1. Introduction

With the surge of cryptocurrencies such as BTC, blockchain mining has gradually entered the public's view, attracting a lot of attention from investors and technology enthusiasts. Mining, as an important way to obtain digital currency, has made mining machines a hot topic. However, despite the widespread discussion of mining machines, many people still lack a deep understanding of how mining machines work and whether they are profitable. This report aims to provide a comprehensive analysis of the mining machine market, from the definition and classification of mining machines to the development history of mining machines, as well as an introduction and comparison of mainstream mining machines currently available in the market, to provide reference for individuals or enterprises intending to enter the mining field.

2. Overview of Mining Machines

2.1 What is a Mining Machine

Simply put, a mining machine is specialized computer hardware used to earn cryptocurrencies. By running corresponding mining software, they use computing power to verify transaction information and create new blocks, producing new cryptocurrencies as rewards in the process. From a macro perspective, any device capable of running mining programs can be called a mining machine, including but not limited to professional mining machines, home computers, and smartphones. From a micro perspective, mining machines specifically refer to high-performance devices designed for mining, such as ASIC mining machines, GPU mining machines, etc.

2.2 Classification and Comparison of Mining Machines

- ASIC Mining Machines: Specifically designed for certain algorithms, such as Bitcoin's SHA-256, Litecoin's Scrypt, Dash's X11, etc., they have very high efficiency and computing power but lack flexibility.

- GPU Mining Machines: Suitable for multiple algorithms and currencies, such as Ethereum's Ethash, Zcash's Equihash, providing good adaptability and versatility, but may not be as efficient as ASIC on a single algorithm.

- CPU Mining: Although most mainstream currencies are difficult to mine with CPUs to obtain significant returns, there are still projects like Monero that emphasize CPU mining friendliness.

- Hard Drive Mining: Represents an energy-efficient mining method, mainly used for projects like Filecoin and Chia, participating in network maintenance by providing storage space.

- LoRaWAN Gateways: The Helium network "mines" by deploying IoT devices, which consumes almost negligible resources, but relies more on network layout and coverage.

Comparison of Cryptocurrency Mining Machine Types and Performance

| Cryptocurrency | Mining Machine Type | Characteristics | Computing Power Reference | Energy Efficiency Reference | Main Manufacturers | |-----------------|---------------------|-----------------|---------------------------|-----------------------------|--------------------| | BTC | ASIC | Specialized and efficient, optimized for SHA-256 algorithm | ~110TH/s | ~3250W | Bitmain, Canaan | | ETH | GPU | Strong versatility, supports multiple currencies | ~100MH/s | ~320W | Nvidia, AMD | | ZEC (Zcash) | GPU/ASIC | Privacy-focused cryptocurrency, Equihash algorithm | ~700 Sol/s (GTX 1080 Ti) | ~250W (GPU baseline) | Nvidia, Bitmain | | DASH | ASIC | Privacy and speed-focused cryptocurrency, X11 algorithm | ~19.5GH/s | ~1350W | Innosilicon | | LTC (Litecoin) | ASIC | Uses Scrypt algorithm, aimed at lowering the barrier to Bitcoin mining | ~580MH/s | ~1500W | Bitmain | | DOGE (Dogecoin) | ASIC | Initially created as a joke, now widely recognized, also uses Scrypt algorithm | ~10GH/s | Depends on specific model | Multiple manufacturers | | FIL | Hard Drive (Storage Space Mining) | Low energy consumption, depends on available storage space | Depends on hard drive capacity | Low | Western Digital, Seagate | | XCH | Hard Drive (Proof of Space and Time) | Environmentally friendly, uses unused hard drive space | Depends on hard drive capacity | Low | Western Digital, Seagate | | HNT | LoRaWAN Gateway | Builds wireless network, extremely low power consumption | N/A | Extremely low | Helium official, third-party | | Monero (XMR) | CPU/GPU | Emphasizes privacy protection, uses RandomX algorithm, more friendly to CPU mining | ~1KH/s (Ryzen 7 CPU) | ~65W (CPU baseline) | Multiple manufacturers |

