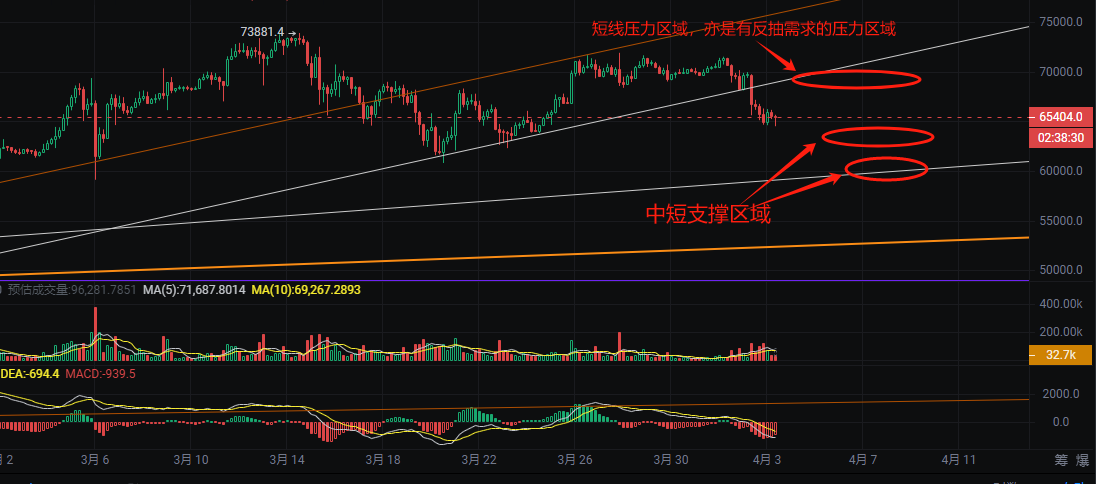

【BTC continues to pressure the long side, with a sharp drop of over 6000. Last night, 4.5 billion CNY vanished into thin air, and 138,158 people saw their assets reduced to zero!】 April 3, 2024, 9:04 AM BTC Market Analysis: As we enter April, the "big cake" has dropped by over $6000. Whether this is a bear trap is unknown, but this pressure on the long side has wiped out over 250,000 retail investors and plundered over 10 billion in liquidity. It must be said that at this moment, the "big cake" is still capricious enough, with the rise and fall entirely at the mercy of the main players. There are no apparent resistance or support levels, and daily fluctuations of two to three thousand dollars are commonplace! Today's BTC Focus: Support at 63800/62000/59000, Resistance at 68800. This pressure on the long side has caused most altcoins to plummet by over 30%, and most people's positions have retreated by over 30%. For those who did not reduce their positions on the high last week, they have taken another roller coaster ride. Such frequent roller coasters will only turn investors from believers into speculators, from medium-term to short-term traders. The mindset instilled by the main players is to accelerate the harvesting of market liquidity. At this moment, the trend is very similar to the half-month before the landing of the ETF. At that time, the "big cake" lingered around 43000 for a long time, jumping up and down daily. Many people thought that the landing would be negative and sold off their chips. What happened next is clear to everyone. The "big cake" continuously surged to a high of 73881. After everyone threw away their chips, many people's initial investments have now multiplied by 1-3 times, thus missing out on cheap chips. At this moment, the more you trade, the higher the cost, not only failing to make big money but also exacerbating losses! In terms of operations, I have several suggestions at this moment: ① For those who are short, it is a good time to enter the market in batches with a 30% position! ② For those with 30-50% positions, it is best to wait and observe. Your position limits your operations, and your position is already sufficient. Be patient and wait. You must leave yourself with a position to resist risks, so doing nothing at this moment is the best operation! ③ For those who are fully invested, all you can do is wait, because if you are a disciplined executor, you will not be fully invested at all! At this moment, besides maintaining a calm mindset and patiently waiting, do not engage in short-term trading, as your mindset is not suitable! ④ For big players, I suggest using dollar-cost averaging or spot grid trading. The high volatility at this time is very suitable for grid trading; it can automatically sell high and buy low within the range you set, which is very suitable for big players to increase capital utilization!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。