Original Title: Restaking: Everything Old is New Again

Original Author: David Han

Original Translation: Ladyfinger, Blockbeats

Editor's Note:

Ethereum's Restaking protocol and LRT are becoming hot topics in the cryptocurrency field. With the PoS consensus mechanism and a security fund of nearly $112 billion, the concept of restaking provides a new way to contribute to network security while earning additional rewards. The successful launch of Eigen Layer and its rapid rise to become the second largest DeFi protocol further demonstrates the potential and attractiveness of the restaking concept and technology.

The restaking protocol allows validators to restake their already staked Ether to protect new Active Validation Services (AVS), providing not only an additional income channel for validators but also bringing new security and financial incentives to the entire Ethereum ecosystem. However, as LRT develops and the complexity of the restaking mechanism increases, new risks emerge. These risks not only involve security and financial stability but also potential impacts on the future stability of the Ethereum consensus protocol.

Preface

The PoS consensus mechanism represents the largest economic security fund in the cryptocurrency world, totaling nearly $112 billion. However, protecting the network's validators has not been reduced to only earning basic rewards on locked ETH. For a long time, Liquid Staking Tokens (LST) have been a way for participants to bring their ETH and consensus layer earnings into the DeFi space—either by trading or re-staking in other transactions. Now, the emergence of restaking in the form of liquid restaking tokens introduces another layer.

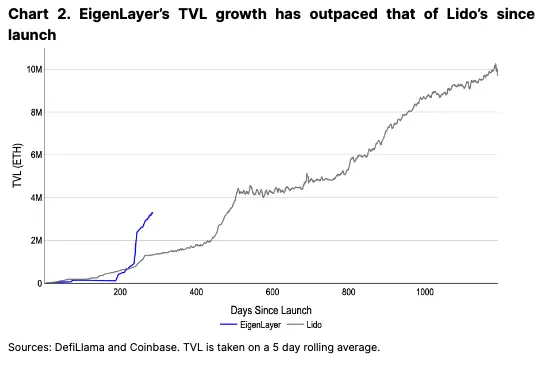

Eigen Layer's relatively mature staking infrastructure and excessive security budget have allowed it to grow to a total value locked (TVL) of $12.4 billion, making it the second largest DeFi protocol in the ecosystem. Eigen Layer enables validators to earn additional rewards by reusing their held ETH for Active Validation Services (AVS). As a result, intermediaries in the form of liquid restaking protocols have become more common, driving the spread of light rail.

That being said, from a security and financial perspective, restaking and light rail may bring additional risks compared to existing staking products. As the number of AVSs increases and light rail differentiates its operator strategies, these risks may become increasingly opaque. Nevertheless, restaking rewards are laying the foundation for a new class of DeFi protocols. If such proposals are implemented, separate discussions about reducing staking issuance to the Minimum Viable Issuance (MVI) could further enhance the relative importance of long-term staking yields. Therefore, heightened attention to restaking opportunities is becoming one of the biggest crypto themes this year.

Ethereum Restaking Infrastructure

Eigen Layer's restaking protocol went live on the Ethereum mainnet in June 2023, with AVSs set to be introduced in the next phase of its multi-stage rollout (2Q24). In practice, Eigen Layer's restaking concept provides validators with a way to protect new features in Ethereum, such as data availability layers, rollups, bridges, oracles, cross-chain messages, and potentially earn additional rewards in the process. This represents a new income stream for validators in the form of "security as a service." Why has this become such a hot topic?

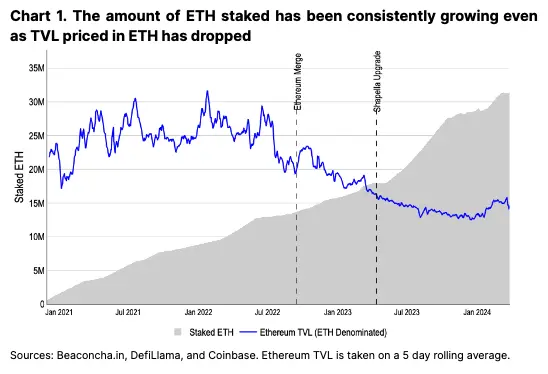

As the largest PoS cryptocurrency, ETH currently has a huge economic base to protect its network from hostile majority attacks. However, at the same time, the relentless growth of validators and staked ETH can be said to have exceeded the necessary conditions for protecting the network. In the merge (September 15, 2022), 13.7 million ETH was staked, roughly enough to protect the network TVL of 22.1 million ETH at the time. As we begin to publish, there are now approximately 31.3 million ETH staked, tripling in ETH terms, but Ethereum's TVL in ETH terms today (compared to the end of 2022) is actually lower at 14.9 million ETH (see Figure 1).

