reading into a List. There's a project library, which includes some projects I've looked at, records of community meetings, and many articles that I consider good. This method may not be good, but I think it can generate some thoughts and viewpoints. Although I make all these things public to everyone, very few people actually read them. In reality, it's like keeping a record of my own reading.

I also pay attention to market sentiment. For example, if a few KOLs I follow say they don't want to look at the market now, or if the community sentiment is bleak and no one is discussing the market, I think it may be at the bottom range. However, I don't look at purely trading-related things very much, which is an area where I am lacking, such as looking at candlestick charts and technical analysis.

BlockBeats: Do you think technical analysis is very important in the current market environment?

0xSleepinRain: I think the core point is the effectiveness of candlestick charts. In many cases in this industry, other people draw candlestick charts for you to see. I can only say that candlestick charts are important, but not that important. If you can beat Bitcoin purely relying on candlestick charts, it's a bit unrealistic. In this highly competitive market, it tests your ability to choose assets.

Because I have a partner who looks at candlestick charts, I show him the candlestick charts after finding good assets, and then choose a relatively ideal entry point. Otherwise, I might give up or wait longer, so this can complement each other. I haven't had much time to study candlestick charts recently, but in reality, I'm just finding excuses for my laziness.

BlockBeats: So reading is a very important part of building your cognition?

0xSleepinRain: Yes, I think there are two parts: reading and writing. For me, writing is the process of presenting my thoughts, of course, it doesn't have to be posted on social media, but you can write something yourself, make a record, such as building a Notion, and then review these things regularly. My initial understanding of the industry came from the process of building my knowledge base, from Bitcoin, public chains, DeFi, to NFT, Gaming, etc., building my own framework, and then creating branches based on this framework.

Additionally, I have a little notebook where I write down some personal insights or very insightful words when I see them. This concept is actually very important. Everyone wants to make big money, but your operations with $100,000 are completely different from those with $1 million. The final question to consider is to make investment decisions based on your asset size and how to control risks, to live longer in the market than others. These insights and thoughts can help you.

