Title: A Brief History of Memecoins: Their Past and Future

Author: freezer

Publication Date: MAR 28, 2024

In this article, we will introduce:

- The origin of Memecoins: Proof of Work Meme Blockchain

- How Memecoins have evolved over time: ICOs, tokens, DeFi summer, Solana

- How NFTs have impacted the Memecoin landscape

- Latest developments and new trends

- Potential risks and opportunities

What is a Meme?

A meme is a unit that carries cultural ideas and symbols, constantly spreading and diffusing in people's consciousness. Similar to genes, memes vary in their ability to spread, with resonating memes enduring while less influential ones are quickly forgotten.

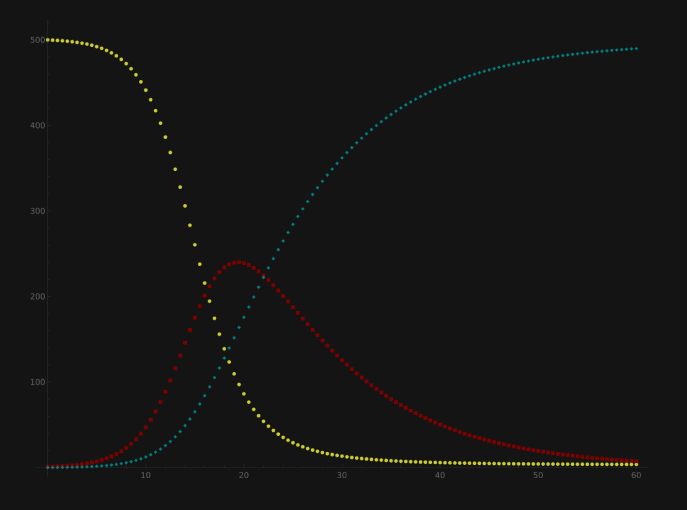

The concept of "Internet memes" was introduced with the internet, allowing memes and cultural ideas to spread at a faster pace, typically in the form of images, videos, GIFs, and jokes. A study likened the spread of internet memes to a disease: "Memes spread in a viral pattern, using an SIR model that is reminiscent of disease transmission."

The spread of internet memes is similar to the spread of infectious diseases.

"Meme coins" are a type of cryptocurrency whose value is derived solely from associated memes, essentially bringing financial value to the concept of memes.

With the emergence of meme coins, cultural ideas, symbols, and their dissemination can be traded and speculated upon. Their value is based on the relevance of the meme and the ability to capture mindshare, creating a new type of market where cultural resonance can be quantified and holds financial value.

