Author: EarnBIT

Translation: Plain-language Blockchain

In April 2024, Bitcoin will undergo another halving, an event that occurs every four years, reducing miners' rewards. The evolution of the market structure supports the widely anticipated uptrend. This halving cycle is fundamentally different from the past, and our guide summarizes common price predictions and unique driving factors.

1. Bitcoin Halving Cycle

The halving will correspondingly reduce the number of newly mined bitcoins. This occurs after every 210,000 blocks, forming a four-year price cycle. Previous halvings took place in 2012, 2016, and 2020.

"The total issuance will be 21,000,000 coins. They'll be distributed when a node generates a block, every four years halving. First four years: 10,500,000 coins. Next four years: 5,250,000 coins. Following four years: 2,625,000 coins. Following four years: 1,312,500 coins. And so on…" - Satoshi Nakamoto, "Cryptography Mailing List," January 8, 2009

This event will reduce miners' profitability. Miners use custom hardware (Application-Specific Integrated Circuits, ASIC) to process transactions. According to CoinDesk's data, mining a block in 2023 requires at least $10,000 to $15,000 in profit. After the halving, costs may soar to $40,000 per coin.

2. When is the Bitcoin Halving in 2024?

The reward will decrease from 50 bitcoins per block to 6.25 bitcoins and will further reduce to 3.125 bitcoins on April 19, 2024. You can view the countdown to the Bitcoin halving here.

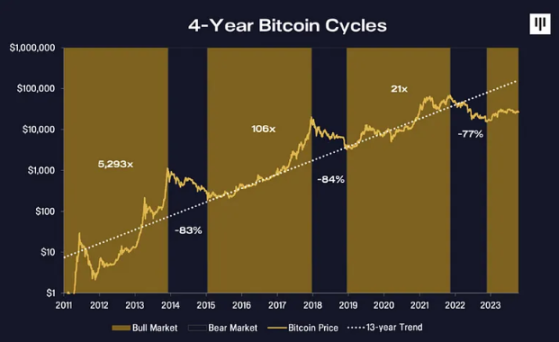

Bitcoin's four-year price cycle. Source: Pantera

3. Impact on Price: Bitcoin Halving Background

While the narrative of scarcity is important, factors other than supply contraction also play a role. In theory, a decrease in inflation should boost demand, but the actual price impact may be limited.

The slower coin production reduces the inflation rate while ensuring Bitcoin's supply remains limited (21 million). This non-inflationary nature appeals to cryptocurrency enthusiasts: unlike fiat currency and gold, Bitcoin is not influenced by central institutions and natural reserves.

Lower rewards promote the network's health and sustainable development. According to Dig1C0nomist, the annualized energy consumption is 141.46 TWh, equivalent to the entire energy consumption of Ukraine, with a carbon footprint similar to Oman (78.90 Mt of CO2).

Bitcoin is also influenced by factors beyond the speed of supply expansion. These factors include both internal and external drivers in the blockchain industry: regulation, the Federal Reserve's monetary policy, geopolitical factors, and more.

According to the Efficient Market Hypothesis (EMH), if all traders are aware of the halving, the effect must already be reflected in the price. However, as Warren Buffett said over thirty years ago, "Investing in a market where people believe in efficiency is like playing bridge with someone who has been told it doesn't do any good to look at the cards."

As highlighted by Grayscale, the change in supply structure is the only certainty. The halving brings Bitcoin closer to its maximum supply, posing challenges for all miners.

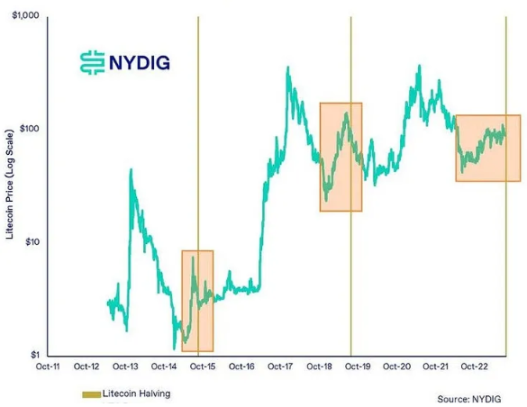

In other words, Bitcoin's scarcity is also programmable and therefore known in advance. Models directly linking it to price increases may have flaws. Otherwise, Litecoin (another cryptocurrency that undergoes halving) would continue to rise after each halving, which is not the case.

Litecoin's halving cycle. Source: NYDIG

4. Historical Perspective: Macro Background

Previous halving events were accompanied by factors emphasizing Bitcoin as an alternative store of value or helping it indirectly benefit.