Excessive staked ETH and the security, liquidity, and reliability of the underlying assets put it in a unique position to promote the security of other decentralized services. In other words, we believe that reconsidering restaking as a concept is largely inevitable as an extension of ETH's intrinsic value. However, there is no free lunch. To ensure the correctness of these services, restaking is used for behavioral verification and may be subject to slashing or penalties, similar to traditional staking. (That is, slashing will not be enabled when the first set of AVSs is released in 2Q24.) Similarly, restaking operators will also receive additional ETH (or AVS tokens) for their services, similar to staking.

Ethereum LRT

To date, Eigen Layer's TVL growth has been staggering, second only to Lido (Ethereum's leading liquid staking protocol). Eigen Layer achieved this while retaining most of the deposit cap process and before launching any real-time AVS. That said, it's difficult to decouple the ongoing supply demand from user interest in short-term points and airdrop farming. While the amount of restaked ETH may continue to grow in the long run as the protocol matures, we believe that TVL may experience a short-term decline when airdrop farming ends or if early AVS rewards are lower than expected.

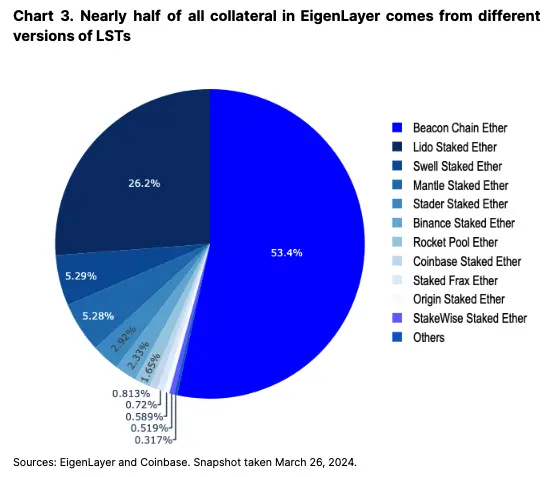

Eigen Layer is built on the existing staking ecosystem, allowing validators to stake a diverse range of underlying LST or native staked ETH (via Eigen Pods). In practice, validators direct their withdrawal addresses to Eigen Pods to earn Eigen points, which will be redeemable for protocol rewards in the future. The LST locked in Eigen Layer (1.5 million ETH) accounts for approximately 15% of all LST, while the total ETH locked in Eigen Layer represents nearly 10% of all ETH used for staking (3 million out of 31.3 million ETH). (LST itself represents 43% of all ETH staked in the ecosystem.) In fact, we believe that the recent interest in new validator onboarding is due to the stabilization of staking demand after October 2023. In February 2024, over 2 million ETH was added to staking, coinciding with the pause in deposit caps for Eigen Layer. Indeed, some LST providers are increasing their target APY as a way to attract new users to their platforms by leveraging the interest in restaking.

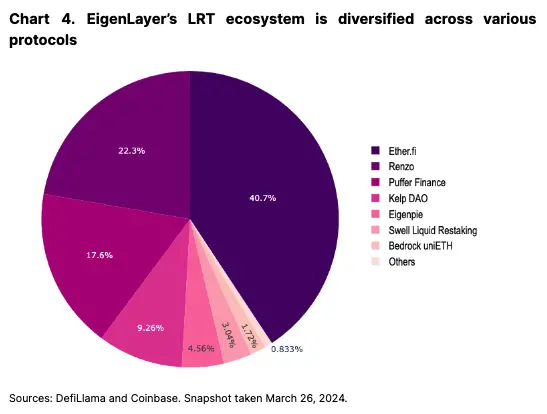

Learning from the popularity of LST, a diverse LRT ecosystem has emerged, with over six protocols offering liquid restaking token versions with various incentives and airdrop schemes. Of the 3 million ETH protected in Eigen Layer, approximately 2.1 million (62%) is wrapped in secondary protocols. We have seen a similar pattern in the liquid staking market before and believe that diversification of alternatives will be important as the industry grows.

