Financial asset tokenization represents the next step in financial technology revolution, solving problems and inconveniences in traditional models by achieving asset digitization, distributed ledgers, and tokenization. This is a major technological innovation in the wealth management industry, and it is a significant manifestation of RWA in reality.

Authored by: BiB Exchange

Introduction

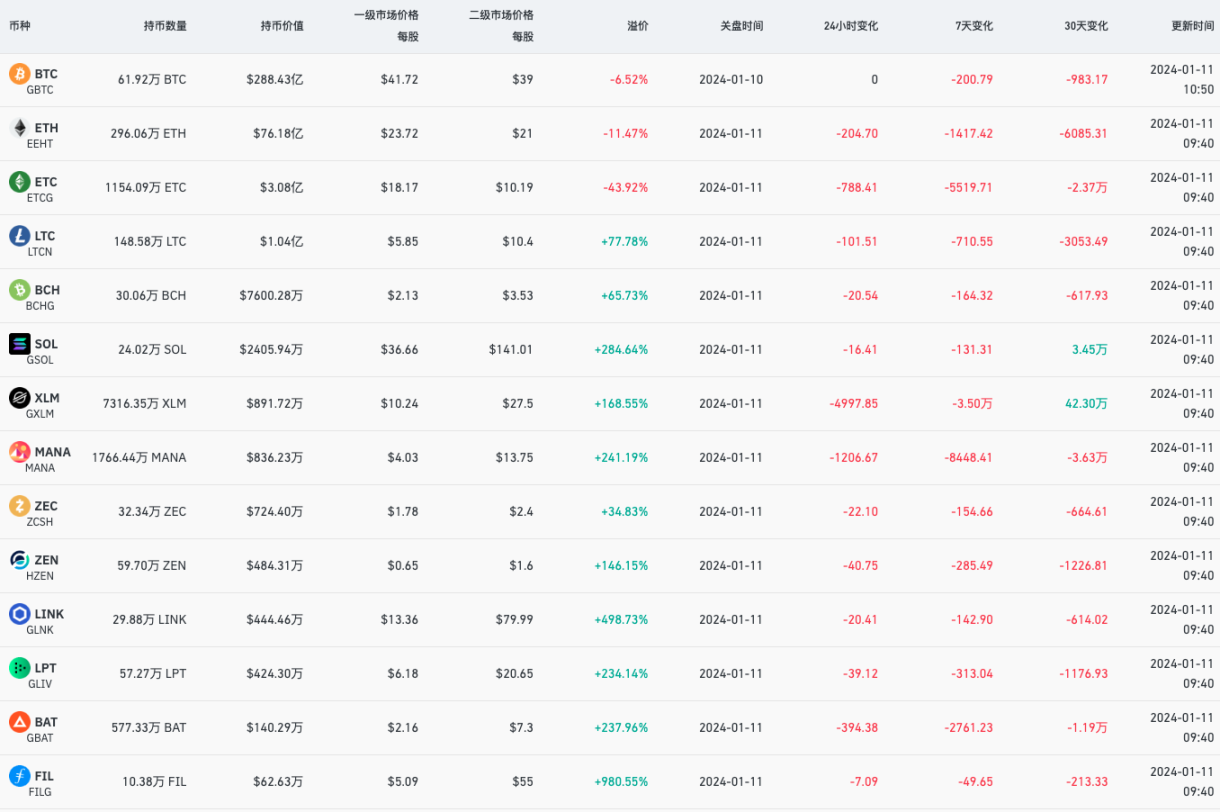

On January 11, 2024, Singapore time, the SEC from across the ocean announced the approval of a Bitcoin spot ETF, and the market was in a state of great excitement. However, Grayscale Fund quietly sold off a large amount of chips, including dozens of digital currencies such as BTC/ETH, especially impacting the entire market with the selling pressure on Bitcoin. However, Grayscale quietly increased its holdings of a currency over the past month, called XLM!

What is XLM? XLM is the native cryptocurrency of the Stellar network. Stellar is a decentralized open-source blockchain network designed to connect the global financial system by facilitating convenient, fast, and low-cost asset transfers. XLM is used to pay transaction fees and prevent network abuse, while also supporting the rapid exchange and liquidity of RWA-type digital assets.

The Stellar network can bring more RWAs onto the chain and expand their liquidity through asset digitization and tokenization. XLM and the Stellar network provide a low-cost, efficient global circulation and trading infrastructure for RWAs. Overall, the decentralized and cross-border payment features of the Stellar network provide an attractive platform for the digitization of real assets. It supports transactions within the network and serves as a bridge between digital assets, thereby promoting the broader application of RWAs on the blockchain.

RWA not only reflects an increase in holdings of a single currency, but also includes the dynamics of big players. For example, the recent remarks by the CEO of BlackRock have brought RWA's performance back into people's view. The CEO of BlackRock believes that the approval of a Bitcoin spot ETF is very important for the advancement of real digital assets online. He sees ETFs as a technology and origin, just like Bitcoin and other asset storage technologies. He believes that the next step for financial assets will be tokenization. This means that each stock and bond will have its own distributed ledger, recorded in a general ledger, and each investor will have their own management number and digital identity.

Through tokenization, many problems with existing stocks and digital assets can be eliminated, achieving instant settlement and significantly reducing costs. In addition, RWA assets based on distributed ledgers can easily determine real-time ownership of assets, thereby achieving better corporate governance, such as exercising voting rights. Financial asset tokenization represents the next step in financial technology revolution, solving problems and inconveniences in traditional models by achieving asset digitization, distributed ledgers, and tokenization. This is a major technological innovation in the wealth management industry, and it is a significant manifestation of RWA in reality.

I. Background and Principles

1.1 Development Background from Reality

According to a report by the Boston Consulting Group, the market size of tokenized assets is expected to reach $16 trillion by 2030. This will account for 10% of the global GDP at the end of 2030, a significant increase compared to $310 billion in 2022. This estimate includes on-chain asset tokenization and fragmentation of traditional assets (exchange-traded funds (ETFs), real estate investment trusts). Considering the potential market size, capturing even a small part of this market will have a huge impact on the blockchain industry. Even at $16 trillion, tokenized assets will still be only a small part of the current global total asset value, estimated at $900 trillion (less than 1.8%, and not considering the future growth of the global total asset value). It can even be considered that the real potential market is the entire global asset market, as anything that can be tokenized can be represented on-chain as RWAs. The initial participants include Goldman Sachs, Siemens, KKR, Hamilton, and other assets on-chain, and institutions such as BOC International and UBS have approved proposals for RWAs as tokenized forms of collateral such as real estate, invoices, and receivables.

1.2 Basic Principles

RWA refers to real-world assets off-chain that are brought on-chain through tokenization, serving as another source of income in the DeFi ecosystem.

Three steps of RWA:

RWA process, also known as off-chain packaging; Off-Chain Formalization, Information Bridging, and RWA Protocol Demand and Supply.

1) Off-Chain Packaging

Packaging assets off-chain to make them compliant, clarifying the value of assets, ownership of assets, and legal protection of asset rights. It is important to consider the following dimensions:

- Value: The economic value of the asset can be represented by the fair market value of the asset in traditional financial markets, recent performance data, physical condition, or any other economic indicators.

- Legitimacy: Ownership of the asset can be determined through deeds, mortgages, bills, or any other form.

