Author: E2M Researcher Steven

Advisor: Dongzhen@zhendong2020, Marco@cmdefi

Preface

- Why is it worth paying attention to recently?

After the approval of the Bitcoin spot ETF, the next narrative immediately shifted to the Ethereum-centric narrative logic: Ethereum spot ETF in May + London upgrade + Restaking, and so on.

- A glimpse into the development pattern of Ethereum

Before the Merge, Ethereum was more like the development model of a startup company. PoW gave miners block rewards as an early marketing tool and did not care about the value of the token. The token economy rapidly inflated, with the priority being the precipitation of value > user experience.

The purpose of the Merge is not to improve the performance of Ethereum, but to reduce the consumption of generating the blockchain (converting PoW to PoS), using a Web2.0 analogy, it is more like reducing costs and increasing efficiency in the upstream part of an industrial chain, laying the groundwork for future sustainable development. The token economy also becomes deflationary, while also focusing on user experience, gradually transforming miner income into staking income, and reducing Gas fee income.

The London upgrade corresponds to The surge, prioritizing user experience (e.g., increasing transaction speed, reducing Gas fees).

Future upgrade cycles will be relatively short, and after the Shanghai upgrade, Ethereum will change the consensus of PoW to PoS in a sense. It has entered a mature stage, although there will be several major upgrades in the future, the core purpose is to focus on on-chain scalability, simpler block validation, lower costs, and stronger and more stable performance.

- Some thoughts

The development of Ethereum is complex and diverse. In the process of studying the overall development path, there are still many unresolved issues to be considered.

Vitalik has played a very strong guiding role in the development of Ethereum. In fact, from the perspective of a company, a good CEO leading the company forward is a very good development method. Ultimately, all the developments in the Ethereum ecosystem driven by V will be Long ETH.

Projects with high valuations such as Arb, OP, ZKsync, Metis, Aave, Compound, Uniswap, and many others are attached to Ethereum and can become hot narratives for a period of time. Ethereum can more or less gain dividends.

Rather than being similar to Microsoft or Apple, it feels more like Nvidia. AI development, VRAR, Web3.0, various clouds, and computing power centers cannot avoid computing power, and therefore cannot avoid Nvidia.

Web 3.0 also has a similar state, and it is difficult for any development to be separated from Ethereum's development. Ethereum's narrative has been relatively quiet for a while, but due to the London upgrade and Ethereum spot ETF, Layer2 and Eth have risen together, including earlier events like Defi Summer, NFT Summer, etc., all of which will drive the price of Ethereum, and projects with longer half-lives also need sufficient interaction with Ethereum.

Many who want to break away from Ethereum are basically thinking in terms of "Ethereum killers". TON, which was discussed before, did not criticize Ethereum and lost its own voice.

The development of Ethereum is very centralized, while the Ethereum chain itself is very decentralized. Sometimes it feels like the centralization level of Ethereum's development is on par with Uniswap's team, and it is not as well done as some protocols like Aave and MakerDAO in terms of decentralization. This also reflects that a project's good development may fundamentally still require centralization.

Perhaps one day in the future, Ethereum can also develop to a very mature stage and then completely decentralized governance, but as long as Vitalik is still young, I feel that day is still a long way off. That being said, Ethereum is only an 11-year-old startup and is far from mature.

1. Background - A Brief Review of Ethereum's History

1.1 History and Forks

The framework of the following content is from: https://ethereum.org/zh/history, as well as other public information. For more specific content, please click the link for reference.

2013 - Phase 0: Birth of Ethereum

Whitepaper released, Ethereum is born

November 27, 2013, Vitalik Buterin released the "Ethereum Whitepaper"

Ethereum founder Vitalik Buterin introduced the token system of the Ethereum platform in the first version of the Ethereum whitepaper;

Abstract

The whitepaper defined smart contracts. It first mentioned the concept of Ether, and explained that Ether could be used as gas on the Ethereum network. When users engage in activities such as transferring transactions and deploying smart contracts, they need to pay a certain amount of gas fees. Part of the gas fees will be rewarded to block validators (also known as miners). If the initiator of the transaction does not pay enough Ether, the transaction will not be executed. If the paid Ether is excessive, the excess will be returned to the initiator's wallet.

2014 - Phase 0.5: Ethereum Sale

Ethereum Sale

July 22, 2014, 00:00:00 +UTC

The presale period for Ether was 42 days, and Bitcoin could be used for purchase.

Abstract

The initial exchange rate was 1 Bitcoin for 2000 Ether, which was maintained for 14 days. Then the exchange rate began to decrease linearly until it reached 1 Bitcoin for 1337 Ether. The token sale ended on September 2, 2014, with a total sales of approximately $18 million, and over 60 million Ether were sold. After completing the purchase, the received Ether could only be transferred after the launch of the Ethereum genesis block.

In addition to the over 60 million presale ETH, there were two other allocations. One allocation was given to early contributors to Ethereum's development, and the other was allocated to long-term research projects. The quantities of these two ETH allocations were 9.9% of the presale ETH quantity each.

When Ethereum was officially issued, a total of 72,002,454.768 ETH were distributed.

Image source: https://blog.ethereum.org/2014/07/22/launching-the-ether-sale

2015 - Phase 1: Frontier

On March 3, 2015, in Ethereum's official blog, four important stages were announced. According to the blog, some of Vitalik's initial thought process was as follows:

Frontier

July 30, 2015, 03:26:13 +UTC

Abstract

Frontier was the initial version of Ethereum, but there was very little that could be done on it. This version was launched after a successful completion of the Olympic test phase. It was aimed at technical users, especially developers. Blocks had a 5,000 unit gas limit. This "thawing" period allowed miners to start operating and early adopters to have enough time to install the client.

