Hong Kong Bitcoin and Ethereum spot ETFs officially approved by regulators.

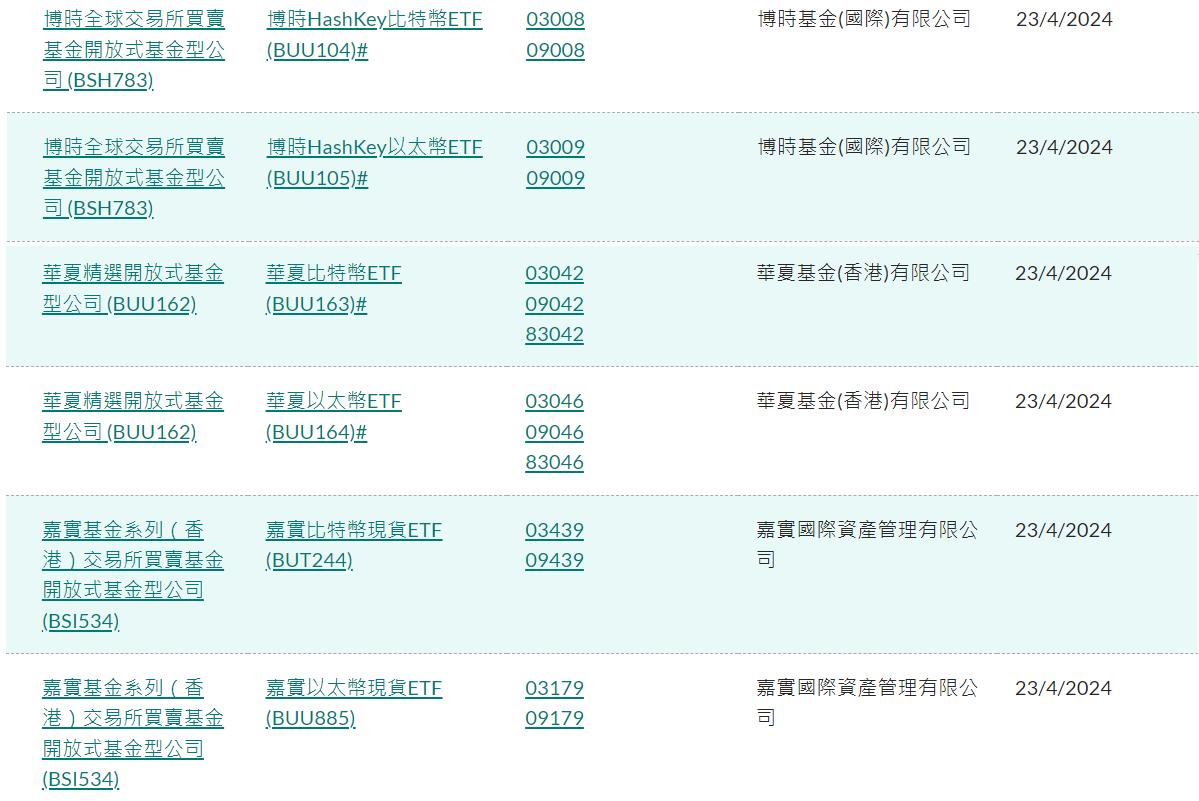

On the evening of April 24th, the Hong Kong Securities and Futures Commission (SFC) officially listed the Bitcoin and Ethereum spot ETFs of Huaxia Fund (Hong Kong), Boshi International, and Jia Shi International on its official website, with the approval date being April 23, 2024. The three institutions also officially announced at the same time that they have obtained the approval of the SFC and are expected to be officially listed on the exchange on April 30.

This is the first time such products have been launched in the Asian market, and these products are designed to provide investment returns closely tied to the spot prices of Bitcoin and Ethereum. Virtual asset spot ETFs reduce the investment threshold and risk. Professional fund management has strict investment processes and risk management mechanisms. ETF products can be traded on mainstream stock exchanges, reducing operational difficulties and risks. In addition, ETF products also provide a physical subscription and redemption mechanism, allowing investors to indirectly hold Bitcoin through holding ETF shares without worrying about the storage and security of Bitcoin.

