Author: LD Capital

The 2024 NVIDIA GTC conference will be held in San Jose, California, USA from March 17th to 21st. NVIDIA's CEO, Jensen Huang, will deliver a speech titled "Don't Miss the Transformational Moment of Artificial Intelligence" and expand the event to include over 900 inspiring conferences, 300 exhibitions, 20 technical seminars covering generative AI, and numerous social activities. This conference will once again focus global attention on hot areas such as AI, metaverse, and semiconductors, causing various AI-related encrypted targets to rise in advance. Since the preliminary formation of the AI track in the encrypted world in 2023, various AI targets in 2024 will become one of the main themes for speculation and investment throughout the year. This article will provide a quick overview of some AI encrypted projects worth paying attention to.

I. Personality Verification

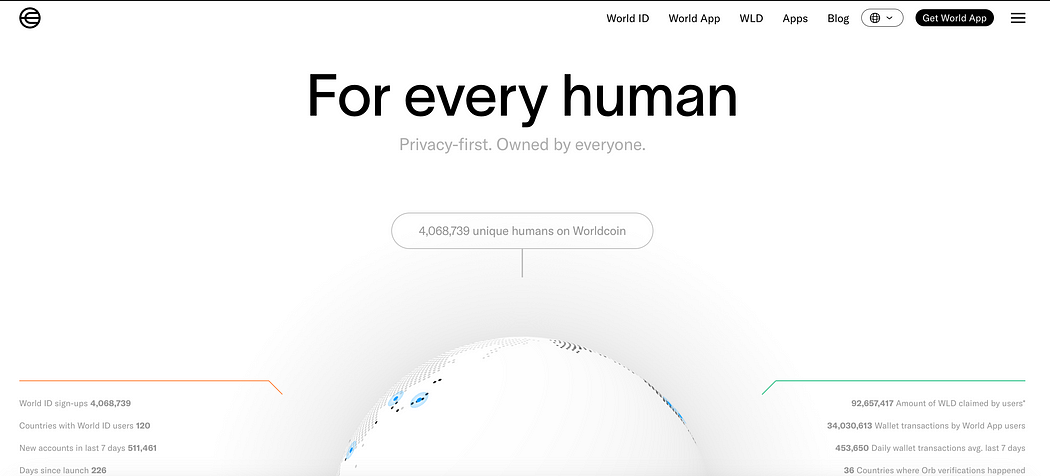

Worldcoin (WLD):

Introduction:

For the consideration of personality verification and economic rights protection in the AI era, Sam Altman, the founder of OpenAI, established Worldcoin in 2020. Worldcoin's vision is to build the world's largest and fairest digital identity and digital currency system. It achieves identity authentication by scanning the irises of every person on Earth, creating a human passport for the Web3.0 era.

Team and Investment:

Sam Altman, the founder of OpenAI, is a co-founder of Worldcoin, and Alex Blania, the CEO and co-founder of Worldcoin, previously served as a researcher at the California Institute of Technology's Institute for Quantum Information and Matter.

Investment institutions include a16z Crypto, Coinbase Ventures, Multicoin Capital, Blockchain Capital, and other top VCs.

Token Situation:

WLD's current market value is $15.6 billion, with a fully diluted valuation of $105.4 billion, a total supply of 10 billion tokens, and a current circulation of 1.47%. The main exchanges for trading are Binance, OKX, and Bybit.

The token release rate is 3.19 million tokens per day, increasing to 6.61 million tokens per day starting in 2024. The current chip structure can be divided into three parts: a portion released to regular users, which is difficult to form a synchronous large-scale selling pressure in the community; a portion provided to liquidity providers, with the new liquidity provider terms that took effect in December 2023 lending 10 million tokens to liquidity providers for a period of 6 months, positively impacting the token price. The final portion is for large holders, who accumulated a significant number of chips when the token price was around $2.

Although the market has been wary of WLD's fully diluted valuation, the current circulation is the more important basis for judgment. In the context of the AI boom, when the speed of forming consensus exceeds the speed of release (selling), it will truly drive the token price up.

