1. Research Report Highlights

1.1 Investment Logic

In the current landscape of platform tokens, apart from BNB, there hasn't been a platform token that can compete with it. BGB is a strong competitor because Bitget has experienced rapid development in the past two years, especially excelling in product experience, marketing, and community building. Particularly in the area of contract trading, Bitget is expected to gain a larger market share.

In addition, the RSI indicator shows that the momentum is still upward, as it has been trading above the midline in 2024. If the market drives BGB above its all-time high price, it is expected that the profit-taking exit could be considered at the 5x resistance level of $2.25.

1.2 Valuation Explanation

Exchanges belong to the economies of scale, and the larger the scale, the non-linear growth of value capture capability. From the current understanding, BGB has chosen scale + profit, sacrificing some compliance. It is one of the few exchanges that still adhere to an aggressive strategy in a bear market, and it is worth anticipating in terms of scale and profit.

The valuation of platform tokens depends on the current value capture capability and growth potential. The value of the exchange comes from the trading share and asset sinking, and the real explosion of trading demand often accompanies the explosion of assets. However, the biggest pain point of centralized exchange platform tokens is that the actual circulation cannot be obtained from public data (excluding the portion held by the founders and the platform itself), so commonly used valuation models are not accurate. It is necessary to pay attention to and analyze what BGB has done for the asset explosion.

1.3 Main Risks

Opaque risk: BGB has shown a relatively high control status since its issuance, with an inflation rate of up to 180% in the past year, and the buyback and destruction mechanism has not been announced to date.

Cyclical risk: Platform tokens do not directly benefit from the bull and bear market conversion of the market, but benefit from the explosion of assets during the period, and the timing of the asset explosion is uncertain, leading to an uncertain window of opportunity.

Regulatory compliance risk: As of now, BGB has not followed a stable compliance route, but has chosen a more competitive aggressive strategy. Once explosive growth occurs, it is easy to attract attention and intervention from regulatory authorities.

2. Project Overview

Bitget is a cryptocurrency derivatives exchange established in 2018, providing spot, derivatives, and copy trading. Users can synchronize their investment portfolios with professional traders in one click. The exchange serves over 8 million users from more than 100 countries and regions, aiming to help users trade more intelligently by providing a secure, one-stop trading solution.

Initially, Bitget's native token was BFT. In 2021, Bitget introduced BGB as the platform token and exchanged BFT for BGB at a ratio of 1:2, after which BFT was destroyed.

2.1 Business Scope

Similar to most centralized exchanges, Bitget's main business is trading between a large number of users. It currently serves over 8 million users from 60 countries, with over 110,000 elite traders and 520,000 copy trading followers.

Bitget offers over 500 spot trading pairs, providing users with a comprehensive trading experience. All types of cryptocurrency investors, whether experienced or risk-averse, can use these products to enrich and develop their investment portfolios. Additionally, to encourage trading and help new investors get used to cryptocurrencies, Bitget distributes thousands of dollars in experience funds to each account after completing specific tasks.

2.2 Founding Team

The majority of Bitget's employees are based in Singapore, with most members coming from mainland China, Singapore, Malaysia, and other Asian regions. The senior management has backgrounds in mathematics and finance, but the level of internationalization is not high. Currently, there have been some adjustments in Bitget's senior management. Out of 27 open positions, only 10% are being recruited, which is lower compared to OKX and Binance.

MD/CEO: Gracy Chen

Gracy Chen is the Managing Director and CEO of Bitget, as well as the CEO of BitKeep (Bitget Wallet), responsible for the global market growth and expansion, strategy, and corporate development. She has an educational background from the Massachusetts Institute of Technology and the National University of Singapore.

COO: Vugar Usi Zade

Vugar has been serving as the COO since 2024, holding master's and postgraduate degrees from Harvard University and the University of Oxford. He is a published author and has also worked as a researcher and consultant on minority issues at the Office of the United Nations High Commissioner for Human Rights (OHCHR). He previously served as the Chief Marketing Officer of Beincrypto and Marketing Director at SONY.

Prior to this, he has 15 years of progressive practical experience in different industries, from Fortune 500 companies to rapidly growing startups. He has developed remarkable products and brand strategies for "unicorn" marketing technology startups and has worked with well-known brands such as Carlsberg, Facebook, Danone, Coca-Cola, and Twitter. Vugar also has a solid background as an experienced management consultant, having served as a senior manager at Bain & Company, focusing on private equity investment.

Institutional Business Head: Alex Hwang

Alex Hwang is the Director of Institutional Business Expansion at Bitget and has previously worked at Deribit and OKX.

Bitget Wallet COO: Alvin Kan

Alvin Kan has previously served as the Asia Head of Sei Network, Ecosystem Growth Manager of BNB Chain, and Data Analysis Manager at Binance.

2.3 Investment Background

The main investors include 8 Decimal Capital, Matrixport, LK Ventures, MX Capital, HashKey Capital, Anlan Capital, and Dragonfly, with a focus on Chinese and Chinese-related capital.

2.4 Development Roadmap Explanation

As of now, BGB has achieved the functional rights related to the 2023 roadmap in the white paper, and the subsequent roadmap has not been disclosed.

3. Project and Business Overview

3.1 Development Strategy and Focus Areas

Bitget has not disclosed a roadmap, but according to the official Bitget blog, the focus of the development strategy in the coming year will be on compliance, emerging markets, and Web3.0. Bitget is working on license applications to promote compliance business development and will vigorously explore the potential and growth opportunities in emerging market countries such as Latin America, Southeast Asia, and Africa. Additionally, leveraging Bitget Wallet, they aim to further expand their business scope in the DEX and Layer2 fields.