- Legal support: In cases involving changes in asset ownership or rights, there should be a clear resolution process, which typically includes specific legal procedures for asset liquidation, dispute resolution, and enforcement.

2) Information Bridging

Bringing data on-chain, where information about the economic value, ownership, and rights of the asset is digitized and brought on-chain. This includes securitization: permission to issue security tokens, KYC/AML/CTF, and compliance with trading platform listing. Regulatory technology/securitization: for assets requiring regulatory supervision or considered securities, there are different regulatory technologies to introduce assets into DeFi in a compliant manner.

3) RWA Protocol Demand and Supply

Driving the entire process of RWA through DeFi protocols; on the supply side, DeFi protocols oversee the initiation of RWAs. On the demand side, DeFi protocols facilitate investors' demand for RWA opportunities. Most DeFi protocols focused on RWA are both the starting point for new RWA initiatives and the market for end products of RWA.

Asset digitization - asset standards - on-chain asset registration - ownership confirmation. Different real assets require the development of different RWA pricing. Establish a quality assessment system for RWAs and study the value models of different industries and types of data to provide a basis for RWA transactions. It is also necessary to establish a platform and application market for the trading and circulation of digital assets, essentially a data element market for RWAs, enabling real-world assets to participate in circulation in the form of data elements.

II. Market Applications

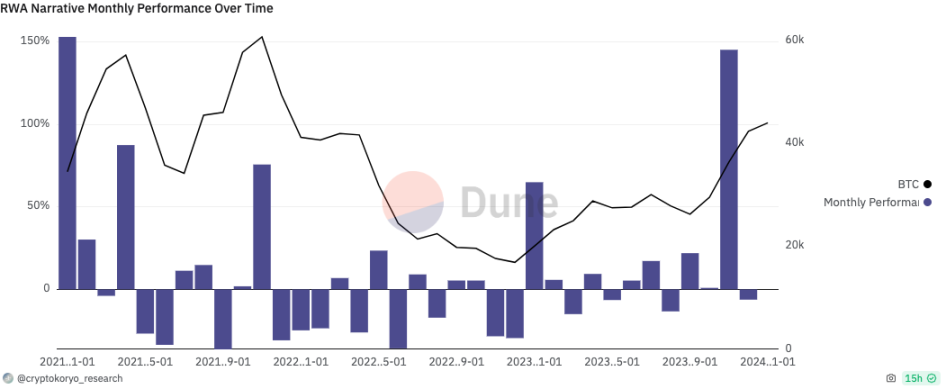

Grand narratives often carry greater funds and opportunities. Why are mainstream investment banks and consulting firms in the United States providing strong endorsements for #RWA? From recent Dune statistics, it is easy to see that the net inflow of RWA in the last month of 2023 has been steadily increasing.

Source: https://dune.com/cryptokoryo/btc-pairs

Market Cases

Based on fiat currency, stablecoins are the original RWA, followed by a series of assets including commercial real estate, bonds, art, real estate, cars, and almost any store of value that can be tokenized. Of course, the most popular basic asset category for RWA is real estate, followed by climate-related basics (such as carbon credit limits) and public bond/stock basics, followed by emerging market credit (mainly corporate debt) basics. An analysis of some typical RWA projects in the market reveals the following important cases:

2.1 Treasury Asset Allocation US Bonds

MakerDAO initially also involved real estate and other assets, considering the default risk of assets. Stablecoin protocols such as MakerDAO indirectly generate income from US bonds by using treasury asset allocation to US bonds, primarily using USDC and later facing the risk of unpegging, with most being US Treasury bonds. MakerDAO mainly purchases US Treasury bonds and does not use an asset issuance platform, but holds US bond assets through a trust legal structure. MakerDAO commissioned Monetalis to design the overall legal structure, and Monetalis uses a trust legal structure based in the British Virgin Islands (BVI) to bridge the on-chain and off-chain.

The stablecoin DAI issued by MakerDAO, pegged to the US dollar, is currently one of the most common use cases for RWA. MakerDAO was also one of the early DeFi protocols to incorporate RWA into its strategic planning, and in 2020, it approved a proposal for RWA as tokenized forms of collateral such as real estate, invoices, and receivables to expand the issuance of DAI. The asset size has now exceeded $3 billion. MakerDAO allows borrowers to deposit collateral assets into the "vault," allowing borrowers to withdraw the protocol's native stablecoin DAI (denominated in USD) debt. The vault is a smart contract that holds the borrower's collateral based on Ethereum until all borrowed DAI is repaid. As long as the value of the collateral remains above a specific threshold, it will not trigger the related liquidation mechanism.

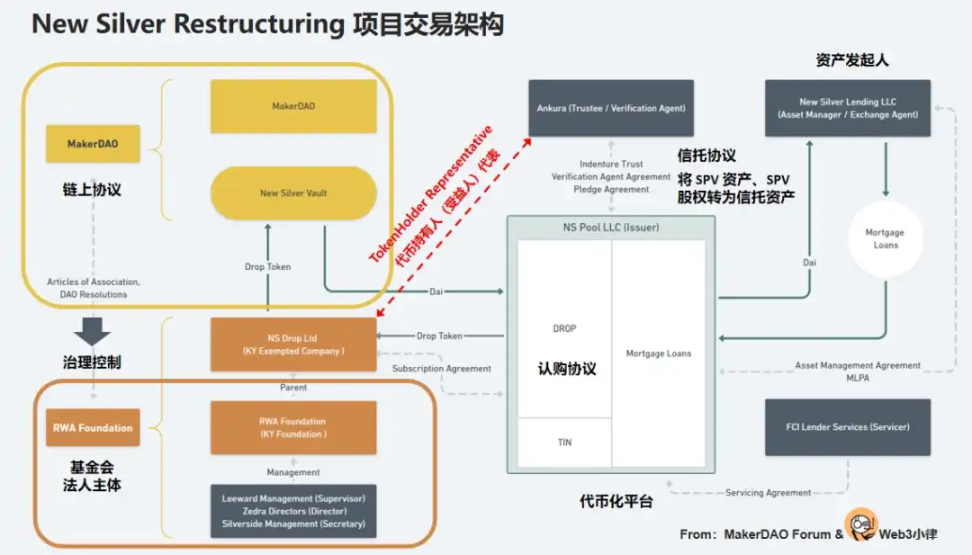

It is important to emphasize the typical project of MakerDAO - New Silver. As the first formal real-world asset (RWA) project in MakerDAO, it was established in 2021 with a debt ceiling of $20 million. The underlying assets of the project are mortgage assets initiated by New Silver, financed through an SPV issuer set up by New Silver on the Centrifuge tokenization platform.

In November 2022, the community proposed an upgrade and restructuring of the 2021 New Silver project, adopting a foundation + SPV transaction structure. This upgrade fully complies with this transaction structure, allowing MakerDAO to have complete control over the project at the legal entity governance level. The main participants in the New Silver Restructuring upgrade and restructuring transaction structure include:

- RWA Foundation: Established in 2021, it operated the previous HunTINgdon Valley Bank (HVB) project. Controlled by MakerDAO governance, the Foundation's Director must make resolutions or exercise any rights according to MakerDAO Resolutions. Through on-chain and off-chain governance systems, MakerDAO is able to have complete control over the project.