Currently, these ETF products can be subscribed or redeemed in cash or holdings, but an account related to Hong Kong needs to be opened to carry out the operation. According to Caixin's report, based on a joint letter issued by the Hong Kong Securities and Futures Commission and the Hong Kong Monetary Authority in December 2023, virtual asset futures ETFs currently available in the Hong Kong market, as well as future virtual asset spot ETFs, cannot be sold to retail investors in mainland China and other regions where the sale of virtual asset-related products is prohibited. However, mainland residents holding Hong Kong identity cards can participate in the trading of the above-mentioned ETFs under compliance, even if they are not permanent residents of Hong Kong.

Fierce competition in the management fees of 6 ETFs

Jia Shi International was the first fund to submit a Bitcoin spot ETF in Hong Kong. According to Tencent Finance's "First Line," the Hong Kong Securities and Futures Commission urgently updated the list of virtual asset management funds on April 10, originally planning to approve a total of 4 Bitcoin spot ETFs in the first batch, including Jia Shi International, Huaxia Fund, Boshi Fund, and Hui Li Financial. However, from the current list, there is no sign of Hui Li Financial.

The application process for several fund companies seemed hasty. Some Bitcoin spot ETF applicants, including Huaxia Fund, hastily assembled a team over a month ago and submitted the application in the second week of March. Two weeks later, Huaxia Fund obtained the approval of the Hong Kong Securities and Futures Commission. The plan for submitting Bitcoin spot ETFs in Hong Kong this time involves at least 20 cooperating institutions, including Bitcoin custodians and market makers, as well as institutions holding comprehensive accounts for virtual asset trading.

In terms of supported currencies, the above-mentioned ETFs issued by Boshi International and Jia Shi International each have both Hong Kong dollar and US dollar counters, while the two ETFs issued by Huaxia Fund (Hong Kong) not only have Hong Kong dollar and US dollar counters but also added a Renminbi counter, simultaneously issuing in three currency counters.

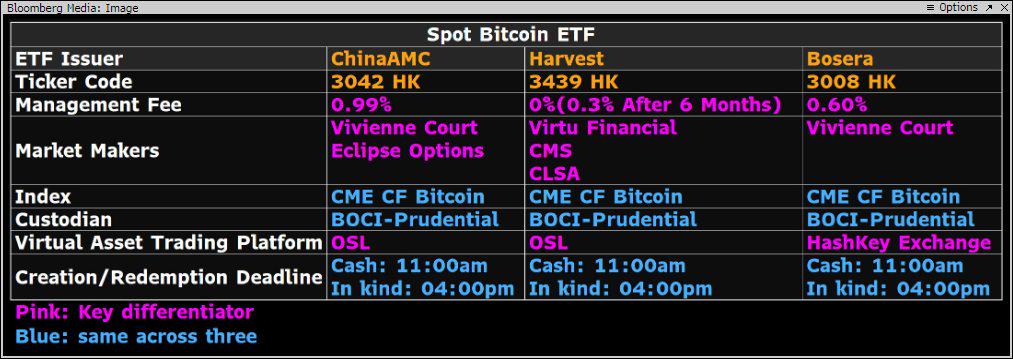

Similar to the fee price war when the Bitcoin spot ETF was launched in the United States, the competition in management fees among these three fund companies in Hong Kong is also fierce. Jia Shi International's product offers a management fee waiver within 6 months, and Boshi International's product offers a management fee waiver within 4 months after issuance. According to Bloomberg analyst Eric Balchunas, the management fees of the three funds are 30 basis points (Jia Shi International), 60 basis points (Boshi International), and 99 basis points (Huaxia Fund), averaging lower than expected. Previously, it was expected that the fees for these ETFs might be between 1-2%. ETF analyst James Seyffart stated that Hong Kong may see a potential fee war due to the launch of these Bitcoin and Ethereum ETFs.

