Challenge Ethereum.

Author: Sal Qadir, Galaxy Research Assistant

Translation: Ivory Mountain Chief Villager, Carbon Chain Value

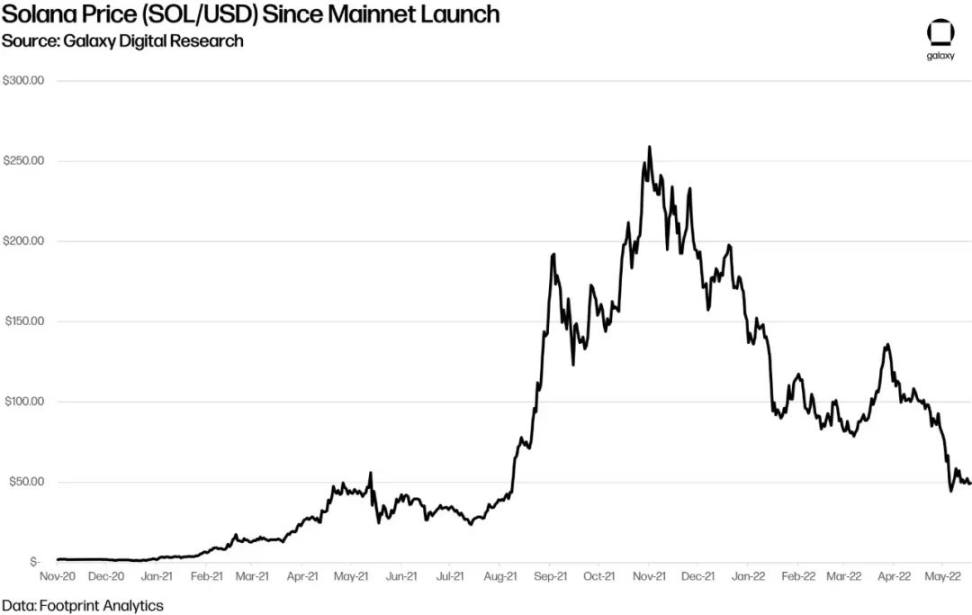

Recently, driven by the concepts of DePin and MeMe coins, the Solana ecosystem has performed well, and its native token SOL broke through $100 on December 24. The trading volume on Solana's DEX briefly exceeded that of Ethereum, leading to a growing chorus of "Solana surpasses Ethereum."

Can Solana really surpass Ethereum?

To gain a deeper understanding of Solana, its core ecosystem, and future development, the chief villager has read some research materials on Solana and finds this comprehensive and informative article by Galaxy to be particularly valuable. It provides a panoramic description of Solana from its establishment to development and future plans, which is rarely seen. Therefore, this selected article by Galaxy, published in 2022, introduces Solana and its ecosystem in depth for readers' reference and learning.

Introduction

Solana is a fast, low-latency, proof-of-stake Layer 1 public chain with a differentiated technical architecture, and its usage on multiple Dapps continues to grow. Although its basic design issues currently limit its flexibility and centralization issues are also apparent, the protocol team's proposed complex technical fixes and upgrades can alleviate or solve these problems. Nevertheless, in the past 12 months, Solana has successfully stood out from other Layer1 public chains and challenged Ethereum's position as the smart contract throne in the cryptocurrency field.

Solana's unique scaling approach stands in stark contrast to most other Layer1 public chains -- with a theoretical throughput of 50,000 transactions per second, low and fixed transaction fees. From a developer's perspective, Solana prides itself on achieving composability without relying on modular stacks, Layer2, or sharding. This report will provide a comprehensive evaluation of Solana, revealing its favorable conditions for occupying and maintaining market share in the Layer1 public chain field.

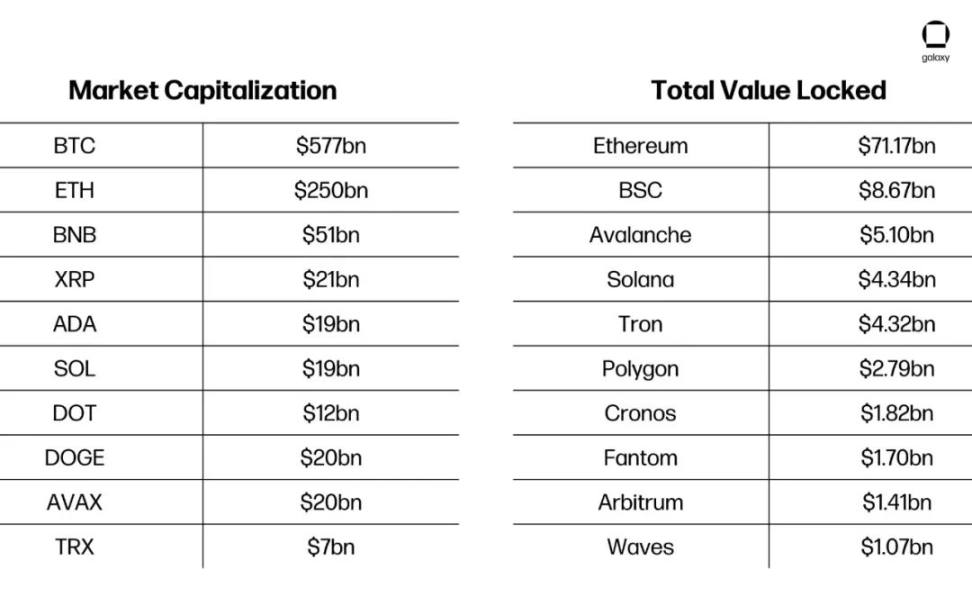

Market value and total locked value

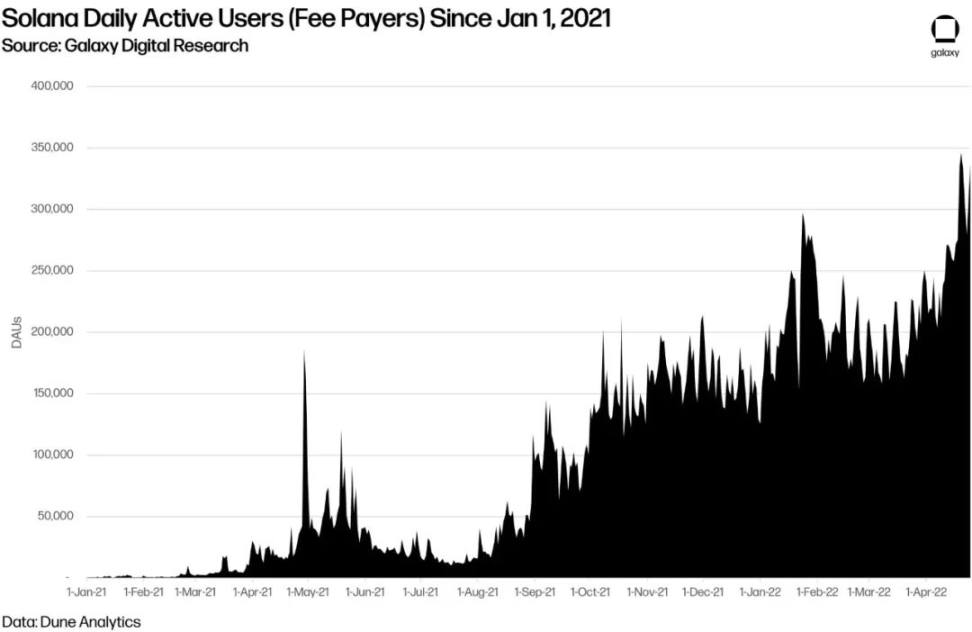

Daily active users (paying users) of Solana since January 1, 2021

SOL to USD price since Solana's mainnet launch

Background and History

Who is Anatoly Yakovenko?

Anatoly Yakovenko founded Solana while working as an engineer in San Francisco, California. Most of his career was spent at Qualcomm, where he used his expertise in application engineering to solve challenging problems in hardware optimization. Anatoly gained a reputation for his strong technical mind, and his most notable achievement was designing high-performance DSP software, which provided high performance for Google Tango (the first mobile device to support smartphone augmented reality features). In 2017, he became interested in cryptocurrencies for the first time through a friend dedicated to deploying deep learning hardware to the cloud (unsurprisingly, such specialized hardware shares many similarities with Solana validator nodes). Anatoly and his friend used these powerful computers to mine Bitcoin and turned a profit after deducting initial capital expenditures. As Anatoly delved into the rabbit hole of proof-of-work mining, he became curious about why proof-of-work was necessary, what caused the slowness of proof-of-work mining, and how to improve it.

One evening in 2017, Anatoly explored single-threaded mining, which is the well-known "red pill" moment. Anatoly inferred that instead of measuring the essential electricity in "proof-of-work" mining, it would be better to measure time. Anatoly firmly believed that linking the security of a cryptographic network to physical constants such as electricity or time is crucial for long-term reliability. In this case, when Anatoly realized that sequential hashing could be used to ensure a certain amount of time between two events, he had an epiphany. Anatoly later described this concept as "Proof-of-History" and published these findings in a white paper draft in November 2017. By February 2018, Anatoly and Greg Fitzgerald released the Solana testnet and official white paper together.

Anatoly's former Qualcomm colleague, Stephen Akridge, suggested modifying Solana's architecture to use parallelized signatures with GPUs for validation. Stephen's valuable contribution both validated the advantages of Anatoly's initial protocol design and prompted him to fully commit to the project. In addition to Greg and Stephen, Anatoly also recruited Raj Gokal and three other senior experts from Apple/Qualcomm to form Solana Labs. Although the project was initially named Loom, the team encountered naming confusion with the Loom Ethereum L2 network. The team eventually decided to rename it Solana, after the Solana Beach in Southern California (where the team lived and worked at the time).

Growing in a Bear Market

Solana Labs was founded in early 2018, led by the visionary founder Anatoly. The mission of the Solana Labs team was to push Solana from a Proof-of-Concept to a production-grade, permissionless public chain. The only problem was that they faced a difficult funding environment in 2018 -- the ICO bubble had just burst. The price of Bitcoin plummeted, and many investors were lukewarm towards blockchain/crypto startups. Raj Gokal, co-founder and COO of Solana Labs, described in an FTX podcast that the Solana team was striving to stand out in fierce competition in 2018. Dfinity (now known as ICP) had just raised $100 million, and Avalanche Labs was founded by Cornell University's renowned professor Emin Gun Sirer based on a novel consensus protocol. Some people saw Solana as just another Layer 1 public chain focused on "vanity metrics" like transactions per second (TPS). At the time, the "crypto circle" based on Twitter was more interested in privacy and interoperability than the scalability of startups. Fortunately, Anatoly convinced a friend he met while playing underwater hockey to become an early investor, who then introduced the Solana team to two other supporters.

The team raised $20 million by offering private token sales to qualified investors. Some early supporters included a founder of Multicoin Capital, 500 Startups, and Race Capital. The Solana test network was able to sustain high-frequency transactions of 250,000 per second, leaving a deep impression on these investors. The private token sale was announced as Series A financing at the end of 2019. While raising funds, the team also established a public test network called Tour de SOL (most of Solana's co-founders are cycling enthusiasts). By March 2020, Solana conducted a $1.76 million public token auction on CoinList and launched the mainnet test version.

Technical Architecture

Solana's Blockchain and Nasdaq Speed

When Anatoly initially developed Solana, he drew inspiration from his personal fascination with programmatic electronic trading. As an ordinary end user accessing popular platforms' APIs like Interactive Brokers, Anatoly was frustrated that his trades were front-run by intermediaries with more capital and trading infrastructure than he had. He wanted Solana to provide a fair competition environment for ordinary users against powerful institutions. In the long run, Solana's goal is to achieve Nasdaq-scale and response speed on the public chain. In fact, the early seed-stage investment plan of Solana's company included the phrase "Solana's blockchain and Nasdaq speed." The design decisions Anatoly made for Solana emphasized speed and information flow, rather than the "store of value" use case focused on by other blockchains like Bitcoin.

The key factors that distinguish Solana from most other Layer 1 public chains are: 1) hardware; 2) the physical passage of "tick-tock" time; 3) composability. These three key attributes collectively form the foundational pillars of the Solana technology stack.

First and foremost, Solana heavily relies on hardware advancements to address the challenges posed by protocol advancements at the software layer, ensuring that its speed and scale will increase with ongoing hardware improvements. Progress in Moore's Law, which applies to CPU transistor density, has slowed down in the past five years but is still ongoing. More importantly, breakthroughs in GPU/parallel processing capabilities driven by the field of artificial intelligence/machine learning show no signs of slowing down in the short term. The Solana team believes that software layer advancements (such as Ethereum's 2.0 update) have been notorious, but due to the limited number of people with the technical depth to implement protocol-level changes securely, software layer advancements may encounter obstacles. Regardless of how quickly they make progress on the underlying protocol, the Solana team is betting on the computer hardware industry advancing year after year. This ensures that Solana's underlying scalability can ride the wave of hardware industry development under similar conditions. This also sets Solana's public chain apart from other Layer 1 public chains, whose scaling roadmaps mainly rely on software design advancements.

The second fundamental concept of the Solana technology architecture is time. Solana decouples time from state updates consensus. Since every transaction on Solana has a timestamp, transactions can be streamed in real-time when they occur. This approach is different from most other public chains, which batch process timestamps in transactions in each block. The benefit of separating time from state updates is that validators can pre-process blocks to increase throughput, as the ordering of their transactions follows a global clock.

