Tonight at 20:15, the showdown of the ADP Non-Farm Employment Change (ADP NFP) is expected to be lower than the previous value. Has the potential good news been realized?

The ADP NFP tonight will definitely have a significant impact on the Non-Farm Payrolls (NFP) on Friday. The NFP is a data released by the US Department of Labor, while the ADP NFP is released by a private company. However, the company is a globally renowned human resources firm, so it is highly influential.

First, let's take a look at the expected value for this period, which is 175,000, lower than the previous value of 192,000. From the expected value perspective, it is definitely good news.

However, based on the data from the end of last month, if it is lower than the previous value of 192,000, there is basically no suspense. Whether it is greater than, less than, or equal to the expected value, it is still hard to say at the moment. This is because at the end of last month, the number of initial jobless claims increased by 3,000, exceeding the expected value by 1,000. Logically, the number of unemployed people is indeed increasing, but it cannot be said that the economy is bad, as the progress of the times and the application of some artificial intelligence (AI) may also compete for jobs.

It is estimated that tonight's figure may be slightly higher than 192,000, which would make the data not look so bad, still good news, but not as expected. The market will likely take advantage of this wave of expectations to harvest this batch of liquidity. If it is equal to or lower than 175,000, there is no need to hesitate, as there will be an opportunity to enter the market in the early morning.

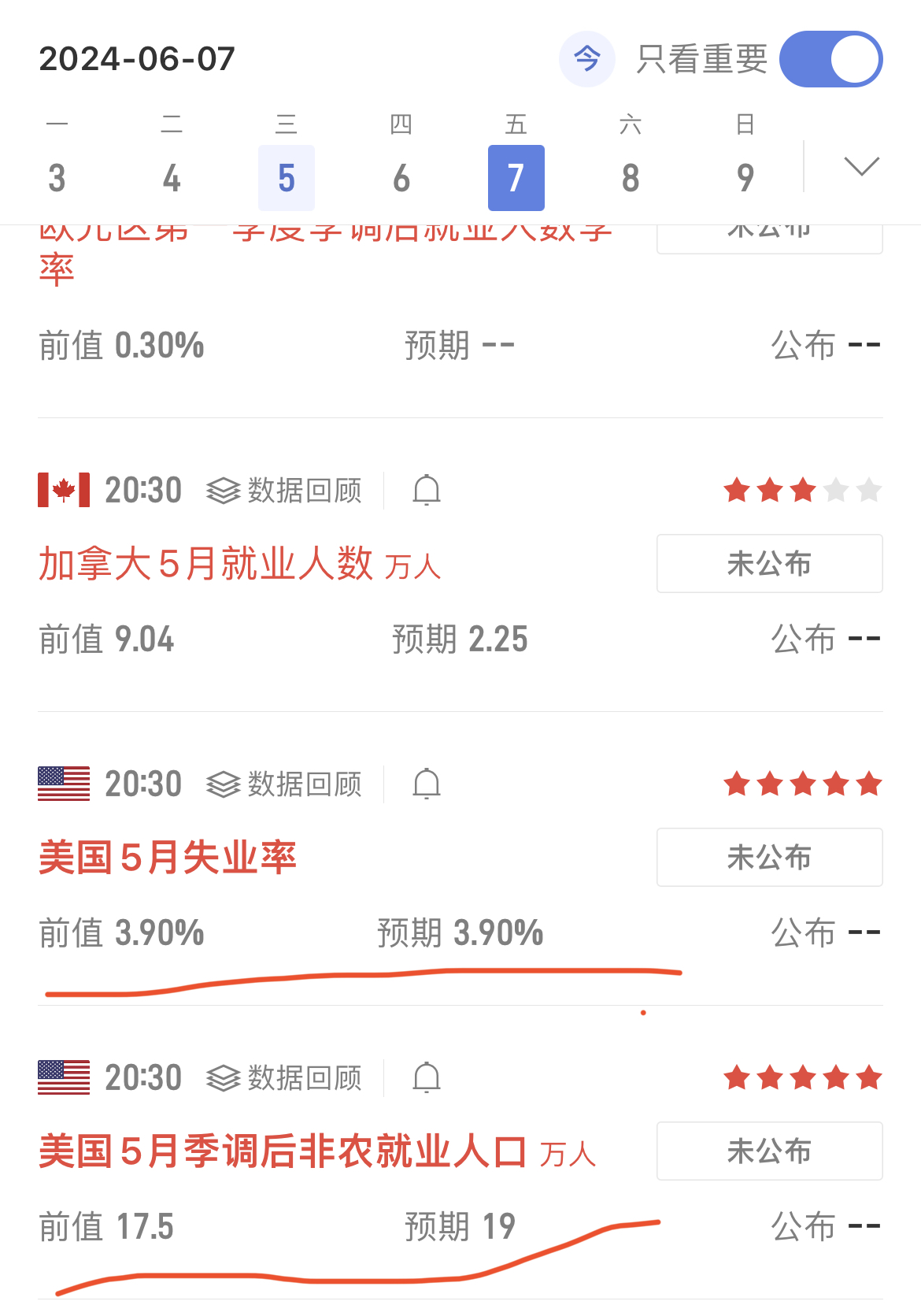

The NFP data on the 7th is expected to be higher than the previous value, which is a potential negative factor. Therefore, tonight's data is crucial. If it is greater than 175,000, reducing positions by at least 85% or exiting the market is advisable. Let the market fluctuate, and then decide whether to enter the short wave opportunity again when the data is released on Friday.

In summary: Tonight's scenarios are as follows: 1. If it is greater than 175,000 but less than 192,000, reduce positions by 85% or exit the market. 2. If it is equal to or less than 175,000, regardless of how the market falls, you can hold and wait for the NFP data on Friday. 3. In the first scenario, it is necessary to reduce positions when the market rises; in the second scenario, there is no rush to increase positions, just wait for the opportunity over the weekend after the Friday data is released.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。