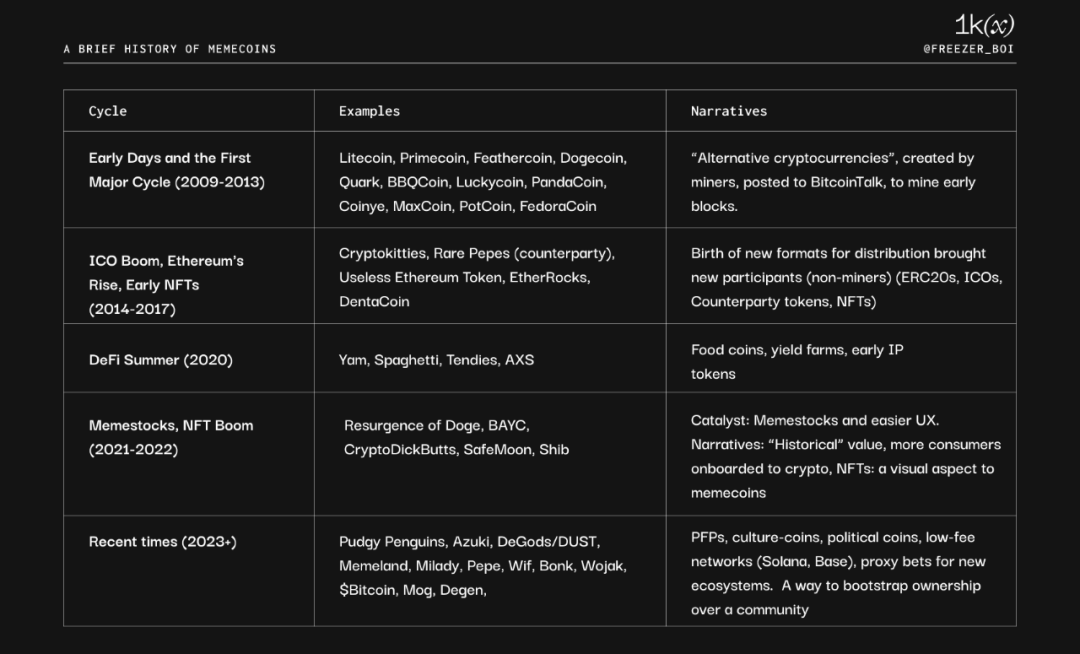

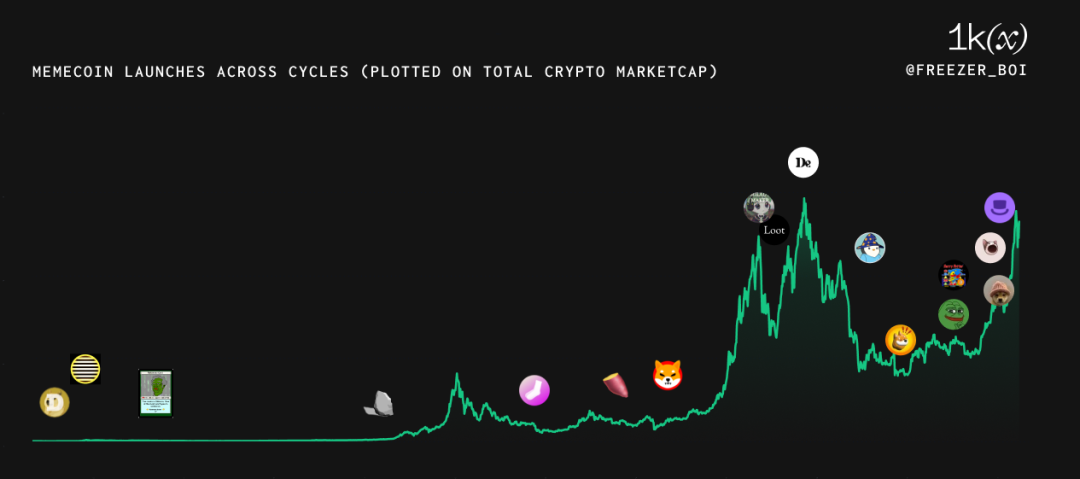

Brief History of Memecoins

The following table and diagrams provide a brief overview of the crypto cycles and the meme coins that emerged during these cycles:

