Author: Shanghai Mancun Law Firm, Lawyer Liu Zhengyao

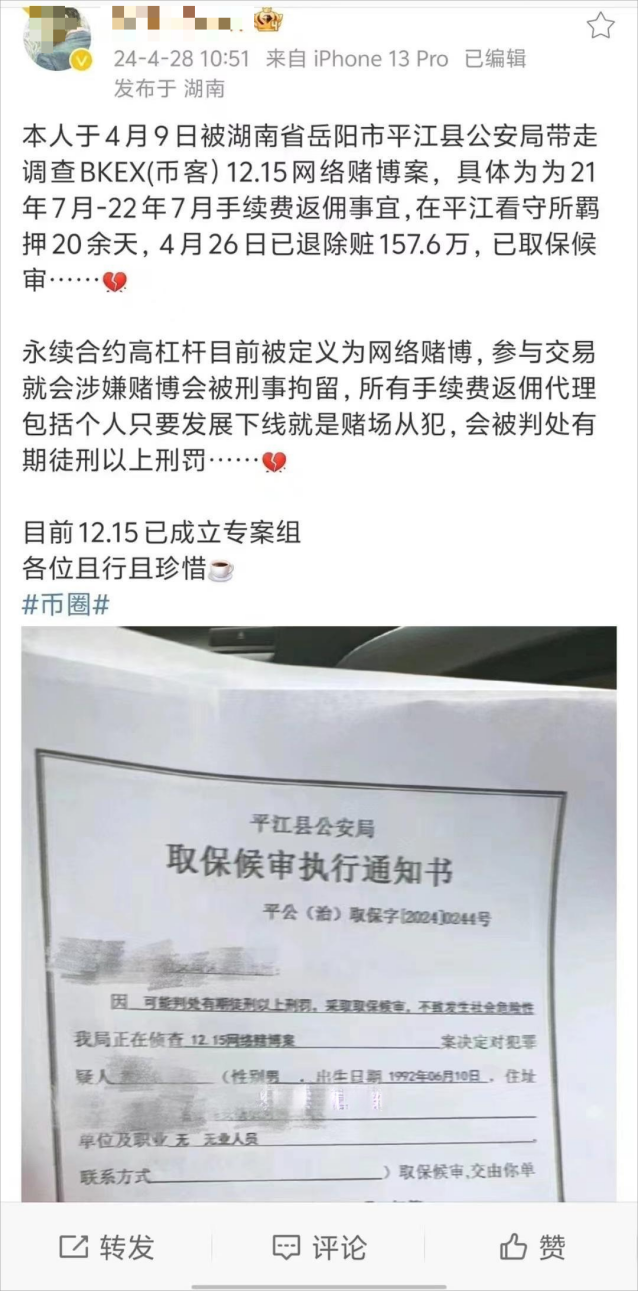

Recently, there has been a blogger (possibly a KOL in the currency circle) on Weibo who claimed that due to suspected involvement in the BKEX (Coin Guest) exchange network gambling case, they are under investigation by the Pingjiang County police in Hunan Province and are currently on bail pending trial.

The blogger warned, "Perpetual contract high leverage is currently defined as online gambling. Participating in trading will be suspected of gambling and will be criminally detained. All commission rebate agents, including individuals, as long as they develop downlines, are accomplices in the gambling and will be sentenced to imprisonment of more than a fixed term…"

In fact, the blogger's statement is not entirely accurate, but it has caused some ripples and has been discussed by some netizens in a few WeChat groups, causing quite a stir. Lawyer Liu will analyze the relationship between playing contracts, leverage trading in virtual currency exchanges, and the crime of gambling from a legal perspective, as well as the likelihood of virtual currency exchanges themselves constituting the crime of operating a gambling establishment.

