Points, in essence, are airdrop commitments, similar to a type of option.

Author: DefiOasis

Introduction: In fact, one of the biggest values we have discovered in blockchain at present is the highly transparent observation of the generation and distribution of funds/wealth, even though this approach is still in an immature stage with many flaws. However, the long-term vision of "transparent and minimally intermediated asset creation and distribution" does bring tremendous positive value to society.

Main Text

Despite the bone-chilling bear market in 2023, many projects still distributed large-scale airdrop rewards to users. The FreeMoney in the bear market attracted users, and just taking Coingecko's data as an example, in the past year alone, projects such as Arbitrum, Celestia, and Blur distributed approximately $4.65 billion in airdrops to users.

Now, half a year has passed since the geek web3's airdrop popular science article "A Brief History of Airdrops and Anti-Witch Strategies: On the Tradition and Future of Lure Culture" was published in September 2023. During this time, the Web3 industry has once again undergone changes, and the airdrop distribution mechanism has also shown new characteristics and trends. This article will analyze and popularize the changes in the airdrop mechanism during this period, further demonstrating the potential pattern and evolution of airdrop strategies in the future.

Point system has become the reference index for airdrops in most projects

The popularity of the airdrop point system is largely due to the promotion by Blur founder Tieshun. From Blur to Blast, the way project parties measure user loyalty has changed from initial trading volume to the amount and duration of user deposits.

Today, the point system is favored by major public chain ecosystem projects, such as Magic Eden, Marginfi, and Kamino on Solana, Bounce Bit and B²Network in the BTC ecosystem, and the rise of the re-staking concept has pushed the popularity of the point system to its peak. With the mining of Eigenlayer points as the core, projects such as Swell, KelpDao, and Ether.Fi have launched a fierce battle of point nesting, and there are currently dual or even triple mining of LST and LRT points.

In fact, the current mainstream point system can be divided into two categories, namely, points primarily based on trading volume and points primarily based on deposits.

The point model primarily based on trading volume is common in NFT trading markets, derivative exchanges, etc. These projects encourage users to increase trading volume, which was the gameplay of the airdrop point system in the past. For users, trading volume points can be completed with a single fund multiple times, to some extent encouraging single users with multiple addresses, making it troublesome to identify witch attacks.

The deposit-based point system is another mainstream point model. This measurement method is more commonly used in lending platforms, public chain projects, and the popular re-staking concept. Points in this model are mainly determined by the amount of funds and the duration of retention.

In order to maximize the attractiveness of funds/capital, such projects usually do not restrict the types of funds they absorb to be relatively single, but actively attract the influx of multiple types of assets, such as allowing users to pledge Bitcoin or part of Ethereum assets in the second phase of Merlin Chain, as well as inscription assets such as BRC-20, Bitamp, and BRC-420.

In today's Web3 world where TVL data is king, the deposit-based point system straightforwardly uses airdrop expectations to attract funds, but it will occupy users' funds for a long time and set a withdrawal restriction period of several months, imposing a huge opportunity cost on users. In this era where witch players are everywhere and real identities are difficult to distinguish, the deposit-based point system can significantly increase the cost of witch attacks, just like Proof of Stake.

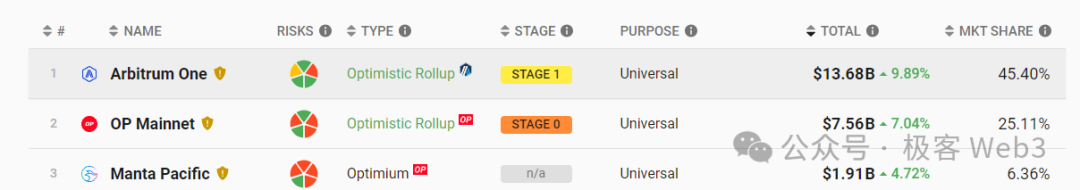

The airdrop expectation of the deposit-based point system almost immediately leads to the growth of TVL data, becoming the breakthrough for the current Ethereum Layer2. As ZK-based Layer2 started during the bear market, the TVL performance of ZkSync and Starknet has been lukewarm, while Manta, ZKFair, and others have followed in the footsteps of Blast, surpassing the aforementioned ZK king in TVL data in a short time and maintaining good data performance even after the airdrop ended.

In addition, projects using the deposit-based point system generally use some soft anti-witch methods, such as linking users' wallet addresses with social accounts such as Discord and Twitter, but even so, it is still impossible to completely stop witch attacks.