Sector Summary:

Compared to other targets, Worldcoin (WLD) monopolizes the AI identity verification track. With the rapid development of AGI, there are not many solutions available to humans for identifying human access, preventing adversarial machine learning, and integrating ZKML. Worldcoin (WLD) has a grand narrative and imaginative ceiling. In addition, Sam Altman, as a leading figure in the AI industry and the "new king of Silicon Valley," has brought positive news to AI projects in the encrypted world with every favorable development of OpenAI. However, traditional financial market investors cannot participate in investments related to OpenAI and its upstream and downstream investments. Sam's establishment and investment in encrypted projects may become the most direct way to participate. Another project he invested in, Arkham (ARKM), will be introduced in the fifth chapter of AI application software.

II. Decentralized Computing Power

Render Network (RNDR)

Introduction:

Render Network is a decentralized GPU rendering platform that enables artists to expand GPU rendering work to high-performance GPU nodes around the world on demand. Through a blockchain marketplace for idle GPU computing, the network provides artists with the ability to expand next-generation rendering work at a fraction of the cost and with significantly improved speed compared to centralized GPU clouds. It aims to provide nearly unlimited decentralized GPU computing power for next-generation 3D content creation.

Since the second half of 2023, Render Network has expanded GPU computing to fields such as AI and ML. To date, Render Network has partnered with four computing clients to provide distributed GPU resources: IO.Net, Beam, FedMl, and Nosana.

At the upcoming 2024 GTC conference, Render Network's founder, Jules Urbach, will attend and deliver a speech on "The Future of Rendering: Real-time ray tracing, artificial intelligence, holographic display, and blockchain."

Team and Investment:

The founder of Render is Jules Urbach. Jules set the strategic vision for OTOY and is the chief architect of the company's technical roadmap. With over 25 years of industry experience, he is widely acclaimed as a pioneer in computer graphics, streaming media, and 3D rendering. He created his first game at the age of 18 and went on to create the first 3D video game platform on the internet, licensing the software to Macromedia, Disney, Warner Bros., Nickelodeon, Microsoft, Hasbro, and AT&T.

Render Network's parent company is OTOY, Inc., founded in 2008, and has since become a leading cloud graphics company. Its pioneering technology is redefining content creation and delivery for media and entertainment organizations worldwide. OTOY has won an Academy Award, and its technology is used by leading visual effects studios, artists, animators, designers, architects, and engineers.

Render Network, headquartered in Los Angeles, California, has a global team and a world-class advisory board, including industry leaders such as Ari Emanuel (WME Co-CEO), JJ Abrams (Bad Robot Productions Chairman and CEO), Mike Winkelmann (Beeple), and Brendan Eich (WME Co-CEO). It has excellent team strength, a successful track record, and industry resources.

Render Network has also received support from top capital, including Multicoin Capital, Alameda Research, Solana Ventures, and LD Capital.

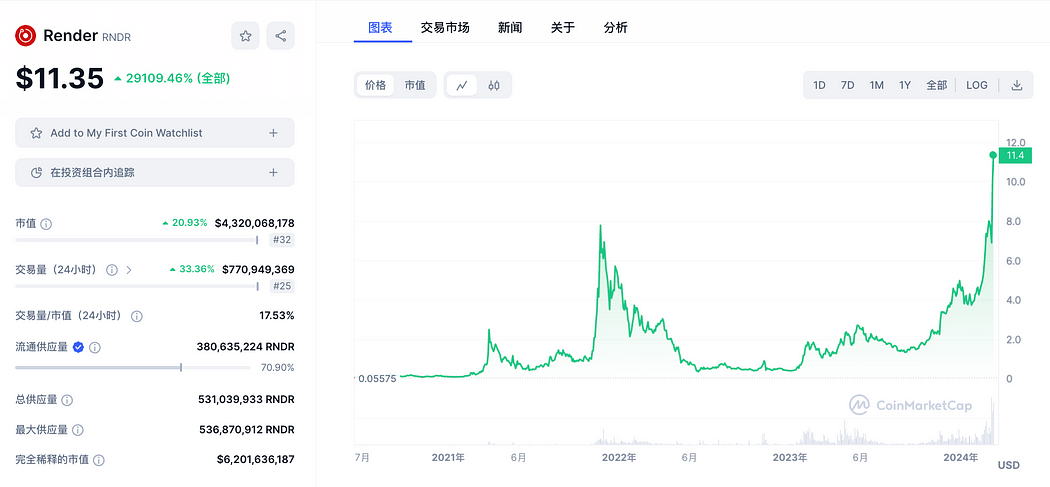

Token Situation:

