In 2023, bitcoin miners had a prosperous year, uncovering over 54,000 bitcoin (BTC) blocks, each comprising 6.25 freshly minted bitcoins along with the fees tied to every discovered block. Archived data collected from btc.com shows that the leading mining pools for the year included Foundry, Antpool, F2pool, Viabtc, and Binance Pool respectively. Together, these five entities found a total of 45,707 block rewards throughout the year.

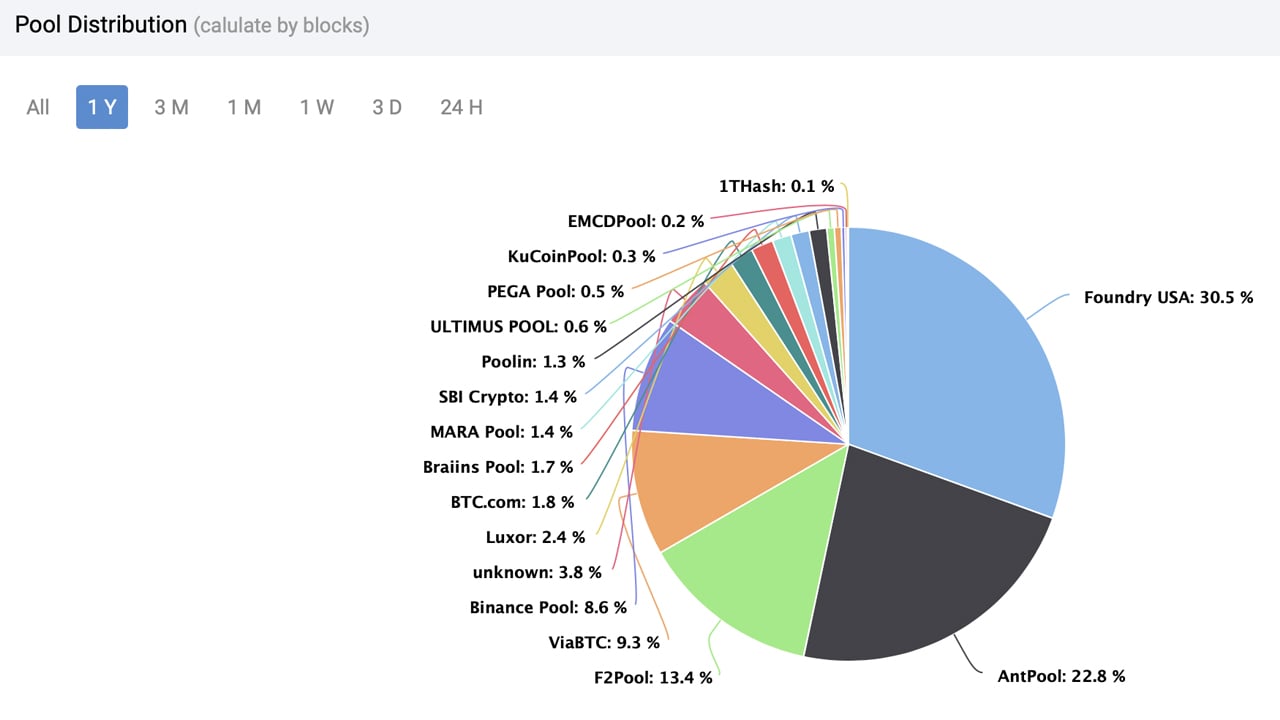

Bitcoin hashrate distribution during the past 12 months calculated by blocks.

In 2023, five dominant mining pools discovered over 84% of all BTC blocks. Other significant contributors included Luxor, which found 1,311 blocks (2.43%), btc.com with 978 blocks (1.81%), and Braiins Pool capturing 894 blocks (1.66%). Throughout the year, the network saw 147 empty blocks, accounting for approximately 0.27% of the total, with Antpool, F2pool, and Viabtc being the primary sources of these empty blocks, numbering 65, 20, and 21 respectively.

