Source: Rongzhong Finance

Author: Lv Jingzhi

Editor: Wuren

Image Source: Generated by Wujie AI

GPT has been soaring for over a year.

Since the release of GPT in November 2022, the ability of generative AI has amazed netizens and has also presented a huge opportunity for entrepreneurs. The first wave of entrepreneurs with information asymmetry as the core value began to emerge, connecting to APIs and charging fees. The "99 yuan unlimited conversation" GPT project began to reap profits. With the increase of such projects, various live course projects with "AI education" as the core value immediately appeared, with some achieving monthly revenues of millions. Subsequently, entrepreneurs in various fields such as education, Web3.0, and consumer sectors all regarded AI as the best cover for their business plans, and began to start businesses in the form of "AI+"…

On the other hand, AI investment has been pushed back into the spotlight. Some institutions even shouted the concept of "All-in".

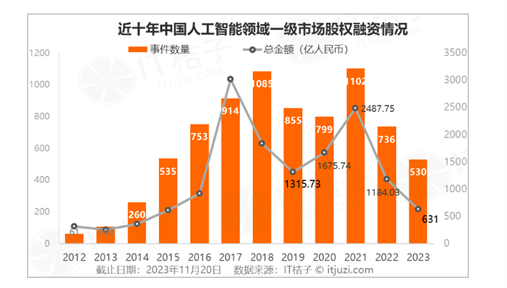

However, a year has passed, and the actual data of the lively AI investment does not seem to be as ideal as it appears. As of November 20th this year, both the number and amount of financing in the field of artificial intelligence have declined year-on-year. Looking at a ten-year perspective, the peak of investment in artificial intelligence in terms of amount still remains in 2017.

On one hand, there are numerous business plans, and on the other hand, there are projects that are difficult to get started with. For AI investors sitting on the opportunity, this year has not been a "flying" year.

01 The Prevalence of Business Plans

If we were to discuss the most popular track in 2023, AI is undoubtedly the one.

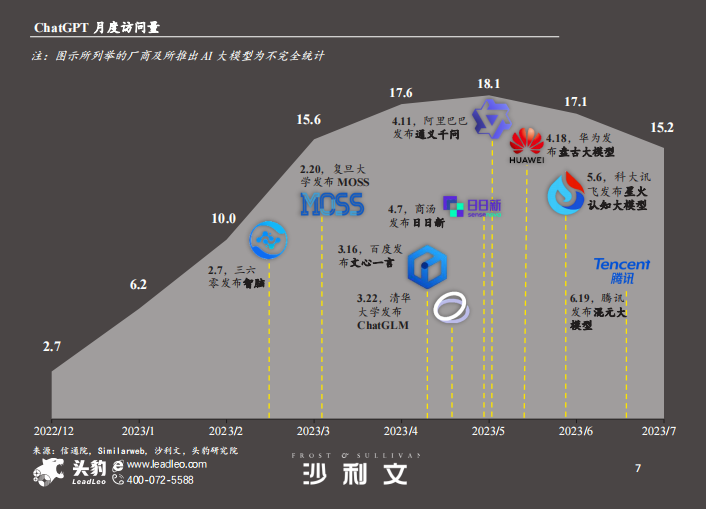

In November 2022, OpenAI's ChatGPT was officially released. By June 1, 2023, the monthly active users of OpenAI had soared to 1 billion, and the frenzy of GPT also triggered a wave of large-scale models in China. In the year of 2023, news of star founders investing in AI startups or large financing for AI star projects continued to emerge. Wang Huiwen, co-founder of Meituan, invested in Silicon Motion Technology, which is a new project by Yuan Jinhui, the founder of OneFlow. Prior to this, Yuan Jinhui had announced in his circle of friends that the OneFlow team would start a new business and the first product to be launched would be a large model inference and deployment system, solving the pain point of high costs in the inference deployment of AIGC (Generative Artificial Intelligence) and LLM (Large Language Models). Zhipu AI, which originated from the laboratory of Tsinghua University, also completed a financing of 2.5 billion yuan this year, with Meituan, Ant Group, Alibaba, Sequoia Capital, and Hillhouse Capital as the backers…

Large companies continued to "go to sea", and practitioners in various tracks began to consider how to connect with AI. Elderly care communities began to research AI intelligent voice companion robots, and those originally in the metaverse clothing industry tried to incorporate AI. After the "double reduction" policy, educators even conducted overnight live analyses of the future trends of "AI education".

