Author: MIIX Capital

Preface:

ETFs have driven and dominated the market in February, with market performance revolving around BTC and ETH. Occasional sector rotation has further propelled the comprehensive rise of tokens. Along with the UNI proposal, the long-dormant DEFI sector has also seen a comprehensive rebound; the MEME coin sector has begun to show a new round of wealth creation effects; and the BTC Staking ecosystem has quietly emerged amidst the rise of tokens and market frenzy.

1. Macro Perspective

1.1 Expected US Rate Cut in June, Market Attitude Optimistic

The US Department of Labor reported a significant increase in non-farm employment of 353,000 in January, the largest monthly increase since January 2023, well above the estimated 185,000 and the previous value of 216,000. This strong labor market performance has raised concerns in the market about the possibility of rising inflation, which was subsequently validated in the year-on-year growth data of the Consumer Price Index (CPI) released on February 13, with a 3.1% increase in January, exceeding the market's expected 2.9%.

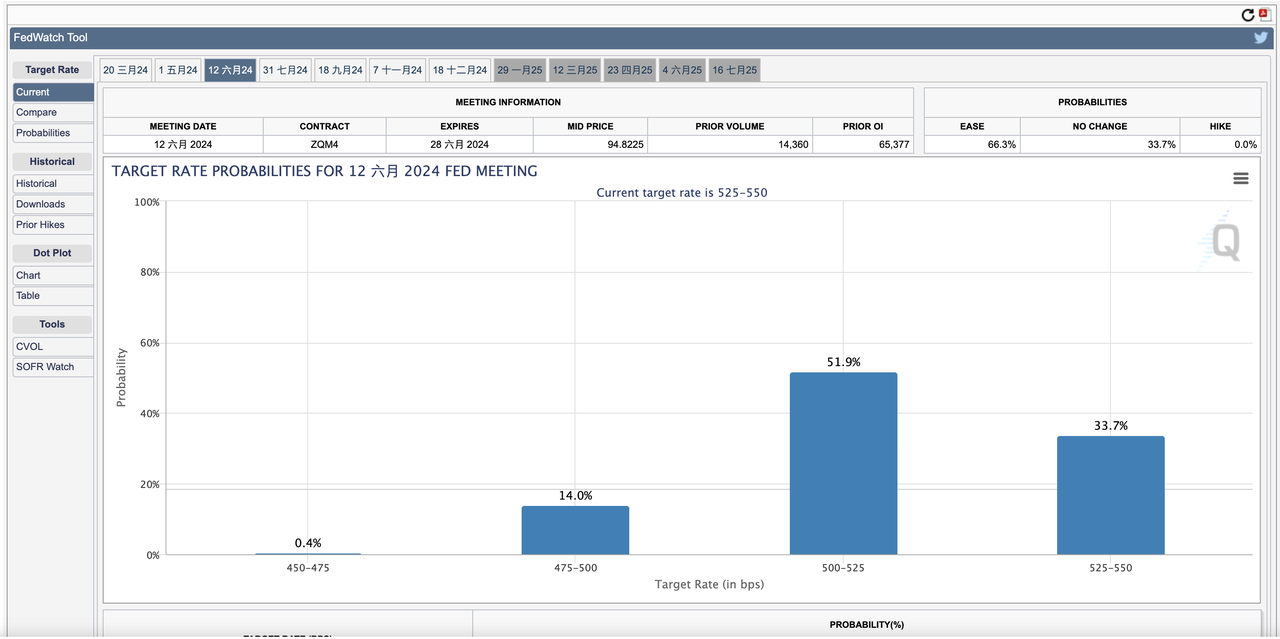

FedWatch

From the FedWatch data, it can be seen that despite previous expectations of a rate cut, the latest data and analysis indicate that the market generally expects the Federal Reserve (Fed) to start cutting rates in June.

In addition, Goldman Sachs has also adjusted its expectations, no longer expecting a rate cut in May, but predicting four rate cuts this year, down from the previous expectation of five. This adjustment reflects a reassessment of the continued growth of the US economy and inflationary pressures in the market.

From the market performance perspective, despite the existence of a certain level of inflation in the current US economy, it has not suppressed the rise of stocks and crypto assets. The market remains optimistic about the subsequent economic development and monetary policy adjustments, expecting the Federal Reserve to find an appropriate balance between controlling inflation and promoting economic growth.

1.2 BTC Rise Mainly Driven by ETFs and MicroStrategy

BTC prices have been soaring, rising continuously from around $43,000 on February 8 to near $64,000, with a staggering increase of 32%.