Similar to the cold start of many Web 3.0 projects, miners received 5 Ether as a reward for each block mined on the "Frontier" mainnet.

Frontier Thawing Fork

September 7, 2015, 09:33:09 +UTC

Block number: 200,000

Ether price: $1.24

Abstract

The Frontier Thawing Fork raised the gas limit per block to 5,000 units and set the default gas price to 51 gwei. This allowed for transactions - transactions required 21,000 units of gas.

The concept of the "difficulty bomb" was introduced to ensure future hard forks to proof of stake.

Homestead

March 14, 2016, 06:49:53 +UTC

Block number: 1,150,000

Ether price: US$12.50

Abstract

The Homestead fork optimized the process of creating smart contracts.

DAO Fork

July 20, 2016, 01:20:40 +UTC

Block number: 1,920,000

Ether price: US$12.54

Abstract

This fork was an unplanned passive fork resulting from an attack on Ethereum.

Metropolis

October 16, 2017, 05:22:11 +UTC

Block number: 4,370,000

Ether price: US$334.23

Abstract

The Byzantium fork laid the groundwork for introducing ZK-SNARKS and began to focus on user privacy and user experience.

2019 - Phase 4: Serenity

Ethereum gradually matured, transitioning from PoW to PoS, with user experience, security, decentralization, and scalability being the most important development directions for Ethereum.

Constantinople Fork

February 28, 2019, 07:52:04 +UTC

Block number: 7,280,000

Ether price: US$136.29

Abstract

Reduced block mining rewards from 3 Ether to 2 Ether.

December 8, 2019, 12:25:09 +UTC

Block number: 9,069,000

Ether price: US$151.06

Abstract

Optimized the fuel cost of specific operations in the Ethereum Virtual Machine.

Improved resilience to denial-of-service attacks.

Enhanced performance of Layer2 solutions based on "zero-knowledge succinct non-interactive arguments of knowledge" and "zero-knowledge scalable transparent arguments of knowledge".

Enabled contracts to introduce more creative functionalities.

2020Muir Glacier Upgrade

January 2, 2020, 08:30:49 +UTC

Block number: 9,200,000

Ether price: US$127.18

Abstract

The Muir Glacier fork delayed the difficulty bomb. Increasing the block difficulty of the Proof of Work consensus mechanism may increase the waiting time for sending transactions and using decentralized applications, thereby reducing the availability of Ethereum.

Deployment of the Staking Deposit Contract

October 14, 2020, 09:22:52 +UTC

Block number: 11,052,984

Ether price: US$379.04

Abstract

The staking deposit contract introduced staking into the Ethereum ecosystem. Although it is a mainnet contract, it directly impacts the timeline for the release of the beacon chain, which is an important part of the Ethereum upgrade.

Beacon Chain Genesis Block

December 1, 2020, 12:00:35 +UTC

Beacon chain block number: 1

Ether price: US$586.23

Abstract

The beacon chain required 16,384 accounts with 32 staked Ether to ensure a secure launch. This occurred on November 27, 2020, meaning the beacon chain began producing blocks on December 1, 2020.

After the merge, a block's time unit will appear in the form of slots and epochs. A slot is created every 12 seconds, and each epoch consists of 32 slots. An epoch is a fixed time period, and validators are reassigned at the end of each epoch.

To become a validator and gain voting rights, a user must stake at least 32 ETH.

For each epoch, validators are randomly assigned to committees to ensure that each committee consists of at least 128 validators. The system uses the random algorithm RANDAO to assign a validator for each period and simultaneously select a committee for that period. The validator is responsible for proposing a block, while the committee is responsible for verifying and voting on the proposal. Once the vote is approved, a block is produced, and the proposer receives a reward; otherwise, not only is the reward not received, but the deposit is also confiscated. The same applies to regular attesters: if they follow the rules correctly, they can receive a reward, but if they behave maliciously, they will be punished. Once the deposit of 32 ETH falls below 16 ETH, the validator's qualification will be terminated.

2021Berlin Upgrade

April 15, 2021, 10:07:03 +UTC

Block number: 12,244,000

Ether price: US$2,454.00

Abstract

The Berlin upgrade optimized the fuel cost of certain Ethereum Virtual Machine operations and added support for multiple transaction types.

London Upgrade

August 5, 2021, 12:33:42 +UTC

Block number: 12,965,000

Ether price: US$2,621.00

Abstract

The London upgrade introduced EIP-1559, reforming the transaction fee market. It continued to delay the difficulty bomb until its activation on December 1, 2021.

Altair Upgrade

October 27, 2021, 10:56:23 +UTC

Epoch number: 74,240

Ether price: US$4,024.00

Abstract

The Altair upgrade was the planned first beacon chain upgrade. It added support for "sync committees" - supporting light clients, and increased penalties for validator inactivity and punishable behavior during the transition to the merge.

Arrow Glacier Upgrade

December 9, 2021, 07:55:23 +UTC

Block number: 13,773,000

Ether price: US$4,111.00

Abstract

The difficulty bomb was delayed by a total of 10,700,000 blocks until June 2022.

2022Grey Glacier Upgrade

June 30, 2022, 10:54:04 +UTC

Block number: 15,050,000

Ether price: US$1,069.00

Abstract

The Grey Glacier network upgrade delayed the difficulty bomb by three months. This was the only change introduced in this upgrade, essentially similar to the Arrow Glacier and Muir Glacier upgrades. Similar changes were also made in the Byzantium, Constantinople, and London network upgrades.