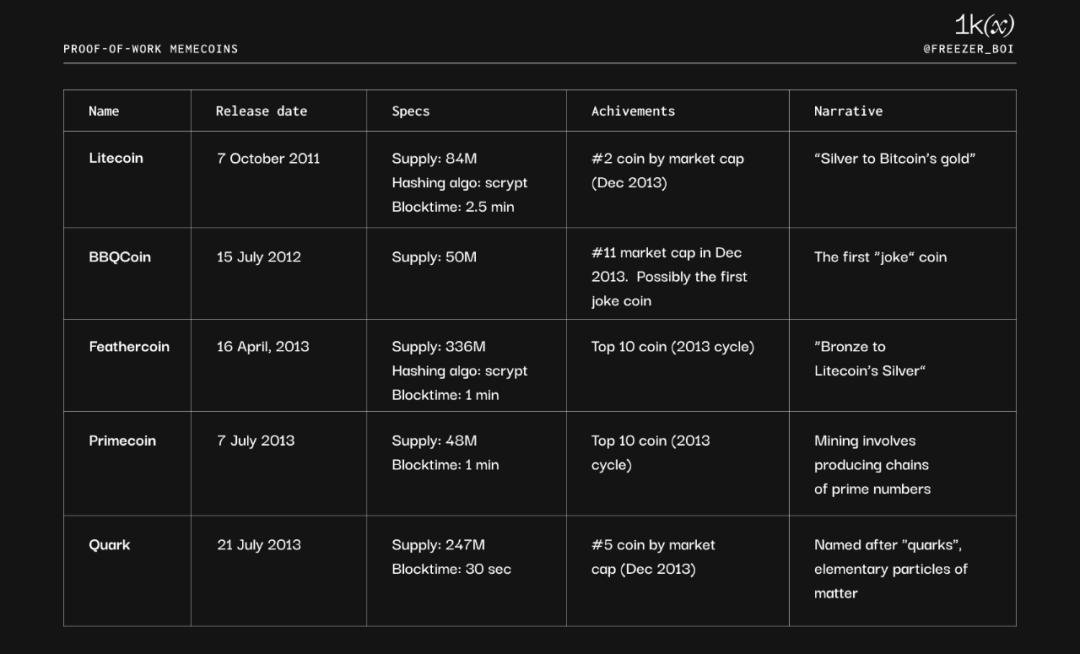

POW Memecoins

Proof of Work (POW) meme coins are primarily designed for miners to allocate their resources to mine and trade new tokens. Many of these meme coins first appeared in the "alternative cryptocurrency" subforum on Bitcointalk. While many meme coins failed to enter exchanges, those that succeeded were listed on platforms like Cryptsy and BTC-E, which are now defunct. Each meme coin is typically differentiated by factors such as name and brand, hash algorithm, block time, and supply, all contributing to their overall narrative (or "meme").

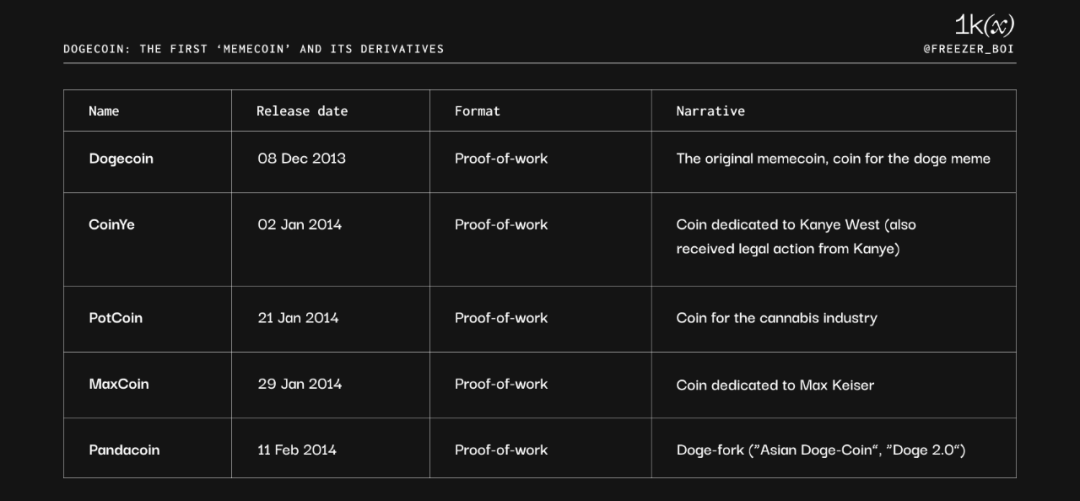

The first wave of tokens after Bitcoin was the "meme coins," which, in a sense, offered little value beyond a new idea. The following diagram illustrates some examples:

Except for Litecoin, all these tokens died out (due to reasons such as low trading volume and market cap, lack of exchange support, susceptibility to 51% attacks, etc.). This may be attributed to several factors: weak meme stickiness (lack of cultural longevity) and participation cost issues (each meme coin is a complete blockchain).

Litecoin's enduring success may be attributed to the pull of Bitcoin's memetic value ("digital gold"), its earlier emergence compared to other meme coins, and sustained support from numerous exchanges.

Dogecoin: The First Memecoin

In the summer of 2013, the original Doge meme ("much wow") began spreading on 4chan and Reddit. On December 8, 2013, Jackson Palmer and Billy Markus capitalized on this cultural trend and released Dogecoin on Bitcointalk. It was the first cryptocurrency based on an internet meme.