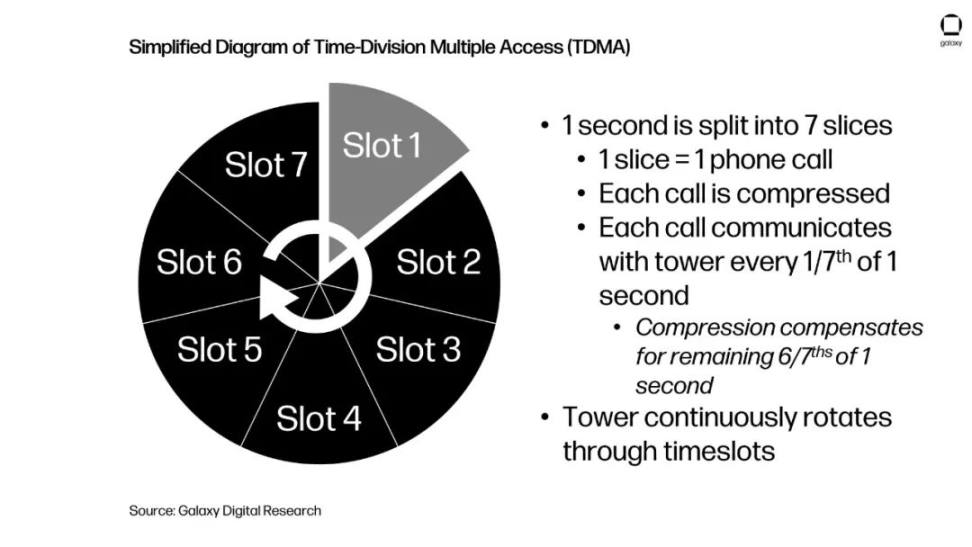

However, it is worth noting that the broader public chain development/research community (other than Solana) rarely acknowledges time as a useful invariance for scaling public chains. The only significant example of using time for scaling distributed applications appears in the telecommunications industry (given the Solana founding team's experience in the telecommunications industry, this is also reasonable). Specifically, TDMA has been the foundation of cellular networks since the 2G era. The details of how TDMA works are beyond the scope of this report, but it can be summarized as using limited resources (RF bandwidth) and slicing the bandwidth into time slots created by a global clock, thus enabling more devices to connect without needing more network resources. Without this crucial, time-based cellular network scaling approach, ubiquitous mobile broadband would not exist today. Below is a simplified diagram of how TDMA works.

TDMA Simplified Diagram

Embracing Monolithic Architecture

Finally, the third key concept supporting Solana's technology is composability. Composability refers to Solana intentionally designing itself as a monolithic public chain. While Solana sees the monolithic path it has taken as a killer feature, in the broader cryptocurrency field, this choice is undoubtedly a contrarian bet in public chain design. Other public chains, such as Ethereum and NEAR, view monolithic architecture as a long-term scalability barrier. These competing Layer 1 public chains are exploring various solutions, such as modular scaling (advanced by projects like Celestia and Evmos in Ethereum), Layer 2 scaling (advanced by projects like Starkware and Aztec in Ethereum), and various forms of sharding (currently implemented in the NEAR protocol on Ethereum's roadmap).

The design trade-offs between these technical approaches are worth discussing in a separate research report. Nevertheless, Solana is unwilling to deviate from its vision of the future of monolithic architecture. The Solana team believes that the benefits of optimizing composability lie in the elegance of building applications on a monolithic global state. They argue that under monolithic architecture, developers writing smart contracts that require different state fragments of Solana will not be burdened by multiple shards or Layer 2 systems. Specifically, if an application developer wants to create an atomic swap between SPL tokens on an NFT platform and SPL tokens on a DeFi application, they can now easily do so because of Solana's global state. If the same developer were to write smart contracts for sharded states, they might need to add additional logic to check which shard each part of the swap is on, increasing the complexity of the related transactions.

As blockchain applications become increasingly complex and intertwined, the development complexity built on modular/sharded systems may multiply. From an end-user perspective, although Layer1 is the same public chain, an application built on one Layer2 protocol may not achieve native interoperability with an application built on another Layer2 protocol (for example, two independent applications built on Optimism or Arbitrum, both Layer 2 solutions for Ethereum). Solana places great emphasis on the end-user experience and believes that modularization/Layer2/sharding is a "last resort" rather than a "necessary evil." It is worth emphasizing that while Solana's approach is well-intentioned, it sharply contrasts with the roadmaps of almost all other Layer1 public chains today. There is no consensus on the user experience of using multiple Layer2 public chains at scale. Today, most Layer1 public chains are still monolithic, and only time will tell the resilience of each blockchain's scaling approach under high usage. Solana has made some reasonable guesses about the future of cryptocurrencies in a non-monolithic mechanism and is committed to maintaining the simplicity of the global state brought by the composable monolithic architecture.

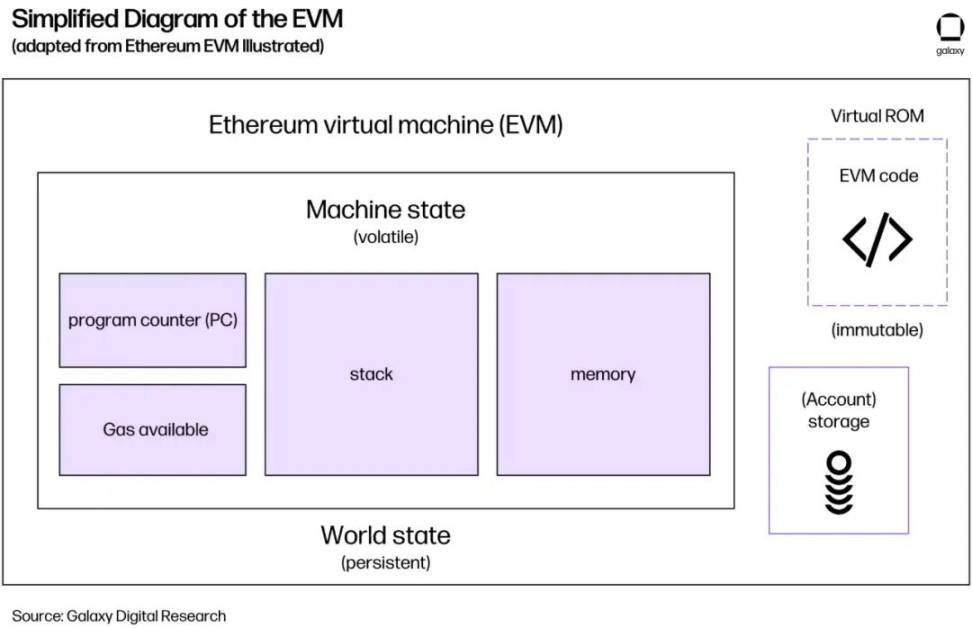

Avoiding EVM

Ethereum Virtual Machine (EVM) is a computational engine and the runtime environment for Ethereum smart contracts. Developers use EVM to build decentralized applications (DApps) on Ethereum. Its purpose is to manage "state" on permissionless Ethereum without the need for permission.

EVM Simplified Diagram

Many other Layer1 public chains and sidechains (such as Avalanche, Binance Smart Chain, Harmony, and Polygon, etc.) have EVM compatibility as a core feature. This is because there are already many DApps running on EVM with code written in Solidity, and porting this code to an EVM-compatible chain is relatively straightforward. These EVM-compatible alternate Layer1s can also leverage existing tools for developers (Hardhat, Truffle, Remix) and user interface/user experience (MetaMask, Coinbase Wallet).

On the other hand, Solana's original design is to run on LLVM instead of EVM. LLVM is a standard compiler toolchain that separates human-readable code (such as code written in Rust) from assembly code (low-level code that can be optimized for hardware). From a practical standpoint, the deployment process based on LLVM can be imagined as source code -> LLVM -> assembly. Solana made this architectural choice for two key reasons. 1.) Solana is designed for hardware optimization, while Solidity/EVM itself does not support hardware optimization. 2.) Programming languages like Rust allow for writing extremely fast low-level code, which is more widely adopted in the developer community and theoretically easier to review by experienced developers. According to the 2020 Stack Overflow Developer Survey, Rust has been rated as the most loved programming language by over 65,000 developers for five consecutive years (by a large margin).

However, the cost of Solana's decision is that there are not many blockchain-specific developers familiar with Rust, so recruiting new talent from competing crypto companies/protocols is often a challenging task. However, some people see this as a positive aspect because the Solana developer community is inherently less "profit-driven" and more dedicated to the Solana ecosystem due to their skill set being useful only for Rust-based blockchain projects.

The high-level technical decisions described above are the "reasons" for the 8 core innovations of Solana described below.

8 Core Innovations of Solana

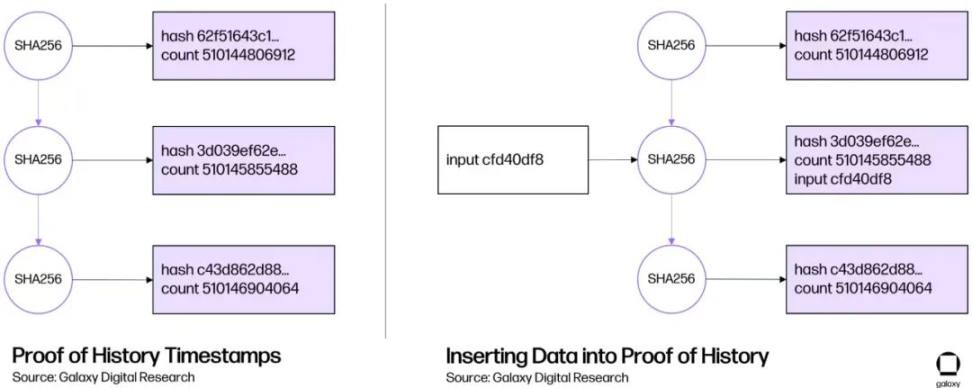

Proof of History (POH) as a Consensus-Preceding Clock: Proof of History is neither a consensus protocol nor a Byzantine Fault Tolerance (BFT) mechanism. Instead, POH is a high-frequency, verifiable delay function (VDF). A VDF is a function that produces a unique output in sequence, with the verification speed far exceeding the production speed. In Solana's Proof of History, the VDF is actually a SHA256 hash function running in a constant loop. The way it works is by initially inputting an arbitrary value (e.g., the word Solana) into the SHA256 function, and then feeding the output of each hash back into SHA256 as input for the next hash. By repeating this process, it can be determined that the time it takes to produce the final output is real, as it is not possible to generate each hash value that depends on the previous hash value in parallel. This sequential hashing data structure allows Solana to effectively create a global "tick-tock" clock, which all transactions on the Solana public chain can reference to prove the order in which these transactions occurred.

In short, Proof of History:

- Loops as fast as possible on a single core with SHA256, with each output being the next input.

- The Solana network samples this repeated loop and records the iteration count and state.

- Information can be inserted into the PoH loop as a hash value along with the state, ensuring the order of information transmission.

Proof of History Diagram

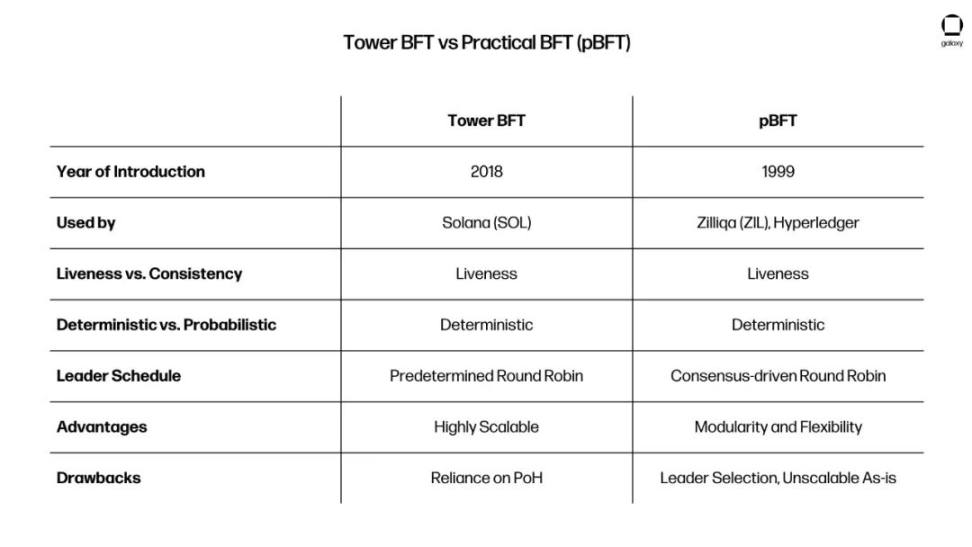

Tower BFT Byzantine Fault Tolerance: Tower BFT is essentially Solana's consensus mechanism. It refers to the practical Byzantine Fault Tolerance (PBFT) implemented by Solana. As a review, Byzantine Fault Tolerance describes the method of solving the Byzantine Generals Problem - coordinating an attack between two geographically distributed generals who can only communicate through messengers. Fault-tolerant systems are designed to prevent bad actors from attempting to spread false information or intercept it before it reaches its destination.

