The original author: Huo Huo

On March 21st, BlackRock announced the launch of the first tokenized fund BUIDL on Ethereum, directly igniting the heat of the RWA (Real World Asset, referring to the tokenization of real-world assets through blockchain technology) track.

However, this is not the first time BlackRock has stirred up the crypto market. As early as January, BlackRock led the long-awaited Bitcoin spot ETF, which caused a sensation, and subsequently ignited a new wave of enthusiasm in the entire crypto market. The price of Bitcoin, which had been low for over a year, began to break through the $40,000 mark.

It is expected that in the future, BlackRock will delve deeper into the crypto industry and become a significant force. As the world's largest asset management institution, why is BlackRock interested in cryptocurrencies? What impact does this have on the subsequent development of the crypto industry? Let's take a closer look at this newly emerging Bitcoin whale in the crypto industry.

Who is BlackRock?

BlackRock, founded in 1988, is currently the world's largest asset management, risk mitigation, and consulting company.

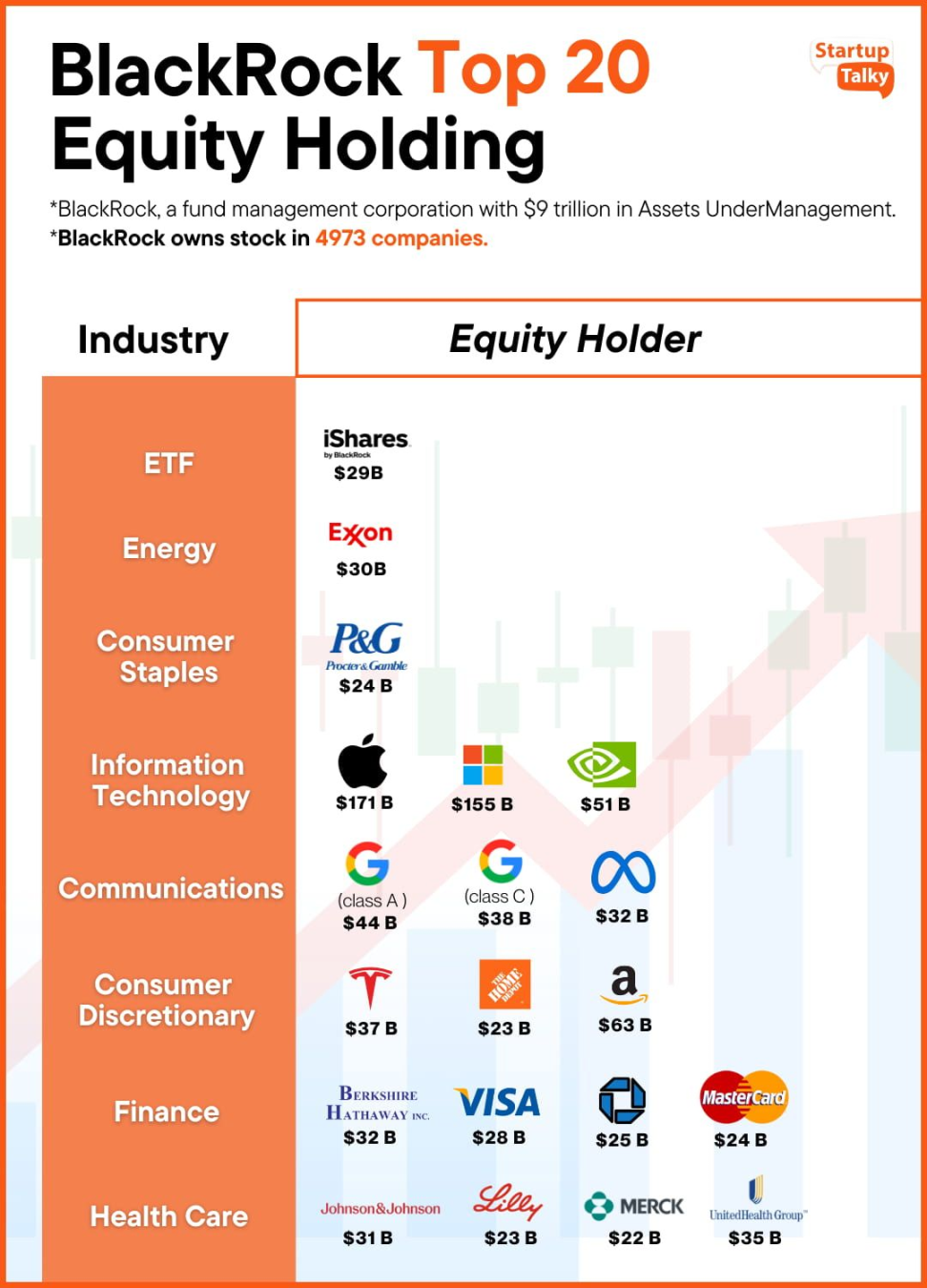

BlackRock currently has 89 offices in 38 countries around the world, with over 16,000 employees, and clients in over 100 countries. At the same time, BlackRock holds stocks in 4,973 companies, including Apple, Microsoft, Nvidia, Amazon, Facebook, Tesla, ExxonMobil, and others.

