Market Overview

With the release of "not so strong" economic data, the market continues to digest the dovish Powell (while many other committee members are hawkish), and the expectation of a rate cut has risen. The Dow has risen for five consecutive weeks, and the S&P and Nasdaq have risen for four consecutive weeks. In particular, the Nasdaq technology index rose more than 3% this week, and US stocks have recovered all of their April declines after the CPI data and reached historical highs.

The bull market that began in October 2022 has not been smooth sailing, with the main setback coming from concerns in the market about the Fed maintaining high interest rates for a long time. However, since then, the S&P 500 index has seen a return of nearly 52%, including a gain of over 10% since 2024.

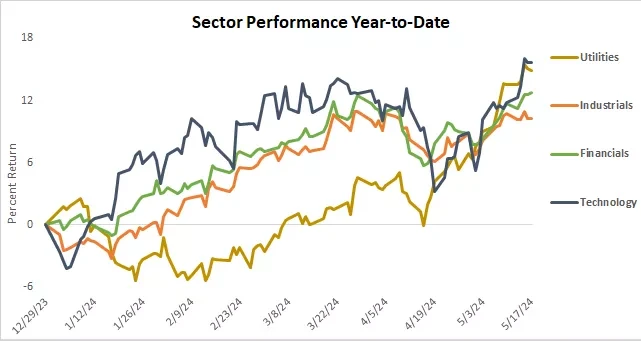

Although much of the market's rise since 2022 has been driven by significant growth in the technology sector (as well as the so-called "seven giants" and the special enthusiasm for artificial intelligence), we need to see that the breadth of the market has begun to expand in recent weeks, which is a positive signal for the sustainability of the bull market. It can be noted that in recent weeks, cyclical industries such as industry and finance, as well as more defensive and interest rate-sensitive sectors such as utilities, have seen growth.

Europe is in support of a rate cut in June, as indicated by the latest inflation data and speeches by central bank officials. However, European stock investors have begun to focus on the prospects for a rate cut after June, a prospect that has been dampened by cautious remarks from officials. European stocks fell slightly last week (but also remained near historical highs).

Chinese stocks continue to strengthen, supported by unprecedented stimulus policies in the real estate market. The CSI 300 has risen to its highest level in 7 months, the HXC index has risen to its highest level in 8 months, and the strongest HSI in Hong Kong has surged by 4.74% to its highest level in 9 months, with the real estate index rising by 9.9% and having risen by 40% in the past four weeks. Analysts generally believe that the government hopes to support this industry but does not want to overstimulate it, so they are still waiting for more policy support.

Gold (historical highs), silver (+11%), cryptocurrencies, copper, and crude oil have all risen. The main reason for the rise in copper prices is the expectation of increased demand driven by the wave of electrification, including electric vehicles, data centers for artificial intelligence, or expanded grid facilities to meet the surge in power demand. In addition, with the reduction of new copper mining capacity and Western sanctions on Russian sources.