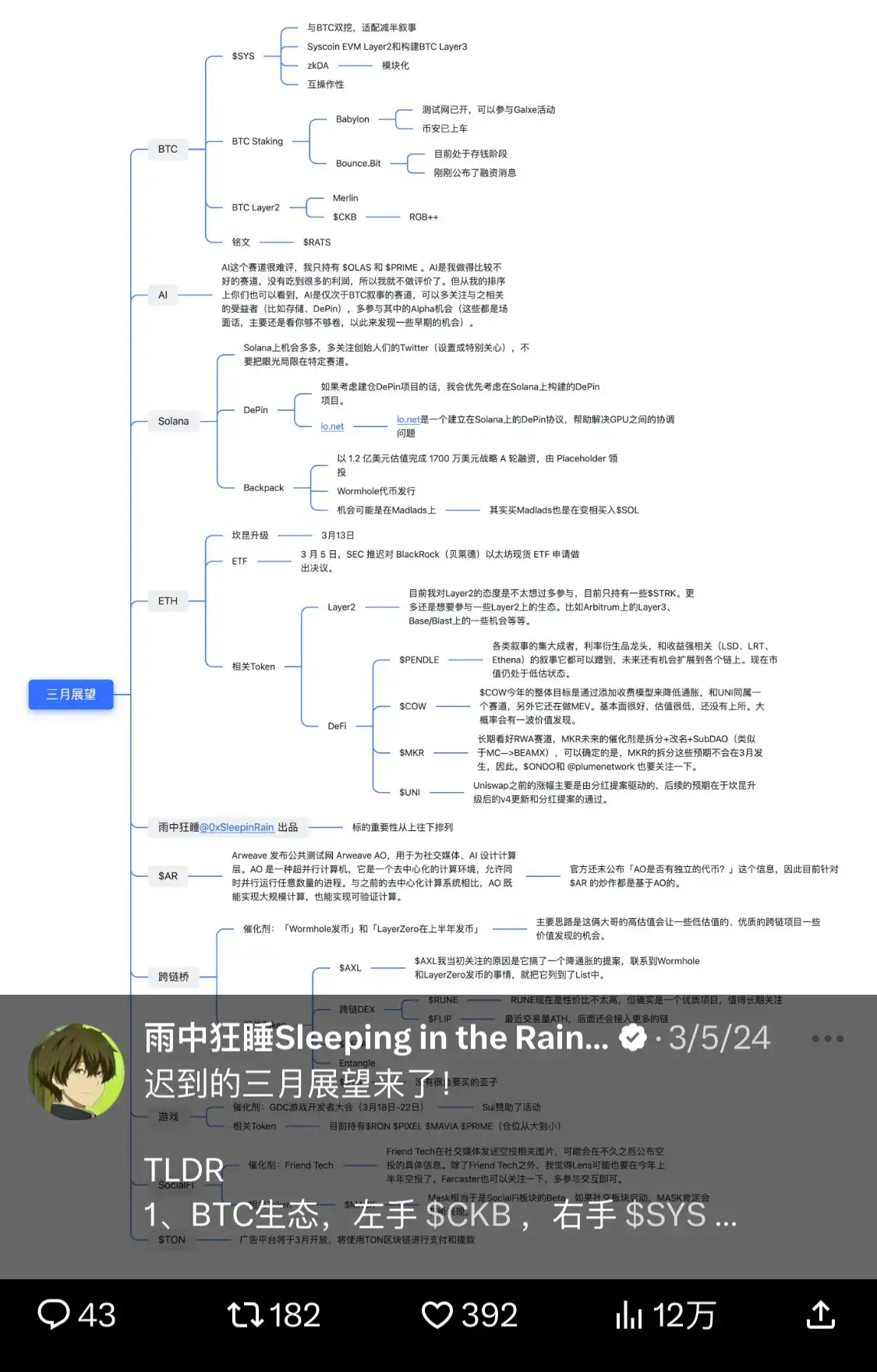

BlockBeats: At the beginning of the year, you started summarizing "Star Narratives," and then updated it every month. How did you decide on the logic and standards for determining the star rating?

0xSleepinRain: I think it's mainly about market recognition, that is, the ability to attract market attention in the near future. If a narrative has successfully attracted a lot of market attention in the past, such as AI, then I will give it a higher rating.

I think Bitcoin has always been a five-star narrative. Memes may be something for short-term speculation, runes will be better, it can help Bitcoin do more things, although there may have been some cooling off before runes, there will always be people pushing it. The market naturally pays attention to the Bitcoin ecosystem, and once a narrative emerges, people will participate.

But one narrative that I didn't handle well at the beginning of the year was Solana. At the time, I ranked it as a four-star narrative, but now it seems to be very strong in all aspects, so it's actually a five-star narrative.

BlockBeats: I saw that you later ranked it above Ethereum.

0xSleepinRain: I now understand that Ethereum is a very large asset, and Europe and the United States are also promoting this point. It may have complexity, but its position is unshakable compared to Solana. I don't know if Ethereum can be replicated, but it takes time. From this perspective, I have hardly participated in Bitcoin L2, why don't I play on Ethereum or Solana? Of course, I think there are wealth opportunities here because there is attention, and it is a long-term sustainable thing. As for Ethereum, BlackRock's RWA is on Ethereum, so since BlackRock is doing this, I will follow targets like ONDO.

BlockBeats: Every time you share your spot trading ideas in the group, you set a stop-loss line. Where did the concept of "spot stop-loss line" come from?

0xSleepinRain: The stop-loss is more for the community. Each of us has different risk tolerance levels. For example, on some assets, I can tolerate more risk, but you may not. One of my problems is that I am "very biased," and I have very high predictions for the trends of some coins, which makes it very difficult for me to hold many coins. For example, I think COW under the Intent narrative has a good chance, so I've been holding it and not in a hurry to sell, and also WEN on Solana, the recent retracement is because I have diamond hands.

BlockBeats: What are some of your "biased" strategies?

