消息面

据 Farside Investors 监测,美国比特币现货 ETF 自推出以来累计净流入 145.62 亿美元。其中:贝莱德 IBIT 累计净流入 176.43 亿美元;富达 FBTC 累计净流入 91.52 亿美元;灰度 GBTC 累计净流出 183.6 亿美元。

据 The Block 数据,截至 6 月 20 日,灰度以太坊信托 (ETHE) 负溢价率现报 1.71%。BlockBeats 此前报道,6 月 19 日,彭博 ETF 分析师 James Seyffart 在社交媒体发文表示,预计以太坊现货 ETF 将于 7 月 4 日前推出。

26 月 23 日,据 Scam Sniffer 监测,5 小时前,一名用户因为签署了多个 Permit 网络钓鱼签名而损失价值 1100 万美元的 aEthMKR 和 Pendle USDe 代币。

行情回顾

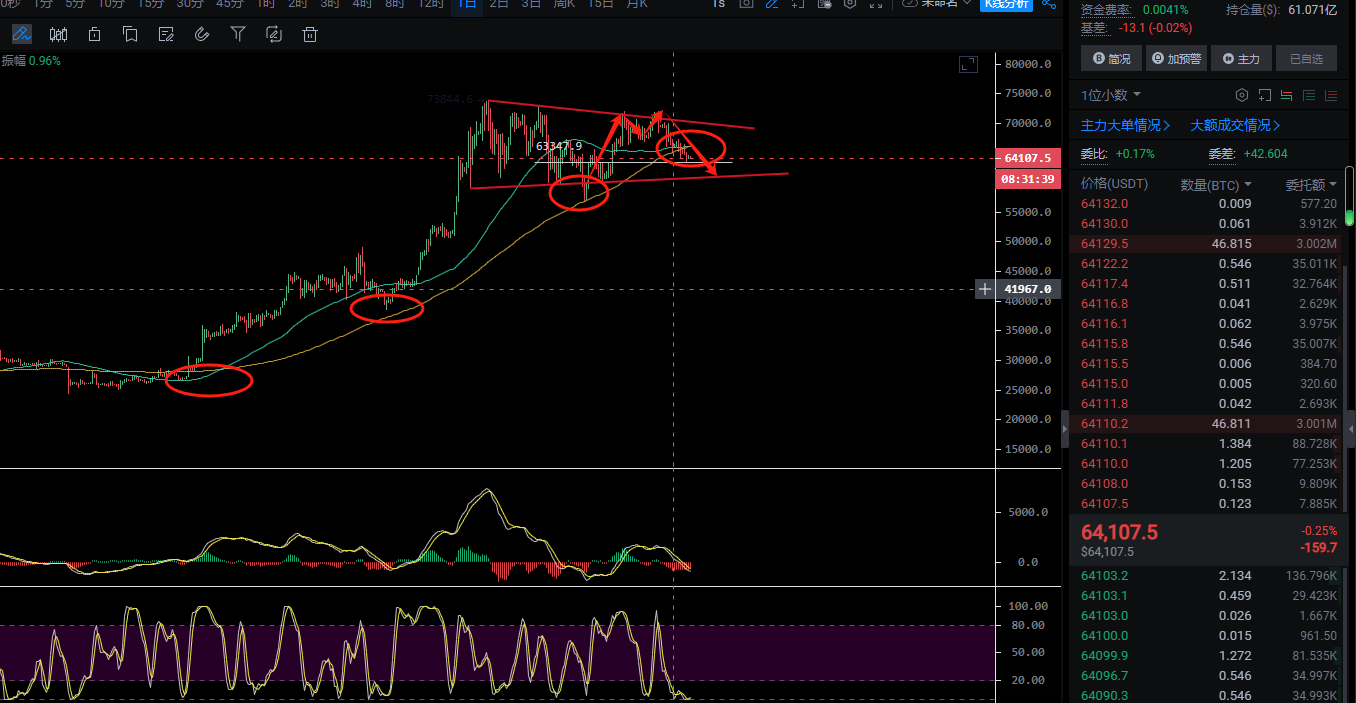

在18号文章中讲到,大饼跌破ma120均线,如果24小时内无法收复则预计三个月震荡将会向下跌破,同时给到的阻力也是实时到达,截止于周末最新的低点也是在63300附近出现反弹,目前周末在64200附近震荡。而以太方面前期反抽比较猛导致止损,但并不影响后续同大饼一起跳水的走势。整体上短期跌破均线后,向下延续一段后经过周末震荡后注意周一开盘可能会出现一定的反抽。

行情分析

首先,与之前通胀变化带来的比特币 ETF 的积极买入相反,比特币 ETF 在过去八个交易日内抛售了 10 亿美元的资产。其次,比特币矿工的场外销售额增长至自 3 月以来的最大单日交易量,一天内销售量突破 3, 200 枚比特币。已上市的矿企占据 3% 的市场份额,但在 5 月净卖出了 8, 000 枚比特币(6 月数据尚未公布,但矿工的卖出量显著增加)。矿工的比特币储备从 6 月 5 日的 1290 亿美元下降到现在的 1180 亿美元。最后,另一卖家群体是比特币早期持有者,他们的卖出金额为 12 亿美元。以上三者似乎都对以 70, 000 美元以上的价格卖出比特币感到满意。预估比特币 ETF 的平均入场价格为 60, 000 美元到 61, 000 美元,价格回到这个水平可能会导致一波清算。