RNDR's current market value is $4.32 billion, with a fully diluted valuation of $6.2 billion, a maximum supply of 546 million, and a current circulation of 70.48%. The main trading markets are Binance, Coinbase, OKX, and other mainstream exchanges. The balanced and minting model (BME model) proposed in the RNP001 proposal from Render Network has been formally approved and implemented. With Render Network's leading development, RNDR has the potential to become a deflationary asset. In the case of strong network utilization and growth, the token may continue to achieve strong price growth.

Akash Network (AKT)

Introduction:

Akash Network is an open network and cloud computing marketplace that builds a market for computing-related resources, providing resources such as CPU, storage, TLS, IP, and GPU. Akash's blockchain is built on the Cosmos SDK application. The cost of hosting applications with Akash is approximately one-third of the cost of Amazon AWS, Google Cloud Platform (GCP), and Microsoft Azure.

In the second half of 2023, Akash Network launched an AI super cloud and entered the AI computing market. The network now supports NVIDIA GPUs and may choose other GPUs such as AMD in the future. It has successfully hosted NVIDIA H100 and A100, as well as a range of consumer-grade GPUs. Access to consumer-grade GPUs is one of the unique features of the Akash super cloud. Akash Network can currently support basic AI model training using its network.

Team and Investment:

The co-founder and CEO of Akash Network is Greg Osuri, with a background in cloud architecture and entrepreneurship dating back to 2008. Adam Bozanich, co-founder and CTO, is a senior professional in the field of software engineering.

Investors disclosed to date include D1 Ventures and GenBlock Capital.

Token Situation:

AKT's current market value is $1.429 billion, with a fully diluted valuation of $2.416 billion, a maximum supply of 388 million, and a current circulation of 59.14%. The main trading venues are Kucoin, Kraken, Osmosis, etc. Coinbase has included Akash Network (AKT) in its asset listing roadmap as of February 27, 2024.

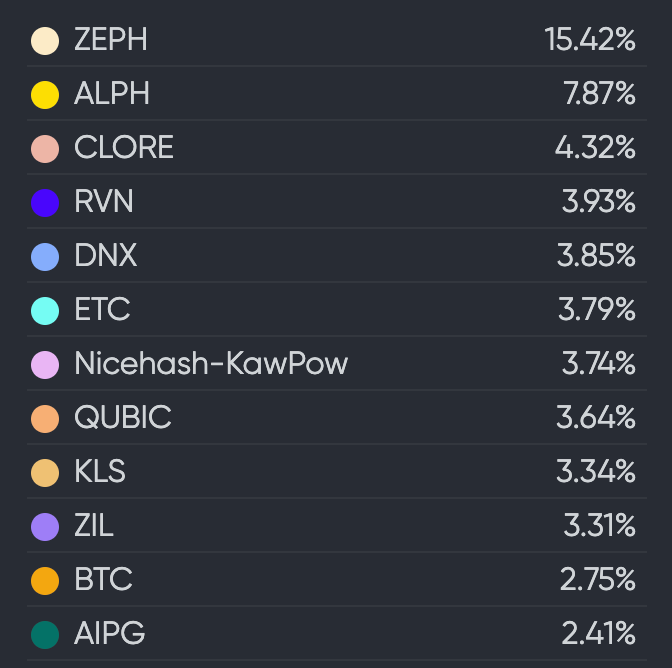

Clore.AI (CLORE)

Introduction:

Clore.AI is a platform that provides GPU computing power rental services based on POW. Any modern computer/server equipped with an NVIDIA GPU can access the network, with over 5500 GPUs currently connected. Its business scope includes AI training, movie rendering, VPN, and cryptocurrency mining. The platform allocates tasks when there is a specific need for computing power. If there is no need for computing power, the network finds the cryptocurrency with the highest mining profitability at that time and participates in mining. The team is based in Europe and claims to strictly comply with European laws to ensure the legality and reliability of the project's operations.

