Incubated by the institutional liquidity network Paradigm and in collaboration with StarkWare, let's take a quick look at the architecture and token plan of Paradex.

By Karen, Foresight News

As the first application chain and cryptocurrency derivatives exchange on Starknet, Paradex has begun to emerge and has also gained official recognition and exposure from StarkWare.

What is Paradex?

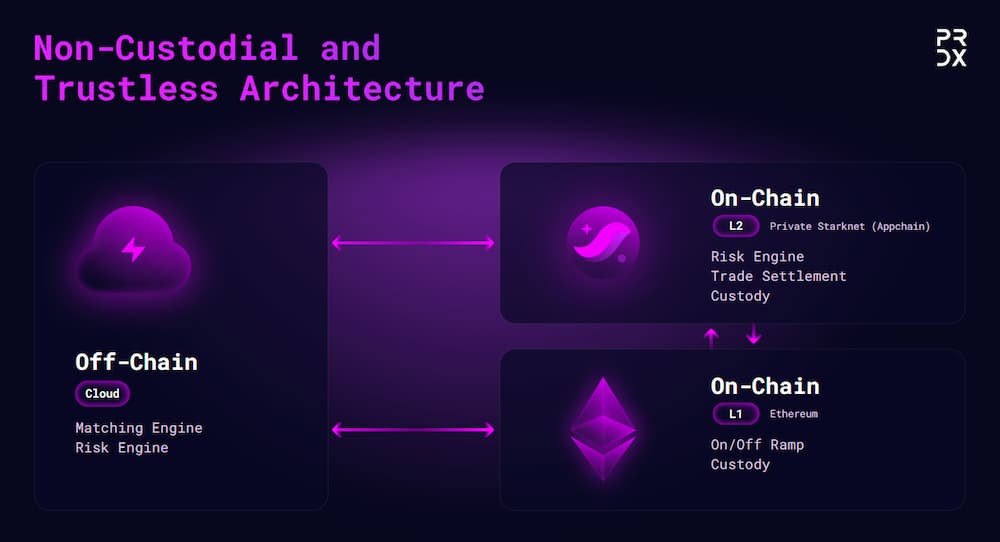

Paradex is the first Starknet application chain and a high-performance cryptocurrency derivatives exchange built on the Starknet application chain. Paradex provides derivative services to users through a self-hosted, trustless infrastructure, with its matching engine off-chain and risk engine on-chain, achieving a balance in transparency, liquidity, and capital efficiency.

Paradex was incubated by the institutional cryptocurrency liquidity network Paradigm (unrelated to the venture capital firm of the same name) and also collaborated with StarkWare during the development process.

Paradigm aims to provide on-demand liquidity to traders while considering trading preferences, execution costs, and immediacy. According to the Paradigm website, Paradigm's cumulative trading volume has reached $348 billion. In December 2021, Paradigm completed a $35 million Series A financing round, led by Jump Capital and Alameda Ventures, with participation from Genesis Trading, QCP Capital, and others. Prior investors in Paradigm's seed round include Dragonfly Capital, Digital Money Group, and Mirana Ventures, among others.

Paradex Architecture and Features

Paradex is a hybrid trading system with both off-chain (cloud) and on-chain components, which is also its unique feature. The risk engine is on-chain, and the matching engine runs in the cloud. Users interact with it by submitting orders. The cloud evaluates whether the order would cause the account to exceed the risk limit, and if so, the order is rejected. Once the order matches with an order in the cloud order book, the order is sent to the chain. Then, the off-chain account balance is updated, and the user can continue trading.

Regarding the fee structure, Paradex adopts two different fee rates for Makers and Takers, aiming to encourage traders to provide liquidity and balance the market's supply and demand relationship. Maker orders provide liquidity to the order book (reserved in the order book, waiting for others to match), while Taker orders match existing orders in the order book, removing liquidity from the order book. The Maker fee rate on Paradex is -0.005%, and the Taker fee rate is 0.03%.

In other words, if a user places a Maker order with a nominal value of $10,000, they will receive a fee of 0.005% of the nominal transaction size, which is $10.50. If a user places a Taker order with a nominal value of $10,000, they will be charged a fee of 0.03% of $10,000.

Currently, Paradex only accepts USDC as collateral, but it plans to transition to a multi-collateral model in the future, accepting a wider range of cryptocurrencies. Additionally, all profits and losses will also be calculated in USDC.

Paradex currently only supports full-margin mode. If users want to open isolated margin positions, they can register a new account. In terms of liquidation mechanism, Paradex conducts regular health checks, comparing account value with account maintenance margin requirements. If the account value falls below the account maintenance margin requirement, the account will be marked as unhealthy and may be forcibly liquidated. All liquidations are handled internally by the insurance fund.