- NS DROP Ltd: A wholly-owned subsidiary of RWA Foundation, it is the executing entity of the transaction. It participates in subscribing to DROP tokens initiated by Centrifuge for the financing party and provides funds. As a token holder representative (DROP/TIN), it exercises the relevant rights delegated by MakerDAO Resolutions. It instructs the trustee Ankura Trust to operate the assets according to the trust agreement.

- Ankura Trust: Established to ensure the independence of the issuer SPV assets and the security of MakerDAO funds. According to the trust agreement between the SPV and the trust company, it stipulates the collateral of SPV credit assets and the pledge of SPV equity, ensuring the integrity of MakerDAO's assets and timely and full disposal in the event of default, providing security for MakerDAO funds.

2.2 ETF Investment

Ondo Finance, as a DeFi protocol, launched a tokenized fund that introduced its OUSG token on the Polygon network, allowing stablecoin holders to invest in bonds and US Treasury bonds. Ondo Finance currently supports four investment funds - US Money Market Fund (OMMF), US Treasury Bonds (OUSG), Short-Term Bonds (OSTB), and High-Yield Bonds (OHYG), marking these investment funds as RWAs (referred to as "fund tokens"). After completing the KYC/AML process, users can trade fund tokens and use them in licensed DeFi protocols.

The Ondo Finance team also developed the decentralized lending protocol Flux Finance, which specifically invests in BlackRock's iShares Short-Term Treasury Bond ETF (SHV). The protocol offers various tokens available for lending, such as USDC, DAI, USDT, and FRAX, with OUSG being the only collateral asset.

Flux Finance allows OUSG holders to pledge OUSG to borrow stablecoins. As a stablecoin provider in the Flux Finance lending pool, users can indirectly earn income from investing in US Treasury bonds without the need for KYC.

2.3 SPV Tokenization + DeFi Protocols

In exploring the reduction of investment thresholds, Matrixport launched the permissionless US bond investment protocol T protocol. The on-chain bond platform Matricdock, launched by Matrixport, chose to establish a Special Purpose Vehicle (SPV) as the issuer for purchasing and holding US Treasury bonds.

Matricdock introduced a product based on US Treasury bonds called Short-Term Treasury Bill Token (STBT), accepting STBT tokens issued by Matrixdock as collateral, enabling low-risk borrowing with US Treasury bonds as collateral. Through this pool, users can deposit stablecoins to earn lending interest, with an expected lending rate of about 5%. Users who deposit stablecoins into the pool will receive lending certificate tokens rUSTP. According to compliance regulations, customers still need to undergo KYC and register their addresses on a whitelist, with a minimum investment requirement of $10 USD.

After investors deposit stablecoins into T Protocol, T Protocol mints TBT. When it accumulates to 100,000 USDC, it entrusts partners to purchase STBT. TBT is pegged to $1 and can be redeemed through the protocol, distributing US bond income through a rebase mechanism. There is also a type of wTBT, which is a non-rebase form of TBT packaging. Behind TBT is the protocol's purchase of STBT and the USDC reserve for T Protocol, acting as an intermediary between non-Matrixdock users and Matrixdock. TBT is also a potential competitor to stablecoins.

2.4 Algorithmic Stablecoin Protocols

Frax Finance has also been exploring the use of RWA assets such as US bonds. Frax Finance and MakerDAO have faced similar challenges in their over-reliance on USDC as collateral. Earlier this year, the unpegging of USDC led to DAI and Frax both falling below $0.9, further prompting Frax Finance to strengthen reserves and reduce reliance on USDC.

Aave's native stablecoin GHO has launched its testnet. GHO is an over-collateralized stablecoin supported by multiple crypto assets. Subsequently, the lending protocol Centrifuge proposed to introduce RWA into Aave and use it as collateral for the native stablecoin GHO. As Aave's RWA provider, Centrifuge's RWA market allows Aave depositors to earn income from real-world collateral, while Centrifuge asset originators can borrow funds from Aave.

2.5 US Bonds / Fund Tokenization

The tokenization of RWA is achieved by launching compliant funds based on short-term US bonds, using on-chain recorded fund transaction data to tokenize "fund shares." This operates in a similar manner to the tokenization of fund shares by traditional financial institutions. Compound's on-chain bond company, Superstate, invests in "ultra-short-term government securities," including US Treasury bonds, government agency securities, and other government-supported instruments.

The requirements for holding fund token shares and investing in the fund are the same. Holders of fund token shares need to register their addresses on the fund's whitelist, and addresses not on the whitelist will not be able to execute transactions. Investors are typically required to be US residents, and only fiat currency transactions are supported, not cryptocurrency transactions such as stablecoins.

Other Cases

This also includes Tron's RWA collateral product stUSDT, Securitization/Tokenization, StrikeX (STRX), INX Crypto Trading Platform (INX), Curio Group (CUR), which are also typical cases of RWA tokenization. Synthetix and Mirror Protocol are decentralized synthetic asset protocols for trading stocks on-chain, initially using synthetic assets, carbon credit certificates KlimaDAO and Toucan, precious metals Pax, L1's Polymeth, real estate tokenization LABS Group, multi-asset tokenization Paxos, and TradFi Polytrade, which currently have a relatively small market size and will not be further discussed here.

III. Operating Mechanism

RWA does not represent capital outflow from DeFi, but rather an attempt by the crypto industry to tap into TradFi, involving a whole set of mechanisms for both borrowing and lending. Here, we will provide a detailed breakdown of several modes of operation for MakerDAO's RWA:

3.1 Participation in Coinbase Prime's USDC Institutional Rewards Program RWA014

Institutional USDC held in Coinbase Prime accounts incurs no custody fees and is also rewarded monthly. Coinbase promises not to lend, pledge, or re-pledge assets in customer custody accounts and ensures that customers can almost instantly freely mint, burn, withdraw, and settle USDC (within 6 minutes).

Because the reserves of USDC issued by Coinbase and Circle are invested in US bonds, the Coinbase Prime program is not designed for direct profit, but rather for the overall development of the USDC ecosystem and to capture market share (essentially sharing a portion of the US bond income with large holders, USDT does not have this benefit. Similarly, Gemini's GUSD is the same, and even simpler, as it does not need to be held by Gemini, only needs to be in the MakerDAO contract vault, and it earns 2% interest).

The proposal also mentions two operational processes, and it may be necessary to analyze the contract to determine which one will ultimately be used.

Operational Method (1)

- Collateralize RWA014-A to mint DAI, stability fee 0%, collateralization ratio 100%.

- Exchange DAI for USDC in the PSM at a 1:1 ratio.

- Deposit USDC into MakerDAO's account opened at Coinbase Prime.

Operational Method (2): Directly use the contract owner's permission to transfer USDC from the PSM pool to MakerDAO's account opened at Coinbase Prime.

References:

Legal: Link to Legal Document

Institutional Rewards Program: Link to Program Details

Proposal: Link to Proposal

3.2 Collaboration with Asset Tokenization Protocols RWA002-006, RWA010-013, RWA015

ConsolFreight packaged its accounts receivable into NFT assets on-chain through Tinlake (which is based on the Centrifuge protocol and essentially simulates traditional finance for small business credit). Tinlake will sell the entire NFT receivable as priority token DROP (fixed interest rate) and junior token TIN (floating interest rate) for financing. MakerDAO uses DAI to purchase DROP tokens, acting as a priority creditor. The off-chain part is mainly handled by the Centrifuge protocol, and most of MakerDAO's RWA adopts this model.