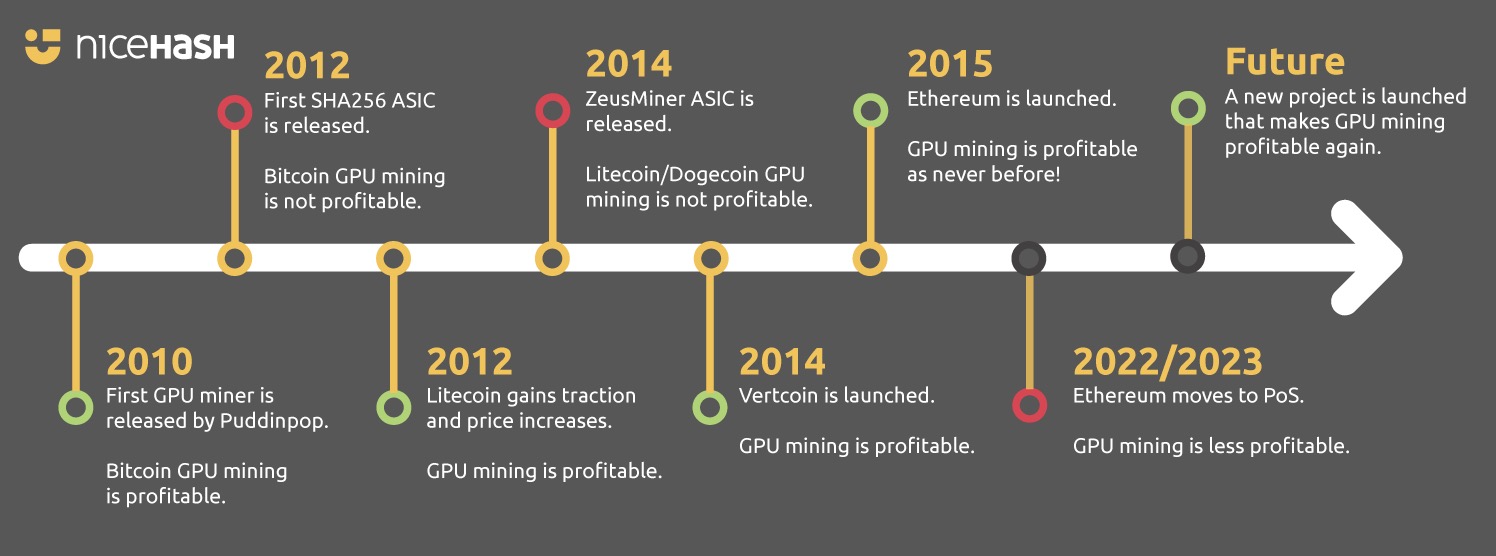

3. Mining Industry Development History and Its Impact

3.1 Development History

CPU Mining (2009)

- Characteristics: Mining using the central processing unit (CPU) of ordinary personal computers.

- Limitations: Inefficient and high energy consumption.

GPU Mining (2010-2012)

- Characteristics: Graphics processing units (GPU) have a significant advantage in parallel processing compared to CPUs, greatly improving mining efficiency.

- Data: For example, the early AMD Radeon HD 5870 could achieve a hash rate of about 400 MH/s.

FPGA Mining (2011-2012)

- Characteristics: Field-programmable gate arrays (FPGA) provided better power efficiency but required users to configure and program them themselves.

- Transition: Although there was some improvement in efficiency, the complex configuration requirements limited its popularity.

ASIC Mining (2013-Present)

- Characteristics: Application-specific integrated circuit (ASIC) mining machines are specifically designed for mining, providing unprecedented efficiency and speed.

- Data: The early ASIC mining machines had hash rates ranging from a few GH/s to TH/s, while current leading ASIC mining machines such as Bitmain's Antminer S19 series can achieve over 95TH/s, with significantly improved energy efficiency.