Bellatrix Upgrade

September 6, 2022, 11:34:47 +UTC

Epoch number: 144,896

Ether price: US$1,558.00

Abstract

The Bellatrix upgrade was the planned second beacon chain upgrade, preparing the beacon chain for the merge. It increased penalties for validator inactivity and punishable behavior to their full value. The Bellatrix upgrade also included updates to fork choice rules, preparing the beacon chain for the merge and the transition from the last proof of work block to the first proof of stake block. This includes making the consensus client aware of the terminal total difficulty 58750000000000000000000.

Paris Upgrade (Merge)

September 15, 2022, 06:42:42 +UTC

Block number: 15,537,394

Ether price: US$1,472.00

Abstract

Paris Upgrade

The Paris upgrade was triggered by the proof-of-work blockchain exceeding the terminal total difficulty of 58750000000000000000000. This occurred on block 15537393 on September 15, 2022, and the Paris upgrade was activated at the next block. The Paris upgrade is the transition to the merge, marking the end of Ethereum's main functionality of the proof-of-work mining algorithm and related consensus logic, and the start of proof-of-stake. The Paris upgrade itself is an upgrade to the execution client (equivalent to the Bellatrix upgrade at the consensus layer), allowing the execution client to accept instructions from the connected consensus client.

Capella Upgrade

April 12, 2023, 22:27:35 +UTC

Epoch number: 194,048

Beacon chain block number: 6,209,536

Ether price: US$1,917.00

Abstract

The Capella upgrade is the third major upgrade at the consensus layer (beacon chain), implementing staking withdrawals. Capella synchronously upgrades the execution layer with Shanghai and enables staking withdrawals.

This consensus layer upgrade allows stakers who did not provide initial deposit withdrawal credentials to provide withdrawal credentials, enabling withdrawals.

The upgrade also provides an automatic account scanning feature to continuously process any available reward payments or full withdrawals for validator accounts.

Shanghai Upgrade

April 12, 2023, 22:27:35 +UTC

Block number: 17,034,870

Ether price: US$1,917.00

Abstract

The Shanghai upgrade introduces staking withdrawals at the execution layer. The Shanghai upgrade is carried out simultaneously with the Capella upgrade, allowing blocks to accept withdrawal operations, enabling stakers to move Ether from the beacon chain to the execution layer.

1.2Why Can Ethereum Become a Deflationary Model?

Proof of Work (PoW) is more like a marketing tactic for early-stage startups, with stable incentives (miners' stable mining income), while Proof of Stake (PoS) is more like equity, representing the net issuance of ETH.

The Merge significantly changed Ethereum's monetary policy. By eliminating miner rewards and converting them to staking rewards, it greatly reduced the issuance of new ETH tokens, resulting in a daily ETH issuance reduction of approximately 88.7%, equivalent to an annualized issuance rate of 0.52% of the total supply, and due to the destruction of Gas fees under EIP-1559, the net issuance trended towards deflation.

There are two key changes:

1.2.1 EIP-1559 introduced in the London upgrade: Introducing the fee burning mechanism

Reference article: Gas and Fees

- Old protocol calculation formula: Gas fee = Gas units (limit) * Gas price per unit

For the simplest on-chain transfer transaction, regardless of how busy the chain is, the Gas limit is fixed at 21,000. Therefore, as long as the Gas price and Gas limit are clear, we can know how much ETH we spent for this interaction. The Gas price will change with network congestion, while the Gas limit remains constant.

For example, if Alice needs to pay 1 ETH to Bob. In the transaction, the fuel limit is 21,000 units, and the fuel price is 200 gwei.

The total fee is: Gas units (limit) * Gas price per unit, which is 21,000 * 200 = 4,200,000 gwei or 0.0042 ETH.

- New protocol calculation formula: Gas fee = (Base fee + Priority fee) × Gas limit, and the maximum increase in the next block's Base fee is 12.5%

Where the base fee set by the protocol is directly destroyed, and the priority fee is the tip paid by the user to the validator.

For example, suppose Jordan needs to pay 1 ETH to Taylor. A transfer of 1 ETH requires 21,000 units of fuel, and the base fee is 10 gwei. Jordan paid 2 gwei as a tip.

The fee is 21,000 * (10 + 2) = 252,000 gwei (0.000252 ETH).

When Jordan makes the transfer, 1.000252 ETH is deducted from Jordan's account. Taylor's account increases by 1.0000 ETH. The validator receives a tip worth 0.000042 ETH. 0.00021 ETH of the base fee is destroyed.

1.2.2 Paris Upgrade

First, the Constantinople hard fork reduced the mining reward from 3 ETH per block to 2 ETH. Then, The Merge transformed PoW into PoS, eliminating the mining reward (160,000 ETH/day) and converting it into staking rewards (1,600 ETH/day), resulting in a drastic 99% reduction in issuance.

After the Paris upgrade on September 15, 2022, Ethereum officially began deflation.

Since the Merge, the total supply of Ethereum has been reduced by over 300,000 ETH, with an annual destruction of 981k and an increase of 723k, resulting in a deflation rate of 0.21% per year.

After the Merge, Ethereum solved the problem of high energy consumption caused by mining, and then focused on performance and fee issues. Layer 2 solutions simultaneously address these two issues, making it the most watched track in the Ethereum ecosystem after the Merge.

1.3 Ethereum's Future Upgrade Roadmap

Vitalik Buterin has proposed a vision for Ethereum's roadmap, categorizing upgrades based on their impact on the Ethereum architecture. This includes:

Merge: Involves the transition from proof of work to proof of stake (completed)

Surge: Achieving over 100,000 TPS on Rollups

Scourge: Involves upgrades related to censorship resistance, decentralization, LSD, and MEV risk

Verge: Involves upgrades to make block verification easier

Purge: Involves reducing the computational cost of operating nodes and simplifying the protocol

Splurge: Others

These upgrades are parallel, meaning whichever part of the research and development progresses faster may be upgraded first.

