In the new market cycle, based on the concepts of heterogeneous chains and parallel chains, the value of DOT will still be fully hyped. However, the project's architecture design has led to slower ecosystem development compared to Cosmos, and the support from top VCs is also insufficient.

Author: MIIX Capital

Introduction

After experiencing the painful period of layoffs, Gavin Wood's handover of the professional manager, and the departure of ecological projects during the bear market, the Polkadot team delivered a series of new features and characteristics in 2023, including XCM V3, OpenGoV governance module, system parallel chains, asynchronous support, and parallel threads, to enhance the interoperability, governance participation and efficiency, and scalability of parallel chains within the ecosystem. In 2024, Polkadot will embark on a new chapter: Polkadot 2.0.

1. Basic Information

1.1 Track

Polkadot belongs to the infrastructure Layer1/Layer0 track, aiming to solve Ethereum's scalability issues as a heterogeneous public chain. However, Ethereum is also moving in this direction, so the prospects of Polkadot are becoming closely related to the development of Ethereum.

1.2 Logic and Goals

Polkadot founder Gavin Wood is the originator of the widely used term "Web3" and aims to lead the blockchain industry in creating a completely new form of the internet. From the perspective of Layer0, Polkadot combines the security of all Layer1 and is committed to solving Ethereum's scalability issues through parallel chains. As a public chain, its core operation still focuses on attracting developer ecosystems.

1.3 Founding Team

Peter Czaban

Founder of Polkadot and Technical Director of Web3 Foundation, dedicated to supporting the development of next-generation distributed technologies. He obtained a master's degree in engineering from the University of Oxford, focusing on Bayesian machine learning. He has worked in defense, finance, and data analysis industries, focusing on mesh networks, distributed knowledge bases, quantitative pricing models, machine learning, and business development.

Gavin Wood

Co-founder of Polkadot and also a co-founder of Ethereum. In January 2016, Wood left the Ethereum Foundation and co-founded Parity Tech with former colleague Jutta Steiner, dedicated to developing clients for the Ethereum network. He also created the Web3 Foundation, a non-profit organization dedicated to promoting the development of decentralized internet infrastructure and technology, with the first project being Polkadot.

Robert Habermeier

Co-founder of Polkadot, first encountered Bitcoin and blockchain in 2011, joined Parity in 2015 and became a core developer for Ethereum, and began collaborating with Gavin Wood and Peter Czaban in 2016 to design the basic expansion architecture of Polkadot.

1.4 Investment & Background

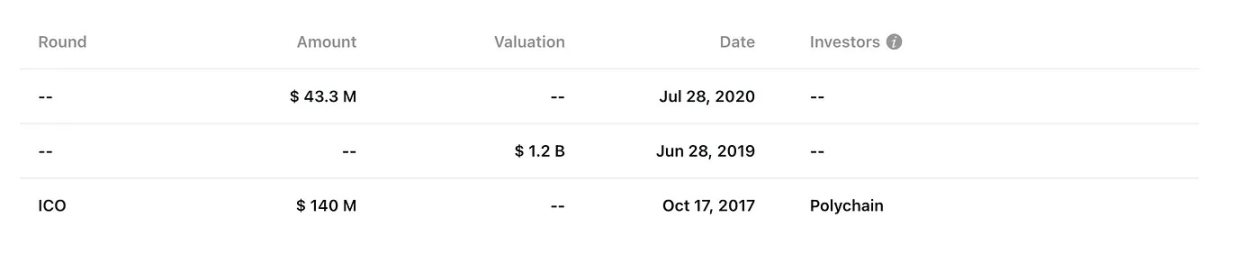

Polkadot's financing information has not been fully disclosed. According to Rootdata, the cumulative financing is $1.833 billion, and the valuation of the latest round of financing is unknown.

There are two organizations associated with Polkadot: the development team Parity Technology and the funding and operations team Web3 Foundation. Web3 Foundation has funded over 600 projects.

In October 2023, the Polkadot development team Parity Tech. announced that it would lay off most of its employees. According to Parity employees, the company's cash depletion led to the layoffs, as Parity's extensive recruitment over the past 12 months had put it in financial difficulties, and the Web3 Foundation also planned to lay off about 40% of its employees.

2. Operation Situation

2.1 Social Media Data

Social media user data: X1,439,010 people, with an average post view of around 50K and likes around 500. Discord has 22,679 people, with 2146 people online simultaneously, and active communication. Reddit has 83,000 people, ranking in the top 2% of communities, but with low activity. There are 4,960,000 YouTube subscribers with 796 videos published, with an average video view of about 20K.

Except for Discord, the activity of other social media accounts is not high recently. Although there is a large fan base on X, the interaction data is not ideal, indicating that actual operations on social media have not been given much attention.

2.2 Visitor Data

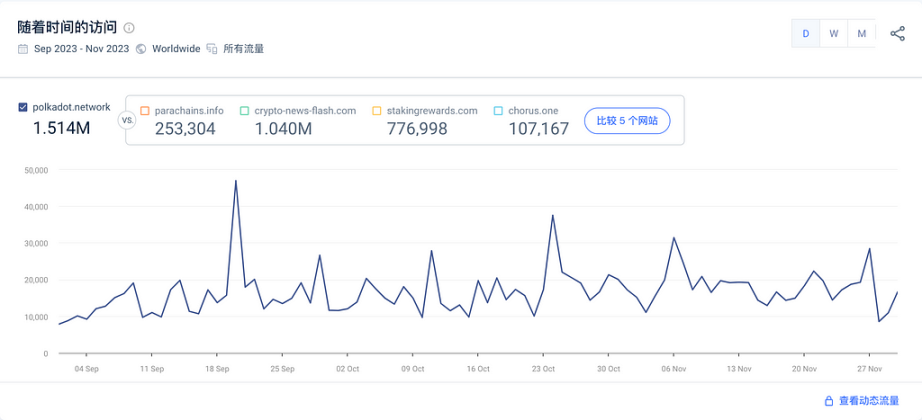

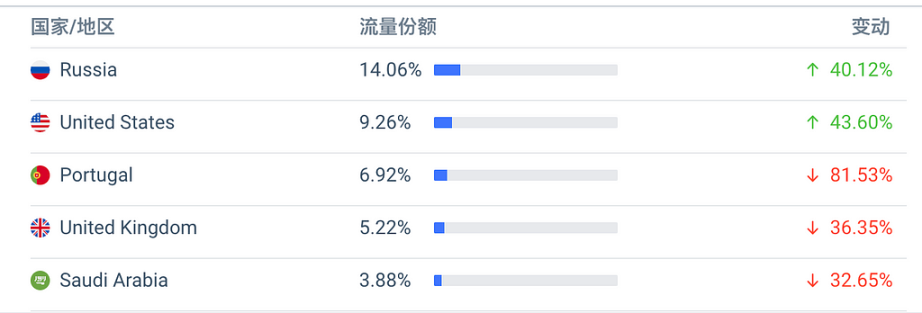

The daily website traffic of Polkadot is around 15,000 people, with the main traffic coming from Russia, the United States, and Portugal. In terms of data, it is in a moderate situation, consistent with the project's market position and current status.