3.2 Market Impact Analysis

In the development history of cryptocurrency mining, several key events have significantly impacted the mining machine market, and the mining machine frenzy has also affected the price fluctuations of digital currencies to varying degrees.

Impact of Key Events

- Introduction of Bitcoin ASIC Mining Machines (2013):

- Impact: The introduction of ASIC mining machines greatly increased the total computing power of the Bitcoin network, making CPU and GPU mining uneconomical. During this period, the difficulty level of Bitcoin quickly rose.

- Data: In early 2013, the price of Bitcoin rose from about $13 to over $1000 by the end of the year. Although the price was influenced by multiple factors, the introduction of ASIC mining machines was considered to have increased market participants and promoted price increases.

- Ethereum Network Congestion and GPU Shortage (2017, 2021):

- Impact: Due to the explosive growth of DeFi and NFT projects, the Ethereum network's transaction volume surged, leading to an increase in gas fees. At the same time, mining demand caused a global shortage of GPUs, leading to price spikes.

- Data: In 2021, the retail prices of some high-end GPUs were 2 to 3 times higher than the suggested retail price. The price of Ethereum rose from about $730 in early 2021 to over $4000 by mid-year.

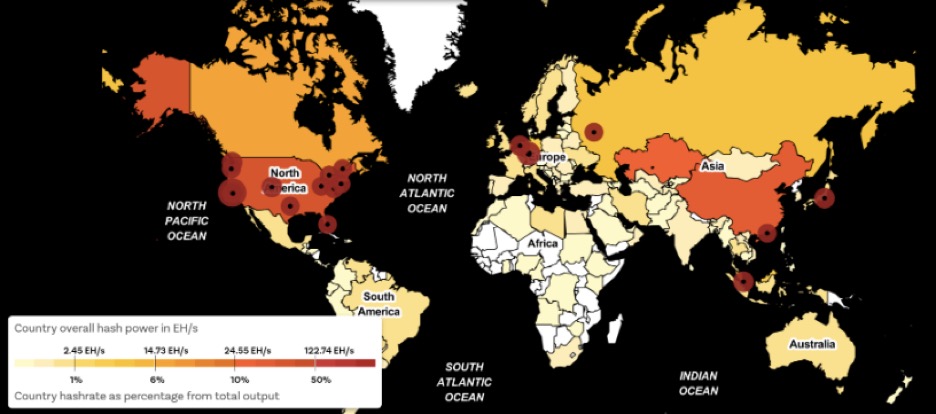

- China's Crackdown on Cryptocurrency Mining Activities (2021):

- Impact: The Chinese government has imposed strict restrictions on cryptocurrency mining and trading, leading to a significant redistribution of global computing power. Many mining farms have moved overseas, such as to the United States and Kazakhstan.

- Data: This event directly led to a decrease of about 40% in the total network computing power of Bitcoin in a short period of time. The price of Bitcoin also experienced a brief and significant fluctuation, dropping from a high point of about $64,000 in May to around $30,000 in July.

Impact of Mining Machine Frenzy on Cryptocurrency Prices

Increased Mining Profitability is Positively Correlated with Cryptocurrency Prices: When cryptocurrency prices rise, more people enter mining, driving an increase in mining machine demand, further exacerbating the frenzy for hardware devices (especially GPUs and dedicated ASIC mining machines). For example, during the bull markets of Bitcoin and Ethereum in 2017 and 2021, mining machine and GPU prices soared, and even shortages occurred.

Changes in New Technologies and Algorithms May Affect Prices: Whenever a new generation of more efficient mining machines is launched, the competitiveness of old mining machines decreases, leading some miners to exit the market. The high efficiency of new mining machines attracts more investors to participate in mining, and this supply-demand change may indirectly affect cryptocurrency prices.