2. What is the Cancun Upgrade? What are the important EIPs implemented?

After the Ethereum merge, the most important thing is to improve TPS performance, reduce Gas fees, and make Ethereum approach a perfect application.

Vitalik believes that for Ethereum to be considered a qualified public chain, it should achieve a TPS of over 100,000. For reference, VISA's average TPS is 2,000, with a peak of over 4,000; PayPal's average TPS is 200, and Alipay can reach 250,000 during peak periods.

The current Ethereum upgrade is called the Dencun upgrade (Dencun + Cancun), with the Cancun upgrade focusing on the Ethereum execution layer, and the Deneb upgrade focusing on the consensus layer.

The Cancun upgrade corresponds to part of The Surge, with the goal of achieving over 10 TPS.

According to the information on GitHub, the Cancun upgrade will implement the following six EIPs, which will be discussed in detail in the next section.

Apart from Proto-Danksharding (EIP-4844), the Cancun upgrade also includes EIP-6780, EIP-1153, EIP-6475, and EIP-4788, among other improvement proposals.

2.1 Proto-Danksharding - EIP 4844

The most important aspect of the Cancun upgrade is the introduction of Proto-Danksharding as a transitional phase for Ethereum's complete sharding expansion, with the ultimate goal of dividing the mainnet into 64 shards to achieve over 100,000 TPS.

Proto-Danksharding aims to address the high cost of transaction fees on the Ethereum main chain compared to the Rollup solution. This is due to the significant cost (16 gas/byte) of providing calldata for data availability on the Ethereum main chain. The original plan was to provide each block with 16MB of dedicated data space for Rollup in the data shards, but the actual implementation of data sharding is still a distant prospect.

Currently, data transmitted from Layer 2 to Layer 1 is stored in Calldata and permanently stored in the execution layer. Additionally, for security reasons, Calldata requires gas for every execution step to prevent network resource abuse.

After the Ethereum merge, the consensus layer (responsible for PoS consensus) and the execution layer (responsible for executing contract code) were separated. The execution layer's task is to execute the data stored in Calldata, which can be considered a type of data for transaction types.

The content contained in Calldata can be divided into two parts:

Execution results

Transaction data - which has limited utility after validation and can be downloaded for verification, and does not necessarily need to be transmitted to the execution layer - EIP-4844 aims to address the issue of transaction data, which accounts for over 60% of the total cost of Calldata.

Proto-Danksharding introduces a new transaction type called Blob (Binary Large Objects), which carries an additional data packet (approximately 125kb) and is only stored in the consensus layer, similar to an external cache database for the data transmitted from Layer 2. This separates it from Layer 1's Calldata. As a result, Blob data only needs to be accessible for verification within a certain time frame and does not need to be fully executed in Layer 1, significantly reducing the burden on Layer 1.

Each Blob introduced by Proto-Danksharding has a size of 128 KB, and each Ethereum block is planned to contain 3-6 Blobs (0.375 MB - 0.75MB), gradually expanding to 64 in the future.

Compared to the current Ethereum block size of less than 200KB, the introduction of Blobs will significantly increase the data capacity of Ethereum blocks.

EIP-4844 is a precursor to Danksharding, aiming to enable Ethereum nodes to temporarily store and retrieve off-chain data, while Layer 2 itself compresses off-chain data. This is expected to increase the throughput of Layer 2 by nearly 2 times if the Cancun upgrade successfully achieves the average target of attaching 3 Blobs to each block. If the ultimate goal of attaching 64 Blobs to each block is achieved, the throughput of Layer 2 will increase by nearly 40 times.

Proto-Danksharding also introduces EIP-1559 to further reduce the cost of Blobs:

Different types of gas should have different base fees and maximum limits

Blob data fees are cheaper - as Blobs do not compete for block space, the gas fees should be lower, naturally reducing costs

For those interested in viewing transaction data, EIP-4844 also introduces the KZG (Kate-Zaverucha-Goldberg) commitment scheme as part of the process for Blob verification and proof generation. The KZG commitment is a polynomial commitment scheme that allows submitters to use a short string to commit to a polynomial, enabling verifiers to confirm the commitment using a short string. In simple terms, KZG simplifies the verification of a large amount of data into the verification of a small encrypted commitment.

Comparison before and after the introduction of Proto-Danksharding.

2.2 Others

EIP-6780 proposes to modify the SELFDESTRUCT opcode function in preparation for future applications of Merkle trees. Subsequently, the efficiency of Ethereum storage will be greatly improved through the application of Merkle trees.

EIP-1153 introduces a transient storage opcode, allowing the protocol to perform temporary storage, thereby saving network gas fees.

EIP-6475 is a complementary solution to EIP-4844, providing improved readability and compact serialization by introducing SSZ encoded transaction types.

EIP-4788 aims to improve the structure of cross-chain bridges and staking pools.