2.3 User Activity

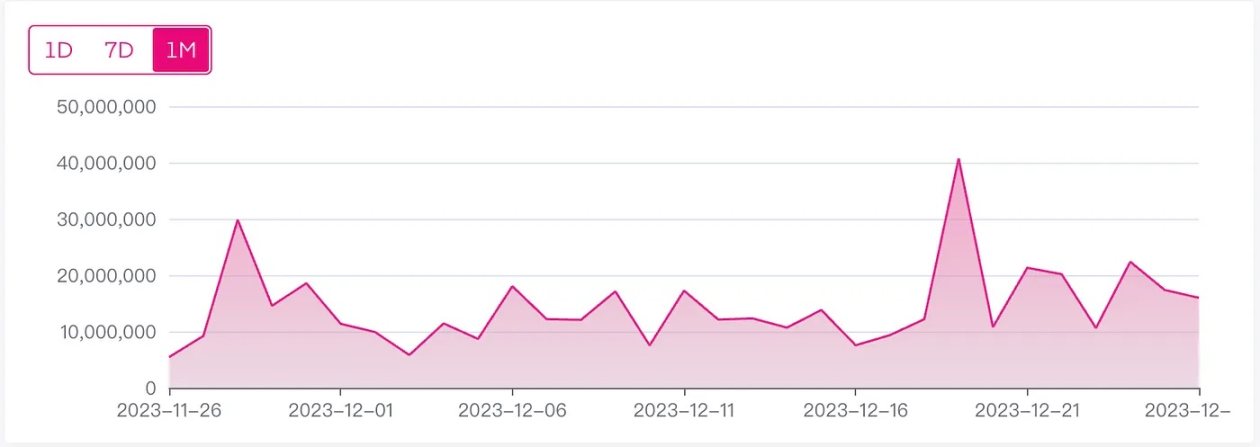

As of December 27, 2023, the average daily trading volume of Polkadot is around 15 million DOT, equivalent to $130 million.

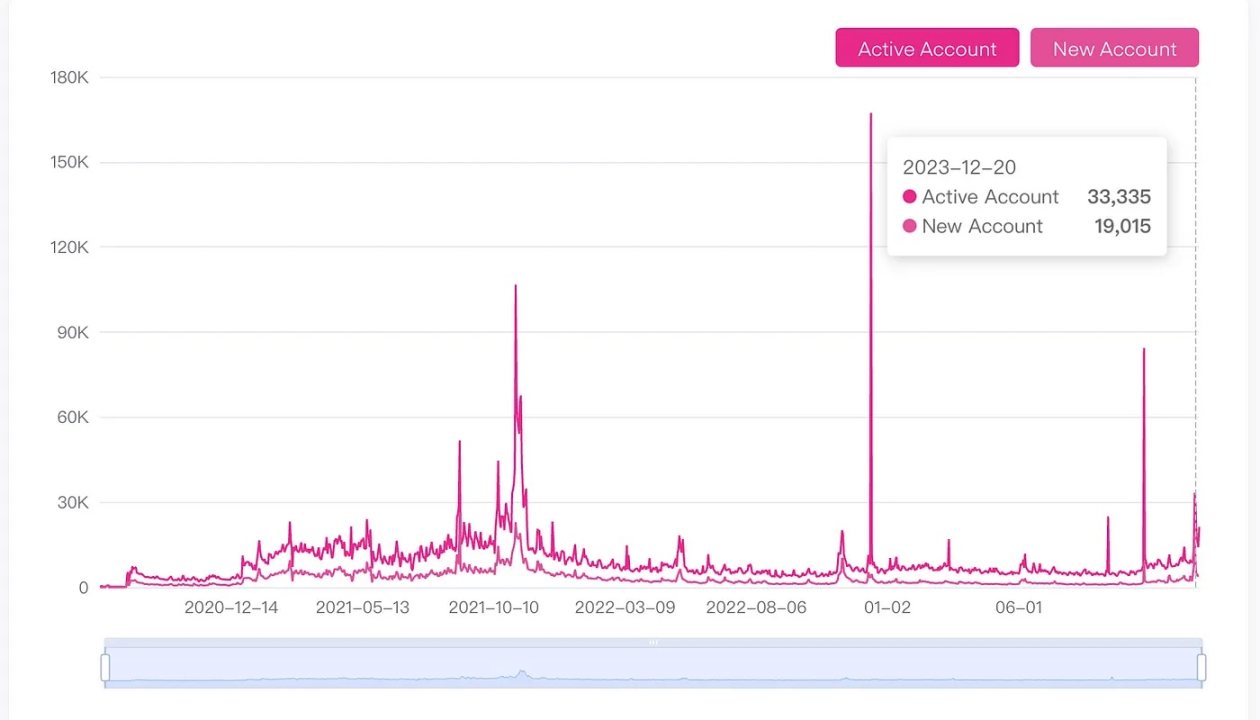

During the Mingwen market outbreak, the Polkadot network experienced its highest trading volume in history, with 6.9 million transactions on December 22, 2023, compared to only about 10,000 transactions on normal days. The overall performance of Polkadot has reached up to 80 transactions per second.

During the Mingwen market period, Polkadot's daily active users peaked at 7k-8k, with new addresses around 2–3K; while Cosmos had about 20K daily active users and 20K-50K new addresses, showing a significant difference.

2.4 Fees & Revenue

As a public chain project, the transaction fees for the Polkadot protocol are still almost zero, similar to Cosmos. However, compared to Ethereum's daily transaction fees of nearly $10 million, it pales in comparison. The market also does not use traditional financial valuation methods such as P/E and P/S for public chains. The significant increase in coin price is largely the result of market makers, retail investors, narratives, market sentiment, and VC support.

