The original article was written by: Xiyou, ChainCatcher

Original article edited by: Marco, ChainCatcher

On May 29th, the iShares Bitcoin Spot ETF IBIT, managed by BlackRock, has surpassed Grayscale's GBTC to become the world's largest Bitcoin spot ETF in terms of BTC holdings.

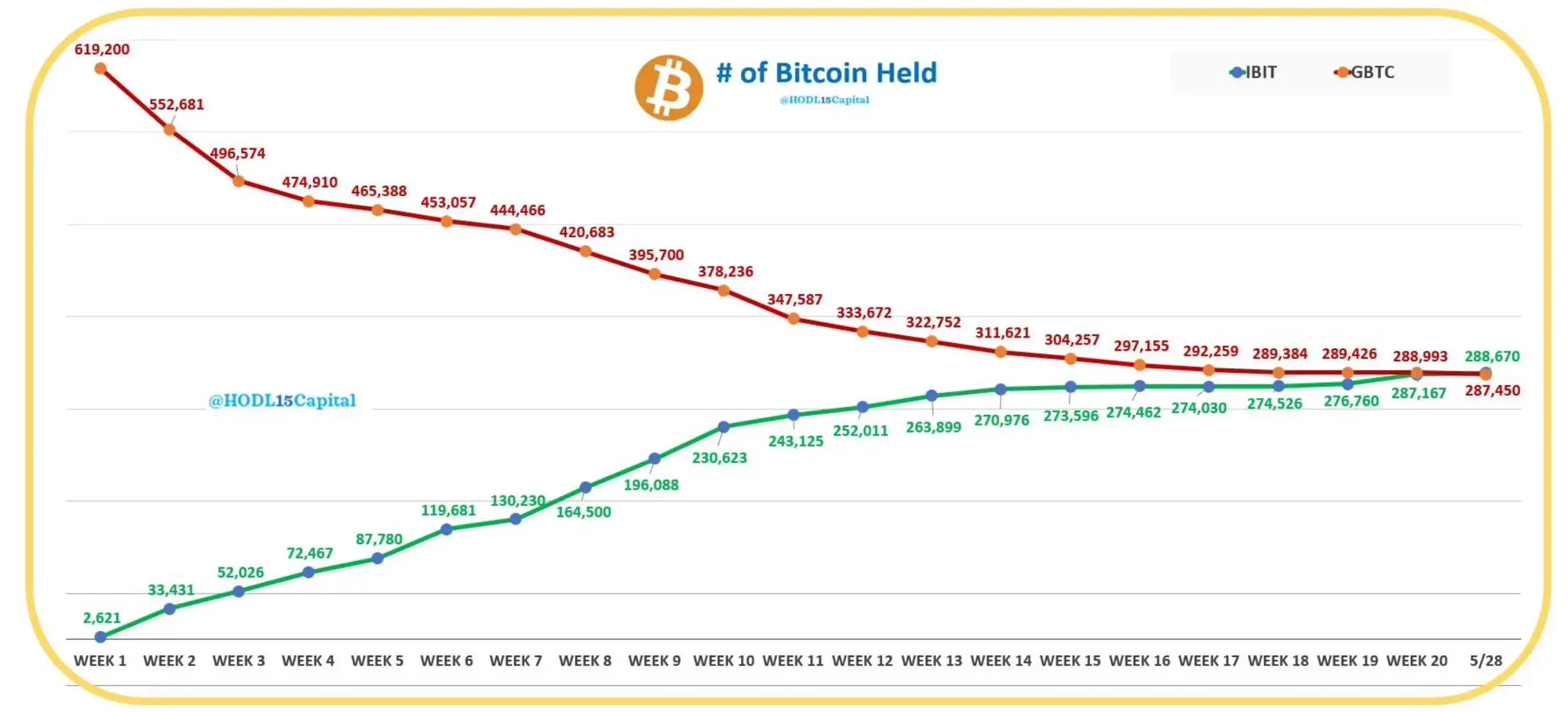

According to HODL15Capital data, on May 28th, approximately $102 million (1503 BTC) flowed into BlackRock's Bitcoin spot ETF IBIT, with a total BTC holding of over 288,670, valued at approximately $19.795 billion.