3. Related Data Situation

3.1 Layer2 Data Situation

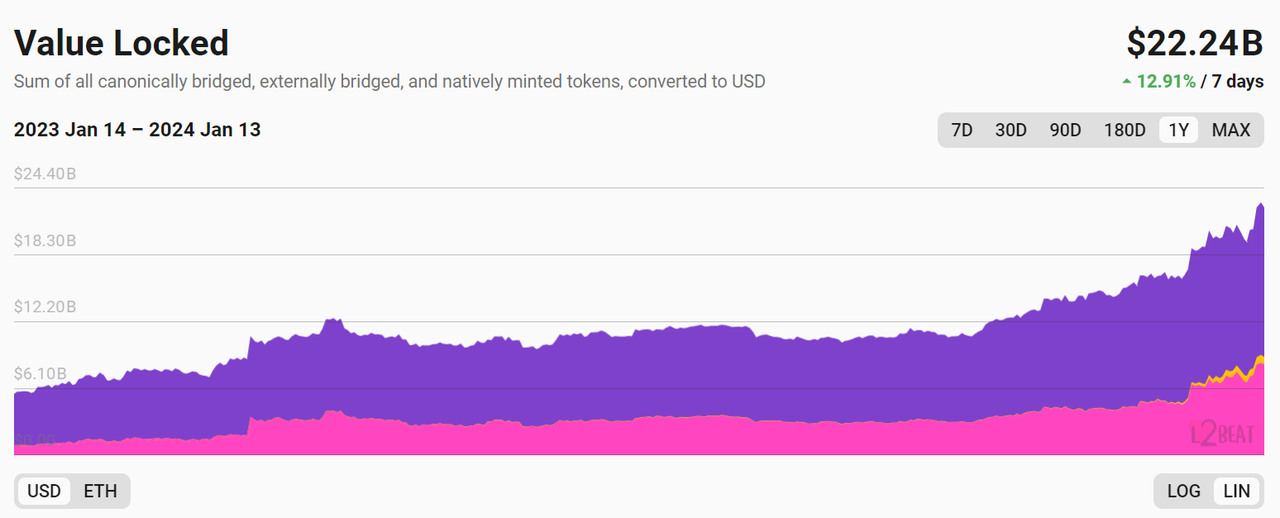

- Total TVL

The total TVL has exceeded $20 billion.

Data Source: https://l2beat.com/scaling/tvl

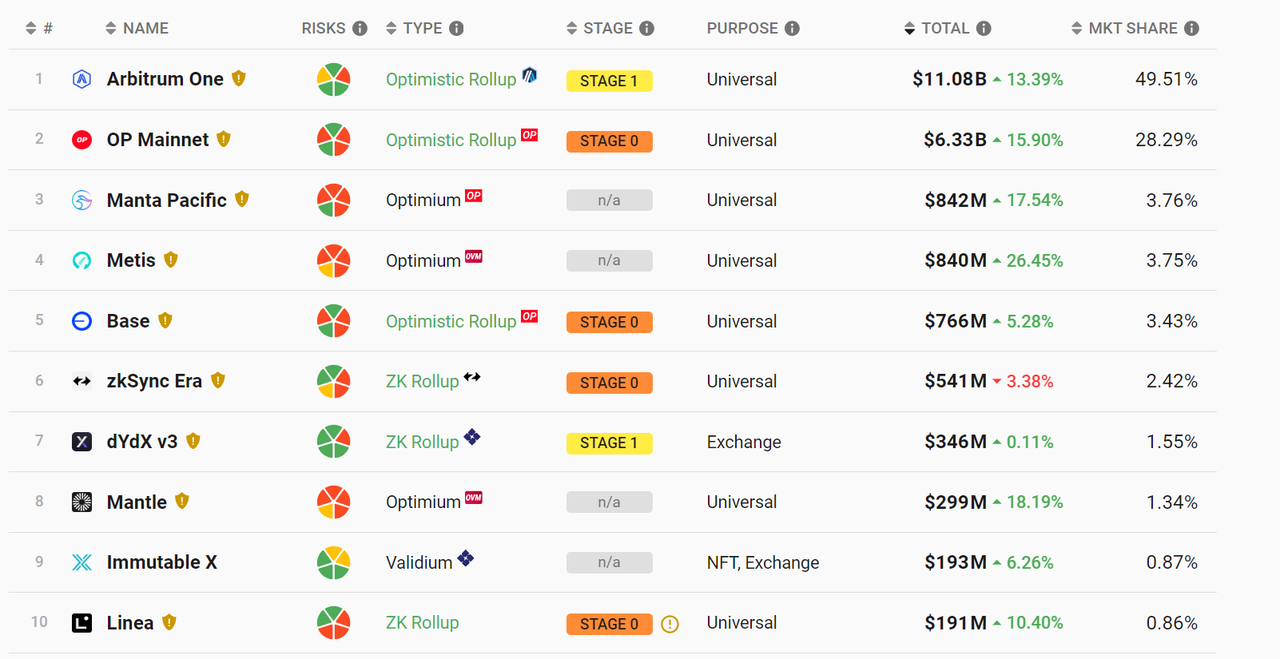

- Layer2 TVL Situation

While Vitalik believes that ZK is the ultimate solution for Rollup, in reality, Arb+OP and other Op solutions have already exceeded 85%. Additionally, many projects are also experimenting with the combination of OP+ZK, continuously iterating.