Essentially, the deposit-based point system significantly increases the cost of witch attacks by luring hunters. Some project parties have come up with the idea of using whether users have made deposits for other projects as a reference data for airdrop distribution: for example, when Altlayer distributes airdrops, "whether the user is a depositor of Eigenlayer and Celestia" is used as a powerful restriction condition.

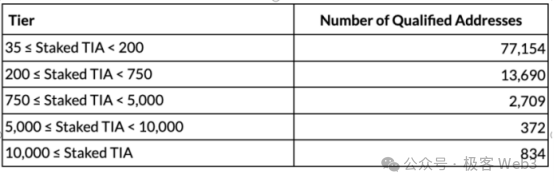

Altlayer used a tiered system for airdrop distribution, and the distribution of points was based on the amount of TIA deposited by users on the Celestia mainnet, with clear tiered divisions. The amount of airdrop rewards a user can receive is determined by the amount of deposits they have made in networks such as Celestia, not by the number of accounts they have. However, the airdrop share for a single account is limited, and after meeting the minimum deposit amount, there are clear rules for the lower and upper limits of rewards. This is essentially the hierarchical incentivization of POS.

Although this type of airdrop distribution method resists airdrop hunters, large holders with a lot of assets can still split deposits into multiple parts (similar to how people running Ethereum Validators often split their ETH into multiple parts, each with 32 ETH, to meet the minimum staking threshold for each Validator).

For small fund wool parties to meet the expected conditions of airdrops—each receiving address must have reached a minimum deposit threshold in the past—they often have to consolidate funds from multiple addresses into a single receiving account. But for project parties, having money is righteousness, and the "bourgeoisie" witch is valuable.

In fact, "everything can be point-based." In addition to the above two mainstream point calculation methods, there have been comprehensive point calculation schemes such as LineaDeFiVoyageXP, B²Buzz and bsquaredOdyssey from B²Network, and tasks released on Galxe, which are based on user trading volume, fund retention time, as well as sign-ins, social media interactions, inviting referrals, and team formation, capturing more comprehensively the user's contribution to their ecosystem.

Points, in essence, are airdrop commitments, similar to a type of option where you pay a certain cost today and can expect to receive XX in return in the future.

However, unlike the transparent APY of DeFi mining, under the guidance of the point system, users base all their actions on "unreleased token economic models, undisclosed airdrop allocation plans, and unpredictable future market conditions," engaging in blind mining. In reality, mining points is a game of asymmetric information between users and project parties, testing users' research and investment capabilities.

At the same time, airdrop points are essentially unlimited inflationary, and for small fund users, the participation of large holders dilutes the airdrop share. Of course, this is similar to staking Ethereum Validators, where those with a large amount of staked funds will receive more dividends (this rule has been unchanged for years).

Whether based on trading volume or fund retention time, point systems purely based on fund measurement undoubtedly direct the majority of rewards to large holders; some projects may add lottery-like blind boxes and random point lottery forms to redistribute to small fund users, seeking a balance between large holders and regular users.

However, the point system has been criticized for becoming increasingly similar to many existing play styles on Web2 platforms, requiring users to complete various complex tasks to earn points, leading the community to question whether users are experiencing the ecosystem or becoming slaves to project work.

Increasing emphasis on core players for airdrops, "sunshine inclusiveness" for multi-chain users

However, a wide-ranging airdrop with multiple standards and screenings can cover as many users as possible, making different groups happy and winning the community's favor for project parties. But as the competition intensifies, project parties can only hope for layered screening to accurately distribute incentives to real users, gradually leading to the extinction of wide-ranging airdrops on the EVM chain.

However, non-EVM ecosystem projects such as Sei, Celestia, and Dymension have opened up new ideas for wide-ranging airdrops, conducting "sunshine inclusive" airdrops for multi-chain user bases, with the core distribution targets being high-quality players on the chain.

In general, airdrop projects have multiple considerations for these high-quality users, considering active users on platforms with abundant funds and partnerships on multiple chains such as EVM and Solana, and assessing the on-chain user activity through various dimensions such as user interaction amounts, transaction frequencies, and gas consumption during specific time periods, seeking truly high-quality active players.