BlackRock, a top equity holding company, as of August 2023, source: startuptalky

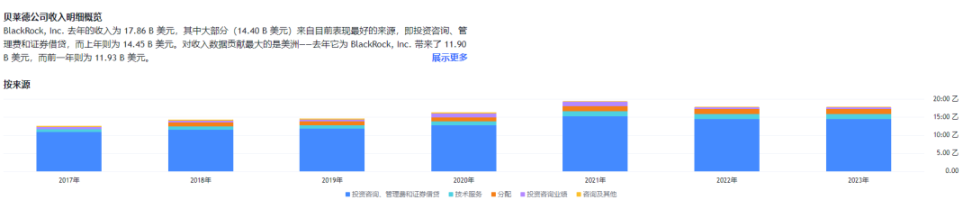

In terms of revenue, in 2023, BlackRock's total revenue was $17.86 billion, with the largest portion ($14.4 billion) coming from investment advisory, management fees, and securities lending. The Americas region contributed the most revenue in 2023, with $11.9 billion. Overall, financial advisory and management fees account for the majority of the company's revenue, with the United States contributing the majority of the company's revenue.

Source: https://in.tradingview.com

According to reports, in the fourth quarter of 2023, BlackRock managed assets worth $100 trillion, which means that even without launching a Bitcoin spot ETF, as a towering tree in the global financial industry, BlackRock still sits firmly in the top position. So why did BlackRock start to enter the crypto industry? Is it a normal expansion of its own development? Or does BlackRock see the potential of Bitcoin, that it can hedge traditional financial risks? Or does BlackRock believe that this is a good addition to their investment portfolio?

BlackRock's Crypto Actions

In fact, as early as the past few years, BlackRock has begun to show interest in the crypto industry and blockchain technology. However, at that time, there were many challenges. Firstly, the market's volatility was relatively high, and secondly, there was a lack of reasonable regulation, and market rules had not been fully established. In addition, over the past decade, the SEC has been concerned about market manipulation and has consistently rejected applications for Bitcoin spot ETFs, so there were no significant moves.

However, on January 11, 2024, a consortium led by BlackRock launched the first batch of Bitcoin spot ETFs in the United States, named iShares Bitcoin Trust (IBIT), directly reversing the embarrassing situation of the past decade of rejections of Bitcoin spot ETF applications and opening a new chapter in crypto development.

1) One of the biggest drivers for the approval of Bitcoin spot ETFs

BlackRock is an organization with a large number of approved ETF records. According to foreign media reports, the company has had 575 out of 576 applications approved by the SEC, with a success rate of nearly 100%. The only ETF rejected was in October 2014, a actively managed ETF jointly submitted by BlackRock and Precidian Investments, and the reason for the rejection given by the SEC was the lack of transparency in profitability.

However, in the face of the SEC's rejection of Bitcoin spot ETFs for a decade, in order to increase the approval rate, BlackRock also made adequate preparations in the application process. On June 15, 2023, when BlackRock submitted the application for a Bitcoin spot ETF, it addressed the issues of concern to the SEC one by one. For example, to meet the SEC's requirement for effective monitoring measures to prevent market manipulation, BlackRock plans to sign a regulatory sharing agreement with relevant well-known platforms and list Coinbase as the proposed ETF's custodian to ensure the secure management of Bitcoin.

Due to BlackRock's participation and its reputation, many investment/asset management institutions joined the application competition, such as Fidelity, Invesco, VanEck, Cathie Wood’s Ark Investment Management, WisdomTree, and many other financial companies, most of which listed Coinbase as the ETF custodian service provider.

Unfortunately, on June 30, the SEC stated that the documents submitted by BlackRock, Fidelity, and other companies lacked clarity and comprehensiveness, and thus rejected the application for a Bitcoin spot ETF. A few days later, BlackRock resubmitted the application. Generally, the resolution time for the SEC's decision on Bitcoin spot ETF applications is a maximum of 240 days, and although there may be lengthy exchanges and discussions, the applications were not outright rejected as in the past, bringing hope for future potential approvals, seen as a positive sign of progress.

And according to the then predictions, based on the time of publication of the rule change documents for each ETF application in the Federal Register, Tokeninsight predicted the possible approval times for 8 institutional ETFs as follows:

As it turned out, in accordance with the earliest predicted time, on the early morning of January 11, the SEC officially approved 11 Bitcoin spot ETFs, including BlackRock.