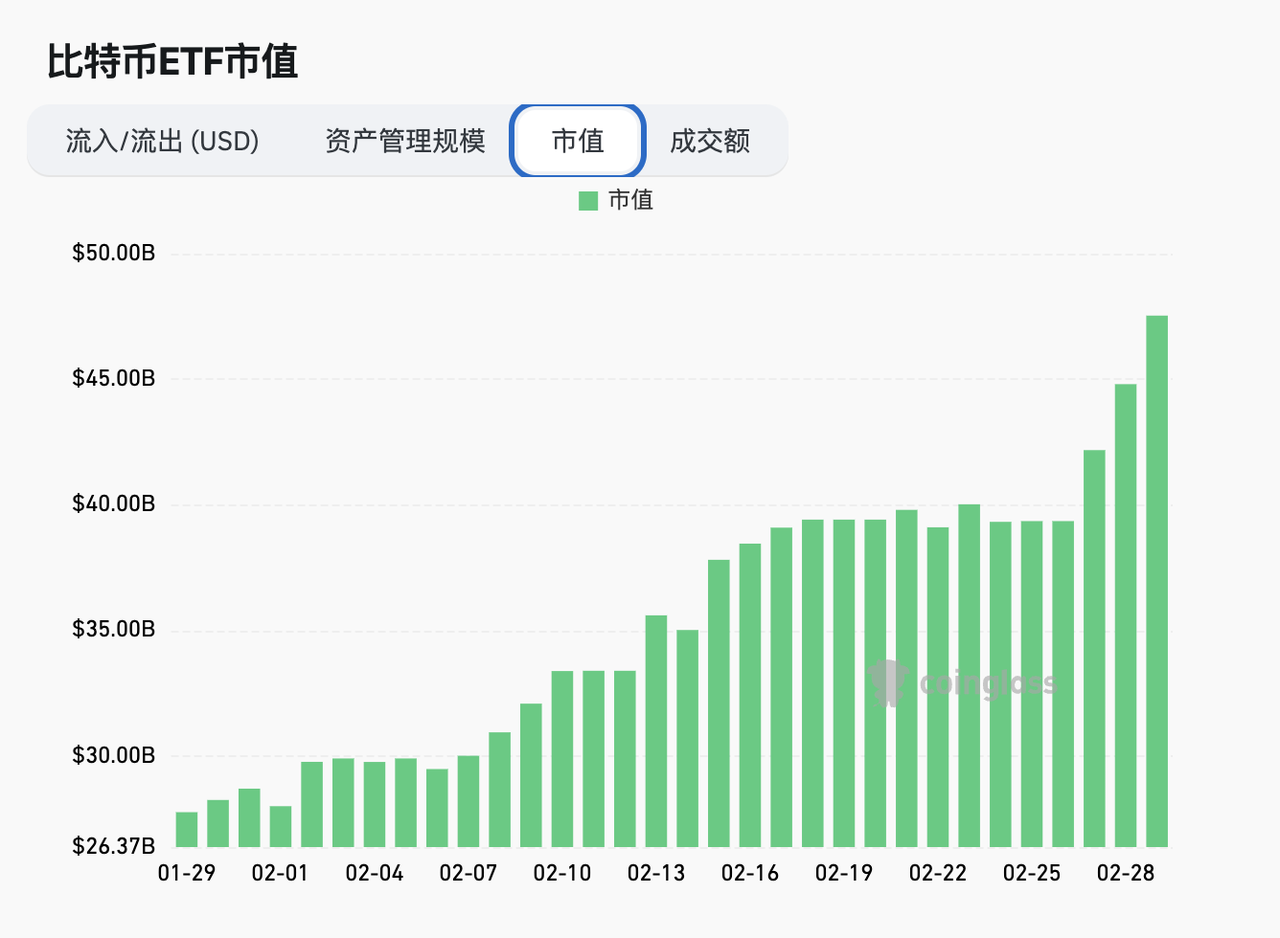

coinglass Bitcoin ETF Overview

From the perspective of ETF inflows, the rise in prices overlaps with the inflow of ETF funds, and the significant role of ETFs in driving Bitcoin prices is evident. As of the 29th, the cumulative managed assets of 11 ETFs had reached $42.238 billion, accounting for 3.81% of the total market value of Bitcoin, exceeding the amount of Bitcoin held by Binance exchange wallet addresses.

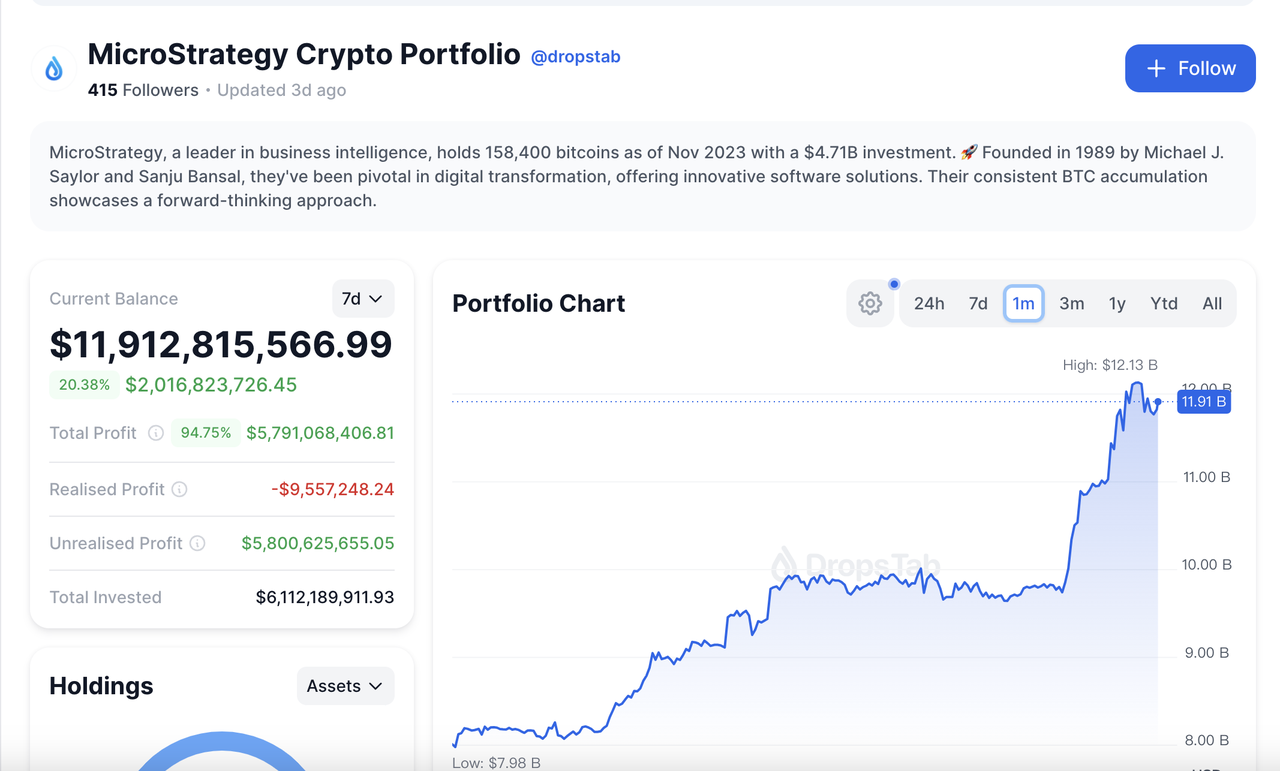

dropstab's MicroStrategy Bitcoin holdings market value position

In addition, MicroStrategy is also a major source of capital inflows in the BTC market. On the 26th, MicroStrategy founder Michael Saylor announced on his social platform that MicroStrategy had purchased 3,000 bitcoins at an average price of $51,813 from February 15 to 25. With this, MicroStrategy now holds 193,000 bitcoins, with assets reaching a high of $11.9 billion.

