The business model has not undergone major innovation, but the Stacks ecosystem market potential is significant, coupled with investment from Binance Labs, it has a certain level of attention value.

Author: Nan Zhi, Odaily Star Daily

On May 13th, Zest Protocol announced the completion of a $3.5 million seed round of financing, led by Tim Draper, with participation from Binance Labs. It is reported that the protocol utilizes the Bitcoin Layer 2 Stacks' Nakamoto upgrade and cross-chain asset sBTC to provide fully native Bitcoin network lending services. In recent years, Binance Labs' investments in the Bitcoin ecosystem are few, does Zest have unique advantages? Odaily Star Daily will analyze Zest's business in this article.

Zest Analysis

Zest was founded in 2021, released the Zest Protocol prototype in the second quarter of 2023, and completed the audit in the fourth quarter. It will follow Stacks' Nakamoto upgrade to provide native Bitcoin lending services.

Zest Lending Scheme

Existing lending solutions on Stacks largely rely on centralized entities, with the borrower typically being a trusted committee or custodian alliance. The underlying operation is very opaque, and centralized organizations will incur additional costs, making lending activities uneconomical.

The upcoming Nakamoto upgrade on Stacks will address the centralization issue, and Zest Protocol will utilize this upgrade to create native Bitcoin lending services. First, what is the Nakamoto upgrade?

Nakamoto is a milestone update for Stacks, which will shorten the block time to about 5 seconds (consistent with Bitcoin before the upgrade, about 10 minutes or higher). In addition, this upgrade will also introduce sBTC, a secure and efficient wrapped version of Bitcoin that is naturally integrated with the Stacks consensus mechanism. Previously, depositing BTC was equivalent to depositing with a centralized institution, delivering tokens created elsewhere on the network. After the upgrade, sBTC achieves decentralized, trustless two-way anchoring, equivalent to BTC freely crossing between the Bitcoin mainnet and Stacks.