In 2012, the EU was in the midst of a severe debt crisis. By November 2013, Bitcoin surged from $12 to $1,100.

2016 saw a frenzy of initial coin offerings, with over $5.6 billion flowing into other cryptocurrencies. By December 2017, Bitcoin rose from $650 to $20,000.

In 2020, inflation concerns were high during the COVID-19 pandemic. By November 2021, Bitcoin surged from $8,600 to $68,000 and hit a historic high of $69,044.77 on November 10. Its perceived role as a safe-haven asset played a significant part.

Bitcoin Halving in 2024: Seeking Clues from Past Performance

Past performance does not guarantee future results, and as shown, influencing factors are not limited to cryptocurrencies. However, past halving events provide clues to some potential scenarios.

Timing of Highs and Lows

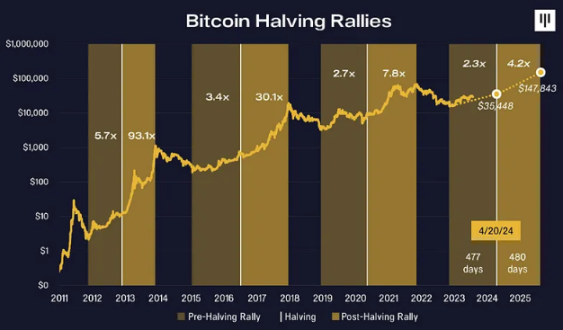

In theory, Bitcoin rebounds from lows long before the halving, typically 12-16 months before the event, according to CoinDesk's data. Analysts at Pantera estimate that the bottom usually occurs 477 days before the halving event.

The uptrend continues both before and after the halving. The post-halving uptrend lasts an average of 480 days (until the subsequent bull market peak).

This time, the lowest point occurred before the expected date (December 30, 2022). It happened on November 10 ($15,742.44).

Rebound of Bitcoin halving market. Source: Pantera

If history repeats, according to Pantera's communication, the market will stop at the end of 2025.

Bitcoin Halving in 2024 Prediction: Quickly Return to $69,000?

In the past three halving cycles, Bitcoin's price surged by over 30% in the first eight weeks. As Marcus Tilen, founder of 10x Research, stated, during that period, Bitcoin's average increase was 32%.

Given the current price of $52,456.77, if the same trend repeats, the price will return to the historic high of $69,000. Tilen added that this possibility increases "the closer we get to the Bitcoin halving."

Daily RSI

10xResearch reported on February 19 that the daily Relative Strength Index (RSI) had surpassed 80. This momentum indicator measures the speed and change of price movements, and when the index reaches 70, it signifies strong upward momentum.

Historically, when RSI exceeds 80, it indicates that the price will increase by over 50% in the next 60 days. The last time Bitcoin's 14-day RSI reached such a high point was in December 2023. As of February 22, it was at 70.88%.

5. Bitcoin Halving in 2024 and Spot ETF

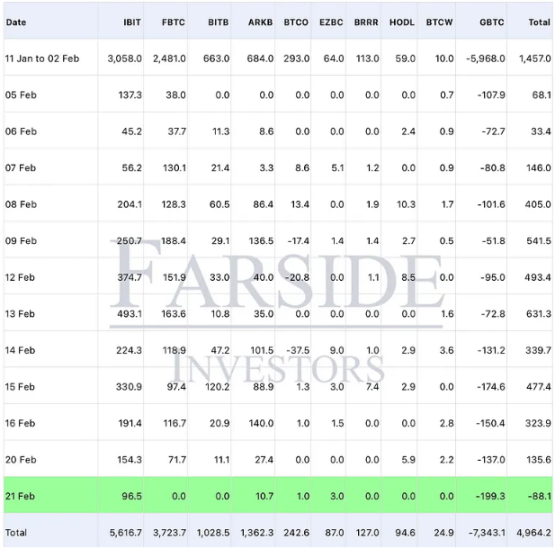

This year, Bitcoin's rise has been supported by the adoption of spot Bitcoin ETFs. So far, these trading platforms have attracted over $5 billion in net inflows, allowing investors to gain investment returns from Bitcoin without directly holding it.

This inflow of funds not only supports investors' high spirits but also alleviates the selling pressure from block rewards (i.e., all newly mined bitcoins may be sold).

According to Grayscale's calculations, based on the current production of 6.25 bitcoins per block, the annual selling pressure amounts to $14 billion (based on a price of $43,000). After the 2024 halving, the total will decrease to $7 billion, requiring less buying pressure to offset the selling pressure.