Data Source: https://l2beat.com/scaling/summary

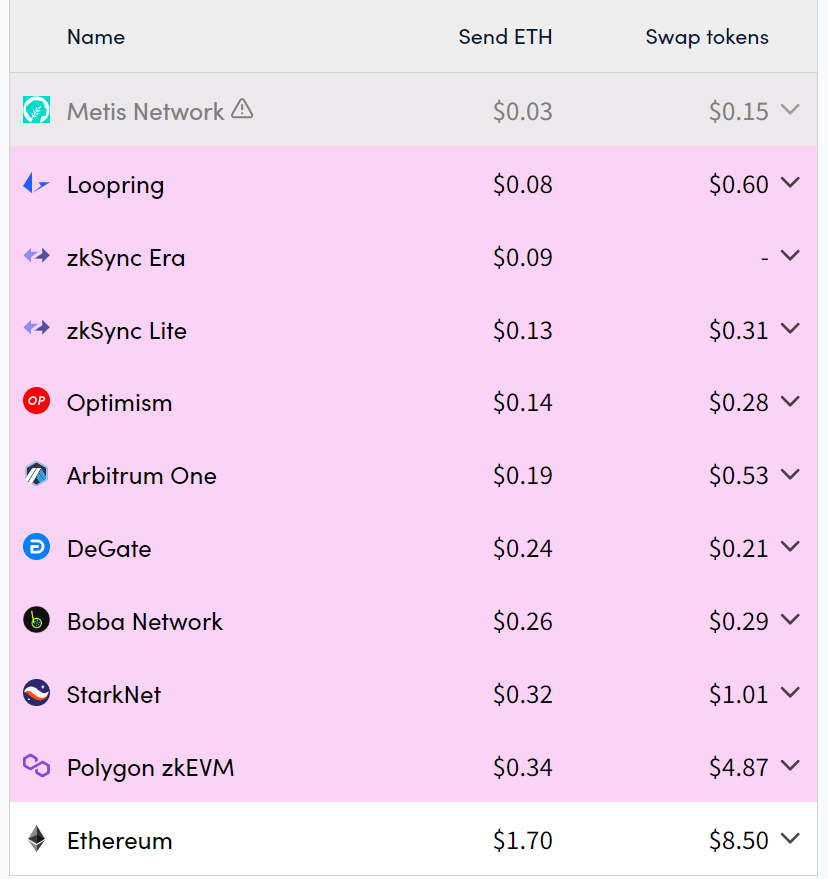

- Layer 2 Gas Fee Situation

The gas fee for a single transaction is only a few dollars, which may be a small amount for early adopters of web3.0, but it is still too expensive for mass adoption.

Data Source: https://l2fees.info/

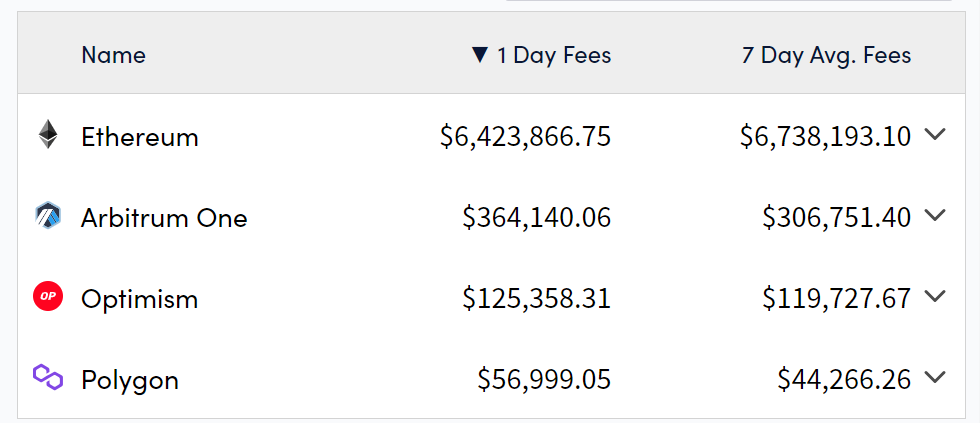

- Income Situation

Data Source: https://cryptofees.info/, select category Layer1, Layer2, and select the four public chains shown in the image.

