Besides the emerging dark horses, what other potential projects are there?

By Joyce

Recently, the Solana ecosystem has been gaining momentum, with the rise and popularity of projects such as Mingwen NFT, Depin, and MeMe, making it a strong competitor to the continuously hot Bitcoin ecosystem, far surpassing other public chains such as Ethereum.

As a public chain that was deeply integrated with the FTX platform in the past, the Solana ecosystem suffered a significant blow after the FTX scandal, with prices dropping to single digits. After nearly a year of dormancy, Solana's price has been on the rise and has now climbed to $97.

In addition to the increase in token prices, the Solana ecosystem has also seen the emergence of a batch of new projects that have performed very well, truly catching people's attention.

In addition to these emerging dark horses, what other potential projects are there in the Solana ecosystem? Let's take a look together.

Overview of the Solana Ecosystem

According to the latest data from DeFiLlama, the current Total Value Locked (TVL) of the Solana ecosystem is around $1 billion, ranking fifth among all public chains, following Ethereum, Tron, BSC, and Arbitrum.

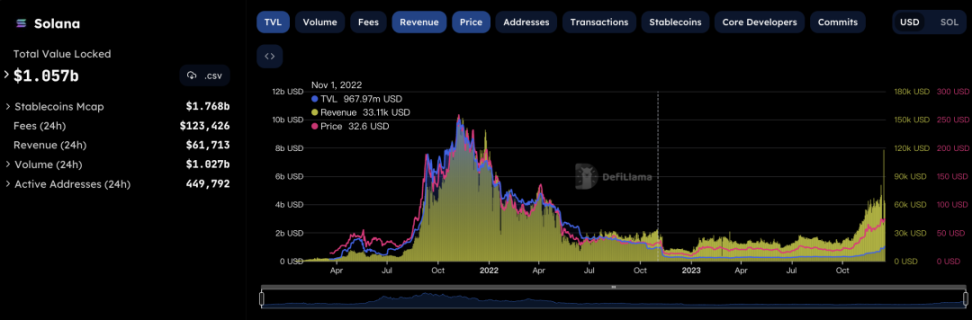

TVL, Solana price, and overall chain revenue trends in the Solana ecosystem, data source: DeFiLlama

After the FTX scandal, the Solana ecosystem's TVL dropped from nearly $10 billion to $3 billion, and the Solana price also dropped from 32U to a low of 14U. After nearly a year, the TVL has now exceeded the level before the FTX scandal, and the token has surged, surpassing $97.

From the trend chart of Solana's TVL, token price, and overall chain revenue, it is clear that the growth in token price far exceeds the growth in TVL, and the growth in overall chain revenue exceeds the increase in token price.

Of course, the daily income on the Solana chain is currently not high, only tens of thousands of dollars, so the absolute data is not very meaningful. However, compared to Ethereum, TRON, BSC, and Arbitrum, which rank high in TVL, Solana has shown a very good growth trend.

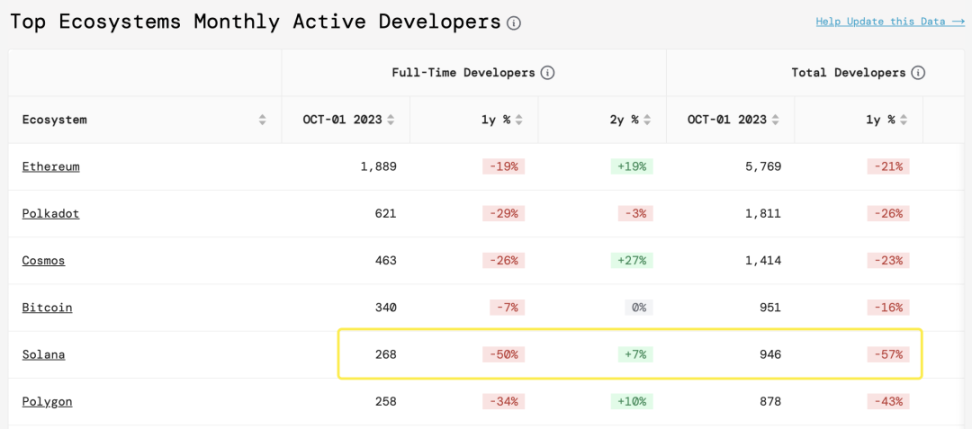

Number of developers in various public chain ecosystems, data source: developerreport.com

Developers are the foundation of a public chain ecosystem's development. Currently, the number of full-time and part-time developers in the Solana ecosystem totals 946, ranking fifth among all public chains, not far from the number of developers in the Bitcoin ecosystem.