The success of Dogecoin brought about a new category of cryptocurrencies that are humorous, satirical, use celebrities (such as Kanye West, Max Keiser), animals (such as PandaCoin), or attempt to capture specific communities. These were all proof of work tokens launched in the "Alternative Cryptocurrency" subforum on Bitcointalk. "Technical details" became less important, with everything centered around the "meme." The following diagram shows some examples:

ICO Craze and the Rise of Ethereum

The rise of Ethereum sparked a wave of innovation, bringing new use cases, better user experiences, and new users.

Some specific improvements include:

- Easier token launches (ERC20 standard)

- Bringing in new user groups (non-miners)

- Token creators can earn more money (unlike zero-premine PoW tokens, ERC20 tokens are directly sold through ICOs)

- Introduction of interoperability/unified ecosystem/unified wallets (via ERC20)

The ICO era gave birth to a wave of more "serious" projects, such as theDAO, Filecoin, Tezos, EOS, Cardano, Tron, and Bancor, which attempted to have some practicality or purpose beyond meme value. During this period, there were a few meme coins that, while not particularly attention-grabbing, still garnered some interest.

One example is the Useless Ethereum Token, launched in June 2017, which mocked the concept of ICOs and raised 310 ETH in its ICO.

Although Dentacoin initially aimed to be a "cryptocurrency for dentists," it was still considered a meme coin and reached a peak market cap of $2 billion in January 2018.

HAYCOIN was the first ERC20 token listed on Uniswap and was one of the meme coins created during this era (2018). It was created by Hayden Adams, the founder of Uniswap, for testing the Uniswap protocol. Initially, it did not receive much attention and had low trading volume, but due to its historical significance, it experienced a revival in 2023.

Collectible Memes and Early NFTs

In addition to cryptocurrencies, a subset of the Pepe meme known as "Rare Pepes" emerged, which were not publicly released and carried a watermark stating "RARE PEPE DO NOT SAVE."

From 2016 to 2018, a group of Counterparty developers and Pepe meme enthusiasts created the Rare Pepe wallet Pepe Cash and orchestrated the trading of "Rare Pepe memes" on the Counterparty protocol.

Rare Pepes are often considered the second NFT series ever created and continue to hold value, with some selling for over $500,000.

With the release of CryptoPunks, MoonCats, and CryptoKitties, NFTs began to enter the mainstream Ethereum era, representing non-fungible tokens that can point to images and other media. EtherRocks, initially launched as a joke on Reddit in 2017, saw a resurgence in 2021, reaching a floor price of 305 ETH in August, valued at $1 million at the time.

Another example of collectible meme coins is Unisocks (SOCKS), launched by Hayden Adams on May 9, 2019. He listed 500 physical socks that could be exchanged for SOCK (ERC20). At the time of writing, each sock's price has reached as high as $53,000, possibly making them the most expensive socks in the world.

DeFi Summer

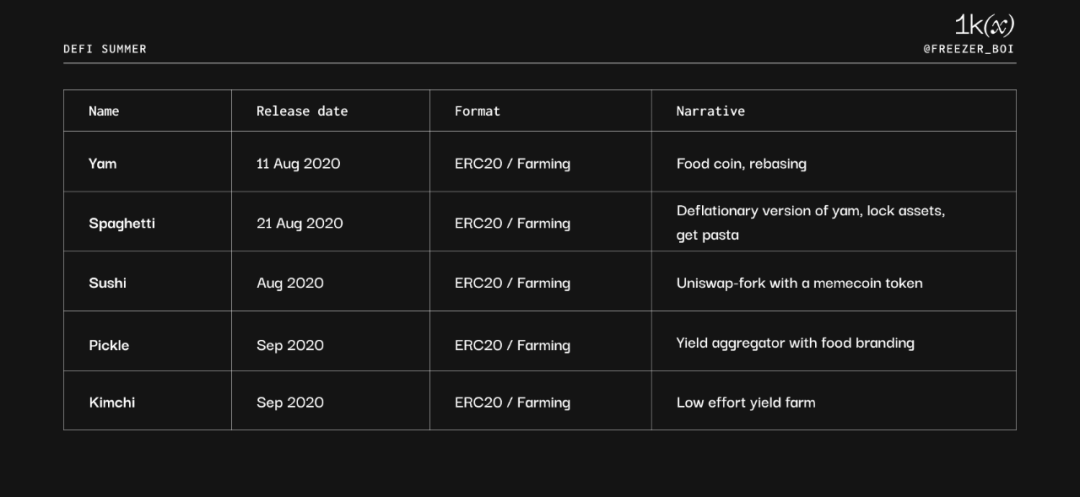

In June 2020, Compound Finance pioneered a new token distribution method called "liquidity mining" or "yield farming." Users locked their assets to provide liquidity and received token rewards in return.