3.3 Product and Business Situation

3.1 Code and Products

Based on Github data, Bitget Limited's Github activity is relatively low, with minimal daily maintenance and updates. This is likely related to the type of exchange products, as maintenance and updates of centralized platform code are rarely made public.

3.2 Product Highlights

BGB

As the passport of the Bitget ecosystem, holding or staking BGB in the ecosystem provides benefits such as participating in IEOs, receiving Launchpool new project tokens, unlocking exclusive airdrops, zero-fee withdrawals, discounted purchases of mainstream cryptocurrencies, participating in coin listing voting, and contract trading rewards.

Bitget Wallet

Bitget Wallet uses the proprietary DESM encryption algorithm to ensure the security of digital assets. It is a user-friendly Web3 wallet chosen by over 6 million users, currently supporting over 70 mainnets. Additionally, BitKeep Swap aggregates multiple mainstream DEXs and bridges, supports 220,000 tokens, and provides the most powerful swap function, allowing users to trade tokens using Instant Gas without paying any native tokens as gas fees.

Bitget Copy Trading

Bitget Copy Trading is known for its detailed functionality among leading exchanges, with over 130,000 trading experts and 650,000 copy trading users. The cumulative revenue from contract and spot copy trading is 430,000,000 USDT.

3.3 Official Website Data

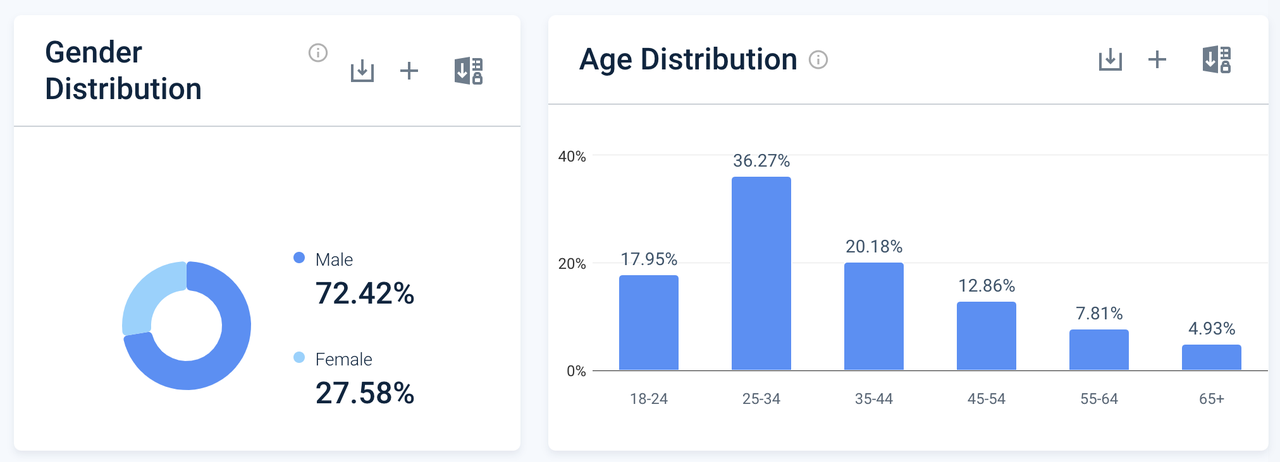

According to Similarweb data, Bitget has a monthly visit count of approximately 10,800,000. Male users make up a significant portion of the user base, and in terms of age distribution, the highest proportion of users are in the 25–34 age group, followed by the 35–44 and 18–24 age groups, with the lowest proportion of users aged 65 and above. This may reflect a preference for the website or service content among young male users.

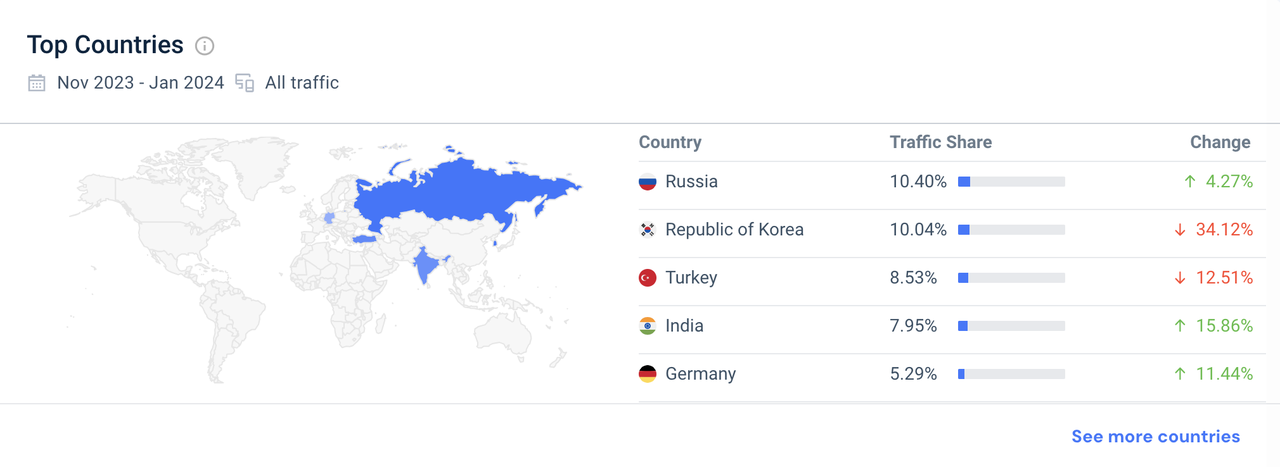

From November 2023 to January 2024, the top five countries/regions in terms of traffic sources are: Russia: 10.40% of total traffic, South Korea: 10.04% of total traffic, Turkey: 8.53% of total traffic, India: 7.95% of total traffic, and Germany: 5.29% of total traffic.