On the same day, funds managed by Grayscale's GBTC flowed out over $105 million (approximately 1543 BTC), marking the largest outflow in nearly two weeks. GBTC holds approximately 287,450 BTC, valued at $19.758 billion.

IBIT's BTC holdings have officially surpassed GBTC, leading by over $300 million, making it the world's largest Bitcoin spot ETF in terms of BTC holdings.

Online for 4 months, IBIT attracted approximately $20 billion

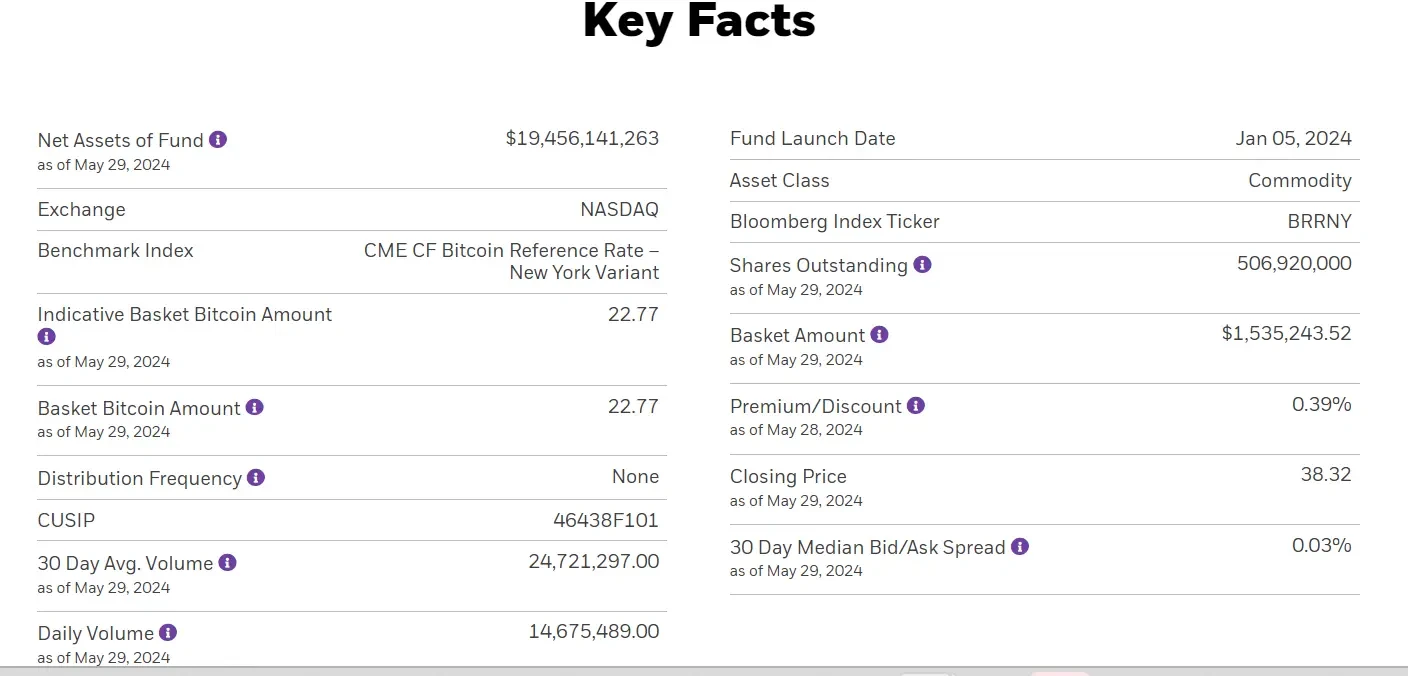

According to data from BlackRock's official website, as of May 30th, the average daily trading volume of IBIT in the past 30 days was $24.72 million.