1.3 ETH Spot ETF Becomes the Next Market Focus

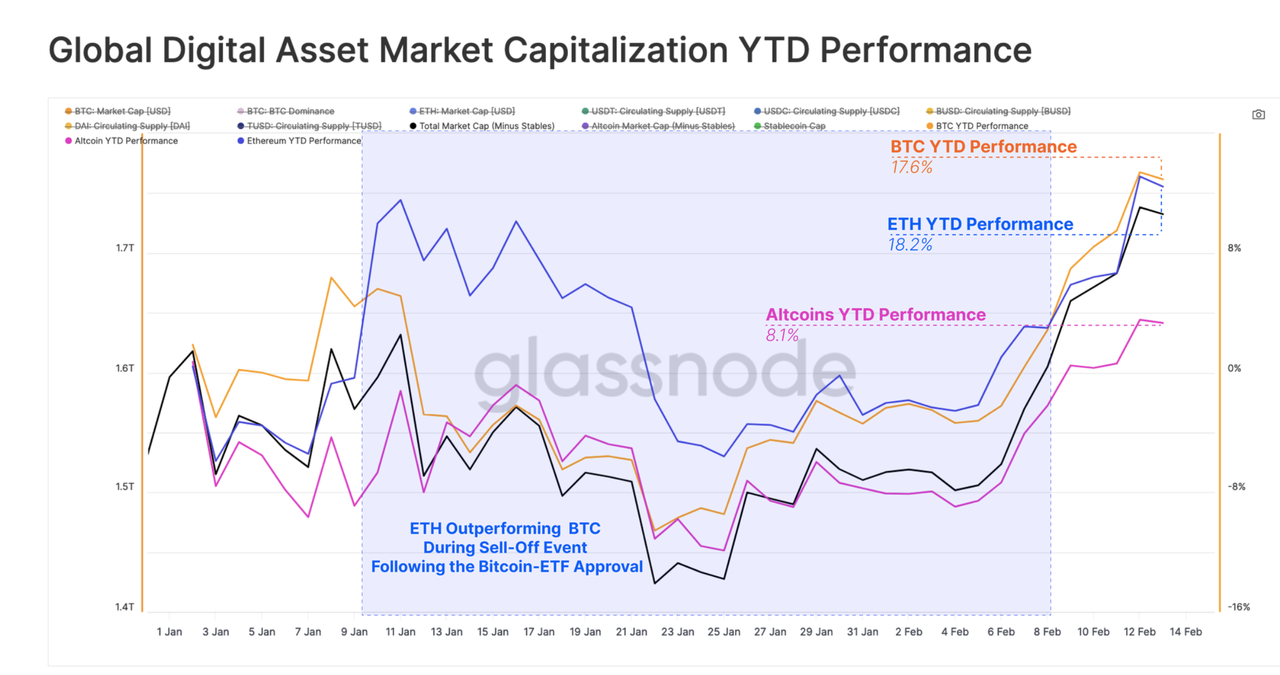

glassnode's global digital asset market performance since the beginning of the year (Year-To-Date, YTD)

The approval of BTC spot ETFs has injected great confidence into the market. Therefore, the timing of the launch of ETH spot ETFs has become one of the current market focuses. Meanwhile, the rise of ETH has also begun to lead beyond BTC, and the market is starting to shift its focus to ETH. The most important date currently is May 23 (the date of the SEC's final decision on VanEck's ETH spot ETF). If the subsequent ETH spot ETF can also be approved, it represents another great victory for the crypto market. More traditional investors can participate in the ETH market through ETFs, introducing new funds into the crypto market.

At the macro level, despite the challenge of rising inflation, the market performance in February was unaffected and continued to reach new highs under the strong push of ETF funds. Currently, the market is more concerned about the delay in the timing of rate cuts rather than the possibility of further rate hikes. As the selling pressure from grayscale investments gradually diminishes, we will continue to monitor the inflow of funds into the market and observe whether BTC can continue to create new historical highs.

2. Industry Data

2.1 Market Cap & Ranking Data

The 30-day gains of BTC and ETH this month are both close to 50%. The main reasons are the actual inflow of funds from ETFs and the expected push from ETH ETFs. However, for ETH, the market has not yet seen a significant market reaction to the speculation surrounding the Dencun upgrade on March 13. As for the timing of the approval of ETH spot ETFs, the market currently predicts it will be before May 23.