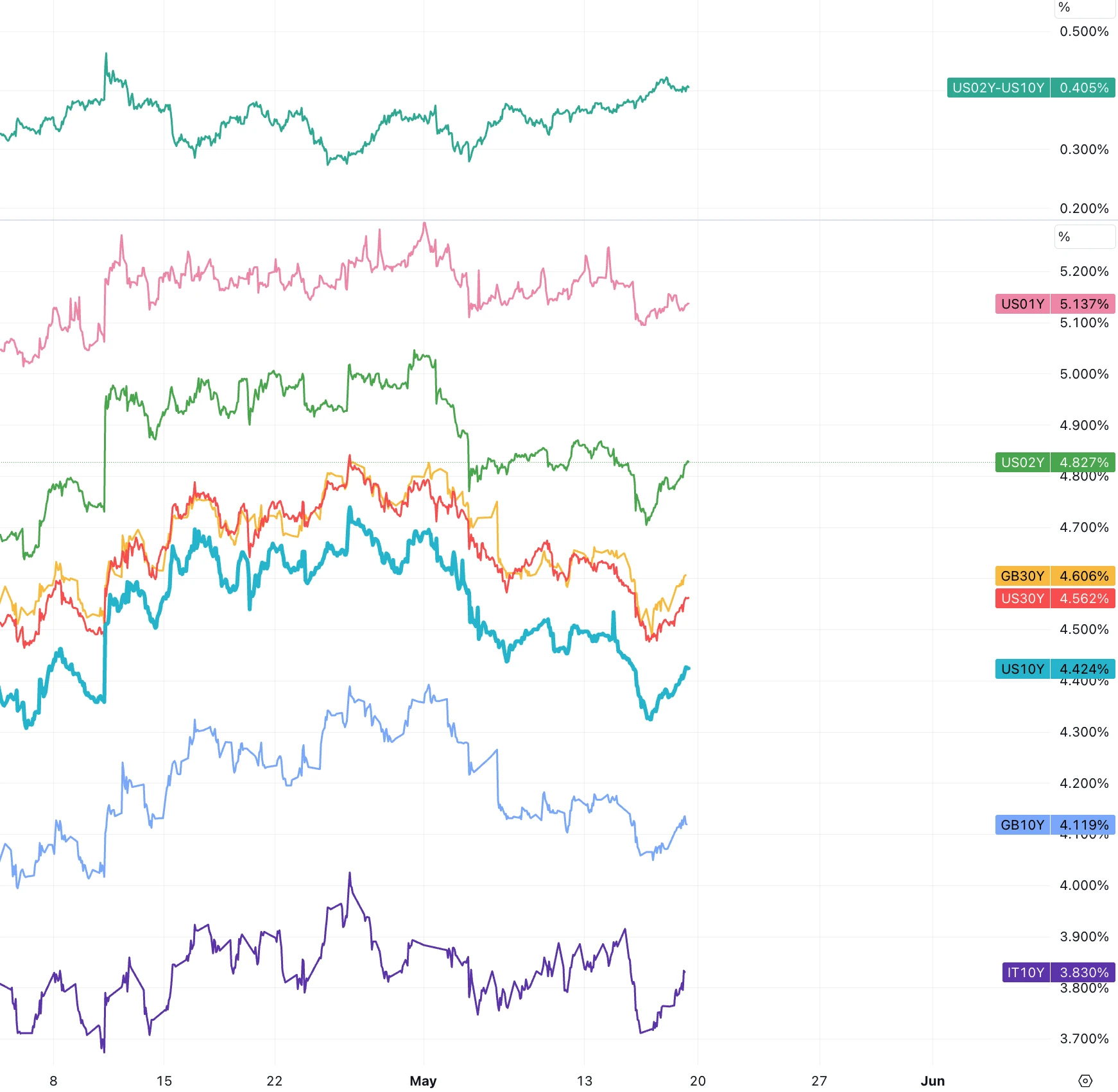

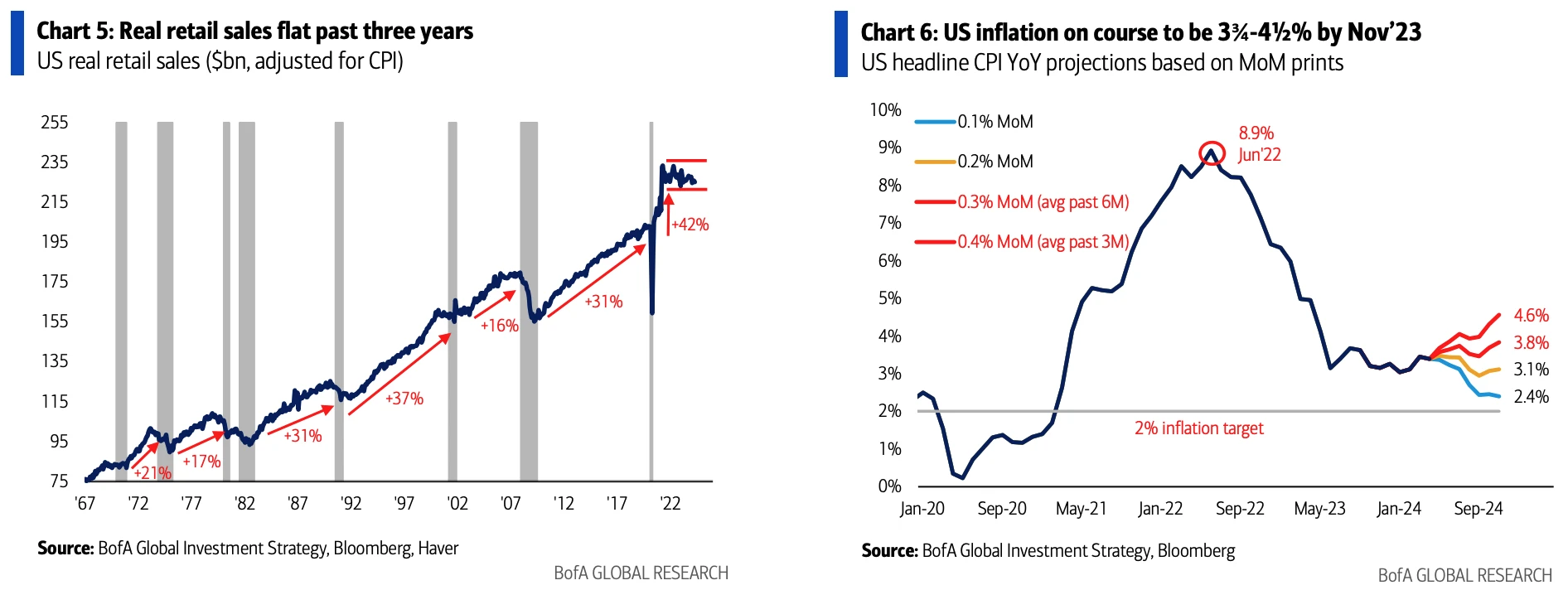

The V-shaped trend of US bond yields only fell slightly throughout the week. From the point of view of the timing of the trend anomaly, this is related to the indications of serious resistance to growth from several leading US economic indicators, although it is considered positive for the stock market:

- In the stock and commodity markets, the "goldilocks" state seems to have returned (the economy is doing well, the Fed can control inflation, although it may not return to 2%), but there are some concerns in the bond market.

Q1 Performance

So far, 93% of S&P 500 companies have reported their performance, with 78% exceeding EPS expectations. The profit growth rate of 5.7% is the highest year-on-year profit growth rate since the second quarter of 2022 (5.8%). For the second quarter of 2024, 54 S&P 500 companies have issued negative earnings guidance, while 37 S&P 500 companies have issued positive earnings guidance. Analysts expect the EPS growth rate for the second quarter to reach 9.2%. In addition, analysts also expect the profit growth rates for the third and fourth quarters of 2024 to be 8.2% and 17.4%, respectively.

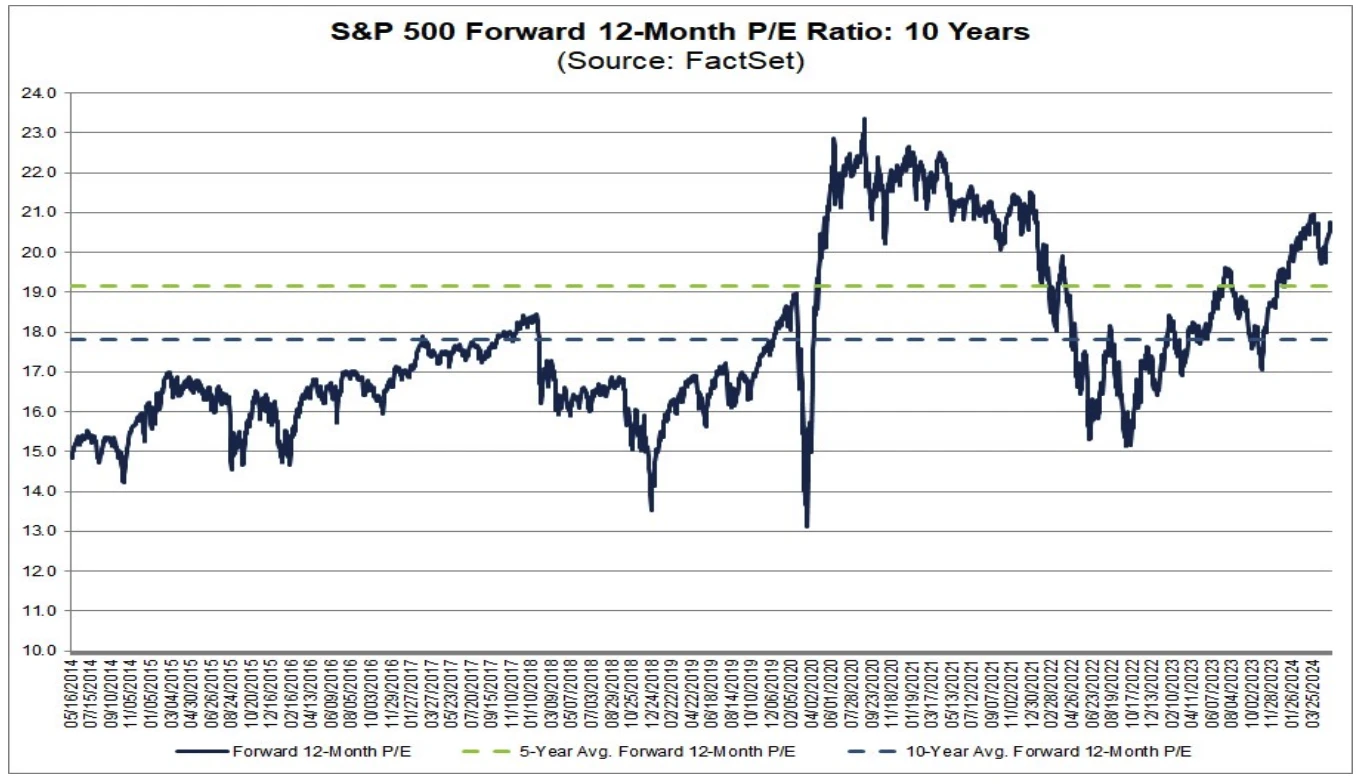

Optimistic expectations support higher valuations: the expected 12-month P/E ratio for the S&P 500 is 20.7. This P/E ratio is higher than the 5-year average of 19.2 and the 10-year average of 17.8:

Price Data

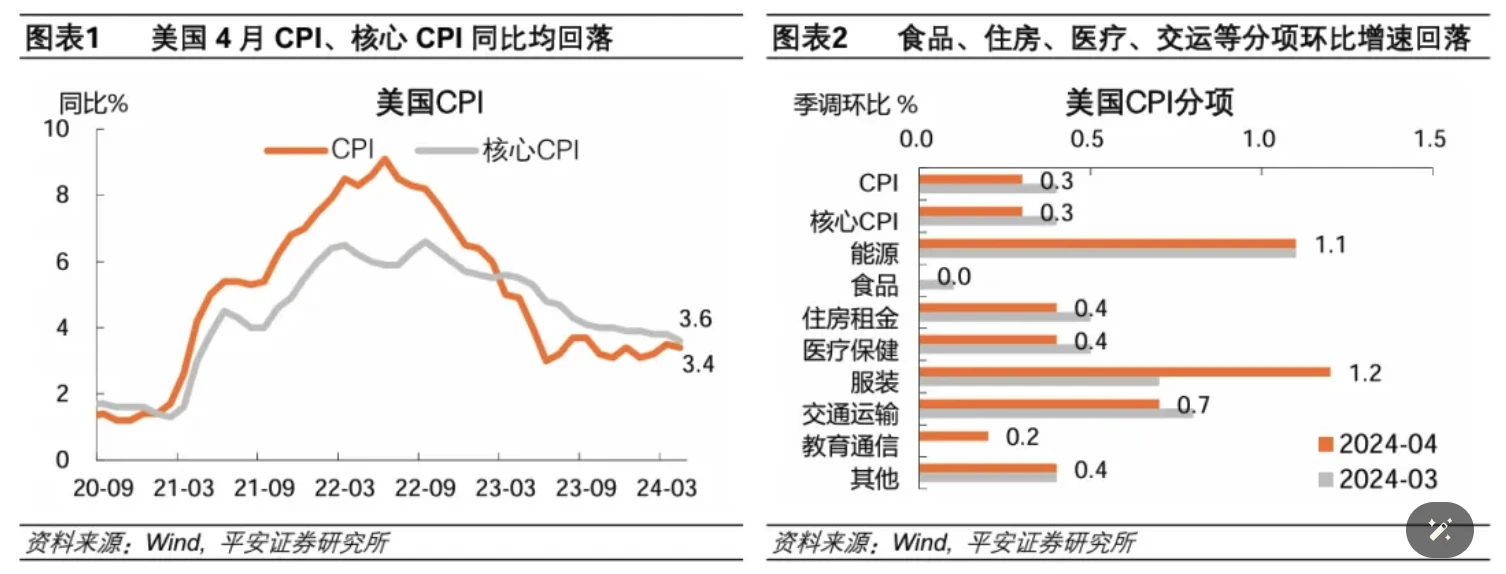

Last week, the highly anticipated April CPI (Consumer Price Index) report was released. The results were in line with market expectations, and inflation seems to have returned to a moderate trend after several months of anxiety caused by reports of higher-than-expected inflation.

The fundamental trend of the CPI report is encouraging. The overall core CPI year-on-year has dropped to 3.6%, the lowest level in three years. It rose by 0.3% month-on-month, lower than the expected 0.4% and the previous month's 0.4%. Although these numbers alone are not particularly optimistic, this is the first CPI report this year that has not exceeded expectations, enough to trigger the long-awaited bullish sentiment after the FOMC.

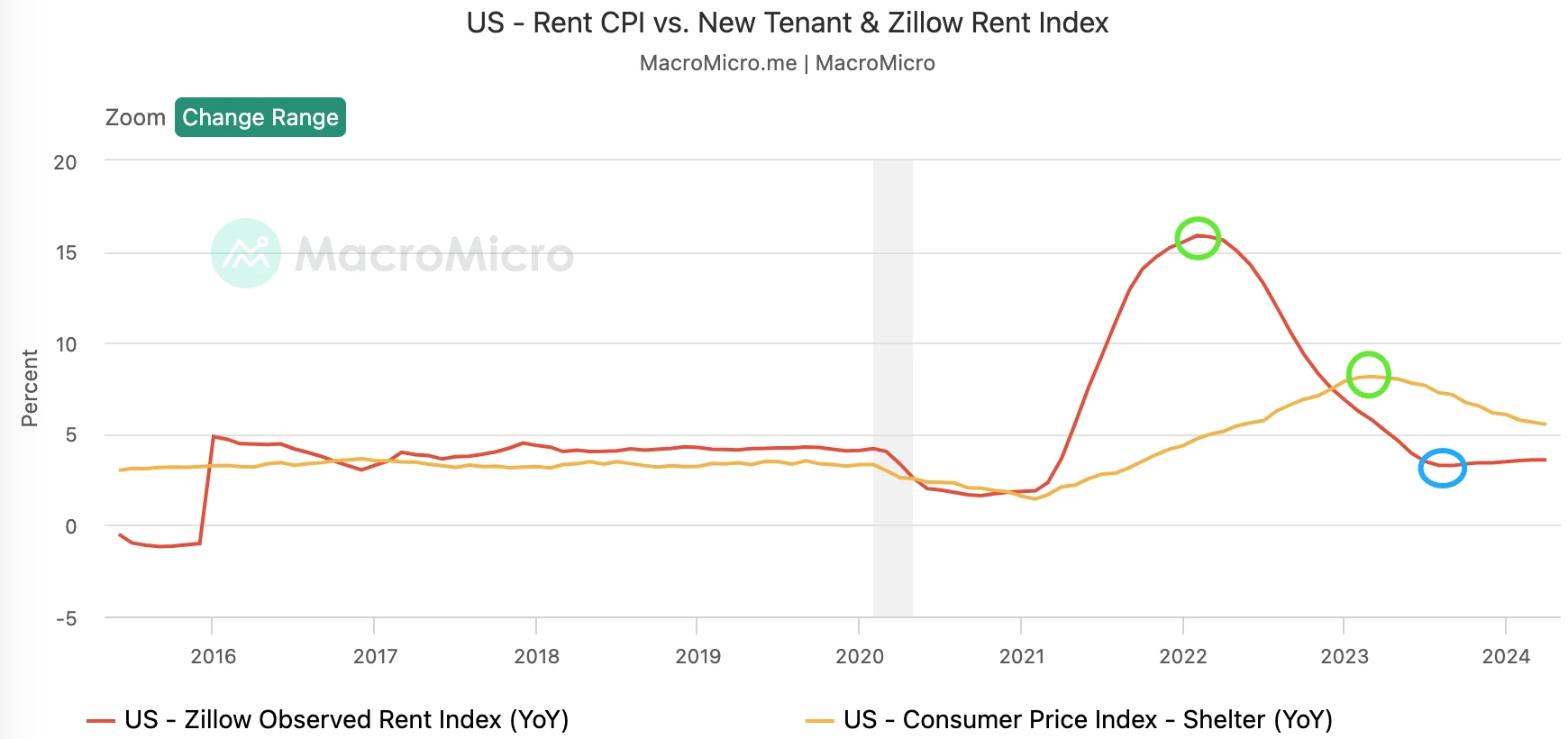

In particular, commodity prices continue to decline, and the decline in the cost of cars and home goods has played a supporting role. In the past 6 months, the core commodity end has been declining except for February, echoing Powell's recent statement that commodity inflation has basically returned to pre-pandemic levels, and is continuing to suppress inflation. Core services rose by 0.4% month-on-month and 5.3% year-on-year, still the largest problematic part of the CPI. The biggest contributor is housing, which rose by 0.4% month-on-month and 5.5% year-on-year. Rent inflation and owner-equivalent rent (OER) both rose by 0.4%. Housing and gasoline contributed to over 70% of the nominal CPI increase this time. Other services including transportation, car insurance, and medical care have slightly declined, while education unexpectedly rose by 0.2% (additional disruption from the student movement?).