As for the number of ecosystem projects, although many hot projects have emerged in the Solana ecosystem in recent months, the total number of projects is not very high. Currently, DeFiLlama has recorded 104 projects, far fewer than the top five TVL-ranked ecosystems such as Ethereum, BSC, and Arbitrum, and also fewer than ecosystems with lower TVL such as Avalanche, OP, Polygon, etc. However, there are quite a few emerging dark horses recently, so it can be said that the quality of projects in the Solana ecosystem is noteworthy.

Staking Protocols

According to Staking Rewards data, the total staked amount on Solana has reached 400 million, estimated to be over $28 billion at the current price, accounting for over 71.4% of Solana's total market value.

Compared to Ethereum's staking ratio of 23.7%, Solana's staking ratio is indeed very high, surpassing not only Ethereum but also most other public chains. Therefore, there are also many staking projects on Solana, with four of the top ten projects in terms of TVL being liquidity staking protocols.

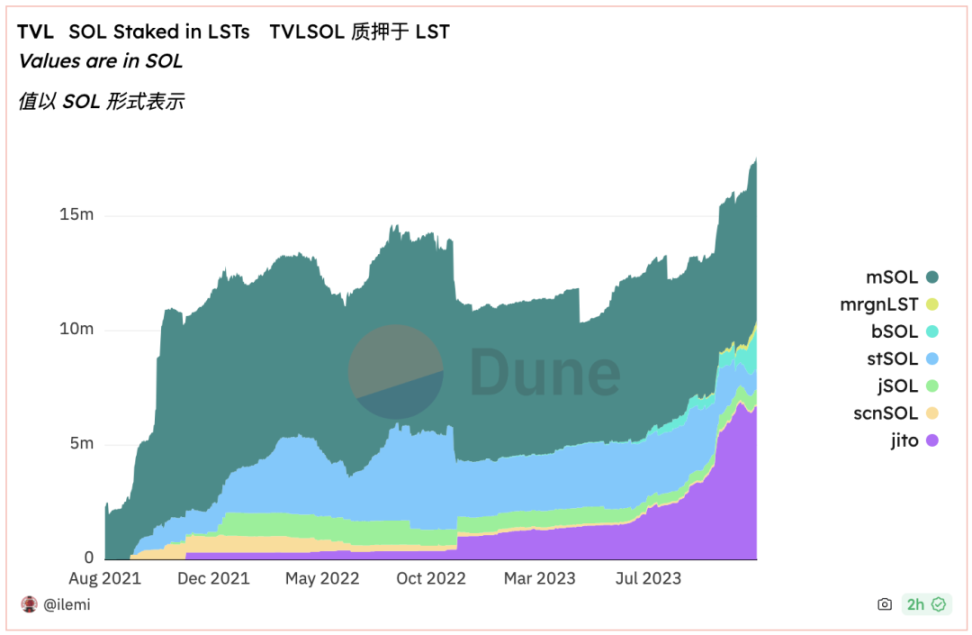

Overview of market share changes in Solana's staking protocol ecosystem, data source: Dune@ilemi

Among them, Marinade Finance is the leader in the liquidity staking protocol track in the Solana ecosystem and is also the top project in terms of TVL. As a well-established project launched in 2021, Marinade Finance has taken the lead, but from the market share change chart, it is clear that its market share is being eroded.

Jito is a recent standout dark horse, with a steep growth trend in its staking share over the past year. Jito is the first staking protocol in the Solana ecosystem to allocate MEV rewards to users. Users can stake Solana to obtain JitoSolana, which can help users earn staking rewards and MEV rewards. Starting from October, Jito's staking data has seen explosive growth, and its staked TVL is now not far from Marinade Finance, which ranks first. At the end of November, its governance token was listed on Coinbase and Binance, and it has been performing well since its listing.