On the other hand, airdrops are often distributed to long-term staking users, especially large stakers, represented by Cosmos ecosystem ATOM, TIA, and INJ stakers. Strictly speaking, staking airdrops are not a new play style, as ATOM stakers in the previous cycle received airdrops of multiple high-quality assets in the Cosmos ecosystem, but the advantages of this chain airdrop are often overlooked due to the inability of airdrop returns to cover the losses caused by the decline in ATOM prices during the bear market.

(The profits of early Celestia stakers have caused FOMO in the community Source: @jaga1117)

Thanks to the popularity of modular blockchain narratives, projects with the slogan "staking gets airdrops" have emerged one after another, and with the hot concept of re-staking, staking has once again become a popular narrative. Under the staking airdrop narrative, severe FOMO emotions spread across different communities, with people essentially looking for the next "golden shovel." For example, PythNetwork received over 100,000 staked funds even without the actual release of APY and airdrop returns. However, as staking addresses and staked amounts increase, the minimum threshold for airdrops is expected to gradually rise.

The popularity of staking has also led to a system of nested staking among project parties. When project party A distributes airdrops to token stakers on partner platform B, A also introduces staking for its own token, leading stakers to believe that staking and locking on the A platform will allow them to receive airdrops from other project parties such as C and D, creating an airdrop expectation (actually PUA) that effectively absorbs the funds of A platform airdrop recipients.

Under this chain condition, an A—B—C—D Stake infinite nesting can be formed, ultimately trapping people in staking expectations, with the opportunity cost of funds being paid in the end, and airdrop returns being received. Considering that the tokens received from airdrops are often different from assets bought on the secondary market, the holding cost and psychological pressure are much lower than the latter, so people are more willing to lock funds on platforms with staking airdrop expectations for the long term.

In addition to large stakers, some project parties may also airdrop to blue-chip NFT holders within the community, such as PudgyPenguins, BoredApeYachtClub, CryptoPunks, BadKids from Comomos, and MadLads from Solana, NFT brands on the Ethereum mainnet. These NFT holders are generally OG users in their communities.

In summary, although airdrops bring everyone together in the sunshine, the core distribution targets for airdrops today are high-quality active users and large stakers. On another level, multi-chain "sunshine inclusive" airdrops are generally used as "barren marketing strategies" within non-EVM chain ecosystems or new ecosystems, with the main purpose of gaining word-of-mouth and capturing players from other ecosystems. Project parties still aim to help grow ecosystem data and increase user on-chain activity and fund retention, distributing these airdrops to users who have contributed as much as possible.

Future airdrop rule reference conditions

In addition to the above points, we have identified some trends that may become reference conditions for airdrops in the future:

1. Airdrop shares tied to official background NFTs: Official background NFTs are gradually becoming the new standard for project airdrops. Although these "equity" NFTs do not actually have clear airdrop shares tied to them, through frequent mentions or indirect endorsements by project parties on social media, they have unwittingly become an unspoken rule for project airdrops today.

After holders of Altlayer's AltlayerOGBadge and OhOttie!NFT series received large airdrop shares, under the community's FOMO emotions, the official NFTs of projects such as EigenLayer, zkSync, and Berachain, which have not yet conducted airdrops, are seen as important chips that must be seized next.

However, whether these NFTs are collectibles or serve as airdrop vouchers requires users to have strong predictive abilities and a long-term assessment of their attitudes towards project parties. At the same time, these "equity" NFTs have become potential channels for project parties to cash in before issuing tokens due to PUA speculation, with no shortage of insider trading behavior.

2. Project parties show a tendency to value developers in airdrops: Blast split airdrop shares in half between regular users and developers, Celestia allocated one-third of the total airdrop to GitHub developers, and Staknet almost openly rewarded a large number of developers with airdrop shares. More and more star projects are beginning to focus airdrop distribution on developers, making "contributing code to the project" or "posing as a legitimate developer" a new way of luring, leading to a large number of low-quality projects on the chain, hoping to receive ecosystem rewards. This phenomenon may intensify in the future, and new countermeasures are likely to be introduced (expected to involve AI).

3. Collaborate with professional witch-hunting agencies to screen qualified users: Recently, Celestia and Manta have partnered with TrsutaLabs to screen users who meet the criteria, while Linea provides options for anti-witch projects such as Nomis, GitcoinPassport, and Clique in the real-person verification (POH) process. It seems that project collaboration with witch-hunting agencies to screen users is becoming a new trend.

Professional agencies integrate multi-chain data and the depth of user participation in airdrop projects to conduct more comprehensive analysis of the witch risk of addresses. However, they have also been criticized for being overly strict or not intelligent enough, resulting in the wrongful identification of innocent addresses as malicious transfers that cannot be recognized.