Rents have a lag of about a year, and with the expected slowdown in housing price increases, officials believe that inflation will continue to decline. Zillow's new rental price growth rate hit a low point in September at +3.27%, but then stagnated, combined with the rise in commodity prices, which raises doubts about whether future inflation data will continue to exceed expectations:

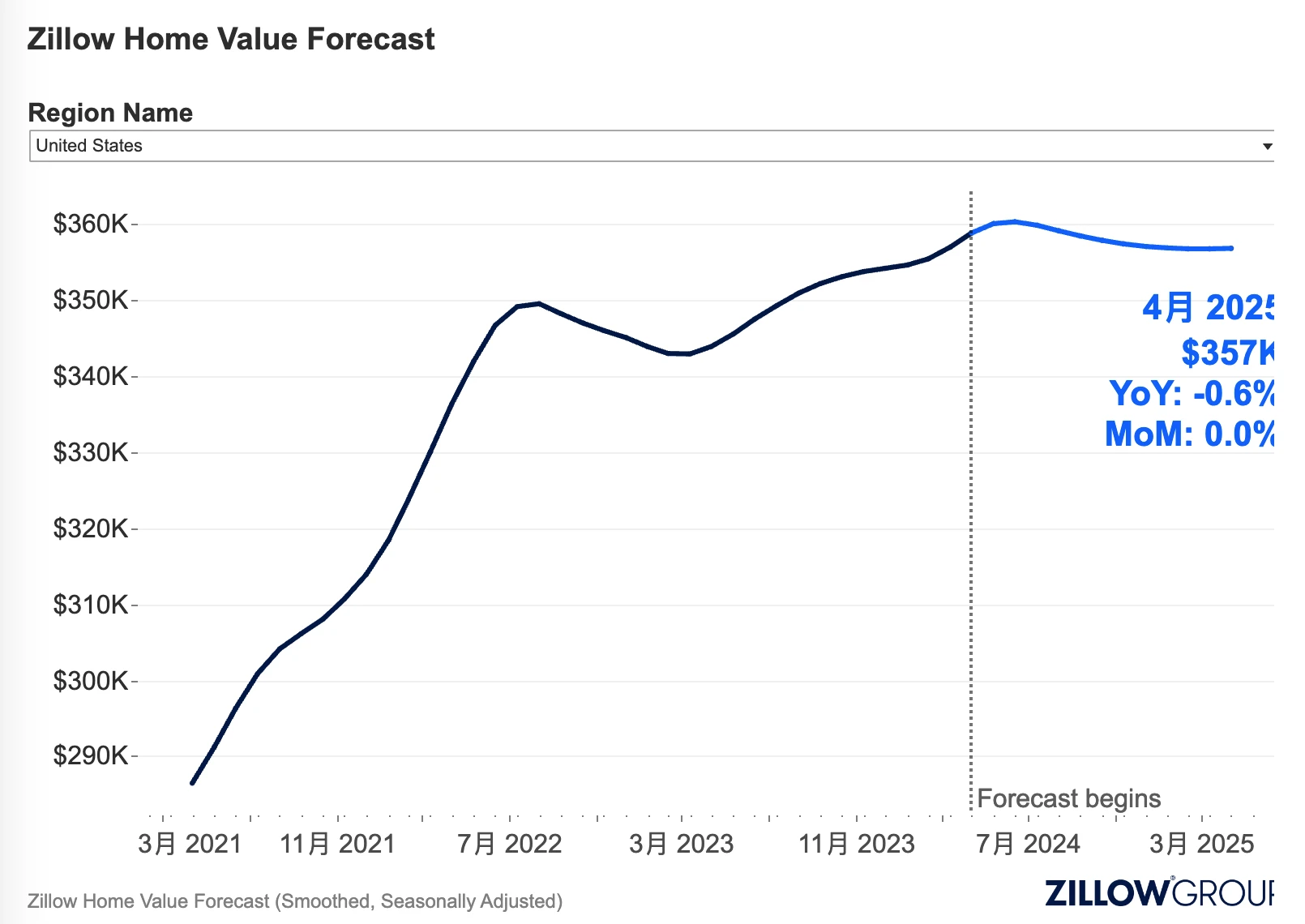

Zillow predicts that housing prices will peak this summer and turn downward. It is currently projected to grow by 0.6% in 2024, lower than the previous month's forecast of 1.9% growth in 2024, and much lower than the average annual appreciation rate of around 5% before the pandemic. Zillow predicts that housing prices will decline by 0.9% in the next 12 months. The main reason is the surge in listings, shifting the market in favor of buyers:

The "New Fed Echo Chamber" Nick pointed out that after the April report, it will take two more CPI reports to strengthen the Fed's confidence. The Fed may still not cut interest rates before September. The significance of the April CPI data is that it preserves the possibility of a rate cut later this year and alleviates some concerns that the Fed may need to further open the door to rate hikes.

The PPI data released on Tuesday is quite interesting. Driven by energy prices and service costs, the nominal PPI rose by 0.5% month-on-month in April, significantly higher than the expected 0.3% and last month's 0.2%, with a year-on-year increase of 2.2%, in line with expectations, but reaching a new high for the year. The core PPI, excluding food and energy, also rose by 0.5%, significantly higher than the expected 0.2%, with a year-on-year increase of 2.4%, also in line with expectations.

At first glance, these inflation numbers are obviously not good news, but the market didn't drop much before the opening, and the reason is the government's revision of last month, with the nominal and core month-on-month inflation rates for March changing from an increase of 0.2% to a decrease of 0.1%. This completely changed the interpretation from inflation to deflation, and the market was also at a loss, whether it should be nervous because of the significantly higher-than-expected PPI last month, or happy because of the timely deflation last month? From the final trend, the market chose the latter, and all three major stock indexes opened with a sharp rise.

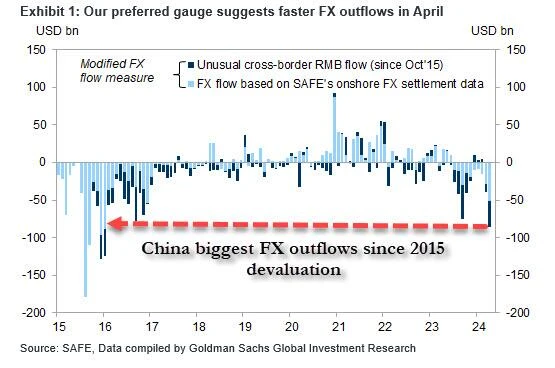

Record Chinese Bond Sell-Off

As of March, China has sold US bonds for the fifth consecutive month, with a total sell-off of $53.3 billion in the first quarter, setting a historical record. Even during the 2008 financial crisis, there was no such sustained reduction in holdings of government and institutional bonds.

Bloomberg analysis points out that despite the approaching Fed rate cut cycle, China is still selling US dollars and US bonds, so there should be a clear intention… With the restart of the US-China trade war, the pace of China's sale of US securities may accelerate, especially if Trump returns to the presidency.

While selling off US dollar assets, official gold holdings are on the rise. According to PBOC data, the proportion of gold in reserves climbed to 4.9% in April, the highest level since 2015. The IMF mentioned that since 2015, both China and closely related countries have increased their holdings of gold in foreign exchange reserves, while countries in the US camp have remained stable, which seems to indicate that their central bank purchases of gold may be due to concerns about the risk of sanctions.

On the other hand, Japan is buying. According to data from the Ministry of Finance, foreign holdings of US bonds reached $8.09 trillion in March, higher than the previous month's $7.97 trillion, setting a new historical high. US bonds had a strong performance this month, with the most foreign buying in three months. Japan's volume of US bonds has also surged, now at a historical high of $1.19 trillion.

MEME Hype, Companies Immediately Cash Out to Suppress Stock Prices

From Monday to Wednesday, a post by Roaring Kitty on X after a three-year hiatus triggered a massive short squeeze on Gamestop and AMC Entertainment Holdings, with the company's market value reaching $19.8 billion at one point. The rally lasted only 2 days and then entered a correction. Then on Friday, GME announced the issuance of 45 million shares to suppress the speculative fervor (retail is fuel, not people), but the stock still has nearly doubled in May so far (AMC also announced the issuance of $250 million in shares this week). In addition, GameStop also forecast that net sales for the first quarter will drop from $1.24 billion in the same period last year to between $872 million and $892 million.