As early as February 2021, MakerDAO and New Silver issued the first RWA002Vault through Centrifuge. Subsequent larger-scale introductions of RWA were based on the SPV tokenization path. The MakerDAO Centrifuge RWA business model implementation path is as follows:

- The asset originator establishes a legal entity for each pool, namely SPV, to isolate financial risks and provide funds for specific RWAs as the underlying assets of specific Centrifuge pools.

- Borrowers tokenize off-chain assets into NFTs through the AO (underwriter) to use as on-chain collateral.

- Borrowers sign a financing agreement with the SPV and require the AO to lock their NFTs in the Centrifuge pool associated with the SPV.

- After the NFT is locked, DAI is extracted from the Centrifuge reserve and transferred to the SPV's wallet, where the SPV wallet then exchanges the DAI for USD and transfers it to the borrower's bank account via bank transfer.

- On the NFT's maturity date, the borrower repays the financing amount plus financing costs. Repayment can be made directly in DAI on-chain or by transferring USD to the SPV. The SPV converts the USD to DAI and pays it to the Centrifuge pool. After full repayment, the locked NFT is returned to the AO and destroyed.

References:

Centrifuge Business Model: [Link to Business Model](Insert Link)

https://news.marsbit.co/20230518165414358768.html

https://docs.centrifuge.io/learn/legal-offering/#offering-structure

3.3 Model Based on Trust and Asset Securitization Companies RWA001, RWA008, REA009

Asset securitization companies divide long-term lease financing bonds into senior and junior tranches. The senior tranche borrows DAI from the Maker protocol in the form of debt, while the junior tranche is composed of other external investors. DAI is minted to the ETH address of the TFE (tax-favored entity), and then transferred from the TFE to a jurisdiction-specific "trust" account (or its equivalent account). From there, when LendCo calls, DAI is borrowed from the trust, eliminating custody risk for DAI (it is understood that the trust company is also established by the MAKERDAO team). LendCo is responsible for over-the-counter trading of fiat currency and DAI.

Reference: Proposal for Off-Chain Asset-Backed Lender

3.4 Liquidity Bond Strategy Based on Monetalis Clydesdale Collaboration RWA015

Monetalis provides a complete solution and reports periodically to MakerDAO, mainly investing in short-term bond ETFs (mainly Blackrock fund's treasury bond ETFs). The model is similar to the third type and also follows the trust model and fund flow of the 21st proposal, but the trust part is provided by the third party Monetalis. First, RWA tokens are used as collateral to mint DAI, with a stability fee of 0%. Then, DAI is exchanged for USDC/USDP in MakerDAO's PSM pool, and then provided to Monetalis for the purchase of US bonds, with interest manually paid by Monetalis. Asset allocation strategy, collateral value assessment, and the authority to initiate liquidation are all within MakerDAO.

Reference: Execution Proposal for Stable US Treasury Securities

3.5 Indirect Introduction of RWA Income

DeFi native applications that want to engage in RWA business generally have two approaches: one is to directly build projects based on RWA income, and the other is to indirectly introduce RWA income as protocol revenue. Currently, the largest-scale RWA asset held by MakerDAO is Monetalis Clydesdale. The purpose of MIP65 is to use a portion of the stablecoins held by MakerDAO to earn more stable income by investing in high liquidity, low-risk bond ETFs.

The RWA business model implementation path for Monetalis Clydesdale is as follows:

- After MakerDAO's vote, Monetalis is appointed as the executor and reports periodically to MakerDAO.

- Monetalis, as the project planner and executor, has designed a complete trust structure based on BVI to bridge the on-chain and off-chain synergy.

- All MKR holders of MakerDAO are the overall beneficiaries and issue instructions through governance to purchase and dispose of trust assets.

- Coinbase provides exchange services for USDC and USD.

- Funds are used to invest in two types of ETFs: Blackrock's iShares US$ Treasury Bond 0-1 yr UCITS ETF and Blackrock's iShares US$ Treasury Bond 1-3 yr UCITS ETF.

- The income from the US bond ETFs belongs to MakerDAO, and MakerDAO then distributes the protocol revenue to DAI holders by adjusting the deposit interest rate.

Reference: Makerburn Rundown

3.6 Asset-Backed Model

This type of token is a new security that represents the economic rights of underlying assets. The asset issuer issues and registers the assets outside the blockchain system, and after a third party purchases the assets, tokens are issued in proportion to the corresponding relationship, with the counterparty risk being the asset issuer and the asset-backed token issuer. Backed Finance is a regulated entity based in Switzerland that, under Swiss DLT legislation, can tokenize real-world securities in a packaged form on-chain, giving tokens economic rights.

Backed Finance purchases corresponding assets through a third-party institution, which are then held by a licensed custodian, and issues the corresponding tokens through Backed Finance. Each token tracks the price of the underlying assets through on-chain and off-chain data but does not involve other rights such as stock voting rights. Currently, the assets issued include stocks from Coinbase and Blackrock iShares ETF, with the asset issuer being the issuer of the underlying assets, such as Coinbase's stocks, and the token issuer being Backed Finance. Here, there are at least two levels of counterparty risk, coming from Coinbase and Backed Finance. Backed Finance is a typical project that issues corresponding tokens using the asset-backed model, and its legal documents explicitly state that the token only tracks the price of the underlying assets (tracker of the underlying) and does not hold other rights of the securities.