In the Solana system, Tower BFT is an innovation on traditional BFT systems, where validators somehow vote on a block (we'll call this initial vote X), and in the subsequent two blocks, validators will only vote on blocks derived from "X". Each time a validator votes in support of a block derived from "X", the "rollback timeout" is doubled. Due to the existence of POH, each validator can verify the information in the block, so they can discard blocks that are inconsistent with Solana's history. Nodes on the network can only receive inflation rewards within the maximum vote lockout time. This helps ensure that the economic interests of validators are aligned with the fork they believe the majority of the network is voting for.

Block

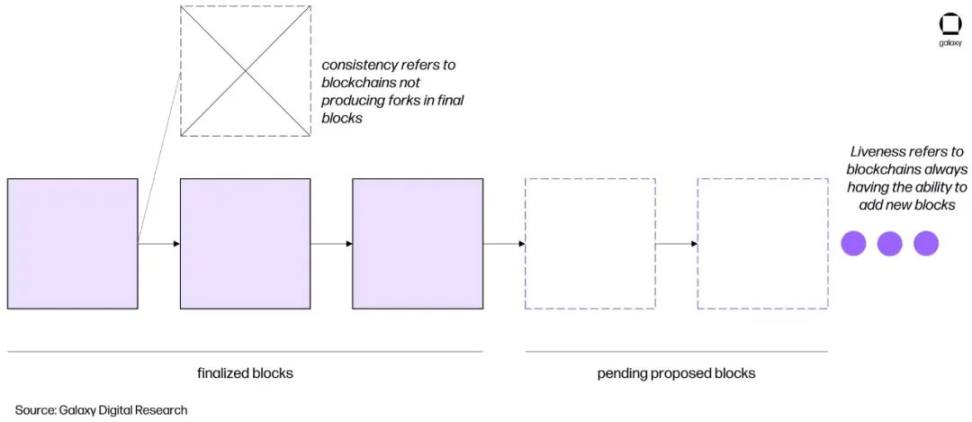

In Tower BFT, liveness (the ability to always add new blocks) takes precedence over consistency (the potential number of forks in the final block) (see diagram). The difference between Tower BFT and standard PBFT implementations is that Tower BFT relies on POH as a global clock before reaching consensus. This allows Solana to reduce latency and message passing overhead, which are common drawbacks of traditional PBFT. In Tower BFT, validators can vote within a fixed time period of a hash value or "epoch". Generally, an epoch is equivalent to 400 milliseconds (although it may change with ongoing hardware advancements). As mentioned earlier, each subsequent epoch forces the network to stop and "unwind" the tick-tock time (also known as the timeout time) that must be doubled to "unfold" potential votes.

For example, if each validator on Solana has voted 38 times in the past 15 seconds (15,000 ms / 400 ms = ~38 epochs), the network's timeout time is actually ~3,400 years. (2^38*400)/1000/60/60/24/365. The premise of this BFT method is that the timeout time grows exponentially as blocks are produced. Unlike Proof of Work, once a supermajority of validators vote on a PoH hash value, that hash value cannot be rolled back. The end result is not probabilistic.

In Tower BFT, the network can calculate timeouts asynchronously without the need for point-to-point communication. Each vote cast by validators contains a small piece of verifiable information (tied to POH). If other validators observe that a proposed vote contains information that cannot be verified by POH, that vote is directly discarded. This is why the "tick-tock" enabled by POH, separate from the BFT mechanism itself, is crucial to Solana's scalability approach.

BFT

Gulf Stream Memoryless Forwarding Protocol: In a memory pool, unconfirmed transactions are idle, waiting for network processing. In a memory pool structure like Bitcoin or Ethereum, traders who pay higher fees (or tips) can incentivize network miners or validators to confirm their transactions faster and remove them from the memory pool. The size of the memory pool and the cost of transactions being recognized by the blockchain represent the supply and demand relationship for block space on a specific blockchain.

For Solana, imagine if Solana validators could manage a "Mempool" theoretically with 100,000 transactions (Solana actually does not use a literal Mempool). With these parameters, assuming a throughput of 50,000 transactions per second, Solana validators can clear this memory pool in a matter of seconds. However, this oversimplification overlooks the importance of public chain propagation. In most public chains, mempool transactions are propagated in the node network through a gossip protocol. The gossip protocol refers to a peer-to-peer communication method for transmitting data through a distributed node network. The efficiency of the gossip protocol is due to advanced technologies such as Bloom filters, which help nodes more efficiently propagate transactions to other nodes. This efficiency comes from Bloom filters using hash functions to determine whether an element is not contained in a given data structure (constant time). However, as public chain throughput increases, the computational cost of running Bloom filters may become too expensive due to the large number of hash values that need to be calculated each time a Bloom filter is instantiated. Therefore, the Solana team has adopted a block propagation method that is completely different from most other public chains.

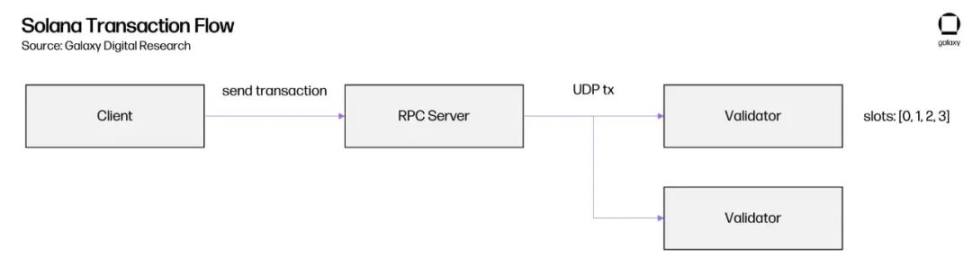

Solana Transaction Workflow

Solana Transaction Workflow

Gulf Stream describes Solana's unique transaction propagation method, which pushes transaction caching and forwarding to the edge of the network. Because validators know the order of transactions and who the future leaders will be, they can execute transactions in advance. This allows leading validators to switch faster (similar to relay runners in track and field starting their own segment before passing the baton to a teammate). The innovation that makes Gulf Stream technology possible is the known leader schedule (using the running analogy again, the relay team will determine the running order of each member in advance). This leader schedule is generated every other epoch (about 2 days), meaning transactions are sent directly to the current and next leader, rather than being randomly propagated like in the Ethereum mempool. Most public chains do not have this specific leader principle. In addition to allowing transactions to be executed in advance and facilitating seamless leader switches, this approach also reduces the memory load on validators, as they do not need to track unconfirmed transactions and shortens confirmation times. The main risks of Gulf Stream are: 1) increased risk of collusion among validators (because leaders are predetermined, but the Solana team believes that this risk is minimal due to Solana's fast block time); 2) spam tendency, as Gulf Stream is memoryless, spam transactions will be sent directly to the leaders.

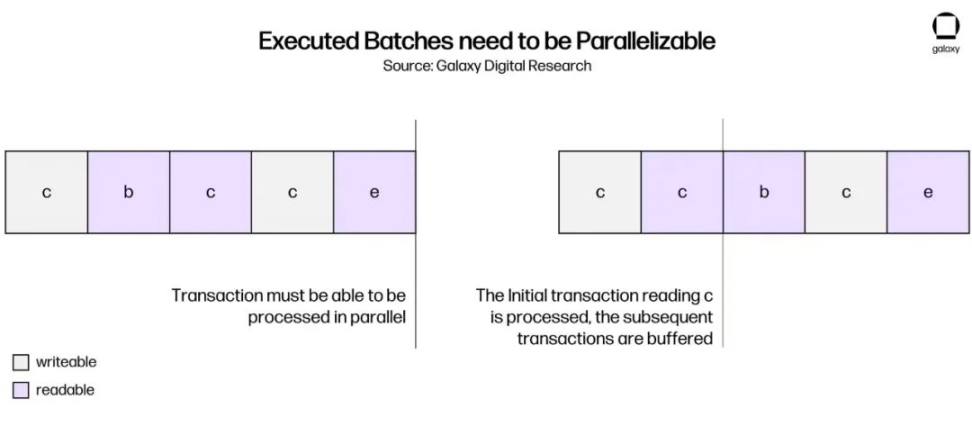

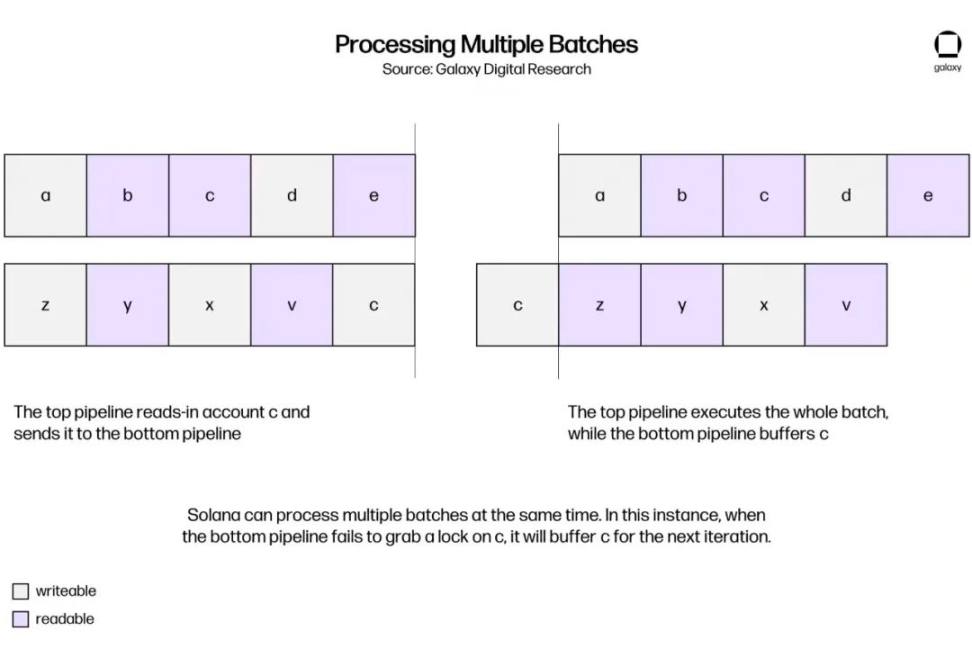

Sealevel Parallel Smart Contracts: Sealevel is a virtual machine that allows smart contracts to be executed simultaneously on a blockchain with the same state. In contrast, EVM-compatible public chains are single-threaded, allowing only one smart contract to modify the state of the public chain at a time. Sealevel's parallel smart contract execution engine is supported by its core validators, allowing transactions to be executed simultaneously on a public chain with the same state. The operation of Sealevel is similar to an operating system technology called "scatter-gather". Developers in the Solana ecosystem must declare in advance the state they will read and write. While this increases the complexity of development, it also allows Solana to execute any non-overlapping smart contracts in parallel. Sealevel ultimately uses Berkeley Packet Filters to hand over transaction execution to the hardware level. By leveraging the Sealevel virtual machine, transactions that only read the same state on Solana can be executed concurrently, and non-overlapping transactions can also be executed simultaneously.

First Batch

Second Batch

Turbine Block Propagation Protocol: The block propagation method of Turbine is largely inspired by platforms like BitTorrent. Turbine works by breaking down the data stored in a block into smaller data packets. The current block leader divides the block data into data packets no larger than 64kb, and each data packet is sent to different validators. After receiving the data packet, validators will transmit it to other neighbors. These neighbors will then propagate the data packet to their neighbors. Additionally, Turbine also takes into account potential dishonest nodes that may send incorrect data or fail to send data to neighboring nodes. To address this issue, the leader generates Reed-Solomon erasure codes. Erasure codes allow each validator to reconstruct the entire data block without receiving all data packets. If the leader sends 30% of the data packets using erasure codes, the network can discard any 30% of the data packets without losing the data block. The leader can also adjust this ratio based on the network's status. These changes are based on the packet loss rate observed by the leader from previous data blocks.

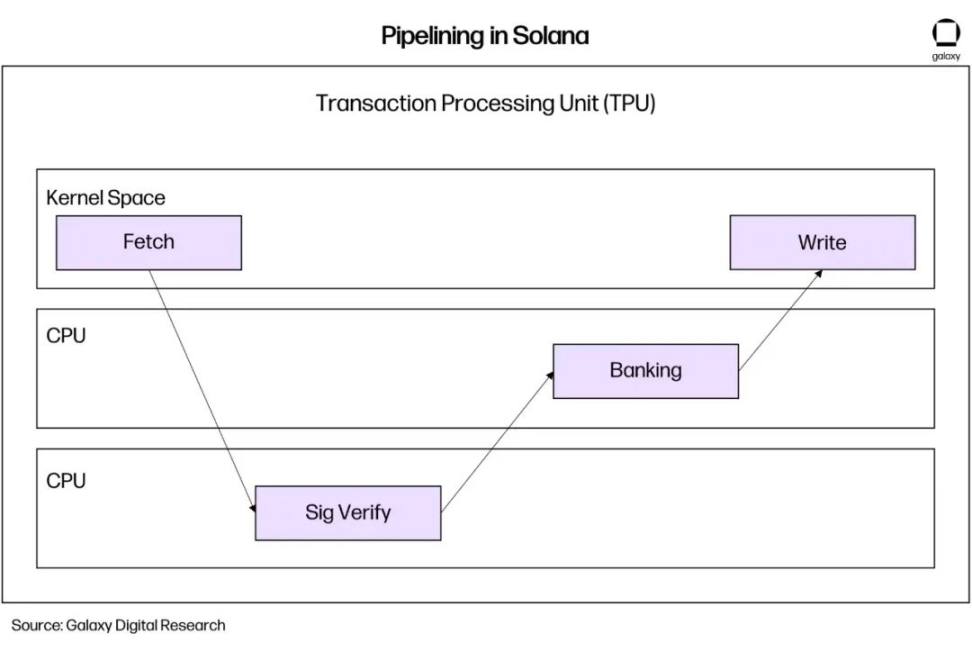

Pipeline

Pipeline (Transaction Processing Unit for Validation Optimization): Pipelining refers to hardware-level optimization that allows Solana to split the input data stream into different processes running on different hardware. Pipelining uses message queues supported by Rust channels to build a pipeline divided into 3 stages.