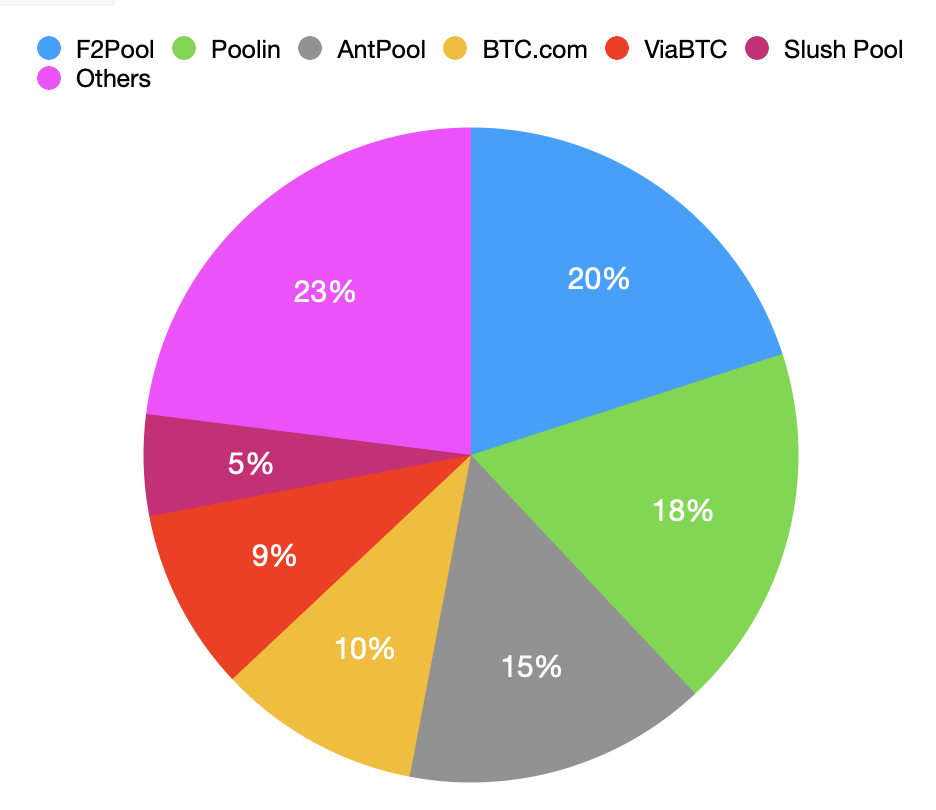

4. Distribution of Mining Pool Computing Power

Mining pools are an important part of cryptocurrency mining, allowing miners to combine their computing resources to increase the chances of finding blocks and distribute rewards based on the proportion of contributed computing power. Over time, the distribution of mining pool computing power has been constantly changing, reflecting market competition and technological progress. Here are the computing power distributions of some mainstream mining pools and other notable pools:

Mining Pool Name

Percentage of Computing Power (%)

Location

F2Pool

20

China

Poolin

18

China

AntPool

15

China

10

China

ViaBTC

9

China

Slush Pool

5

Czech Republic

Others

23

Multiple regions

Distribution of Computing Power in Major Mining Pools (Using Bitcoin as an Example)

- F2Pool: Founded in 2013, it is one of the earliest Bitcoin mining pools in the world and is currently the largest single Bitcoin mining pool.

- Poolin: Founded in 2017 by key members from BTC.com, it competes fiercely with F2Pool.

- AntPool: Operated by Bitmain, it is an established mining pool serving miners globally.

Other Notable Mining Pools

- BTC.com: This mining pool has historically been one of the leaders in computing power, but its market share has declined in recent years.

- ViaBTC: Founded in 2016, it offers mining services for multiple cryptocurrencies, including Bitcoin, Bitcoin Cash, and Litecoin.

- Slush Pool: Established in 2010, it is the world's first Bitcoin mining pool. Although it may not have as much computing power as the aforementioned large pools, it is widely respected for its long history and contributions to the community.