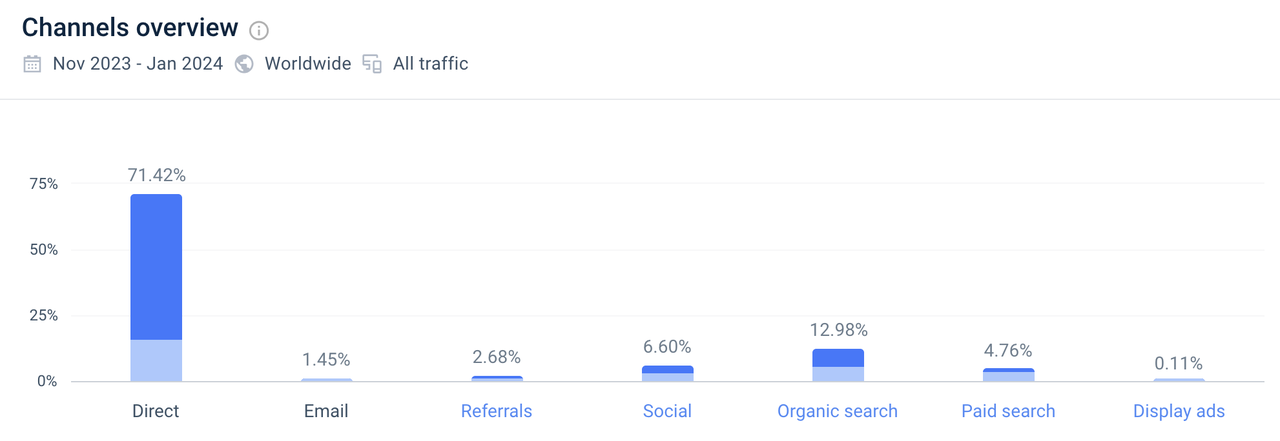

Direct traffic accounts for 71.2% of total traffic, indicating that most users directly access the website by entering the URL or using bookmarks. This may indicate a high level of brand awareness and user loyalty. The relatively high proportion of organic search suggests that the website may have a good ranking in search engines.

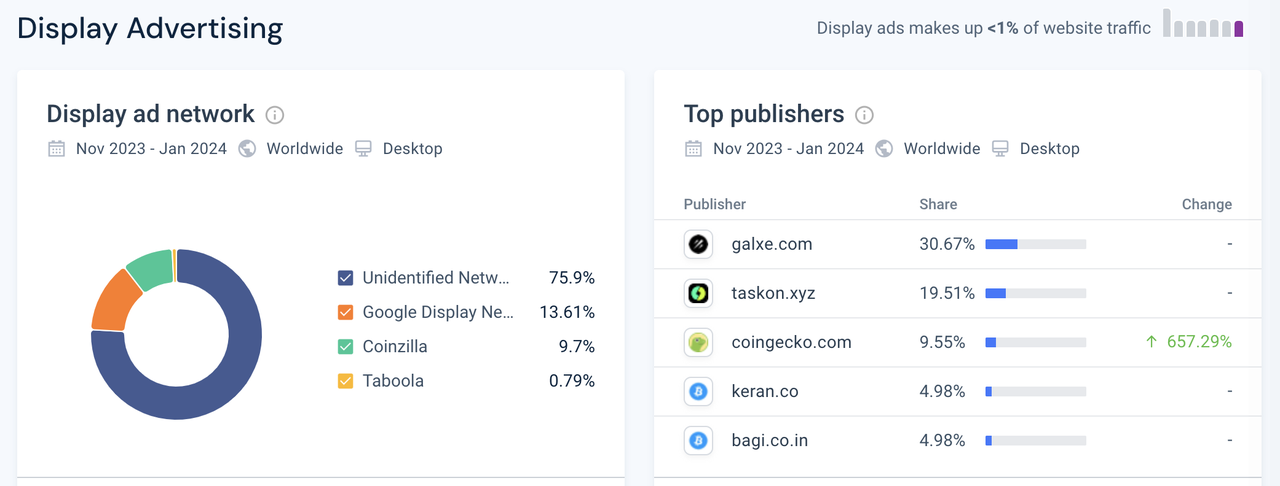

Additionally, display ad traffic constitutes less than 1% of total traffic, indicating that the website's traffic is not primarily derived from display ads. Among popular media, coindesk.com is the main media source, while coingecko.com shows significant growth trends.