Solana Pipeline

In the first stage, data is fetched and sent to the kernel (operating system) level for blocks. Specifically, the kernel space passes the data to the next GPU stage, where signatures can be verified in parallel. Once the signature is verified, the GPU transfers the data to the CPU for the next banking stage. Meanwhile, the kernel space has already fetched the next set of data and sends it to other blocks to be written to the public chain by the central processor.

An analogy can help explain this concept, such as washing dishes. Typically, dishwashing is divided into multiple stages: rinsing, sterilizing, drying, and storing. The first person is responsible for rinsing dirty dishes and storing clean, dry dishes, rather than having one person complete each step in sequence. However, they will hand the dishes to another person who is only responsible for sterilizing. Perhaps this person can also use a basin filled with clean soapy water to wash/sterilize many dishes at the same time (a rough analogy to GPU parallelization). Finally, the third person will focus on drying these dishes and return the washed dishes to the first person to store them in the appropriate place.

Cloudbreak Horizontal Scalable Account Database: Cloudbreak enables Solana to utilize concurrent read and write at the hardware level. Solana does not rely on traditional databases to achieve this goal (which is very difficult), but instead borrows principles from operating systems to build a different type of database. Architecturally, Cloudbreak handles account data in the following way:

- Accounts and fork indexes are stored in RAM

- Accounts use memory mapping

- Each memory mapping stores accounts from a single proposed fork

- Mappings are randomly distributed on solid-state drives

- Utilizes copy-on-write semantics

- Writes are added to the random memory mapping of the same fork

- Indexes are updated after each write

The Solana team had to build all query and data operation tools from scratch instead of relying on general database abstractions. Therefore, the Solana network can support up to 1 million reads and writes per second on a single solid-state drive, even when the number of accounts on Solana exceeds 10 million, making it impossible to store all the data in RAM.

Archiver Distributed Ledger Storage: Archiver is best viewed as a lightweight client that does not download the entire ledger of Solana. This is important because Solana generates approximately 4 PB of data annually, and only large validators with large storage specifications can store all this data. Archiver allows more nodes to store Solana's historical data, helping to reduce centralization risks. Essentially, archivers are similar to validators that validate transactions; they also download parts of Solana's ledger and provide replication proofs (ProReps) to a wider set of validators to ensure they are not engaging in malicious behavior.

Actual Performance of Solana

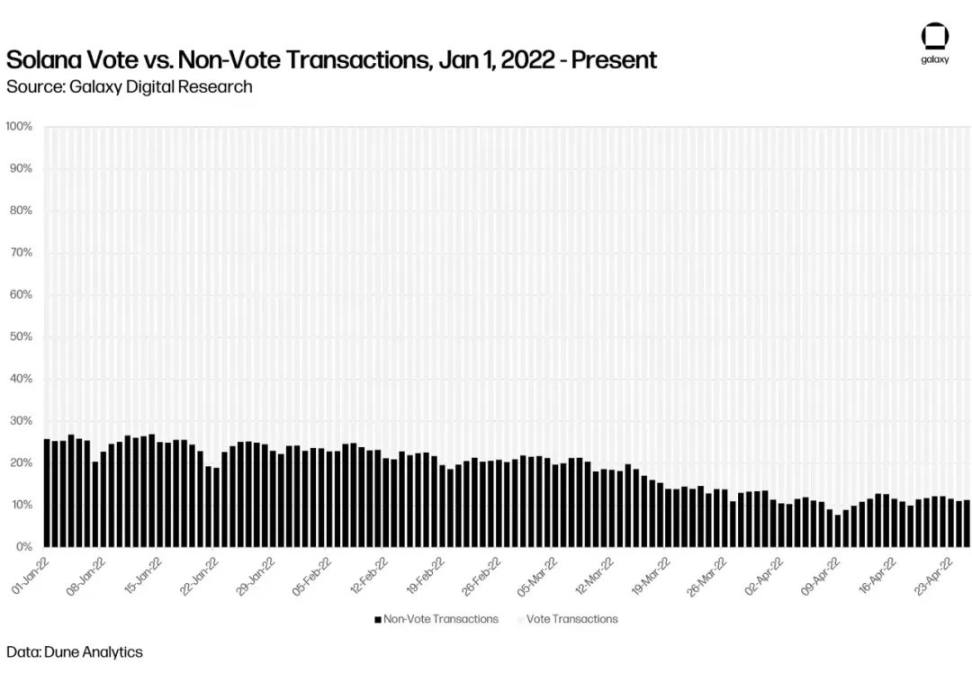

Comparison of voting and non-voting transactions on Solana from January 1, 2022, to present

Without considering factors that may render "apples-to-apples" comparisons with other public chains invalid, it is impossible to objectively assess Solana's performance as a scalable public chain. For example, Solana's whitepaper claims a theoretical throughput of 710,000 transactions per second. However, at the time of writing, Solana's website shows an average of about 1,500 transactions per second (TPS) over the past 6 hours. This indicates a roughly 500-fold gap between Solana's ideal future and current reality. It is problematic to take Solana's reported TPS at face value because it includes internal consensus information as transactions, which is not the standard practice for any other public chain. In Solana, consensus information is called "voting transactions" - they are transactions that validators with voting accounts process for vote registration, vote collection, and new vote signing. On Solana, transactions involving Dapp smart contract interactions are called "non-voting" transactions (most other public chains only count "non-voting" transactions in their TPS count). According to data from Dune Analytics, voting transactions accounted for 80-90% of all transactions on Solana from March 2, 2022, to April 3, 2022. Therefore, subtracting the "consensus overhead" from Solana's reported TPS of about 1,500 yields a real TPS of approximately 300 non-voting transactions per second (although this is a moving target).

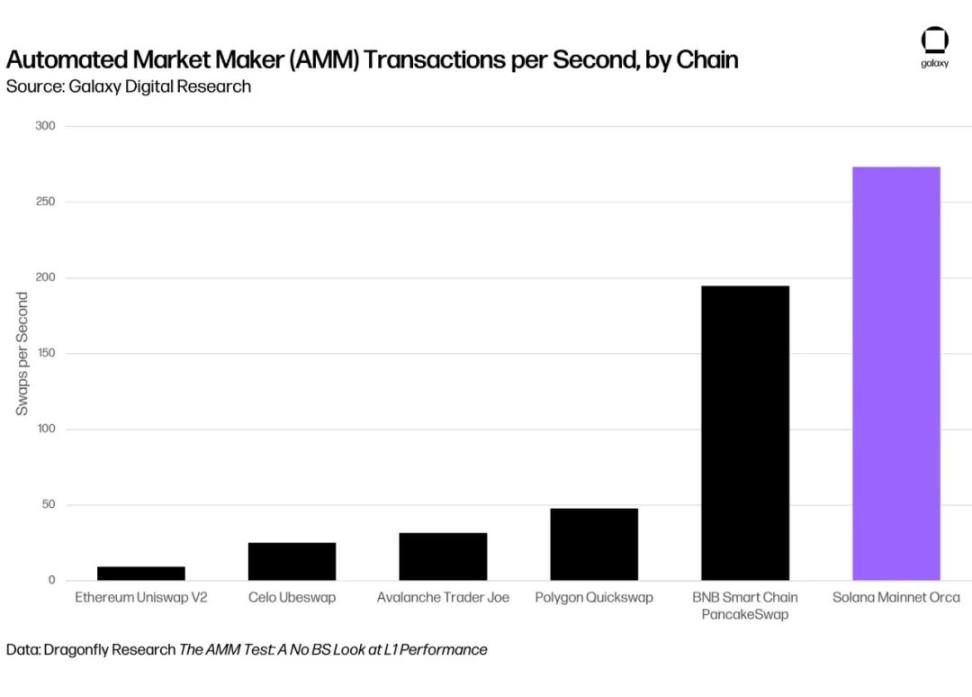

Auto MM

According to research by Dragonfly Capital, Solana's true scalable performance is 10-25 times higher than that of competing Layer 1 protocols. However, measuring Solana's reported metrics at face value does not show the 100x or 1000x performance improvement often reported. Dragonfly's approach involves normalizing the performance of each network by conducting AMM transactions using fully packed blocks on the test network. While this is not a perfect benchmark, it certainly allows for comparisons between various Layer 1 public chains. Although Solana's actual performance based on these benchmarks (approximately 272 Orca exchanges per second) falls far short of the theoretical performance of 710,000 TPS mentioned in its whitepaper, it is still an incredible number compared to other protocols (such as Ethereum's 12-15 TPS limit). From a scalability perspective, this also highlights that Solana's technology seems to be a leader among its peers (for now). However, other non-EVM public chains (such as NEAR) also have the potential to achieve high "actual throughput".

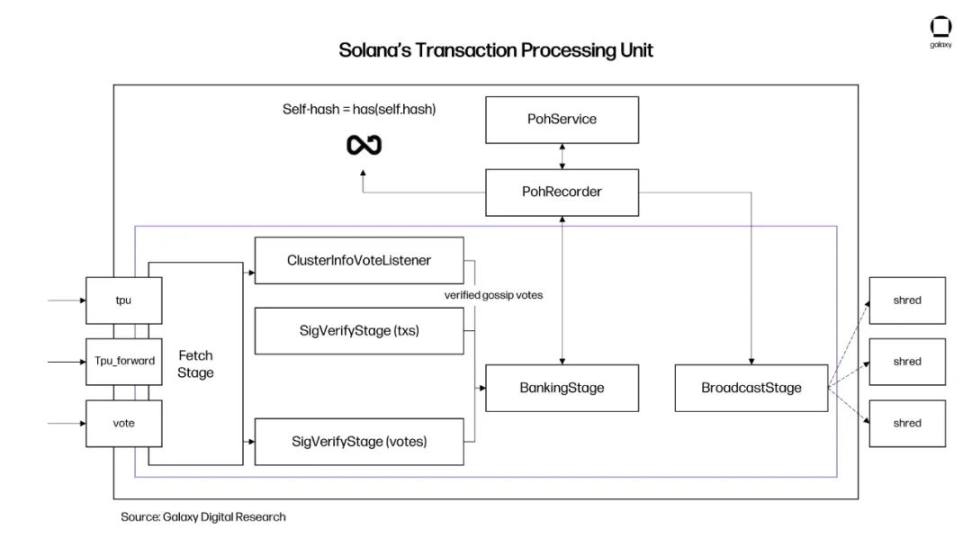

Solana Transaction Processing Unit

Combining all the concepts described so far, here is an overview of the theoretical lifecycle of Solana transactions:

Before the transaction: During the development process, Solana smart contract developers explicitly declare a list of all accounts that a transaction interacts with - this is crucial for Solana's parallelization of state changes through Sealevel.

Dapp sends the transaction to a user's wallet (such as Phantom) for signing.

The user signs the transaction with their private key, paying a fee of 0.000005 SOL (this number is currently fixed and determined).

The Dapp uses the sendTransaction HTTP API call to send the user-signed transaction to the Solana RPC server.

The RPC server reads the validator schedule (changes every 2 days) and forwards the transaction as a UPC packet to the current and next validator leader.

The leading validator receives the transaction through its transaction processing unit (pipeline).

For a detailed overview of this process, please refer to the following article.

Token Economics

SOL token is the native cryptocurrency of Solana, operating similarly to other smart contract platforms like Avalanche and Ethereum. SOL has three main uses: 1) Paying transaction fees in exchange for using computational resources on the Solana network, 2) Securing the Solana network by directly staking SOL tokens in one's own validator or delegating to other validators, and 3) Voting in governance decisions related to the Solana network.