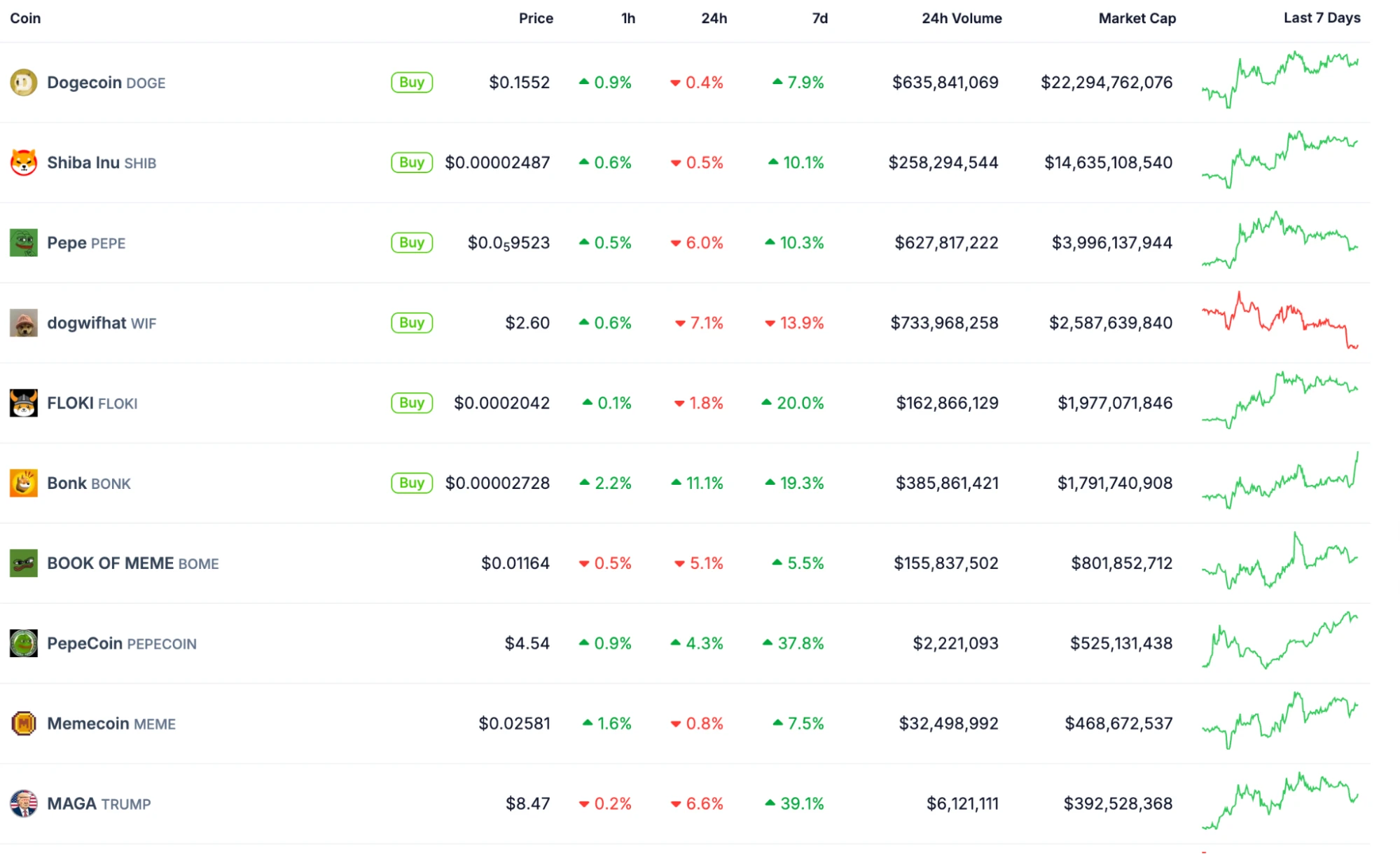

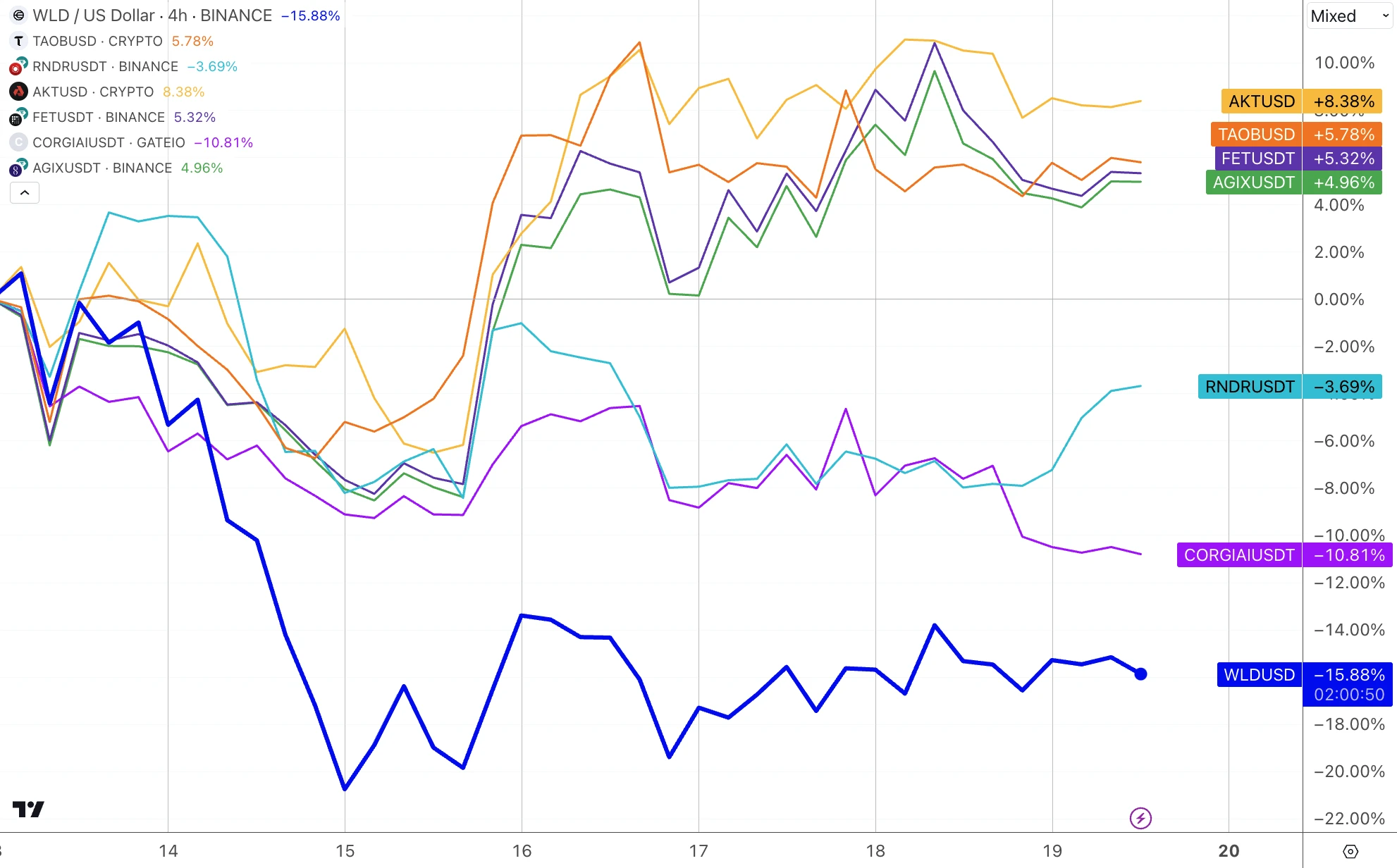

It seems that the MEME concept tokens in the cryptocurrency space have not been affected by the bearish stock market, showing significant strength in the past 7 days, with PEPE's 10% increase pushing its market value to $4 billion, reaching the top 30 in market value (including stablecoins), the only token in the top 100 by market value to rebound to a new high.

