In addition to developing social attributes, the information data platform, if able to combine more financial transaction attributes, will be another source of profit.

Author: DT, DODO Research

With the rapid development of the WEB3 industry, data query and analysis have become the focus of user attention. Representative information data service platforms are undergoing commercial tests and transformations, standing at the crossroads of pursuing self-sustainability.

This article takes DeBank, 0xScope, Nansen, Dexscreener, Arkham, and Dextool as examples of six data service information products, discussing the choice of monetization paths and the platform landscape driven by capital. The reason for choosing these six products is twofold: first, they have been in service for a relatively long time and have a stable user base; second, they represent different attempts at choosing monetization paths.

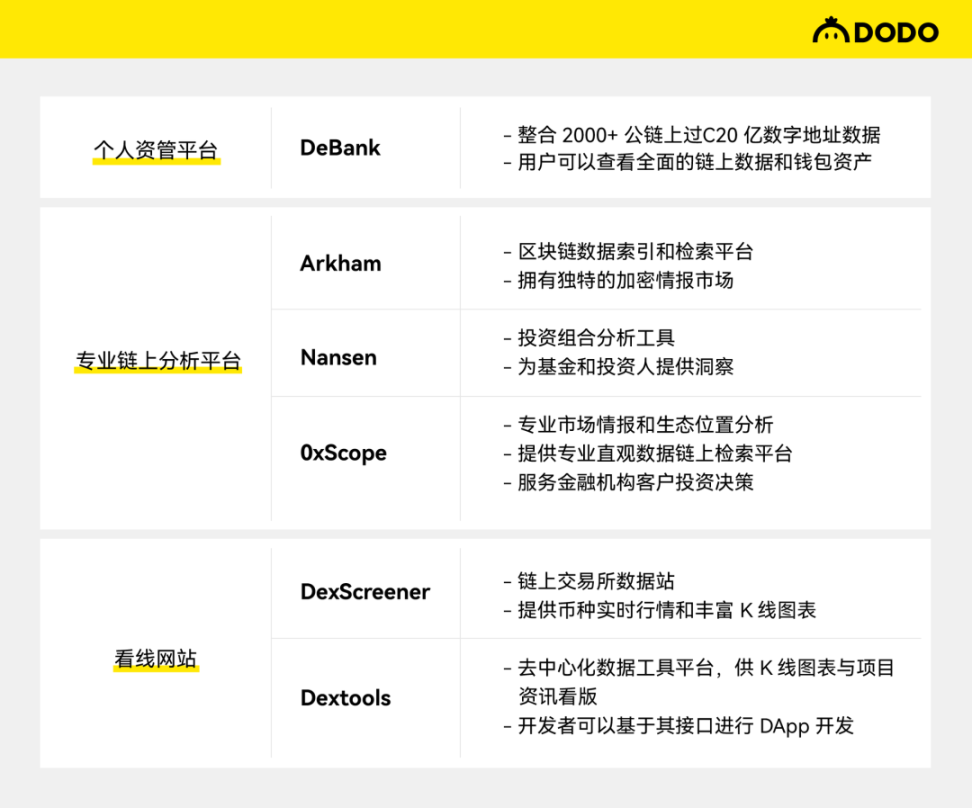

Below, we briefly introduce the services provided by these six information websites, which can be mainly divided into three categories:

- The first category is Debank, a leading personal asset management platform that can easily manage various assets on the entire chain.

- The second category includes 0xScope, Nansen, and Arkham, which are professional on-chain analysis platforms, providing visual on-chain data and actively analyzing services such as smart wallet, large transfers, and on-chain analysis of project party wallets/large holder wallets.

- The third category includes Dexscreener and Dextool, which are charting websites providing on-chain project charts and project information introduction services.

Traffic Analysis

Next, we observe the popularity of these six platforms and compare them with the centralized exchange leader Binance and the decentralized exchange leader Uniswap based on the website visit statistics from the independent data platform SimilarWeb.

It can be observed that DexScreener, Dextools, and Debank, which are more oriented towards retail users, have monthly visits ranging from approximately 5-15 million, which is quite comparable to Uniswap despite being quite distant from Binance. Arkham, Nansen, and 0xScope, on the other hand, provide more professional services and target institutional users or users using their API services. Many retail users only choose to follow their push content on Twitter, so they lag behind in website traffic.

