This article will introduce the Bitget Wallet product, ecosystem, and BWB token economics, and briefly discuss its market competitiveness and future development potential.

Author: Kazmin

Recently, the Bitget Launchpad project Bitget Wallet (BWB) was launched with a snapshot on June 1, 2024, following the previous announcement of the ecosystem token BWB and the airdrop plan in March. This time, BWB adopts an investment model, requiring the investment of BGB or USDT during the holding statistics phase to obtain purchase shares. Since the announcement of the BWB token in March, I have been paying close attention to the Bitget Wallet. In order to facilitate interested players to deepen their understanding, this article will introduce the Bitget Wallet product, ecosystem, and BWB token economics, and briefly discuss its market competitiveness and future development potential.

Establishing the modern standard for wallets in the industry

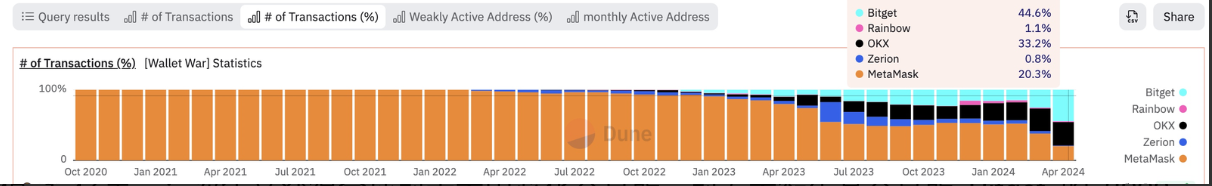

Bitget Wallet is an all-in-one Web3 wallet, and among the five mainstream wallets (Metamask, OKX Web3, Bitget Wallet, Rainbow, and Zerion), it is a long-standing veteran. Public data shows that its global user base exceeds 20 million, and in April 2024, its swap trading volume and transaction amount surpassed MetaMask.

Bitget Wallet, formerly known as BitKeep, was founded in 2018 and was relatively unknown at first, until it gained fame in 2020 with DEX token market and other functions during DeFi Summer, occupying a leading position in the Chinese DeFi community. Almost all Chinese DeFi participants were using BitKeep to query and trade tokens at that time.

In 2022, Bitget Wallet completed a $15 million Series A financing led by Dragonfly Capital, with a valuation of $100 million. The following year, it received a $30 million investment from Bitget, one of the top ten centralized exchanges globally and top five derivatives exchanges, raising its valuation to $300 million. Subsequent investments from well-known institutions such as Dragonfly Capital have further supported the continued development and growth of Bitget Wallet.

Subsequently, Bitget Wallet continued to innovate, adding various practical features such as Swap, cross-chain bridge, NFT, Dapp, gradually evolving into the product structure we see today. The current product structure of Bitget Wallet includes: multi-chain wallet + cross-chain trading + AI market + NFT market + DApp + inscription platform + Launchpad + coin earning center. This product structure may seem common now, as many popular wallets have similar product structures, but it was actually first defined by Bitget Wallet.

Horizontal comparison among mainstream wallets

Let's compare Bitget Wallet with two other mainstream wallets, MetaMask and OKX Web3.

First, MetaMask, which is undoubtedly well-known. It was the first wallet I used. However, MetaMask's limitations are quite apparent, such as the lack of support for multiple chains, DeFi tools, and the inability to aggregate and display the total value of tokens across different chains in the same wallet, making the experience of participating in various DeFi and airdrop projects quite challenging. Criticizing MetaMask in this way may not be fair, as MetaMask may be adhering to the "small and beautiful" product design concept of "personal private key wallet" (similar to the simplicity of Bitcoin's design and its lack of scalability), but the changing user preferences may also indicate the preferred design direction for wallets today.

By comparing Bitget Wallet with traditional wallets like MetaMask, we can easily see its remarkable pioneering nature, marveling at the team's agile capture of user needs:

The first wallet to adopt a multi-chain perspective, breaking down the barriers between chains when most wallets only rely on and support a single public chain, allowing users to manage multi-chain assets with a single wallet.