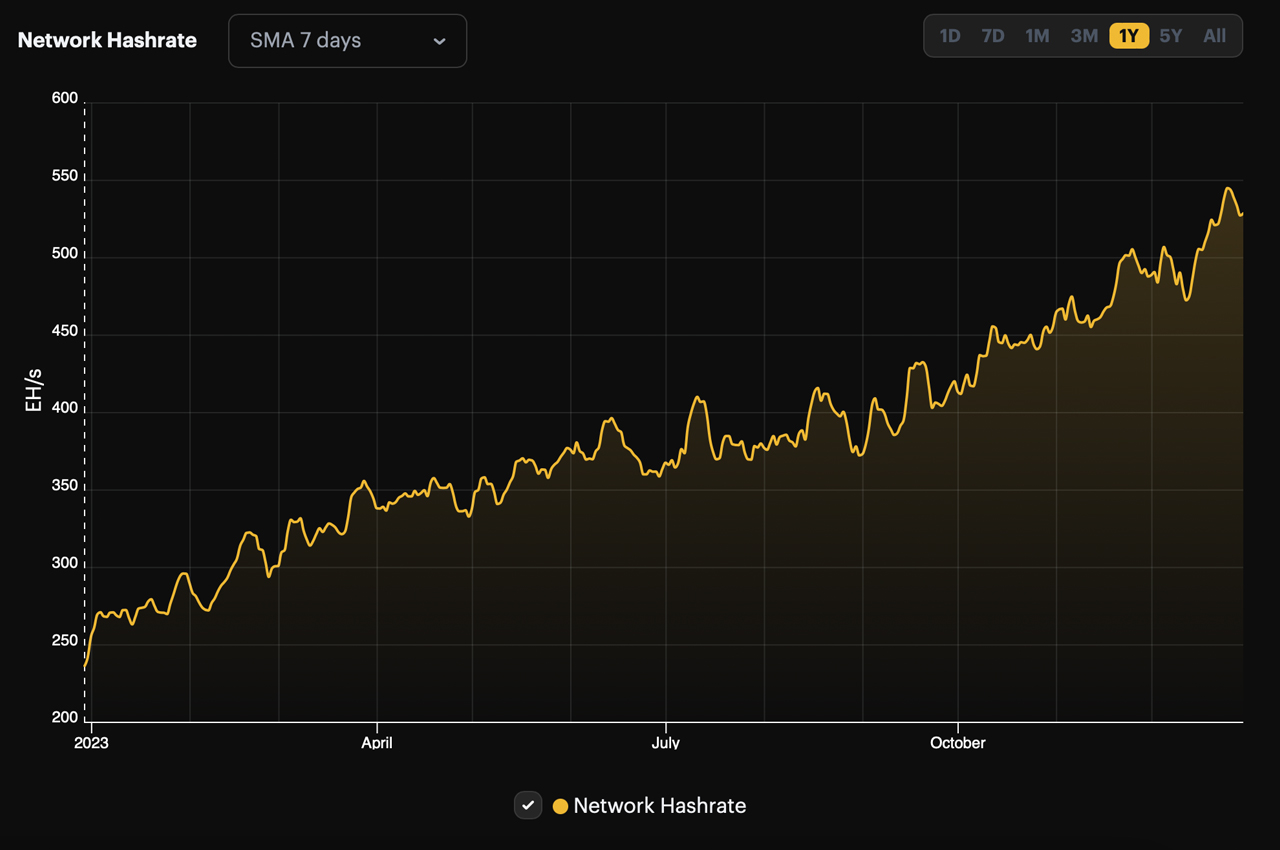

Bitcoin’s network hashrate over the past 12 months has increased by more than 300 EH/s.

The year also marked a significant increase in Bitcoin miners’ capabilities, as the hashrate soared to a record 545 EH/s on Dec. 24, 2023. This figure represents a substantial growth from nearly eight years prior in January 2016, when Bitcoin’s hashrate first hit one quintillion hashes per second (H/s). Standing at 529 quintillion H/s, the network’s total hashpower at the end of the year underscores an exponential evolution of total hashrate.

Firms including Bitmain, Canaan, Microbt, and Auradine rolled out advanced generation miners in 2023, anticipated to further boost the hashrate. These cutting-edge devices, capable of delivering upwards of 375 terahash per second (TH/s), also demonstrate superior efficiency with ratings below 20 joules per terahash (J/T). This time last year, Foundry had 71.84 EH/s and today it stands at 147 EH/s. Antpool had 49.95 EH/s and today it is 139 EH/s, while F2pool had 31.99 EH/s in December 2022, it now has 62.27 EH/s.

With the curtain closing on 2023, the pivotal year marked immense growth and innovation for the bitcoin mining industry as a whole. With the halving event looming in April 2024, set to cut block rewards from 6.25 to 3.125 BTC, the sector braces for momentous change on the horizon. But 2023 underscored the industry’s robust advancement, poised to take on the shifting landscape following the reduction in subsidies. With the halving approaching, it will be telling to observe how these dominant mining pools navigate the changing terrain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。