Spot Bitcoin ETFs have absorbed "almost the equivalent of three months of potential selling pressure after the halving." This took only 15 trading days.

Cumulative fund inflows for Bitcoin ETFs. Source: Farside Investors

6. Predictions for 2025: Bitcoin's Price After Halving to Reach $150,000 to $200,000

Due to market expectations, the market typically rises in the period before the Bitcoin halving. As of February 22, 2024, experts and research institutions are generally optimistic, predicting an average price range for Bitcoin in mid-2025 of $150,000 to $200,000.

Bitcoin's order book liquidity has reached its highest level since October 2023, although lower than before the FTX collapse. Unless demand decreases (contrary to the current situation), the reduction in new Bitcoin supply is bound to boost its price. Some analysts suggest that a new all-time high has already begun.

Bernstein states that pre-halving behavior reflects the upcoming supply contraction and growing demand for spot ETFs. The company expects the price to "hit a new all-time high in 2024" and peak at $150,000 in mid-2025.

Anthony Scaramucci, founder of Skybridge Capital, expects Bitcoin to reach a high of $170,000 or higher in July 2025. In an interview with Reuters in January, he said:

"Whatever the price is on the halving day in April, multiply it by four, and that's where it's going to be over the next 18 months."

Scaramucci used a conservative starting point of $35,000 (the price at the halving) to calculate $170,000. With the current price of $52,000, this scenario would push Bitcoin over $200,000.

Meanwhile, according to his long-term estimate, the market value of this pioneering cryptocurrency should reach half the value of gold. This would require the market value to grow from the current approximately $1 trillion to about $6.5 trillion, an increase of over 6 times.

Skeptics: More Drivers Needed to Reach All-Time High

Rachel Lin, co-founder and CEO of SynFutures, says the halving "is unlikely to trigger a full-fledged bull market" unless cryptocurrency adoption significantly increases, "which alone is not enough to bring Bitcoin back to nearly $69,000, let alone surpass it."

However, due to the U.S. elections, local regulators may reduce "headline-chasing" behavior at this critical time. Therefore, there may not be too much negative news to dampen investor enthusiasm for cryptocurrencies in the future. This could pave the way for the next bull market trend.

Short-Term and Mid-Term Factors to Watch

The halving is a mid-term positive factor. Peter Henn of CCN summarized the positive and negative factors Bitcoin may face in the coming weeks and months.

The adoption by institutions is a major positive factor, along with price rebounds and positive technical indicators. However, adverse changes in regulatory policies and macroeconomic backgrounds, such as rising inflation, may affect market sentiment.

Mid-term warning factors include regulatory policies and other competing cryptocurrencies, including central bank digital currencies (CBDCs). Hacks and other security vulnerabilities could undermine market trust.

Over the next 1-2 years, Bitcoin may also rise due to improvements in the Lightning Network and its strengthened position as a store of value.

Bitcoin Halving in 2024 and Miners

As long as the economic incentives are sufficient, miners will continue to secure the blockchain. Therefore, the price of Bitcoin must be high enough to offset the costs during and after the halving.

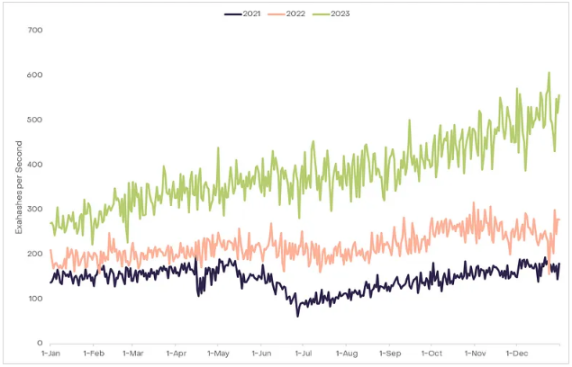

Hash rate reached a historic high in 2023. Source: Glassnode.

Large miners are actively accumulating Bitcoin. According to Taras Kulyk, founder of SunnySide Digital, "the halving has been considered by most companies" because "they have been anticipating and incorporating the halving price into their forecasts for years."

Meanwhile, miners with higher electricity costs and lower equipment efficiency may eventually have to shut down operations, considering their hardware investments and daily expenses. Improving operational efficiency is crucial for continued operation and profitability after the halving.