These early information data platforms specializing in blockchain are forming a scale by continuously providing rich tools, accumulating a large user base, and laying a solid foundation for subsequent commercial attempts.

Funding Information

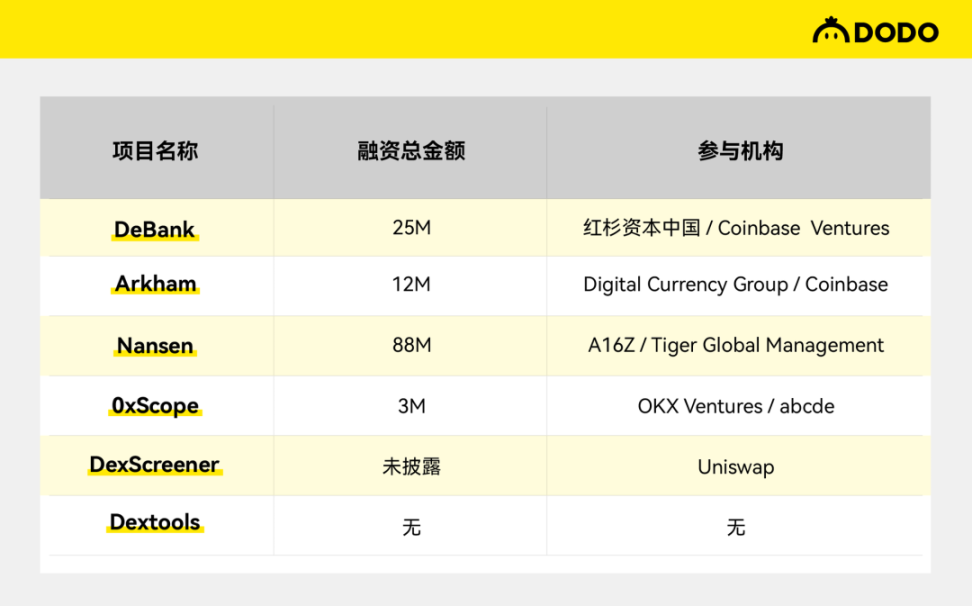

Early-stage projects providing information data services generally need to build their reputation through free features, so the participation of venture capital occupies a significant part. We then list the funding information of these six information data products one by one, referring to the data from the Crunchbase website.

These pioneering platforms for data analysis mostly choose venture capital to drive rapid growth. Several projects in the table have received tens of millions of dollars in financing, becoming a strong guarantee for their commercial layout. Capital empowerment helps these early-stage platforms to rapidly strengthen their operational capabilities and expand their business scope. Data platforms accelerate the completion of their own product and commercial systems through investment assistance.

Although DexScreener did not disclose its financing information, it is known from the Crunchbase website that it has also received funding from Uniswap and several angel investors in the early stages. In addition, Dextools has taken its own path, starting from the grassroots community, issuing the $DEXT token to raise funds from the community and establishing a complete token-based payment mechanism.

Payment Mechanism

External capital has helped strengthen the operational capabilities of these projects in their early stages, and direct fee-based monetization of services to end users remains a necessary step for long-term independent commercialization.

Observing the business frameworks of these six projects, we find a variety of payment conversion strategies and differences. Their fee models can be roughly divided into four categories:

- Enterprise/institutional customized services

- Project advertising

- API traffic fees

- Retail monthly fees

Nansen and Arkham, leading on-chain data analysis tools, mainly target enterprise institutions, so their core source of revenue comes from customized high-end data services. DeBank and 0xScope also seek commercial cooperation with projects through traffic monetization via developer interfaces, and at the same time, these four platforms also offer retail payment plans. Dextools and Dexscreener, on the other hand, have a more mass-market positioning, providing free services to general users and charging project advertising fees to unlock more detailed information.

Of particular interest is Arkham Intelligence, which, in addition to its commercial subscription services for institutions, has developed a blockchain intelligence reward platform called Arkham Intel Exchange to provide a channel for monetizing on-chain intelligence. Buyers and sellers can trade blockchain data analysis results on this platform. Although the platform currently has few users, the launch of Arkham Intel Exchange showcases an innovative and crypto-native new business model.