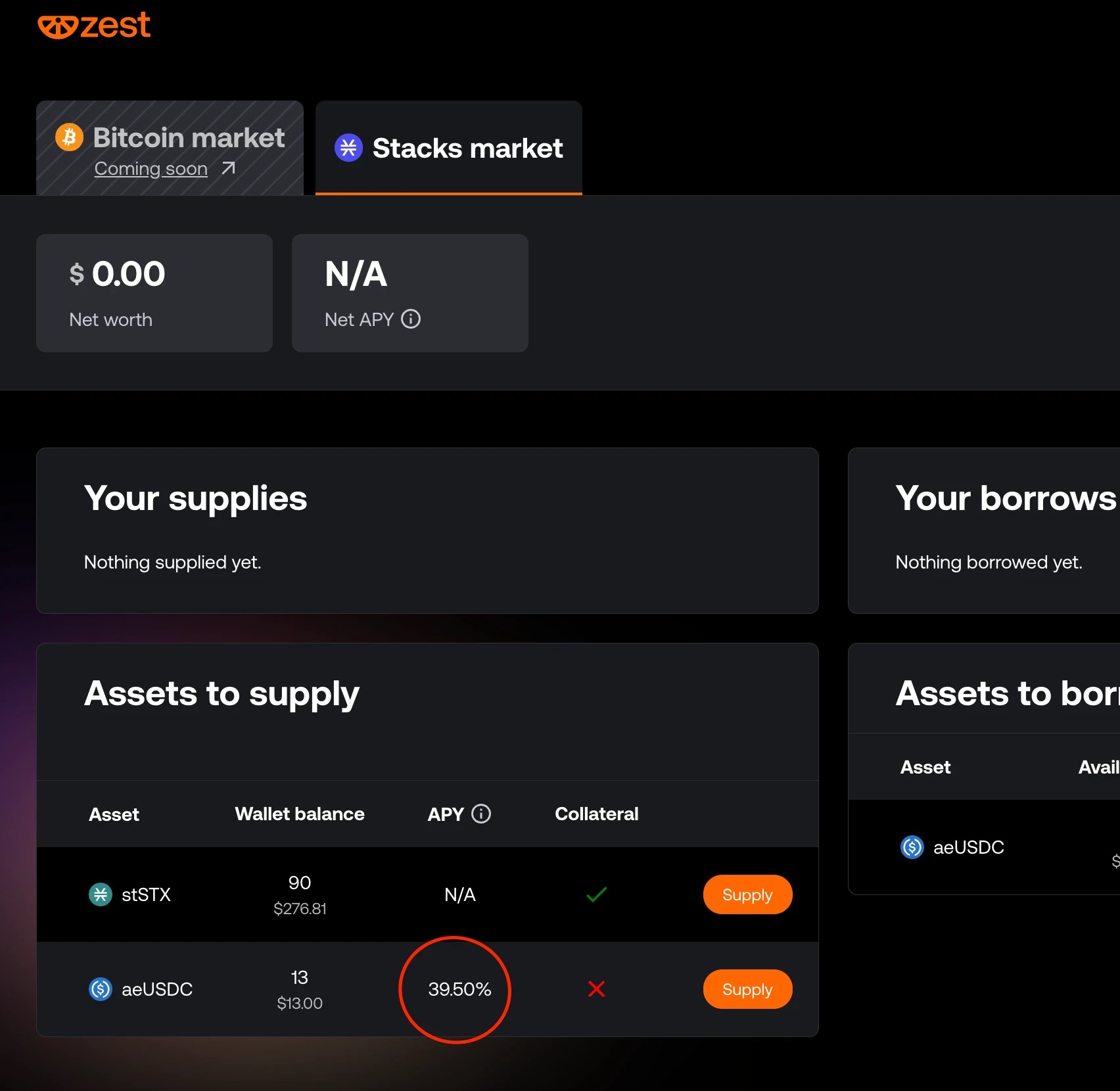

After the upgrade, Stacks gained high BTC liquidity and network performance, and Zest will utilize this liquidity to conduct lending business. Users will obtain sBTC by crossing native Bitcoin and enter Zest's pool to earn profits.

Zest's BTC liquidity pool is divided into two types, lending pool and profit pool. The former is no different from the conventional lending model, using a pool-to-pool lending form, where users conduct lending operations in the corresponding pool and pay or receive corresponding interest.

In the profit (Earn) pool, users only participate as lenders, and Zest introduces a third-party role, the pool delegate, to the profit pool. The pool delegate is a credit expert who initiates and manages the liquidity pool, conducts due diligence, and negotiates terms with borrowers. The pool delegate needs to review the borrower's reputation, expertise, and performance to evaluate loan terms. Once the borrower and the pool delegate agree on the borrower's interest rate and collateral ratio, the pool delegate provides funds for the loan from the managed pool.

The borrowers in the profit pool are limited to institutions, including market makers, exchanges, centralized lending institutions, miners, and enterprises that accept Bitcoin payments. Borrowers need to contact the pool delegate, join the whitelist, deposit assets into a specific loan treasury, and then submit a loan request. Interestingly, the profit pool also supports borrowers to extend the loan, meaning signing a new loan contract to extend the loan when the repayment date is near, only needing to pay the due interest.

Financing Situation

On May 13th, Zest Protocol completed a $3.5 million seed round of financing, led by Tim Draper, with participation from Binance Labs, Trust Machines, Flow Traders, Hyperithm, Bitcoin Frontier Fund, DeSpread, Tykhe Block Ventures, Asymmetric, Primal Capital, Gossamer Capital, Scimitar Capital, and others. This is the only round of financing at present.

As for Binance Labs, its recent investments in the Bitcoin ecosystem include BounceBit on April 11th, Babylon on February 27th, and Lorenzo Protocol at the end of 2022. Its investments in the Bitcoin field have a certain level of scarcity.

He Yi commented on this investment: "Zest Protocol's technology meets the needs of Bitcoin holders and borrowers, unleashing the potential of Bitcoin's programmability and interoperability. At Binance Labs, we have always been looking for industry leaders, and we look forward to seeing the Nakamoto upgrade of Stacks driving the growth of Zest Protocol."

Tycho Onnasch, founder of Zest Protocol, stated: "We aim to redefine Bitcoin lending. We are here to complete the long-standing task of migrating the Bitcoin lending market to the chain, where it rightfully belongs."

Conclusion

Zest's business model is relatively traditional without major innovation, but its binding with the underdeveloped Stacks ecosystem has high attention and significant market potential. Coupled with investment from Binance Labs, it has a certain level of attention value.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。