So today, I'm going to write a short article to talk about various U cards and the pros and cons of using U cards, to provide answers for friends who have such questions.

01. What is a U card?

The usage of U cards can be summarized as follows: transfer virtual currency (including but not limited to USDT) from a wallet address to the chain address of a MasterCard, and users can use the card for direct card swiping consumption within China, or directly withdraw RMB from ATMs.

Cardholders can bind payment methods such as Alipay, Meituan, and Ele.me, smoothly using the U card as a payment tool for domestic consumption, without the need to go through the process of exchanging virtual currency for fiat currency through OTC.

According to relevant policies in China, virtual currencies such as Bitcoin are considered a specific virtual commodity and do not have the same legal status as currency. They cannot and should not be used as currency in the market in China. However, the payment method using international U cards seems to magically achieve the equivalence of virtual currency to fiat currency?

In fact, this is not the case. The virtual currency recharged into the U card will be settled as foreign currency by the card's operator. When users use the U card for transactions in China, it is no different from other bank cards with international payment functions, because there are international settlement agreements, and merchants and platforms such as Alipay still charge fiat currency.

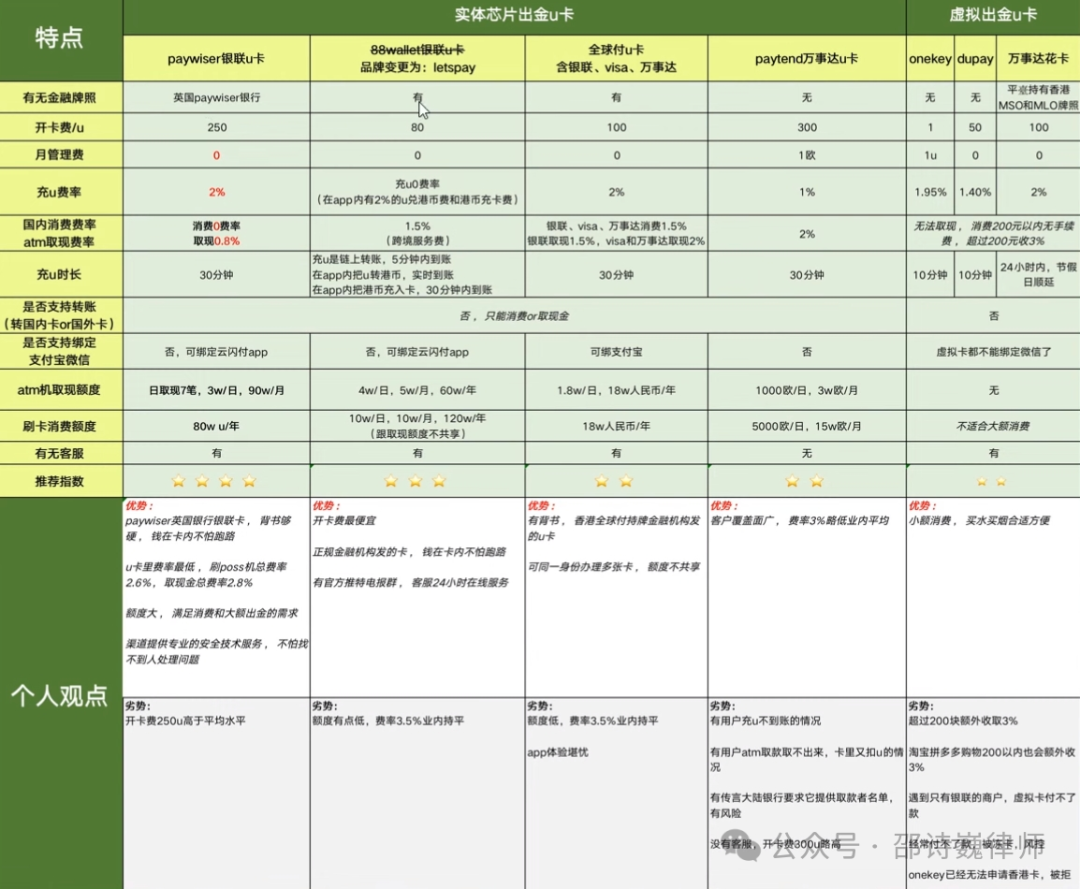

U cards can be physical or virtual, for example, "UnionPay U card" and "MasterCard U card" are physical U cards, while "dupay" is a virtual U card. The fees and usage conditions of various cards are slightly different, as detailed in the following figure.

(Source: Up Dahuaxianyou)

02. Pros and cons of using U cards

1. Can avoid the risk of card freezing

We often say that although buying and selling virtual currencies is not prohibited in China, the risk is indeed quite high, ranging from card freezing to involvement in criminal activities. If you sell U to someone and the funds they transfer to you are proceeds from illegal activities (such as scams or money laundering from online gambling), the probability of the card being frozen is very high.

Therefore, the reason for card freezing is that: first, you are using a domestic bank card, and second, you have received abnormal incoming funds (fiat currency), triggering the bank's risk control system.

However, the U card itself is a foreign bank card, and the funds received in the card are not fiat currency but virtual currency, which has nothing to do with domestic banks, so it will not be frozen.