Reference: Introducing Backed Finance

IV. Projects and Platforms

4.1 Originating from Traditional Financial Giants

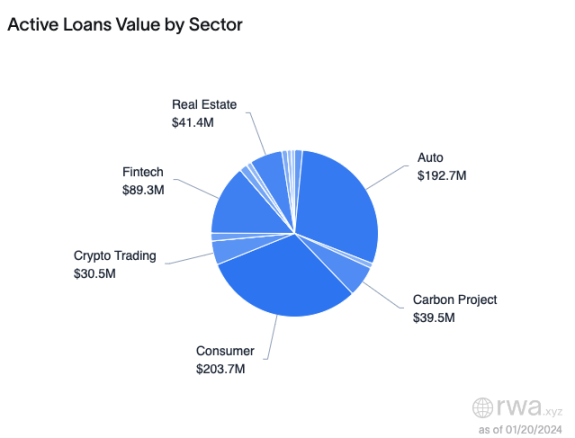

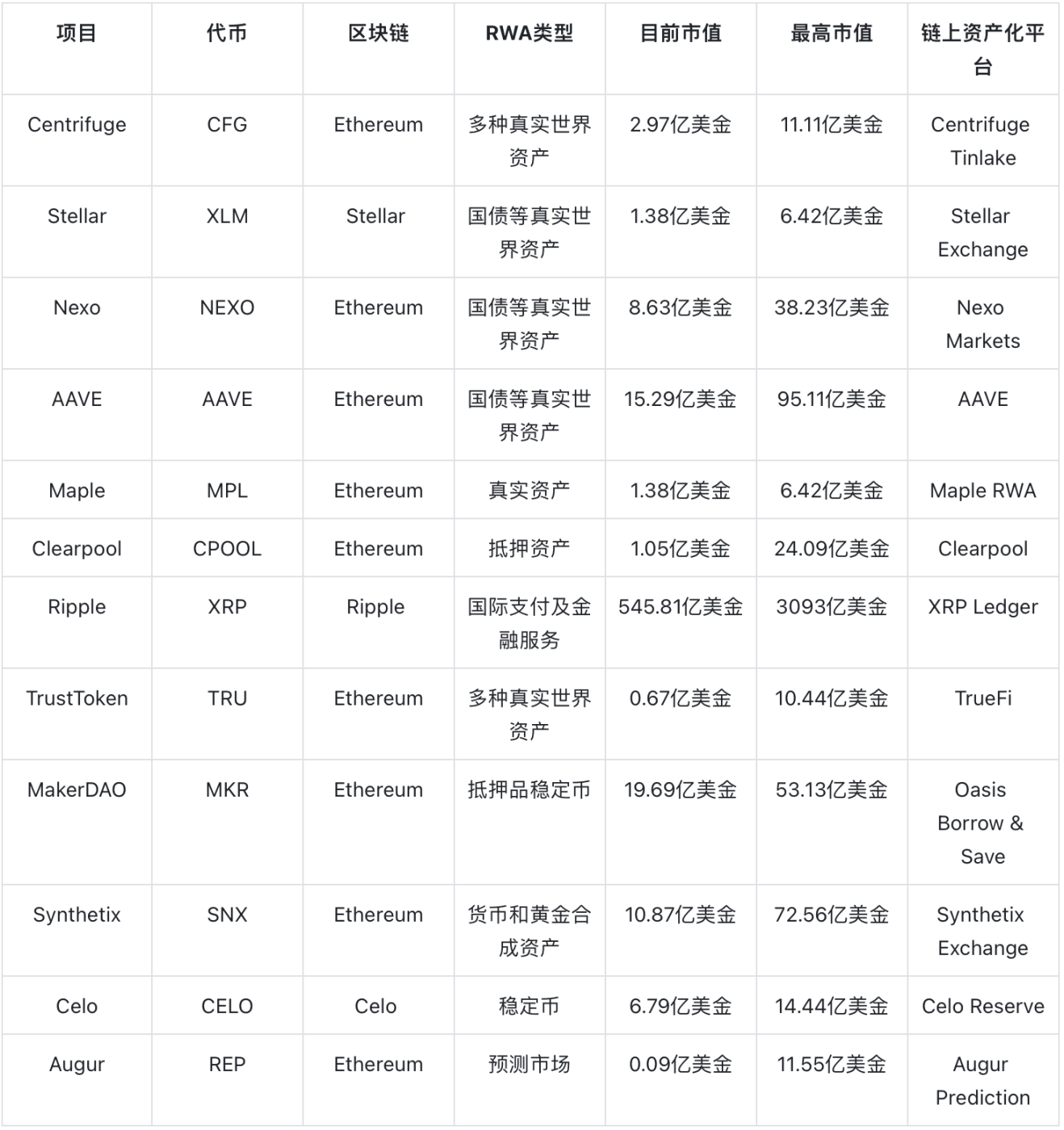

What projects are there related to RWA? In fact, most of the time we are narrowly focused on the crypto-related sector of RWA. RWA is not only reflected in traditional government bonds, but also in many industries and levels. Through the following image, we can see that there are projects happening in carbon energy, consumer projects, cryptocurrency trading, financial technology, real estate, and automation projects, among others.

First, traditional institutions Franklin Templeton and Wisdomtree are conducting experiments in the tokenization of government bonds on the public chain Stellar, attempting to use blockchain technology to change traditional financial business models. The project involves the tokenization of government bonds, transforming traditional government bond assets into digital tokens. Stellar was chosen as the experimental public chain platform. Stellar provides fast, low-cost transactions and handles asset issuance and exchange in a decentralized manner. Although conducted on the public chain, the project mainly uses centralized equity registration. This means that token ownership and transaction records may be registered and managed by centralized entities (possibly financial institutions).

This experiment may be a gradual step for traditional financial institutions to accept and integrate blockchain technology. In the future, there may be more attempts, and it is also possible to gradually achieve a greater degree of decentralization in terms of technology and regulation. The experiment of tokenizing government bonds on Stellar by Franklin Templeton and Wisdomtree demonstrates the exploration of blockchain technology by traditional financial institutions, although the current trend leans towards using centralized equity registration. This to some extent reflects the regulatory and risk considerations faced by the financial industry when adopting new technologies.

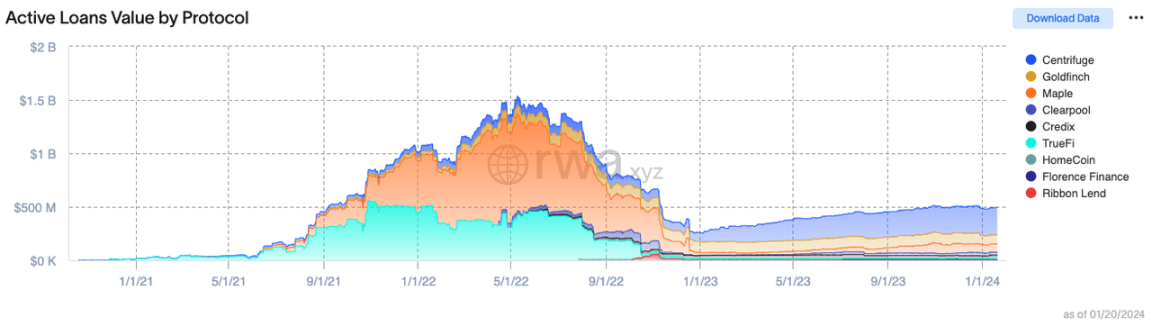

From the above graph and the table data below, we can clearly see that at the end of 2021 and the beginning of 2022, the entire RWA volume experienced a huge surge, followed by stable development. As of today, RWA has formed a situation where multiple institutions are advancing together.

4.2 Comparison and Analysis of Several Major Lending Platforms and Service Providers

Centrifuge, as one of the earliest DeFi protocols for RWA, is also the technology provider behind leading protocols such as MakerDAO and Aave. It is an on-chain credit ecosystem aimed at providing a way for small and medium-sized business owners to collateralize their assets on-chain and obtain liquidity. Centrifuge Prime includes a compliant legal framework established for DAOs and DeFi protocols, a complex tokenization and issuance platform, decentralized and objective credit risk and financial reporting, and diverse asset categories and issuers, addressing many issues related to KYC and legal recourse. Every asset originator on Centrifuge needs to establish a corresponding independent legal entity for the fund pool, namely a special purpose vehicle (SPV).

In summary, the relationship between asset originators, issuers, investors, and Centrifuge in Centrifuge, as well as the specific investment and financing process, is as follows:

- Borrowers finance on-chain using real estate as collateral.

- The asset originator establishes an SPV for the fund pool (one fund pool may have multiple collateral loans from different borrowers).

- The asset originator initiates and verifies RWA, and mints NFTs.

- Borrowers sign a financing agreement with the SPV, collateralizing NFTs in Tinlake, and the Tinlake pool mints DROP or TIN tokens.

- Centrifuge and Securitize collaborate to help investors complete KYC and AML processes. Securitize is an SEC-licensed entity that provides accredited investor verification services.

- Investors sign investment agreements with the SPV corresponding to the Tinlake pool, which include investment structure, risks, terms, etc., and then purchase DROP or TIN tokens with DAI.

- When an investor provides liquidity in DAI to the corresponding fund pool, the SPV exchanges DAI for USD and transfers it to the borrower's bank account.

- Investors can request redemption of their DROP or TIN tokens at any time, but must ensure that DROP tokens are redeemed before TIN tokens, and TIN tokens cannot fall below the set minimum ratio.