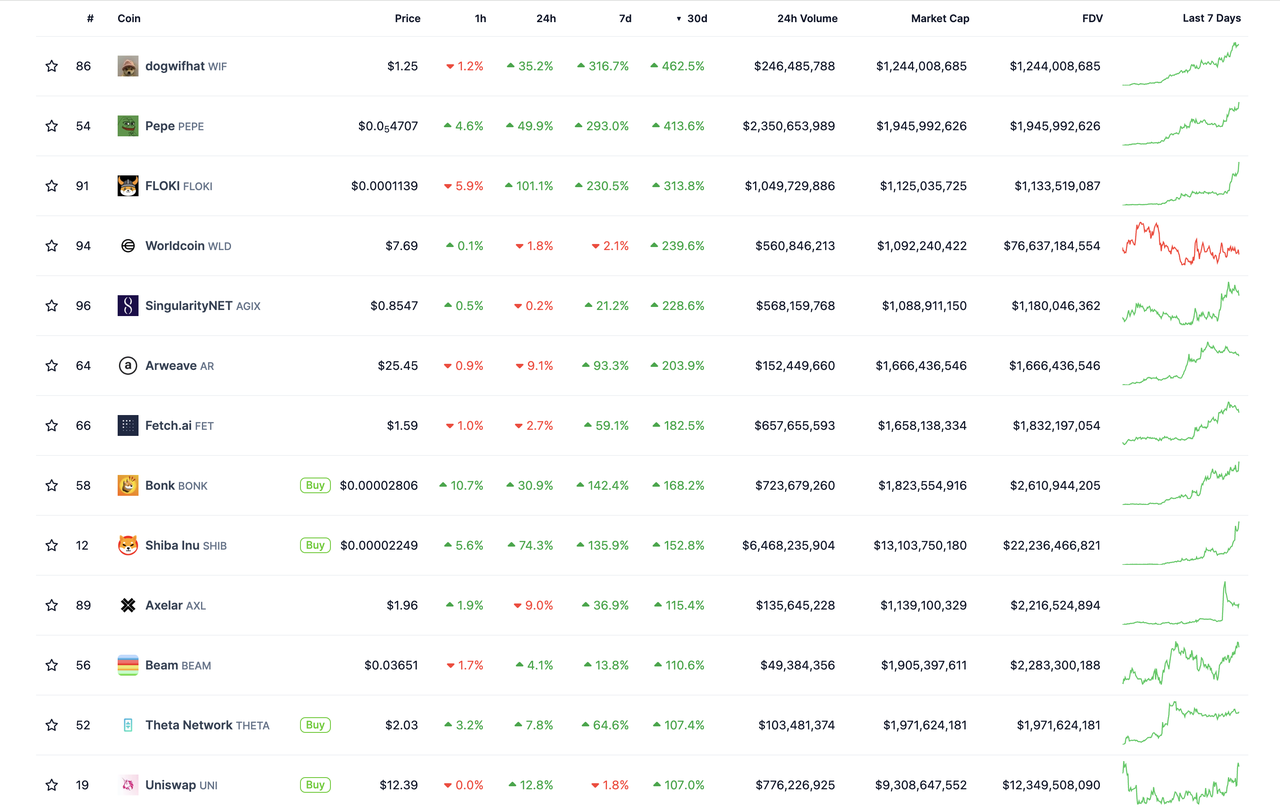

Among the top 100 tokens by market cap, the tokens with the highest gains in February were WIF (+462.5%), PEPE (+413.6%), and FLOKI (+313.8%). The rise was mainly concentrated in the last week of February, showing clear signs of sector rotation. Currently, the upward trend is concentrated in the MEME coin sector, which has shown significant differences from past cycles, especially in bull market cycles.

Note: It is recommended that investors remain cautious after the sector rotation to MEME coins. In past cycles, MEME coins have usually been the last sector to rotate, indicating that the upward trend is nearing its final stage.

Among the top 100 tokens by market cap, only Monero saw a 14.2% decline in February (StarkNet has been online for less than 30 days). The main reason is that Binance announced on February 6 that it would delist XMR, Aragon, Multichain, Vai, and other tokens on February 20. Binance stated that "these tokens do not meet the expected standards".

About WIF (dogwifhat)

dogwifhat is a MEME coin on the Solana blockchain. The project began planning in April 2023 and traded sideways at around $0.15 for about 3 months. As of March 2, 2024, its market cap has reached $1.2 billion, making it a dark horse in this round of MEME market surge. The entire website design is also very interesting. (This token has not yet been listed on Binance).

About PEPE

PEPE is a MEME coin that was launched in April 2023 and had the highest increase in that round of MEME coins. It reached a peak of $0.00000372 on May 6, 2023, after which BTC also reached a recent cyclical peak, followed by an overall decline, sliding all the way to October 20, 2023. It recently restarted on February 5, 2024, reaching a historical high of $0.00000444, with a market cap of $1.863 billion.

About FLOKI

FLOKI was first listed in the summer of 2021. There were reports that Tesla's founder bought a Shiba Inu and named it Floki. FLOKI, as a concept related to Musk's pet, soared, and Musk often posted pictures of his pet on X, and it has also risen by more than three times in the past month.

