Introduction:

Due to the relevant laws, regulations, and policies in China, if opinions and views related to blockchain/virtual currency are posted on domestic social media platforms (such as Zhihu, Weibo, Douyin, etc.), it is very easy to be deemed as a violation, have posts deleted, or even have accounts banned. Therefore, many influential figures in the cryptocurrency community are more active on Twitter.

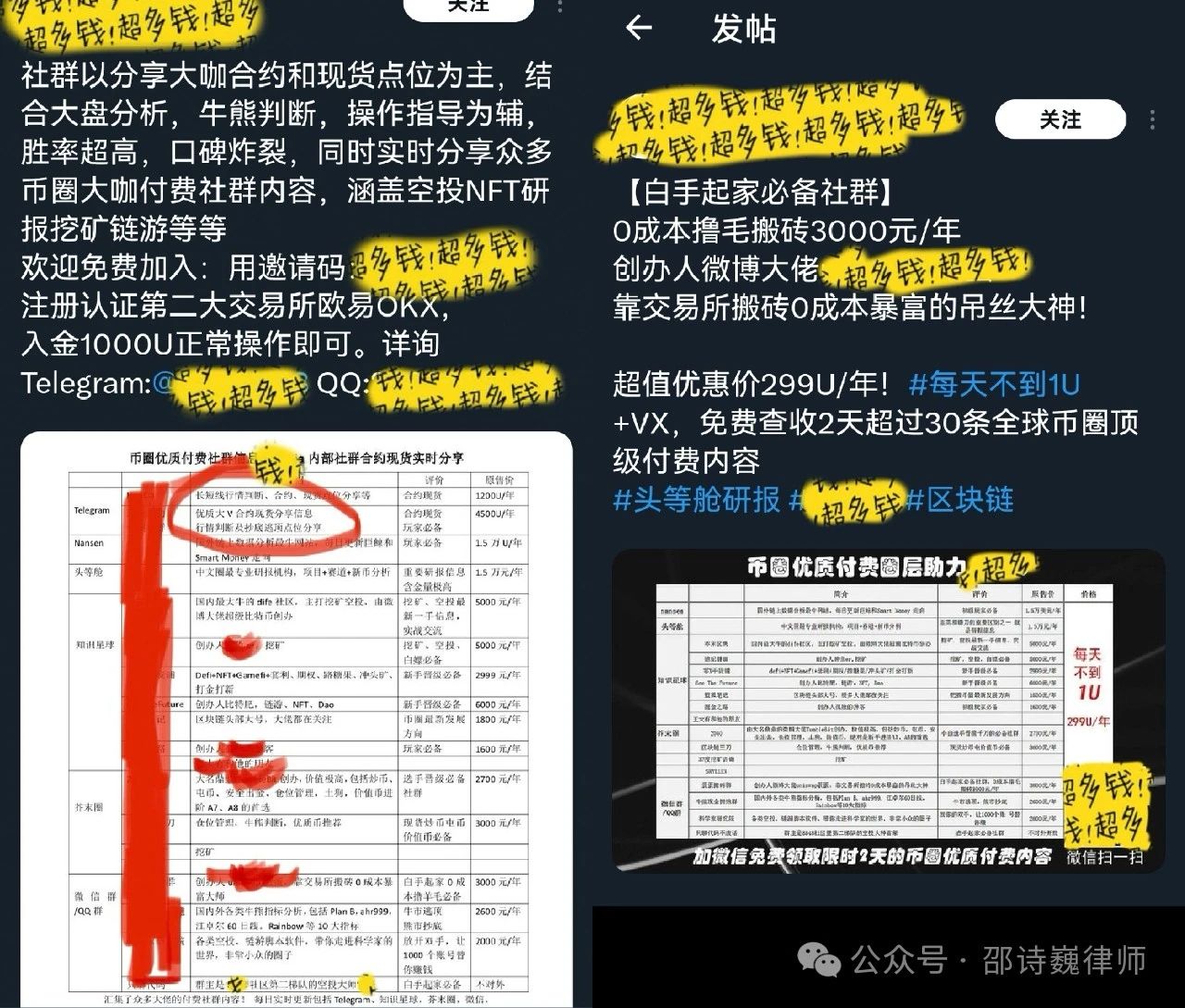

If the views of these influential figures are increasingly recognized by more people and they gain more followers, then with more traffic, there will be more possibilities for monetization. In addition to publishing advertisements, promoting products, and attending related events, creating paid communities for private domain operations is also a common monetization model for influential figures.

For operators of cryptocurrency communities/KOLs, what are the legal risks of operating knowledge-based paid communities? In this article, Lawyer Shao analyzes this issue in combination with relevant policies and regulations in China and provides related advice.

In 2013, a notice from five ministries mentioned preventing the money laundering risks of Bitcoin. In 2017, Announcement No. 94 mentioned the prohibition of token issuance and financing activities for virtual currencies. In 2018, the "Risk Warning on Preventing Illegal Fundraising in the Name of 'Virtual Currency' and 'Blockchain'" mentioned the prohibition of speculation in virtual currencies. In 2021, Notice No. 924 mentioned that virtual currency-related business activities are illegal financial activities. In 2022, the China Internet Finance Association and others issued the "Initiative on Preventing Financial Risks Related to NFTs"…

Therefore, considering that China's relevant policies generally hold a negative attitude towards virtual currencies and related investment and speculative financial activities, if community operators establish "knowledge planet" type communities, they need to be mindful when providing information or one-on-one consultations to users. They should not provide specific investment and financial advice to the group, nor should they guide users to recharge at specific exchanges, play contracts, or engage in leveraged trading.