The GME meme coin on Solana surged 40 times at one point last week, showing a high degree of synchronization with the trend of GME stock:

GPT 4o Advances AGI Further

OpenAI launched a new AI model last week called GPT 4o, which will be open to all users. It can perform real-time reasoning across text, audio, and visual (images and videos), with a speed twice as fast as GPT 4 Turbo, but at only half the cost. The new model can observe your emotions and can handle situations where you interrupt it. The audio model can respond in an average of 320 milliseconds, almost the same as human communication response time. In a demonstration video, 4o can engage in video conversations with users to help analyze the surrounding environment. OpenAI also demonstrated 4o helping guide children in learning mathematics in real-time on an iPad.

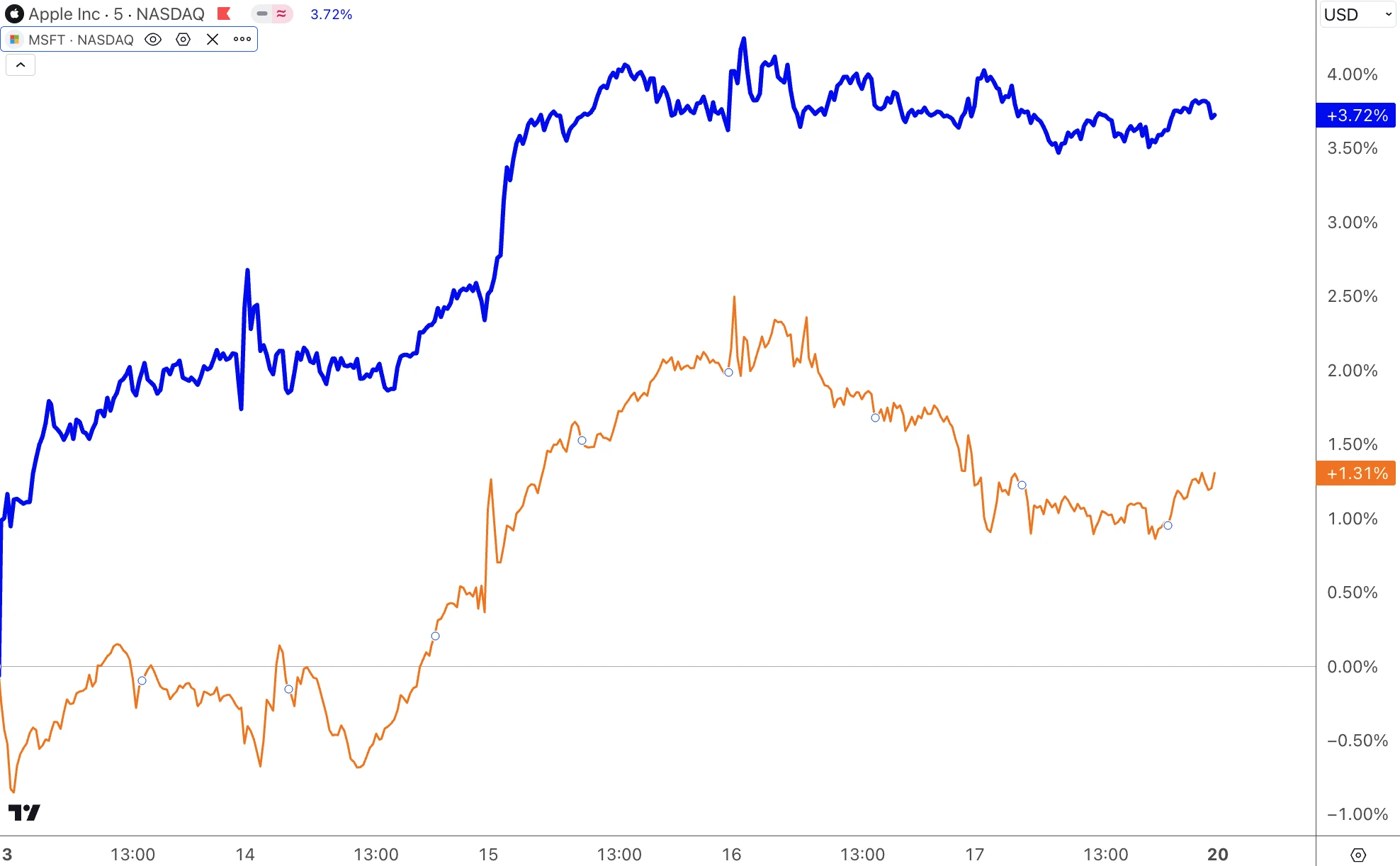

Microsoft's stock price and AI concept cryptocurrencies did not react much to this. However, there are rumors that Apple is finalizing details to integrate some GPT technology into the iPhone. If Siri can use this technology, it will make a huge leap in interaction quality and user experience, so the biggest reaction last week was from Apple.

Tesla Rehires the Laid-Off Supercharger Team

Based on Bloomberg's report, one of the returning individuals is Max De Zegher, the former Director of North American Charging Business, second only to the former head of the charging business, Rebecca Tinuity. It is currently unclear how many people have been called back. Last Friday, Musk wrote on X that Tesla will spend over $500 million to expand its Supercharger network, emphasizing that these are new sites and do not include existing operating costs, in an attempt to dispel market doubts. Regarding Musk's capricious behavior, some supporters have quoted his previous words, stating that the simplest way to simplify is to delete, and if you don't add back at least 10%, then it means you didn't delete thoroughly enough. However, others have expressed concern that the best talent has likely been snatched up immediately, and even if Tesla rehires them, they will be subpar, which is not a good thing.

Retail Investor Sentiment High

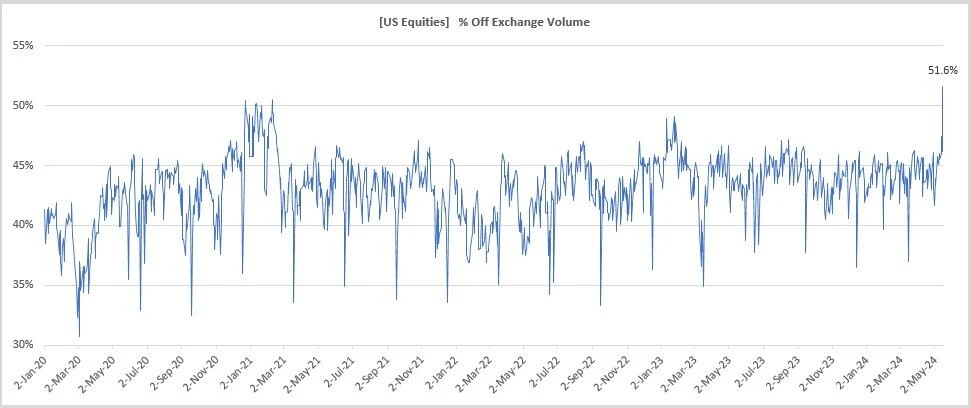

An increase in over-the-counter trading volume is usually seen as an indicator of increased retail trading activity. On Friday, the percentage of over-the-counter trading volume as a share of total US stock trading volume reached 51.6%, the highest level on record. Goldman Sachs analyst Scott Rubner stated that he has heard more discussions about "FOMU" (fear of missing out) this week. Additionally, the hashtag "#DOW40K" is trending on social media, indicating that retail traders are excited about the recent performance of the Dow Jones Index.