3.4 Social Media Data

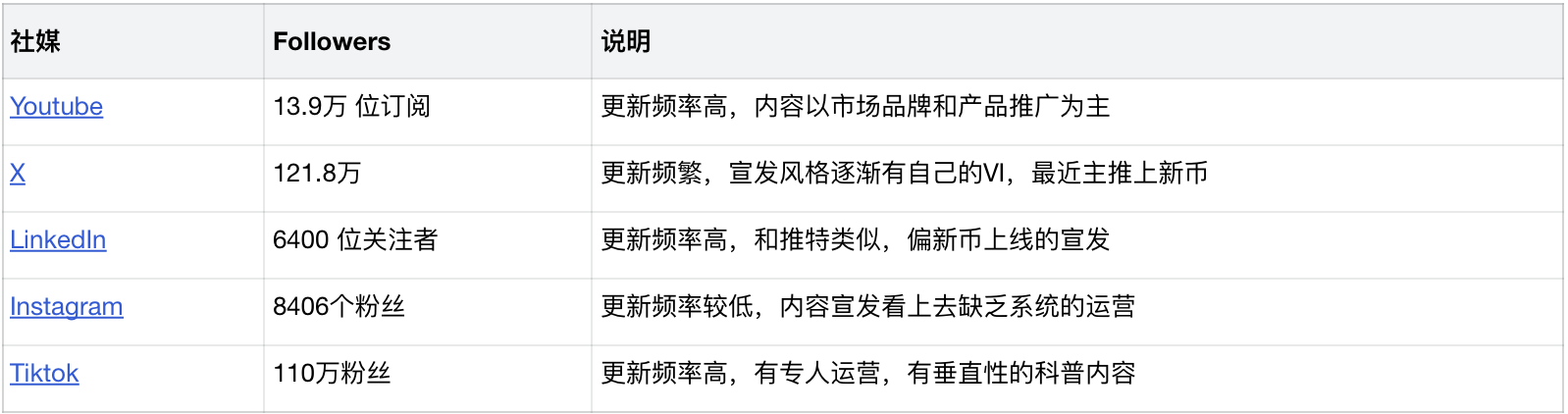

Bitget's global community development is well-categorized, indicating a certain level of emphasis on and potential for development in various markets.

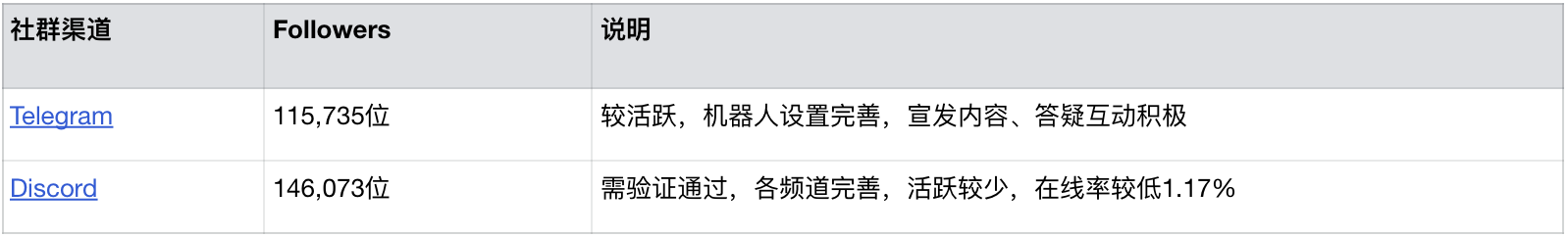

3.5 Community Data

3.6 Market Heat

Google data shows that the keyword "Bitget" has the highest search interest in the China region, reaching a perfect score of 100. Pakistan ranks second with a search interest of 66, followed by Trinidad and Tobago at 51. Saint Helena has a search interest of 38, ranking fourth, and Cambodia has a search interest of 34, ranking fifth.

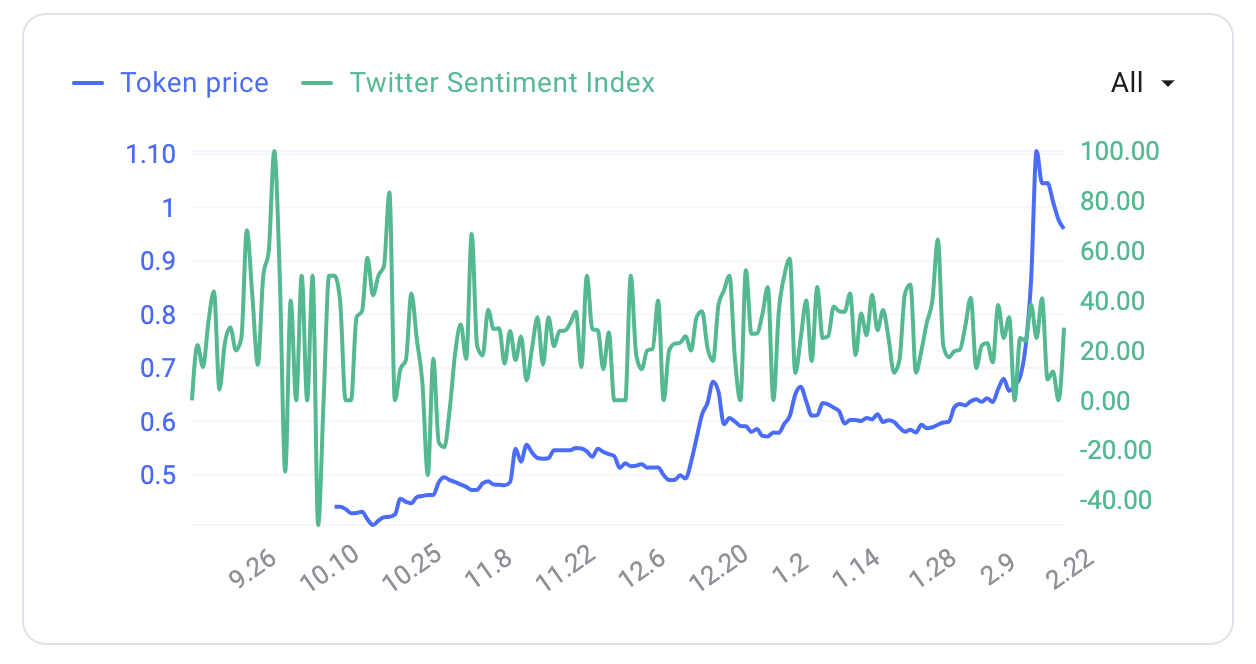

According to TrendX data, there have been 629 positive discussions, 1100 neutral discussions, and a total of 1809 discussions, representing a 77.01% increase compared to the average. The two lines in the graph fluctuate throughout the entire period, but their relationship is not very clear. This may indicate that there is not a direct or strong correlation between the Twitter sentiment index and the tracked indicators, or their relationship may be influenced by other factors.