Specific GPU models, configurations, and rental prices can be viewed on the official website. Those providing computing power can receive CLORE tokens as rewards, with better server performance resulting in higher rewards. Those using computing power can pay with CLORE, BTC, or USD.

Since the LD report recorded the computing power from November to the present, there has been a significant increase in the data observed on the Hiveon platform, with the share increasing from 3% to 4.32% and the ranking rising from 11th to 3rd.

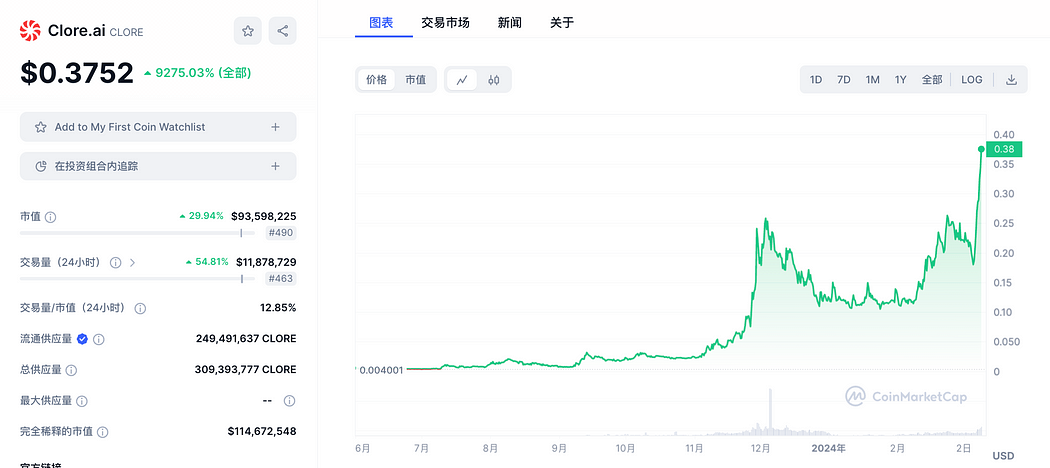

Token Situation:

CLORE's current market value is $93.59 million, with a fully diluted valuation of $114 million, a total supply of 1.3 billion tokens, and a current circulation of around 250 million. The main trading markets are Mexc, Gate, Bitget, etc. It is a POW token that uses the kawpow algorithm and is resistant to ASIC mining. The token has no pre-mining or ICO, with 50% of each block allocated to miners, 40% to lessors, and 10% to the team.

Sector Summary:

With breakthroughs in AI represented by ChatGPT and Sora, the demand for computing power for AI training and inference will enter a new era in terms of scale and quality. GPUs and computing power will become indispensable in the AI field, and related projects are worth focusing on and are likely to develop rapidly. High-quality projects that have not yet been launched include io.net, GPU.net, Aethir, etc.

III. AI Infrastructure

Bittensor (TAO)

Introduction:

Bittensor is an open-source protocol that supports blockchain-based machine learning networks. Machine learning models collaborate for training and are rewarded in TAO based on the value of information they provide to the collective. TAO also grants external access, allowing users to extract information from the network and adjust their activities based on their needs.

For Bittensor, the project itself does not compute or provide data for on-chain machine learning. Instead, it mobilizes all off-chain AI models to collaborate. In simple terms, Bittensor does not produce algorithms but acts as a carrier for algorithms.

Team and Investment:

Bittensor was founded by Jacob Robert Steeves, who was previously a software engineer at Google. Co-founder Ala Shaabana was previously an assistant professor at the University of Toronto and a postdoctoral researcher at the University of Waterloo, graduating from McMaster University. James Woodman is the Chief Operating Officer of Bittensor and previously worked in business development at GSR.