2.5 Code Development

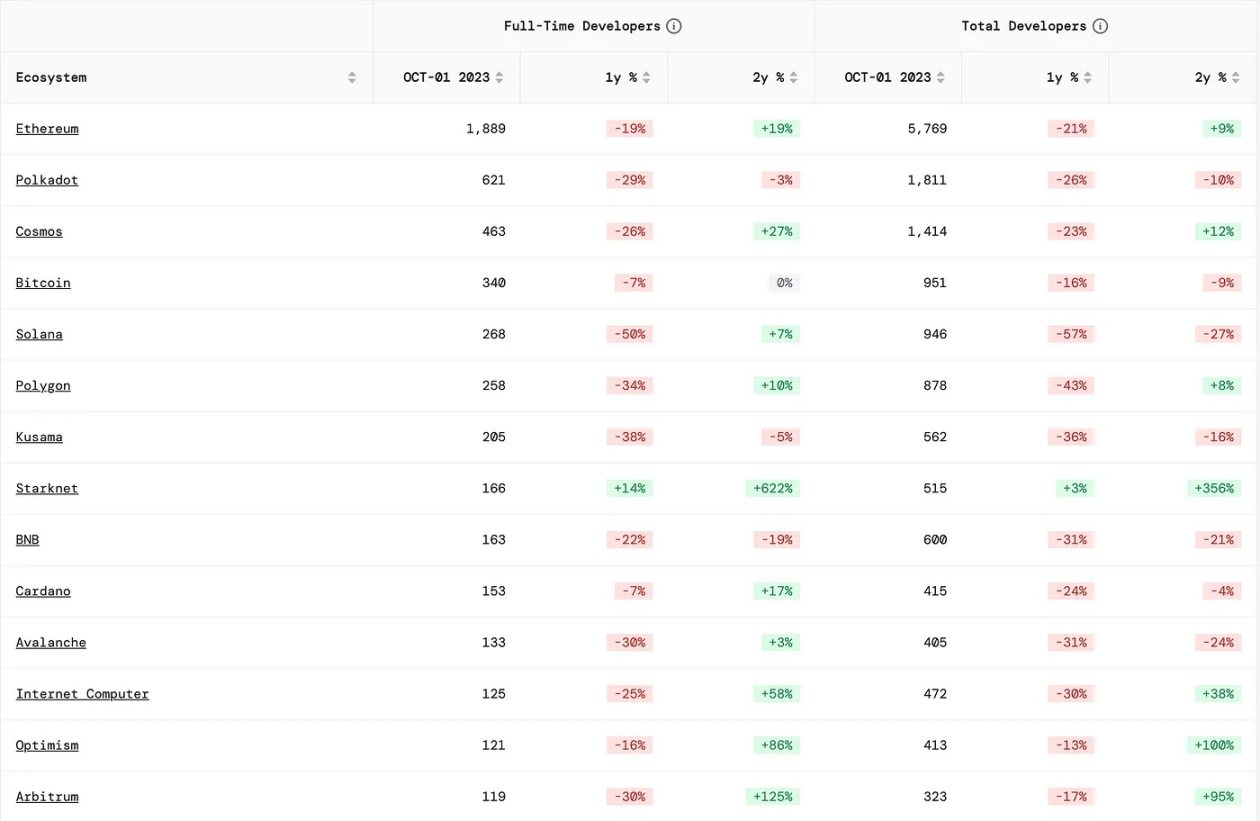

According to Electric Capital's statistics, the number of developers for most projects sharply declined in Q4. Currently, Polkadot's developers occupy the second place among all full-time and full-time plus part-time developers in public chains. (This is mainly due to the statistical criteria, as parallel chain developers and application developers are also included in the statistics.)

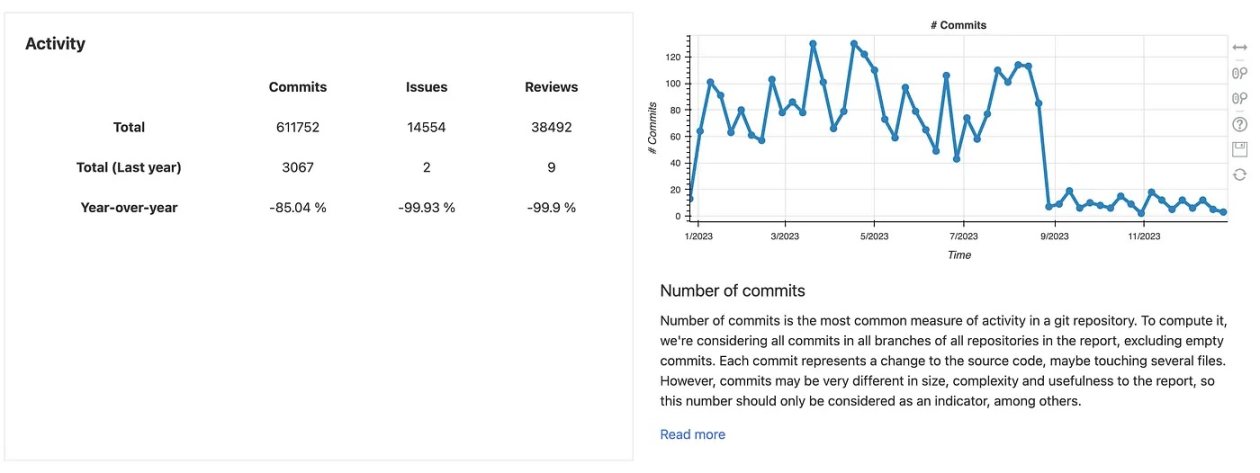

In fact, Polkadot's code development progress has shown a significant decline since September 2023. The reason is likely due to internal personnel turmoil and layoffs at Parity Tech. in Q4, leading to a sharp decline in the number of developers.

2.6 Development Plans

On December 25, 2023, Gavin Wood outlined the outlook for the coming year: Polkadot will face a series of important developments and busy work in the new year. Three upcoming key infrastructures are Agile Coretime (on-demand parallel chains), ETH Snowbridge, and Kusama Bridge. In addition, there is the upcoming technology "Elastic Expansion," expected to be implemented in 2024.

Agile Coretime

Coretime is a new concept for Polkadot 2.0, representing the time required for validation and consensus on Polkadot, the scarcest resource in the Polkadot network.

Agile Coretime aims to address the criticized parallel chain auction model of Polkadot. Coretime proposes to abandon the lease period and slot model, and instead purchase the usage time of the chain. This purchase is divided into bulk purchases and instant purchases, with bulk purchases once a month and instant purchases similar to pay-as-you-go. In other words, it used to be the purchase of the chain's position, but now it is the purchase of usage time. This usage time can be resold by the purchaser and multiple chains can take turns using it.