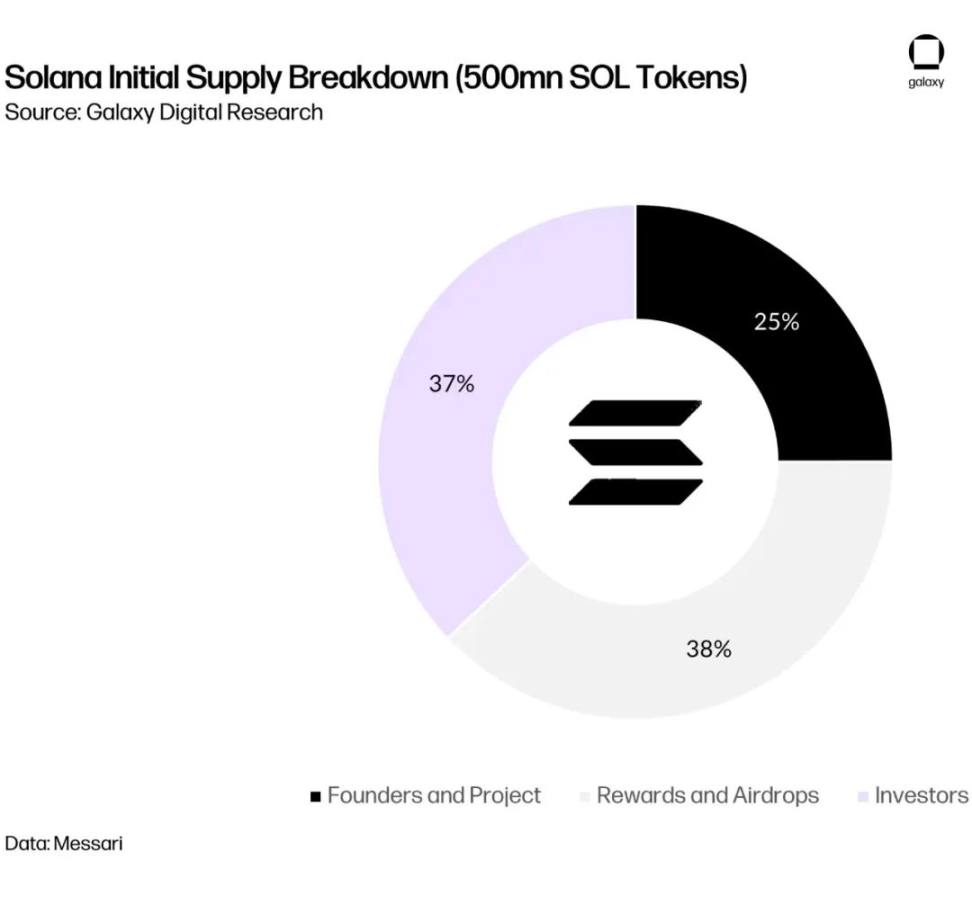

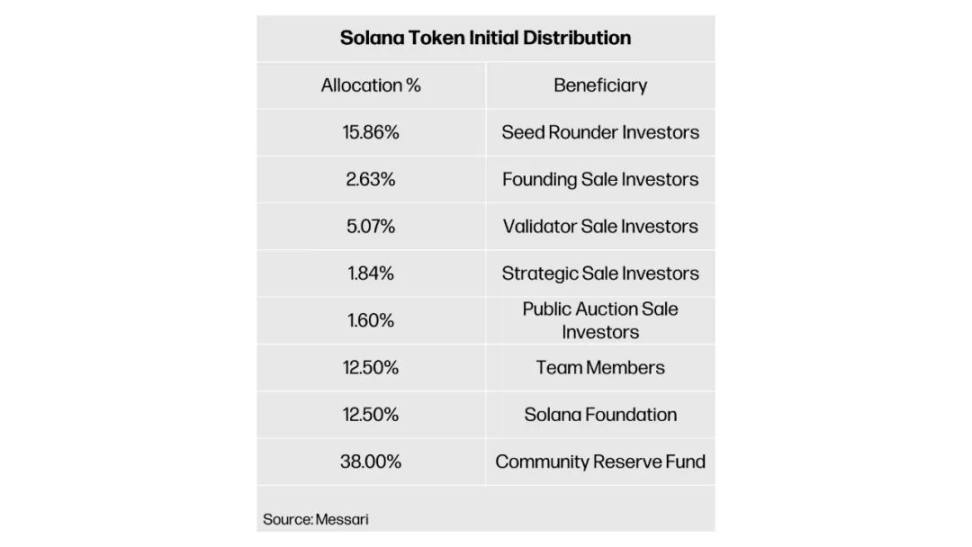

Initial supply details of Solana

In addition to Solana's native SOL token, Solana also supports Solana Program Library for developers to create their own Solana-compatible fungible tokens. In simple terms, the Solana SPL token standard is to Solana as the ERC-20 token standard is to Ethereum.

According to CoinGecko's data, the total market value of SOL + SPL tokens is estimated to be approximately $25.1 billion. Compared to Ethereum's ETH + ERC-20 market value of about $510 billion, this number seems insignificant (the size of the SOLANA ecosystem is about 5% of the size of the ETH ecosystem). These numbers indicate that the SOLANA ecosystem still has significant room for growth before it can pose a serious challenge to Ethereum. Some well-known "pure" SPL tokens (as opposed to cross-chain tokens) include STEPN (GMT), Serum (SRM), Marinade Staked SOL (mSOL), and Audius (AUDIO).

Token Sales

The Solana team initiated five rounds of financing, with four rounds being private sales. These private sales began in the first quarter of 2019 and ended in July 2019, when MultiCoin Capital led a $20 million Series A investment in Solana Labs. Other companies participating in the fundraising included Distributed Global, BlockTower Capital, Foundation Capital, Blockchange VC, Slow Ventures, NEO Global Capital, Passport Capital, and Rockaway Ventures. In exchange for their investment, these companies received SOL tokens (specific amounts were not disclosed). Solana announced this capital raise on Medium in mid-2019.

By 2020, Solana completed its fourth private sale (referred to as a strategic sale) and held a public auction organized by CoinList, adding approximately $4 million to its treasury. On April 8, 2020, Solana Labs also transferred all protocol-related IP and 167 million SOL tokens to the newly established Solana Foundation. The remaining token allocation of the initial SOL token supply was distributed to Solana Labs team members, the Solana Foundation (for funding development and balancing validator voting rights), and the "community reserve fund" for supporting community activities and application developers (also managed by the Solana Foundation).

After the network launch, the disbursements from the Solana Foundation began to be cashed out monthly. At launch, the foundation also unlocked 11 million SOL, lent to market makers for six months. This caused some backlash within the community, as they were unhappy that these tokens were not included in the circulating supply calculation, significantly altering the token distribution. While collaborating with market makers is common in the cryptocurrency community, Solana holders seemed to be unhappy with the secretive nature of this action. These lingering concerns eventually led the Solana team to burn an equal amount of tokens from the foundation's allocation.

Token Supply

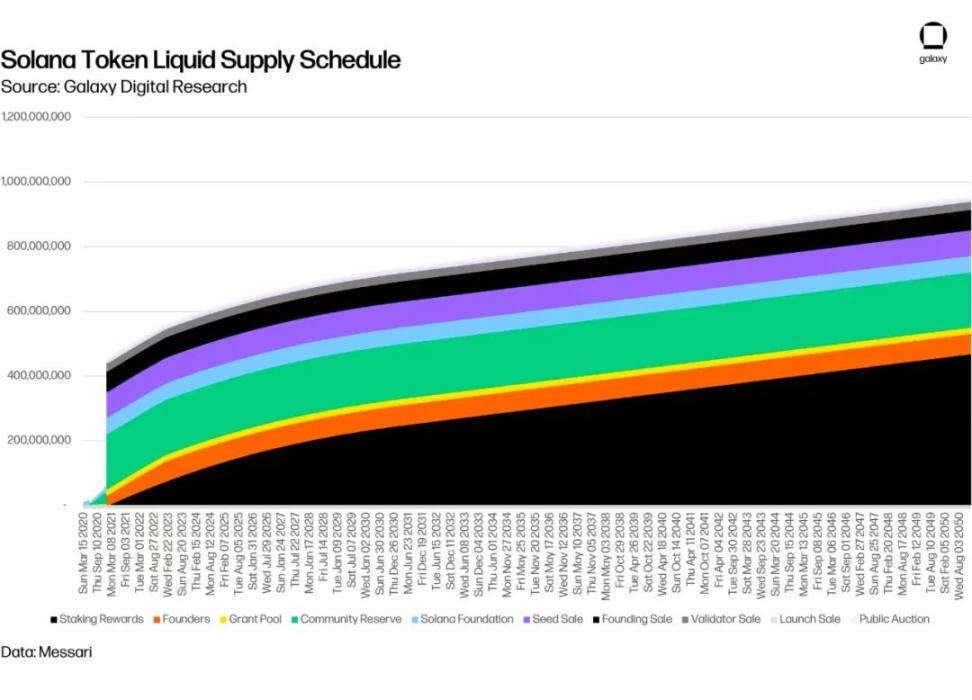

Solana's token supply has an inflation schedule, with the current inflation rate at 7.2%. The inflation rate will decrease by 15% each year (referred to as the "deflation rate"). Solana's inflation rate will decrease by 15% until it stabilizes at 1.5%. In other words, Solana's inflation rate has a linear devaluation schedule of 15%, starting at 7.2% and ending at 1.5%. Newly issued tokens will be distributed to validators and stakers in the network based on their staked proportion. In the long term, Solana plans to permanently maintain the inflation rate at 1.5%.

From the supply curve, it can be seen that the pre-sale private token sales had a lock-up period of only 9 months. These tokens were unlocked on the 17th of 2021. Additionally, the founder's allocation will be fully cashed out by January 2023. These two large-scale distributions have unlocked a significant amount of token supply. The entire grant pool allocation was also fully unlocked in January 2021. These tokens will be used for ecosystem funds, such as the $100 million fund announced in January 2022, and for developing the validator ecosystem through incentive programs.

Token circulating supply schedule

Validators

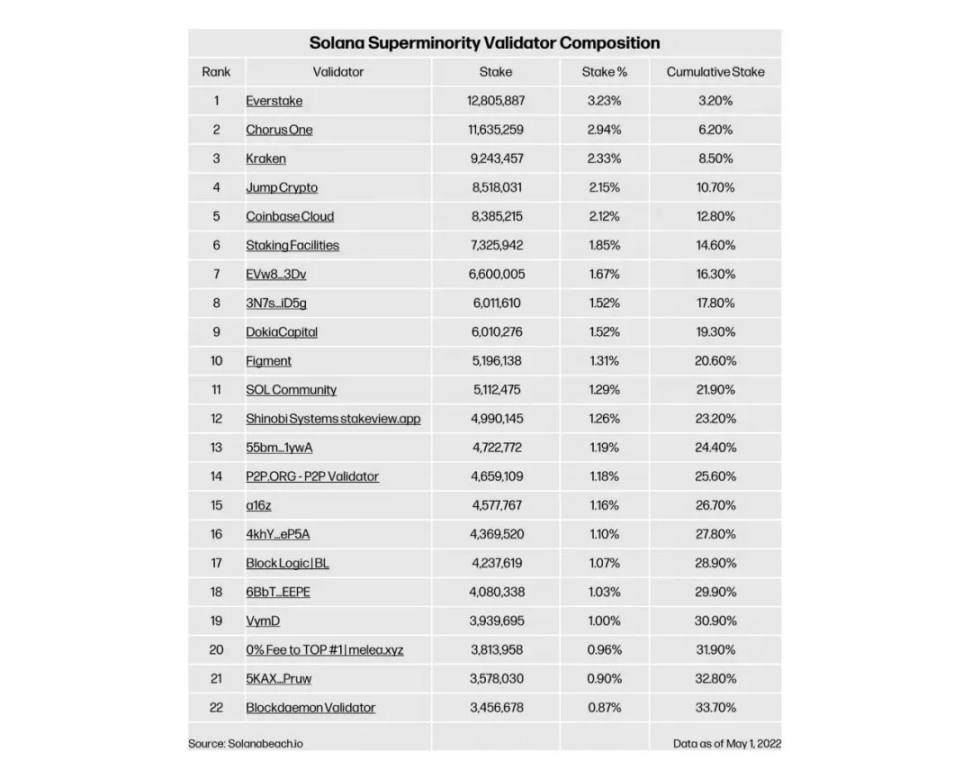

Solana's proof-of-stake network consists of 1763 validators (as of May 6, 2022, according to solanabeach.io). The distribution of stakes among these validators is relatively concentrated, with only 22 validators holding approximately 33% of all Solana stakes in the network. In other words, due to the significant influence of the stakes held by these 22 validators, theoretically, they could single-handedly hinder the network's development. This concentration of stakes is not unique to Solana (Avalanche's validators also exhibit a similar level of stake concentration).

There are several factors contributing to this level of concentration. Firstly, custodians and centralized exchanges hold large balances of Solana tokens through their daily operations, allowing them to earn additional income by running their own validators. Running a proof-of-stake validator is much simpler compared to operating mining rigs on proof-of-work chains like Bitcoin. Centralized exchanges only need to point their substantial Solana balances to their own validators to immediately start voting and proposing blocks to the Solana network. Validators on proof-of-stake networks only need to control (directly or through delegation) a significant amount of the native tokens of the network to achieve economies of scale. If a centralized exchange has a large amount of Solana on its balance sheet, it can almost immediately run a very profitable validator business with minimal effort/management costs. This is different from starting to mine Bitcoin, as the operational challenges of running a large-scale proof-of-work Bitcoin mining operation go beyond the core capabilities of a centralized exchange's business operations.