Alternative "Innovation and Expansion" for Wool Farmers

1. Expansion from the EVM chain to other chains

With the transparency of information and the maturity of the EVM chain ecosystem, a shortage of airdrop shares, especially on the overcrowded Ethereum Layer2, has become common. Ordinary users are unable to compete in terms of amount and activity, and the low input-output ratio has led wool farmers to seek opportunities in other directions, focusing on chains with good TVL or capital backgrounds such as Sui, Aptos, and Solana.

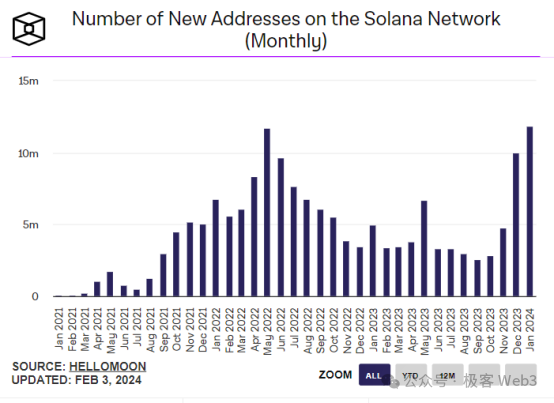

The overflow effect of EVM chain users is evident in the recent rise in user activity and TVL data on public chains such as Sui and Solana. In these ecosystems, simple interactions similar to UNI on Jupiter can lead to airdrop opportunities, which is also common in the BTC ecosystem.

(The wealth effect has reactivated many new users on the Solana chain)

2. Shifting focus from large fundraising projects to small and refined ones

Projects with large fundraising often have a long airdrop distribution period due to a lack of cash flow, and the front line of wool farmers is correspondingly extended. Long-term investment without returns has become the norm. In addition, large fundraising implies project stability, which may attract many people to participate, diluting the airdrop shares.

As a result, some wool farmers have shifted their focus to small and refined projects. These projects often disclose small fundraising amounts, but due to the smaller number of participating users, the cost-effectiveness of wool farming is higher. Projects such as Starknet, Layerzero, and ZkSync, which have been jokingly referred to as "The Three Idiots" by the community due to their long-term PUA behavior, have all experienced varying degrees of declining active data.

Another wool farming strategy is to look for projects with a background in major exchanges. Given that the value of airdropped tokens depends on the expectations of major exchanges, many wool farming activities revolve around projects associated with major exchanges such as Binance, OKX, and Coinbase, as well as projects funded by Binance Labs Fund, Coinbase Ventures, and projects within the ecosystems of major exchanges. Another type of bargain hunting revolves around top-tier VCs such as Paradigm and a16z, which participate in fundraising but with smaller amounts, and projects that appear to be relatively niche.

In addition, relatively obscure airdrop rules, such as continuous check-ins for NFP and registration for Arkham, can lead to a satisfying average airdrop share per person. However, once an obscure rule that leads to a wealth effect appears, it becomes a widely accepted rule in the market, and trying to "copy" it to form a continuous path dependency may not be feasible. This market, and even the world, is almost full of uncertainty, and past historical experiences may not necessarily apply to the broad future. All so-called "rules" and "conventions" are likely to be rewritten in the near future.

Perhaps leading projects in each race are trying to invent new airdrop rules, which may lead to different innovations. However, the fundamental principle remains that the recipients of rewards distributed by project parties will always be loyal users who are "early adopters + deeply involved + large fund contributors."

Debate: The Game between Airdrop Farmers and Project Parties

Recently, Starknet referred to users focused on airdrops as "electronic beggars" on social media and even created a "electronic beggars" channel on its official Discord, which sparked community criticism. Similar conflicts between project parties and airdrop players have also occurred with Scroll. Later, individuals associated with Scroll and Starknet personally engaged with the community and even blacklisted users on social media, causing community outrage. Although the parties involved later apologized, they were unable to completely dispel the community's grievances. This public relations controversy has had a reverse marketing effect on the community and is worth analyzing as a case study.

This public opinion incident has exposed the delicate relationship between airdrop farmers and project parties. The unspoken rules that have developed over a long period between wool farmers and project parties regarding airdrops seem to have led to misunderstandings between the two. Many users believe that airdrops are their deserved "earnings," as they have worked hard and actively contributed during the bear market, generating transaction fees and helping project parties create the illusion of prosperity on the chain, and should receive "compensation." However, these users are often very purposeful, and project parties may not fully buy into their intentions.