Some may ask: What if my MasterCard U card receives illicit U? What are the risks? Will it be frozen?

2. What to do if the U card receives illicit U?

With a U card, there is no need to cash out U into fiat currency through OTC, so there is naturally no issue of receiving illicit funds. However, the possibility of receiving illicit U into the card cannot be completely avoided.

But it is important to understand a concept: U itself will not be marked as illicit, only the address will be illicit. If a person uses U for transactions in a case, large exchanges such as Binance and OK will blacklist the addresses involved in the case. If funds received from a blacklisted address are transferred into the U card, the recipient's account will be blocked by the exchange, and the coins in the account can only be received and not withdrawn.

Using a U card to receive U, without going through an exchange, will not trigger the exchange's risk control mechanism. Therefore, receiving illicit U will not affect consumption and withdrawals. Unless the issuing institution of these U cards has related KYT risk control measures (Know Your Transaction, understanding your transactions. KYT is a process used by financial institutions to monitor and track whether there is fraud or suspicious activity in financial transactions, which can help financial institutions identify the source and destination of each transaction, assess transaction risks, take corresponding measures, and report suspicious transactions to regulatory authorities), under this premise, there is indeed a risk of the card being frozen if illicit U is received.

According to online rumors, the People's Bank of China requires international U cards such as MasterCard U cards to provide a list of customers with abnormal withdrawals, but there seems to be no official authoritative announcement.

3. Can using U card transactions avoid criminal risks such as aiding and abetting crimes?

The reason for involvement in aiding and abetting crimes is that one's bank card has received proceeds from upstream criminal activities. So many people believe that if the funds received in the card are U and not fiat currency, there is no criminal risk. But this is not entirely true.

All types of U cards do not support transfers, only consumption or withdrawals, so there is indeed a greatly reduced possibility of illegal transactions involving the transfer of funds upstream and downstream through the U card itself. However, there are still people using U cards for arbitrage: after agreeing on the price difference between U and fiat currency, they use their U card to receive U for others, and the difference obtained from withdrawing from an ATM is their profit. If the received U is proceeds from fraud, the entire chain of transferring the fraud proceeds from ¥ to USDT to the U card and then cashing out to ¥, isn't this aiding and abetting?

Moreover, taking the MasterCard U card as an example, the card issuance fee is 300 U, the monthly management fee is 1 euro, the U recharge fee is 1%, and the ATM withdrawal fee is 2%. With such high costs, why would anyone be willing to give you U to help them cash out, isn't this clearly problematic? This kind of transaction model also advocates subjective ignorance? No lawyer can save you from this.

4. Legal risks of being identified as engaging in illegal foreign exchange transactions

About the legal risks of buying and selling USDT, Lawyer Shao has written several articles to popularize the topic, such as "More U Merchants May Be Charged with Illegal Business Operations", "OTC Merchants' Criminal Risks of Illegal Business Operations", "Beware of Illegal Business Operations When Introducing Others to Buy and Sell Foreign Exchange", and "Convicted of Illegal Business Operations for Helping Others Exchange Foreign Currency", so this article will not elaborate further on this.

In the transaction chain of USDT → transfer to U card → cash out to RMB, if the upstream U is obtained through foreign exchange, there are two scenarios:

① Exchanging RMB for personal use without the purpose of business is an administrative violation. If discovered by the foreign exchange management authority, it will be subject to administrative fines.

② If it involves high-frequency trading with the purpose of profiting from the price difference and transactions with unspecified parties, it will be classified as illegal business operations by the judicial authority.

5. U Card Scams

There is a certain threshold for applying for a U card, so many novices will seek agents. However, the agents are also mixed, and if you unfortunately encounter a scammer, it will be difficult to seek justice. For example, the scammer gives you a second-hand U card, and during the guidance process, the recharge link they provide is actually an authorization. When you recharge a large amount of U into the card, you will find that the U in the card has mysteriously disappeared.

Conclusion

So, returning to the initial question of this article: Can U cards be used? The answer is yes, but only for personal use to cash out the U in hand. It is more like a recharge card for a supermarket, used as needed. If you want to use it for arbitrage or as a tool for foreign exchange, the legal risks arising from this are still very high.

The problem has never been the tool itself, but the people using it.

The domestic U card agency industry also has many problems. For example, promoting the idea that with a U card, your card will not be frozen, or listing the advantages of the card for use by online gambling personnel, individuals subject to card penalties, and public officials trading coins, etc. Such blatant promotion, isn't it waiting for the country to take action?

Lawyer Shao believes that the future lifecycle of U cards in China should not be very long. The reason is simple:

First, it increases the use of virtual currency in China, which contradicts China's long-standing negative attitude towards virtual currency in relevant policies.

Second, the country has been cracking down on "two-card" crimes and conducting "card-cutting" operations for several years. Does this kind of U card agency promotion imply allowing individuals subject to card penalties to use this card?

So, this thing is very easy to be played badly.

It is rumored that several U card projects have been targeted by local police, resulting in issues such as unreceived recharges and inability to withdraw from ATMs, but it is unclear whether this is true or false.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。