In the Polkadot 1.0 version, Polkadot is based on a relay chain that connects to up to 100 parallel chains, which is different from Ethereum's single-chain architecture. The advantage is that parallel chains can share security and XCM communication capabilities.

However, this parallel chain auction discourages small and medium developers, as in the latest auction, obtaining the right to use a parallel chain slot requires staking nearly $300,000 worth of DOT tokens and only has a lease period of 24 months. This significantly increases the development costs for small and medium developers and hinders ecosystem innovation.

The slot auction for 2024 is only scheduled until April 13, and if Agile Coretime goes live, the remaining slot auctions will be canceled. This may indicate that Agile Coretime may be integrated before this date.

Snowbridge

Polkadot is preparing to build a cross-chain bridge to connect with Ethereum, and Snowbridge aims to create a trustless bridge to achieve interoperability (fund interchange) between Polkadot and Ethereum. Snowbridge's design principles are trustlessness, generality, and deterministic execution. Its goal is to achieve Ethereum & Polkadot interoperability comparable to Polkadot's parallel chain interoperability, expected to be launched in Q1 2024.

The launch of Snowbridge indicates that Gavin has considered drawing resources such as funds, users, and developers from the Ethereum ecosystem and has begun preparing for a "witch attack" on Ethereum.

Kusama Bridge

Technology to connect Polkadot and its sister network Kusama. This can link the liquidity on the Kusama network and Polkadot, as well as enable information sharing and communication on both chains, but the performance is unknown.

Elastic Expansion

The goal is to achieve asynchronous support, allowing collators to submit parallel chain blocks using older relay chain parent blocks, thereby improving the efficiency and scalability of the Polkadot network.

3. Token Data

3.1 Token Overview

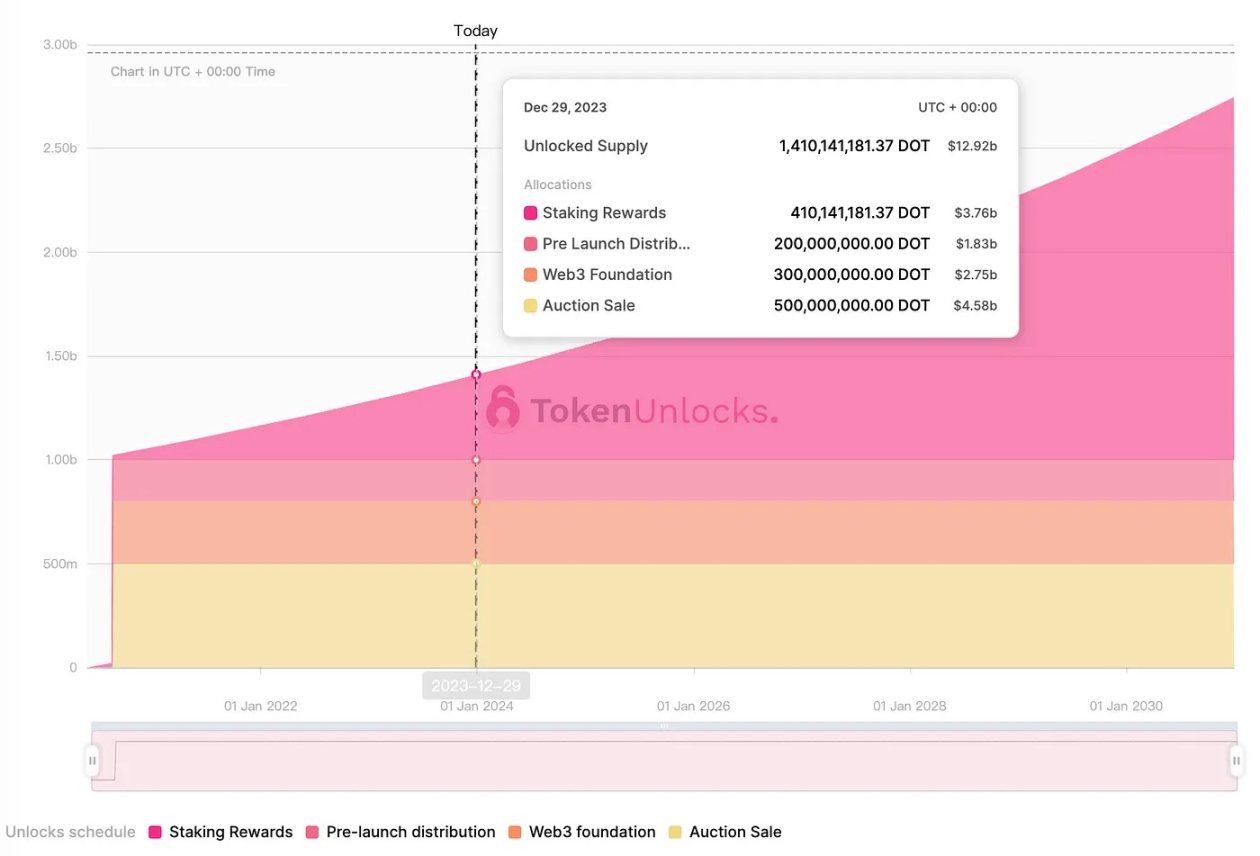

DOT's initial issuance was 10 million, but Polkadot split the face value of DOT in August 2020, so the initial total issuance of the new version of DOT tokens is 1 billion, with unlimited annual issuance thereafter.

Inflation Situation

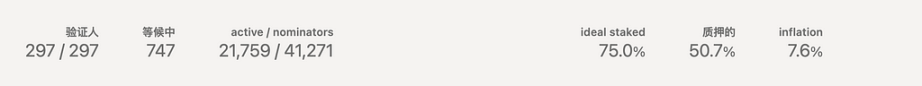

The above is the inflation situation we found for Polkadot. The current annualized inflation rate is 7.6%, and the inflation consists of the following parts:

- Rewarding validators and nominators through token issuance;

- Inflation caused by token issuance to the treasury;

- Deflation caused by improper behavior, i.e., Slashing;

- Deflation caused by transaction fees;

The inflation caused by token issuance to reward validators and nominators accounts for the largest proportion and is the main factor of overall inflation.