According to official documents, Bittensor had a "fair launch" in 2021 (no pre-mined tokens), and the token is called TAO. The fair launch means there were no common practices such as VC rounds, private rounds, ICO/IEO/IDO, foundation reserves, etc., making it a purely mined coin. The official website of Bittensor disclosed well-known investors and market makers such as DCG, GSR, Polychain Capital, and Firstmask. The involvement of investors may include large institutions acting as validator nodes or even miners, participating in TAO mining, or institutional coins mined by Bittensor can be owned and then distributed to market makers for market making.

Token Situation

TAO has a market value of $4.59 billion, a fully diluted valuation of $15.123 billion, a maximum supply of 21 million, and a current circulation rate of 30.36%. The issuance is halved every four years. The main trading markets are Gate, Kucoin, and Mexc, and the token has not yet been listed on major CEX.

TAO mines approximately one block every 12 seconds, with each block rewarding miners and validators with 1 TAO. According to the current inflation schedule, this will result in the issuance of 7,200 new TAO into circulation every 24 hours, distributed on average by miners and validators (including stakers).

A large number of tokens are currently in a staked/delegated state, with the largest address holding 250,000 tokens, all of which are in a delegated state. The top 20 addresses collectively hold over 1.7 million tokens, and the largest freely held addresses are 209,000 and 48,000, totaling 250,000. Currently, 6.37 million tokens are in circulation, with the top 20 addresses holding 27% of the circulating supply. Token staking does not have a lock-up period and can be unstaked at any time. However, due to the high returns, good market expectations, and the low cost for early stakers, there may not be a large-scale unstaking during a market uptrend. Looking at the on-chain addresses and historical price trends, TAO's large token holders are concentrated, leading to significant price increases, making it an obvious strong coin.

Livepeer (LPT)

Introduction

Livepeer is a decentralized video streaming network built on Ethereum, providing a scalable platform-as-a-service for developers who want to add real-time or on-demand video to their projects. Livepeer can increase the reliability of centralized broadcast service video streams while reducing associated costs by up to 50 times. After OpenAI released Sora on February 16, Livepeer announced that as part of the AI video plan, the community is working to introduce these features into the Livepeer network in the coming months.

Team and Investment

The co-founder and CEO of Livepeer is Doug Petkanics, who previously co-founded Wildcard Inc and Hyperpublic (acquired by Groupon). He holds a degree in computer science from the University of Pennsylvania. Eric Tang is a co-founder and core developer of Livepeer, having previously founded Wildcard and served as the president of the Carolyn Faye Kramer Fan Club.

Investors include DCG, Pantera Capital, Coinbase Ventures, CoinFund, Tiger Global, and others.

Token Situation

LPT has a market value of $797 million, and the token is currently fully in circulation. The main trading venues are Binance, OKX, and Coinbase.

In Livepeer, new tokens are minted and distributed to delegators and orchestrators in each round. Here, rounds are units measured in Ethereum blocks, with one round equal to 5760 Ethereum blocks. The average block time in Ethereum is 14 seconds, meaning a round lasts approximately 22.4 hours, and the inflation rate automatically adjusts based on the staking rate.

Numbers Protocol (NUM)

Introduction

Numbers Protocol is building a decentralized image network to create community, value, and trust for digital media. Its digital protocol redefines digital visual media as assets for registering and retrieving images and videos in the digital network. The Numbers blockchain is dedicated to supporting the entire lifecycle of modern digital assets through additional smart contract support, including NFT minting, royalty distribution, and more.

On February 6, Numbers Protocol announced its selection for the Google News Digital Transformation Program.

Team and Investment

The founder and CEO of Numbers is Tammy Y, who holds a Ph.D. in particle physics and has educational experience from National Taiwan University and the University of Manchester.

Investors include Protocol Labs, Binance, Race Capital, YouTube, and Twitch.

Token Situation

NUM has a current market value of $120 million, with a fully diluted valuation of $205 million. The maximum supply is 1 billion, and the current circulation is 58.77%. The main trading venues are Kucoin, Gate, and Pancake. The token was issued in November 2021, and the price has been declining. However, the recent release of favorable cooperation resources from Web2 and the increasing popularity of the data sector indicate that it is a mid-market value target with low-level climbing.