3.7 Partners

It is understood that Bitget has established partnerships with companies such as Morph, DOTA 2, Coinrule, Copper, CoinStats, MAX Exchange, and Coinpanda, and has engaged in strategic partnerships with blockchain projects such as Linea, BlockBooster, and Celestia to expand its ecosystem and provide diversified services to users.

4. Token Circulation and Distribution Situation

4.1 Total Supply and Circulating Supply

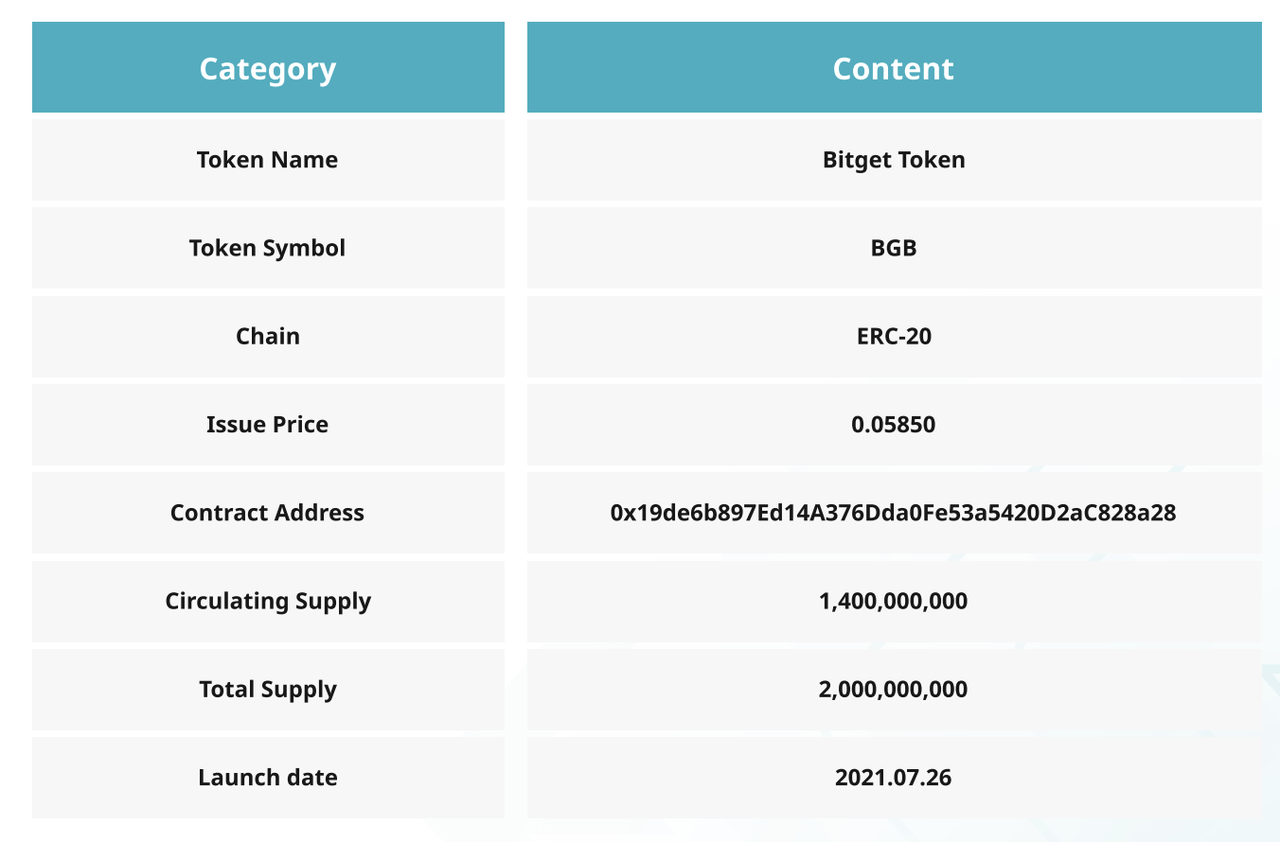

The current supply of BGB is 20 billion, with a circulating supply of 14 billion. It was first launched on July 29, 2021.

