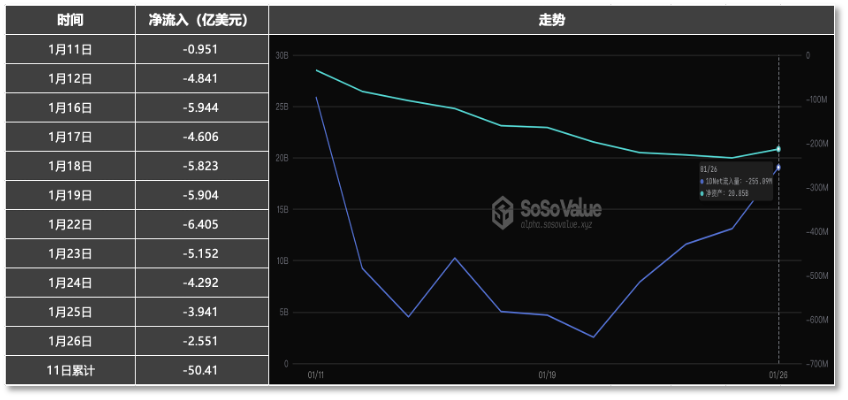

As of January 26, the 10 Bitcoin spot ETFs approved by the SEC have experienced 11 trading days. According to SoSo Value data, the total trading value during this period reached $1.67 billion, with total net assets of $26.74 billion.

In terms of net inflows, Grayscale's GBTC has continued to experience negative values, i.e. "net outflows". On January 26, the last trading day of last week, GBTC's net outflow reached $255 million, the lowest outflow of funds since the first day of trading.

As of January 26, GBTC has accumulated a net outflow of $5.041 billion over 11 trading days. In addition to GBTC, on January 26, the other 9 Bitcoin ETFs were all in a net inflow state, with the highest being Fidelity's FBTC, with a net inflow of approximately $1 billion; followed by BlackRock's IBIT, with a net inflow of $87.13 million.

The Bitcoin ETF products of these two companies have been in a "race for first place" in terms of daily net fund inflows during the brief trading history.

Analysts believe that the reason for the large outflow of funds from Grayscale's GBTC is that early investors are redeeming arbitrage after the product transitioned from Bitcoin Trust to Bitcoin ETF. In addition, the high management fee of GBTC compared to similar products in the market may also prompt early investors to redeem, leading to fund outflows. Consequently, Grayscale also needs to sell the Bitcoin it manages to meet redemption demands.

During this period, the continuous outflow of funds from Grayscale's GBTC has brought selling pressure expectations to the BTC spot market, causing the BTC price to briefly fall below $40,000. However, as the outflow of GBTC funds slowed down, the price of BTC rebounded, and on January 28, BTC once again rose above $42,000.

GBTC Outflow Slows Down, BTC Rebounds to $42,000

Since the launch of Bitcoin spot ETFs in the US market on January 11, products from 10 different companies have accumulated a total of $26.74 billion in 11 trading days, but Grayscale's GBTC has lagged behind, with funds continuously flowing out.

On the first day of trading on January 11, GBTC saw an outflow of $95 million, which was also the least outflow of funds in a single day. Since then, the value of outflow funds for this Bitcoin ETF has been in the billions of dollars on a daily basis. On January 22, GBTC saw a single-day outflow of over $640 million, setting a record for the largest single-day outflow to date.

GBTC has continued to experience net outflows since its listing

GBTC has continued to experience net outflows since its listing

After funds continued to flow out of GBTC, the cryptocurrency market has been recording the amount of Bitcoin sold by Grayscale. According to the current subscription/redemption rules of this ETF-like product, when investors request redemption/sale of GBTC, Grayscale also needs to sell Bitcoin to meet investor redemption demands.

Data from Lookonchain as of January 23 shows that on January 11, Grayscale sold over 2,000 Bitcoins, and in the subsequent Bitcoin ETF trading days, Grayscale's daily selling volume has been over 10,000 Bitcoins, with two instances even reaching 14,000 Bitcoins.

In addition, the liquidation of FTX, which is in the bankruptcy process, also accounts for a large portion of the outflow of funds—FTX's liquidation of 22 million shares of GBTC is valued at $1 billion.

Bitcoin briefly surged to $49,000 due to the approval of ETFs, and with funds flowing out of GBTC and Grayscale selling Bitcoin, market selling pressure began to brew.

On January 23, Bitcoin fell below $40,000 after a continuous decline, coinciding with the outflow trend of funds from Grayscale's GBTC. However, as the net outflow value of GBTC gradually decreased after setting a record high on January 22, by January 26, the net inflow of funds for this Bitcoin ETF had narrowed to $255 million, and Bitcoin rebounded, currently standing in the $42,000 range.

In addition to Grayscale, the ability of other Bitcoin ETFs to attract funds has continued to strengthen, especially for iShares Bitcoin Trust (IBIT) issued by BlackRock and Fidelity Wise Origin Bitcoin Fund (FBTC) issued by Fidelity. As of now, the total net inflow funds for these two ETFs are $2.173 billion and $1.925 billion, respectively, and their corresponding net asset values have reached $21.9 billion and $19.4 billion.