Sector Summary

AI Infrastructure

AI infrastructure is a core component of the AI track in the cryptocurrency market and can be further divided into more specific sectors, such as data protocols including The Graph (GRT) and Ocean Protocol (OCEAN); decentralized storage including Filecoin (FIL) and Arweave (AR); computing networks including Phoenix (PHB); and distributed AI computing networks such as Gensyn. With the rapid development of Web2 artificial intelligence, Web3 infrastructure projects with good resources tend to cooperate with Web2 companies to accelerate their own development and exposure.

IV. AI Agent

Fetch.ai (FET)

Introduction

Fetch.ai creates AI platforms and services that allow anyone to build and deploy AI services on a large scale anytime, anywhere. Its main products include the chat and interaction frontend Delta V, the backend AI agent architecture, AI Engine, AI Agents, Agentverse, and Fetch Network. On March 5th, Fetch.ai announced the launch of the $100 million infrastructure investment project "Fetch Compute," which will deploy Nvidia H200, H100, and A100 GPUs to create a platform for developers and users to utilize computing power, deepening the foundation of the AI economy. Additionally, Fetch.ai will introduce innovative reward mechanisms for its community through this project. Starting from March 7, 2024, users staking Fetch.ai's native token FET will receive Fetch Compute Credits as rewards, which they can use to pay for GPU usage on the Fetch Compute network.

Team and Investment

Humayun Sheikh is the CEO and founder of Fetch.ai and Mettalex, as well as an investor in DeepMind, focusing on AI, machine learning, blockchain, and token-based economies. Edward Fitzgerald is the Chief Technology Officer of Fetch.ai, previously working at Nokia Bell Labs as a researcher in adaptive consensus protocols. Maria Minaricova is the Business Development Director of Fetch.ai's Cambridge Innovation Lab, utilizing AI Agents technology, Web3, and AI/ML tools to develop cutting-edge technology. Fetch.ai's investment institutions include DWF Labs and Outlier Ventures.

Token Situation

FET has a market value of $25.16 billion, a fully diluted valuation of $34.64 billion, and a current circulation of 836 million tokens. The main trading markets are Binance, Coinbase, and Bybit. Following the investment in computing power infrastructure and the expansion of FET's staking and use cases on March 5th, the token price has been on the rise, with potential for further growth if substantial progress is made in the field of computing power.

SingularityNET (AGIX)

Introduction

SingularityNET is an open and decentralized AI service network with the mission of creating a decentralized, democratic, inclusive, and beneficial general AI. Developers can publish their services to the SingularityNET network, and anyone with an internet connection can use these services. Developers can charge for the use of their services using native AGIX tokens. SingularityNET's services can provide reasoning or model training across multiple domains, such as images, videos, voice, text, time series, bio-AI, and network analysis. These services can be simple, such as encapsulating a well-known algorithm, complete end-to-end solutions for industry problems, or standalone AI applications. Developers can also deploy autonomous AI agents that interoperate with other services on the network. For example, they can facilitate trustless and automated transactions through multi-party hosting, publish new AI services and organizations on the blockchain, track successful API calls, and define pricing strategies.

Team and Investment

Ben Goertzel is the founder and CEO of SingularityNET, also serving as the Chief AI Scientist of Hypercycle and the Chairman of the OpenCog Foundation, with degrees from New York University and Temple University. Janet Adams is the Chief Operating Officer of SingularityNET, previously holding operational roles at the Royal Bank of Scotland and HSBC, with degrees from the University of Essex and Imperial College.

The disclosed investment in SingularityNET and Singularity DAO from the investment group LDA Capital amounted to a commitment of $25 million in May 2022.

Token Situation

AGIX currently has a market value of $17.47 billion, a fully diluted valuation of $27.38 billion, a maximum supply of 20 billion, and a current circulation of 63.84%. The main trading markets are Binance, OKX, and Bybit. Over 27.55% of the tokens are accumulated on Binance, with exchanges collectively holding about 40% of the tokens, and the project team holding 6.5% of the tokens. The top 20 large holders of on-chain tokens have engaged in significant wallet accumulation behavior, with no large-scale selling.

