$METIS token is widely used, including network fees, node staking, and governance voting, serving not only as a store of value but also making contributions to the network's development.

TL;DR

The rumors about the founding team of Metis being "Vitalik Buterin's mother/friend" are beneficial to Metis, whether as a gimmick or a reality, as it has no harm to Metis.

Metis's ecosystem projects have developed rapidly, covering all the hotspots in the market, attracting numerous well-known developers to join, demonstrating its accurate capture and application of market heat.

Metis recently launched an ecosystem incentive program totaling billions of dollars, attracting more high-quality projects to deploy on Metis, continuously expanding its ecosystem, demonstrating its proactive work attitude and contribution to ecosystem growth.

Unlike other Layer2 solutions, Metis initially focused on decentralized sequencer breakthroughs, ensuring network security and decentralization through the creation of sequencer pools and node staking mechanisms, solving the centralization issue of other Layer2 single sequencers.

$METIS token is widely used, including network fees, node staking, and governance voting, serving not only as a store of value but also making contributions to the network's development.

1. Project Summary

Metis is an Ethereum Layer 2 network that stands out among many Layer 2 networks by introducing innovative technologies such as decentralized sequencer pools and Hybrid Rollup, aiming to maintain high throughput and fast transactions while ensuring network decentralization and security.

2. Project Details

2.1 Team

The team currently has a size of around 11-50, with an average tenure of 1.8 years, and the total number of employees has increased by 4% in the past six months.

Elena Sinelnikova(Co-Founder): Founder of the non-profit blockchain organization Crypto Chicks, which is dedicated to blockchain education for women, providing opportunities for women to learn and enter the blockchain field.

Kevin Liu(Co-Founder&Product Lead): Kevin is the co-founder and CEO of ZKM (zkm.io) and also the strategic director of the MetisDAO Foundation, responsible for supervising the formulation and implementation of the foundation's internal strategic plans. Kevin completed his MBA at the University of Chinese Academy of Sciences and is an active researcher in token economics, DAO, and governance protocols.

Yuan Su(Co-Founder&CTO): Yuan Su holds a Bachelor's degree in Computer Science and a Master's degree in Business Administration. He held several management positions at IBM Canada and CaseWare in 2003, with extensive experience in software engineering and management. In 2022, Yuan founded Nuvo Technologies.

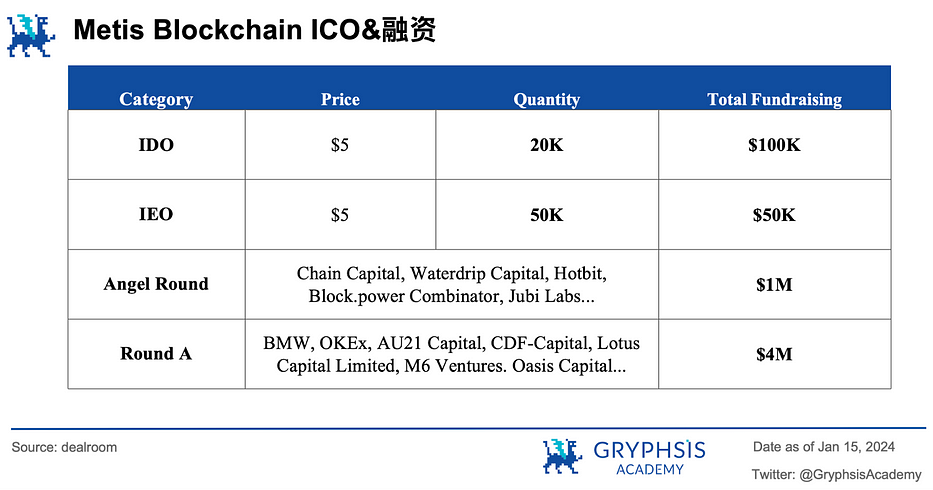

2.2 Financing Status

Metis has completed a $1 million angel and seed round of financing, a $4 million Series A round of financing, with investment institutions including Block Dream Fund under OKEx, Genblock Capital, Cryptomeria Capital, etc.

Institutions currently investing in Metis include Gate.io, DFG, AU21, HOT labs, CatcherVC, Parsiq, Chain Capital, Genblock Capital, OK, and others.

2.3 Recent Developments

2.3.1 Community Testing

On January 16, Season 1 Community Testing was launched on the Sepolia testnet to test the POS Sequencer pool by exploring various Dapps. Users will also receive corresponding Testing Points rewards.