Financial Professionals Predict: "Indigestion" to End in Six Months

From the data, it seems that the inflow of funds into other Bitcoin ETFs does not seem to offset the panic brought about by the high outflow of funds from Grayscale's GBTC. When GBTC transitioned to an ETF on January 11, the scale of the fund managed by Grayscale was as high as $25 billion, supported by 619,162 BTC.

Before this, GBTC was a Bitcoin trust, established in 2013, allowing investors to invest in Bitcoin by purchasing GBTC shares without directly buying Bitcoin.

However, as a trust product, GBTC does not support redemption, meaning that once investors subscribe to shares, they cannot redeem them for Bitcoin in the primary market. If they want to sell, they can only do so through the secondary market of GBTC shares. Therefore, GBTC may experience trading at a premium or discount to the underlying asset (negative premium).

Since the beginning of 2021, GBTC's negative premium has been increasing, reaching nearly 50% discount in December 2022. The heavily discounted GBTC attracted many investors. Until the SEC accepted the transition of GBTC to a Bitcoin ETF, the discount eventually narrowed to near 0, meaning that many investors holding GBTC are likely to be in a significantly profitable state, and after GBTC was listed as a Bitcoin ETF, they chose to take profits.

Nicholas Panigirtzoglou, an analyst at JPMorgan, analyzed that during 2023, investors were attracted by the discounted net asset value and invested as much as $3 billion in GBTC on the secondary market. "If the previous estimate of $3 billion is proven to be correct, and considering that $1.5 billion has already exited, there may be another $1.5 billion exiting the Bitcoin field through profit-taking from GBTC, thereby exerting further pressure on the price of Bitcoin in the coming weeks."

In addition, Grayscale's GBTC has a management fee rate of 1.5%. Its CEO believes that, given the liquidity of GBTC, minimal spread, and a good track record over the past decade, "a 1.5% fee rate is reasonable." However, this rate is outrageously high compared to the 0.25% fee rates of BlackRock, Fidelity, and 4 other companies, and Franklin Templeton's EZBC fee rate is even as low as 0.19%.

Grayscale's Bitcoin ETF is not competitive in terms of fee rates, which may also cause some investors to switch to other Bitcoin ETF products with more suitable fee rates.

As for how long Grayscale's selling will continue, some analysts have expressed optimistic expectations.

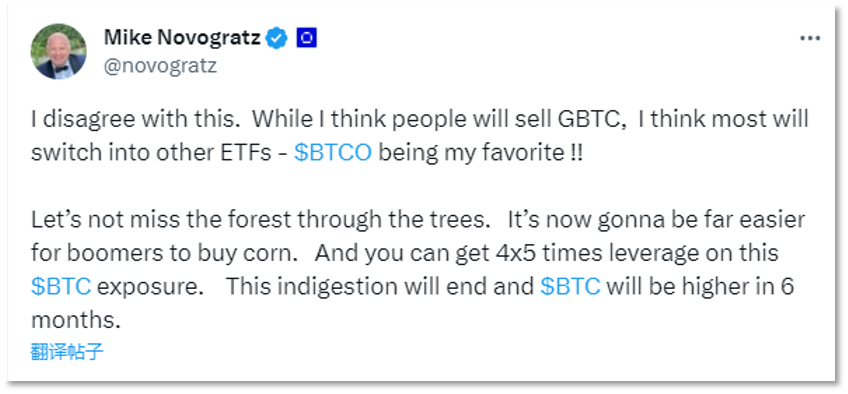

On January 21, Michael Novogratz, founder of the US cryptocurrency financial services company Galaxy Digital Holdings, posted on social media that although investors will sell GBTC, most will switch to other ETFs. He is not worried about the current volatility and predicts that the "indigestion" state in the market will end within six months, and BTC will reach new highs.

Novogratz predicts that the "indigestion" state in the market will end within six months.

Novogratz predicts that the "indigestion" state in the market will end within six months.

Another analyst, when analyzing the time for the selling pressure to end based on Grayscale's selling data, stated that the company currently holds over 500,000 BTC. If we calculate at a rate of 14,000 BTC per day, it will take about 39 days to completely sell off. "Considering the impact of non-working days, Grayscale may complete all sales by mid-March."

Indeed, in addition to Grayscale, other companies offering Bitcoin ETF products are all in a state of net fund inflows. In the long run, the cycle of funds entering this new ETF will gradually lengthen, and multiple products will continue to attract funds. Matthew Sigel, Director of Digital Assets Research at VanEck, believes that $40 billion will flow into the Bitcoin ETF market within two years, while Eric Balchunas, Senior ETF Analyst at Bloomberg, is even more optimistic, marking the inflow volume over two years at $50 billion.

(Disclaimer: Readers are strictly advised to comply with local laws and regulations. This article does not represent any investment advice.)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。