Since its launch on January 11th, in just 4 months, IBIT has successfully attracted approximately $20 billion worth of BTC, making it one of the fastest-growing ETFs in history.

Regarding IBIT's outstanding performance in such a short period, ETF analyst Eric Balchunas of Bloomberg expressed that IBIT is a legend. Historically, only one ETF has reached a $20 billion asset scale in less than 1000 days, with JEPI taking 985 days to achieve this, while IBIT achieved the same scale in approximately 137 days.

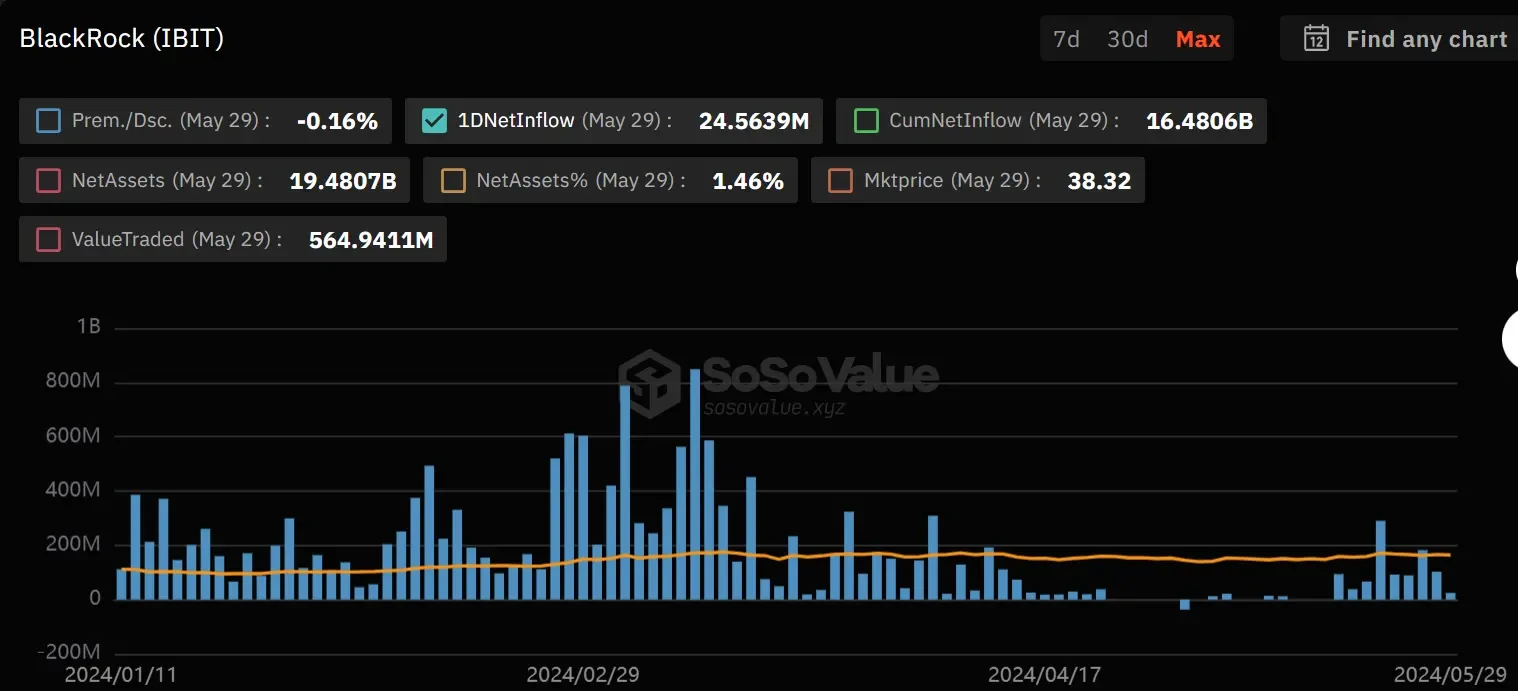

According to SoSoValue data, from the launch of IBIT on January 11th until mid-April, funds have been consistently flowing in for over 3 months.