Currently, the applications supported by Season 1 Community Testing include Hummus Exchange, League.Tech, Tethys Finance, Midas Games, Netswap, and other projects such as Enki, League.Tech, etc., will join later. Each Dapp corresponds to a different points pool, and each operation has a different points ratio. Participants can obtain testnet $METIS at zero cost and earn points through network faucets.

Currently, the rules for points and rewards are as follows:

All participants can earn points by completing corresponding tasks, and a single operation can be repeated, but each repetition can only earn 75% of the previous points.

If the amount held is greater than the total points, the points will be converted into the amount (increasing points).

The more points, the higher the rewards, directly proportional to the participant's points ranking.

It is worth noting that the EDF plan launched by Metis in December 2023 (total of 4.6M $METIS) will allocate $3M in tokens to achieve decentralized Sequencer. It can be seen that this community testing not only has rich incentives at zero cost but also paves the way for future Sequencer profit sharing blueprints. It can be anticipated that as a member of the Metis community, active participation in ecosystem construction will provide feedback that other Layer 2 solutions cannot currently offer.

2.3.2 MetisEDF

On December 18, Metis officially launched the MetisEDF (Ecosystem Development Fund) plan, allocating 4.6M $METIS (valued at 5.5 billion USD) of ecosystem funds to achieve decentralized Sequencer (as mentioned above), Dapps Grants, Dapp Building mining incentives (as below), liquidity incentives, and other ecosystem development activities.

Among them, Dapp Building, also known as BMR (Builder Mining Rewards), will allocate 10,000 $METIS tokens to ecosystem projects each month, with 4,000 tokens linked to trading volume.

The ecosystem projects are not limited, and both DeFi, ReFi, DeSci, NFT, DAO, and GameFi can receive incentives. The reward distribution is calculated based on the proportion of a project's transaction count to the total ecosystem transaction count, ensuring that project teams can receive fair rewards.

2.3.3 MetisJourney

On December 6, Metis launched the $5 million incentive program #MetisJourney to incentivize and attract more related Dapps in the DeFi category for deployment.

In essence, Metis will focus on decentralized Sequencer community testing, migrating DA layer to Ethereum, achieving decentralized Sequencer, and focusing on the ecological deployment of LSD projects.

The above are the main developments from December 2023 to the present. In just two months, Metis has provided billions of dollars in incentive plans, from the decentralized Sequencer testing involving the entire ecosystem community to the activity incentives for every project team. From funding support, community support to ecological resources, these actions all contribute to expanding Metis's influence and activity.

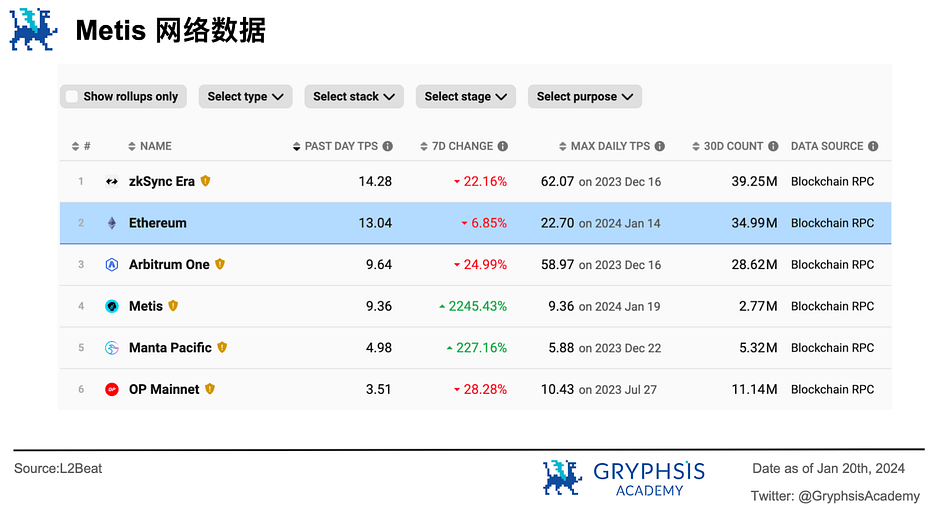

These positive developments are also reflected in its ecosystem data. As of the time of writing, Metis's TVL/highest TPS per day has ranked in the top 5 of Layer 2, with a 120% increase in TVL within one month and a 337.16% price increase. Currently, Metis's TPS is processing 9.36 transactions per second. Although there is a significant gap compared to networks like zkSync Era and Arbitrum, the comprehensive data and update frequency indicate that Metis's network updates and iterations are relatively fast (e.g., the last highest data for the Optimism network was in July last year), and its performance and speed are relatively excellent.