Fund Flows

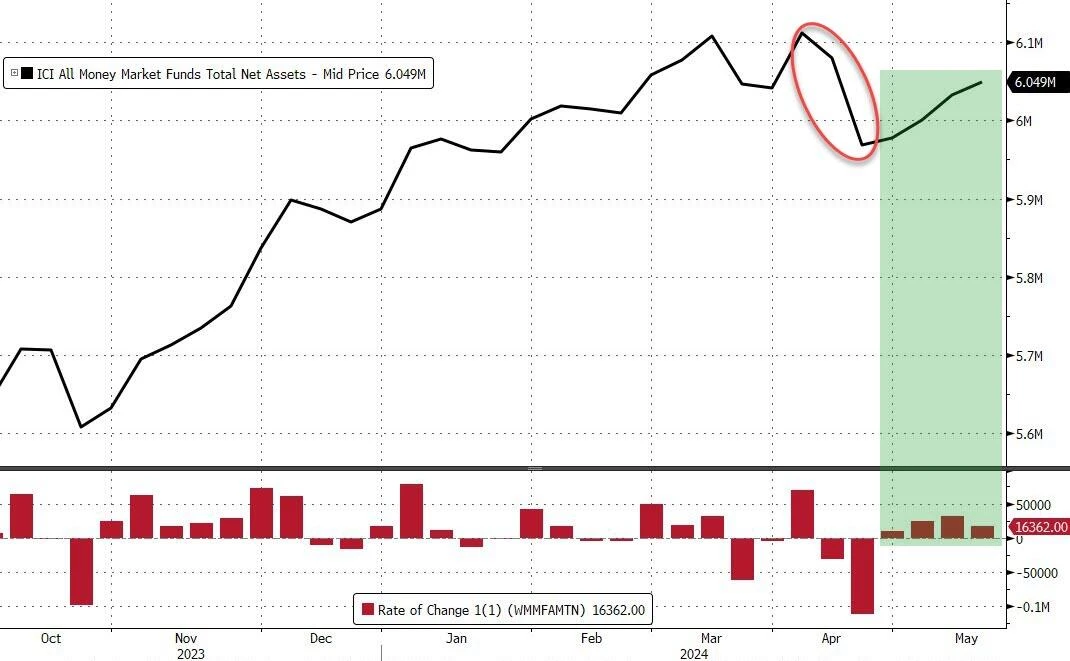

Money market funds saw inflows for the fourth consecutive week (+$16.4 billion), returning to a historical high of over $6 trillion after a seasonal tax-related decline:

There is also ample cash flow globally, with foreign central bank usage of the Fed's reverse repurchase agreements (earning interest on cash) reaching the highest level in a year:

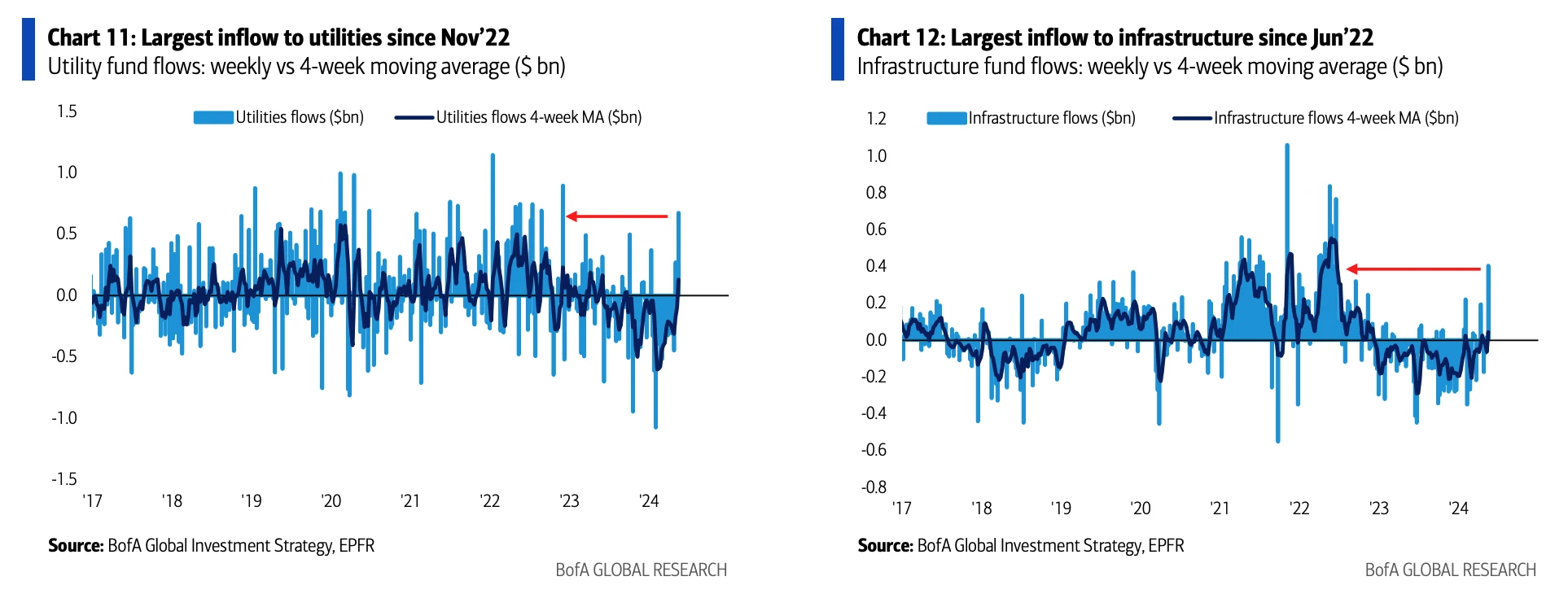

Funds flowing into the Utilities and Infrastructure sectors reached their highest level in over a year:

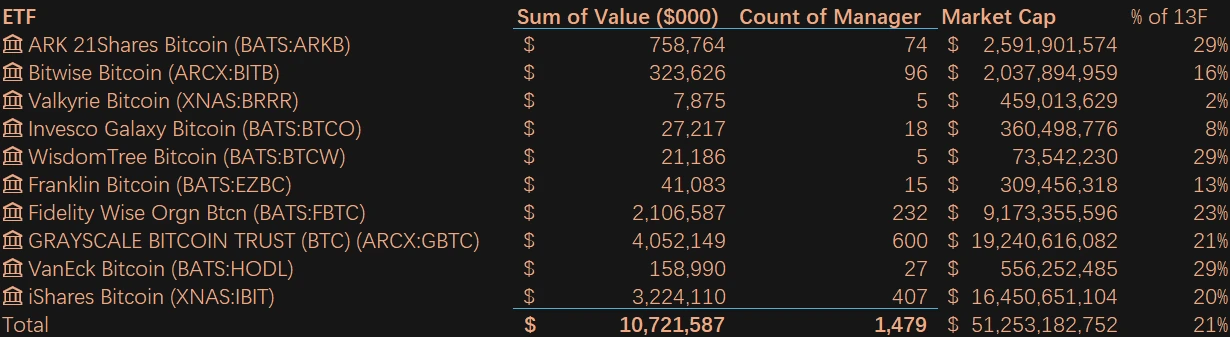

13F Shows Extreme Popularity of Bitcoin ETF in Q1

Nearly 1,500 holding records worth $10.7 billion, accounting for 20% of the total ETF value, were reported, with 929 institutions holding at least one Bitcoin ETF. 44% of companies hold IBIT, and 65% hold Grayscale GBTC (likely previously held shares converted after listing rather than additional holdings), with 99% of institutions located in the US, and Hong Kong companies ranking second.

The largest owner, MILLENNIUM, is valued at $1.9 billion. Bracebridge Capital holds over $400 million, a hedge fund managing endowment funds for Yale University and Princeton University. The Wisconsin Investment Board (mainly public pension funds) reported holding over $160 million in Bitcoin funds. Even the previously critical JPMorgan reported holding a small amount of spot Bitcoin ETF shares.

Bloomberg analysts commented, "Normally, these big institutional fish don't show up in 13F for about a year (when ETFs gain more liquidity), but as we've seen, these are not ordinary good signs, as institutions tend to act collectively."