The first wallet to launch DEX market data, starting from on-chain market data on Ethereum and gradually expanding to multiple chains, providing real-time intelligent asset market data and popular rankings.

The first wallet to implement and advocate for seamless cross-chain trading, allowing users to freely move assets between any public chains without needing to understand concepts such as gas fees and cross-chain bridges.

The first wallet to introduce a Launchpad, allowing users to participate in new projects within the wallet and capture more opportunities to make money.

OKX Wallet, backed by OKX, although it has an independent web plugin version, is designed as an embedded wallet within the web and mobile platforms, which is quite different from Bitget Wallet, which is also backed by an exchange. There is not much more to add about OKX, as it has equally excellent interaction design and rich and user-friendly product features, providing an excellent user experience for airdrop interactions and DeFi projects.

Since the bull market, there have been many wallet projects active in the public eye, such as Backpack, Venom, Uniswap, and the newly launched Binance Web3, among others. However, looking at the entire wallet race, the former champion MetaMask seems to be struggling, while Bitget Wallet and OKX Web3 are advancing side by side, leaving other competitors far behind. Considering the technical requirements for wallet products, it is difficult to imagine any other player entering the competition of these two new kings, but at the same time, it is also very exciting to see who will lead the next development direction for wallets in the future.

From a wallet to an ecosystem platform, a six-year ambition to lay out?

Integrating so many functions into a single product end, it is clear that Bitget Wallet intends to redefine wallet products, transitioning from a "personal private key wallet" to a "Web3 ecosystem platform." This is probably based on the rich experience of expanding excellent products into ecosystems by Chinese companies. We have already seen the same development path in many Chinese Web2 products, such as WeChat, Alipay, and Douyin.

In fact, Bitget has indeed demonstrated the on-chain extension and decentralization of the entire ecosystem around Bitget Wallet, and has built the Bitget Onchain Layer, ultimately forming a complete Bitget Ecosystem. The official website provides a detailed outlook on the overall development path, and I will quote and summarize some of it here.

Currently, the Bitget Ecosystem is first and foremost promoting the redefinition of Web3 wallets and the construction of the Bitget Onchain Layer.

The redefinition of Web3 wallets refers to transforming wallets from "entry points" to "platforms." The core needs of Web3 users mainly include asset management, asset discovery, asset trading, and airdrop coin earning, all of which are effectively served by the aforementioned product features.

The construction of the Bitget Onchain Layer is divided into three parts:

Aggregated trading services: Bitget Wallet aggregates hundreds of DEXs from nearly 50 public chains through its native Bitget Swap, providing users with the best trading paths and introducing gas-free and high-speed trading modes. This aggregation not only simplifies the user's operation process but also significantly reduces trading costs and risks, providing great convenience for users.

Security and Liquidity: In terms of security, the Bitget Onchain Layer provides effective protection for users, isolating malicious DApps attacks and ensuring the security of user assets. In terms of liquidity, Bitget Swap not only aggregates on-chain spot liquidity but also covers OTC, on-chain derivatives, and Pre-Market, greatly enhancing the flexibility and convenience of user trading.

Enhancement of User Experience: Bitget Wallet has always adhered to the "Mobile First" concept, promoting DApps to be more mobile-friendly and provide a native experience through standardized development SDK and UI KIT. This mobile-focused strategy will further drive the mass adoption of crypto and enhance user experience on mobile devices.

The next step is to open up and co-build the ecosystem. Bitget Wallet has established a $10 million BWB Ecological Fund, aiming to donate and invest in high-quality products and assets, especially those related to on-chain trading. This not only demonstrates its deep involvement and support for industry development but also provides rich resources and a platform for developers, promoting the prosperity of the ecosystem.

By collaborating with industry developers, Bitget Wallet will create Modular Functional DApps (MFD). MFD can be an independent DApp or integrated as a functional component into Bitget Wallet's native functions. This flexible architecture not only meets diverse user needs but also helps developers and DApp projects increase their revenue.

