来源: Cointelegraph原文: 《{title}》

根据加密货币做市商Wintermute在4月14日发布的报告,与传统金融市场相比,比特币(BTC)正在展现出对宏观经济逆风越来越强的抵御能力。

该报告指出,在目前持续的市场下跌中,尽管标普500指数和纳斯达克指数跌至一年来的最低点,债券收益率攀升至2007年以来的最高水平,比特币仍表现相对稳健。

“比特币的下跌相对温和,重新回到了美国大选期间的价格水平,”Wintermute写道。

根据Wintermute的说法,“这标志着其在危机情况下的历史行为的显著转变。” 过去,比特币的跌幅往往大于传统金融指数。此变化凸显了比特币在宏观经济动荡中“明显增长的韧性”。

Obchakevich Research创始人Alex Obchakevich告诉Cointelegraph,他认为这是一个暂时的趋势:

“随着贸易战的加剧,比特币可能会重新成为风险资产之一。因为投资者很可能会在黄金中寻找庇护。”

Obchakevich表示,导致比特币稳定的因素包括通过交易所交易基金(ETF)带来的机构投资增长,以及由于其去中心化和独立性而被推广为数字黄金。

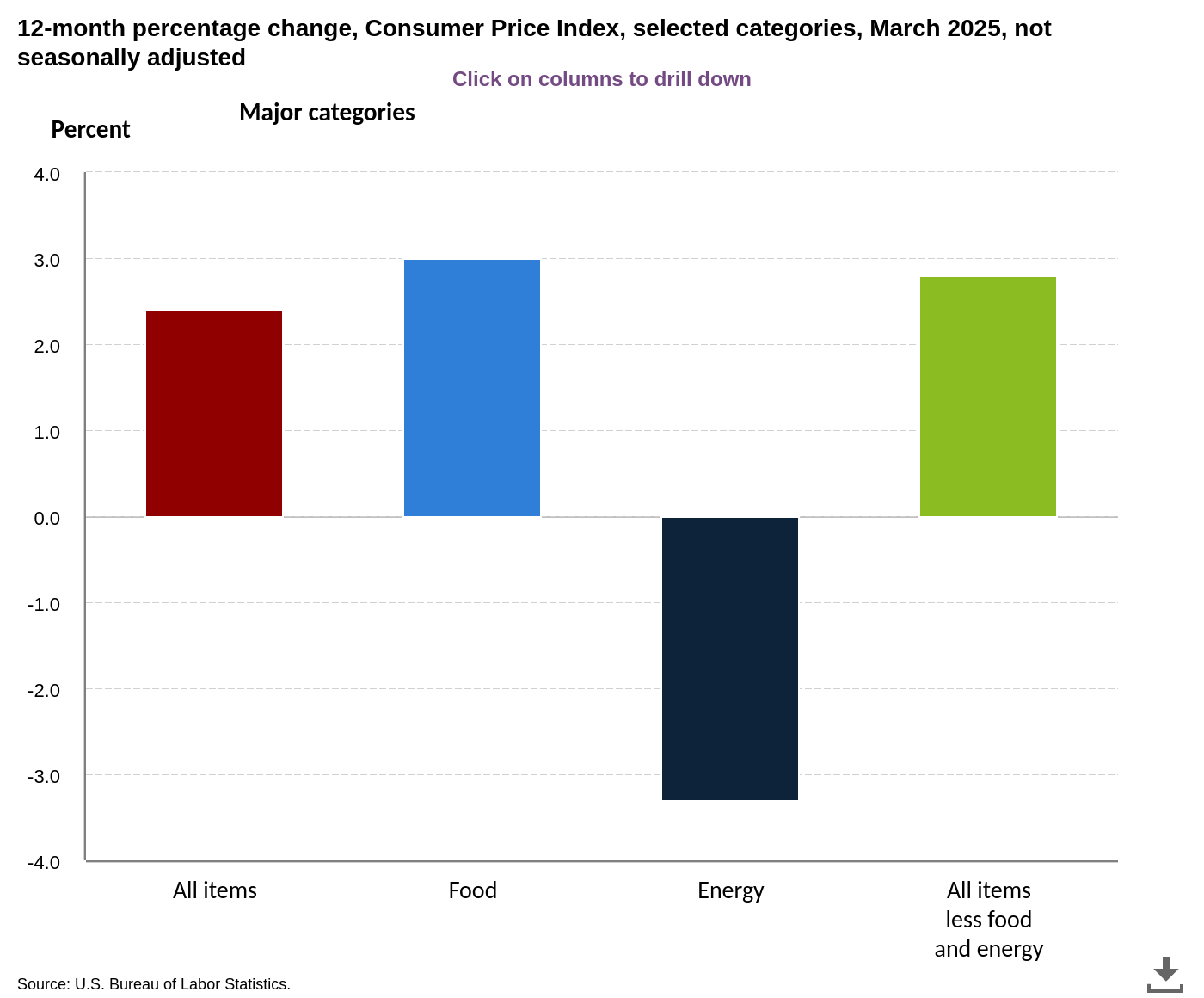

在过去一周,比特币价格上涨7%至83700美元,在发稿时接近86000美元。这一增长发生在消费者价格指数(CPI)同比上涨2.4%,环比下降0.1%之际,这是自2020年5月以来的首次月度下降,表明通胀正在降温。

年度消费者价格指数百分比变化。来源: 美国劳工统计局

此外,3月生产者价格指数(PPI)同比上涨2.7%。2月份该指标为3.2%,同样显示出通缩压力的迹象。不过,据Wintermute称,这一趋势可能很快逆转:

“尽管在实现美联储2%的通胀目标方面取得了进展,但全球贸易紧张局势的升级带来了新的潜在通胀风险,这尚未在3月份的数据中体现出来。”

月度生产者价格指数百分比变化。来源: 美国劳工统计局

Bitwise分析师Jeff Park最近认为,美国总统特朗普的贸易政策将在全球范围内造成宏观经济动荡和短期金融危机,这最终将导致比特币的更广泛采用。他表示应该预期通胀上升:

“关税成本很可能通过更高的通胀由美国和贸易伙伴共同承担,但相对影响将对外国更为沉重。这些国家将需要找到方法来应对其疲软的增长问题。”

Wintermute解释说,持续的贸易战加剧了通胀上升和经济放缓的风险。预测市场Kalshi的交易员最近将美国今年陷入衰退的概率预估为61%,摩根大通则认为概率为60%。

相关推荐:比特币交易员准备迎接涨至10万美元的行情,“脱钩”与“黄金引领BTC”趋势初现端倪

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。