Another noteworthy development is the DeBank Chain plan launched by Debank. The chain has not yet gone live, and Debank aims to create DeBank Chain as an asset layer for social finance, allowing Debank to earn additional fees through L2 sorting. The launch of DeBank Chain demonstrates another potential for profit for information analysis platforms.

It can be seen that these early-stage blockchain data analysis platforms still have room for exploration and optimization in their business models. How to leverage the unique financial attributes of the Web 3 domain to create different commercial profit models has always been a primary challenge for information analysis platforms. According to TokenInsight's forecast, by 2025, the market size of the entire encrypted data analysis industry is expected to reach $1.5 billion, and the total number of direct fee-paying users may exceed one million. With the advent of mass adoption of blockchain, this market will be immensely huge.

Estimated Revenue

As these projects are still in the early stages of entrepreneurship and have not disclosed their profitability or subscriber numbers, we can only simulate the analysis based on big data on the general monthly visit rates and the ratio of real users to paying users in the Web2 website market.

Generally speaking, for many digital content subscription products, a conversion rate of around 5% of monthly active users into paying users is a typical range, while a conversion rate of 1-3% is more common for most early-stage applications or tool websites. Due to the early adoption of subscription services by Web3 users, a conversion rate of 1% is estimated here. Additionally, since there is usually a difference between the monthly website traffic and the actual monthly visitors, for some tool or trading websites, the repeat visit rate of users may be higher, with each user browsing more than 20 pages per month. Therefore, it is estimated that the real number of users is about 10% of the monthly website traffic.

Based on the above estimation and the subscription package price of 15u/m for DeBank, with a real user base of 10% of the monthly website traffic of five million, resulting in 500,000 real users, and assuming a 1% subscription service conversion rate, there would be 5,000 subscription users per month, equaling approximately $75,000 in monthly revenue, or $900,000 in annual subscription revenue.

For Nansen and 0xScope, with a subscription fee of approximately 100u/m, and based on the above estimation, the annual subscription revenue for each service is estimated to be around $960,000 and $900,000, respectively. As Arkham Intelligence has not launched user subscription services, it cannot be estimated.

In addition, Dextools and Dexscreener mainly generate revenue from advertising. In the first half of the year, DODO Research estimated that Dextools' annual advertising revenue is approximately $10 million, and with a similar monthly visit rate, Dexscreener, after introducing paid enhanced advertising services, is reasonably estimated to generate at least $5 million in revenue.

Please note that the above revenue estimates do not represent actual data, but are only estimates derived by the author based on market conditions and on-chain data. Furthermore, subscription fees and advertising revenue are only part of the revenue for these types of platform websites, as custom analysis services for institutions and API fees also contribute significantly to the revenue.

Conclusion

The author believes that, in addition to developing social attributes, if information data platforms can integrate more financial transaction attributes, it will be another source of profit. In the Web3 domain, trading and profitability have always been the top priorities for users, whether it's Debank's asset management platform, Nansan, Arkham, and 0xScope's on-chain data analysis platforms, or Dexscreener and Dextools' candlestick chart websites. Users visit these platforms to obtain the necessary information and make money through trading.

Therefore, if these platforms can establish unique partnerships with exchanges (both decentralized and centralized), making it convenient for users to trade in one place and profit from it, it will be a win-win situation for both the exchanges and the information platforms. Similar attempts have been made in Debank's Rabby wallet, and it is hoped that more information platforms will have similar services.

The support from institutional capital and actual user visit data shows the importance of information data platforms in the era of multi-chain and rapid growth of blockchain data. Choosing profitable methods that suit their positioning and strengths, persisting in iterative optimization of products and user experience, and achieving rapid growth through external financing at necessary stages are all crucial for establishing a strong position in the blockchain data service market.

If these platforms can organically integrate business methods with trading functions and social attributes, it will open up greater possibilities for these information platforms and help them occupy a more important role in the era of massive information.

References

- https://marketplace.dexscreener.com/product/token-info

- https://dodotopia.notion.site/memecoin-ab277c208caf460dad997741ae282d51

- https://www.scopescan.ai/pricing?network=eth

- https://cloud.debank.com/

- https://codex.arkhamintelligence.com/intel-to-earn-and-the-arkham-intel-exchange/exchange-concept

- https://www.nansen.ai/plans-original

- https://www.crunchbase.com/

- https://www.similarweb.com/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。