Interpretation:

Pool Concentration: Through the data table and pie chart, we can clearly see that the top few pools (such as F2Pool, Poolin, AntPool) occupy a large share of the market. This indicates a high concentration of computing power in the top mining pools in the Bitcoin mining field.

Geographical Distribution: The table also provides information on the location of the mining pools, reflecting the dominant position of certain countries or regions in the Bitcoin mining industry. It also indirectly reflects the impact of factors such as policies and electricity prices on the distribution of mining pools.

Diversity and Decentralization: Although the top few mining pools occupy a large proportion, the "Others" category with 23% share shows a certain degree of diversity in the market. This is beneficial for maintaining network decentralization and security.

5. Evolution of Mining Machines to Date

Physical Mining Machine Rental and Sales

- Sales: Manufacturers sell directly to consumers or through distribution channels. With the rise of mining frenzy, the demand for high-performance mining machines is increasing.

- Leasing: Individuals or enterprises can lease mining machines for a period of time, reducing the entry threshold. Leasing services provide flexibility, allowing users who do not have enough capital to purchase mining machines to participate in mining.

Cloud Mining Services

- Purchasing Computing Power: Users can purchase computing power provided by cloud mining platforms without directly buying and managing physical mining machines. This reduces the complexity of mining and direct investment.

- Computing Power Leasing: Similar to purchasing computing power, but usually exists in shorter-term contracts, providing users with greater flexibility and lower entry thresholds.

Mining Machine Hosting Services

- Hosting Operation: Mining machine owners host their machines in professional mining farms, where the machines are maintained and monitored by professional teams. This relieves individual miners of the burden of equipment management and optimization.

- Facility Leasing: Provided to users who want to control their own machines but do not want to handle hardware setup and maintenance issues themselves, they can lease the location and facilities of professional mining farms.

Other Mining Industry Services

- Maintenance and Optimization: With the popularity of mining machines, companies providing mining machine repair, upgrade, and optimization services have emerged to help miners maintain their equipment in optimal condition.

- Consulting Services: Providing industry knowledge, investment advice, and risk assessment services for newcomers. These services aim to help clients make informed investment decisions.

- Software Solutions: Developing specialized mining software to improve mining machine efficiency, optimize computing power configuration, and provide data analysis, monitoring, and management functions.

Importance of the Ecosystem

Building a healthy ecosystem for the mining machine industry chain is crucial for the entire cryptocurrency mining industry. It not only enables participants to more effectively access resources and services but also promotes technological innovation, enhancing the overall competitiveness of the industry. At the same time, with the fluctuations in the cryptocurrency market, these services provide the necessary flexibility and adaptability, helping miners and investors maximize profits and reduce risks.