Autonolas (OLAS)

Introduction

The Autonolas protocol is a DAO tool based on smart contracts, implementing a mechanism for coordinating, protecting, and managing software code on public blockchain, and providing incentives based on developers' relative contributions to the growth of the Autonolas ecosystem. Autonolas has four core components: multi-agent system architecture, agent service consensus (state-minimized consensus tool), architecture for encrypted native off-chain services (AI agents need to execute off-chain logic to maintain high performance), and on-chain protocols. In simple terms, Bittensor (TAO) aims to unify different algorithms in a consensus network, while Autonolas (OLAS) aims to unify the application modules of different AI agents in a consensus network.

Team and Investment

David Minarsch is the CEO and co-founder of Valory, the parent company of Autonolas. He holds a Ph.D. in Economics from the University of Cambridge, specializing in multi-agent services, and previously served as the head of multi-agent services at Fetch.ai.

David Galindo is the CTO and co-founder of Valory, the parent company of Autonolas. He previously served as the cryptography lead at Fetch.ai and is a member of the EU Blockchain Observatory and Forum expert group, with over 15 years of work experience.

Investors include Signature Ventures, Semantic Ventures, True Ventures, Proof Group, and others.

Token Situation

Based on the data disclosed by the project team, OLAS currently has a market value of $253 million, a fully diluted valuation of $2.857 billion, and a current circulating supply of 47.61 million tokens. The main trading market is on Uniswap, with recent listings on Bitget, and further listings on Dex are expected as the project gains momentum and develops. Previously, issues related to the project team's token selling and centralized token operations led to a lackluster token price. There is a new token staking proposal, and the fundamental outlook remains positive, but continuous monitoring of actual operations and token chip structure is needed.

Summary of Sectors

There are no substantial projects in the AI agent or AGI sector in the cryptocurrency space, and Web2 companies are far ahead in implementing AGI. When researching targets in this sector, it is important to not only track the progress of the projects themselves but also closely monitor the progress of AGI and AI agent in the Web2 tech community, as this will drive the development of cryptocurrency AI projects and token prices.

V. AI Application Software

Arkham (ARKM)

Introduction

Arkham is a cryptocurrency intelligence platform that systematically analyzes blockchain transactions and de-anonymizes them to show users the individuals and companies behind blockchain activities, as well as data and analysis related to their behavior. It has four important modules: Arkham Ultra for synthesizing blockchain data, a frontend display profiler, an information exchange, and a token system.

Team and Investment

Miguel Morel is the current CEO of Arkham and also a co-founder of Reserve Protocol. Alexander Lerangis is the business development director. Investors include Binance Labs, Sam Altman, Tim Draper, and others.

Token Situation

ARKM has a market value of $411 million, a fully diluted valuation of $2.74 billion, a total supply of 1 billion tokens, and a current circulation of 15%. The main exchanges are Binance, Bybit, and Gate.

QnA3.AI (GPT)

Introduction

QnA3.AI is an AI-driven Web3 knowledge platform and research and trading tool, focusing on providing GPT in the Web3 space. It integrates AI question-answering bots, technical analysis bots, and asset trading capabilities into the Web3 world. In January 2023, QnA3.AI launched its mining function, and with the expected airdrop, it aims to significantly increase its user base. QnA3.AI's mining function utilizes idle computing power while browsing the web, and users can participate by installing a Chrome plugin to complete data collection, cleaning, and pre-training tasks in the background, earning QnA3 Credits as rewards.

Team and Investment

Kane is the founder and CEO of QnA3.AI. The team's detailed information has not been publicly disclosed, but based on the resources obtained since the project's development, the team and investment background are relatively strong. QnA3.AI is a project incubated by Binance Labs in the sixth season. In February 2024, it announced an investment from the Solana Foundation to establish a strategic alliance focused on AI and DePIN development. QnA3.AI also announced a new investment from Binance Labs on March 8th. Its products are integrated into the Binance and OKX wallets.