On the first day of its launch, over $110 million flowed in when the BTC price was $46,000. On March 12th, the highest amount of funds flowed in, reaching approximately $848 million, and the next day (March 13th), the BTC price hit a historical high of $73,700.

Regarding the growth of IBIT's funds, Eric Balchunas stated that IBIT's low fees, high liquidity, and the strong influence of BlackRock's iShares brand are contributing factors.

Additionally, he added that although the total number of IBIT trades has decreased recently, the average trade size has increased, indicating that large investors are replacing retail "small fish."

Behind the outflow of GBTC funds: high fees and premium or discount risks

Why has GBTC been experiencing outflows while IBIT has been experiencing inflows, despite both being Bitcoin spot ETFs?

According to HODL15Capital data, since the launch of IBIT, GBTC has been in a state of outflows almost every week, providing IBIT with the opportunity to quickly surpass it.

GBTC, under Grayscale, has been in existence since 2013 and was the earliest compliant product for public participation in BTC investments, managing approximately 619,000 BTC before the launch of Bitcoin spot ETFs.

The "GBTC's BTC accumulation or reduction" was once considered an important indicator of BTC price trends in the crypto community.

Why has the asset management scale of GBTC been shrinking since the launch of BlackRock's IBIT and Fidelity's FBTC Bitcoin spot ETFs? This is mainly because GBTC and Bitcoin spot ETFs operate differently.

GBTC is a Bitcoin trust fund, meaning investors entrust their money to Grayscale, which then purchases and holds the cryptocurrency on behalf of the investors, issuing shares to represent their stake in the trust fund. Investors can only buy shares on the secondary market and cannot redeem them.

The price of GBTC shares is related to the quantity of BTC it holds and its market value, but it often experiences significant premiums or discounts. A premium refers to the share price of GBTC being higher than the value of BTC it holds per share, while a discount refers to the share price being lower than the value of BTC it holds per share.

Bitcoin spot ETFs are ETFs that directly hold BTC, and their prices are consistent with the BTC market price, without experiencing premiums or discounts.

In January of this year, GBTC was approved by the SEC to be converted into a Bitcoin spot ETF, allowing investors to freely redeem their fund shares through authorized participants (AP) and convert their ETF shares into US dollars. This means that GBTC holders cannot cash out their profits until the product is converted into an ETF.

The outflow of funds from GBTC is mainly due to two reasons:

First, GBTC's management fees are excessively high, being 5-6 times higher than those of its competitors. GBTC's management fee is approximately 1.5%, while the fee rate for Bitcoin spot ETFs is only around 0.2% or lower.

Second, it can avoid the risk of premiums or discounts associated with GBTC, as the inability to redeem shares in GBTC may lead to significant differences between its fund price and the market value of BTC, while the price difference between Bitcoin spot ETFs and the market price of BTC is minimal.