After the news was released, Bitcoin surged briefly, rising over $49,000. After that, Bitcoin also began a spiral upward trend. As of now, in less than three months, Bitcoin has surpassed $71,000 at its highest.

In fact, from the beginning of BlackRock's proposal for a Bitcoin spot ETF application, the market started a mode of positive cheering with prices. Bitcoin broke through $30,000 and $40,000 in October 2023, and after the application was approved, it directly reached $45,000.

Bitcoin trend over the past year

And among the companies that applied for the issuance of Bitcoin spot ETFs, 5 chose CEX Coinbase as the custodian institution, and Coinbase's price rose from $70 in October 2023 to a high of $187 in December.

Coinbase 2023 Token price trend

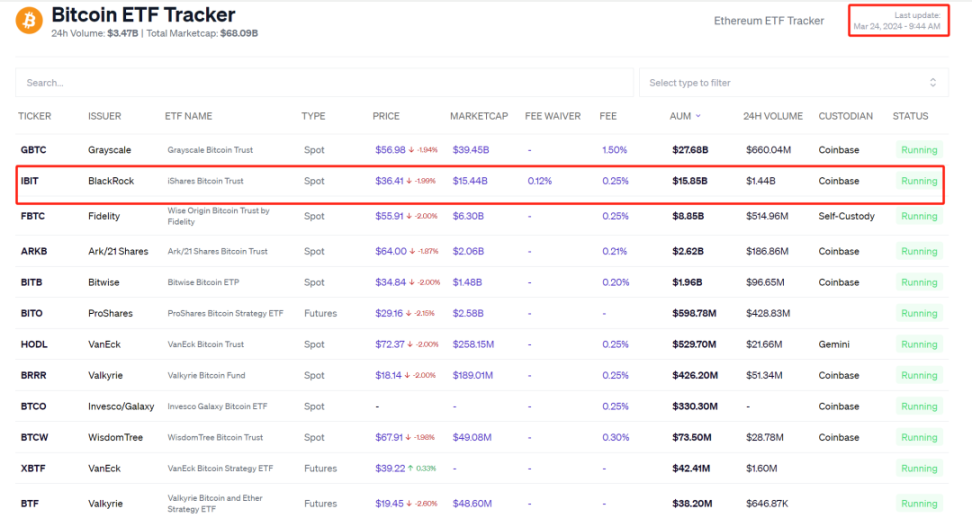

According to ChainCatcher's report on March 24th, since its first appearance on January 11, 2024, the new Bitcoin spot ETF (excluding GBTC) has significantly increased its Bitcoin holdings. Nine new Bitcoin spot ETFs (excluding Grayscale GBTC) currently hold 474,363.55 BTC. Among them, BlackRock's IBIT leads with a holding of 242,829.94 BTC, making IBIT a giant among its peers, accounting for 51.19% of the total holdings of these nine. When considering GBTC along with these 9 BTC, the total rises to 824,615.55 BTC, approximately 3.92% of the Bitcoin cap.

According to Cointelegraph's analysis on March 25th, assuming that the current capital flow does not undergo drastic changes, the number of Bitcoins in BlackRock's Bitcoin spot ETF may surpass that of the crypto asset management company Grayscale's GBTC in the next three weeks.

Although the market predicts that in the short term, the approval of the Bitcoin spot ETF may not have a significant stimulating effect, in the long term, its presence will significantly enhance the compliance and investability of digital assets, thereby improving market depth and liquidity, and also helping to reduce market volatility and enhance investor confidence.

Overall, BlackRock's reputation and influence as the world's largest asset management company, as well as its professional knowledge and experience in launching and managing ETFs, have led the SEC and the market to believe in the feasibility and value of a Bitcoin ETF, bringing significant impact to the crypto world. Next, let's take stock of its multiple investments and preparations in the crypto field.

2) Major Shareholder of the Largest Bitcoin Holding Company

In BlackRock's cryptocurrency investment portfolio, it holds a 5.53% stake in MicroStrategy. MicroStrategy, as a business intelligence and software company, is currently the largest holder of Bitcoin. BlackRock acquired MicroStrategy's shares through various funds and ETFs, such as iShares Core S&P 500 ETF, iShares ESG Aware US Aggregate Bond ETF, and iShares Russell 1000 Growth ETF.

MicroStrategy currently holds approximately over 120,000 Bitcoins, worth over $5 billion, and has issued over $2 billion in debt to fund its Bitcoin purchases. According to Forbes' recent analysis, BlackRock's stake in MicroStrategy is equivalent to owning over 6,600 Bitcoins, worth over $300 million. This makes BlackRock one of the largest institutional holders of Bitcoin, even though it does not directly own any Bitcoin. BlackRock's ownership of MicroStrategy shares also reflects its optimistic outlook and confidence in the company and the future of Bitcoin.