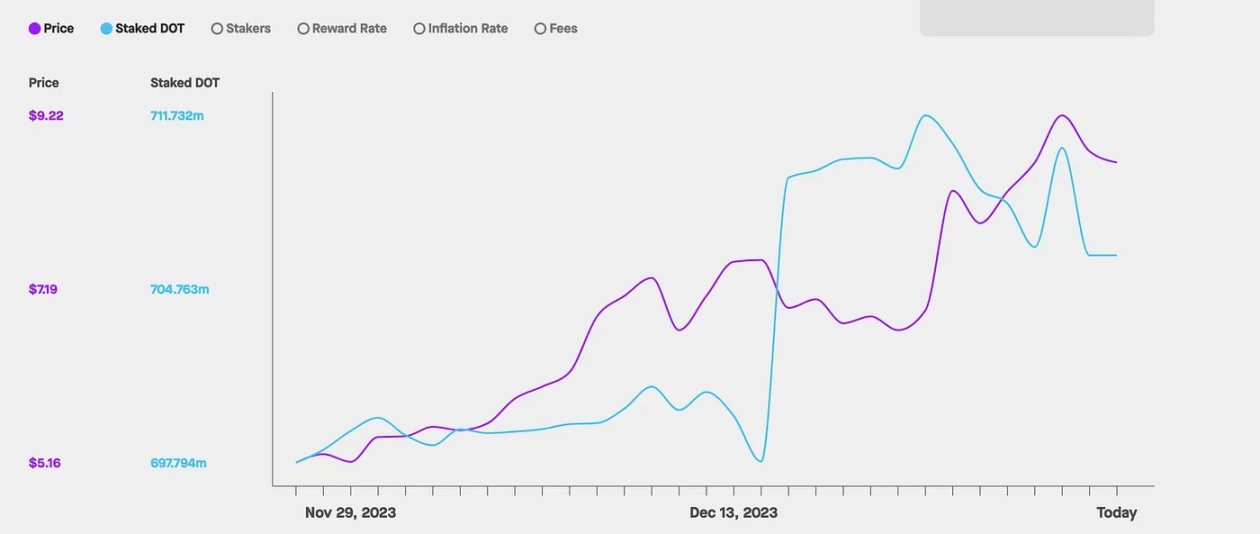

3.2 Staking & Rewards

Currently, approximately 53.82% of the tokens have been staked, with a staking reward of 14.93%. After deducting the inflation rate, the net yield is approximately 6.84%. The data shows that when the staked amount of DOT shows a downward trend, the coin price shows an upward trend, indicating that the staking rate is not directly correlated with the coin price.

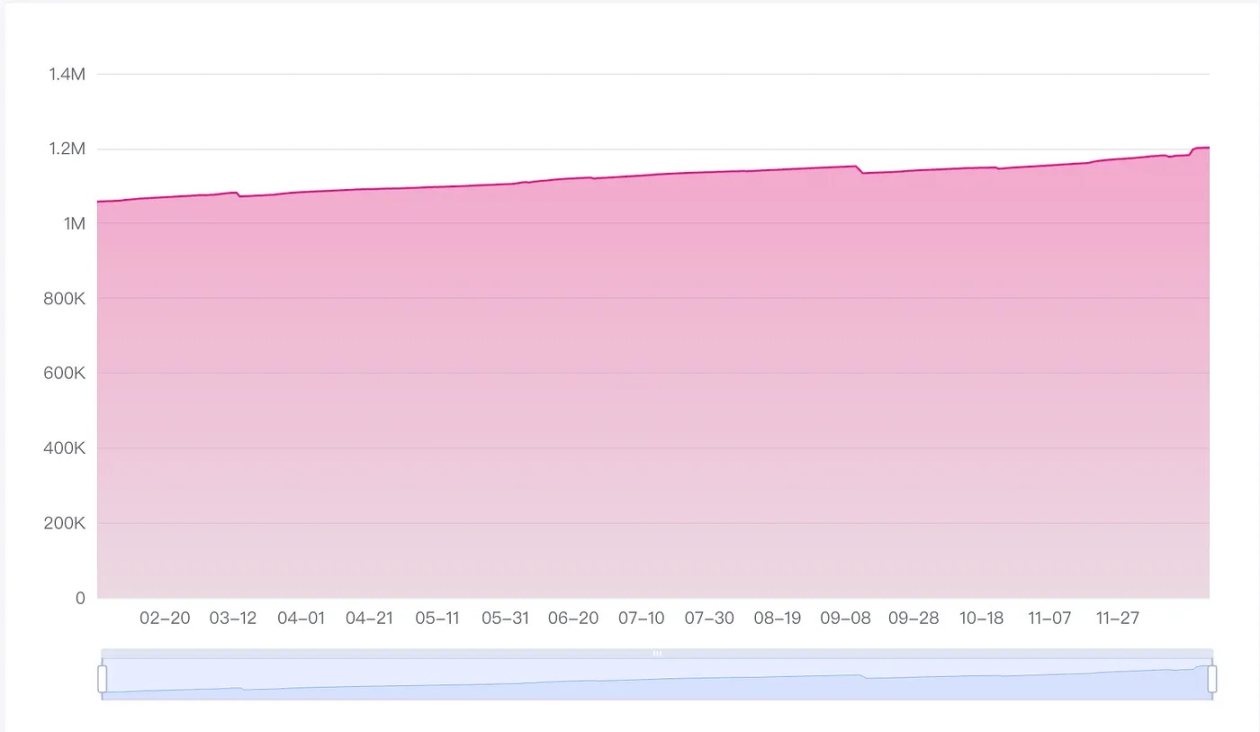

3.3 On-chain Data

The number of on-chain DOT holding addresses has been continuously increasing, but the specific accumulation of retail holders is currently unknown. In just one month, with the market trending upwards, DOT's daily trading volume has seen a significant rebound, indicating a deepening interest in DOT in the market, suggesting that Polkadot still has the opportunity to become the market's sentiment focus in the next market cycle.