3.2 TPS

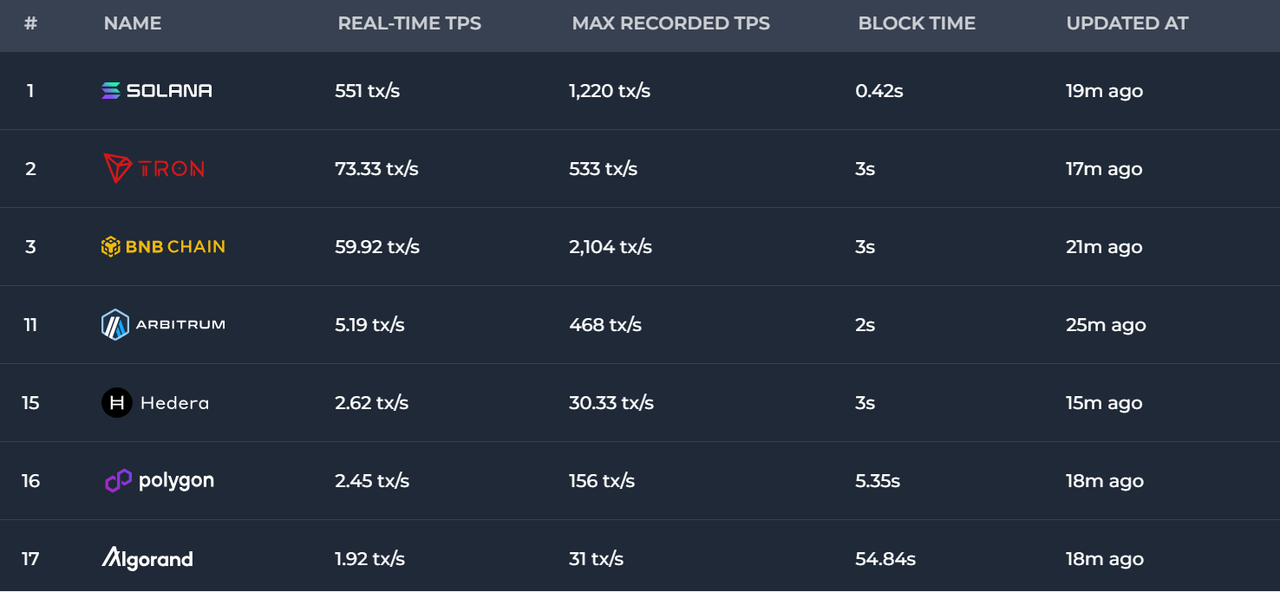

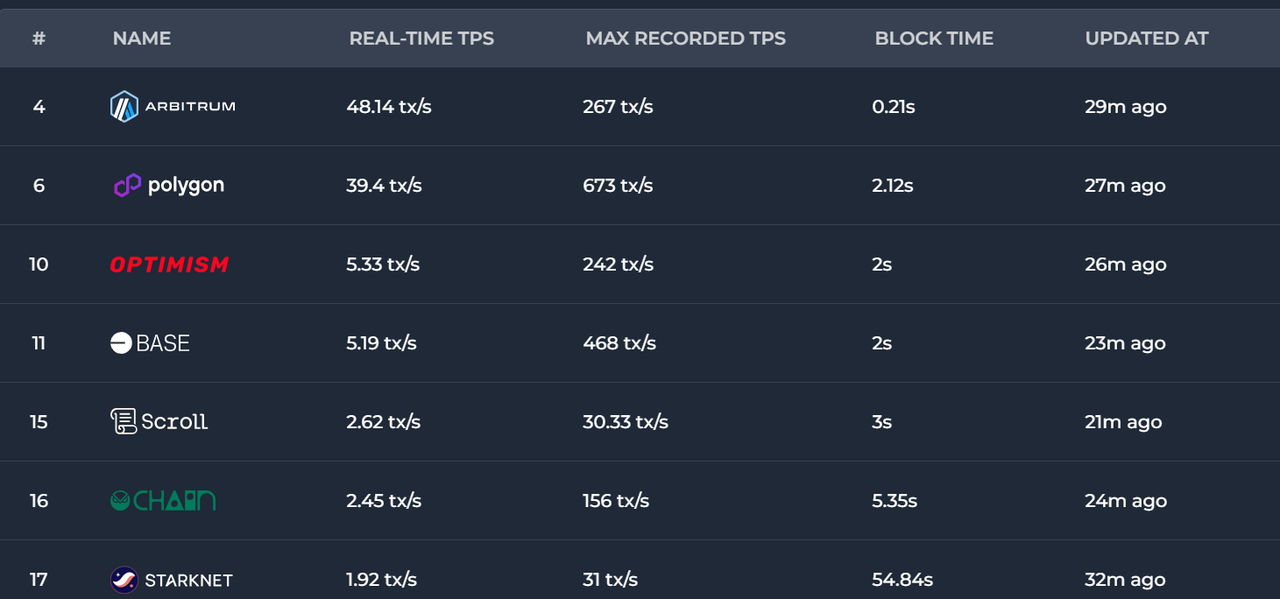

The initial TPS of Ethereum was 108. The theoretical TPS of Layer2 can exceed 100,000 transactions per second (TON), but currently, there are no applications at this level, which is a cause for concern.

Data Source: https://chainspect.app/dashboard/tps

The real-time TPS on Layer2 currently does not exceed 50.

Data Source: https://chainspect.app/dashboard/tps?tag=layer_2

4. Remaining Issues to be Resolved

Is Ethereum's liquidity somewhat fragmented due to multiple different Layer2 solutions? Potential solutions include sequencer sharing, decentralized sequencers, etc.

CM: It's not easy for funds from Chain A to move to Chain B. The concept of Layer2 is a service layer, with Arb and derivatives like Gmx as the main focus. The Layer2 market is relatively small, and initially, the task of Layer2 is to segment Ethereum's business to Layer2. The current solution is to solve it through the application layer. The experience issues are resolved through cross-chain applications. From the perspective of chains, there will inevitably be a phenomenon of fund fragmentation, mainly a security issue.

DZ: It seems that Layer2 has recently gained a lot of attention? Has the expectation for Layer2 increased? Will the introduction of 4844 immediately reduce fees? This may lead to changes in the landscape, such as the transfer of USDT from Tron to Ethereum Layer2.

Appendix - Knowledge Popularization

1. Network Upgrades and Forks

In the development process of the Ethereum protocol, network upgrades and forks have the same meaning, both involving changes to the Ethereum protocol, adding new rules (in the form of EIPs), which can be planned or unplanned. However, the meaning of a hard fork is somewhat different. It refers to a network update that is not fully backward compatible and may even change the existing functionality of deployed contracts, rendering some previous transactions invalid.

2. Introduction to EIP/ERC

Main reference source: https://eips.ethereum.org/EIPS/eip-1, specifically EIP-1

2.1 EIP Categories

EIPs can be divided into three major categories:

**Standards Track EIP: **These EIPs describe any changes that affect most or all Ethereum implementations, or any changes or additions that affect the interoperability of applications using Ethereum. In simple terms, these are EIPs that change the details of most or all Ethereum implementations. They can be further divided into the following types:

Core: Refers to modifications that may lead to forks and require changes to consensus (e.g., EIP-5, EIP-101), as well as changes that may not necessarily be related to consensus but may be related to Ethereum's "core development."

Networking: Refers to proposed improvements to the devp2p communication and Light Ethereum Subprotocol, as well as modifications to the Whisper and Swarm network protocol specifications.

Interface: Refers to improvements to Ethereum client API/RPC definitions and standards, call method names, and contract ABIs, among other language-level standards.