"To put it simply, I guess the word 'AI' is probably in the business plans of any track this year," said investor Liu Yang (pseudonym) decisively. A serial entrepreneur in the Web3.0 industry described the current entrepreneurial situation in this way, "Now, without an 'AI+' concept, who would dare to show their business plan to investors."

Image Source: Head Leopard Research Institute

AI projects are springing up like mushrooms, but there are few successful AI projects that have secured funding.

"Some large model projects have secured funding, but there are very few projects in the application-oriented AI field that have secured funding," said an AI investor. The main reason is that projects at the application level have not addressed practical pain points. "For example, I know a founder in Chongqing who developed a project to correct students' compositions, which was highly recognized by the investment community at the time, and some investors even went to the airport to intercept him. Another popular scenario is AI diagnosis. If a child falls ill in the middle of the night, AI diagnosis can help parents make quick diagnoses and decisions for medical treatment. These projects indeed address practical pain points." In comparison, the likelihood of projects that focus on information asymmetry, such as content migration, teaching, AI entrepreneurship training, or adding AI-based face-swapping and generative content to their original projects, securing funding is relatively low.

In June of this year, an AI collaborative office project developed by a team of doctors in Singapore received investment from a private investor. Xiao Yang (pseudonym), a member of the team, said, "AI investors are actually very cautious about this wave of enthusiasm. So, if you don't have technological barriers in the industry, and you only have a conceptual business plan without a tested product, no barriers, or a product that is extremely easy to replicate, then you are almost impossible to secure funding."

According to Xiao Yang, the core members of the project team are all from a doctoral team at the National University of Singapore, and he has been involved in language model projects for at least three years. In the first half of this year, the team's project had passed the testing phase, and the marketing team was establishing commercial channels with B-end enterprises. "Since the team members are all doctoral students, they often participate in some innovation competitions at school, and they also get to know some investors through their mentors. One private investor was very interested in our project. He participated in the investment when our project was two-thirds completed, mainly to cover our R&D expenses."

"In fact, the reason why AI has been so hot this year is because many consumers have seen the potential for more AI applications. However, for entrepreneurs and investors who have been in this track all along, this is not a fresh and sustainable growth point. Therefore, most investors who receive business plans in this wave of enthusiasm will rationally examine the team's background, the time spent in deep cultivation in the industry, and the investment amount will also be relatively conservative, basically covering your next stage of R&D, and further investment will be made if there is progress," Xiao Yang said.

02 Investors Hesitant to Get Started

Many people talk about starting an AI business, but there are few good projects. This has created a situation where there are many people talking about investing in AI, but there are few projects to invest in. At the beginning of 2023, some funds enthusiastically discussed "All-in AGI", and even a fund manager said, "Let's not look around anymore, let's just go All-in AI." However, looking at the data at the end of the year, as of November 20, there were 530 primary market equity financing events in the field of artificial intelligence, a decrease of 27.99% compared to the same period last year, with a total financing amount of 63.1 billion yuan, a decrease of 46.7% year-on-year.

Image Source: IT Orange

Why is this happening?

Lin Ping (pseudonym), a very active AI investor in 2023, analyzed it this way, "Both the project side and the capital side have their own difficulties."

From the project side, "There are too many people who want to start an AI business, and the supply exceeds the demand." Seeking investment for scenario-based AI entrepreneurship should be a process of "finding a hammer for the nail", first having specific needs and then executing, and then seeking investment by evaluating whether the specific needs are large enough and painful enough. However, many projects now do the opposite, first building a "multi-dimensional artificial intelligence platform", and then looking for money while looking for a specific direction. "For investors, it is really difficult to get started with such projects, as they are not clear about the specific revenue model and market size."

Funding-wise, USD funds do like AI entrepreneurship, but this year USD funds themselves are facing fundraising difficulties, which will also affect their bold moves to lay out in high-risk, long-cycle fields like AI. On the other hand, some mature RMB funds are gradually entering the AI field, but they prefer to invest in projects that have already undergone market validation and have achieved good results.

On the other hand, the limited application scenarios of AI, slow commercialization process, and long investment return process are also reasons why many investors are very cautious about this.

Take autonomous driving as an example. Intelligent driving has always been a highly anticipated landing scenario for artificial intelligence. "According to the expectations of some technology founders when autonomous driving was most popular in 2016, I should have been able to drive hands-free on the Second Ring Road in Beijing by now," joked a hard-tech investor. However, the reality is far from the ideal.