Token Situation

According to the whitepaper, GPT has a total supply of 1 billion tokens, with 10% allocated during the TGE stage: Jumpstart 3%, airdrop 0.5%, Market Maker 3%, and Development 3.5%. Currently, about 65-80 million tokens are in circulation, with a market value of approximately $45.5-56 million.

This concludes the translation of the provided content.

Alethea AI (ALI)

Introduction

Alethea AI is an intelligent and interactive NFT metaverse. As a pioneer of decentralized iNFT protocols, Alethea AI is at the forefront of embedding AI animation, interaction, and AI generation capabilities into NFTs. Community members can create, train, and earn iNFTs in an intelligent metaverse called Noah's Ark. Intelligent NFTs (iNFTs) are a new NFT standard that can create NFTs with embedded AI animation, voice synthesis, and AI generation capabilities.

Alethea AI uses the CharacterGPT feature to generate AI characters, making it the world's first multimodal AI system that can generate interactive AI characters based on natural language descriptions. It allows users to quickly generate interactive artificial intelligence characters with higher fidelity in appearance, voice, personality, and identity. These generated AI characters can be tokenized, customized, and trained on the blockchain to fulfill various roles and tasks.

The development of artificial intelligence is fundamentally changing the way content is created. Large language models such as GPT-3 and ChatGPT, as well as text-to-image models like Stable Diffusion, DALL-E 2, and MidJourney, are now being integrated into Alethea AI's text-to-character image artificial intelligence system.

Team and Investment

Arif Khan is the CEO and founder of Alethea AI. He previously worked at Grab and LinkedIn and served as the Chief Marketing Officer at SingularityNET from 2017 to 2019. He is a graduate of the Singapore Management University.

Alethea AI has received support from top-tier capital firms such as Multicoin Capital, Binance, Crypto.com Capital, LD Capital, and others.

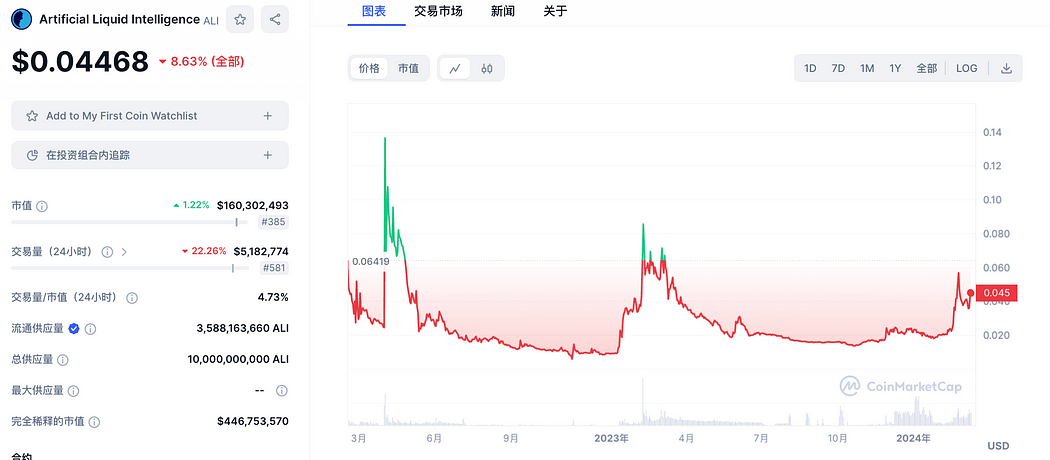

Token Situation

ALI currently has a market value of $160 million, a fully diluted valuation of $446 million, with a maximum token supply of 10 billion and a current circulation of 35.88%. The main trading venues are HTX, Gate, Crypto.com, with potential for further expansion into mainstream DEX platforms.

Sector Summary

The AI application sector has the highest number of projects and is the most tangible sector. It is important to focus on the data behind the projects, their popularity, product experience, and underlying resources when selecting projects. Projects with high AI hype include Sleepless AI (AI), Delysium (AGI), NFPrompt (NFP), and ecosystem application projects such as PAAL AI (PAAL) and ChainGPT (CGPT).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。