To ensure the platform does not go bankrupt, Paradex adopts a layered approach:

- Insurance fund;

- External liquidator plan (not yet launched);

- Socialized Losses.

Another important feature of Starknet is the reduced complexity of logging in. In order to allow users to use the familiar MetaMask wallet without managing a separate Starknet wallet, Paradex has built a Starknet wallet within the application.

In the Paradex application, users need to connect their Ethereum wallet first, then sign an Onboarding transaction in the Paradex UI, which will deterministically generate a Starknet private key based on the user's Ethereum L1 signature. During transactions, the Starknet private key is used to sign any transactions authorized by the user on Layer2, and the UI will automatically execute these signatures when needed. It is important to note that currently, transfers from non-Paradex L2 wallets to Paradex L2 wallets are not supported. In other words, users can only perform cross-chain operations from an Ethereum wallet on the Paradex Portfolio page.

Paradex Token Plan

Paradex launched its public test version on the mainnet on February 19 and introduced a token plan and a Leaderboard to incentivize user participation.

According to Paradex's roadmap, governance will be launched in the second quarter of 2024, allowing the community to vote on protocol upgrades. In other words, Paradex may issue tokens in the second quarter.

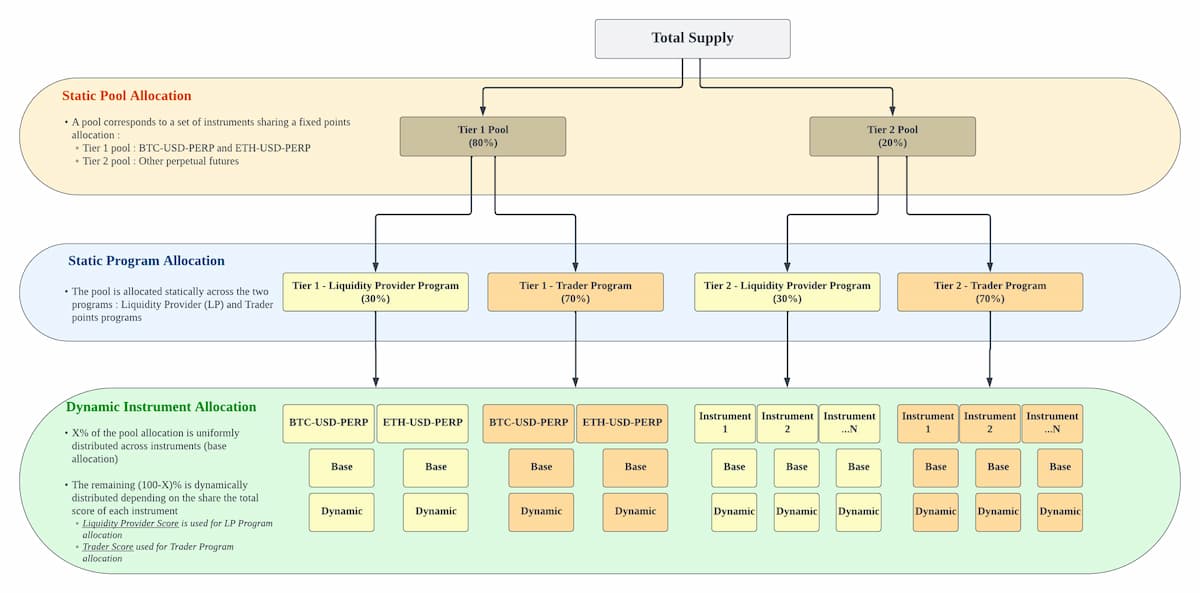

The current methods for earning Paradex points only support providing liquidity and trading. Liquidity provision mainly refers to liquidity supply and Maker trading volume, which calculates a dynamic score for each wallet (liquidity provider score) based on quote quality and Maker trading volume on each contract, and then calculates the score for each wallet (as a percentage) based on all wallets to determine each wallet's share of the score for each instrument.

In the trading fee points plan, a dynamic score for each wallet (trading fee score) is calculated based on the fees recently paid for each instrument (e.g., BTC-USD-PERP) by the wallet, and then the score for each wallet is measured as a percentage based on all wallets to calculate each instrument's overall wallet trader points share.

According to official data, Paradex has a cumulative trading volume of $86 billion, with a daily average trading volume of around $170 million in the past week. The current open interest is $3.9 million, the TVL is $6.9 million, and the total number of users is only 191.

Overall, as a high-performance cryptocurrency derivatives exchange based on Starknet, Paradex has a unique architecture and incentive mechanism, providing users with an efficient and transparent trading experience. However, while the in-app wallet provides convenience to users, it may also limit Paradex's interoperability and user experience. With the continuous development of the market and increasing competition, Paradex needs to continuously innovate and improve its products and services to meet the evolving market demands.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。