Ranked third is Blaze Stake, with its staked token being bSOLl. Launched in May 2022, thanks to the overall explosion of the Solana ecosystem, Blaze's token has also surged several times in recent months.

In addition to these star staking protocols, the Solana ecosystem also has some innovative staking protocols for unreleased tokens, which have seen rapid growth recently and have attracted considerable attention due to their airdrop expectations.

Depin

Depin (Decentralized Infrastructure Network) is a recently popular track, based on Solana's advantages of high speed and low fees. Currently, the Depin track in the Solana ecosystem covers decentralized physical infrastructure, AI computing power, mapping, and IOA services, among other sub-sectors. Outstanding projects in this track include Helium, Mobile, Hivemapper, DIMO, and RNDR.

Among them, Helium is the pioneer project in the Depin track and is currently the leader in the Solana ecosystem's Depin track. Founded in 2013, Helium is a distributed IoT project that initially used its own Layer1 network and later migrated to the Solana ecosystem due to reasons such as EVM compatibility and TPS. Currently, Helium's IoT ecosystem is very mature compared to others. The recently popular Depin project, Mobile, is an ecosystem project of Helium, with a growth of over 16 times in the past month.

Hivemapper and DIMO are both decentralized mapping projects that incentivize users to provide driving map data through tokens. Both have already launched tokens.

As a peer-to-peer rendering power matching AI platform, RNDR can be considered the industry's recognized star project this year. With the rise of the AI track, RNDR, as a representative project in the AI track, has seen its market value soar, with a current circulating market value of $1.6 billion. It has also tapped into the recent hot Depin track and announced its expansion from Polygon to the Solana network, gaining significant attention.

NFT and Inscriptions

The recent inscriptions and NFTs in the Solana ecosystem have also received a lot of attention. Two leading inscription projects—SOLs and Lamp—have been developing well.

SOLs, as the leading inscription project on the Solana chain, created a legendary five-fold increase after being listed on a CEX, gaining strong momentum. Although there has been a recent pullback, overall, it is still performing well.

Lamp also has good momentum. As the smallest unit on Solana, the name Lamp, like Sats, also carries a MeMe attribute. Currently, the floor price of Lamp is 1.66 Solana, with over 5200 holding addresses.

In addition to inscriptions, the NFTs in the Solana ecosystem have been very popular in recent months, with the leading NFT project Mad Lads standing out. Mad Lads was launched by the framework development company Coral on Solana, using its own wallet Backpack for issuance. Its advantage lies in being in the form of xNFT, allowing direct operation of DeFi, GameFi, and more in the future, completely opening up the imagination for Mad Lads. Currently, the floor price of Mad Lads has exceeded 200 Sol, showing a strong trend of becoming the "bored apes" in the Solana ecosystem.

In addition to Mad Lads, many other popular NFT projects have emerged in the Solana ecosystem in recent days, such as the Open Solmap, which is comparable to Bitmap. Currently, it has over 18,000 holders and a 24-hour trading volume of over 50,000 SOL, firmly leading the NFT trading in the Solana ecosystem.

Also, Saga, which ranks second in 24-hour trading volume (as of December 21st), known as the "red box," saw its floor price skyrocket from 0.3 SOL to over 14 SOL within a few hours, and is currently around 5 SOL, demonstrating the fervor and FOMO level of NFTs in the Solana ecosystem.

MeMe

When it comes to MeMe, in addition to the inscriptions on various chains, the two hottest MeMes in the market recently both come from the Solana ecosystem—BONK and Silly.

BONK, as the first MeMe in the Solana ecosystem, has caused a stir with a growth of over 50 times in the past two months. BONK is the first MeMe in the Solana ecosystem based on a Shiba Inu prototype, and its Airdrop to the Solana community during last Christmas attracted attention, bringing new vitality and confidence to the entire ecosystem during the FXT scandal.

In the Saga mobile phone, which was launched in May this year, the phone priced at 599 included a gift of 30 million BONK. At the peak of BONK's value, it far exceeded the value of the phone, leading to a surge in sales of the Saga phone…

However, the recent decline in Bonk's popularity has made way for the new MeMe Silly in the Solana ecosystem. Silly originated from a "dragon" costume worn by Toly, co-founder of Solana, at a conference, combined with the concept of the Year of the Dragon, quickly gaining popularity as a MeMe. Within three days, it saw a growth of over ten times, demonstrating the strong FOMO power in the market.