This new paradigm marked the beginning of "DeFi summer" and reached its peak in "food coin" yield farming, offering annualized returns of 10,000% in meme coins in exchange for locking tokens in Yam or Pickle contracts.

Meme Stocks and Doge Coins

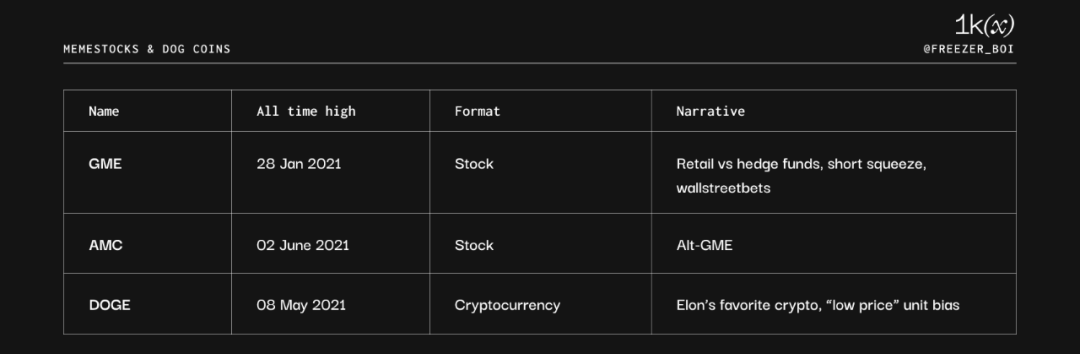

Stimulus measures, rate cuts, cheap funds, and COVID lockdowns created a high-risk environment globally throughout 2021.

In early 2021, retail traders congregated on Reddit, spreading the "Gamestock" meme, leading to a rapid increase in stock prices. Thanks to Robinhood's user-friendly experience and commission-free trading, a large number of ordinary users participated.

The "GME" frenzy led many to speculate on other assets, especially those available on Robinhood. DOGE was listed on Robinhood in 2018 at $0.008, making it very attractive to retail users. In early February 2021, Elon Musk began tweeting heavily about Doge memes. DOGE reached its peak in May 2021, with a market cap of $90 billion.

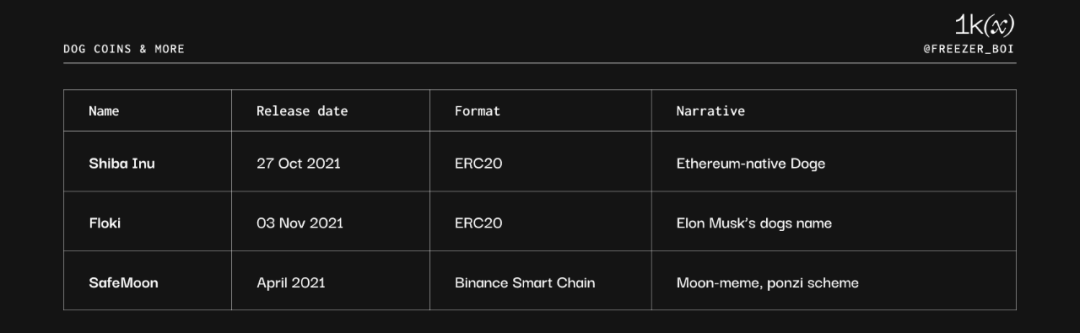

DOGE's popularity gave rise to more dog-themed meme coins, including Shiba Inu, Floki, and Safemoon, all reaching valuation peaks within a few months.

NFT Craze: "Meme Coins with Pictures"

With the introduction of the ERC721 standard and the emergence of general markets like OpenSea, NFTs created a new category of unique, visual expressions of "culture" or "meme."