IBIT also drew attention for breaking the previous record of $10 billion set by traditional ETFs, reaching this threshold in just 49 days. The previous record holder was JPMorgan Nasdaq Stock Premium Income ETF (JEPQ), which took about three years.

Highlights of Big Players' Actions in Q1

Shift in AI investments: While NVIDIA has long dominated the field of artificial intelligence, many investors in the first quarter turned their attention to other companies. For example, Druckenmiller reduced his holdings in NVIDIA, believing it to be overvalued in the short term. At the same time, some investors began to focus on other stocks that are expected to benefit from the AI revolution, such as Apple, Meta platform, and Microsoft.

Focus on Chinese companies: Due to concerns about the slowdown in the Chinese economy, the Chinese stock market has experienced a difficult period. However, some well-known investors saw investment opportunities and increased their holdings in Chinese retail and technology companies. For example, David Tepper significantly increased his holdings in companies such as Alibaba, Baidu, and Pinduoduo. Big short Michael Burry significantly increased his positions in JD.com and Alibaba.

Buffett's secret stock revealed: Berkshire Hathaway has always kept one stock in its portfolio a mystery. In the latest 13-F filing, the mystery was finally revealed, and the stock is the Swiss-registered insurance company Chubb.

CME's Intention to Trade Bitcoin, Coinbase Plummets on News

On Thursday local time, it was reported that the Chicago Mercantile Exchange plans to launch spot Bitcoin trading to meet Wall Street's demand. CME declined to comment on this. After the news broke, the US cryptocurrency exchange Coinbase plummeted by 9.4% in overnight trading. However, CME primarily serves institutions, while Coinbase primarily serves retail investors—Q1 Coinbase retail trading revenue was $935 million, far exceeding institutional revenue of $85 million.

Weekly Focus

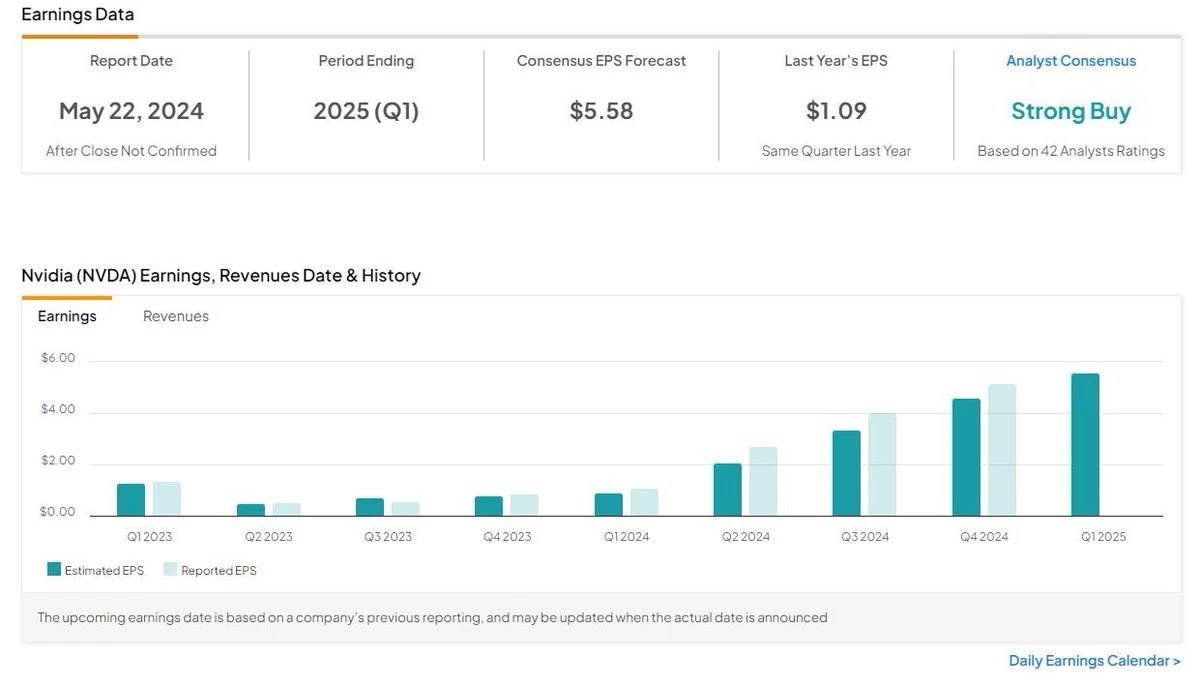

If last week there were still inconsistent views on the signals of inflation, the next major catalyst is the release of NVIDIA's report this week. The consensus expectation is that NVIDIA's revenue for the first quarter of the 2025 fiscal year is expected to reach $24.65 billion, more than double the year-on-year growth. The company's previous revenue guidance was $24 billion, with a 2% fluctuation. The expected net profit for the same period is $12.87 billion, with a year-on-year increase of over 530%.

NVIDIA has exceeded expectations for five consecutive quarters since Q3 2022. It's worth noting that at that time, ChatGPT had not yet appeared, and the real explosion occurred in the spring of 2023, after which NV profits began to skyrocket due to the booming sales of AI GPU chips. One question is that the percentage of exceeding expectations in the last three quarters has gradually decreased, from 2x% to single digits, but this should not be overly concerning, as it is already much stronger than before. Several institutions have raised NVIDIA's new target price range, from $1,100 to $1,350.

The factors driving the upward guidance of NV's performance include announcements from Microsoft, Google, Amazon's AWS, and Meta, showing that this year's capital investment in cloud computing is as high as $177 billion, far exceeding last year's $119 billion, and is expected to continue to increase to $195 billion by 2025. These investments will provide continued growth in NVIDIA's data center revenue and profits, especially in the next generation.

The Blackwell AI chip will be released later this year. The proportion of NV's data center revenue has soared from 50% to 80%, with AI remaining the main driver of growth for NVIDIA.

Analysts' high confidence in NVIDIA's future performance growth potential is mainly based on: first, product supply and market demand. Better supply of the H100 GPU (shorter delivery times) and strong demand for the H200 GPU in China have provided strong support for NVIDIA's performance in the current quarter. The upcoming Blackwell series of GPUs (B100 and B200), expected to be sold from the third quarter and to capture the majority of the market share in the fourth quarter. The average selling price of these two GPUs is expected to be more than 40% higher than existing products, indicating higher revenue potential.

AMD and Intel are catching up with NVIDIA. However, in the GPU market, NV firmly controls about 92% of the market share. As we have analyzed before, NV's barrier is not only the chip itself, but also the software and community ecosystem, which collectively reduce the cost for customers, making it difficult for competitors to surpass in the short term.

In terms of valuation, NV has entered the 2 trillion club, with Apple's revenue being more than 7 times that of NV in the same category, so NV needs to maintain high growth to sustain its stock price. However, in order to invalidate the growth story, several quarters of poor financial performance are needed to possibly change market sentiment and cause a significant decline in stock price. Therefore, even if this financial report disappoints, the market position will not be shaken by one less-than-ideal financial report, and a rebound in the short term is also expected in the absence of alternatives.

Referring to the past few weeks, we have seen tech companies that have disappointed, including ASML, Intel, AMD, SMCI, and ARM. After the lower-than-expected financial reports, their stock prices dropped by varying degrees of 10-30%, but as of now, they have mostly recovered more than half of the decline.

In addition, several senior officials of the Federal Reserve will make appearances and speak this week, including Governors Powell and Waller, as well as regional Fed Presidents Williams and Bostic. The focus is on the stance of the next Fed successor, Waller. Last week, he did not comment on any economic and monetary policy prospects in his speech. The minutes of the previous FOMC meeting will also be released on Thursday.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。