These data fully demonstrate the strong development momentum and market recognition of Metis in the Layer 2 field, showing its enormous potential and value in the Layer 2 market.

3. Technical Framework

3.1 Hybrid Rollups

As early as March 2023, Metis proposed the Hybrid Rollup solution, combining the advantages of OP-Rollup and ZK-Rollup technologies, allowing Metis to leverage the strengths of both ZK-Rollup and OP-Rollup.

For example, OP-Rollup's optimistic assumption that all transactions are correct for fast on-chain processing increases network processing speed, while ZK-Rollup has advantages in proving transaction validity and protecting user privacy. By combining the two, Metis DAO's Hybrid Rollup will achieve:

1) EVM compatibility: Despite being a hybrid Rollup solution, it remains compatible with EVM, allowing existing Dapps to easily integrate.

2) Enhanced security: By incorporating validity proofs, Rollup adds an additional security layer on top of fraud proofs, ensuring the accuracy of off-chain transactions and reducing centralization risks.

3) Lightning-fast transaction confirmation: Utilizing ZK Rollup technology allows for rapid final confirmation of transactions, reducing confirmation times.

4) Optimized capital efficiency: With the ability of Hybrid Rollup to minimize gas consumption, users can allocate resources more wisely, optimizing their capital efficiency.

The Metis DAO Foundation has launched ZKM, an open-source ZKP system service provider based on MIPS technology. By developing the ZK Rollup component zkMIPS, a functional component that can address the drawbacks of OP Rollup and ZK Rollup and leverage the advantages of both Rollup types to achieve efficient application of Hybrid Rollup.

By segmenting transactions between the two Rollup types, ZKM can:

Process simple transactions quickly on OP Rollup

Use ZK Rollup for transactions requiring higher security

Avoid including too many fraud proofs on the main chain, reducing costs

This hybrid approach aims to balance speed, security, and cost, achieving the best Rollup solution, making ZKM suitable for a wide range of transactions and different user needs.

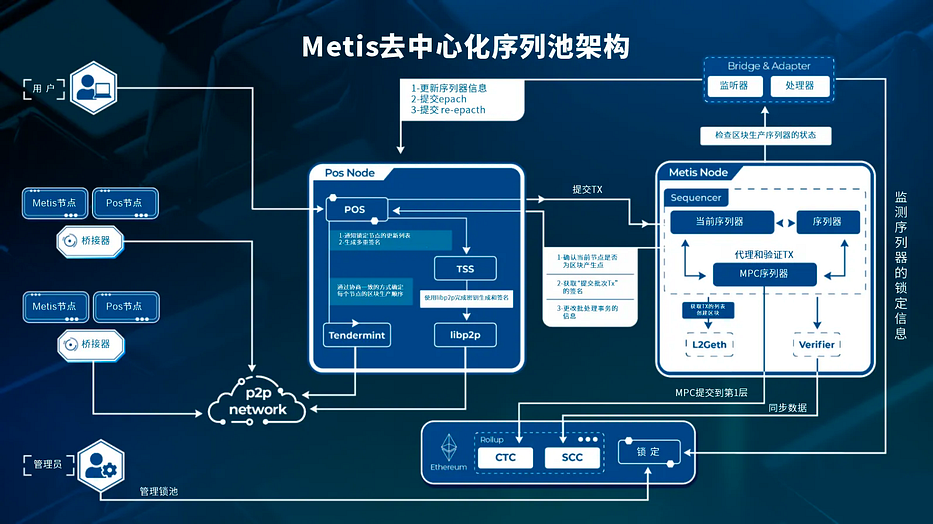

3.2 Decentralized Sequencer

In the Rollup solutions of Layer 2, the Sequencer is responsible for collecting, ordering, and submitting user transactions. However, due to its sorting function, it is prone to MEV gray income, where the Sequencer can gain additional income by manipulating or front-running transactions or prioritizing high gas transactions, leading to a lack of decentralization in transactions or the entire network being affected by attacks due to a single Sequencer.

To address this issue, Metis has made the Sequencer decentralized through a series of designs and technologies. The following are the basic concepts to understand this framework:

- Tendermint Consensus Algorithm

In a consensus round, Validator A is selected as the proposer, collects a batch of transactions, and packages them into a new block. Other validators check the validity of the block and vote. If the final approval votes exceed 2/3, the block achieves finality.