Some of the most notable NFTs include CryptoPunks, Bored Apes, Squiggles, and Pudgy Penguins. NFTs can be used as profile pictures on platforms like Twitter and Discord, spreading virally as a form of identity. These PFPs represent status and "membership" in a cultural club. Many collectors have become wealthy, but they cannot sell their NFTs without "leaving the community." To reward loyal holders, some NFT projects issued a "meme coin" (ERC20) to their community, providing liquidity, utility, and cultural "currency" value to the NFT.

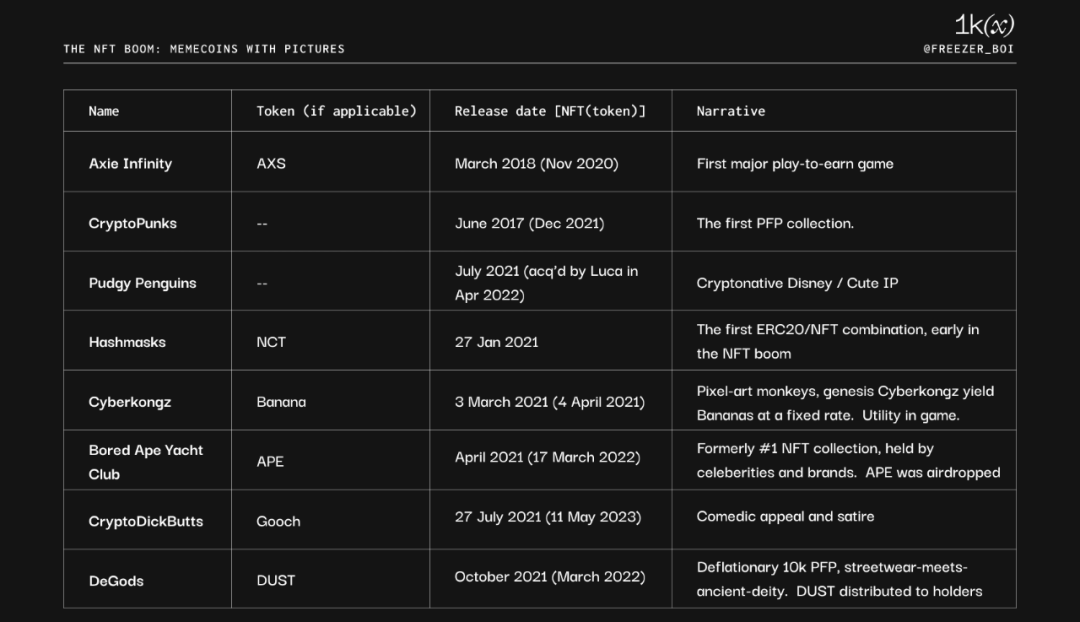

Examples of NFT projects (and their potential meme coins) in this era include:

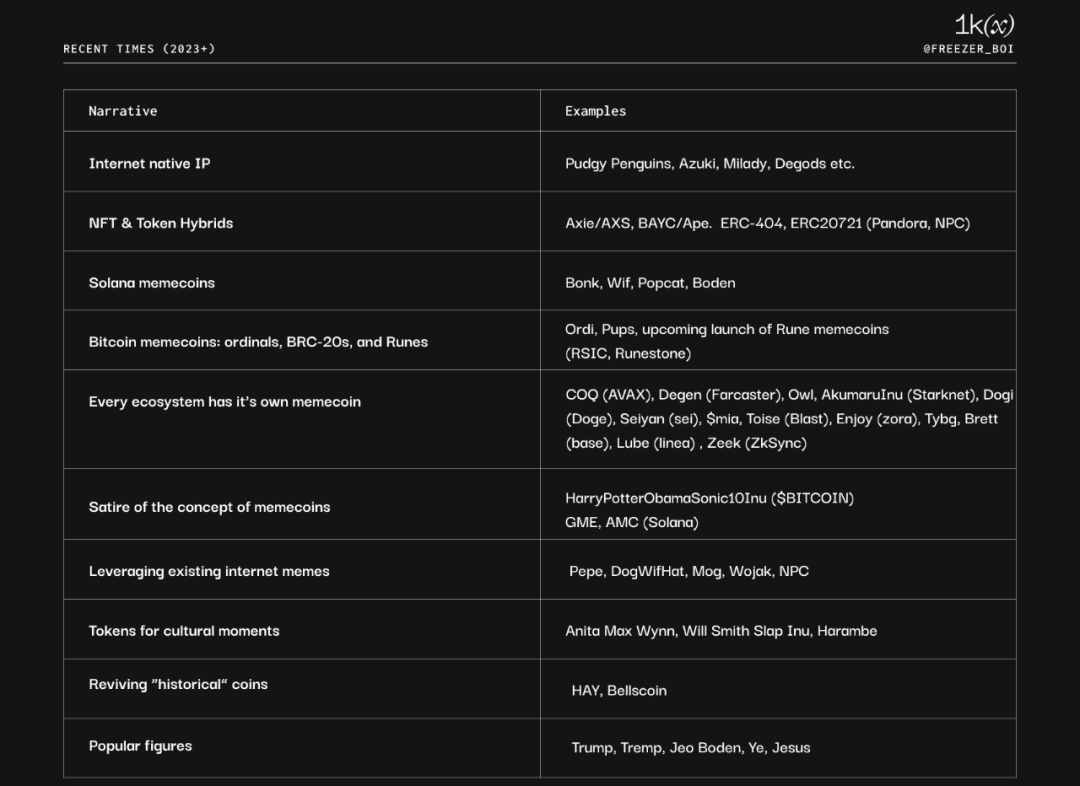

Recent Developments (2023+)

As cryptocurrencies recover from the bear market, new memes, cultures, ideas, and ecosystems continue to emerge. Meme coins are one of the few asset categories that have received sustained attention, both in terms of trading volume, market value growth, and social interest, with recent surges in interest.

Some recent meme narratives include:

Common Models

Every cycle has some form of meme coins: Meme coins manifest in different ways based on underlying technology, such as PoW coins, ERC20, and NFTs, representing one of the earliest "applications" of new technologies or form factors.

Meme coins accumulate value in the same way despite their various media: They all rely on attention, narrative, and hype to survive and spread. While new media always sparks initial excitement, sustained attention is necessary for long-term value. Simply turning it into an NFT or creating an Ordinal is not enough; attention has highly cyclical characteristics and requires deeper attention-driving factors after the initial media hype cycle.

Meme comes first, coin comes second: For the most successful meme coins, such as doge, pepe, and dogwifhat, internet memes take precedence, and meme coins leverage existing meme popularity for dissemination and promotion.

Memes Originating from Crypto are Just Getting Started: Crypto natives have begun creating memes that can successfully spread beyond the web3 circle. A typical example of this trend is the rise of native crypto intellectual property, especially NFT projects like Pudgy Penguins.

Low Price Equals Meme: From the earliest altcoins, users have been drawn to tokens with low "prices" (due to large supplies). There is a psychological appeal in the idea that if a seemingly insignificant token reaches $1, it could make the holder a millionaire overnight. Therefore, the price itself becomes a meme.

Strong Community + Marketing: Meme coins require a strong community, founders, or "spokespeople" to create content, promote the brand, and spread the "meme."

From Wild Growth to Professional Operation: The first wave of meme coins was relatively primitive, often fair-launched with no internal allocation to team members. This method of release has many benefits but also brings some risks, such as rug pulls and fund theft. A emerging solution is to have dedicated teams driving the ecosystem development around meme coins, such as PFP projects.

