News

On March 12th, according to Cointelegraph, the Securities and Exchange Commission of Thailand has amended its rules to allow the launch of private funds investing in Bitcoin spot ETFs traded on U.S. exchanges. However, as reported by the Bangkok Post on March 12th, only institutional investors and "ultra-high net worth individuals" are allowed to invest in these Bitcoin ETF funds.

On March 12th, according to Farside Investors data, the net inflow of Bitcoin spot ETF was $505 million yesterday, with $563 million flowing into BNY Mellon's IBIT and $494 million flowing out of Grayscale GBTC.

On March 12th, according to Lookonchain monitoring, 10 hours ago, a whale once again withdrew 2,050 BTC ($147.67 million) from Kraken. Since March 1st, the whale has withdrawn 10,340 BTC ($742.98 million) from Kraken.

Market Review

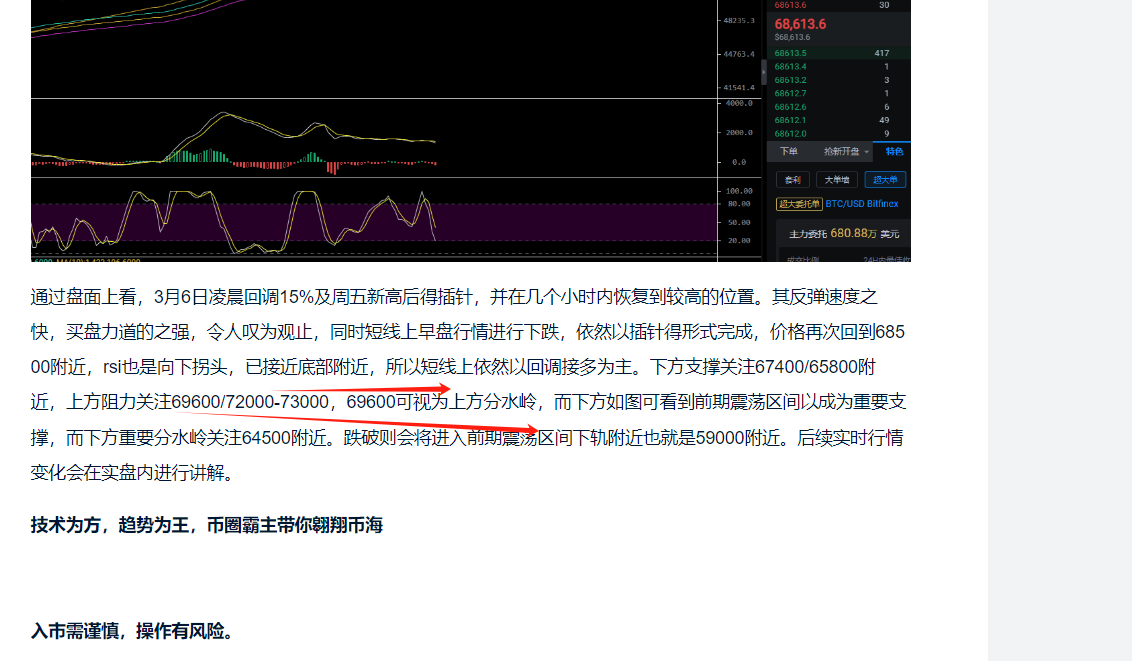

In yesterday's article, it was mentioned that the indicators have bottomed out, and the main strategy is to go long on the rebound. However, there was no rebound yesterday, and the price went up directly, reaching near 72800, which aligns with the breakthrough near 69600 and reaching the 72000-73000 range as mentioned in my article, yielding a profit of two to three thousand points. Currently, the market continues to oscillate at high levels. How should we operate?

Market Analysis

Macro Analysis: In terms of funds, the market value of stablecoins has not shown a more significant growth compared to the previous bull market, and its growth momentum is gradually slowing down. In addition, the market funds are limited, and the leverage effect has led to a clear rotational market. Therefore, we have not yet seen the clear characteristics of the acceleration phase in the bull market. There are only 37 days left until the halving event, which will lead to old mining machines with insufficient computing power facing shutdown issues. At the same time, the current mining landscape has changed significantly compared to the last halving. It is currently difficult to determine whether miners will adopt a strategy of dumping to acquire mining machines at low prices. After all, ETFs often engage in bottom fishing, increasing the risk of dumping. It is worth noting that the BTC market value ratio still remains at 51%, indicating that funds have not yet flowed significantly into the altcoin market. This further proves the point that the bull market has not yet arrived. Therefore, it is currently a good time to layout altcoins. In summary, the current market is in the transition phase from the early bull to the middle bull, and factors such as fund flow, mining landscape, and the emergence of new projects collectively influence the market direction. When laying out investments, investors should fully consider these factors in order to better seize market opportunities.