- Threshold Signature Scheme (TSS) and Multi-Party Computation (MPC)

Both are cryptographic technologies, where:

Threshold Signature Scheme: It allows a group of users to share control of a key. In this scheme, the key is divided into multiple parts (or shares), with each user holding a part. Only when a sufficient number of users (reaching the set threshold) act together can a valid digital signature be generated. This method can increase the security of the system because an attacker must simultaneously obtain a sufficient number of key shares to attack the system.

Multi-Party Computation (MPC): It allows multiple parties to jointly compute the output of a function without directly sharing inputs. For example, in a class's exam scores, to protect students' privacy, individual scores cannot be disclosed to others, but an average score needs to be calculated. Each student only needs to provide their own score input, without knowing the inputs of other participants, to obtain the result. Non-participants can only know the final result, but participants can know their own data and the result, achieving privacy protection.

Metis has transformed the traditional single-point Sequencer into a Sequencer Pool, achieving decentralization (resisting MEV and addressing single-point failures) through the introduction of node staking mechanisms, rotation mechanisms, and more.

1) Sequencer Pool

Source: Metis Chinese Blog

Due to cost-effectiveness considerations, most current Layer 2 solutions operate their own centralized single Sequencer. However, this introduces a single point of failure issue, where the entire network will be affected if the Sequencer is attacked. Metis has established a Sequencer node pool to address such issues, ensuring that the network can continue to operate normally even if one Sequencer in the pool goes offline for any reason.

In terms of resisting MEV, originally only a single Sequencer entity could see the contents of the transaction pool. Now, Metis has introduced multiple Sequencers, and any Sequencer staking into the pool has the right to see the transaction pool contents and process transactions.

In this case, if a Sequencer wants to act maliciously, there is no guarantee that it will actually be selected to process transactions. Additionally, other Sequencers are observing the transaction pool, and if any misconduct is detected, the Sequencer will be penalized. Furthermore, when transactions enter the Sequencer pool, the Tendermint consensus algorithm is used, requiring 2/3 of Sequencer signatures to package and submit transactions, ensuring that transactions are not disrupted.

By expanding the number of Sequencer nodes through the Sequencer pool, competition and transparency are increased. Introducing a consensus algorithm decentralizes power, eliminating the risk of single technical control and enhancing the decentralization of Sequencers.

2) Node Staking

We know that MEV is the miners' cake. When Metis openly distributes benefits through the Sequencer pool, preventing miners from single-handedly controlling it, it challenges their interests. Will miners resist and cause a decrease in network processing efficiency, especially for DeFi transactions, leading to user asset losses, user attrition, and reduced usage, ultimately creating a vicious cycle?

Fundamentally, the path to decentralizing Sequencers is not a technical balance but a dispute over interests. The biggest difficulty in achieving decentralized Sequencers is not a technical issue but resistance from vested interests.

So, how does Metis address the issue of miner revenue?

Metis has introduced a node staking mechanism, requiring nodes to stake the network token $METIS to participate in the network. To become a Sequencer node, a stake of at least 20,000 $METIS (worth approximately $2.4 million) is required. However, once a Sequencer participates in transaction block production, it can simultaneously receive gas income from processing transactions and additional $METIS staking incentives. This not only compensates for the miners' lost MEV income but also creates a positive feedback loop, increasing miner revenue. How is this achieved?

First, in terms of resisting MEV, it is unfriendly to miners but user-friendly. Users no longer need to pay extra gas for faster transaction processing and are not at risk of miners front-running to their detriment. This mechanism is not available in other Layer 2 solutions. When protecting user interests, users will flock to the network. At this point, transaction volume increases, and miners receive more gas fees. As Metis uses the native token $METIS as network gas, each user transaction increases the demand for $METIS, stabilizing/raising its price. As a result, the staking incentives in $METIS held by miners also appreciate with the development of the ecosystem.

Additionally, validators are set up to reward the detection of malicious Sequencers, encouraging validators to intensify their scrutiny.

By setting a threshold for node participation, the sunk cost of nodes is increased because once misconduct is detected, the large amount of staked tokens will be completely forfeited. By setting token staking incentives, node participation is increased, aligning network interests with miner interests. However, staking also controls the circulation of tokens in the market, maintaining the token price while also discouraging nodes from easily engaging in misconduct to avoid significant asset losses, achieving "using tokens to protect the network."

3) Sequencer Rotation

After processing transactions, they need to be broadcast to other nodes for ledger synchronization (Proposer), which is responsible for the final transaction confirmation. To ensure that Proposer nodes do not encounter issues during the transaction confirmation phase, Metis has introduced a rotation mechanism.