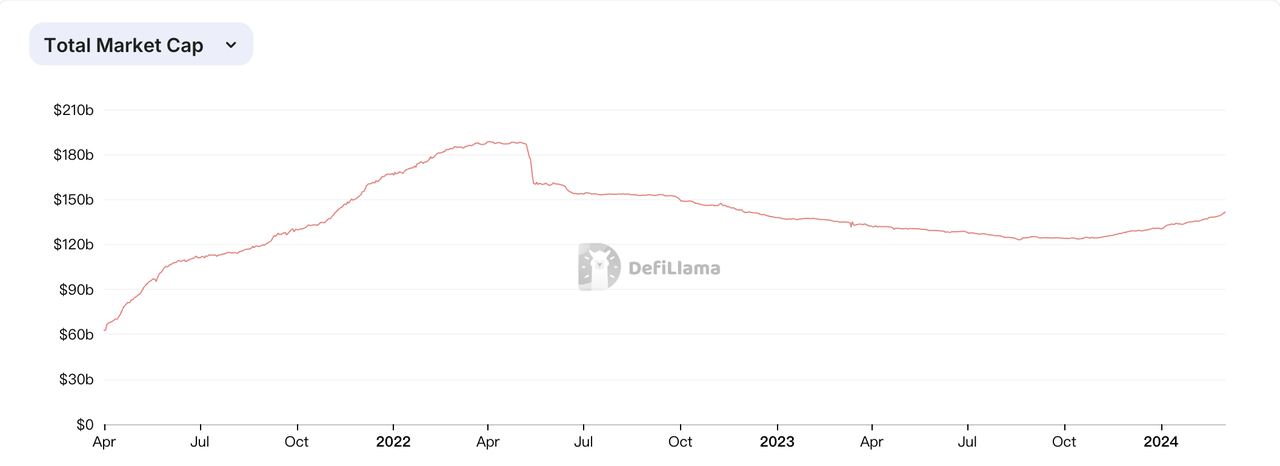

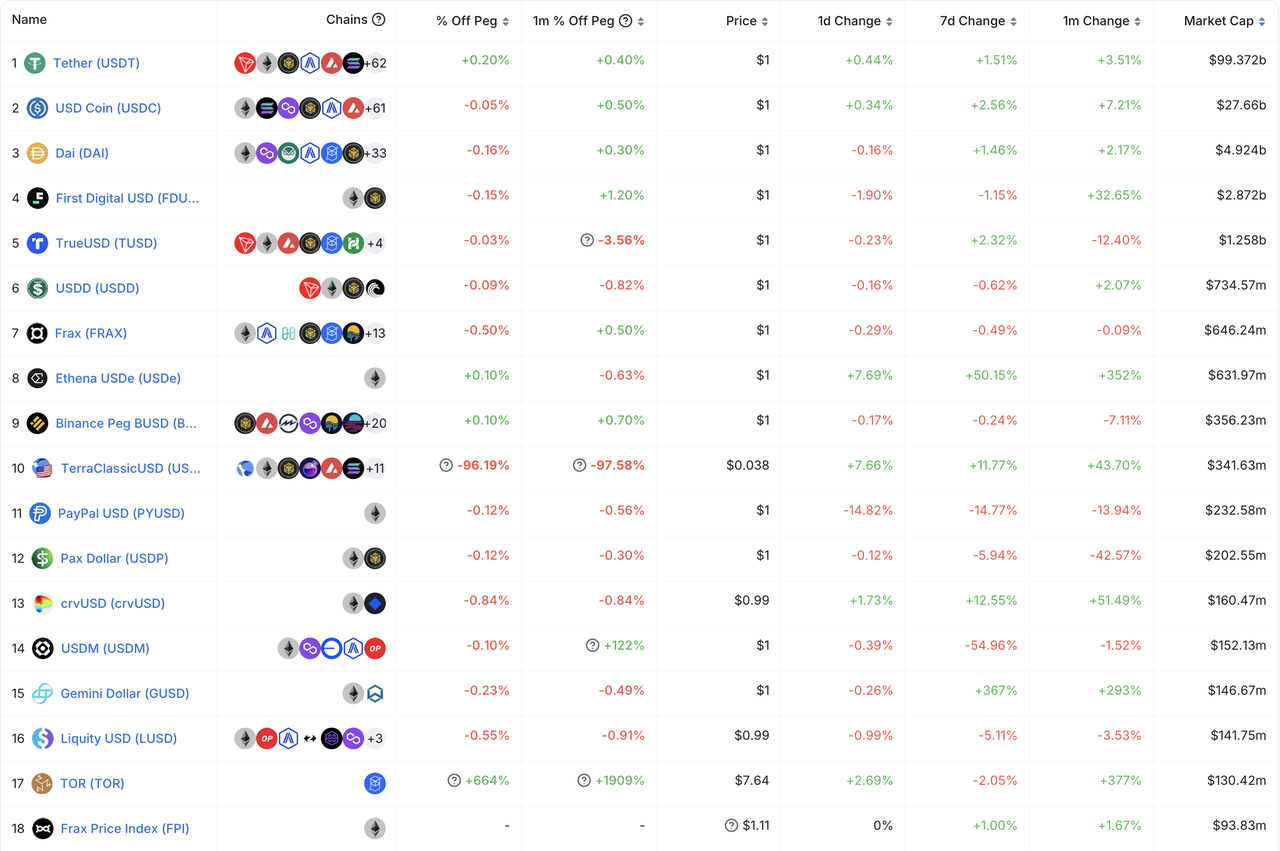

2.2 Stablecoin Inflows and Outflows

Stablecoin quantity continued to grow in February, and the slope indicates that this growth may still be accelerating, with the total stablecoin supply reaching $141.2 billion. The fastest-growing stablecoin this month is FDUSD, similar to January (up 32.65% this month, up 20.41% in January). At this rate, it is expected that FDUSD will surpass DAI to become the third largest stablecoin within a quarter.

FDUSD is issued by FD121 Limited, a subsidiary of First Digital Limited, a custodian company based in Hong Kong (branded as First Digital Labs). It is a stablecoin pegged 1:1 to the US dollar. The rapid growth of FDUSD is believed to be due to its trading pairs being listed on Binance, replacing the position of BUSD.

From a public chain perspective, stablecoins on Ethereum amount to approximately $73.7 billion, accounting for 52.2% of all public chain stablecoin reserves. Apart from Ethereum and Tron, the growth of stablecoins on other public chains is relatively small.