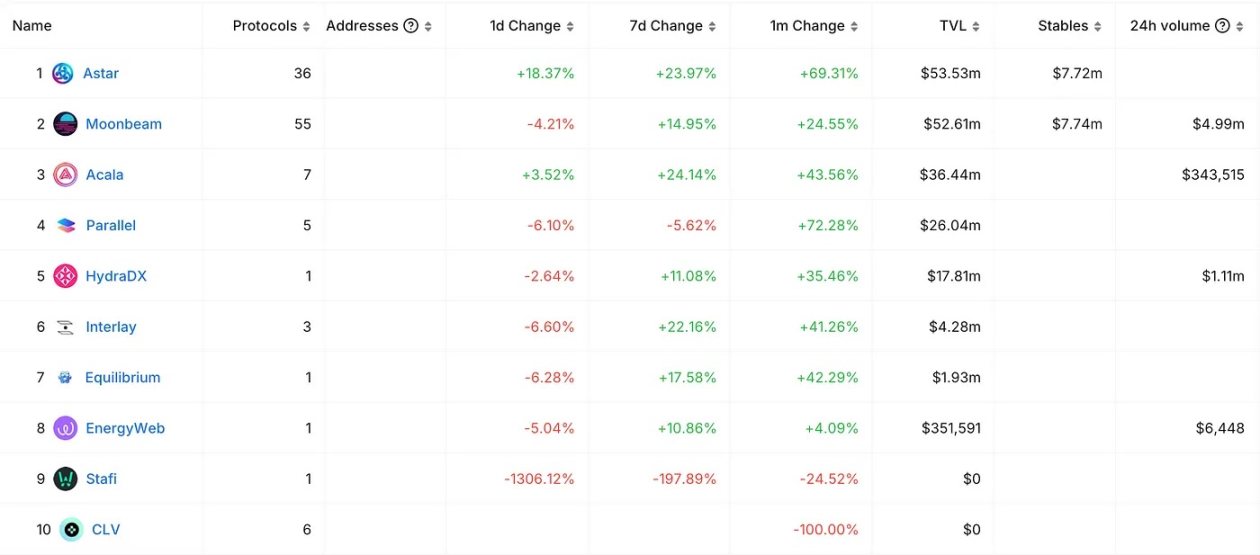

4. Ecosystem Development

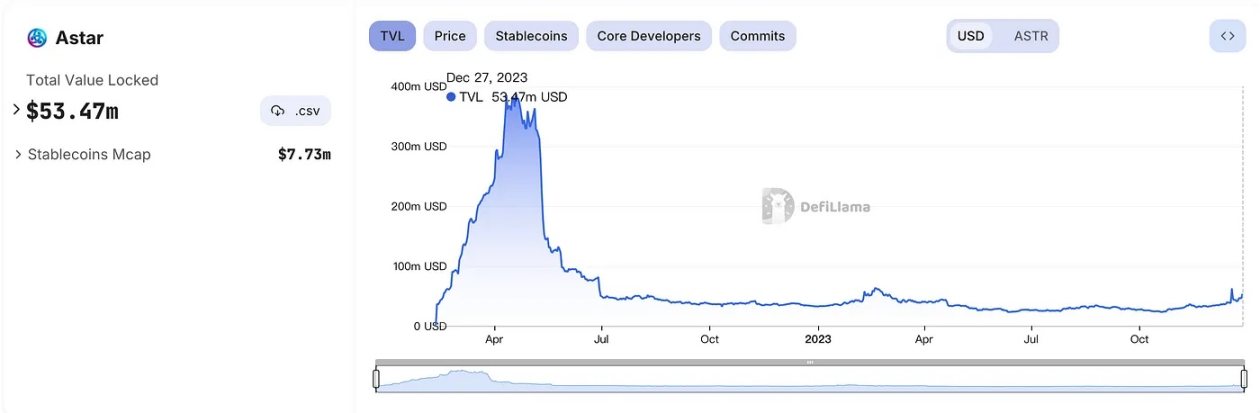

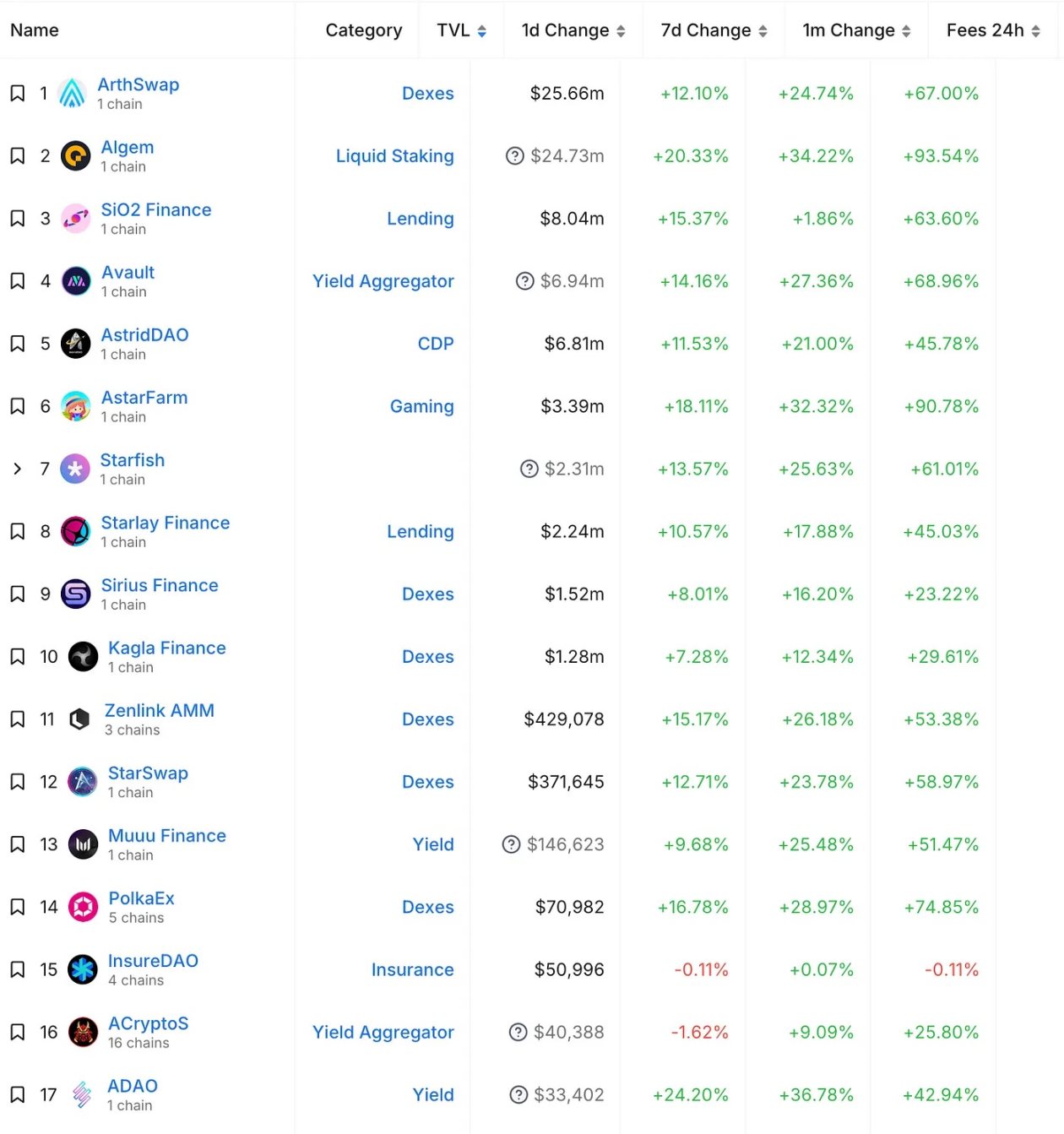

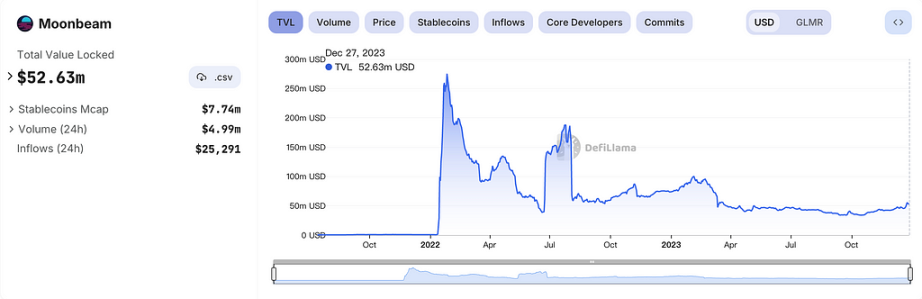

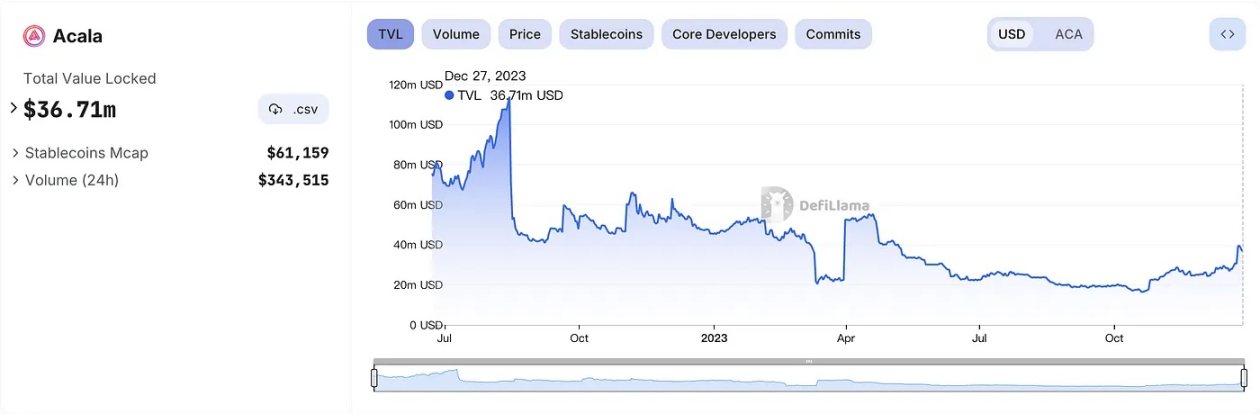

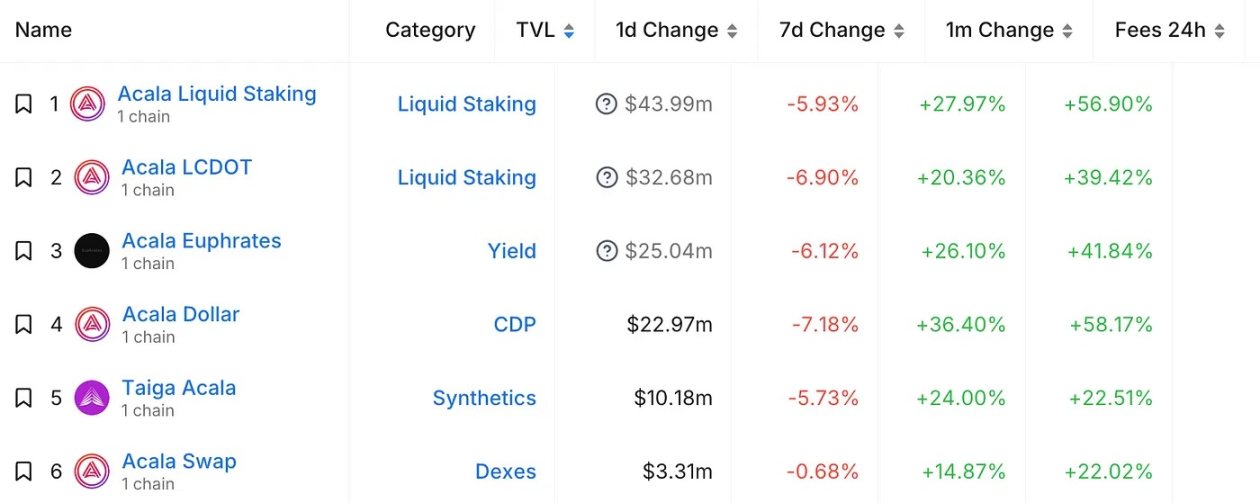

In the Polkadot ecosystem, Astar, Moonbeam, and Acala firmly occupy the top 3 positions in parallel chain TVL (Total Value Locked) (as shown in the TVL data above). Astar is a DEX and the largest DEX on Polkadot, Moonbeam is a lending platform and the largest lending platform on Polkadot, and Acala is an LSD platform and the largest LSD platform on Polkadot.

4.1 Astar

Astar Network is a blockchain project that provides a platform for decentralized applications (DApps) and decentralized finance (DeFi) services. As part of the Polkadot ecosystem, Astar Network aims to provide a multi-chain smart contract platform that supports multiple blockchain virtual machines, including Ethereum's EVM (Ethereum Virtual Machine) and WASM (WebAssembly).

Astar is the #1 public chain in the Polkadot ecosystem, primarily focused on DeFi products. With its position in the Polkadot ecosystem, compatibility with EVM and WASM, and unique incentive mechanism, Astar aims to become an important platform for building and deploying efficient, interoperable decentralized applications and financial services. Although it has shown some recovery under the influence of market trends and narratives, its performance is not ideal.

In the Polkadot ecosystem, a DeFi-focused ecosystem has already formed, and ArthSwap is the highest TVL DeFi application on Astar, and also the best-performing DEX in the entire Polkadot ecosystem, but limited to the Polkadot ecosystem.