I. Uncovering the BKEX Exchange

According to publicly available information online, the BKEX exchange was established in June 2018 by individuals such as Ji and Yuan. Since its establishment, especially since 2020, a large amount of negative information can be found online, such as initiating multiple air coin projects, maliciously freezing and deducting customer funds, etc. Lawyer Liu even saw photos of users holding banners for rights protection at the Oriental Hope Tianxiang Plaza in Chengdu High-tech Zone (said to be the actual operating address of BKEX). The authenticity of these contents is unknown, but there has been no official statement from BKEX, and the BKEX official website also shows a DNS error and cannot be opened. According to an article by "Metaverse NEWS" public account on November 5, 2021, after the "9.24 notice," BKEX still openly solicited customers for trading in China, which is indeed a risky operation.

There is also a post on Zhihu (posted on May 31, 2023) claiming that the BKEX exchange was "rounded up" by the police. Of course, as a lawyer, without seeing specific information about BKEX being filed (such as the filing notice issued by the public security organs to the victims, the detention/arrest notice given to the family members, the police incident report by the public security organs, etc.), we cannot guarantee the 100% truth of the above information. However, it can be confirmed that many of BKEX's operations do indeed carry significant criminal legal risks.

II. What is a Perpetual Contract?

The blogger in the screenshot mentioned above claimed that perpetual contracts and high leverage trading have been classified as gambling. To determine the accuracy of this statement, it is necessary to understand what a perpetual contract is (understanding perpetual contracts naturally leads to an understanding of high leverage).

Many of the current practices in the currency circle are derived from traditional securities and futures markets, and perpetual contracts are one of them. Perpetual contracts (Perpetual Futures, or PERP) are a unique investment model in the currency circle, invented by Arthur Hayes, the founder of BitMEX, in 2016. Unlike futures contracts, perpetual contracts have no expiration date (delivery date), which means that as long as you do not liquidate your position due to margin call, you can hold a contract permanently and choose the settlement date freely.

In general, perpetual contracts have the following characteristics: first, they can be long or short, a basic operation shared by both traditional futures contracts and virtual currency contracts; second, high leverage, with virtual currency exchanges being able to offer leverage of over 100 times, which is much more stimulating compared to the maximum 20 times leverage of traditional futures contracts; third, margin mechanisms and funding rates. Friends interested in these two points can explore them on their own, and as a legal practitioner, Lawyer Liu will not delve into the financial field.

Leverage trading differs from contract trading in terms of trading details, such as the source of funds. The funds for leverage trading are borrowed from the platform, and the leverage ratio for leverage trading depends on the amount of funds borrowed by the trader. In addition, the forced liquidation price and trading fees (commission) also differ. However, fundamentally, both contract trading and leverage trading are risk games of "betting small to win big."

III. Is Playing Contracts with Leverage on an Exchange Considered Gambling?

The criminal law articles or judicial interpretations in our country do not provide a detailed explanation of what constitutes gambling. According to academic interpretation, "gambling" refers to the act of using chance to gamble or play games of chance with property (Zhang Mingkai). The requirement for chance means that the outcome of gambling cannot be foreseen in advance, that is, it is a "game of chance."

In practice, not all gambling activities constitute criminal offenses. There are mainly two types of gambling offenses in our country's criminal law: one is organizing gambling activities; the other is engaging in gambling as a profession. According to judicial interpretations, the so-called organizing gambling activities must be: for profit, "organizing gambling activities with 3 or more people, with a total amount of rake exceeding 5,000 yuan; or organizing gambling activities with 3 or more people, with a total amount of gambling funds exceeding 50,000 yuan; or organizing gambling activities with 3 or more people, with a total number of participants exceeding 20," etc. In addition, providing assistance such as funds, computer networks, communications, and payment settlement to others knowing that they are committing gambling crimes constitutes complicity in gambling crimes. If the above conditions are not met, administrative penalties for public security and order may be imposed.

So, does playing contracts on an exchange constitute the crime of gambling?