Methods to improve efficiency include purchasing more advanced equipment, selling held bitcoins on-chain, and issuing equity. For example, Canada-based Hut8 is increasing mining farm efficiency through custom software and hopes to acquire more power plants. After a recent merger with USBTC, its hash rate almost doubled to 7.3 exahashes per second.

Marathon Digital, the top-ranked publicly listed miner based on actual hash rate, launched a $750 million mixed equity offering. Core Scientific recently completed an oversubscribed $55 million equity financing round to restore debt capacity. The company is also focused on keeping its hardware online and fully utilizing available equipment.

However, CEO Adam Sullivan believes the Bitcoin network has a "self-healing nature" and will continue to incentivize miners. As more mining machines shut down and hash rates decrease, the proof-of-work difficulty will also decrease. This can offset the growing speed and fluctuating interest in node operations.

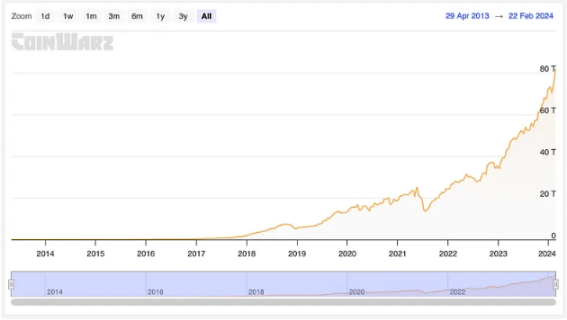

Bitcoin mining difficulty chart. Source: CoinWarz.

Mining difficulty is the moving average of the average block count, and when the block generation speed is too fast, the difficulty increases. Therefore, the network adjusts automatically, releasing larger block shares for those who stay to reward them. For the remaining participants, mining becomes more profitable.

7. Rising Transaction Fees and Miner Income

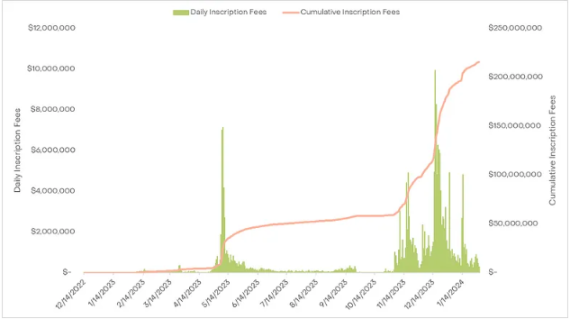

The 2024 halving took place after the launch of Bitcoin Ordinals. This protocol, which supports Bitcoin NFTs, has brought new use cases, driving an increase in transaction fees and developer activity. These effects provide additional reasons for optimism about the profitability and sustainability of mining.

In November 2023, the Ordinals frenzy pushed Bitcoin transaction fees to their highest level in two years (over $37), surpassing Ethereum gas fees. Since then, NFT fees have consistently accounted for over 20% of miner income.

As of February 22, 2024, Bitcoin is one of the top three blockchains in terms of NFT trading volume. In December 2023, it became the leader. Therefore, Ordinals activity is a novel way to incentivize miners with higher transaction fees and maintain network security.

Growth of Bitcoin NFT fees. Source: Glassnode.

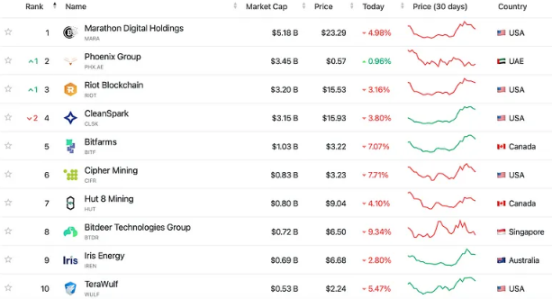

The high transaction fees have led to a surge in the stock prices of listed mining companies. At the end of 2023, these companies saw huge profits as miner income was nearly four times the two-year average level.

Since then, fees have dropped to just over $4. However, mining stocks such as Marathon Digital (MARA) and Cleanspark (CLSK) have outperformed Bitcoin in the past three months, rising by 116.57% and 231.28% respectively. They may also respond positively to stable stock market performance.

Market capitalization of the top ten Bitcoin mining stocks. Source: companiesmarketcap.com

Top Mining Locations

According to data from the World Population Review, the United States led with a 35.4% share of the cumulative hash rate in 2023, followed by Kazakhstan (18.1%), Russia (11.23%), Canada (9.55%), and Ireland (4.68%). China was once the second-largest mining location, but it banned Bitcoin mining in 2021, leading miners to migrate to Kazakhstan.