6. Comparison of Mainstream Mining Machine Companies in the Market

Company

Founded

Country

Advantage

Products

Market Positioning

Race Track Layout

Bitmain

2013

Beijing, China

High-performance ASIC mining machine manufacturing

Antminer series

Leader in cryptocurrency mining hardware

Mining machine manufacturing + mining pool operation + AI

Canaan Creative

2013

Hangzhou, China

Innovative ASIC technology

AvalonMiner series

Blockchain hardware and computing solutions

Mining machine + blockchain technology application exploration

NVDIA

1993

California, USA

Leading GPU technology

GeForce series

Graphics processing and high-performance computing

GPU mining + multi-domain technology applications

AMD

1969

California, USA

Advantage in CPU and GPU

Radeon GPU, Ryzen CPU

Diversified computing solutions

GPU mining + gaming/server market

MicroBT

2016

Shenzhen, China

Efficient ASIC mining machine design

WhatsMiner series

Competitor in the cryptocurrency mining machine field

Mining machine production + driving technological progress

Innosilicon

2006

Shenzhen, China

ASIC Design and Manufacturing

Multiple cryptocurrency mining machines

Provider of cryptocurrency mining solutions

Manufacturing of multi-currency mining machines + electronic/storage layout

Ebang International

2010

Hangzhou, China

Transitioned to cryptocurrency hardware manufacturing

Ebit mining machine series

Cryptocurrency hardware and technology services

Mining machine manufacturing + exchange platform development

Core Advantages and Main Products: The core advantages of each company are reflected in their flagship products. For example, Bitmain's Antminer series and Canaan Creative's AvalonMiner series are both known for high-performance ASIC mining machines. NVIDIA and AMD, on the other hand, hold important positions in the gaming and professional markets in addition to cryptocurrency mining, thanks to their GPU products.

Market Positioning: Bitmain, Canaan Creative, MicroBT, and Ebang focus more on cryptocurrency mining hardware, while NVIDIA and AMD play a role in a broader high-performance computing field, with cryptocurrency mining being just one of the application scenarios.

Blockchain Track Layout: Although these companies have different main businesses, they are all seeking deeper development and application of blockchain technology. Bitmain and Canaan Creative are focusing on the broader expansion of blockchain technology, such as AI and global high-performance computing solutions, while NVIDIA and AMD support diverse applications of blockchain technology through their GPU technology.

7. Leaders in the Mining Market

Company

Country

Service

Advantages

Positioning

Partners / Projects

Key Data

Cipher Mining

USA

Bitcoin mining data center operation

Efficient data center management

Leader in Bitcoin mining field

N/A

N/A

Bitfury

(2011)

Netherlands

High-performance mining machine manufacturing, mining data center operation

Global leader in blockchain technology

Innovator in blockchain technology and cryptocurrency mining

Hut 8 Mining Corp

Data centers distributed in North America and Europe

Hut 8 Mining Corp (2017)

Canada

Blockchain infrastructure and Bitcoin mining

Environmentally friendly mining solutions

Sustainable digital asset mining and blockchain technology company

Bitfury

Operates over 100MW of green energy data centers

Core Scientific

USA

Digital asset mining and blockchain technology service provider

Blockchain innovation combined with AI technology

Major player in North American digital asset mining operations

Horizon Kinetics

Has over 300MW of mining capacity

Marathon Patent Group (2010)

USA

Digital asset technology company, focused on mining operations

Large-scale operation in the cryptocurrency mining field

Technology company focused on Bitcoin mining

DMG Blockchain Solutions

Increases Bitcoin mining hash rate

Riot Blockchain, Inc. (2000)

USA

Mining business and blockchain technology investment and development

Owns large-scale high-performance mining facilities

Pioneer in blockchain applications and cryptocurrency mining

Whinstone US, Inc.

Planning a 1.4GW mining facility

Genesis Mining (2013)

Hong Kong

Cloud mining services

Provides various cryptocurrency cloud mining services

Leader in the cloud mining industry

Hive Blockchain Technologies

Over 2 million global users

Hive Blockchain Technologies (2017)

Canada

Blockchain technology company, involved in cryptocurrency mining

Mining using green energy sources

Creating new value through blockchain technology

Genesis Mining

Operates ETH and BTC mining farms

Conclusion and Analysis:

Positioning of Market Leaders: Most of the listed companies have become leaders in the blockchain and cryptocurrency mining field due to their specific technological advantages and market positioning. For example, Bitfury and Core Scientific represent innovation and specialization in blockchain technology and data center operations.

Importance of Environmental Sustainability: Companies like Hut 8 Mining Corp and Hive Blockchain Technologies emphasize mining using green energy, showing an increasing focus on environmental sustainability in the market. This also reflects the growing trend of environmental pressure and enhanced sense of social responsibility in the cryptocurrency mining industry.

Trend of Collaboration and Mergers: With the industry's development, many companies are expanding their business scope and market share through collaboration or mergers with other enterprises, such as the acquisition of Whinstone US, Inc. by Riot Blockchain, Inc. This signifies the expansion of the industry scale and increased concentration.