All Sequencer Lists are stored in an address controlled by MPC, and the Sequencer selected from the pool to handle processing is determined by a POS mechanism. Based on the voting weight of their respective Sequencer nodes (related to the staked amount) and combined with a random hash drop method, block producers are selected in a fairer manner. If a Sequencer closes or stops serving, it will also be rotated, ensuring that the network operates 24/7 and avoids network paralysis.

Metis's Sequencer pool and staking amount are closely linked, aligning node interests with network interests, ensuring the resistance and decentralization of Sequencers, and returning network benefits to all contributors involved in construction and operation. The network's financial volume is mainly supported by the DeFi category, and Metis's decentralized Sequencer undoubtedly provides a strong attraction point for its DeFi products. As a result, various DeFi Lego projects such as Farming, LSD, Lending, CDP, and more will gradually build a diverse ecosystem for Metis.

3.3 MVM

Based on OP-Rollup, Metis has designed its own virtual operating environment MVM, which is EVM-compatible and separates the computation and storage modules. This not only allows any existing Ethereum dApp to easily build on Metis but also provides users with better processing efficiency and lower gas fees.

Since MVM is designed based on OP-Rollup, it inherits its fraud-proof workflow. When validators package transaction results on-chain, there is a challenge period that allows anyone to raise fraud proofs for questioning. If accepted, incorrect state updates will be revoked. The MVM_Verifier in MVM serves this purpose.

By separating computation and storage, transactions are first calculated off-chain, and the on-chain storage retains transaction state, achieving lower on-chain costs and efficient processing due to concurrent execution.