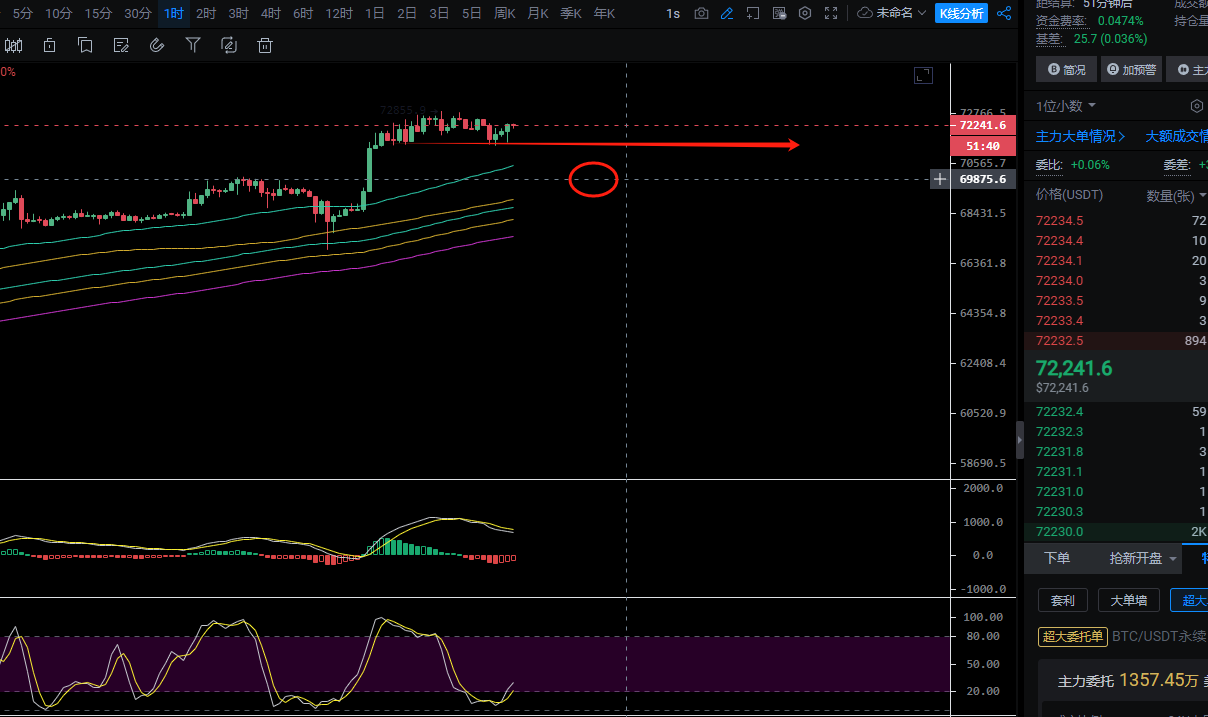

As shown in the chart, after breaking through the new high yesterday, it has been oscillating around 72600-71300 for a night. There has been no breakthrough in either direction, but it is worth mentioning that the short-term upward trend is very strong, and any slight dip is immediately bought back. This indicates the strength of short-term buying. Therefore, the main strategy is still to go long on the low side. As long as it does not fall below around 69000, a rebound can be used for long positions. The key support below is around 71300/70000. The upper resistance is around 73000. Stabilizing at 73000 can lead to 75000. Subsequent real-time market changes will be explained in the actual trading.

Historically, Bitcoin has basically doubled after breaking through the new high. I have collected the doubling time for you.

2013.3: 18 days

2013.11: 10 days

2017.3: 84 days

2020.12: 18 days

2024.3: You fill in.

In the previous article, it was emphasized that there will be no black swan events at the macro level, so don't be afraid to be bold. As for Ethereum, there is not much to say. The dominance of Bitcoin has always remained high, and funds have not yet flowed out, so it will be dragged along by Bitcoin. Yesterday, it also reached the resistance level mentioned in previous articles at 4070, which was very effective. Once it stabilizes, it can go to 45000. Please use your own judgment.

Technology is the method, and the trend is the king. The dominant force in the coin circle will guide you through the sea of coins.

Enter the market cautiously, as there are risks in operations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。