Introduction and Analysis of BWB Token Economics

The official website also provides a detailed introduction to the BWB token economics. BWB will serve as the official ecological token of Bitget Wallet and the system token of Bitget Onchain Layer, playing multiple roles in the ecosystem, including community governance, staking, participation in Bitget Wallet Launchpad and various airdrop activities, as well as eligibility for Bitget platform activities and on-chain project airdrops, and the use of multi-chain gas fees after the launch of the AA wallet.

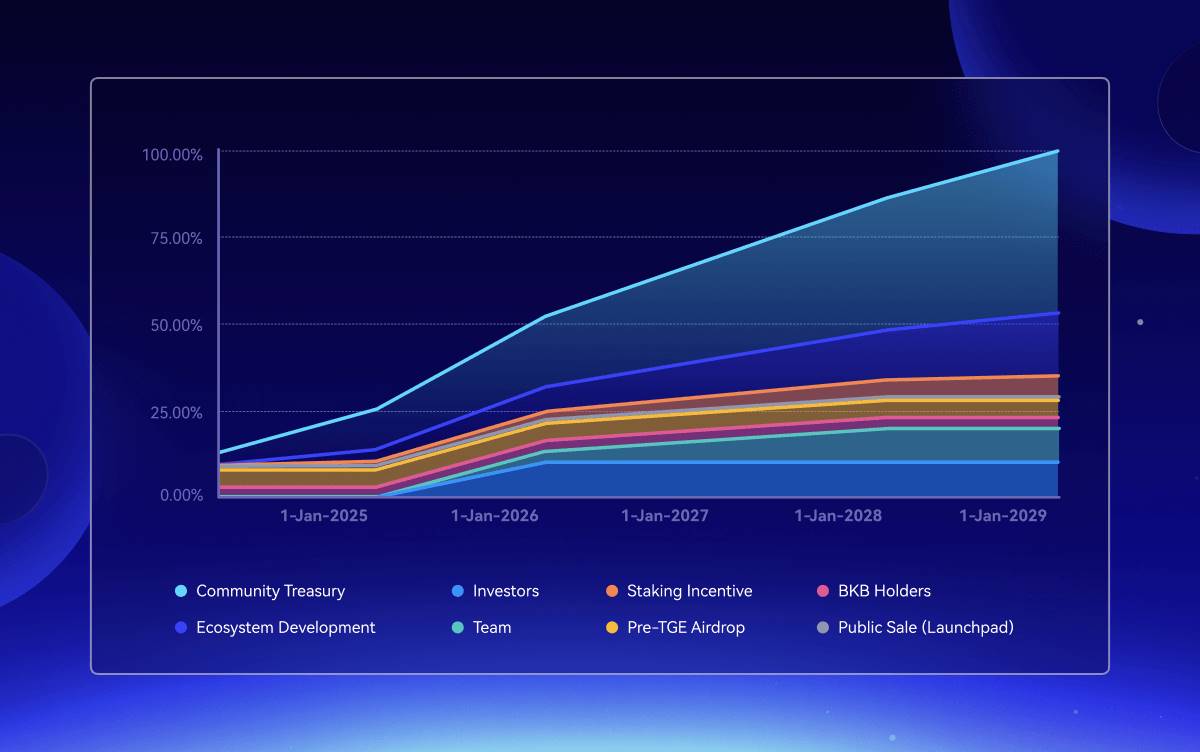

The total supply of BWB is 1 billion, with the specific allocation as follows:

Private investors: 10%, linear release over 12 months after a 12-month lock-up period.

Public offering: 1.1%, with 0.1% allocated through the Bitget Wallet Launchpad platform.

Pre-TGE airdrop: 5% for users participating in airdrop activities.

BKB holders: 3%, exchanged proportionally for holders of BitKeep platform points (BKB).

Team: 10%, linear release over 36 months after a 12-month lock-up period.

Ecological development: 18%, used for ecosystem development, linear unlock after TGE.