4. Economic Model

4.1 Allocation Mechanism

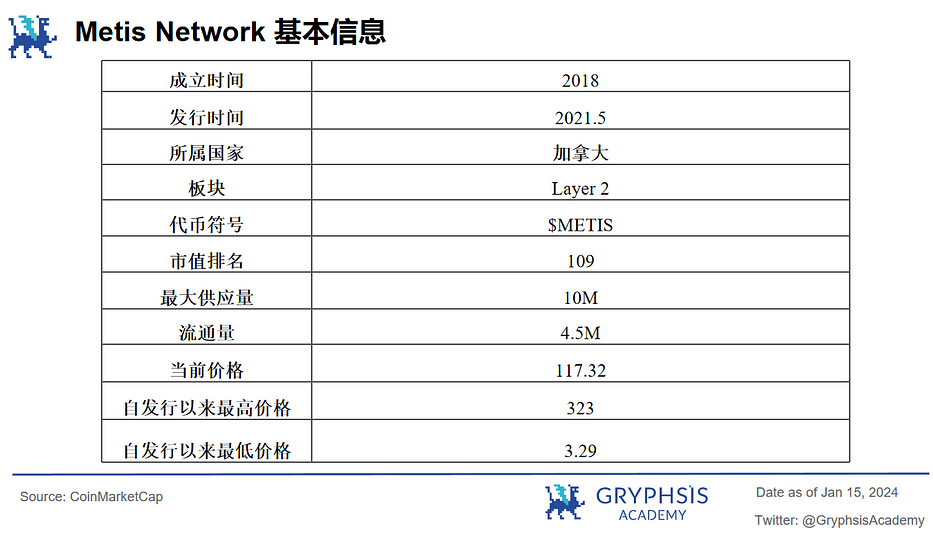

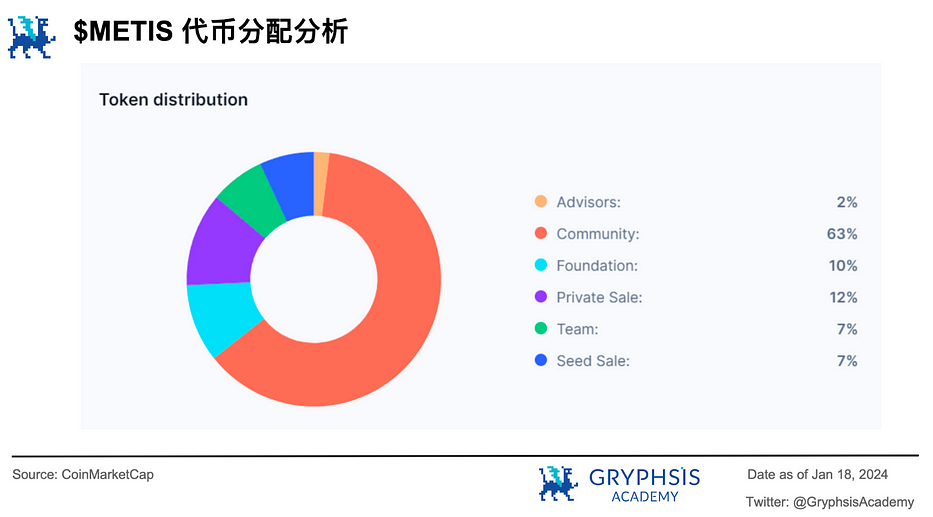

Metis's native token is $METIS, with a total supply limit of 10 million, issued in May 2021. The shares corresponding to "advisors, founding team, investors" have been fully unlocked, and the remaining tokens will be allocated to community development.

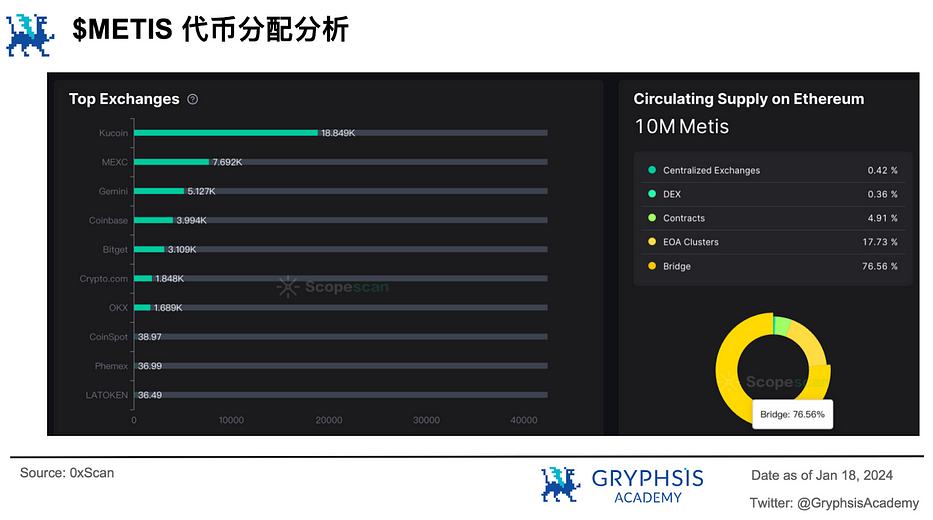

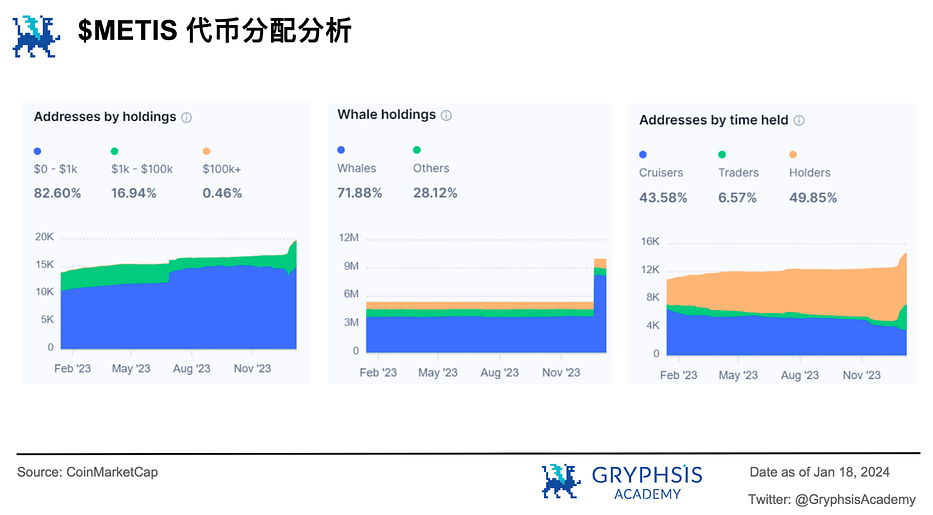

Currently, 4.5 million $METIS is in circulation. Analyzing the circulating supply through 0xscan, it is found that nearly 76.53% of the tokens are in the Metis Bridge, EOA addresses hold 17.94%, and the number of holding addresses has increased by 17.5% in the last month. The holders are generally long-term oriented, with over half of the holders having held $METIS tokens for over a year. About 80% of holders hold tokens worth less than $1,000, with only a few holders owning over $100,000 worth of tokens. The token distribution is relatively decentralized.

In addition, among the CEXs supporting $METIS, Kucoin, MEXC, and Gemini have the best liquidity.