In fact, whether it's contracts or leverage, as analyzed in the first point of this article, their basic mode is to bet small to win big. However, the crime of gambling in criminal law does not only consider betting small to win big, but also whether its mode conforms to the following closed loop: investment of property—gambling gameplay (randomness of results, speculation, chance)—return of property. According to the guiding case No. 146 of the Supreme People's Court in 2020, in the case of "Chen Qinghao, Chen Shujuan, Zhao Yanhai's operation of a gambling establishment," trading in "binary options" (i.e., only need to buy or sell) in the name of using the price trend of a foreign exchange variety over a period of time outside the statutory futures exchange via the internet to solicit investors, where the profit or loss is determined based on whether the investor buys the rise or fall, and the principal is owned by the website (the house) if the bet is wrong, and the profit or loss is not linked to the actual price fluctuation, is essentially "betting on size," which constitutes a gambling crime.

From this, we can conclude that if contract trading on a virtual currency exchange, even with a high leverage ratio, does not adopt the "binary options" trading model, and the future profit or loss of the contract corresponds to the actual market fluctuation (price movement) of the virtual currency, and is not simply a crude loss or profit, but has functions such as stop-loss and take-profit set by the trader, and the ability to choose to close the position, Lawyer Liu believes it does not constitute the crime of gambling. As for whether it constitutes other crimes such as illegal business operations, see the analysis below.

IV. Does Opening Contracts on a Virtual Currency Exchange Constitute the Crime of Operating a Gambling Establishment?

According to the analysis in the third point of this article, if contract trading on a virtual currency exchange does not constitute the crime of gambling, then naturally it does not constitute the crime of operating a gambling establishment for the virtual currency exchange.

However, it must be mentioned that in practice, there are indeed many exchanges that have been convicted of operating a gambling establishment due to contracts and high leverage trading. There are two possibilities here: one is that the contracts opened by the convicted virtual currency exchange are false contracts, such as the common "needle-insertion" operation in the virtual currency market today (even some so-called top exchanges have done this in the past), exchanges manipulating the market to profit, or the "binary options" gambling model mentioned in the aforementioned case No. 146, which indeed constitutes a crime, and even being convicted of operating a gambling establishment is considered lenient, and some also constitute the crime of fraud (with heavier penalties); the other possibility is that exchanges with contracts that completely conform to the mainstream market practices are mistakenly classified as gambling activities, and as a result, the exchange is mistakenly classified as operating a gambling establishment. This situation is not uncommon either. Due to the lack of understanding of virtual currency and exchange operation models, and even traditional securities and futures knowledge, by some grassroots judicial authorities, they cannot fully understand emerging things, ultimately leading to misclassification.

However, for defense lawyers, Lawyer Liu's advice is that if it is believed that the client's actions do not constitute the crime of operating a gambling establishment, it is best not to rush into a plea of not guilty. It is necessary to consider whether operating a virtual currency exchange and providing contract services would constitute the crime of illegal business operations. This is especially important when operating a virtual currency exchange under the premise of violating regulatory provisions (violating the "9.24 notice") and engaging in virtual currency contract business that is extremely similar to futures contracts. Although virtual currency exchanges are not equivalent to futures exchanges, and virtual currency contracts are not strictly futures contracts, in the judicial context where the application of the crime of illegal business operations is easily expanded, once it is determined to be illegal business operations, the fine is significantly higher than that for operating a gambling establishment. Under the premise of similar main penalties, the crime of illegal business operations is actually disadvantageous to the client.

V. Conclusion

Many of the criminal cases in the currency circle today stem from the state's cautious and strict attitude towards virtual currency, with policy provisions represented by the "9.24 notice," not to mention the independent operation of virtual currency exchanges (both domestically and overseas). For domestic citizens (or other legal entities), even providing marketing, payment settlement, and technical support services for overseas virtual currency exchanges constitutes illegal financial activities and will be held legally responsible.

As a lawyer specializing in providing legal services in the fields of web3, blockchain, and virtual currency, Lawyer Liu has seen too much joy and sorrow in the currency circle. Regarding the contract issues discussed in this article, it is inevitable to end with a clichéd piece of advice: cherish life and stay away from contracts. This is not only for ordinary currency circle players, but also for entrepreneurs in the currency circle, because while players may lose property, entrepreneurs may also lose their freedom.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。