4.2 Token Model

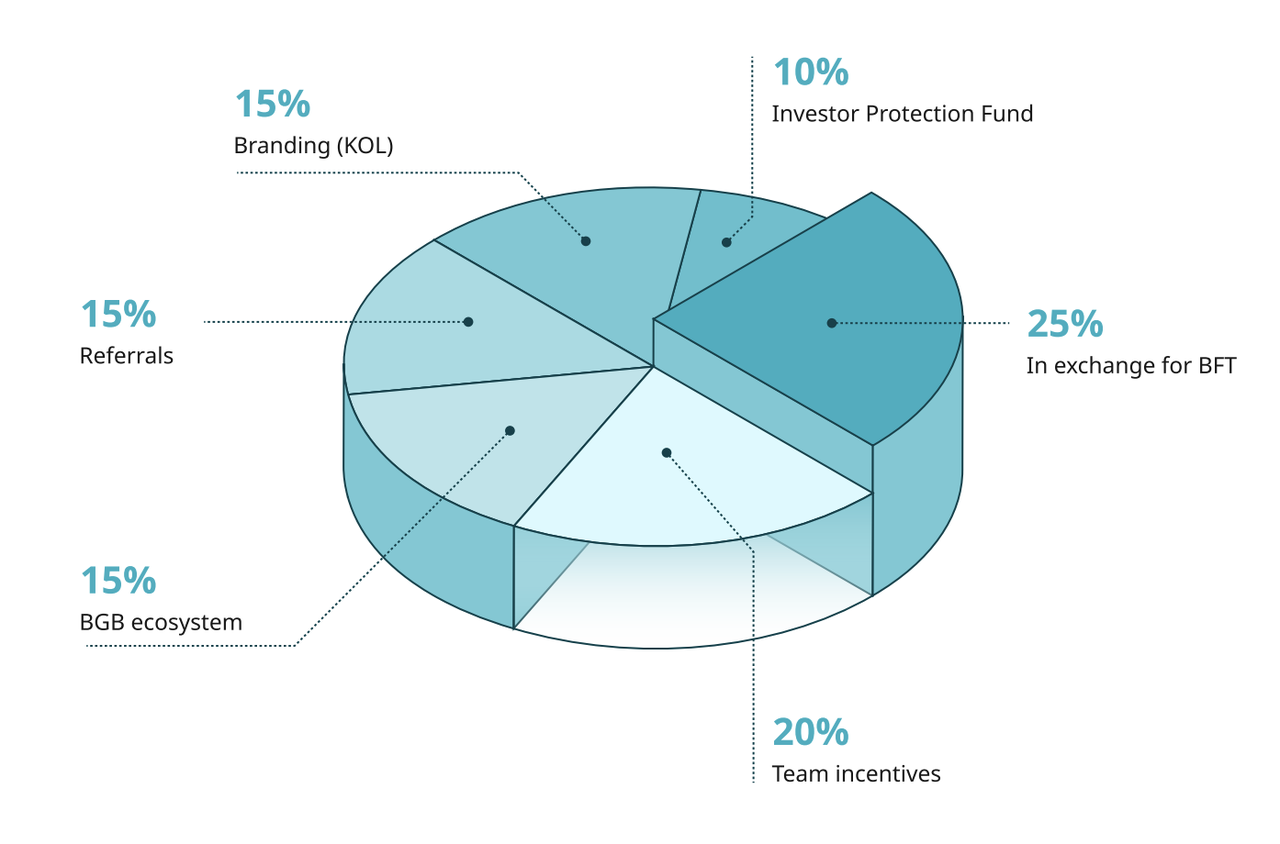

The total supply of BGB is 2,000,000,000, all of which are used for proportional exchange to the original BFT holders, with the specific allocation as follows:

- 15% for community and platform user acquisition, with a maximum annual release of 4%;

- 15% for brand promotion, with a maximum annual release of 3%;

- 15% as an ecological investment fund for Bitget's ecosystem development;

- 20% for core team incentives, with a 2% unlock every 6 months, fully unlocked over 5 years (60 months);

- 10% for investor protection fund, to be unlocked based on the actual compensation amount when the user compensation plan is activated.

Every quarter, Bitget platform will use 30% of all fee profits for BGB repurchase and destruction, and all records of the destroyed tokens will be publicly disclosed on the platform.

4.3 Market Performance

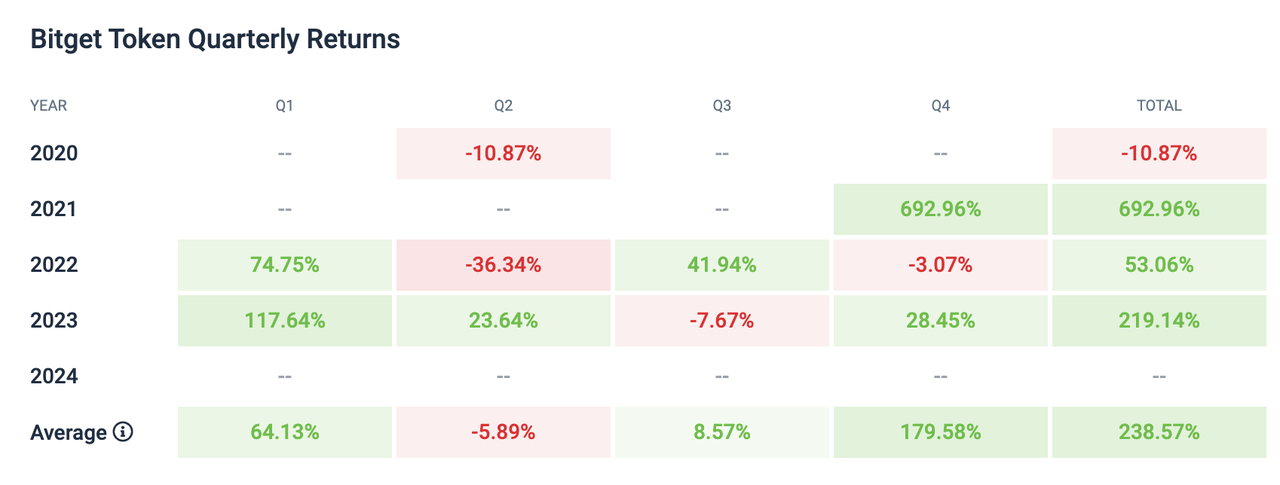

The average annual growth rate of BGB over the past 5 years is 238.57%, with the best performance in 2021, where the price of BGB increased from $0.014985 to $0.118827, a 692.96% increase. Typically, Bitget Token performs best in the fourth quarter, with an average increase of 179.58%, and worst in the second quarter, with an average decrease of -5.89%.