- Borrowers repay the financing amount and fees when the NFT expires, and the NFT is returned to the asset originator.

Clearpool is a decentralized credit protocol that provides uncollateralized loans to institutions. Users can borrow using various currencies such as BTC/ETH/OP, and lenders can only provide liquidity to institutional fund pools they are invited to join. CPOOL is the governance token of Clearpool, with two main functions: holders can vote on whitelisting new borrowers, and they can also earn rewards from the Clearpool oracle. The platform features decentralized lending governance achieved through blockchain and smart contracts. It has variable interest rates based on market dynamics of supply and demand, with rates increasing during high demand. The platform also utilizes decentralized user ratings, using algorithmic rating models and external rating API to assess user risk.

Goldfinch primarily provides loans to debt funds and fintech companies, offering USDC credit lines to borrowers and supporting their conversion to fiat currency. Goldfinch's model is similar to traditional banking in the financial industry, but with decentralized auditors, lenders, and credit analyst pools. Auditors of Goldfinch's borrowers must hold staked governance tokens GFI. It has the following features:

- Decentralized P2P lending platform - allows borrowers and lenders to directly engage in lending on the platform without intermediaries.

- Lending pools and credit scoring: Debt funds rate borrowers' credit using evaluation and scoring algorithms to provide them with appropriate lending terms. High-risk borrowers need to pay higher interest rates and provide collateral.

- Relies on decentralized auditors and governance processes to ensure the security and sustainability of the protocol, reducing the role of centralized institutions.

- Collects interest/fees from borrowers. Part of the profits is distributed to governance token holders. Its innovation combines traditional credit with decentralized finance/blockchain technology, providing more efficient, transparent P2P lending and broader financial access and inclusivity.

Maple is mainly for institutional accounts, offering undercollateralized loans or even uncollateralized loans. Maple employs professional credit reviewers to rigorously audit the credit of borrowers. The parties involved are institutional borrowers, lenders, and fund pool validators. Lenders provide funds available for lending, while institutions act as borrowers, and validators review the qualifications of borrowers. Borrowers need to comply with KYC and AML requirements, and validators need to have certain credit industry qualifications to ensure the efficiency and safety of lending.

Therefore, Maple combines real-world asset collateralized loans into RWA tokens for circulation on-chain. It provides a new channel for on-chain collateralized financing for enterprises. By introducing institutional investors, it reduces the cost of corporate financing and provides investors with new collateralized crypto assets. However, with the collapse of Three Arrows Capital, FTX, and others, Maple experienced a $52 million bad debt, and its requirement for KYC and lack of decentralization have been controversial.

In November 2023, the DeFi credit market Credix Finance announced a $60 million credit line, focusing on asset-based lending opportunities and managing a $3 billion investment portfolio. The company supports various categories such as personal loans, business loans, and invoice loans. Interestingly, this project is based on the popular browser wallets Phantom and Solflare on Solana. For borrowers, it also functions as a multi-signature wallet, and the platform tends to offer fixed-income products for blockchain projects.

TrueFi is an uncollateralized credit protocol driven by on-chain credit scoring. Since its launch in November 2020, TrueFi has issued over $1.8 billion in loans to more than 30 borrowers and paid over $40 million in interest to protocol participants. Borrowers include leading cryptocurrency institutions, fintech companies, credit funds, and traditional financial companies.

TrueFi introduces an uncollateralized loan model where borrowers do not need to provide traditional collateral but are evaluated for credit risk through the platform's trust system. This is an innovation compared to the traditional financial system's requirement for physical collateral. TrueFi's two products, TrueFi Lend, allow users to provide funds to earn interest, while TrueFi Borrow allows users to borrow by collateralizing crypto assets. The TrueFi platform uses TrustToken (TUSD) as its base currency, which is a stablecoin pegged to the US dollar.

Of course, there are other projects, including the well-known Aave, which is not only a decentralized lending protocol on Ethereum but also, to some extent, an RWA project supporting the deposit and borrowing of various digital assets. In terms of RWA, Aave has explored the possibility of introducing real-world assets such as real estate into its protocol and continuously experimenting with tokenizing real-world assets.

Currently, RWA is directly sold B2B, with RWA assets sold directly to institutional investors and other B-side users. In reality, it is a B2B2C model where the end-users use the structured DeFi product as the underlying collateral asset, sold to C-side users through DeFi platforms such as Angle Protocol (with underlying assets as Backed Finance bC3M), USDV (with underlying assets as MatrixDock STBT), TProtocol (with underlying assets as MatrixDock STBT), Mantle mUSD (exchangeable for Ondo Finance USDY), and Flux Finance (with collateral as Ondo Finance OUSG).

This model accelerates the promotion of RWA assets in DeFi and provides users with more diversified product choices. There are many such projects, most of which are based on the issuance of traditional financial assets and require further exploration of other forms of innovative projects.

4.3 Ecosystem Projects

As investors in the cryptocurrency industry, we may be more concerned about the investment value of these RWA assets in the market and what emerging projects are worth investing in. What is the ecosystem of RWA? First, let's take a look at the summary and analysis of the entire RWA based on the combination of CMC and Feixiaohao.

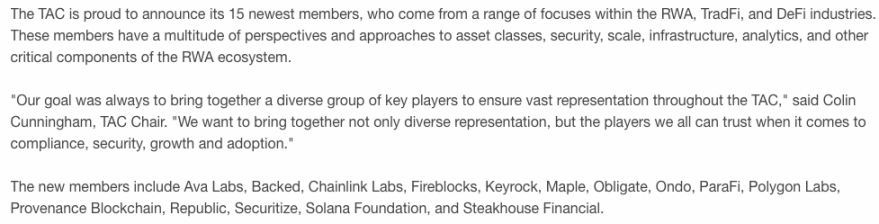

Tokenized Industry Alliance (TAC)

First, it is important to focus on the establishment of the Tokenized Industry Alliance, initiated by companies such as Coinbase, Circle, and Aave. This alliance demonstrates the shared interest of the crypto industry in tokenizing RWA. The alliance is dedicated to promoting the global adoption of RWA and considering the formulation of compliant principles to facilitate the adoption of blockchain technology, including Base, Centrifuge, Credix, Goldfinch, and RWA.xyz, among others. We can see some potentially promising emerging projects that have recently joined the list.

Through this list, especially the 15 institutions or projects that recently joined on January 16, 2024, we can observe a particularly interesting phenomenon: many public chains and well-known projects, including Chainlink, Polygon Labs, and the Solana Foundation, are actively joining this alliance. What does this reflect? It indicates that native blockchain projects are gradually joining traditional finance and strengthening cooperation with real-world assets.