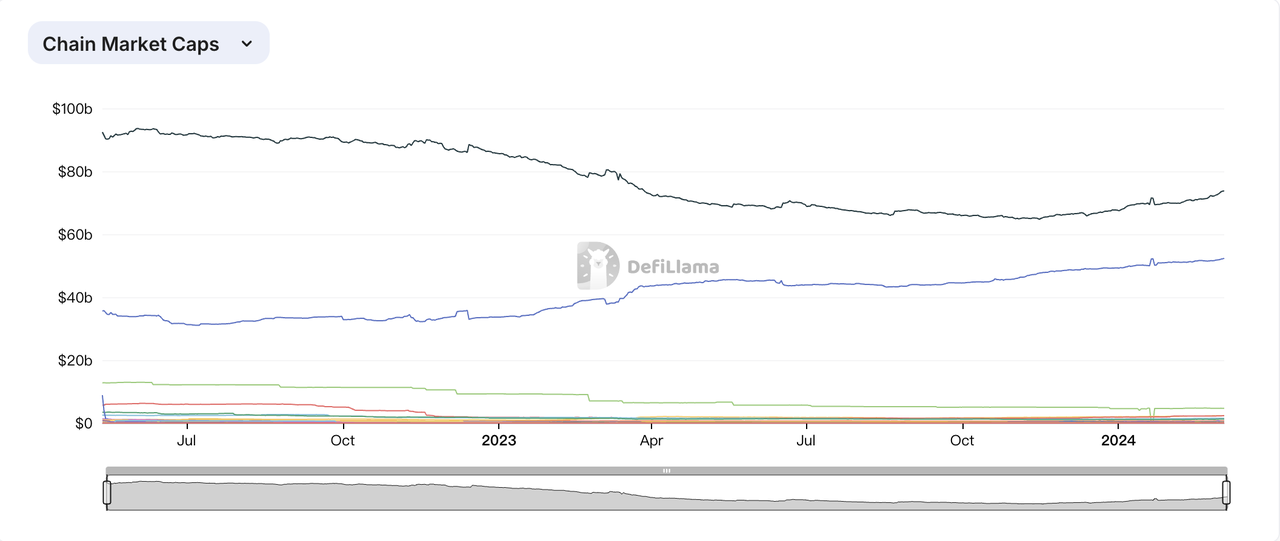

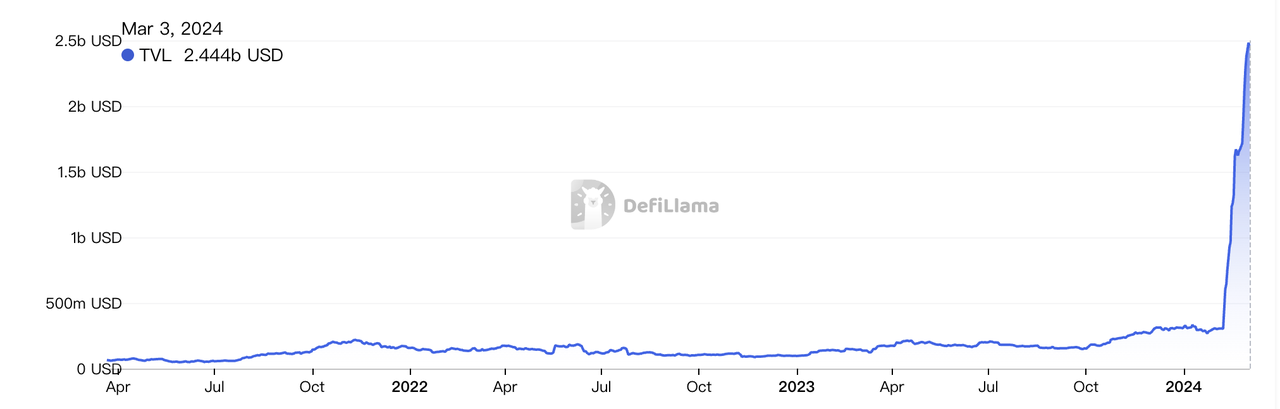

2.3 On-Chain TVL Rankings

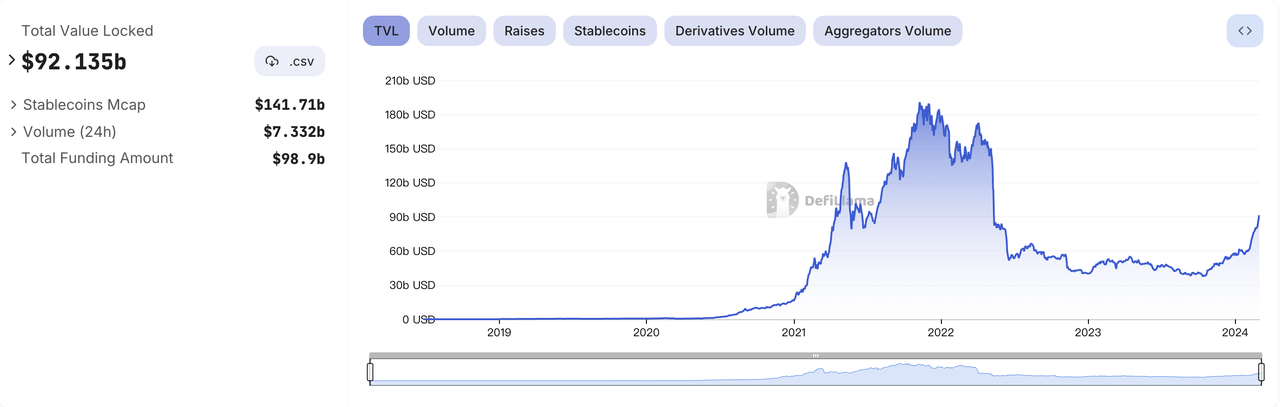

U Standard

DefiLlamaData: On-chain TVL has accelerated with the rise in ETH prices.