而当比特币在 5 月 2 日跌至 56, 500 美元时,贝莱德发表声明,称「主权财富基金和养老金基金即将入场」。这在一定程度上阻止了比特币的进一步下跌,但现在,贝莱德表示他们的比特币 ETF IBIT 有 80% 的购买量来自散户而非机构。目前, 61, 000 美元的价格水平与 21 周动态平均线一致,而在之前的周期中,这一指标在买入(比特币价格高于 21 周动态平均线)或卖出时都是很好的风险管理指标。我们预估 145 亿美元的比特币 ETF 中有 30% 的资金来自寻求套利的对冲基金,而八个交易日的 ETF 清算表明,这些基金可能没有在期货到期日(6 月 28 日)临近时延续套利交易(做多 ETF 对做空 CME 期货),因为套利机会已经消失。

由于套利(资金费率)的吸引力减弱,这次比特币 ETF 的购买量未能实现增长。当美国证券交易委员会(SEC)在 5 月 20 日暗示以太坊 ETF 可能获批时,随着期货头寸的增加,市场结构得到了大幅改善。在三周左右的时间内,市场购买了 44 亿美元的以太坊期货头寸(增幅达 50% )和 30 亿美元的比特币期货。结合 5 月 15 日的 CPI 数据,这有效地改善了市场结构并帮助比特币价格回升至 70, 000 美元,早期持有者、矿工和 ETF 因而主动选择卖出比特币持仓。

从日线级别上可以看到,目前行情已经跌破这段上涨趋势线也就是ma120这个条均线,这个位置在跌破前走的非常纠结。但最终还是选择向下,这种趋势的选择短期是无法改变的。周五的下跌一度打到63300附近,四小时出现了止跌迹象不跌破新低的情况下,可以开多尝试一波反抽,反抽目标看65000-65200及66100附近。若走出反抽试探,则将是二次卖点。最次也将跌到62400附近,然后60650,强势则一举破6万,在57000/54300寻找支撑。以太方面同步进行,一旦以太在下跌趋势前面,出现补涨跳起来空就完了。

总结一句,日线开盘价无法重回65000则下跌趋势线不变,本季度将持续震荡下跌。预计周一开盘先涨后跌,自行操作。行情波动较慢,文章更新会随行情而动。

入市需谨慎,操作有风险。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。