Rise of Cloud Mining Services: Companies like Genesis Mining that provide cloud mining services are becoming increasingly popular, offering a low-threshold entry into the cryptocurrency mining field for individuals and small investors. This reflects the growing demand in the market for more flexible mining solutions that do not require hardware configuration.

Technological Innovation and Efficiency Improvement: All companies are seeking to improve mining efficiency and reduce operational costs through technological innovation, reflecting the increasingly competitive nature of the cryptocurrency mining field and the trend of constantly pursuing high-performance technological solutions.

8. Challenges, Risks, and Opportunities

As the cryptocurrency mining industry continues to develop, miners and investors face various challenges and risks, as well as opportunities:

Electricity Costs: Electricity expenses are one of the major operational costs for mining. Regions with low electricity prices provide a significant cost advantage to mining farms.

Regulatory Risks: Cryptocurrency mining is subject to strict regulation by various countries, especially concerning issues related to power consumption and environmental impact, which may lead to the relocation or closure of mining farms.

Technological Advancements: Mining machine technology continues to advance, and new generations of machines can quickly render old equipment obsolete. Investors need to constantly update their equipment to remain competitive.

Market Volatility: The fluctuation of cryptocurrency prices directly affects mining profits, and high volatility increases investment risks.

9. Future Development Predictions for Mining

Shift to Clean Energy: With increasing concern for environmental issues, mining farms using renewable energy sources will become a trend.

Technological Innovation: ASIC and GPU technologies will continue to advance, potentially leading to more efficient and energy-saving mining equipment in the future.

Changes in Consensus Mechanisms: With the increasing popularity of consensus mechanisms like POS, the traditional POW mining method may gradually decrease, which will have a profound impact on the mining machine market.

Diversification of Services: In addition to hardware sales, mining machine companies may provide more one-stop services, including hosting and cloud mining.

10. Investor Perspective (Volcano X Capital)

Early Investment Returns

Volcano X Capital has always had a strong interest in the mining industry and made early investments in the field. With keen market insights and professional industry analysis, it has achieved good investment returns. These successful cases demonstrate Volcano X's forward-looking investment perspective and effective risk management strategies in the mining field.

Mining Machine Market Analysis and Forward-looking Description

As the cryptocurrency market matures, especially with mainstream digital currencies like Bitcoin gaining increasing recognition from global investors, the mining machine market has also shown significant growth. Volcano X has conducted in-depth analysis and research on the mining machine market, focusing on the trend of technological advancement from ASIC mining machines to the development of cloud mining services. From the continuous improvement of mining hardware performance to the optimization of mining efficiency, and the improvement of the mining ecosystem, all these factors together are driving the advancement of the mining industry.

In the future, with the further expansion of blockchain technology applications and the improvement of the cryptocurrency system, mining machines and related mining products will continue to benefit from the overall industry growth. In addition, as more countries and regions legalize digital currencies and establish regulatory frameworks, the market is expected to attract a wider range of participants and larger-scale investments.

Future Development Prospects of Mining Products

In the current bull market, the significant increase in Bitcoin prices has brought about a new wave of enthusiasm for the mining industry. The high Bitcoin prices mean that mining activities can bring higher economic returns, attracting more investors and miners to enter the market, increasing the demand for mining machines and related mining services.

Volcano X Fund believes that despite facing multiple challenges such as electricity costs, environmental impact, and policy regulation, the mining market will continue to maintain its momentum of sustained growth through technological innovation and market mechanism adjustments. In particular, technological advancements in energy efficiency and environmental impact reduction will be key factors supporting the future development of mining products.

In summary, Volcano X Fund is optimistic about the important role of mining products and services in the future development trend of digital currencies. It will continue to leverage its deep knowledge and resources in the industry to explore new investment opportunities for long-term capital appreciation. At the same time, the fund will closely monitor industry dynamics and policy changes, adjust its strategies flexibly, and maximize the capture of market opportunities while managing investment risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。