0xSleepinRain: Judging the catalysts for narratives. For example, I think the Intent narrative may rise around Cancun, so I buy UNI and COW, although their rise may not be due to this reason, there is also some luck involved. Luck may not be so good on some assets. I need to wait a long time to confirm my own logic, but if it has risen a lot before, and I believe the catalyst I'm waiting for hasn't come, then I probably won't sell. In this PVP market, narrative rotation is very fast, and diamond hands are also very easy to get hurt.

BlockBeats: Actually, many people didn't have time to get off the bus in April's retracement, and almost no one expected the bear market to last this long.

0xSleepinRain: Actually, the market has already told you, for example, Bitcoin had six consecutive monthly gains, indicating a need for a retracement. I think I had the opportunity to exit at that time, but I didn't think it through, which was also a mistake on my part.

BlockBeats: Didn't think through what?

0xSleepinRain: I didn't think through the demand for a pullback and how much the pullback might be, and I developed an emotional attachment to altcoins.

View on the Market

BlockBeats: What speculative expectations do you think are still in this cycle?

0xSleepinRain: In addition to the expectation of liquidity returning after the interest rate cut, there are also expectations for the election at the macro level. Under this expectation, the demands of all parties should be stability and the competition for crypto voters. But if there is no new expectation support in the future, the market may enter a quiet state. Liquidity is not very good right now. I'm not too optimistic. Of course, when liquidity returns, a new wave of opportunities will emerge. This is a long-term thing.

BlockBeats: Yeah, each cycle is different, right?

0xSleepinRain: Yes, I think predictions are not important, we should think about what state the market is in. For example, on April 29th, I thought the market entered the bottom phase because I saw that the community sentiment was too pessimistic, giving a deep bearish feeling. But think about it, this year is an election year, so it's unlikely that there will be major events, at least it should be more stable.

There were too many bearish people at the time, so I thought I could bottom fish some assets. I chose Ethereum at the time, and I also bought a lot of assets related to its ecosystem. Anyway, there's a stop-loss line, so if I judged wrong, I would surrender.

BlockBeats: There's a lot of discussion now about high FDV and low circulation. What's your take?

0xSleepinRain: I think this will bring about new narratives, and the market will look for tokens with full circulation, zero unlocking, and already fully priced by the market. Actually, I also read Cobie's article, and his core point is that the market's buying actually happens at the primary level, not the secondary, which may lead to new coin listings not performing so well.

In fact, there has already been discussion on social media about "not taking each other's orders," I think it's important because it's a market issue, and the market will gradually realize and improve. I think the market may gradually grow into a smarter state in the future, and fundamentally, it's because the market lacks liquidity.

BlockBeats: Do you think the crypto market will experience the "super large price increases" of the past few bull markets in the future?

0xSleepinRain: I think it will, because the crypto market gives us a gambling opportunity. Although we can't always turn the crypto market into a casino, as GCR mentioned, many people participate in the crypto market because it's like a casino, it's more convenient than going to Macau, and the certainty of making money (maybe) is higher than in Macau. So the crypto market and altcoins will not disappear, as long as there is demand in the market, it will continue to exist, and people will make moves based on altcoins.

BlockBeats: In the next period, what direction will you focus on?

0xSleepinRain: My main position is currently in Ethereum, for example, Pendle is my long-term position. I mentioned this in my May outlook, although I placed ETH relatively low when I wrote it. Additionally, AI is also placed relatively low, one is because there are many catalysts recently, and two is because the overall market is counterintuitive, when everyone is bullish on AI, its performance is not good, so it needs to wash out those bullish people.

I also have some holdings in Solana, but I generally don't actively buy. The main task for Solana is also written in the group name, which is to accumulate coin-based assets. Participate more in the Solana ecosystem, everything is for the growth of SOL coin-based assets.

BlockBeats: One last question, how long do you think it will take for the altcoin market to return to its original price position?

0xSleepinRain: I'm still relatively optimistic about the future, especially for Ethereum, there's a chance to break new highs. After the expectations are exhausted, I will choose to rest.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。