Because the scenario of artificial intelligence is not only about having strong enough technology, but also requires high demands on policy regulations and market promotion. Taking autonomous driving as an example, at the policy and regulatory level, from the opening of high-level autonomous driving to the definition of accident liability, everything needs to be gradually improved and implemented. Secondly, the promotion of drivers by car manufacturers is the "last mile" to increase the penetration rate of autonomous driving. Instantly conveying road conditions and decision-making information at the vehicle-interaction level, and fully educating drivers at the operational level, are all necessary processes for the commercialization of autonomous driving.

The multifaceted influencing factors have prolonged the commercialization process of autonomous driving, which has also dampened the enthusiasm of investors. In 2021, there were a total of 144 investment and financing events in the domestic autonomous driving industry, with a total financing scale of 93.2 billion yuan. In 2022, there were about 128 investment and financing events in the autonomous driving industry, with a financing scale of one-fourth of 2021, totaling only 24 billion yuan. By the third quarter of 2023, there were 54 financing projects in the domestic autonomous driving industry, with a disclosed total financing amount of approximately 6.8 billion yuan, only one-fourth of 2022.

In addition to popular scenarios, AI has seen innovative projects in the office, creation, education, and other fields this year. However, many investors who have been deeply involved in the hard-tech track for many years have a similar feeling, "This year, we have not seen enough 'painful' scenarios."

"Whether the 'AI+' model has revolutionary innovation and improves production efficiency is crucial. It's important to make a 'snow in the snow' technological breakthrough, rather than just adding to the already good things," said one investor.

03 Investors' Efforts to Attract Talent

There are many AI projects in the AI track, and many entrepreneurs, but real talent is very scarce.

The Times Weekly has reported that even for ordinary positions, the supply and demand ratio for AI talent is only 1:5, meaning that for every 5 open positions, only 1 person can match, and the other 4 positions are difficult to fill for a long time. Positions such as vector databases, multimodal large models, and intelligent agents require not only execution but also top-notch talent, making it even more difficult to find suitable candidates.

It's difficult for companies to recruit, and it's even more difficult for investors to find excellent entrepreneurs. Lin Ping expressed, "Many AI founders are themselves Ph.D. holders. Even if they don't start a business, they will have academic achievements, and many entrepreneurs are still very young and have not yet clarified their future career plans. Many of them have made significant contributions in technology, but their attitude towards entrepreneurship is ambiguous. For them, if entrepreneurship fails, they can go back to academia, but for investors, this hesitation is a huge risk. Therefore, excellent entrepreneurs not only need to be innovative and have technical skills but also need to have determination."

In order to find founders who meet the criteria, investors are also making great efforts, some even starting from scratch.

For example, the well-known "Little Genius" and "Old Baby" fund from ZhenFund has launched the "Post-00 Tough Guy Plan". The official account posted a recruitment advertisement, "Be a 'tough guy' at twenty." After describing how startups like Xiaohongshu, miHoYo, and Midjourney have become industry unicorns, the organization stated that it is willing to provide 100 million yuan to support post-00 entrepreneurs. The post included an application link, requiring applicants to provide their school major, entrepreneurial product, team, and ideas.

Wanting to discover excellent founders from graduation to entrepreneurship and continuously monitor their growth, ZhenFund is not the only organization. Many hard-tech investors have accumulated rich resources of academicians and universities over the years. If academicians bring out high-quality postdoctoral fellows, they will also have the first opportunity. Elite universities such as Harbin Institute of Technology and University of Science and Technology of China have frequently discussed the possibility of establishing university funds with investment institutions to encourage outstanding students to start businesses.

In addition to focusing on good candidates in school, many investors also participate in various technical competitions. "Running competitions is more than running roadshows." Many organizations have also started various competitions to discover "hidden gem" projects.

Moreover, some investors even start their own competitions. A venture capitalist in Wudaokou switched from the new consumer track to the technology track last year because he saw the opportunity in generative AI. However, after entering the circle, he found that finding projects was not so easy. "I graduated in international finance, so my understanding of technology is definitely not as deep as that of investors who graduated in CS. In order to understand the projects, I read a lot of literature to understand academic concepts, and in the process, I constantly exchanged ideas with peers to build my own understanding. Later, I started a 'Money-Making Competition' to increase the opportunity to encounter innovative projects. Many VC investors came later, and this led to the emergence of an investment community platform."

Throughout 2023, AI investment did not seem as prosperous as it appeared on the surface, but most people are still confident about AI investment in 2024. For every 1% increase in technological breakthroughs, there will be a large number of new ways to develop applications at the application layer. In 2024, as the gradual elimination of shell applications, the commercialization of TOC and TOB scenarios such as wearable intelligence, social, entertainment, office, and production, investors are still waiting for a hot enough opportunity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。