In the long daily chart of the past year, BGB's trading price was initially below $0.20 in early 2023, but quickly experienced its first surge in February, pushing the price above $0.50, and reaching a new all-time high in December.

It is worth noting that $BGB encountered resistance at the long-term 1.414 Fib Extension level (Fibonacci extension) of approximately $0.665, preventing further market growth. $BGB retraced from this resistance, found support at the 0.618 Fib Retracement (Fibonacci retracement) level of $0.566, and returned to this resistance level in 2024.

From a token exchange rate perspective, the correlation between BGB and BTC was 0.868 in May, while the BGB/ETH pair was 0.884. Compared to the correlations of 0.949 and 0.894 for the BNB/BTC and BNB/ETH pairs, BGB as a trading token undoubtedly exhibits more independence.

4.4 Factors Affecting Value

The advantages and disadvantages of BGB are equally apparent. As an emerging and rising trading platform, BGB may experience explosive independent market performance alongside Bitget's explosive growth. However, this also entails risks associated with centralized platform tokens:

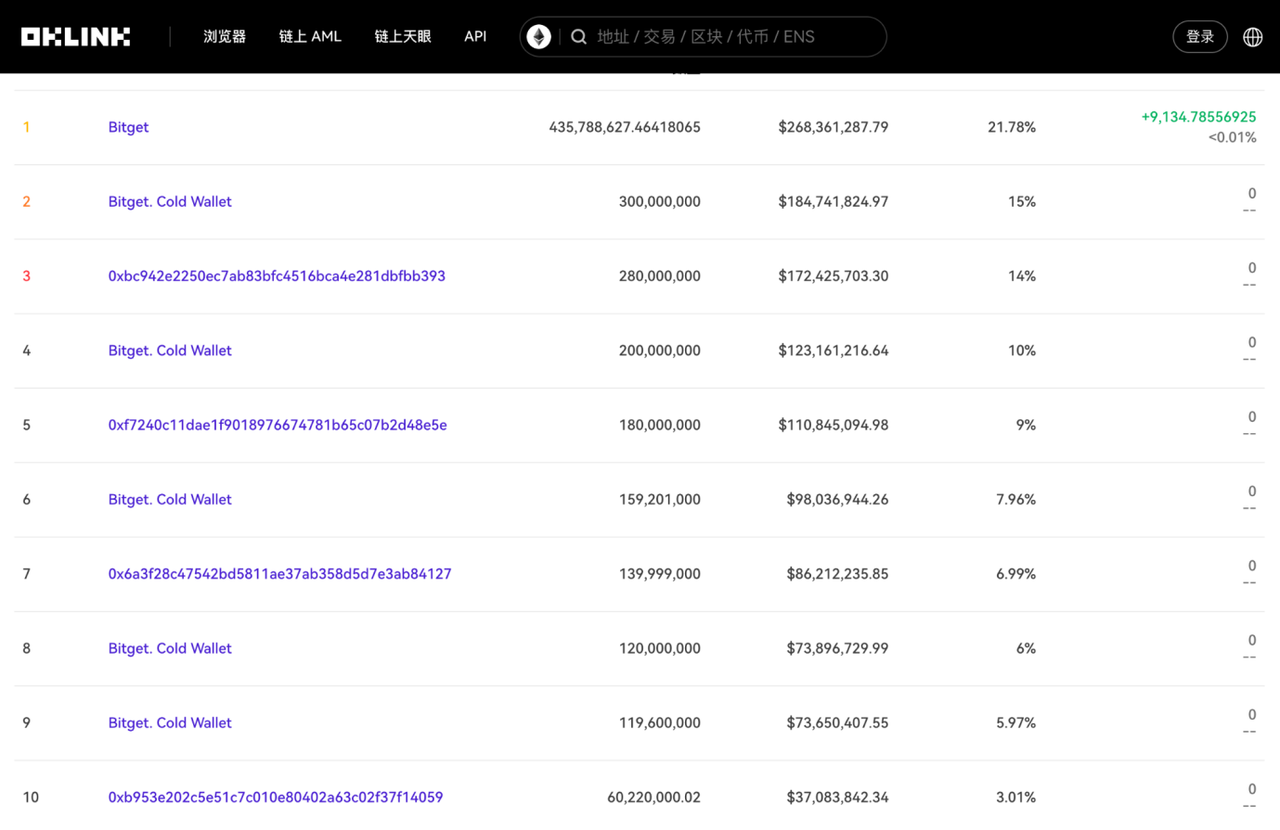

- Number of token holders: 2,566, with the top 10 holders collectively owning 99.74% of BitgetToken (1,994,798,584.93 tokens), posing a high risk of control. Investors need to be particularly cautious.

- According to the latest BGB whitepaper, the repurchase and destruction mechanism for BGB has not been determined. In this situation, the annual inflation rate of BGB is 180.00%, meaning 900 million tokens were generated in the past year, posing a certain risk of inflation and token devaluation.

5. Business Analysis

5.1 Project Scale and Potential

Public data shows that Bitget's annual trading volume has reached 3.14 trillion USD, with a daily average futures trading volume of 12 billion USD, and a year-on-year increase of 94% in spot trading volume, reaching 81.6 billion USD, while BGB trading volume growth rate has also reached 110%. The adoption rate of the Bitget exchange itself is continuously increasing, with its user base reaching an incredible milestone of 200,000 this year, with approximately 1,500 employees responsible for operations.