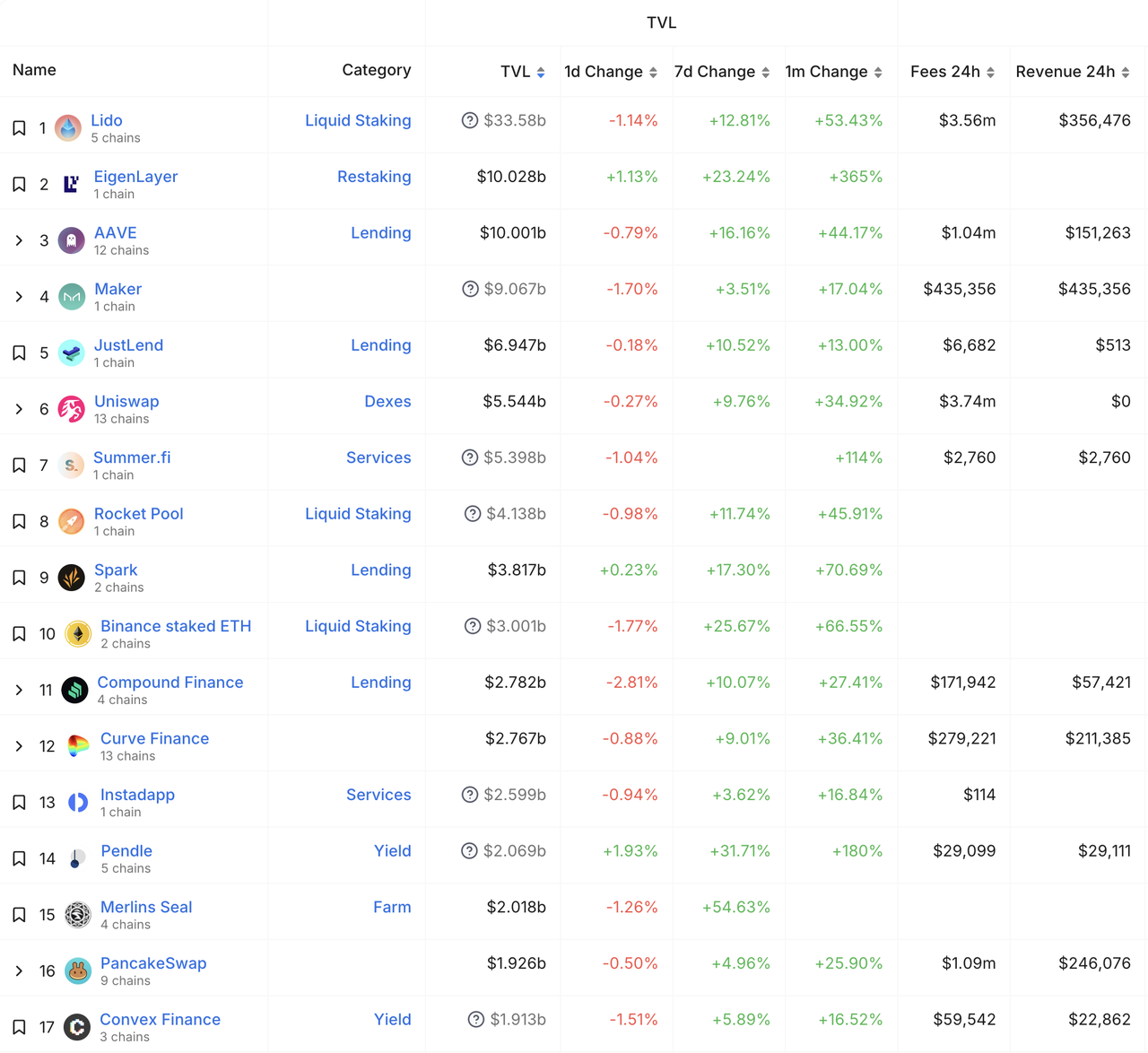

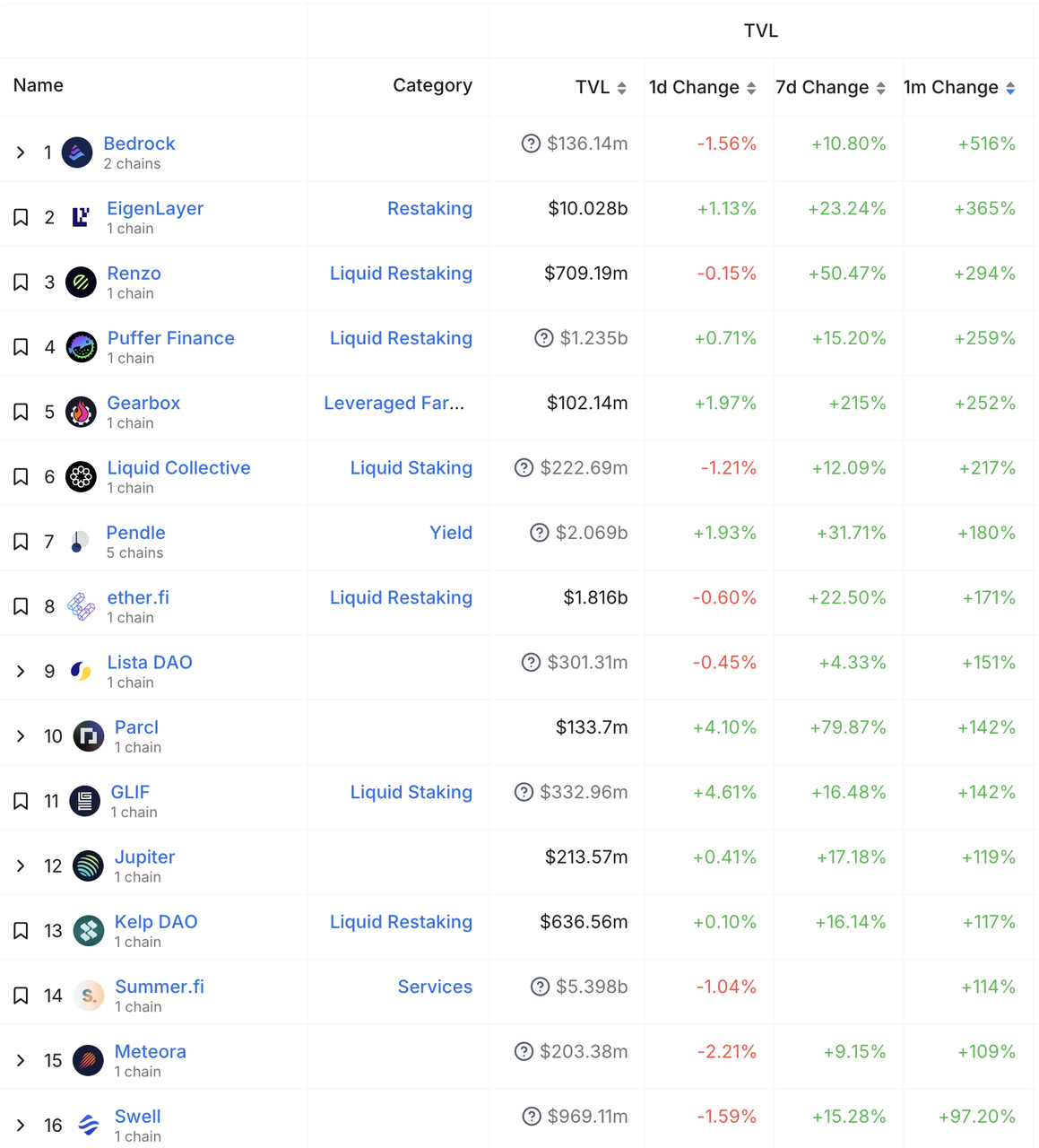

Due to the significant rise in ETH and the Fee Switch proposal by Uniswap, the overall performance of the DeFi sector has been impressive. The most notable is the EigenLayer project, with a TVL exceeding $10 billion, a monthly increase of over 360%, surpassing the former second-place AAVE.

Defillama Data: Among the 131 projects with a TVL exceeding $100 million (only 96 in January), the largest increase is seen in Bedrock. With the gradual warming of the LRT market and the narrative of Restaking, the rigid demand for Pendle is gradually emerging, especially for future institutions, making Pendle a good tool for hedging risks.

Categorized by DeFi type, the LSD sector still has the highest TVL, at approximately $53.3 billion; Restaking projects based on the LSD projects total about $10 billion; LRT projects based on Restaking total about $5 billion.

Categorized by chain type, Bitcoin's TVL has increased by 694%, reaching $2.43 billion, and Ethereum's TVL has increased by 52.3%.

The significant increase in Bitcoin's ecosystem TVL is benefiting from its Layer2 narrative, with many projects starting to support staking BTC and receiving financing from many top VCs. This trend is expected to continue and perform well in cyclical markets.

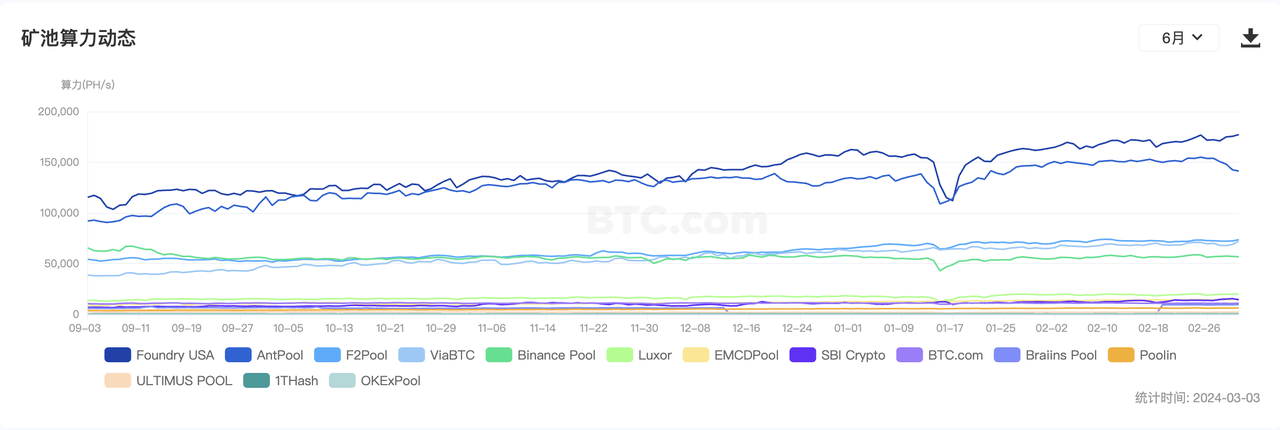

2.4 BTC/ETH Mining Pool Data

BTC has continued to steadily increase its computing power.