Currently, the fees for the 11 approved Bitcoin ETFs in the United States range from 0.19% to 1.5%. Fidelity's Wise Origin Bitcoin Trust (FBTC) has a fee rate of 0.25%, with fee waivers until July 31, 2024. BlackRock's iShares Bitcoin Trust also has a fee rate of 0.25%, with 0.12% for the first 12 months (or until assets reach $5 billion). ARK's 21Shares Bitcoin ETF (ARKB) has a fee rate of 0.21%, with 0% for the first six months (or until assets reach $1 billion). Grayscale's Grayscale Bitcoin Trust (GBTC) has the highest fee rate at 1.5%.

The approval of the Hong Kong Bitcoin spot ETFs comes about three months after the U.S. Securities and Exchange Commission approved the first batch of U.S. Bitcoin spot ETFs on January 11. According to Bloomberg's data, the Bitcoin ETFs in the United States have accumulated $56 billion in assets so far.

Physical subscription and redemption ETFs will open up a compliant "cash out" channel

In Hong Kong, the issuance of virtual asset spot ETFs can be traded using either the cash model or the in-kind model. For cash subscription and redemption, the fund must obtain virtual assets on a licensed exchange in Hong Kong, either through on-exchange or off-exchange trading. For physical subscription and redemption, virtual assets need to be transferred into or out of the fund's custody account through a securities firm.

Different from the model of the U.S. Securities and Exchange Commission, which only allows cash redemption for spot Bitcoin ETFs to reduce the number of intermediaries and increase controllability, allowing physical subscription and redemption means that customers can buy or sell ETF shares using relevant cryptocurrencies instead of using U.S. dollars.

Analysts pointed out that physical subscription and redemption ETFs will open up a compliant "cash out" channel for Bitcoin and Ethereum. Especially for institutions and high-net-worth investors, converting Bitcoin into ETFs with a fixed proportion can effectively avoid potential card freezing issues when "cashing out" through exchanges; it can also reduce the security risks of wallet and private key management, further protecting their asset security.

Previously, the discussion about the attractive fund size of the Hong Kong Bitcoin and Ethereum spot ETFs had sparked heated debates. On April 15, Bloomberg's senior ETF analyst Eric Balchunas stated on X platform, "We believe that if they (ETF issuers) can attract $500 million in funds, they would be very lucky. The reasons are as follows: 1. The size of the Hong Kong ETF market is very small, only $50 billion, and residents of mainland China cannot purchase these ETFs through official channels. 2. The approved three issuing institutions (Boshi Fund, Huaxia Fund, Jia Shi Fund) are all relatively small in scale. There are currently no large institutions like BlackRock participating. 3. Hong Kong's basic ecosystem has insufficient liquidity and low efficiency, so these ETFs may see larger spreads and premium discounts. 4. The fees for these ETFs may be between 1-2%. This is far from the extremely low fees in the United States."

Nevertheless, the approval of the Hong Kong Bitcoin ETFs "may be an important market opportunity," as Bloomberg ETF analyst Eric Balchunas stated in another research note, "This opportunity may significantly increase the region's assets under management (AUM) and the trading volume of Bitcoin ETFs."

Herbert Sim, Chief Operating Officer of the cryptocurrency exchange Websea, previously expressed to the public that the approval of the first spot Bitcoin ETF in Hong Kong will increase the demand and inflow of funds for large U.S. ETF issuers such as BlackRock, and he expects this situation to continue. He stated, "With the reduced supply of Bitcoin due to the halving, the price will definitely soar."

According to a post by cryptocurrency commentator Bitcoin Mang on April 12, before the approval, large investors or whales holding at least 10,000 BTC were accumulating Bitcoin at the current price level in anticipation of the approval of the Hong Kong virtual asset ETFs. "The group accumulating Bitcoin is the largest whales (>10k). If I have to guess, this is a positive contrarian signal."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。