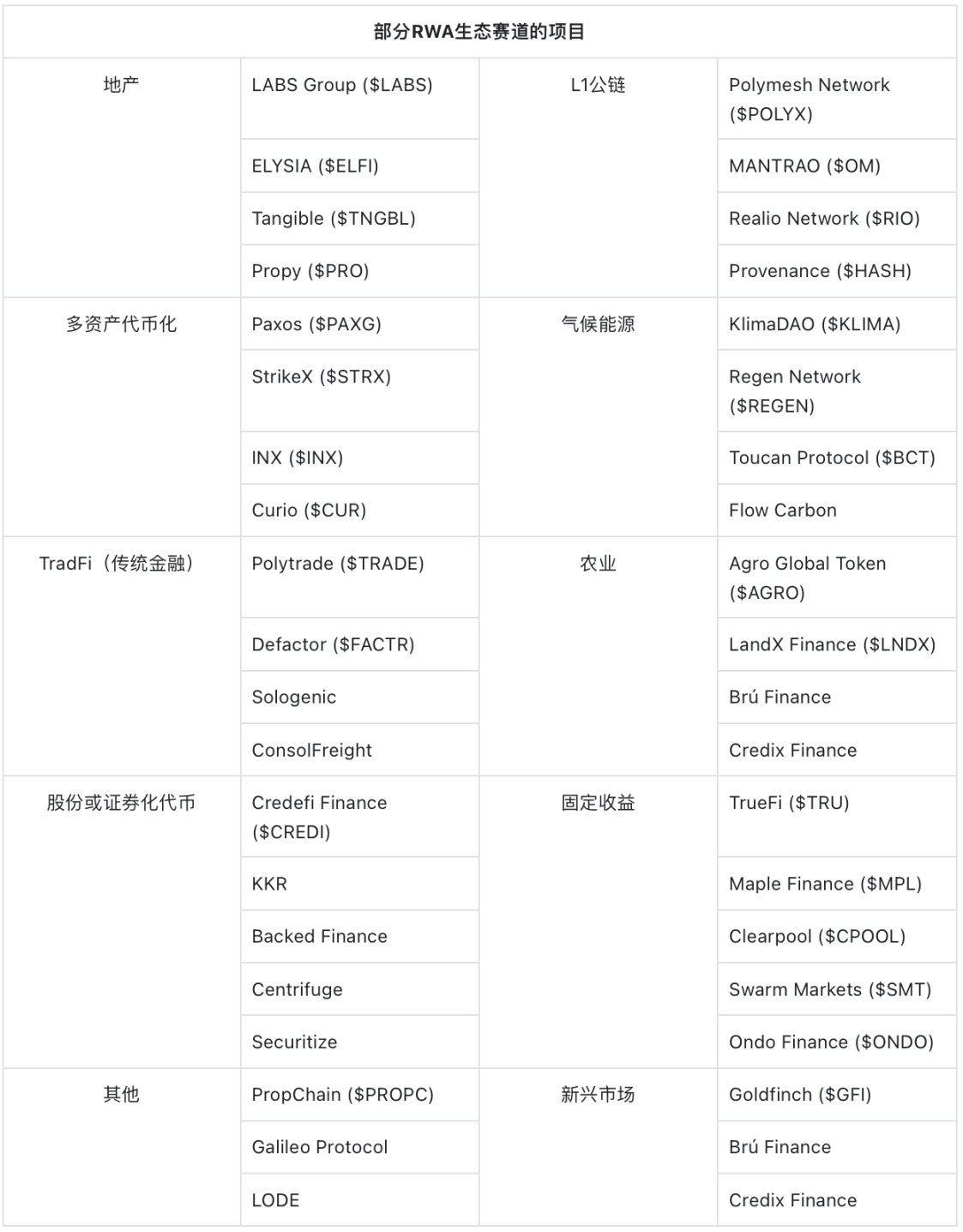

New Track, New Projects

Next, it is important to pay attention to the emergence of projects in different tracks, including real estate, multi-assets, traditional finance (TradFi), Layer-1 blockchains, climate/renewable energy finance (ReFi), agriculture, identity verification, private equity, public equity, private fixed income, public fixed income, emerging markets, security token offerings, and more. Based on public information, the following table categorizes these projects. It is evident that many high-quality projects have not yet issued tokens, such as Credix based on the SOL chain, and these high-quality projects are worth paying attention to.

V. Regulation, Suspicions, and Challenges of RWA

Ultimately, RWA is the securitization of offline assets on-chain, so it is important to consider the relevant regulations for offline assets and the execution of regulations in the traditional financial market. Especially in the area of digital asset innovation, it may seem easy, but there are actually strict limitations.

5.1 Regional Regulation

1) Legal Punishment in Singapore

Singapore has gained a reputation for supporting cryptocurrencies due to its early industry regulatory measures and consultative approach to regulatory agencies. However, despite Singapore's potential full support for asset tokenization, it is not actually "crypto-friendly" at all. This is essentially what the Monetary Authority of Singapore (MAS) also says. Last year, Ravi Menon, Managing Director of the Monetary Authority of Singapore, delivered a speech titled "Supporting Digital Asset Innovation, Opposing Cryptocurrency Speculation." In 2023, he further stated that cryptocurrencies "have not passed the test of digital currency."

First, there is the issue of Singapore's recognition of cryptocurrencies. For example, in April 2023, in the case where the Algorand Foundation sought to liquidate the Three Arrows Capital Singapore entity and claim 53.5 million USDC, the Singapore High Court ruled that it does not recognize cryptocurrencies as currency and ultimately dismissed Algorand's liquidation application.

At the same time, Singapore has strict regulations on cryptocurrencies, even tracing third-party sources of funds. In September 2023, in August, Singapore uncovered the largest money laundering case in recent years, with the arrest of Su Baolin, the founder of Xinbao Investment, and 10 others, involving money laundering activities worth over 2.4 billion Singapore dollars. At least one international bank is closing accounts of clients with citizenship in countries such as Cambodia, Cyprus, Turkey, and Vanuatu. Other banks in Singapore have begun evaluating whether to accept new funds from similar background clients based on the case, which will take longer.

At least 10 local and international banks in Singapore are involved in this high-profile money laundering scandal, raising concerns about their efficiency in combating illegal profits. Members of the Singapore Parliament raised over 30 questions in Parliament this week, covering the rigor of their review procedures, suspicious transaction reports, and the reputation impact of Singapore as a wealth center.

2) High Threshold in Hong Kong

In June 2023, the Securities and Futures Commission (SFC) of Hong Kong began accepting license applications from cryptocurrency exchanges. On the surface, Hong Kong seems to be more crypto-friendly than Singapore. For example, Hong Kong regulators urged banks to accept more cryptocurrency exchanges as clients. However, this friendliness comes with many conditions. Hong Kong still only has two licensed exchanges, with only spot trading and a limited token list. 98% of the exchange's assets must be stored in cold wallets. The exchange must also establish a legal entity in Hong Kong for custody. Operating an exchange in Hong Kong is neither simple nor cheap, as approval requires a team of lawyers, advisors, and insurance providers. So far, only OSL and HashKey have passed, and in August 2023, both platforms announced on the same day that they had obtained approval from the Securities and Futures Commission to upgrade their licenses to provide virtual asset trading services to retail clients.

We have heard through unofficial channels that the process of obtaining a VASP blockchain license in Hong Kong is very expensive, with quotes reaching as high as $100 million from specialized intermediaries, as the entire process requires various institutions and a large number of corporate and individual qualifications, making the process cumbersome and time-consuming. Even institutions as powerful as Binance have faced difficulties in obtaining this license and ultimately decided not to pursue it. Only the Bxx exchange took a different approach and directly purchased shares of a BC company with the necessary license qualifications.

3) High Taxation in Japan

Japan has shown a relatively positive stance on cryptocurrency regulation, taking measures to ensure transparency and security in the industry. However, high taxation and strict issuance standards may pose challenges for companies looking to develop in the country. The ruling party in Japan, the Liberal Democratic Party, has explicitly stated its intention to make Japan the capital of Web3. One of the main obstacles for Japan to become a destination for cryptocurrency entrepreneurs may be high taxation.