Additionally, from the perspective of retail users, it is very easy for users to delegate their held Solana tokens to popular validators. Some centralized exchanges even offer delegation as a feature of their products and provide additional income from static token balances in exchange for a cut from staking rewards. Furthermore, users may be more willing to delegate tokens to validators they recognize from a branding perspective. In this sense, "the rich get richer" as dominant validators attract new delegated capital and further strengthen their influence on the network. For proof-of-stake systems like Solana, this is a particular form of centralization. However, there are two potential solutions that can help alleviate the current high level of centralization in the Solana proof-of-stake network.

In terms of demand, the first potential method to mitigate the centralization issue in the proof-of-stake network may be the growing trend of "liquid staking." Liquid staking providers (such as Marinade) are protocols that represent users' delegated stakes, similar to any staking provider. Users choose to delegate their stakes through providers like Marinade, and in exchange, the liquid staking provider issues liquid staking tokens (such as mSol). The issuance of these tokens is at a 1:1 ratio with the Solana staked amount, allowing users to freely use other DeFi products within the Solana ecosystem while earning staking rewards on the underlying Solana staked amount. Since liquid staking providers have a vetted onboarding process with new partner validators, they are able to delegate tokens to users in a decentralized manner (i.e., they will distribute stakes to smaller validators). In fact, the fastest way for new Solana validators to start earning profits by receiving delegations from liquid staking users is through collaboration with liquid staking providers. However, it cannot be guaranteed that liquid staking providers will ultimately provide or encourage more decentralization of validators. Seeking decentralization in the selection of underlying validators is not a necessary choice for liquid staking protocols, but it may be a powerful strategy.

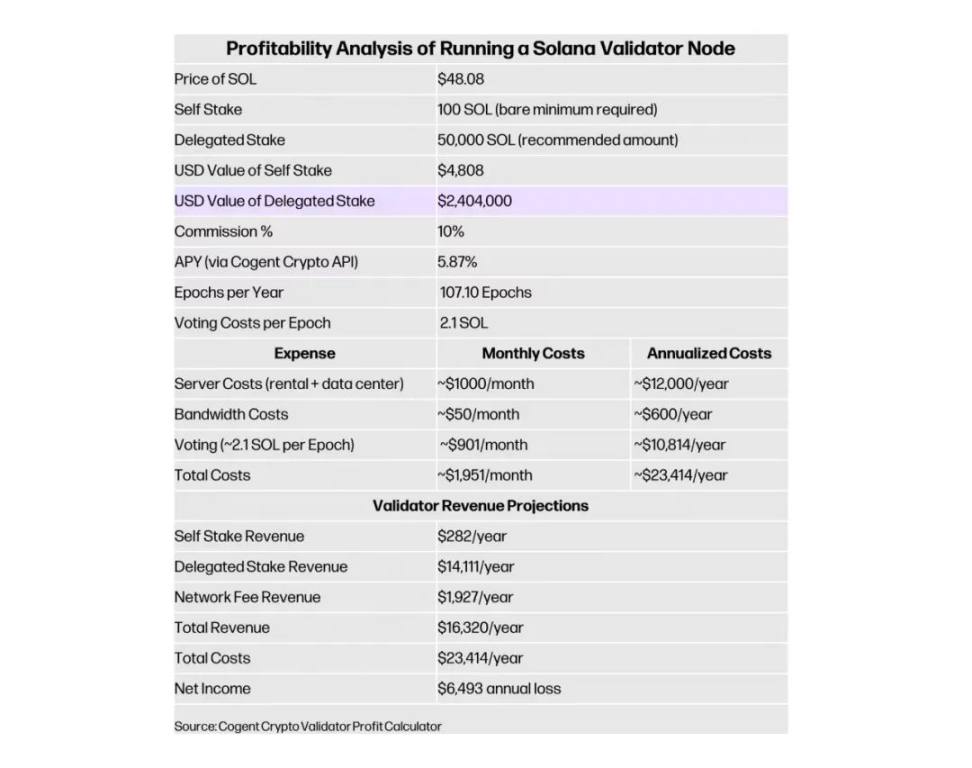

In terms of supply, a solution to increase the decentralization of the Solana network is to incentivize more validators to ensure the security of the Solana network. The rate at which validators join Solana has been slow, as the network is currently one of the most challenging and expensive validation networks. The economic viability of running validators is not particularly attractive, mainly due to the fact that the price of Solana has risen much faster than the speed at which protocol modifications require validators to meet core requirements. In other words, the high cost of voting, expensive hardware, and the substantial staking required (in USD terms) are major obstacles to the economic prosperity of Solana validators. Despite this, Solana remains more attractive in certain aspects compared to other networks like Avalanche. Solana has no limit on the ratio of delegated stakes to self-stakes, which increases the opportunity for proactive validators to achieve economies of scale. Once their validators start running, they can attract an unlimited amount of delegated SOL based on the weight of their validator's stake. The Solana Labs team is aware of the economic challenges faced by running validators, and they have shown interest in modifying parameters such as high voting costs. However, running validators on the Solana network is unlikely to be particularly inexpensive due to the high computational requirements. Validators on the Solana network may have a certain degree of centralization due to the high minimum computational requirements. The broader crypto community needs to consider how high the level of decentralization really is.

Key Participants

Wallets - Gateway to Web3

Non-custodial cryptocurrency wallets are a prerequisite for users to enter the crypto world. Wallets are the fundamental bridge between end-users and decentralized applications, enabling actions to be fully conducted on-chain - from minting NFTs to obtaining collateralized loans in DeFi, to paying for goods and services. In the "accountless internet" model embodied by Web3, wallets serve as the user's identity, and many have pointed out that the wallet user interface has been a bottleneck for mainstream crypto applications globally. In 2021, the bull market for Solana produced several Solana-compatible wallets, including Solflare, Sollet, and Phantom. However, Phantom stood out and became a dominant player in the Solana ecosystem (similar to the role of MetaMask in Ethereum).

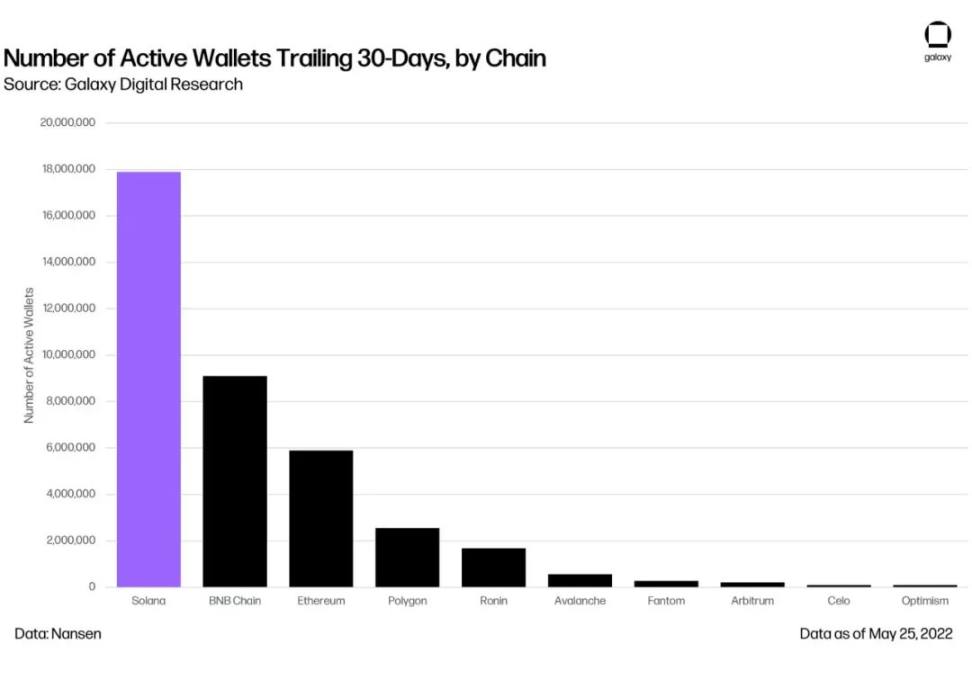

Phantom Wallet was founded in March 2021 and underwent several stages of private testing before its public release in July 2021. In the following 9 months, Phantom's user base has grown to approximately 2 million monthly active users. The wallet itself is both a browser extension and a mobile application (similar to MetaMask). However, Phantom stands out by emphasizing a user-friendly interface and advanced features. These features include directly staking SOL to validators and displaying the user's NFTs on a separate tab within the wallet. Additionally, it supports key management and exchange functionality for hardware wallets (such as Ledger) provided by Raydium. Through direct integration with FTX, users can purchase Solana with fiat and deposit SOL tokens directly into Phantom (similar to the service provided by Coinbase through its exchange and wallet coupling). According to Phantom's Twitter account, the wallet facilitated $16.1 billion in SOL staking, $1.37 billion in trading volume, 2 million Dapp transactions, and 1 million token transfers. Furthermore, the wallet has a user base of 2 million monthly active users, with 1.6 million users owning at least one NFT. The high level of engagement led the Phantom team to raise $109 million in funding, valuing the wallet at $1.2 billion. In comparison, MetaMask's parent company Consensys recently raised $450 million at a valuation of $7 billion, bringing MetaMask to 30 million monthly active users.

So far, Phantom's success, coupled with its financial strength, has brought synergies to Solana developers, who can rely on battle-tested Solana wallet APIs to connect their existing 2 million user base to their respective Dapps. This is an important aspect of the unique Solana ecosystem, which is often overlooked and explains why Dapp usage on Solana has been consistently high compared to other Layer1 blockchain platforms.

Active wallet count

Solana Ecosystem

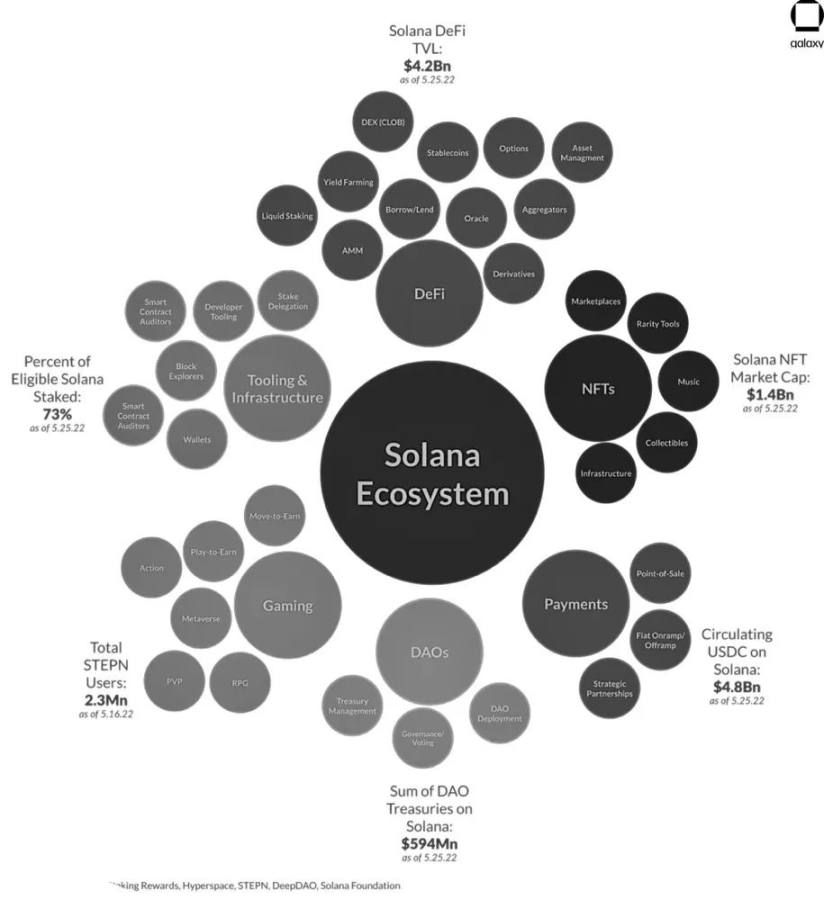

The Solana ecosystem can be divided into the following segments: DeFi, NFT, payments, DAO, gaming, and infrastructure.

To be updated

DeFi

DeFi is currently the largest vertical in the Solana ecosystem, and perhaps the most important. Solana's technical infrastructure is built from the ground up to accommodate trading use cases, allowing any Solana user to operate like a high-frequency trader in the traditional financial space.

