The oracle and DeFi are not new tracks, and the competition pattern of these two tracks has almost taken shape. However, API3 can still explore new opportunities in these two highly competitive markets.

➤First, look at the data

The Total Value Secured (TVS) of API3's oracle saw a huge increase in 2024.

Some may express doubts, as most coin prices saw significant increases in 2024. However, we can look at the market share.

According to Defillama data, in May 2023, API3's TVS accounted for 0.02% of the entire oracle market. But the latest data shows that API3's market share has reached 0.22%, a tenfold increase.

Some may still be skeptical because 0.22% is still a small proportion. However, the recently announced OEV network that favors API3 is currently in the testing phase. The following content will interpret the substantial growth after the launch of the OEV network.

➤First-party oracle

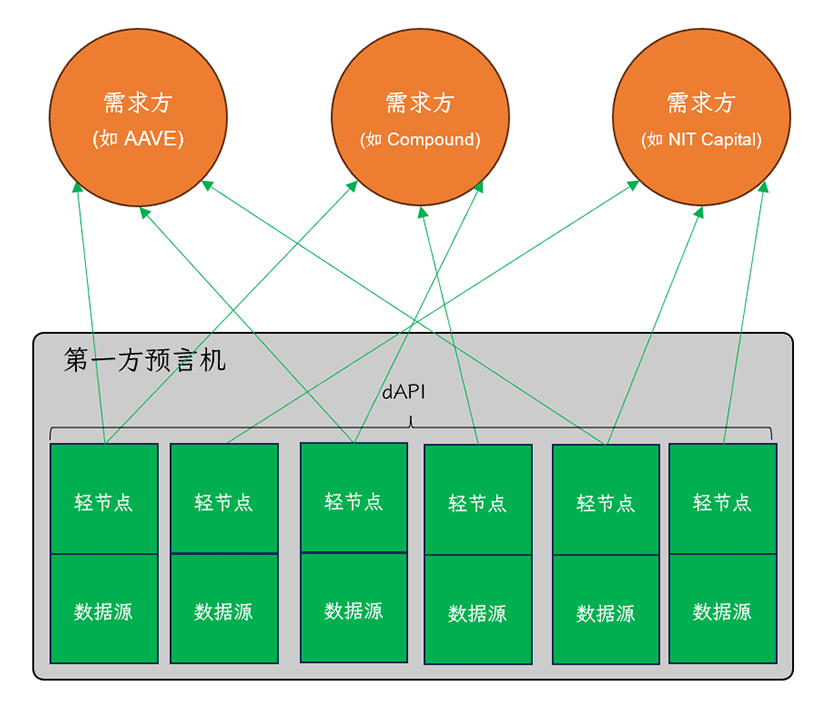

What is the difference between a first-party oracle and a third-party oracle?

If we look at the data flow, both third-party oracles and first-party oracles are submitted to data consumers (currently mainly DeFi smart contracts) by data providers.

However, there are differences in implementation. Third-party oracles are aggregated and filtered by third parties before being supplied to data consumers, hence the name "third-party oracle."

API3's first-party oracle has developed a lightweight node program—Airnode. Data source providers can relatively easily establish lightweight nodes without needing to understand blockchain knowledge, and the hardware requirements for nodes are also lower.

Comparing the two diagrams, the third-party oracle has an additional step of data aggregation and filtering by a third party, which may pose security risks. Logically, having one less data transmission step provides an additional safeguard.

On the other hand, oracle nodes need to make money, and they may also need to pay the data source. However, third-party oracles have an additional fee entity. It is possible that the cost for users may be lower for first-party oracles. Of course, these retail investors may not understand this, but operators of DeFi applications are more likely to understand. It is also difficult for the assistant to make a specific comparison of the fees for the two types of oracles, so the analysis can only be made logically.

➤OEV network

▪MEV vs OEV

MEV (Miner Extractable Value)—the value that miners can capture. Ethereum Gas includes base Gas and tip Gas, and miners often prioritize processing transactions with higher tip Gas. For example, when there are arbitrage opportunities on-chain or when manipulating transaction order, miners can earn higher tip Gas income (before EIP1599, it was competitive price Gas, with similar logic), which is the miner extractable value.