After the Coincheck hack incident in early 2018, Japan's regulatory authorities took a very strict stance on cryptocurrencies, causing some concerns about the local industry being in crisis. After the collapse of FTX in November 2022, Japan's regulatory approach was considered a significant victory. Japan requires cryptocurrency exchanges to separate exchange and customer assets, helping users to truly recover their funds. Japan is one of the earliest major economies to implement stablecoin regulations, but it has set high standards. Only banks, trust companies, and money transfer service providers are allowed to issue stablecoins, and they must comply with strict requirements, including keeping 100% of the assets in Japanese trusts and investing only in domestic bank accounts.

4) Diverse Attitudes in the United States

Cryptocurrency advocates often criticize the U.S. government, especially Gary Gensler, the chairman of the U.S. Securities and Exchange Commission (SEC), for being unfriendly to cryptocurrencies. The bigger issue is not overly strict regulation, but rather the ongoing debate about what constitutes a security and what constitutes a commodity. The SEC has filed complaints multiple times. Many in the industry are closely watching the Ripple court ruling, hoping it will set a clarifying precedent. Businesses related to cryptocurrencies may be subject to regulations on anti-money laundering compliance from the U.S. Department of the Treasury.

- SEC Regulation: The U.S. Securities and Exchange Commission (SEC) regulates RWA projects involving securities. If RWA involves securities, such as fundraising through tokenization, token issuance is considered a securities offering, and ICOs (Initial Coin Offerings) may need to comply with SEC securities regulations.

- CFTC Regulation: The Commodity Futures Trading Commission (CFTC) regulates RWA projects involving commodities. Certain real assets, such as commodities, may be subject to CFTC regulation.

- State-level Regulation: Some states may have independent financial regulatory agencies that may also regulate RWA projects. Regulations may vary from state to state.

Therefore, the regulation of Real World Assets (RWA) and blockchain in the United States presents a diverse situation, involving different regulatory agencies and regulations at different levels. Blockchain technology and crypto assets are subject to the attention of multiple regulatory agencies. The SEC, CFTC, the U.S. Department of the Treasury, and other agencies may all be involved in regulating blockchain and crypto assets.

5) EU Standard Framework

Here, we have to mention the MiCA policy of the EU regarding cryptocurrencies. The MiCA regulation is a legislative framework proposed by the EU aimed at providing clear legal provisions and regulatory standards for crypto assets in the market. This regulation is the EU's first comprehensive legislative framework for digital assets and cryptocurrencies. The MiCA regulation covers a range of matters related to cryptocurrencies, including the definition of crypto assets, registration and regulation of market participants, rules for issuing crypto assets, and compliance reporting requirements.

The MiCA regulation stipulates that any market participant providing crypto asset services in the EU must register with the European Securities and Markets Authority (ESMA) and obtain the relevant authorization. This includes cryptocurrency exchanges, digital asset wallet providers, and entities issuing or providing crypto assets. The scheme primarily aims to strengthen investor protection. It sets requirements for transparency to ensure that investors can understand the nature and risks of their investments. Additionally, the regulation also sets certain rules for advertising and marketing.

The MiCA regulation sets a series of rules for entities issuing crypto assets, including transparency, disclosure of information, and white paper requirements. These rules are intended to ensure that issuers provide sufficient information for investors to make informed decisions. The MiCA regulation requires crypto asset service providers to comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations to ensure that their platforms are not used for illegal activities. The MiCA regulation advocates for EU cooperation with international partners to ensure consistency in the regulation of crypto assets globally, preventing regulatory arbitrage and compliance loopholes.

5.2 Suspicions

Of course, there are also skeptics, such as in Arthur Hayes' article "Expression," where he expresses a preference for decentralized and code-based solutions and criticizes the complexity and potential risks of RWA projects. He advises caution when investing in governance tokens and emphasizes the importance of holding Bitcoin to hedge against fiat currency depreciation. The specific criticisms of RWA are as follows:

Decentralization and Dependence on Nations

Arthur Hayes believes that cryptocurrencies relying on national laws will not succeed on a large scale. He argues that decentralized blockchains are expensive because they do not rely on nations. He questions why blockchain tokenization should be chosen when centralized options such as Real Estate Investment Trusts (REITs) already exist and are managed by experienced companies.

Real Estate Fragmentation

He discusses the lofty goal of owning real estate, especially for the millennial and older generations. He points out challenges for RWA, including the desire for physical structures rather than digital tokens, the uniqueness of properties hindering liquidity, and the existence of traditional securities like REITs with liquidity.

Debt-based Tokens

He discusses the popularity of tokens representing ownership of profitable debt, especially those related to U.S. Treasury bonds.

He supports competition among USD-pegged stablecoins but criticizes investment in governance tokens, seeing it as a speculative bet on USD interest rates. He proposes alternative options, such as shorting ETFs holding government bonds to gain exposure to interest rate fluctuations without using crypto governance tokens.

Bitcoin Spot ETF

He expresses concerns about the potential impact of traditional asset management companies entering the Bitcoin ETF field. He worries about a scenario where large asset management companies hold all the Bitcoin, causing Bitcoin trading to stagnate and threatening the network's viability. The recent market downturn due to significant selling pressure from Grayscale confirms this point.

Fiat Currency Depreciation and the 2024 Election

He predicts a significant increase in global currency printing in 2024 due to political motivations for re-election, leading to a devaluation of currency value. He encourages viewing Bitcoin as a hedge against fiat currency depreciation and inflation.

5.3 Challenges

Trust Challenges

He discusses the challenge of trust and the incentive structure that minimizes fraud risk but still requires a certain level of trust. He points out that both the on-chain and off-chain aspects of RWA involve legal, financial, and technological components, with financial and technological logic already having rich practice. However, the qualification to purchase government bonds is often overlooked, as DAOs are not legal entities in most countries and regions.

Regulatory Policy Challenges

He mentions the regulatory challenges, noting that most underlying assets of equity markets can be traded in traditional financial markets with strict regulations and full support for ownership of each RWA's underlying assets, which is not a formed regulatory requirement in most regions.

Technology Maturity Challenges

He acknowledges the increasing maturity of technologies like DID, ZK, and oracles but highlights the serious security issues still present in the DeFi field, such as code vulnerabilities, price manipulation, MEV, and private key leaks.

Stability Challenges of Off-chain Asset Custody

He points out the increasing diversity and unguaranteed risks of the market and underlying assets represented by RWA. For example, some people use real estate in Shenzhen Bay for RWA, but investors do not know if there is physical collateral endorsement.

In conclusion, the article provides a detailed explanation of RWA, aiming to draw attention to the RWA ecosystem and provide essential groundwork for participating in this field. It highlights the continuous development of RWA in the blockchain and decentralized finance (DeFi) ecosystem. The tokenization of RWA provides a strong bridge to bring traditional real assets into the crypto world, offering investors a broader and more flexible range of asset portfolio choices.

The successful development of RWA requires deeper integration with the traditional financial system and the real economy, especially as people transition from Web2 to Web3. The tokenization of RWA signifies the integration of financial and real assets, providing more choices for global investors. BiB Exchange will continue to focus on regulatory compliance, ecosystem integration, technological innovation, social impact, risk management, and community participation to promote a more comprehensive understanding and participation in this emerging field, while driving its sustainable development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。