ERC: Refers to application-level standards and conventions. This includes token standards, name registration, URI schemes, account abstractions, etc.

Meta EIP: These EIPs revolve around changes to Ethereum's processes (or events within the process), including modifications to processes, user guides, decision-making processes, development environments, and tools. Because these changes require community-wide compliance, they require community consensus.

Informational EIP: These EIPs are non-standard improvements that do not propose new features, only design issues, and opinions on general guidelines or information for the Ethereum community, and do not necessarily represent consensus or suggestions from the Ethereum community.

The EIP repository has been separated into ERC and EIP repositories. EIP-7329 proposes to split ERC specifications from the EIP repository into a new repository to retain only core protocol EIPs. Therefore, the current EIP repository tracks past and ongoing improvements to Ethereum itself and protocols built on it in the form of EIPs. The ERC (Ethereum Request for Comment) repository tracks past and ongoing improvements to application standards in the form of ERCs. The ERC repository has produced well-known standards such as ERC-20, ERC-721, ERC-1155, etc.

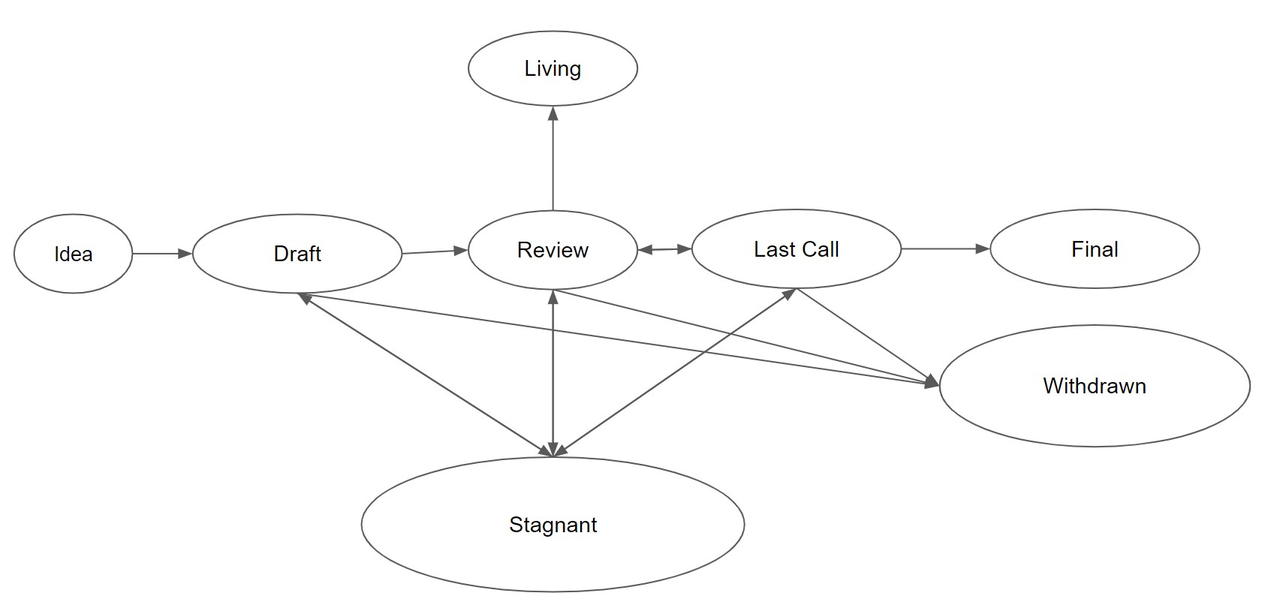

2.2 EIP Review Process

Idea - The idea of a draft proposal. This will not be tracked in the EIP repository.

Draft - The first formal tracking stage in EIP development. When the format is correct, the EIP will be merged into the EIP repository by the EIP editor.

Review - The EIP author marks the EIP as ready and requests peer review.

Last Call - This is the final review window before moving to the Final state for the EIP. The EIP editor will assign the Last Call status and set a review end date (last-call-deadline), usually 14 days later. If necessary normative changes occur during this period, the EIP will revert to Review.

Final - The EIP represents the final standard. The final EIP is in a state of finalization and should only be updated to correct errata and add non-normative clarifications. The PR to move the EIP from Last Call to Final should not contain any changes other than status updates. Any content or editorial proposed changes should be separate from this status update PR and submitted before it.

Stagnant - Any EIP in Draft or Review state that has been inactive for 6 months or longer will be moved to Stagnant. The author or EIP editor can revive it from this state by moving the EIP back to Draft or an earlier state. If not revived, the proposal may remain in this state indefinitely.

EIP authors will be notified of any algorithm changes to their EIP status.

Withdrawn - The EIP author has withdrawn the proposed EIP. This status is final and the EIP number cannot be reused. If the idea is later pursued, it will be considered a new proposal.

Living - A special status for an EIP intended to be continuously updated and never reach a final state. The most notable example is EIP-1.

References

Detailed Explanation of Ethereum Cancun Upgrade

Rollup Economics: We Overestimated the Impact of EIP-4844 on Scalability

Vitalik: What Exactly is Danksharding?

EIP-4844: The Core of the Cancun Upgrade

Why is the Emergence of Blast a Big Fortune for Layer2?

The Future Battle of Ethereum Layer2, Variety or Dominance?

Binance Research Report: In-depth Analysis of Decentralized Sequencers

Understanding Ethereum's Verkle Tree in Depth

IOSG Ventures: Merging Soon, Detailed Explanation of Ethereum's Latest Technical Roadmap

An Article on the Current Status of Sequencers

Understanding Ethereum Gas Fee Calculation: How to Reduce Transaction Costs?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。