4.2 Token Utility

$METIS is mainly used for the following purposes:

1) Network transaction fees: Users need $METIS as transaction gas when interacting with Metis. The network returns 30% of the transaction fees to the protocol to support its development.

2) POS staking: Nodes must stake to participate in the network. Additionally, (Sequencer) nodes can receive block rewards and staking rewards in $METIS simultaneously.

3) Community governance: Holding $METIS grants governance rights in the ecosystem, allowing participation in network proposal voting.

$METIS differs from other Layer 2 tokens such as Optimism and Arbitrum, which can only be used for governance. $METIS has a rich range of use cases, undoubtedly bringing more demand for the token, while also controlling market circulation through token staking. Both of these factors have led to a price increase of 299.82% for $METIS in the past month (of course, not excluding other factors such as proactive project development).

Furthermore, $METIS is not currently listed on well-known exchanges such as Binance. If the decentralized Sequencer testing can be successfully completed, resolving the core issues of single-point failure and misconduct in Layer 2, it is believed that both $METIS and its ecosystem will experience a qualitative leap.

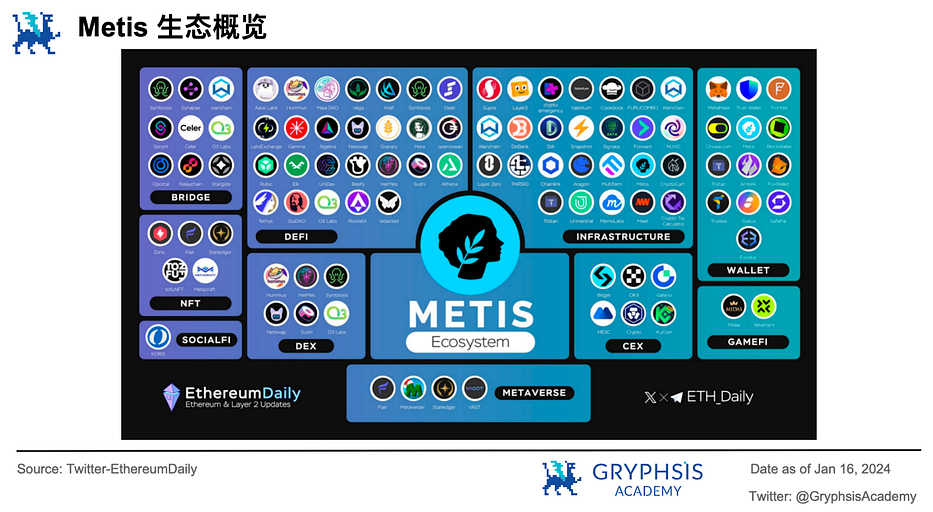

5. Ecosystem Projects

Metis's current ecosystem covers a wide range of areas including DeFi, Infrastructure, Wallet, Gamefi, DEX, SocialFI, NFT, Bridge, with DeFi and infrastructure projects being the majority. The ecosystem includes well-known developers such as Daniel (who brought $1 billion TVL to the Fantom ecosystem) developing WAGMI, as well as emerging projects on the testnet such as League Tech, Hercules, and Enki, among others, which we will now focus on one by one.

1) WAGMI

WAGMI (formerly Popsicle Finance) was officially deployed on Metis on January 10 and received a $2 million grant from Metis.

WAGMI was developed by renowned developer Daniele Sestagalli. Daniele has previously attracted billions of dollars in ecosystem projects to Avalanche and Fantom. The entry of WAGMI into Metis, whether in terms of industry influence, development technology, or ecosystem resources, will undoubtedly greatly enhance the market's favorability towards Metis and raise market value expectations.

As a comprehensive DeFi solution, WAGMI currently offers functions such as Swap, liquidity pools, and GMI, and will later support arbitrage robots and perpetual trading, among others.

Once it supports perpetual contract trading, it will allow the creation of liquidity pools for leveraged trading without permission, as well as the creation of liquidity pools for users to trade native tokens of ecosystem projects such as Revenant, Hummus, Netswap, Athena, and Tethys, greatly expanding user trading opportunities and bringing higher activity and liquidity to the ecosystem.

In addition, on January 2, WAGMI announced a partnership with DWF Labs, with DWF purchasing 26.6 million $WAGMI. Whether in the development of the project or its strategic deployment on Metis, WAGMI and its developer Daniele are likely to have a strong positive impact on Metis.