In the long run, if native staking ETH issuance decreases due to increased staking participation (resulting in lower yields), restaking may become an increasingly important avenue for ETH yields. A separate discussion on reducing native staking ETH emissions could further enhance the relevance of restaking yields (although it is still early in the discussion phase).

That being said, the expected yield for AVS is relatively low after launch, which may pose a short-term challenge for LRT. For example, the largest LRT, Ether.fi, charges a 2% platform fee on its TVL for "insurance vault management." However, not all light rail systems have the same fee structure, leaving room for competition in this regard. But if we use this 2% fee as a headline for calculating breakeven costs, AVS would need to generate approximately $200 million in annual fees (based on a TVL of $12.4 billion) to break even—more than what Aave or Maker have charged in the past year fees. This raises the question of how much business AVS needs to generate to increase the overall yield for ETH stakeholders.

Emergence of Validation Services

As of today, AVS has not been launched on the mainnet. The first AVS to be released (in early 2Q24) will be EigenDA, a data availability layer that can play a role similar to Celestia or Ethereum's blob storage. After the Dencun upgrade successfully reduced L2 fees by over 90%, we believe EigenDA will be another tool for cheaper L2 transactions in the modular arsenal. However, building or migrating to L2 to leverage EigenDA is a slow process and may take several months to generate meaningful income for the protocol.

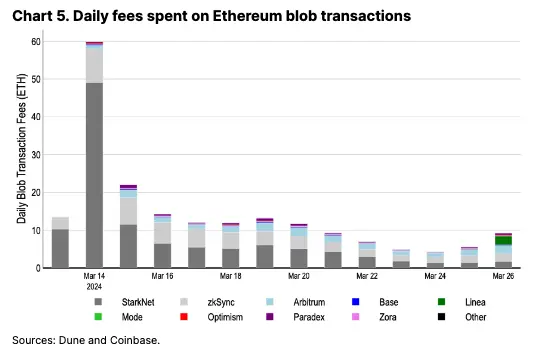

To estimate the initial yield for EigenDA, we can compare it to the cost of Ethereum's blob storage. Currently, approximately 10 ETH per day is used for various major L2 blob transactions, including Arbitrum, Optimism, Base, zkSync, and StarkNet (see Figure 5). If EigenDA sees similar usage levels, our conservative estimate suggests an annualized yield of approximately 3.5k ETH for restaking rewards, equivalent to an additional reward of about 0.1%. Fees in the first few months may even be lower than this estimate, although adding multiple AVSs may quickly increase the yield.

Other AVSs being built in the Eigen Layer ecosystem include interoperability networks, fast finality layers, location mechanism proofs, Cosmos chain security bootstrappers, and more. The opportunity space for AVS is very broad and continuously growing. Restakers can choose which AVS they want to earn with their staked ETH, although this process becomes increasingly complex with each new AVS.

Challenges and Strategies for LRT

This raises the question of how different LRTs will handle (1) AVS selection, (2) potential slashing, and (3) eventual token securitization. In traditional staking, there is a clear one-to-one mapping between validator responsibility and income, making LST a relatively straightforward matter considering all factors. However, with restaking, the multi-to-one structure adds some nontrivial complexity to how earnings (and losses) are accumulated and distributed (as well as the diversity of LRT issuers). LRT not only pays out basic ETH staking rewards but also rewards for obtaining a set of AVS. This also means that different LRT issuers will potentially pay out different rewards.

Many LRT models have not been fully clarified at this time. However, if each project has only one LRT, all token holders in a given protocol may be subject to uniform AVS incentives and slashing conditions. The design of these mechanisms may vary by LRT provider.

One suggestion is to take a layered approach, allowing LRT issuers to adopt a range of "high" and "low" risk AVS, although this would require establishing undefined risk criteria. Additionally, depending on the architecture design, token holders' ultimate rewards may still be paid out across all AVS, which we believe goes against the purpose of a risk-layering framework. Alternatively, decentralized autonomous organizations (DAOs) could decide which AVS to select, but this raises questions about who the key decision-makers are in these DAOs. Alternatively, LRT providers could serve as interfaces for Eigen Layer, allowing users to retain decision-making power over which AVS to adopt.