https://explorer.btc.com/zh-CN/btc/insights-pools

The mining pool data for Bitcoin has grown as shown in the above figure, with the total network hash rate reaching 575.08 EH/s. Foundry USA, AntPool, and F2Pool are the top three in terms of hash rate. The mining pool's hash rate continued to maintain a steady upward trend this month, with a 7.2% increase compared to the previous month. There are currently 7,044 blocks remaining until the halving, which is expected to occur on April 19, 2024, two days earlier than the previous estimate of April 21.

ETH staking volume continues to rise!

The ETH staking quantity continues to increase, currently accounting for 26% of the total quantity, with a staking volume of 1.82 million tokens this month. The Restaking market is still ongoing.

Additionally, the ETH mainnet gas has significantly increased along with the market. In February, the net burning of ETH mainnet was 46,839 tokens. It is expected that the high gas situation will continue until June due to the Dencun upgrade and the ETH ETF, and the total amount of Ether is expected to be less than 120 million tokens by then.

3. Market Trends

3.1 Comprehensive Rebound of the DeFi Sector

In February, the token prices of DeFi projects all saw significant increases. According to Coingecko data, the market value of DeFi category tokens has increased by 31% in the past 30 days, with Uniswap rising by 100%. This was mainly due to the proposal of the Uniswap Foundation's fee switch, which has reignited market attention to the DeFi sector, leading to a substantial increase in the token prices of the entire DeFi category.

3.2 Rotation and Rise of the MEME Sector

The recent market surge has experienced rotation among mainstream coins, AI, DePIN, GameFi, DeFi, and MeMe sectors. In February, MeMe coins such as Dogecoin, Shib, and PEPE all saw increases of over 300%, resulting in significant wealth effects. However, the market volatility of MeMe coins is relatively high, and recently SHIB market makers have been mainly selling, so investors still need to be cautious.

3.3 Initial Signs of the BTC Staking Ecosystem

By staking BTC as the underlying asset and leveraging the consensus of BTC market value, the introduction of BTC ecosystem narratives and airdrop expectations has rapidly absorbed TVL and has become a highly anticipated business model. Currently, Merlin Chain's TVL has reached $3 billion, with BTC accounting for 53% and ORDI accounting for 33%. As a result, many BTC Layer2 projects have been gradually gaining attention, such as Babylon, which received investment from Binance and aims to enhance the security of the Cosmos ecosystem through BTC re-staking. The broad prospects of BTC staking are being recognized by more people, and it is recommended to continue monitoring this trend.

4. Investment and Financing Trends

In February 2024, the cryptocurrency market completed a total of $700 million in investment and financing activities, a slight increase of 0.67% from the previous period of $695 million. The public data is as follows:

- 134 financing events, a year-on-year increase of 55.81% (118 projects in January 2024);

- 6 acquisition events, a year-on-year increase of 20%, indicating an increase in acquisition activities;

- The average financing amount was $7.2193 million, a year-on-year decrease of 10.74%;

- The median financing amount was $4 million, a year-on-year increase of 19.4%.

Although the average financing amount has decreased, the number of financing events, acquisition events, and the median financing amount have all increased, indicating that while the market activity is increasing, investment and financing are becoming more rational.

The largest 5 rounds of financing in February were:

- EigenLayer completed a $100 million financing, valuation undisclosed;

- Flare Network completed a $35 million financing, valuation undisclosed;

- Ether.Fi completed a $27 million financing, valuation undisclosed;

- Avail completed a $27 million seed round financing, valuation undisclosed;

- MetaStreet completed a $25 million financing, valuation undisclosed.

In addition, investment and financing events were found to be: 38 seed rounds (up 40% year-on-year), 15 strategic financings (down 21% year-on-year), 13 pre-seed rounds (up 30% year-on-year), and 8 other types (no change). Among them, seed round financing events were the most common, followed by strategic financings and pre-seed round financings, with fewer events of other types.

From the VC perspective, Animoca Brands made the most investment actions in the infrastructure, NFT, and GameFi fields, while Binance Labs and Multicoin Capital made the most investments in the DeFi field, and other VC companies focused their investments on the infrastructure field.

Investment activities in the cryptocurrency field increased in February, both in terms of the number of projects and the amount of investment, reaching a high point in nearly a year. Investments are still concentrated in the infrastructure and DeFi directions. This trend may have a positive impact on the market sentiment in March, attracting more investors to enter the market.

After March, the development trend of cryptocurrency and blockchain investment activities may be influenced by various factors such as the global economic situation, technological innovation, and policy environment. If there are no major adverse events or policy changes, and market sentiment remains positive while technological innovation continues to advance, it is expected that investment activities will continue to grow in March. However, market volatility and policy changes remain key risk factors, and investors need to remain vigilant, continue to monitor the situation, in order to make timely and accurate investment decisions.

5. Summary

The market trends and dynamics in February 2024 have revealed several important trends:

- The market's significant response to macroeconomic data and policy expectations, especially after the release of data on employment growth and inflation.

- The strong momentum of the cryptocurrency market, especially the significant price increases of BTC and ETH driven by ETFs this month.

- Continued issuance of stablecoins, continuous growth of on-chain TVL, and steady increase in mining pool data, all demonstrating investors' optimistic expectations for the future.

- The increase in total financing amount indirectly indicates the improvement in market activity and investor confidence.

Despite facing macroeconomic uncertainty and regulatory challenges, investment in technological innovation and infrastructure construction continues to grow, indicating the long-term potential and development space of the cryptocurrency market. Investors and market participants should continue to monitor macroeconomic indicators, technological innovation, and changes in the policy environment in order to make wise decisions in the ever-changing market. We look forward to the cryptocurrency market in April continuing to demonstrate its unique innovative capabilities and its penetration and impact on the global financial ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。