2) Enki

ENKI is the first native LSD protocol on Metis and is launching a decentralized Sequencer testnet based on Metis Sequencer (opened on January 19). ENKI is an important part of the Metis nodes, aiming to simplify the staking process for Sequencers in the Metis ecosystem to increase staking rewards, allowing even users with fewer Metis to participate.

Users can earn rewards by staking $METIS. The decentralized POS Sequencer community test for Metis requires each Sequencer to stake 20,000 $METIS. For nodes with insufficient funds, they can go to the ENKI platform to allow community users to participate in node staking and receive node test incentives and node mining incentives.

At the same time, as Metis will focus on the LSD track in the near future, the platform's TOKEN will have significant value in the Metis ecosystem.

Overall, ENKI's solution lowers the barrier to user participation, allowing more users to participate in the Metis ecosystem, providing a more inclusive and efficient staking and reward platform.

3) League Tech

League Tech is a SocialFi platform on Metis, similar to "Friend.tech" on Metis, introducing new features such as shorting mechanisms, dynamic reputation, badge systems, league creation and betting, and a three-tier access model, among others.

It is currently actively deploying and preparing to participate in community testing.

4) Hercules

Hercules is a DEX customized for Metis using CamelotDEX technology, providing a diverse range of DeFi financial services. It mainly offers the following services:

I) Dynamic AMM: Supports dynamic asset liquidity based on the UniSwap V2 model.

II) Directional Swap Fee: Customized fees based on direction (buy or sell).

III) NFT Liquidity Positions: Opening positions to obtain non-fungible collateral positions (spNFTs), enjoying additional composability for higher capital efficiency.

IV) Custom Launchpad: A customized platform offering various token issuance strategies: fair issuance, recommendation, discounts, airdrops, whitelists, and more.

Hercules's financial services are quite diverse, aiming to become the primary DEX for Metis by creating a wide range of financial tools.

5) NUVO

NUVO is Metis's first Inscriptions project, featuring NIP-20 and NIP-721 protocols, providing efficient DeFi solutions by addressing congestion and high fees for Inscriptions deployment, minting, and transfer.

It mainly includes two main product features:

1) NuMarket: A dynamic trading platform for asset movement between EVM and Inscriptions, enhancing accessibility and market dynamics.

2) NuDex: A dedicated derivatives trading market that allows zero-cost (no $METIS Gas required) trading. It offers perpetual contract trading, margin trading, spot trading, lending, and borrowing, providing cutting-edge financial experiences.

NUVO, as an Inscriptions protocol, also provides asset liquidity and derivative trading, offering rich support for the liquidity of Inscriptions and other assets.

In addition to these emerging protocols, some top DeFi applications have actively supported Metis, such as AAVE, Stargate, Sushi, and others, bringing a large number of users and liquidity to Metis. The support from these top DeFi applications not only validates the reliability and stability of Metis technology but also significantly increases Metis's market recognition and influence.

Of course, Metis also has some native projects worth paying attention to, such as NetSwap (the first native DEX), Tethys Finance (a financial services platform), Hummus Protocol, and others. Leveraging Metis's technological advantages, especially in the DeFi category, these projects are not to be underestimated in terms of user experience and ecosystem support.

6. Conclusion

Since its establishment, Metis has attracted widespread market attention due to its co-founder's identity as "Vitalik Buterin's mother/friend," whether as a gimmick or a real connection, this market hype has brought a lot of favorable exposure to Metis.

Metis's current ecosystem projects are thriving, covering all the current market hotspots, such as the Inscriptions NUVO, the social aspect of League Tech (Friend.tech), and the LSD track of Enki, among others. Many well-known developers such as Daniele (who brought in billions of TVL for Fantom) have also joined. It is evident that Metis has accurately captured and applied market heat, a thriving ecosystem, and active developers, undoubtedly laying the foundation for Metis's explosive growth.

Recently, Metis has launched numerous ecosystem incentive projects totaling billions of dollars, maintaining existing projects while attracting more high-quality projects to deploy on Metis, continuously expanding the ecosystem. Its proactive attitude has also brought considerable growth in volume and application to the ecosystem.

Compared to other Layer 2 solutions, Metis initially focused on a breakthrough in decentralized Sequencers. Through the creation of Sequencer pools and node staking mechanisms, along with the current community testing, it not only maintains network security and decentralization but also returns undue profits from Sequencers to the community, addressing the longstanding issue of centralization of single Sequencers in other Layer 2 solutions.

The $METIS token differs from other Layer 2 tokens in its greater utility, from network fees to node staking and governance voting. $METIS not only serves as a store of value but also contributes to the network's development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。