Upcoming Risks

However, at launch, the restaking process should be relatively straightforward for operators, as EigenDA will be the only AVS that can be protected. However, a feature of Eigen Layer is that ETH is committed to one AVS and can then be further redirected to other AVS. While this can increase earnings, it also increases risk. When it comes to the hierarchical structure of slashing and claim conditions between services, the challenge arises when the same restaked ETH is submitted to multiple AVS. Each service creates its own custom slashing conditions, so there may be a situation where one AVS slashes the restaked ETH for misconduct, while another AVS wishes to reclaim the same restaked ETH as compensation for the injured participants. This could lead to conflicts in final slashing, although as mentioned earlier, EigenDA will not have slashing conditions at initial launch.

Adding to the complexity of this setup is the "collective security" model of Eigen Layer—where AVSs leverage a common staked ETH pool to protect their services—can be further customized through "attributable security." This means that individual AVSs may have the potential to receive (additional) restaked ETH that is used solely to protect their specific service—a form of insurance or safety net for AVS paying premiums. Therefore, as more AVSs are introduced, the role of operators becomes more technically complex, and slashing rules become more difficult to follow. In addition to this restaking complexity, the expansion of LRT removes many fundamental strategies and risks from token holders.

This is a concern because ultimately, we believe people will go where the rewards are highest among these LRT providers. Therefore, LRT may be incentivized to maximize yields to gain market share, but this may come at the cost of higher (albeit hidden) risks. In other words, we believe it is important to reward risk-adjusted rewards rather than absolute rewards, but it may be difficult to maintain transparency on this. This could lead to additional risks as LRT DAOs are incentivized to restake multiple times to stay competitive.

Furthermore, if LRT payouts are entirely in ETH, LRT may also exert downward selling pressure on non-ETH AVS rewards. In other words, if LRT needs to convert native AVS tokens into ETH (or equivalents) in order to redistribute rewards to LRT token holders, the accrued value of repurchases may be limited by recurring selling pressure.

Additionally, LRT also carries significant valuation risk. For example, if an expanded staking withdrawal queue occurs (following the Dencun Fork on Ethereum, validator churn limits reduced from 14 to 8), LRT may temporarily deviate from its underlying value. If LRT becomes a widely accepted form of collateral in DeFi (e.g., LST in borrowing and lending protocols), this could inadvertently exacerbate liquidations, especially in low-liquidity markets.

This is assuming that these DeFi protocols are able to correctly assess the added value of LRT. In reality, LRT represents a diverse portfolio of holdings, the risk profile of which may change over time. New constituents can be added or removed, or the AVS itself may change its risk or solvency. We can envision a scenario where a market downturn may simultaneously affect several AVS, disrupting the stability of the light rail and amplifying the risk of forced liquidation and market volatility. Recursive borrowing will only magnify these losses. On the other hand, protocols that can decompose LRT into its principal and yield components can help mitigate this risk, as tokenized principal can be used as original collateral, and tokenized yield can be used for interest rate swaps.

Finally, as Ethereum co-founder Vitalik Buterin emphasized, in some cases, significant failures in the re-staking mechanism could threaten the fundamental consensus protocol of Ethereum. If the amount of restaked ETH is large relative to all held ETH, there may be economic incentives to enforce erroneous decisions that could destabilize the network.

Conclusion

The re-staking protocols of Eigen Layer are expected to become the cornerstone for various new services and middleware on Ethereum, which in turn can provide meaningful sources of ETH rewards for validators in the future. From EigenDA to Lagrange's AVS, it can greatly enrich the Ethereum ecosystem itself.

That being said, wrapping underlying protocols with LRT around the base protocol may lead to implicit risks of opaque reset strategies or temporary dislocations from the underlying protocol. The unresolved question remains of how different issuers choose which AVS to adopt and how to allocate risks and rewards to LRT token holders. Additionally, the initial yield of AVS may not meet the market's high expectations, although we expect this to change over time as AVS adoption grows. Nonetheless, we believe that re-staking supports open innovation on Ethereum and will become a core part of the ecosystem infrastructure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。