When users profit, they worship the KOL as a deity; when users suffer losses, they will unite to safeguard their rights and report cases of fraud to the police station. In short, users in the cryptocurrency community are adept at using legal weapons to protect themselves.

01 Can membership fees be collected in USDT or platform tokens?

USDT, as a stablecoin pegged to the price of the US dollar, is stable in price. In the eyes of the cryptocurrency community, it has become a common payment method. However, it should be noted that as early as the notice from five ministries in 2013, it was mentioned that Bitcoin should be treated as a specific virtual commodity, does not have the same legal status as currency, and should not be used as a circulating currency in the market. This policy also applies to USDT and other virtual currencies.

If membership fees are collected in USDT or virtual currencies issued by exchanges, it is already treating virtual currencies as a payment method equivalent to legal tender. In this case, if one receives coins from upstream illicit sources, their exchange account may be frozen at best, and they may face criminal charges such as aiding and abetting or concealing illicit activities.

02 Is it permissible to speculate on coins with community members?

If one is trading coins on their own and incurs losses from investing in some altcoins, it can be overlooked. However, it is not advisable to trade coins together with group members. After all, whether the coins issued by the project party will rise or fall in the future, and whether the project party itself is reliable, are all asymmetrical information.

As mentioned in Notice No. 924 in 2021, "Participating in virtual currency investment and trading activities carries legal risks. Any legal person, unincorporated organization, or natural person investing in virtual currencies and related derivatives, if it violates public order and good customs, the relevant civil legal acts are invalid, and the resulting losses shall be borne by the investor; if it is suspected of disrupting financial order and endangering financial security, it shall be investigated and dealt with by the relevant authorities in accordance with the law."

Although this notice does not list specific legal responsibilities related to participating in virtual currency exchanges, based on specific circumstances, there will always be a criminal charge that can be applied, as the criminal law in China does not lack catch-all provisions.

03 What are the considerations when helping project parties attract new users?

Various projects in the cryptocurrency community emerge endlessly, and there can be mutual benefits from cooperation between project parties and KOLs. Project parties can accumulate more potential users through the strong fan base and influence of KOLs, while KOLs can earn cooperative benefits by promoting and publicizing project parties.

When a project is initially accumulating users, it often sets up various new user reward mechanisms. A common new user acquisition model is that User A can generate their exclusive QR code or link in the product poster, and if User B registers through the shared QR code or link, User A can receive relevant rewards from the platform.

According to Chinese law, pyramid selling refers to the act of organizers or operators developing personnel, obtaining illegal gains through the calculation and payment of rewards based on the number of directly or indirectly developed personnel or sales performance, and disturbing economic order and affecting social stability. If there are more than thirty participants within the organization and the hierarchy is more than three levels, the organizers and leaders should be held criminally responsible.

I have encountered a case of organizing and leading pyramid selling activities, where a KOL stood for the project party, participated in several events, and expressed some views. Later, the project party was involved in the case, and ultimately, both the KOL and the project party were convicted of organizing and leading pyramid selling activities.

04 Is it permissible for community operations and KOLs to issue NFTs?

Since promoting others' projects carries certain legal risks due to various complex reasons such as asymmetrical information, is it permissible to issue one's own NFTs within the community? In an article by Lawyer Shao titled "网红KOL发币让粉丝来分享红利,这事合法吗?," it was also mentioned that China's relevant policies do not allow any organization or individual to issue tokens. As a localized product of NFTs, digital collectibles mainly emphasize their value as digital artworks and guard against their financial attributes.

If some KOLs guide users psychologically through hype, deception, price manipulation, etc., causing a large number of users to purchase their NFTs, but they are unable to provide sustained and stable high-quality services to users, and then sell the NFTs at inflated prices to gain high profits, resulting in significant losses for many users, if subsequent users report cases of fraud, the criminal liability of the KOL cannot be avoided.

05 What are the risk points to consider when operating communities on foreign chat apps like Twitter?

According to Article 2, Paragraph 1 of the "Regulations on the Management of Internet Group Information Services," "Providing or using internet group information services within the territory of the People's Republic of China shall comply with these regulations."

Therefore, as long as a person is in China, regardless of the type of software used to operate a community, they need to comply with relevant domestic laws and policies. From a criminal law perspective, as long as a Chinese national commits a crime or the criminal act or result occurs within the territory of China, the judicial authorities of China have jurisdiction.

In addition, according to the "Interim Provisions on the Administration of International Networking of Computer Information Networks of the People's Republic of China," if an individual's act of "climbing over the wall" is discovered, there may be legal risks of being ordered by the public security organs to stop networking, receiving warnings, fines, confiscation of illegal gains, and other administrative penalties.

06 Conclusion

It is hoped that this article can provide some directional thinking for operators of cryptocurrency communities/KOLs in the process of community operations. More practical and operational solutions need to be analyzed in combination with the content of community services and specific scenarios.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。