Staking incentives: 6%, used to incentivize users to stake BWB.

Community treasury: 46.9%, used for user growth and community incentives, with 6.9% distributed at TGE and the rest linearly released.

The tokens will be distributed and released over five years according to the schedule shown in the following image.

I evaluate the entire BWB token economics from the following perspectives:

- Reasonableness of the Allocation Plan

The allocation plan for BWB tokens demonstrates Bitget Wallet's comprehensive consideration and long-term planning for ecosystem development. Specifically:

Private investors and public offering: Private investors and public offering together account for 11.1%, with the lock-up and linear release periods for private investors ensuring market stability and mitigating the risk of mass sell-offs. The relatively small portion for public offering, but with allocation through the Launchpad platform, increases opportunities for ordinary users to participate.

Team and ecological development: The team accounts for 10%, and the lock-up and linear release periods incentivize long-term commitment and development, attracting top talent. The ecological development accounts for 18%, a relatively high proportion, demonstrating Bitget Wallet's emphasis on ecosystem expansion and innovation, laying a financial foundation for future development.

Community incentives and staking incentives: The community treasury accounts for 46.9%, with 6.9% distributed at TGE. These tokens are used for user growth and community incentives, ensuring community activity and loyalty. The staking incentives account for 6%, encouraging users to stake BWB, stabilizing token prices, and increasing user participation.

- Diversity of Token Use Cases

BWB tokens have multiple use cases within the Bitget Wallet ecosystem, increasing the token's utility and demand, including community governance, staking, multi-chain gas fee payments, participation in platform activities and airdrops, among others. These use cases not only enrich user experience but also enhance the token's circulation and value.

- Feasibility of the Release Schedule

The release schedule for BWB is set to gradually distribute and release over five years, which helps control market supply. Although it may be conservative for speculative traders, it helps avoid excessive token inflation and significant selling pressure. This demonstrates Bitget Wallet's long-term development planning, attention to market stability, and confidence in ecosystem participants.

- Potential Market Impact

The design and allocation plan for BWB tokens reflect Bitget Wallet's deep understanding of market demand and industry dynamics:

Liquidity and Security: Through multi-chain deployment and strict lock-up periods, BWB tokens' liquidity and market security are ensured.

User participation and community development: Through various incentive mechanisms, BWB promotes active user participation and healthy community development.

Innovation and expansion: The high proportion of ecological development funds provides solid support for future innovation and expansion, demonstrating Bitget Wallet's commitment to executing long-term strategic planning.

- Potential Returns

Compared to other wallets, BWB is currently undervalued:

Total BWB supply: 1,000,000,000 BWB

Circulating supply of BWB: 123,361,000 BWB (circulation rate of about 15%)

Points exchange ratio: 4.1 BWB points = 1 BWB

Current OTC BWB points price: $0.15, equivalent to an OTC price of $0.615 for BWB. The circulating market value of BWB can be calculated as approximately $76 million, while the global market value of FDV is $615 million, with a project valuation of $300 million, only twice as much. With the project's large scope, the potential returns from participating in the project are worth looking forward to.

Long-termism Leads Web3 into the Future

We can see that Bitget Wallet and the Bitget Onchain Layer it has built are not just a tool or platform, but a complete ecosystem that will provide users with comprehensive services from asset management and trading to value-added services. It seems that Bitget Wallet has been an important part of a long-term strategy for a long time, and has consistently executed and promoted innovation, which is scarce in the restless Web3 world today.

I have deep respect for all teams and projects in the Web3 world that hold long-termism. In my opinion, Bitget Wallet not only provides an excellent product experience but also demonstrates a team advantage in understanding user needs, capturing demand, and rapidly iterating innovation, which I believe will be a strong cornerstone in executing any strategic plan.

Finally, I hope that BWB can play more roles in the ecosystem, provide broader empowerment and applications, and further build a successful Bitget Onchain Layer and Bitget Ecosystem. Just as defining the product structure of a wallet defines a successful evolutionary path for an ecosystem platform.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。