Concerns about Environmental Restrictions

Bitcoin mining still faces extremely high unsustainability - in 2023, the energy consumed by Bitcoin mining was equivalent to the entire country of Australia, or seven times Google's annual energy consumption (91 terawatt-hours).

In the United States, Bitcoin mining accounts for 0.6% to 2.3% of electricity demand, equivalent to the entire electricity consumption of a state like Utah. Earlier this year, the U.S. Energy Information Administration requested detailed reports on energy usage from all U.S. miners. The agency's report stated:

"Concerns raised by the U.S. Energy Information Administration include stress on the power grid during peak electricity demand, potential increases in electricity prices, and the impact on energy-related carbon dioxide (CO2) emissions."

Major news outlets such as The New York Times have raised concerns about the "public harm" caused by large mining facilities. The Biden administration has a critical stance on cryptocurrencies, and the U.S. Energy Information Administration emphasized that price surges have encouraged more mining activity, leading to increased energy consumption.

Meanwhile, New York has implemented a two-year ban on new mining operations unless they rely entirely on renewable energy. In Texas, miners can receive rewards for reducing operations during periods of high energy demand, as part of a "demand response" program.

8. On-Chain Indicators: Long-Term Positive Signs

Finally, let's take a look at two technical indicators that provide an overall view of Bitcoin and potential price trends.

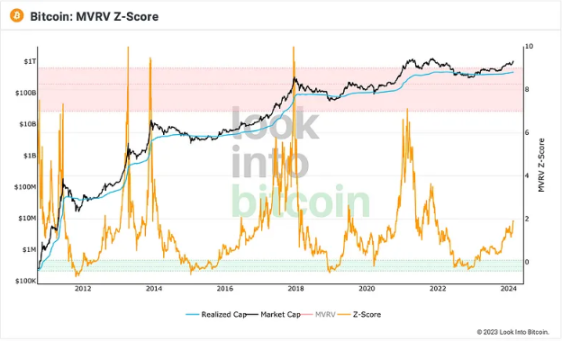

MVRV Z-score

MVRV is an oscillator that compares Bitcoin's market value to its realized value, or its spot price to its realized price. This chart visualizes market cycles and profitability, helping to identify periods when coins are undervalued or overvalued.

Bitcoin's MVRV Z-score chart. Source: lookintobitcoin.com

As the market matures, Bitcoin's peaks, volatility, and returns become less intense. Against the backdrop of increasing adoption of this pioneering digital currency, the growth rate of its realized price has slowed compared to past cycles. Therefore, progressive growth is more likely to occur than explosive surges, with better long-term growth potential.

At the same time, a large portion of Bitcoin has been accumulated by long-term holders. The supply of long-term holders reached a historic high at the end of 2023, and whales continue to show confidence in the asset this month.

9. Power Law Corridor

The Power Law Corridor shifts the focus from the current price to whether Bitcoin is overbought or oversold. This charting tool creates a channel, including lower and upper bounds of the price range.

Breaking above the midline indicates an overbought state, while the opposite indicates an oversold state. Breaking above the bottom line suggests further growth is possible, and Bitcoin typically reaches the midline level within 1-2 months.

Bitcoin 2024 halving price prediction: Power Law Corridor projection as of February 17, 2025. Source: bitcoin.craighammell.com

According to James Bull, an overbought state typically lasts about 1.5 years (a strong bull market), while a massive bear market cycle lasts 2.5 years. However, the model also has its critics. As its creator Harold Christopher Burger stated:

"Recognizing that Bitcoin follows a power law is temporary. In addition to time, there are other factors that should affect the price of Bitcoin, such as its scarcity," but "in the log-log plot, the fit of the power law is getting better, indicating that the model may be valid."

10. Conclusion

Before and after each halving, Bitcoin's price is driven by multiple factors beyond scarcity. The 2024 halving occurred against the backdrop of large-scale Bitcoin ETF inflows, increased on-chain activity, strong momentum, and overall market maturity.

With improvements in the macro environment, including expected Fed rate cuts, Bitcoin seems destined to stand out in the Power Law Corridor. It has endured the longest bear market, and large miners have prepared for the consequences of the halving reward.

Our Bitcoin 2024 Halving Price Prediction

EarnBIT's analysis team believes Bitcoin will rise to $55,000 to $60,000 before the halving, with a full-year range of $32,000 to $85,000. Past performance does not necessarily predict the future, and new black swan events are always possible, but so far, the overall environment seems conducive to growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。