For example, on AAVE, if someone's loan is about to be liquidated, the liquidator will pay a higher tip Gas to the miner to prioritize processing the transaction. The miner earns the tip Gas.

Assuming:

(1) The liquidation price of the ETH is 2805,

(2) The current price of ETH is 2820

(3) AAVE has set a 1% threshold for oracle updates (meaning that the oracle will only update ETH price data when the price fluctuates by 1%).

Then: The price must drop to 2791.8 or rise to 2848.2 for the traditional oracle to update the data. So, when ETH drops to 2791.8, the traditional oracle updates the data to AAVE, and then the liquidators rush to liquidate the ETH, as they rush to update, the miner earns the highest tip fee, which is MEV.

OEV (Oracle Extractable Value)—the value that oracles can capture.

Continuing with the previous example—

API (first-party oracle) obtains this information in advance and knows that someone's ETH is about to be liquidated at a price of 2805U.

So, once ETH drops to 2805U (note that this is earlier than the traditional oracle), API (first-party oracle) updates the ETH price data to AAVE and simultaneously proceeds to auction the liquidation of the ETH.

Note that these two actions, updating the data and liquidating, are carried out simultaneously, so there are no competitors for liquidation, and there is no need to pay the miner a tip. This results in more liquidation income and saves the tip to the miner, converting MEV to OEV (oracle extractable value).

▪OEV Network working principle

The OEV Network is a ZK-rollups Layer2 network developed using the Polygon CDK.

The main function of this network is auctioning, and of course, this auction process is decentralized.

Auction participants use automated bots to search for extractable value in the data published by API3 and participate in the auction. The highest bidder pays and then obtains the meta-transaction. What is a meta-transaction? It is updating the dAPI and triggering the corresponding transaction behavior, thereby obtaining the corresponding income.

In the previous example, when ETH drops to 2805, API3 updates this extractable value data, and auction participants find the data and participate in the auction. For example, if the assistant successfully auctions, after payment, the assistant obtains the right to update the price data and executes the liquidation, and the income from this liquidation belongs to the assistant.

➤Beneficiaries of OEV

Most of the auction proceeds will be returned to the dApp, and in the example in this article, AAVE can receive most of the auction proceeds. Additionally, because API3 efficiently updates price data to DeFi applications, DeFi applications (such as AAVE in this article) also reduce their risks.

A small portion of the auction income is obtained by the OEV network, and this part mainly benefits the API provider, which is the first-party oracle.

Therefore, the beneficiaries of OEV include data sources and DeFi applications. Both data providers and data consumers, which are DeFi applications, should actively participate in the OEV network.

➤Market space for OEV

Observing MakerDAO, it has auctioned off assets worth over $600 million.

Except for during a bear market crash, AAVE generally liquidates nearly $1 million to $10 million in assets each month. Over the past 3 years, a total of $2 billion in assets has been liquidated.

In the past year, Compound has seized $76 million in collateral.

The application of OEV is not limited to lending protocols, but liquidation in lending protocols should be the main market.

➤In conclusion

If we ignore the principles and only consider the surface concept, API3's concept is:

"First-party oracle + ZK-rollup Layer2 + OEV",

where the first-party oracle and OEV are conceptual innovations, and ZK-rollup Layer2 is a hot track.

There is room for speculation.

By focusing on the principles of OEV, #API3 uses the advantages of first-party oracle data, including data initiative and low cost, to change the way oracle data is updated and to execute liquidation and other behaviors, converting some MEV to OEV. On the OEV network, through a decentralized auction mechanism, most of the OEV value is returned to dApps (such as AAVE in this article), and a small portion is allocated to the participants in the OEV network (primarily the first-party oracle data source). This improves the rationality and fairness of value distribution, which is beneficial for improving the stability of DeFi applications. Therefore, the OEV network and API3 should receive support from data sources and DeFi applications (such as MakerDao, AAVE, Compound, etc.) and should have considerable development space in the future.

Finally, in a situation where the competition pattern of oracles and DeFi is basically stable, API3 can find an innovative point in the market by converting some of the MEV into OEV and distributing it to relevant participants. This product strategy design is very insightful.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。