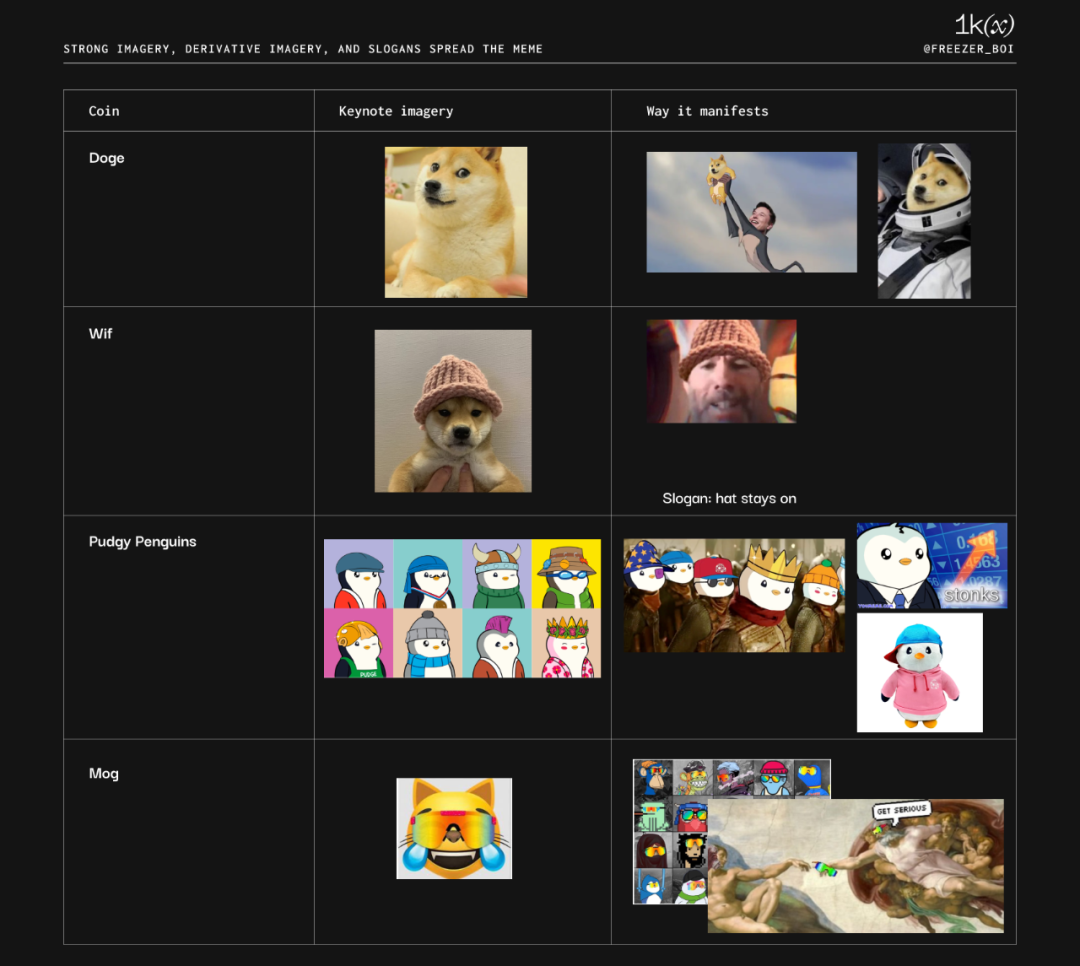

Spreading Memes through Strong Imagery, Derived Imagery, and Slogans: Imagery is the primary way memes spread on social networks. It typically starts with a tone-setting symbol and is expressed in various ways.

Opportunities

With a total market value of over $600 billion and daily trading volume exceeding $13 billion, meme coins hold significant financial value.

As the sole function of memes is to spread to others' minds, capturing the next "meme" early can be a profitable opportunity. Creators and investors "work for the meme" by expanding its influence and become early believers in the process.

Whether it's a ticket to riches, a choice to follow a specific KOL, or speculation on social trends and ideas, meme coins have been experiencing explosive growth since the beginning of cryptocurrencies.

Criticisms and Risks

Despite abundant opportunities, meme coins are not without risks. Many meme coins tend to attract users looking for effortless instant wealth, treating them as a form of lottery or gambling.

Another common trend is "rug pulls" and "pump and dump schemes," which occur almost daily in the meme coin market. According to a recent report by blockchain analysis company CipherTrace, rug pulls accounted for 99% of all crypto scams in 2023, with total losses of $2.1 billion. Therefore, it is crucial to examine some key features of meme coins, such as the status of LP tokens (are they burned or held centrally?), team allocations, transfer taxes, and whether contract permissions have been renounced.

Additionally, meme coins lack regulatory clarity. One of the most notable meme coin regulatory events was the Thai Securities and Exchange Commission banning tokens that have "no clear objective or substantial content" and are influenced in price by social media trends and KOLs in June 2021.

Another major issue is that, aside from any malicious behavior, memes may also fail to "survive" due to a lack of interest, attention, and emotional resonance. These investment losses could lead to a hostile or indifferent holder community.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。