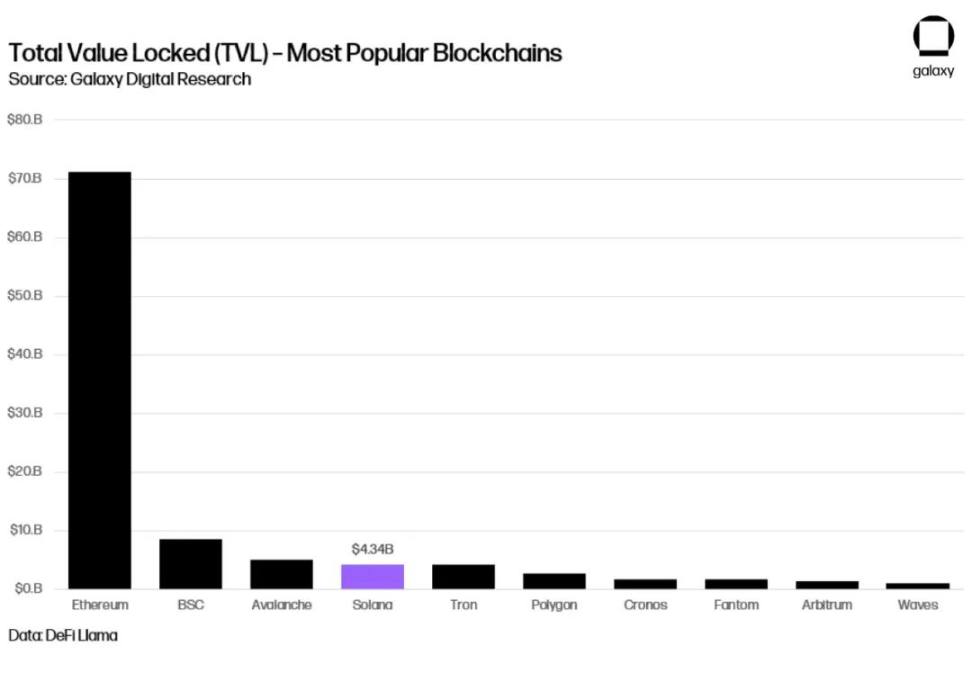

According to DeFi Llama's data, Solana holds approximately 3.74% of the DeFi TVL market share across all chains. This share currently lags behind Ethereum (63.78%), BSC (8.26%), and Avalanche (3.89%). However, from a DeFi perspective, these high-level metrics do not fully reflect the level of innovation in each network. Apart from Ethereum, it can be argued that while BSC and Avalanche may have more impressive absolute TVL, a deeper dive into the dominance of DeFi protocols within these chains reveals that they are not as impressive.

Most popular public chains

As for BSC, 47% of the BSC TVL is driven by PancakeSwap, which is known to be the preferred DEX for problematic, low-capacity token projects. Additionally, Avalanche has 21% of its TVL coming from Aave, which was ported to Avalanche due to its EVM compatibility. In other words, in terms of TVL, even the top projects on Avalanche are not specifically tailored for the network (although some may consider this to be a feature rather than a flaw, given the convenience of integrating existing EVM-based projects into AVAX). On the other hand, Solend is the top DeFi protocol on Solana, holding only 13% of the dominance. The top 5 protocols by TVL on Solana are Tulip (2nd), Atrix (3rd), Raydium (4th), and Marinade (5th). The total value locked by all these protocols is significant, representing various use cases within Solana's growing DeFi ecosystem. The following will introduce several key primitives to enable developers to build powerful DeFi applications on the Solana network.

Serum

On August 31, 2020, Serum was released as an open-source software project built on Solana. It was initiated by the Serum Foundation and received support from a group of cryptocurrency trading and DeFi experts, including FTX, Alameda Research, and the Solana Foundation. The goal of Serum is to become the "infrastructure layer for a $100 trillion economic activity," achieved by establishing a centralized order book, matching engine, fast settlement/trading, and low transaction costs on-chain. Two key assumptions drive the design philosophy of Serum.

- Central Limit Order Books (CLOB) will replace Automated Market Makers (AMMs) as the de facto standard for DeFi trading.

- Composability in DeFi will lead to step-function improvements in functionality due to the specialized collaboration of different protocols.

Before the emergence of Solana, CLOB in DeFi was considered a pipe dream. Ethereum's scalability limitations and high gas costs led to the explosive growth of AMMs based on primitive design patterns, such as the constant product formula powering Uniswap. On Ethereum, running CLOB on-chain for all transactions required for CLOB was simply not feasible due to the enormous demand for block space. Passive trading based on the constant product pricing model and bidirectional liquidity pools were the only reliable way to fully bring decentralized trading on-chain. The Serum team realized the limitations of AMMs during the peak of DeFi Summer in 2020 and subsequently shifted from Ethereum to Solana.

The main challenge faced by AMMs revolves around the concept of impermanent loss. Essentially, AMMs only benefit liquidity providers (LPs) when the two assets comprising a specific liquidity pool have a price relationship with mean-reverting properties. Stablecoin pairs (such as USDT/USDC) are ideal examples for AMMs, maximizing LP fees and minimizing impermanent loss from unfavorable price movements exploited by arbitrageurs. However, users want to trade more than just stablecoin pairs, which is the crux of the problem. Many believe that AMMs will never take off due to their limitations, although the fact remains that AMMs are a very useful platform, even generating significant trading volume beyond mean-reverting assets. However, the rise of AMMs is largely due to the lack of on-chain CLOB. It is speculated that the implementation of decentralized CLOB will absorb a significant amount of AMM trading volume, as AMMs have several advantages:

- Active liquidity management (each order displays the desire to execute a certain quantity at a certain price)

- Market makers (attracted by the activity of CLOB)

- Limit orders (help reduce impermanent loss)

- More liquidity (resulting in greater trading volume, lower slippage, and hedging capabilities)

The second key factor driving the design philosophy of Serum is that DeFi should be open, permissionless, and composable. In other words, people should be able to integrate Serum with other DeFi protocols to build something more powerful than the sum of its parts. Composability means that any DeFi-based application can easily integrate Serum into its existing stack, creating its own comprehensive financial services system. What does this composability look like in practice?

Suppose someone wants to launch a fast, inexpensive decentralized exchange on Solana. This person can learn Rust, create an on-chain matching engine, test it, find market makers for liquidity, build a graphical user interface, and finally deploy the application to the trading environment. With Serum, the same person can create a DEX graphical user interface, plug in Serum on the backend, and have a fully functional application running within 10 minutes. More importantly, all applications built on top of Serum can share Serum's liquidity. This approach achieves significant economies of scale, akin to the rise of cloud kitchens in the fiercely competitive restaurant and food delivery industry.

Many products and protocols have been built on top of Serum, which is only possible due to Solana's monolithic and speed-optimized architecture. Perhaps the most typical example is Raydium, which created a DEX frontend on Serum that was so impressive, it led Serum to abandon its own DEX frontend and focus solely on building the backend DeFi primitive protocol for other protocols to use. Raydium focused on creating a killer DEX frontend, gaining a huge advantage over Serum, and forcing both parties to continue doing what they do best. This is the forward path envisioned by Serum for other parts of DeFi.

Pyth

In addition to liquidity, pricing data is the most important raw data for developers to build decentralized financial applications. In Ethereum, third-party services like Chainlink (a third-party service that connects on-chain smart contracts with off-chain data) act as oracles responsible for handling pricing sources for DeFi. Therefore, while Ethereum DeFi smart contract calls can only access information within the Ethereum state, Chainlink oracles enable smart contract developers to access data outside the Ethereum state (such as the current USD price of Bitcoin). Most decentralized applications rely on oracles as critical infrastructure, and Solana is no exception.

In Solana, Pyth is the primary oracle data provider. Pyth is overseen by the Pyth Data Association, whose members include Jump, Jane Street Capital, and Susquehanna International Group. The establishment of the Pyth network aims to meet the needs of these trading giants, whose daily trading operations rely on fast and accurate pricing data. Pyth is also available for developers to use in its architecture for free, but developers can pay for it, essentially as insurance against inaccurate pricing data. The Pyth protocol has three main stakeholders:

- Publishers: The source of all Pyth data, including existing market participants such as exchanges, proprietary trading firms, and market makers. Publishers share their data sources by earning PYTH.

Consumers: Developers of decentralized applications fall into this category. Consumers can use pricing data for free or choose to pay for data fees to reduce risk in case of pricing information source failure. Consumers use Pyth's API to incorporate off-chain data into their smart contracts.

Delegators: Delegators further ensure network security by pegging Pyth tokens to specific data publishers. In exchange, delegators earn a portion of the data fees paid by consumers. However, if the data publisher's data is inaccurate, delegators will lose their stake. If pricing information is inaccurate, delegators effectively act as insurance. Consumers pay a premium directly to the delegator, who then needs to pay out the Pyth staked by consumers in case of data source errors.

These three key stakeholders of Pyth form a virtuous cycle, transmitting high-quality off-chain data to Solana, becoming a cornerstone of the emerging DeFi ecosystem on Solana. Ultimately, the success of Pyth is closely tied to Solana's network performance. Since Pyth updates its prices with every Solana block (approximately every 400 milliseconds), it can provide more frequent and accurate price updates than platforms like Chainlink. This opens up a whole set of programmatic trading use cases that may not be economically feasible on Ethereum-based trading mechanisms. On the other hand, when Solana's network experiences downtime, Pyth's network also goes down. In a notorious event, Solana experienced a 17-hour outage in September 2021, causing the reported Bitcoin price by Pyth to drop by 90%. While such systemic errors are not common, they could potentially jeopardize hundreds of millions of dollars in the Solana DeFi ecosystem and undermine trust in Pyth as a data provider. So far, Pyth has been able to thrive as an oracle.

NFTs

According to data from Hyperspace.xyz, the Solana NFT space has quietly accumulated a total market value of approximately $1.4 billion. In comparison, according to Coinmarketcap, the Ethereum NFT space is currently valued at $10.5 billion. However, the dominance of "Yuga" in the Ethereum NFT landscape is incredibly high. NFT collections owned by Yuga Labs (Bored Ape Yacht Club, Mutant Ape Yacht Club, Bored Ape Kennel Club, Otherside, CryptoPunks, and Meebits) account for approximately 70% of the entire Ethereum NFT market value. In contrast, the top NFT project on Solana, STEPN, currently only accounts for approximately 18% of the Solana NFT market value. This suggests that the "power law" distribution of the Solana NFT space is not as pronounced as that of the Ethereum NFT space. Excluding Yuga Labs' collections, the NFT market value on Ethereum is roughly twice that of Solana. Data from Dune Analytics shows that the monthly trading volume of Solana NFTs is approximately $45 million, while the trading volume of Ethereum-based NFTs is $3-5 billion (equivalent to 1% of ETH trading volume). Although the overall scale of Solana NFTs continues to grow, their usage seems to be driven by small mainstream users.

Compared to Ethereum-based NFTs, the usability of Solana has been increasing in importance in the NFT space, which is why OpenSea added Solana to its list of supported Layer1 blockchains in April 2022. Kraken also followed suit, announcing that its upcoming NFT marketplace will support Ethereum and Solana. FTX's marketplace already supports Ethereum and Solana NFTs. Given the potential complexity of integrating with Solana from a technical perspective (considering its incompatibility with EVM), the moves by these well-known companies are particularly noteworthy. OpenSea, Kraken, and FTX all believe that the opportunity cost of scarce engineering resources, regardless of potential new vulnerabilities in Solana's Rust-based smart contracts, is worth serving their large user base with Solana NFT services. The collective recognition of existing industry players represents a victory for the entire Solana ecosystem and further enhances the credibility of Solana's unique approach to building a user-friendly and scalable Layer1 blockchain.

The top 10 Solana collections of NFTs are summarized in the following image. Impressively, most of these collections were launched in the past 6 months. In late April 2022, Okay Bears sold out its 1.5 SOL mint in a matter of hours, sparking a storm in the NFT world. Within a few days, its floor price soared to 170 SOL. On April 27, Okay Bears became the top-selling collection in a single day on OpenSea, with sales of $18 million. This milestone represents the first time that the daily trading volume of Solana-based NFTs has surpassed that of all Ethereum-based NFTs. As of early May 2022, Okay Bears still frequently ranks in the top ten in terms of trading volume on OpenSea. Clearly, Solana NFTs are not just a passing trend. They are being embraced by multiple premier markets, and in some cases, their trading volume rivals that of top Ethereum NFT collections. From a business perspective, it is reasonable for a company to capitalize on the increasing prominence of Solana NFTs. So far, no other Layer1 blockchain has achieved the level of notoriety that Solana NFTs have. The public blockchain Flow, developed by Dapper Labs and powering popular NFT platforms like NBA Top Shot, may be the only major "competitor" to Solana (it is rumored that Yuga Labs is considering using Flow for future potential ETH, as its scalability for Otheride Mint faces challenges). However, Solana has been permissionless from the start and has a more robust set of primitives beyond NFTs, including powerful DeFi protocols and integration with well-known exchanges. As Solana continues to promote cryptocurrency to mainstream audiences, especially in the United States, this could play a significant role.

Notable figures have also taken note of Solana's rise as a low-cost, fast Layer1 blockchain alternative powering NFT applications. Solana's mature wallet infrastructure, coupled with its ease of use and predictable low transaction fees, makes it a popular choice for influential individuals (especially those outside the cryptocurrency space) to initiate NFT investments. Below are some well-known NFT projects supported by celebrities and built on Solana:

HEIR: This is an NFT platform based on Solana, founded by Michael Jordan (also an investor in Metaplex and Mythical Games) and his son Jeffrey Jordan, connecting fans with professional athletes. The platform launched its first series in early March, inspired by Michael Jordan's six championship rings. The series consists of 5,005 NFTs, priced at 2.3 SOL (equivalent to $221 at launch), with net sales revenue of approximately $1 million.

2974 Series: This NFT series was launched by NBA superstar Stephen Curry to commemorate his surpassing the NBA's historical three-point record. Each of the 2974 three-point shots made by Stephen has a unique NFT, with each shot being represented by a sketch made entirely of the digits 2, 9, 7, or 4. 100% of the profits from this series will be donated to the "Eat" charity foundation, created by Stephen and his wife to help children and families in the Oakland/Bay Area.