During the early airdrop era when wool farmers had not yet formed large groups and there were mostly genuine users (possibly in 2021 and earlier), project parties did not exclude the participation of low-net-worth users due to good user retention rates. However, as mentioned earlier, due to the influx of a large number of wool farmers, this airdrop method that allows mutual recognition between project parties and users is gradually decreasing.

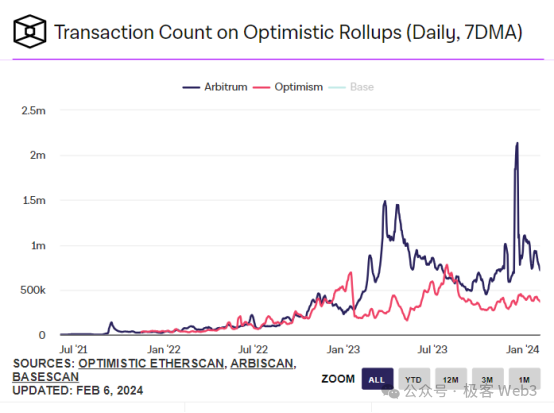

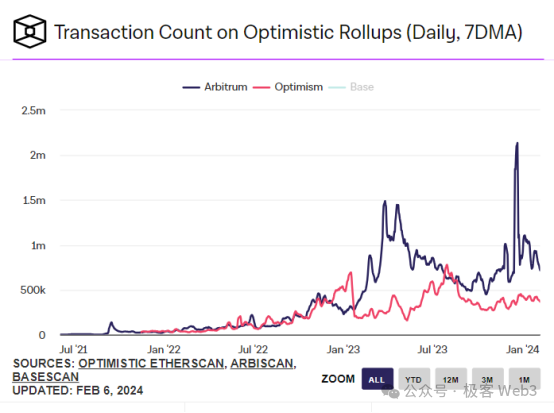

Furthermore, airdrops should not be seen as the end of a project. Some cases have shown that successful airdrop plans can stimulate user activity in projects. Jupiter has an annual airdrop plan, and after the first airdrop distribution, Jupiter's DAU briefly exceeded that of Uniswap; STIP funding plans for Arbitrum and Optimism Op Grants have also kept their active data at high levels for a long time.

(After airdrops, Arbitrum and Optimism remain active on the chain)

Some project parties also take alternative approaches to lock in funds, initially supporting ecosystem projects or developers. For example, Base, which did not issue tokens, attracted large holders to lock funds in the protocol through applications such as friend.tech and Bold, which generate income. However, even excellent applications like Uniswap have faced the problem of stagnant TVL before issuing tokens. It can be said that airdrops are a powerful move when the community's contribution to the ecosystem is weak, growth is sluggish, or even regressing, but they should not be the last move.

(A large number of wool farmers interacting for ZkSync's income during the long bear market)

Conclusion

Community members generally complain that wool farmers support on-chain data, helping projects survive in the bear market, while many project parties ignore wool farmers but attract them through various hints or by collaborating with third parties to initiate tasks, encouraging wool farmers to participate in on-chain interactions, but delaying the announcement of airdrop plans. Such double standards often stir up negative emotions in the community.

Airdrops that primarily attract deposits are using users' liquidity, and in the future, they will need to consider the opportunity cost for users in return for airdrop rewards.

Airdrop standards are shifting from interactive to deposit-based, and in the future, the primary criterion may be users' deposited funds, reflecting the changing dynamics and demands between users and project parties. However, this game between project parties and users may be alleviated as the bull market approaches and the overall crypto market environment warms up. The prisoner's dilemma of airdrop distribution by projects during the bear market may improve as market funds gradually become more abundant. There have been recent complaints about "staking protocols having more ETH than users' holdings." With the changing landscape of fewer projects and more users, the attitude of project parties may also shift from rejecting wool farmers to competing for them.

The original intention of project parties is not to confront the community, but after the addition of thousands of studios to the wool farming army, they need to be more cautious in airdrop distribution. It is now unrealistic to get rich through airdrops, as it requires strong research capabilities or good luck to discover the future value of niche projects. For wool farmers, the golden age of mass airdrops and picking up money everywhere has become history, and the future narrative of airdrops is uncertain. Everything must consider the classic saying, "One's success depends not only on one's own efforts but also on the progress of history."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。