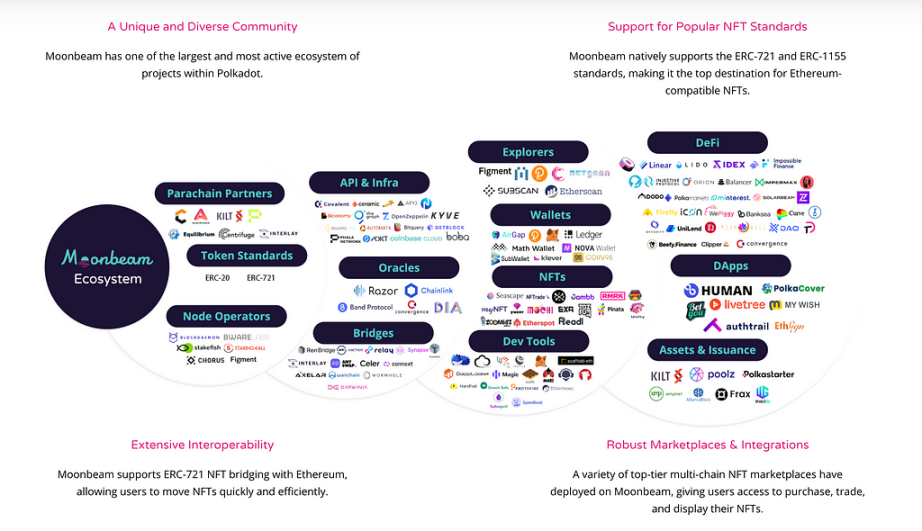

4.2 Moonbeam

Moonbeam is an important project in the Polkadot ecosystem, focusing on a compatibility smart contract parachain. Moonbeam aims to provide full compatibility with Ethereum, allowing developers to use existing Ethereum tools and DApp code to easily build or migrate applications on the Polkadot network.

Moonbeam aims to lower the entry barrier into the Polkadot ecosystem, especially for teams already familiar with Ethereum development, providing a simple migration and development path. Based on the convenience of EVM, Moonbeam is likely to surpass Astar in the future and become the largest parallel chain. The growth potential of Moonbeam's token may be higher than DOT.

In the Moonbeam ecosystem, there are NFT trading markets Tofu and game trading market Seascape. Currently, the highest trading volume NFT is ASTR on the TofuNFT market (according to Dotinsight statistics), but its trading volume is still only around $1,000 per day, indicating overall sluggish NFT market trading volume on Polkadot, with limited participation from retail investors and insufficient liquidity.

4.3 Acala

Acala is a key project in the Polkadot ecosystem, designed to be the decentralized finance hub and stablecoin platform of Polkadot, providing various financial services including stablecoins, decentralized exchanges (DEX), and financial applications, with the LSD protocol being the main focus in the Acala ecosystem. In the ecosystem of parallel chains, each parallel chain has its own specialized DeFi protocol, and Acala is the largest LSD platform on Polkadot.

Acala aims to become the decentralized finance hub in the Polkadot ecosystem, driving the development of the entire ecosystem by providing stable currency and rich financial services.

Due to the XCM information exchange protocol, the exchange of information between chains becomes inexpensive and convenient, making it easy for all liquidity to flow to a single project, creating a syphoning effect. Ethereum, on the other hand, still has significant barriers between chains, leading to the development of separate ecosystems for each chain.

5. Potential Estimation

5.1 Competitive Factors

Competitive factors are selected based on the popularity of the track or long-termism. Considering the warming market conditions, the overall data and market attention for Polkadot indicate that it still has high popularity in the market. On the basis of the track, it has a certain innovative functional design. Polkadot's TPS has been tested in the market, and its XCM communication mechanism is continuously improving, making it highly innovative. It has a strong community, as evidenced by recent market sentiment and on-chain data, indicating market expectations for speculation on Polkadot. It has a stable fan base and social media influence. Polkadot's Twitter has a high number of followers and views, and the key figure Gavin Wood also has a large fan base and market attention. The project's profit model is clear, unlike most public chains, including Ethereum, whose profit models are unclear. It lacks support from venture capital funds compared to Cosmos.

5.2 Core Competitiveness

In the cryptocurrency industry, as a leading Layer0 heterogeneous blockchain, Polkadot competes with Cosmos, and to some extent, with Ethereum and other Layer1 public chains. Its advantages include:

- Shared security model: Polkadot's parallel chains share the security of the Polkadot relay chain, meaning parallel chains do not need to worry about their individual security as they benefit from the security of the entire network.

- Cross-chain message passing (XCMP): Polkadot's XCMP allows trust-minimized communication between parallel chains, facilitating efficient cross-chain interactions.

- Upgradability: Polkadot supports on-chain governance and code upgrades without the need for hard forks, allowing the network to evolve and upgrade smoothly.

- Standardized development framework: Polkadot's Substrate framework provides a standardized and highly modular approach for developing parallel chains, facilitating rapid development and deployment.

The core competitiveness of Polkadot lies in its unique interoperability, shared security model, high scalability, and on-chain governance. These features make Polkadot a powerful platform that attracts developers and project builders, especially those seeking innovation and building cross-chain applications.

However, compared to COSMOS and Ethereum, Polkadot is a relatively new project with a smaller ecosystem and fewer developers and applications. Its ecosystem and technology have not been market-tested for as long as COSMOS. The reliance of parallel chains on the relay chain also limits the independence and flexibility of the parallel chains.

Additionally, Polkadot lacks strong support from venture capital (VC) firms. For example, Delphi Digital announced "All In Cosmos," and Jump Crypto has widely invested in projects such as Celestia, Injective, Sei, and Luna. Strong support from top VC resources is beneficial for the development of projects, but Polkadot lacks this support, leading to significantly lower user activity compared to Cosmos.

6. Conclusion

In the industry competition, Polkadot still maintains high market attention after experiencing periodic turbulence. This is mainly because Polkadot, as a representative of heterogeneous chains, along with Cosmos, competes with Ethereum, especially before the progress and momentum of Layer2 become clear.

In the new market cycle, based on the concepts of heterogeneous chains and parallel chains, the value of DOT will continue to be hyped. However, the project's architecture design has led to slower ecosystem development compared to Cosmos, and it lacks strong support from top VC firms.

Currently, Parity Tech. has recognized its existing issues and, in the 2024 roadmap, plans to improve the auction mechanism, enhance cross-chain collaboration between Ethereum and Polkadot, and improve the XCM parallel chain communication mechanism. Additionally, Polkadot still has the second largest developer community, so we can have greater expectations for DOT's market performance in the new market cycle.

All the above views are not investment advice. If there are any inaccuracies, feel free to leave a comment for further clarification or correction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。