Fractal: Founded by Justin Kan, co-founder of Twitch (which was sold to Amazon for $970 million in 2014), Fractal is a Solana-based NFT marketplace focused on gaming NFTs. Fractal collaborates directly with game studios, supports verified NFT releases, and allows direct NFT trading between players. By leveraging the gaming industry as a wedge, Fractal's ultimate goal is to become a significant player in the Metaverse.

Solana Payments

According to Visa's "2022 Return to Business" study, 59% of small businesses plan to fully adopt digital payments in the next two years. Traditionally, small businesses have been hesitant to adopt cryptocurrency payments due to price volatility and scalability challenges, leading to high transaction fees. In February 2022, Solana announced a partnership with Circle to address these common pain points. Solana Pay is a decentralized payment standard and protocol that allows merchants to accept USDC (as well as other SPL tokens) for digital-native payments, leveraging Solana's fast settlement and low transaction costs. Currently, USDC issued on Solana accounts for 10% of the total USDC supply (as of February 2022), and Solana Pay aims to gradually increase the utility of Solana-based USDC.

From the merchant's perspective, Solana-based USDC can be deposited into the merchant's Circle account, where it can be converted into fiat currency and transferred to the merchant's preferred bank account. From the consumer's perspective, the payment process is similar to other cryptocurrency applications, allowing users to scan QR codes at point-of-sale (POS) terminals or sign transactions using non-custodial wallets in a web browser. One major challenge for end-users is injecting an initial balance of dollars into their non-custodial wallets, but partnerships such as FTX's fiat on-ramp feature on Phantom can partially alleviate this issue. Additionally, merchants can attach NFTs to purchases and directly deposit them into users' wallets. This additional utility is only achievable through native cryptocurrency payments, providing new channels for merchants to increase customer loyalty and ongoing engagement. In the Web2 world, companies like Chipotle have already attracted repeat customers through in-app gamification and tiered reward systems. It is not difficult to imagine that these siloed loyalty programs could be interoperable through permissionless blockchains in this world.

A research report from Bank of America suggests that Solana could become the "Visa of the digital asset ecosystem." While Solana still has a long way to go, it has indeed stood out from other Layer1 blockchains, posing a reliable threat to the massive payments industry. According to a McKinsey report, the industry is expected to generate $2 billion in revenue by 2021.

Solana as the technical foundation of a user-friendly public blockchain --> Fixed and low transaction fees, fast confirmation times

Solana's mature wallet infrastructure, with built-in fiat conversion through FTX --> Wallets with powerful mobile and web interfaces, allowing users to easily convert fiat into the Solana ecosystem

Solana's strong business development/partnerships -> Solana Pay -> Circle partnership

STEPN - The First Mainstream Breakthrough Application for Cryptocurrency?

Stepn claims to be the world's first Web3 "Move-To-Earn" game. Stepn combines elements of Game-Fi and Social-Fi, allowing users to earn SPL tokens (Greenwich Mean Time or GMT) by "wearing" NFT sneakers in the game while running or walking outdoors. The game mechanism requires users to activate the sneakers before walking/running and share GPS data throughout the activity. Stepn also sets a daily limit on the tokens that can be earned. All these mechanisms work together to limit the number of cheating users attempting to obtain GMT/GST tokens from the game. Stepn generates revenue by charging small fees from in-game asset sales, asset trading, sneaker minting, and sneaker rentals. These fees can add up, as Stepn is apparently generating net profits of $3-5 million per day and up to $100 million per month. To demonstrate the power of Web3, all in-game assets, including two interchangeable SPL tokens and NFT sneakers, are owned by the users. It is worth noting that Stepn uses a hybrid custody model, where actively used sneakers and newly minted sneakers are stored in a custodial wallet until the user is ready to transfer their assets to a non-custodial wallet. However, Stepn allows users to manage both custodial and non-custodial wallets on the same interface. Through the non-custodial wallet, users can freely trade their tokens on any Solana DEX and list their NFT sneakers for sale on any Solana NFT marketplace (such as Magic Eden). As a Web3 game, Stepn is able to release a significant amount of liquidity, which is the ultimate value of users investing time to earn assets through Stepn. Compared to the "walled garden" spirit of Web2, Stepn takes an immortal "step" towards showcasing the future of crypto gaming to the world. Most importantly, Stepn brings positive externalities to users in the form of increased physical activity.

Stepn's user metrics support the claim of how Web3 technology is changing gaming applications. Since its launch, the number of active users on Stepn has been increasing almost daily, with the user count doubling approximately every two weeks. Leveraging the composability of the Solana ecosystem, Stepn is able to handle all in-game exchanges of its native tokens (GMT and GST) using oracles. As the user count and in-app interactions increase, the daily active users of the oracles also grow. This is another example of the power of composability primitives in Solana and how the broader ecosystem brings positive outcomes for all participants while minimizing the development redundancy required to create feature-rich applications. Stepn is likely the first mainstream Web3 application to bring cryptographic technology into the mainstream, and it is unlikely to be the last. The fact that Stepn is built on Solana is no coincidence. No other Layer1 blockchain combines powerful developer/user tools with low transaction fees, enabling frequent gamified interactions.

Interruption: Survival Risks of Solana

One of the biggest criticisms of Solana is its history of interruptions. Going back to September 2021, Solana has experienced 12 days of partial or complete interruptions. This equates to approximately 4.44% of the days from September 2021 to May 2022 experiencing network performance degradation or stoppages. While each interruption is unique, the primary factor leading to these interruptions can be attributed to one core issue: spam. Solana's fixed fee structure creates strong economic incentives for actors to send spam to the network, leading to the proliferation of spam. Whether in the form of capturing tokens from the Grape Protocol during the Raydium IDO or minting NFTs through Metaplex's Candy Machine program, spammers sometimes completely overwhelm the Solana network.

These interruptions caused by spam on the Solana network highlight a larger issue that has plagued the internet since its inception. The "Transaction Quality" framework proposed by Polynya for the first time may provide a better way to address the issue of combating spam transactions. Similar to the scalability trilemma framework for blockchains, the Transaction Quality trilemma framework posits that blockchain transactions must choose between reducing spam, resisting censorship, and low fees. In the Web2 world without blockchains, resistance to censorship is often sacrificed to combat spam and fees. In the blockchain world, both Bitcoin and Ethereum use fee markets and mempools to prevent spam transactions while retaining their decentralized networks (resistance to censorship). Solana, on the other hand, is based on low fees and a relatively decentralized network, prioritizing a good user experience. Therefore, the Transaction Quality trilemma framework correctly indicates that Solana is paying the price for its tendency towards spam in exchange for low fees and decentralization. Due to Solana's unique technical architecture choices, the level of spam on the Solana network is unparalleled and not seen on any other popular Layer1 blockchain.

On one hand, some view Solana's spam problem as a "good problem" because it indicates:

- Solana can handle a large volume of transactions (before it shuts down)

- The Solana network has enough economic value, motivating participants to capture this value first (the prevalence of bots)

- Developers in the Solana ecosystem are not deterred by this recurring issue (despite the interruptions, Solana Dapps and developer activity continue to grow)

On the other hand, critics of Solana point out that the spam problem will continue until Solana makes fundamental changes to its protocol, changes that almost all other major Layer1 blockchains have already implemented: specifically, mempools and fee markets. The existence of these two tools is precisely to prevent spam transactions from clogging valuable block space. Despite experiencing multiple interruptions, the Solana team is still adamant about not implementing mempools and fee markets, putting them in a very unique design space that could potentially address these issues. Given the interruptions caused by Metaplex's Candy Machine, the Solana team announced three major changes to combat spam on the network:

QUIC: Short for Quick UDP Internet Connections. Initially developed by Google, QUIC aims to improve network speed and efficiency. QUIC will replace UDP for packet transmission on the Solana network (packets are sent directly from RPC nodes to block producers). Solana initially chose UDP because UDP connections do not require handshakes or receipt acknowledgments. However, the interruptions caused by spam indicate that UDP cannot allocate sources and control network traffic, meaning all spam is sent to block producers via UDP. By switching to QUIC, Solana can retain most of the speed-oriented features provided by UDP while enhancing its ability to control incoming spam traffic. QUIC will help ensure that block producers are not overwhelmed by millions of transactions sent through Gulfstream and that they can verify all transactions within Solana's 400-millisecond block time.

Stake-Weighted Quality of Service (QoS) for Transactions: Stake-weighted QoS works in parallel with QUIC. It fundamentally ensures that network traffic will not be overwhelmed by any node with at least X stakes. This change aims to address the priority of network traffic in bandwidth-constrained situations. In this regard, the operation of stake-weighted transaction QoS is similar to proof of stake, where transaction "quality" is partially weighted based on specific stakes relative to other parts of the network.

Fee and Priority Changes: Users will soon be able to attach arbitrary "extra fees" to their transactions to increase the priority weight of their transactions. Previously, users could not express the urgency of their transactions. All fees were fixed, and all transactions were first-come, first-served. Some in the Solana community refer to this upcoming change as a "neighborhood fee market." In other words, during network congestion, fees for users of certain Solana programs (such as DeFi protocols) may skyrocket. However, this fee increase will be a localized phenomenon for DeFi programs and will not affect other smart contract programs on the network.

The unfortunate reality of this situation is that before these protocol-level changes are put into production, Solana applications will be left with no choice but to create their own fee markets in some cases. Metaplex has already charged a fee of 0.01 SOL for any wallet attempting to complete invalid (spam) transactions. Application-based fee markets are a suboptimal and inefficient solution to this problem, as application developers do not have the ability to design custom on-chain economic incentive structures, and therefore cannot reduce spam while maintaining a good user experience. These decisions are best left to Solana's protocol engineers, and it seems that the team is urgently implementing their three protocol-level changes.

However, the more important question here is how Solana will ensure that future interruptions do not trigger a dangerous domino effect for multiple stakeholders in its ecosystem. Unlike NFT and gaming applications, interruptions in DeFi applications may only inconvenience individuals, but DeFi applications are interconnected and cannot be interrupted indefinitely. Time-based DeFi systems face the greatest risk, as liquidations may be triggered when the lost oracles are restored. In this nightmare scenario, positions may suddenly show as under-collateralized, triggering hundreds of automated trade alerts, impacting a large number of people in a short period. With more and more funds flowing into the Solana ecosystem, the impact of interruptions will be magnified. Solana has been fortunate to handle these interruptions while its network is still relatively early-stage, and leveraging these valuable lessons in building sustainable protocols would be a wise move. It is important to note that while these proposed changes are technically elegant and potentially powerful, they are still untested innovations that may not mitigate the problem or may even introduce new issues. In the long run, if the Solana team is ultimately forced to adopt existing, more proven solutions such as mempools and a network-wide fee market, a significant amount of time may be wasted during this period, leading to technical debt.

Conclusion

Solana stands out in the fiercely competitive Layer1 blockchain space because of its doubled-down commitment to achieving a fast, singular scalability vision. In the third quarter of 2021, Solana's gaming projects accounted for only 3% of the total NFT and gaming transactions, but by the fourth quarter of 2021 and January 2022, this proportion had risen to 11% and 22%, respectively (according to data from The Block), which may be the best proof. Clearly, investors are closely watching Solana for its capabilities in DeFi and gaming, leveraging its low transaction fees and high throughput. However, the Solana network has also experienced its fair share of challenges, such as outages and network performance degradation. So far, these hardships have not hindered its adoption by users and developers. Over the past year, Solana has become the most complete alternative to the Ethereum network, as evidenced by its comprehensive integration with multiple well-known NFT platforms, the rapid rise of consumer Dapps like Stepn, and impressive engagement metrics such as active wallet addresses. When the Solana network is operational, it offers an excellent user experience, strong fiat onramps from Coinbase/FTX/Moonpay, powerful DeFi primitives from Pyth/Serum/Raydium/Orca, a fully composable execution environment, and strong growth in both end-users and developers. Solana's growth is relatively diverse, as it has high adoption rates in NFTs, DeFi, and Web3 applications. All these factors combined make Solana an attractive platform for entrepreneurs to build cryptocurrency, Web3, DeFi, gaming, and/or NFT companies on. Today, Solana cannot be seen as a theoretical experiment. The only question for this thriving ecosystem is whether it can handle further growth in concurrent users with its existing technical architecture. Recent outages indicate that significant protocol-level changes are necessary to take the network to the next level. However, if the network's resilience and decentralization of the validator set are not improved, Solana will continue to face challenges that may hinder its development and applications.

Key Points

Solana is the best hedge against the EVM at present. While Solidity still reigns supreme in public chain development, the scalability of the EVM itself seems to have reached its limit. Ethereum is still years away from realizing its scalability vision. During this time, the blockchain space shows no signs of slowing down. In this scenario, even the academic community is skeptical about whether the current form of the EVM can meet the needs of billions of users. Solana is the most complete Layer1 public chain for development, and its scalability performance has reached or exceeded that of the EVM (including derivatives of the EVM, such as Binance Smart Chain).

Solana is built on a strong foundation of DeFi primitives. Serum, Raydium, and Pyth combined form a powerful set of components on which new applications can be built. These primitives are built for institutional use cases and, to some extent, over-designed for retail users. The large surplus for retail use cases helps ensure consistency in user experience. With the popularity of Stepn, the usage of oracles is also increasing significantly.