DeFi Four Pillars

Oracle

Pyth network is the recent star project in the Solana ecosystem. For a long time, when it comes to oracles, people naturally think of Chainlink. Pyth network has indeed added some fresh blood to the oracle track.

Pyth network mainly provides data to smart contract Dapps by obtaining data from top trading platforms, market makers, and financial service providers. Currently, Pyth has connected to over 90 data sources including CBOE, Binance, OKX, Bybit, and supports over 230 Dapps, making it a rare case of a landing in the oracle track recently.

Lending

In addition to the oracle Pyth network, the lending protocol MarginFi has also performed very well in the past year. MarginFi is currently the largest lending protocol in the Solana ecosystem, with a TVL exceeding $300 million, second only to the two leading staking protocols, Marinade Finance and Jito.

MarginFi introduced a point system in July, rewarding users for deposits, lending, and referrals. Since its launch, TVL has skyrocketed, growing hundreds of times in just six months, making it one of the fastest-growing Dapps in the Solana ecosystem. Furthermore, MarginFi has not yet issued a token, and given the recent cases of significant gains in the Solana ecosystem, MarginFi is indeed worth looking forward to.

Another lending protocol, Kamino, with a TVL second only to MarginFi, has recently attracted market attention due to the upcoming Airdrop. Kamino is also one of the fastest-growing DeFi protocols in the Solana ecosystem, with a current TVL of $1.4 billion since its launch in September last year.

Solend was once the leader in lending in the Solana ecosystem. After suffering a cliff-like drop of over 90% in TVL during the FTX event, it has slowly recovered. TVL has returned to $150 million, especially after the introduction of the point system in August, both TVL and token prices have started to rise rapidly.

DEX

Orca and Raydium are both native DEXs on Solana. At their peak, their TVLs exceeded $1 billion, with Raydium even surpassing $2 billion. However, under the current bear market and the impact of the FTX scandal, both DEXs saw a cliff-like drop in TVL. Currently, Orca's TVL is $160 million, while Raydium's TVL is only about half of Orca's.

Orca is the only DEX in the Solana ecosystem with a pure automated market maker (AMM), providing a better trading experience for users. As a DEX that was launched around the same time, Raydium, which shares liquidity with the Serum protocol during the FTX scandal, currently seems to be recovering less than Orca.

Currently, the DEXs in the Solana ecosystem have not shown much performance in this wave of the Solana ecosystem boom, except for the DEX aggregator Jupiter, which attracted market attention due to its first batch of Airdrops in November.

Others

The Solana ecosystem has always used high-speed chains as a breakthrough in competing with other public chains, and derivative Dapps are currently the most demanding applications in the crypto industry for high-speed and low fees. GMX, born in the Layer2 leader Arbitrum ecosystem of Ethereum, is the best example, but unfortunately, the Solana ecosystem has not yet produced a dark horse derivative protocol.

Currently, Drift's TVL performance in derivatives is quite impressive, and the FTX scandal has not had much impact. TVL has grown hundreds of times in the past year, and with no token released yet, the Airdrop expectation has also attracted a lot of attention.

Conclusion

In conclusion, in this recent bull market, from the inscription craze spreading from the Bitcoin ecosystem to the rise of the infrastructure in the Bitcoin ecosystem, as well as the Solana ecosystem's Depin, NFT, MeMe, infrastructure, and more, the market's fervor and FOMO sentiment continue, adding many stories of sudden wealth to the market.

The rise and explosion of the Bitcoin ecosystem is not surprising, after all, as the leader of the crypto industry, the large liquidity expectations and various technological innovations naturally bring prosperity to the ecosystem.

However, the explosion of the Solana ecosystem has indeed brought many surprises. After all, the FTX scandal dealt a heavy blow to the liquidity of many important projects in the Solana ecosystem. The rapid recovery within a year demonstrates the vitality and resilience of the Solana ecosystem.

The title of "Ethereum killer" has slowly begun to resurface, and those who once believed that Ethereum had seized all the opportunities in the public chain during the long bear market are once again looking forward to the emergence of the "killers".

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。