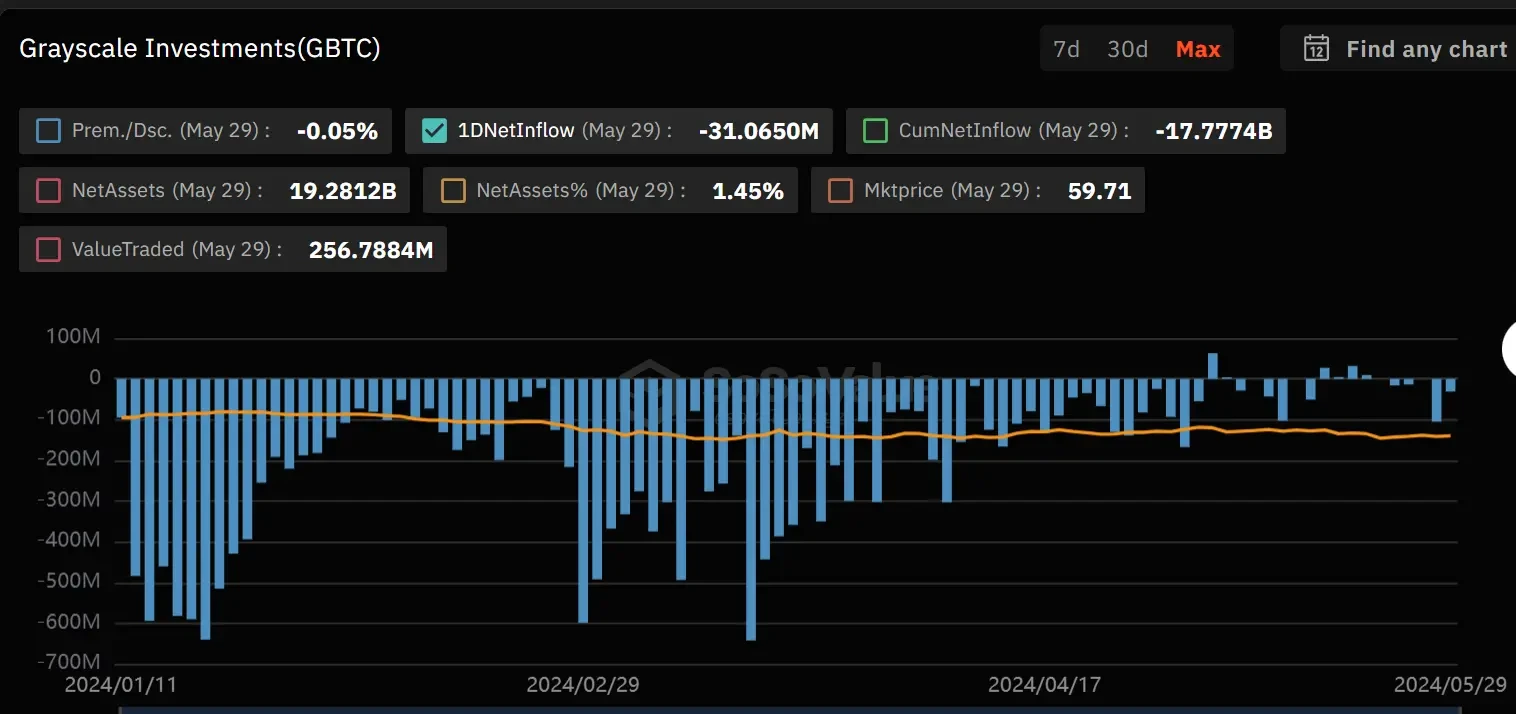

According to SoSoValue data, since the launch of Bitcoin ETFs, GBTC has been in a state of net outflows for 4 consecutive months, with the outflow rate decreasing in May.

As of May 30th, the asset management scale of GBTC is valued at $19.28 billion, with a total outflow of approximately 332,000 BTC over the past 4 months, still holding around 287,000 BTC.

IBIT has become a new force affecting BTC price trends

Now, with a fund management scale exceeding GBTC by approximately $2 billion, IBIT will become a new driving force behind the influence on Bitcoin price trends.

Market maker Wintermute stated, "This represents a significant shift in the supply and demand dynamics of BTC. Investors will now focus on IBIT's fund inflows and outflows instead of GBTC, which may drive attention to Bitcoin ETFs or BTC behind them."

As of May 30th, the total net asset value of Bitcoin spot ETFs is $57.683 billion, with IBIT accounting for over 33.7% of the market share.

Among them, there are 3 Bitcoin ETFs with a scale of over $10 billion, including IBIT (valued at $19.48 billion), GBTC (valued at $19.28 billion), and FBTC (valued at $10.94 billion).

Bitcoin spot ETFs represented by IBIT are becoming the entry point for traditional capital into the crypto field. Compared to the institutional bull run brought by Grayscale in the previous round, the influx of funds from BlackRock and other global asset management companies this time is even larger.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。