5.2 Market Competitive Landscape

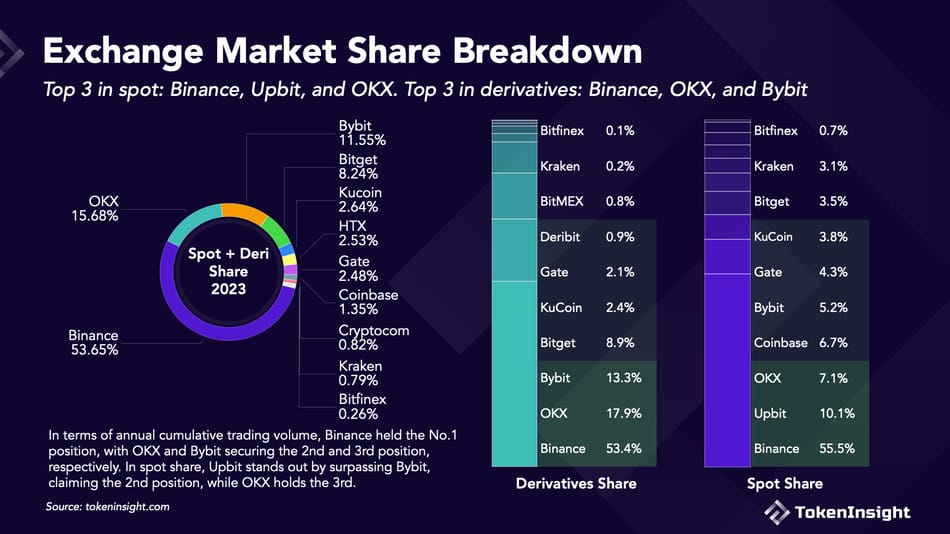

When the annual total trading volume is broken down into spot and derivatives, although Binance's share of spot and derivatives trading volume has decreased by nearly 6.5% compared to 2022, it still firmly holds the market's leading position with a 53.7% share, maintaining strong absolute dominance compared to other exchanges. Bitget's futures trading volume ranks fourth, and spot trading volume ranks eighth.

In the past year, although Binance's market share has slightly declined due to regulatory events, it has maintained its leading position in the industry. Exchanges such as OKX, Bybit, and Bitget are actively working to increase their market share. Bybit, Bitget, and OKX are exchanges primarily focused on derivatives trading, with approximately 91% of their trading volume coming from derivatives trading.

Despite experiencing the most significant regulatory event in history, leading to a decrease in Binance's share of derivatives trading volume from 55.9% at the beginning of the year to 50.4% at the end of the year, its performance remains strong, exceeding market expectations. OKX's market share has reached 19.4%, an increase of approximately 4% from the beginning of the year. The gap between Bybit and OKX's market share was only about 2% at the beginning of the year, but by the end of the year, this gap had widened to 4.4%. Bitget follows closely, with its share fluctuating around 9%.

As the market gradually recovers, the platform tokens of most centralized exchanges have experienced varying degrees of growth. FTT, MX, and BGB from leading platforms have all seen increases of over 200%, surpassing BTC's increase during this period (166%).

5.3 Strengths and Opportunities

Bitget has designed many exclusive benefits around BGB, including participation in new projects, mining, airdrops, fee discounts, group purchases, lotteries, and coin voting. Although it does not have many differentiated advantages compared to other platforms, it offers a wide range of activities and greater benefits.

With strong business potential, as a platform token, BGB is closely related to the development of the platform's business. Bitget's market share in the cryptocurrency derivatives market has fluctuated from 3% to around 10%, with annual trading volume growing by over 300% and profitable trades exceeding 4.2 million. On-chain data shows that over 100,000 traders have shared over $10 million in profits through its copy trading products, indicating significant growth potential for Bitget and BGB in copy trading and futures trading.

The market dynamics are diverse. In 2022 and 2023, Bitget successfully expanded its influence and business boundaries through partnerships with sports events and collaboration with Messi, creating a strong positive perception among industry practitioners and users, which has had a positive impact on the ecological development around BGB.

5.4 Issues and Obstacles

Systemic risks: BGB is an ERC-20 token based on Ethereum, which makes BGB less risky compared to BNB and OKB. However, if the value of Ethereum declines, the value of ERC-20 tokens, including BGB, is also likely to decrease.

Opaque risks: The BGB team unlocks 2% every 6 months, with a maximum annual allocation of 3% for brand promotion and a maximum release of 4% for acquiring new users. Apart from the fixed unlocking schedule for team incentives, the timing and quantity of subsidies for acquiring new users and brand promotion are not fixed, posing a risk of opaque operations.

Liquidity risk: Currently, BGB has limited circulation platforms, mainly concentrated within the Bitget platform. While this is beneficial for value stability to some extent, it also limits BGB's recognition and acceptance by more users, indirectly affecting its value appreciation.

6. Conclusion

In 2023, BGB's remarkable 245% growth surpassed all its competitors, setting a new benchmark in the field of platform tokens, which also demonstrates Bitget's strategic growth, innovative ecosystem expansion, and continuously growing user adoption rate. This momentum positions BGB to potentially reach new highs in 2024, laying a solid foundation.

As the overall market sentiment turns bullish, the crypto industry seems to be preparing for the upcoming bull market. In this environment, BGB's resilience and growth trajectory make it a token worth closely monitoring. With Bitget's continuous strategic investments and consolidation of the ecosystem, BGB has a high potential to establish an independent market performance in the field of platform tokens, becoming a highly promising asset sought after by investors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。