3) $384 Million Investment in Leading Bitcoin Mining Companies

In August 2023, BlackRock invested $384 million in Bitcoin mining companies as part of its strategic exploration of the potential impact of digital currencies on the global economy.

BlackRock's investment in Bitcoin mining companies includes four of the largest and most mature Bitcoin block production companies: Marathon Digital Holdings, Riot Blockchain, Bitfarms, and Hut 8 Mining.

BlackRock's investment in Bitcoin mining companies is a bold and innovative move. On one hand, it promotes the growth and development of the Bitcoin network and ecosystem, enhances the security, stability, and diversity of the network, and supports the innovation and adoption of this technology. On the other hand, it also demonstrates its interest and participation in the cryptocurrency field, as well as its recognition and appreciation of the industry's value and potential.

4) Close Collaboration with Crypto Industry Institutions

The issuer's long-standing negotiations with the SEC regarding the Bitcoin spot ETF application have seen BlackRock actively promoting the matter, while also collaborating and consulting with other stakeholders and experts in the crypto industry (such as Coinbase, Fidelity, and VanEck) to address the SEC's concerns and requirements.

In 2022, BlackRock reached a partnership agreement with Coinbase to integrate its Aladdin operating platform with Coinbase's leading cryptocurrency CEX, creating a robust solution for the IBIT ETF.

In addition to the Bitcoin ETF, BlackRock has also established partnerships with some major cryptocurrency players. It holds a minority stake in the stablecoin company Circle Internet Financial and manages reserves of over $25 billion in government money market funds, supporting Circle's USDC, among others.

BlackRock also manages private Bitcoin trusts for professional clients. According to insiders, the assets of this trust fund have exceeded $250 million, and most clients have since transferred funds to the new ETF.

BlackRock CEO: Bitcoin is the Real Deal

BlackRock's acceptance of Bitcoin has been gradual. During the pandemic, the company's Global Chief Investment Officer for Fixed Income, Rick Rieder, began allocating Bitcoin futures in its funds. According to insiders, BlackRock's Digital Assets Head, Robbie Mitchnick, also helped Fink transition into a Bitcoin believer.

Speaking of Fink, he has been listed on the Forbes Global Billionaires list since 2022. Whether it's investment talent, leadership, or social skills, 72-year-old Larry Fink is known as the "Wall Street Godfather" and the creator of a financial empire, and his contribution to BlackRock's development is undeniable.

However, Fink was not initially a Bitcoin believer. In 2017, he referred to Bitcoin as a "money laundering index" and criticized cryptocurrencies multiple times, calling them "something customers don't really want to invest in."

It wasn't until 2022 that Fink's stance on digital assets began to change significantly. According to insiders, the rebound of Bitcoin after the cryptocurrency crash in 2022 was a major reason for BlackRock's change in perspective.

During an April conference call that year, Fink stated that the company was extensively researching the cryptocurrency space and observing increasing client interest in it. In the same month, BlackRock participated in Circle's $400 million financing. Later in the summer, BlackRock quietly launched a spot Bitcoin product for its institutional clients in the United States, as their first private trust product. BlackRock provided seed funding for this fund and expanded its scale with external investors.

Also in the same year, BlackRock established a partnership with Coinbase, allowing institutional clients who own Bitcoin on the cryptocurrency exchange to use their software toolkit Aladdin to manage portfolios and conduct risk analysis. Therefore, Coinbase is currently the custodian for their Bitcoin spot ETF.

Now, it can be said that Fink is one of the faithful believers in Bitcoin. His company, BlackRock, has legitimized Bitcoin, manages the fastest-growing Bitcoin fund, has established partnerships with leading players in the digital asset industry, and has opened the door for mainstream investors to easily buy and sell Bitcoin, just like trading stocks.

Today, BlackRock's cryptocurrency ambitions are no longer limited to Bitcoin. The asset management company is submitting a pending application to the SEC to launch an ETF holding Ethereum, the second-largest cryptocurrency by market capitalization and the native token on the Ethereum blockchain, with the regulatory deadline set for May, which is worth looking forward to.

Conclusion

As BlackRock's slogan says, "Investing in a New World," BlackRock believes that cryptocurrencies and blockchain technology can change the financial industry and create new opportunities for growth, efficiency, and inclusivity.

Perhaps it is because of the recognition that the demand for and adoption of cryptocurrencies by institutional investors, retail investors, governments, and businesses is constantly growing, BlackRock's interest in cryptocurrencies is no longer limited to following trends or engaging in speculative gambling, but rather as a strategic long-term vision.

It can be foreseen that BlackRock's presence will be indispensable in the future of the crypto field.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。